In short:

- CFOs have worked for months to analyze cash flows and balance long-term financial visions with short-term stabilizing actions.

- Results of that first wave of runway lengthening are paying off. Now it’s time to regroup and reassess prospects for the fall.

- Don’t assume every negative financial blip right now is COVID-19-related.

Enterprise CFOs are in an interesting position. More than half, 55%, of finance respondents to Brainyard’s Summer 2020 Finance Priorities Survey say their teams’ influence has grown since January. CFOs are being called on to combine executive-level strategic vision with surgical precision around cash flow analysis to make spending cuts while protecting growth investments.

Many, though, are pressing pause as they consider a new round of stabilizing actions.

Operating CFO Ty Stewart controls FP&A matters for his firm, Simple Life Insure, which aggregates quotes from 10 top insurers. When a pandemic-driven economic downturn looked inevitable, Stewart took four steps, some reactionary, some precautionary:

First, he shifted revenue forecasting models. “Past earnings models based on ‘business as usual’ won’t cut it, since business as usual allowed for in-person meetings and exchanges,” says Stewart, who is also president and CEO. “This was admittedly difficult and murky, but it had to be addressed.”

Then, he reduced budgets for various operating areas. “We’re tightening the belt on everything from travel reimbursements, when those finally re-enter the picture, to office supply orders to even reviewing subscription fees and costs for outsourced services,” Stewart says. Pointing to the latter three, he says many of these fees can be renegotiated: “It’s always worth a shot.”

Next, he created more frequent, granular communications with investors, upper management and constituents regarding finances.

“Everyone feels tense,” says Stewart, who admits that creating precise revenue forecasts and expense projections, or even offering much good news to team members, is difficult right now. “Keeping channels of information open, transparent and frequent at least bolsters trust in an incredibly uncertain time.”

Finally, he initiated more frequent tax planning focused on better expense projections, finding potential deductions given changes to federal loan and tax rules and spotting potential sources of workable capital to reallocate. “Because they can help maximize deductions, reduce taxable profits and even spot new sources of workable capital, tax planning reviews go hand-and-hand with expense planning,” says Stewart. “Money saved can be directly allocated into more liquid vehicles or used to bring back employees and pay off loans.”

| 5 Tips to Improve Your Accounts Receivable Turnover Ratio |

|---|

| 1. Invoice regularly and accurately. If invoices don’t go out on time, money will not come in on time. |

| 2. Always state payment terms. You can’t enforce policies that you haven’t communicated to clients. If you make changes, call them out. |

| 3. Offer multiple ways to pay. New B2B options are coming online. Have you considered a payment gateway? |

| 4. Set follow-up reminders. Don’t wait until customers are in arrears to start collection procedures. Be proactive, but not annoying, with reminders. |

| 5. Consider offering discounts for cash and prepayments. Cash(less) is king in retail, and you can reduce AR costs by encouraging customers to pay ahead rather than on your normal customer credit terms. |

| Learn more about maximizing your AR turnover ratios. |

Recognizing that new spending cuts can trigger morale dips, Stewart says CFOs should focus on balancing reductions with moves that preserve their companies’ growth — and make sure that message gets out.

Still, there’s no getting back on track with long-term strategic priorities without first keeping operations afloat. With experts predicting a second wave of COVID-19 this fall, CFOs are now being asked to re-stabilize their companies while making cautionary moves to help soften that blow, should it come. The goal: “Ensuring their organizations are cash-liquid enough to manage whatever might come next,” says Stewart.

That said, many executives we talked to cautioned against tunnel vision.

COVID May Not be the Culprit

Neal McAtee, CFO at antiques, art and vintage collectibles valuation site WorthPoint, knows firsthand the disruption that pandemic-related panic can cause. When the site tracked a slight decline in sales in early April, the company assumed COVID-19 was to blame. After all, it had been over a month since the pandemic surfaced, and talk of an economic recession was amplifying.

“The number of free trials that we were seeing each day started to decline more than usual for that time of the year,” McAtee says. “We assumed people were watching the news, trying to figure out what coronavirus was all about, versus surfing the web and finding us.”

The decline continued further into April, with the number of free site trials most impacted.

“As we approached Easter weekend, free trials were at about 50% of what they were in January,” he said. Comparing that to 2019’s numbers, which were higher than 2018’s, McAtee saw that over the holiday weekend, new signups were now down by 40%.

“At that point, we thought that we’d just have to figure out how to survive on that 60% number,” he said.

