In business, financial management is the practice of handling a company’s finances in a way that allows it to be successful and compliant with regulations. That takes both a high-level plan and boots-on-the-ground execution.

What Is Financial Management?

Financial management is the strategic planning, organization, and direction of a company’s finances to achieve its objectives. It encompasses everything from day-to-day cash flow monitoring to long-term investment decisions, verifying that all financial records meet regulatory guidelines at each step.

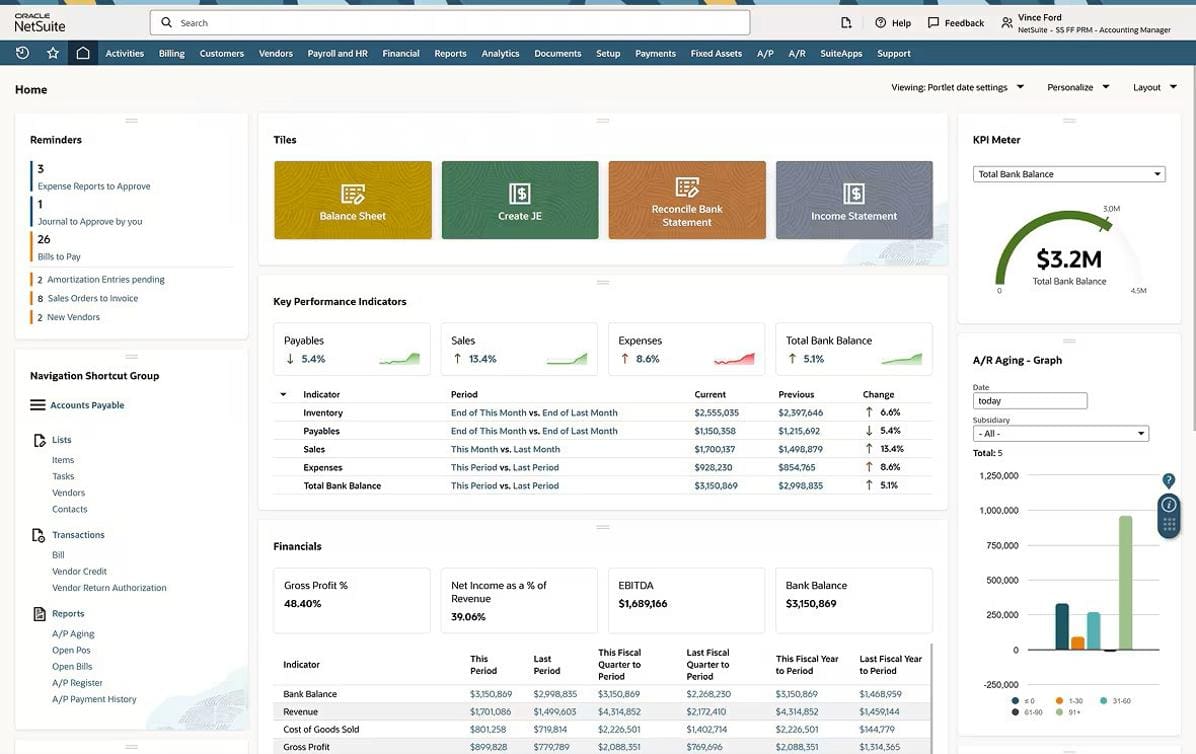

At its core, financial management is the framework that CFOs and finance leaders use to allocate resources, choose growth investments, and improve operational efficiency. Modern financial managers use technology to gain real-time visibility into their companies’ financial health. Accounting software and ERP platforms integrate critical financial functions, such as accounting transactions, fixed-asset management, revenue recognition, and payment processing, into one system, giving staff the data they need to manage the company’s financial performance. This comprehensive approach helps finance teams make informed decisions that drive growth while managing liquidity, maintaining profitability, and navigating potential challenges.

Key Takeaways

- Financial management is the process of planning, organizing and controlling a business’s monetary resources to achieve its strategic goals.

- Modern financial management uses far-reaching financial data to give managers actionable insights that optimize financial processes companywide.

- Financial management guides investment decisions to balance growth opportunities with day-to-day cash flow needs, driving long-term sustainability.

- Successful financial managers require both technical and collaborative leadership skills to understand the business’s complex financial landscape and effectively communicate with non-experts.

Video: What Is Financial Management?

Financial Management Explained

Financial management shapes how businesses operate, compete, and grow. Beyond tracking performance, it influences critical business decisions for everything from setting optimal inventory levels to timing market expansions. With strong management practices, companies gain the ability to spot trends before competitors, identify profitable customer segments, and redirect resources from struggling areas to high-potential opportunities.