As it steeled itself for that, the company also started studying its data and found that the number of customer credit cards being authorized for payment was much higher than the number of new free-trial subscriptions that were being created.

“There was a hole in the bucket,” says McAtee. “We were down because of COVID or the holiday, and we were down because there was a problem in the billing system.”

With that problem fixed, the company’s order volume increased by nearly 100%. The moral of the story? Don’t assume every drop in customer order volume or decrease in sales is caused by the pandemic. Dig deeper.

Austerity Management 101

As a part-time CFO for several businesses, Nan Kreamer, managing director at Newpoint Advisors Corp., is emphasizing liquidity and cash conservation. Kreamer is scrutinizing discretionary spending for return on investment (ROI), all with an eye to managing expenses. She’s using a 13-week cash flow model, a rolling 12-month business forecast and regular assessments of key performance indicators to help her client companies achieve that goal.

Kreamer’s recommended ace in the hole is the cash flow model, which addresses critical points like:

- How much cash do we have on hand?

- Is this enough to get us through the next 13 weeks?

- If not, how can we obtain additional cash quickly, say via a PPP, SBA EIDL loan, new line of credit or accounts receivable factoring?

- What do our accounts receivables look like over the next 13 weeks?

- Are we looking at 30-, 60- or 90-day terms on sales, or is our AR turnover ratio healthy, as in the case of B2C e-commerce sales?

- What are our financial obligations? Which vendors need to be paid on time in order to keep the business running, and where might we cut back for the time being? Think requesting rent reductions, eliminating travel and further reducing unnecessary recurring expenses.

Kreamer cautions CFOs to not confuse cash flow models with profit-and-loss (P&L) statements.

“Cash models factor in what’s coming in and out of your bank account,” she says. By tracking that cash flow — versus just looking at sales and revenues — companies can identify potential financial disruptions and either plan for them or take corrective action.

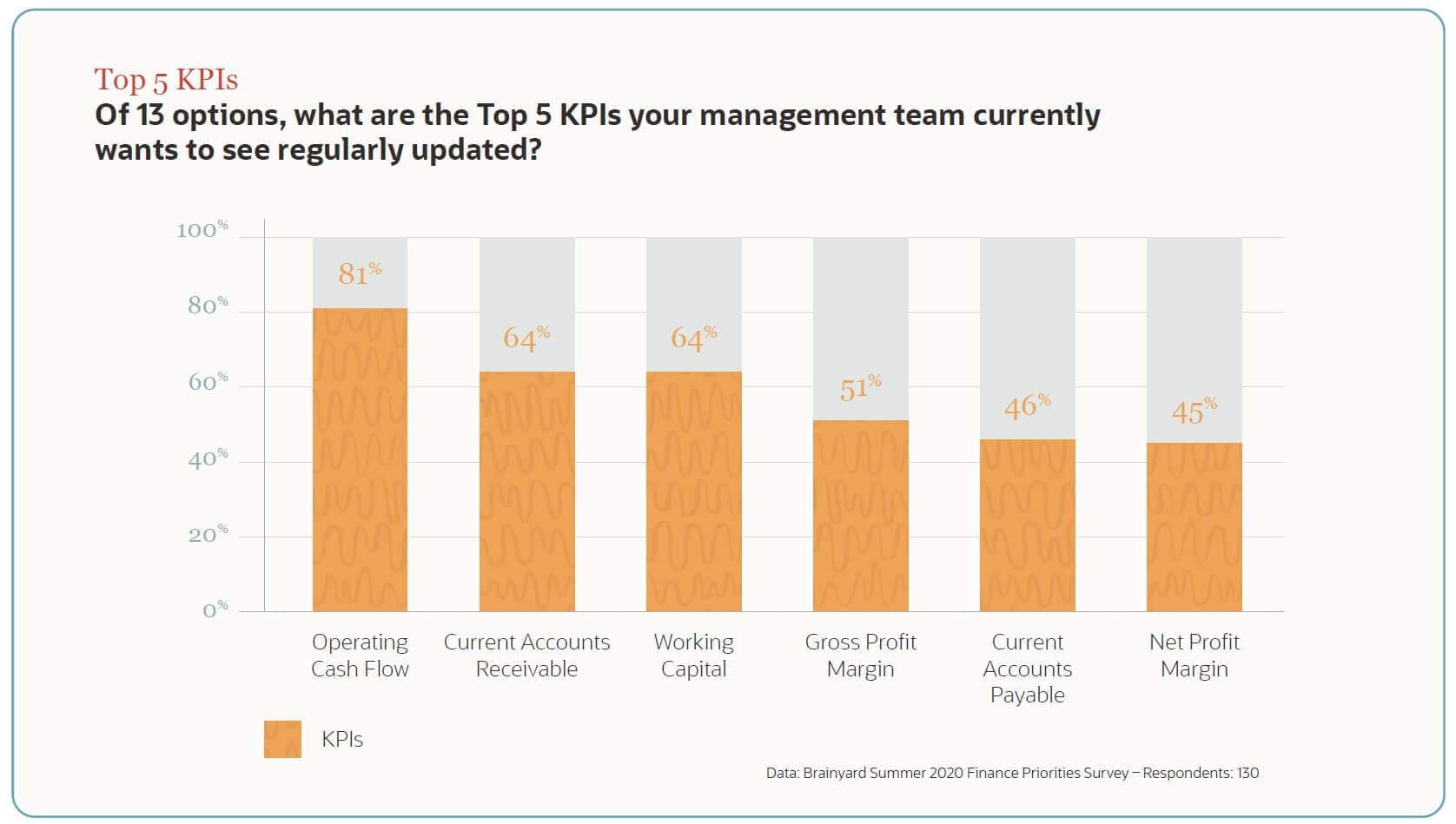

Kreamer says CFOs should also continue tracking and reviewing KPIs on a weekly basis. Some critical metrics include the number of sales calls you need to make per week to reach current sales goals, current inventory turns and current days sales outstanding. “Constantly measuring your metrics helps you understand where you are right now, where you should be and how you can improve,” says Kreamer.

Work with line-of-business management to assess the risk of each reduction and potential business impacts. Then, get aligned on how to proceed.

“Spending cuts can be difficult when top management doesn’t agree on them,” Kreamer says. “The CFO is in the position to say, ‘Okay everyone, here’s the pot of money we have to work with right now. How are we going to use it?’”

Searching for Savings

Speaking of examining every dollar spent, Reuben Yonatan, CEO at GetVoIP, a site that aggregates data for companies seeking telecom services, says that to reduce recurring expenses, the company is focusing on organic marketing instead of paid ads.

“As a company that generates the majority of its revenue from affiliate marketing, this takes a big chunk out of our budget,” says Yonatan. “We’re not doing away with paid ads completely, but we are trying to find a balance that will allow us to see massive results without spending too much.”

The average small business using Google Ads spends between $9,000 and $10,000 per month on paid search campaigns — and may or may not be getting good return on ad spend. If you’re unsure, here’s a guide to auditing ROAS for CFOs.

There are ways to win brand awareness with organic search and a little guerilla marketing. The latter is more time consuming, of course, and takes more effort. But it’s less expensive, and the payoff for a content-based strategy can be impressive: Research suggests content marketing has the power to drive business growth with higher success rates and lower costs — one study showed three times as many leads per dollar as paid ads.

Look Ahead

Most seasoned CFOs have been through at least one recession, but the combination of a generational event like COVID-19 plus an economic downturn has put even experienced CFOs in uncharted territory.

Besides “don’t panic” and Kreamer’s advice about cash flow modeling and forecasting, Michael Rothe, president and CEO at Canadian Finance & Leasing Association, says the current situation calls for as much transparency as possible about the organization’s financials, pain points and agenda.

“Avoid visceral reactions,” said Rothe. “Immediate needs are important, and we focused on them in the beginning. But in terms of big budgeting decisions, we focused on what kind of an association we wanted to be when we came out of this.”

CFLA also dusted off its strategic plan and reviewed it line-by-line to determine how it could conserve some cash and where it could get additional liquidity that it needed to weather the storm. Some options were taken off the table immediately, including the potential sale of some of the organization’s financial investments.

“We don’t want to sell the investments when the market’s tanking just because we were desperate for cash,” says Rothe. “We [also] don’t want to barely make it out and then find that we failed just before the finish line. So in some ways, we’re also spending our way through the crisis.”

Bridget McCrea is a Florida-based freelance writer who writes about business, technology, and finance. She’s the author of five books and a contributor to publications like Logistics Management, Supply Chain Management Review, tED Magazine and Florida Realtor.

For more helpful information from the Brainyard and our friends at Grow Wire and the NetSuite Blog, visit the Business Now Resource Guide.