Whether assessing a new product’s viability, next quarter’s sales strategies, or long-term vendor contracts, financial management offers an analytical foundation for understanding the impact of every decision. This foundation is built on integrated, companywide financial data that gives teams a holistic view of the business’ finances. For instance, finance managers can work with manufacturing departments to forecast production costs, with sales teams to set profitable pricing strategies, and with procurement to minimize material expenses. Fostering these relationships requires financial managers to translate complex data into digestible insights that non-finance colleagues can understand and apply to their work. These efforts turn the traditionally back-office task of financial management into a forward-looking strategy that drives competitive advantage and sustainability.

Objectives of Financial Management

Financial management goes beyond basic bookkeeping and reporting, directly impacting nearly every aspect of a business’s performance, from finding operational efficiency improvements to developing spending habits that support long-term profitability. Financial managers can help their companies achieve these objectives in several key ways:

- Maximizing profits: Provide insights on, for example, rising costs of raw materials that might trigger an increase in the cost of goods sold.

- Tracking liquidity and cash flow: Keep enough money on hand to meet the company’s obligations.

- Meeting compliance standards: Keep up with state, federal, and industry-specific regulations.

- Developing financial scenarios: These are based on the business’s current state and forecasts that assume a wide range of outcomes based on possible market conditions.

- Manage relationships: Dealing effectively with investors and the board of directors.

Ultimately, it’s about applying effective management principles to the company’s financial structure.

Scope of Financial Management

Financial management encompasses the following four major responsibilities.

-

Planning

The financial manager projects how much money the company will need in order to maintain positive cash flow, allocate funds to grow or add new products or services, and cope with unexpected events, and shares that information with business colleagues.

Planning may be broken down into categories that include capital expenses, T&E, workforce, and indirect and operational expenses.

-

Budgeting

The financial manager allocates the company’s available funds to meet costs, such as mortgages or rents, salaries, raw materials, employee T&E, and other obligations. Ideally there will be some left to put aside for emergencies and to fund new business opportunities.

Companies generally have a master budget and may have separate sub documents covering, for example, cash flow and operations; budgets may be flexible or static.

Static vs. Flexible Budgeting

Static

Flexible

Remains the same even if there are significant changes from the assumptions made during planning.

Adjusts based on changes in the assumptions used in the planning process.

-

Managing and Assessing Risk

Line-of-business executives look to their financial managers to assess and provide compensating controls for a variety of risks, including:

- Market risk: Affects the business’s investments as well as, for public companies, reporting and stock performance. May also reflect financial risk particular to the industry, such as a pandemic affecting restaurants or the shift of retail to a direct-to-consumer model.

- Credit risk: Customers not paying their invoices on time, for example, can result in the business not having funds to meet obligations, adversely affecting creditworthiness and valuation, which dictate the ability to borrow at favorable rates.

- Liquidity risk: Finance teams must track current cash flow, estimate future cash needs, and be prepared to free up working capital as needed.

- Operational risk: This is a catch-all category, and one new to some finance teams. It may include the risk of a cyberattack and whether to purchase cybersecurity insurance, what disaster recovery and business continuity plans are in place, and what crisis management practices are triggered if a senior executive is accused of fraud or misconduct.

-

Establishing Procedures

The financial manager sets procedures regarding how the finance team will process and distribute financial data, such as invoices, payments, and reports, with security and accuracy. These written procedures also outline who is responsible for making financial decisions at the company and who signs off on those decisions.

Financial Management Key Areas

Financial management touches every aspect of an organization, with every department benefiting from a targeted approach and specialized expertise. While areas of financial management often overlap, understanding each one’s individual focus helps management teams identify skill gaps within their finance teams and take steps to avoid neglecting important, but overlooked, fields. Key areas of financial management include:

- Investment: Financial managers evaluate capital opportunities, comparing realistic returns against potential risk. This encompasses new equipment purchases, technology upgrades, market expansion initiatives, and acquisition targets. Finance teams determine which investments best support strategic objectives, considering opportunity costs and potential gains.

- Procurement: In partnership with procurement teams, financial managers establish spending controls, negotiate supplier payment terms, and assess total cost of ownership for major purchases. They optimize purchasing decisions by weighing cost reduction goals against quality requirements and supply chain vulnerabilities.

- Working capital: Balancing current assets and liabilities requires tightly managing cash conversion cycles, inventory turnover, and payment collection. By monitoring these working capital metrics alongside sales and cash flow forecasts, managers aim to maintain sufficient liquidity for operations without holding surplus idle cash that could be deployed elsewhere.

- Tax: Beyond compliance, financial managers develop tax strategies that legally minimize obligations without negatively impacting operations. This involves structuring transactions, managing tax provisions, coordinating with external advisors, and monitoring evolving regulations, credits, and deductions that could impact the business’s tax position.

- Risk management: Financial managers identify and quantify potential threats to the company’s finances, from market volatility and supply chain disruptions to operational failures. They develop mitigation strategies that balance risks with growth potential, implementing controls and contingency plans, such as insurance coverage and financial reserves.

- Project management: Collaborating with department heads allows financial managers to assess the financial viability of each initiative, from initial budgeting to comparing final spending to initial projections. Throughout the project lifecycle, managers evaluate ROI and recommend course corrections when costs overrun or resources could be put to better use elsewhere.

- Cash flow: Managing the timing and value of incoming and outgoing cash requires unifying collections, disbursements, and short-term investments. Financial managers forecast cash needs, optimize payment timing, and establish credit to prevent shortfalls without holding idle cash.

- Budgeting: Financial managers lead the budgeting process by setting financial targets and resource schedules based on overall strategic goals. They work with department heads to establish realistic budgets, compare ongoing performance against expectations, and make adjustments when business conditions change.

- FP&A: Financial planning and analysis (FP&A) uses forecasting, scenario modeling, and performance analysis to draw actionable conclusions from raw financial data. FP&A teams identify trends, explain variances, and provide data that guides executive decisions on everything from pricing to product mix.

- Reporting: Accurate and timely financial reporting keeps stakeholders informed and simplifies the end-of-period close. Financial managers use accounting software to quickly prepare internal management reports, external financial statements, and specialized reports for lenders or investors, balancing transparency with confidentiality requirements.

Functions of Financial Management

A financial manager’s activities in the above areas revolve around planning and forecasting and controlling expenditures.

The FP&A function includes issuing P&L statements, analyzing which product lines or services have the highest profit margin or contribute the most to net profitability, maintaining the budget, and forecasting the company’s future financial performance and scenario planning.

Managing cash flow is also key. The financial manager must make sure there’s enough cash on hand for day-to-day operations, such as paying workers and purchasing raw materials for production. This involves overseeing cash as it flows in and out of the business, a practice called cash management.

Along with cash management, financial management includes revenue recognition, or reporting the company’s revenue according to standard accounting principles. Balancing accounts receivable turnover ratios is a key part of strategic cash conservation and management. This may sound simple, but it isn’t always: At some companies, customers might pay months after receiving your service. At what point do you consider that money “yours”—and report the good news to investors?

5 Tips to Improve Your Accounts Receivable Turnover Ratio |

|---|

|

|

|

|

|

Finally, managing financial controls involves analyzing how the company is performing financially compared with its plans and budgets. Methods for doing this include financial ratio analysis, in which the financial manager compares line items on the company’s financial statements.

Strategic vs. Tactical Financial Management

On a tactical level, financial management procedures govern how you process daily transactions, perform the monthly financial close, compare actual spending to what’s budgeted, and meet auditor and tax requirements.

On a more strategic level, financial management feeds into vital FP&A and visioning activities, where finance leaders use data to help line-of-business colleagues plan future investments, spot opportunities, and build resilient companies.

Importance of Financial Management

Solid financial management provides the foundation for three pillars of sound fiscal governance.

-

Strategizing

Identifying what needs to happen financially for the company to achieve its short- and long-term goals. Leaders need insights into current performance for scenario planning, for example.

-

Decision-making

Helping business leaders decide the best way to execute on plans by providing up-to-date financial reports and data on relevant KPIs.

-

Controlling

Keeping each department contributing to the vision and operating within budget and in alignment with strategy.

With effective financial management, all employees know where the company is headed, and they have visibility into progress. This transparency helps managers develop governance models that translate executive-level strategies into departmental actions and keep daily activities aligned with long-term objectives. Financial management provides performance metrics and feedback loops that empower departments to set goals and adjust operations as needed, such as tracking how procurement costs affect margins or how seasonal patterns impact cash flow. This approach helps companies build the resilience and flexibility they need to respond to changing market conditions without losing sight of their goals.

What Are the Three Types of Financial Management Decisions?

Financial management supports three main decision categories: where to invest resources (capital budgeting), how to fund operations and growth (capital structure), and how to maintain liquidity for daily operations (working capital management). These interconnected categories show how individual financial choices impact broader strategic outcomes—purchasing new equipment affects both debt and cash levels, while funding decisions determine available growth opportunities, for instance. Managers use these three lenses to consider both immediate needs and long-term objectives when making decisions.

-

Capital budgeting

Relates to identifying what needs to happen financially for the company to achieve its short- and long-term goals. Where should capital funds be expended to support growth?

-

Capital structure

Determines how to pay for operations and/or growth. If interest rates are low, taking on debt might be the best answer. A company might also seek funding from a private equity firm, consider selling assets like real estate, or, where applicable, selling equity.

-

Working capital management

Working capital management makes sure there’s enough cash on hand for day-to-day operations, such as paying workers and purchasing raw materials for production.

What Is an Example of Financial Management?

Say the CEO of a toothpaste company wants to introduce a new product: toothbrushes. She’ll call on her team to estimate the cost of producing the toothbrushes and the financial manager to determine where those funds should come from—for example, a bank loan.

The financial manager will acquire those funds and allocate them to manufacture toothbrushes in the most cost-effective way possible. Assuming the toothbrushes sell well, the financial manager will gather data to help the management team decide whether to put the profits toward producing more toothbrushes, start a line of mouthwashes, pay a dividend to shareholders, or take some other action.

Throughout the process, the financial manager will check that the company is maintaining enough cash on hand to pay the new workers producing the toothbrushes. She’ll also analyze whether the company is spending and generating as much money as she estimated when she budgeted for the project.

What Is a Financial Manager?

A financial manager is a senior professional who oversees an organization’s health and shapes its financial strategy, typically advancing from roles like financial analyst or controller. While some smaller companies may rely on a limited team or the owner to manage finances in addition to other duties, a dedicated financial manager is usually responsible for developing capital strategies, managing cash flow, evaluating investments, and maintaining banking relationships. This person also collaborates with other managers to align resource allocation and department targets with big-picture objectives. By analyzing complex financial data, a financial manager determines whether companies can fund initiatives, weather downturns, and deliver returns.

Financial Manager Skills

Successful financial managers blend their technical expertise with people skills to help decision-makers and leaders throughout the company thrive as they navigate complex financial pressures. Here are some of the core skills to look for in a financial manager.

- Financial analysis and modeling

- Systems and technology

- Regulatory knowledge

- Strategic communication

- Leadership and collaboration

- Risk management

- Business acumen

NetSuite: Financial Management for Startups and Beyond

Financial management challenges can be daunting for both startups and growing businesses. This is where NetSuite’s financial management software comes into play. With its comprehensive, cloud-based solutions, NetSuite keeps financial data accurate, up-to-date, and accessible anytime, anywhere. From automating complex financial processes to offering real-time visibility into performance, NetSuite is the go-to solution for businesses aiming for seamless integration and efficient financial operations. As a company expands, NetSuite scales with it, providing the right tools to make informed strategic decisions at every stage.

NetSuite’s Financial Management Dashboard

At the outset, financial management responsibilities within a startup include making and sticking to a budget that aligns with the business plan, evaluating what to do with profits, and making sure your bills get paid and that customers pay you. Financial management gets more complicated as the company grows and adds finance and accounting contractors or staffers. You must pay your employees with accurate deductions, properly file taxes and financial statements, and watch for errors and fraud. By building a plan, you can answer the big questions: Are our goods and services profitable? Can we afford to launch a new product or make that hire? What might the coming 12 to 18 months bring for the business? Solid financial management provides the systems and processes to answer those questions.

Financial Management FAQs

What are the challenges of financial management?

Financial management challenges include maintaining cash flow while investing in growth, adapting to evolving regulations and market conditions, and integrating companywide data to create accurate forecasts. Overcoming these challenges often requires balancing competing priorities—such as minimizing costs while maintaining quality—and communicating complex financial information to stakeholders with varying levels of financial expertise.

What are the four Cs of financial management?

The four Cs of financial management are:

- Cash flow: Tracking money as it moves in and out of the business.

- Credit: Managing the company’s creditworthiness and customers with payment terms.

- Customers: Analyzing customer profitability and payment patterns.

- Collateral: Acquiring and maintaining assets the business uses to secure funding.

What are the three Es of financial management?

The three Es of financial management refer to:

- Economy: Acquiring resources that satisfy the company’s needs at the lowest reasonable cost.

- Efficiency: Maximizing output and returns on the company’s resources.

- Effectiveness: Leveraging resources to achieve the company’s financial goals and objectives.