Automation is turning traditionally manual accounting tasks into streamlined, scalable processes—with significant benefits for businesses. Accounting automation offers companies a faster, more accurate way to manage their finances, unlocking opportunities for cost savings, enhanced compliance, improved security, and access to real-time insights. It also helps companies move past the challenges of manual accounting, such as limited scalability and low visibility.

For these reasons, companies are investing in automation for their accounting teams. For companies contemplating becoming part of this automation surge, this article explores 12 important accounting automation benefits, the accounting functions that are best suited for automation, and the challenges businesses might encounter along the way.

What Is Accounting Automation?

Accounting automation is the use of software to perform the historically manual tasks traditionally used to record, manage, and analyze a business’s finances. It helps organizations take a more efficient, accurate, and secure approach to accounting.

Manual accounting—with its focus on human data entry, complex spreadsheets, and paper documents—is time-consuming and error-prone. It limits companies’ visibility into their finances and is hard to scale without hiring additional staff. With automation, however, businesses can streamline their accounting operations, save money, and set themselves up for continued growth. Prime candidates for accounting automation include accounts payable (AP), accounts receivable (AR), payroll, expense reporting, and procurement. The more functions a business automates, the more it frees up the finance team to perform higher-level work.

Key Takeaways

- Manual processes and paper files bog down accountants, CFOs, and business owners with repetitive tasks and busywork.

- Automation brings new benefits for finance teams, particularly in the areas of data access, analysis, and overall transparency.

- Despite fears that automation and artificial intelligence (AI) will take away people’s jobs, these technologies actually have the potential to improve how accounting teams work.

- Accounting automation can pose some challenges, mostly related to implementing new technologies and adapting to new ways of working.

- Businesses can overcome these challenges with proper planning and support from the outset.

Accounting Automation Explained

Accounting involves a wide variety of tasks, many of which are standardized and repetitive in nature. For example, the basic steps of the AP process are the same for nearly all businesses: invoice receipt and verification, invoice approval, payment authorization, payment issuance, and order reconciliation—and many accounting teams continue to perform these jobs manually. Accounting automation leverages technology to streamline and digitize these processes by using specialized, often cloud-based software and AI to automatically capture, categorize, and process financial transactions in real time, significantly reducing human error and the amount of time spent on routine accounting tasks.

Better yet, automated accounting tools can seamlessly integrate with existing enterprise resource planning (ERP) software to create a cohesive ecosystem that facilitates real-time data flow and analysis. As a result, businesses gain greater visibility into their financial health, improved compliance with regulatory requirements, and the ability to make data-supported decisions more rapidly. Moreover, automation in accounting paves the way for scalable financial operations, enabling businesses to adapt quickly to changing market conditions and growth opportunities without proportionally increasing their administrative overhead.

Challenges of Manual Accounting

Manual accounting processes and paper files challenge companies of all sizes. They ensnare accountants, CFOs, and business owners with repetitive, menial tasks, limiting their professional growth and the scalability of their companies. Some of the biggest disadvantages of manual accounting are:

- Wasted time: Manually entering data into computers, storing and retrieving paper files, and analyzing and reporting on data can take up a significant amount of time for all accounting functions. In AP, for example, a backlog of paper invoices to be entered makes it difficult for a business to complete payments on time. Similarly, manually handling the monthly close process, involving a systematic series of steps performed at the end of each month to review, reconcile, and finalize all financial transactions, can consume entire accounting teams.

- Increased risk of errors: The pressure to complete manual, repetitive tasks on time makes accounting processes more prone to mistakes. Human error takes many forms, from transposed numbers and missing decimal points to duplicate entries and incorrect calculations. Even a seemingly minor error can lead to major problems. For instance, one small typo in a spreadsheet formula might cause a business to overcharge customers or issue incorrect financial results.

- Limited scalability: The only way to scale manual processes is to add more manpower. It’s expensive, and it still doesn’t solve all of a company’s accounting challenges. What happens when someone takes a sick day or goes on vacation? Their work starts to pile up. Finance teams that don’t use automation can’t scale successfully, because they’re struggling just to keep up with the day-to-day obligations.

- Limited visibility: For accounting teams overwhelmed by manual tasks, audit trails and financial tracking represent just more items on their to-do lists. Unfortunately, these important functions can fall to the wayside as other priorities emerge. Without a centralized system to record every transaction, businesses have little visibility into the health and compliance status of their financial operations.

12 Benefits of Automation in Accounting

Automation helps businesses overcome the challenges of manual accounting and brings new benefits that finance teams wouldn’t be able to achieve otherwise, particularly in the areas of data access, analysis, and overall transparency. Let’s dive into the top accounting automation benefits.

1. Saves Time

Eliminating manual processes, such as data entry, transaction processing, bank reconciliation, and financial reporting, enables accounting teams to complete these repetitive tasks in a fraction of the time they once required. In the example of a monthly close, accountants would typically have to record all revenue, expenses, and adjustments from prior months, then reconcile them with all of the company’s accounts. It’s a painstaking process, even in the best of circumstances. Accounting automation software records all transactions and instantly cross-checks them with the appropriate accounts in real time, so the only task the accounting team needs to do at the end of the month is export that data into a report. Similarly, accounts payable automation allows businesses to automatically receive, route, pay, and reconcile all invoices. Often, the only human involvement needed is the actual approval of invoices, saving valuable time.

2. Increases Accuracy

By reducing or eliminating human involvement in common accounting tasks, automation removes the risk of errors being introduced and improves accuracy. For example, automated AP systems cut out the manual data entries that can result in typos and missing or duplicated records, while AR automation facilitates accurate billing and automatically receives and records payments. Together, they ensure that the business has the correct financial data needed for strategic decision-making. Automation also gives companies more flexibility in terms of how they handle their financial data. With manual processes and paper files, every time data is changed or moved, it presents an opportunity for mistakes to rear their heads. But with automation, accounting teams can record, move, and update information without risking its accuracy.

3. Improves Efficiency

Automating repetitive tasks and involving humans only when needed makes accounting operations all the more efficient. Take expense reporting, for example. In the typical manual process, an employee completes an expense report document, attaches it to an email along with their receipts, and then sends it all to their approving manager. The manager has to view each receipt and match it to the correct line item on the report before giving their approval and forwarding it to someone on the finance team. Then, the finance team member has to make sure all expenses comply with company policy and set the reimbursement process in motion—often another manual process involving payroll.

An automated expense reporting system streamlines this entire process. The employee can attach each receipt to its corresponding line item, cutting down the manager’s review time. From there, the system can automatically check the expenses against policy and, through integration with automated payroll software, add the reimbursement to the employee’s next paycheck.

4. Decreases Operating Expenses

By completing tasks more quickly, accurately, and efficiently with less human involvement,

accounting automation naturally reduces costs.

5. Speeds Scalability

Beyond operational benefits, automation provides businesses with an opportunity to do innovative things that truly move the needle. When finance teams don’t have to spend as much time on manual, repetitive tasks, they can spend more time partnering with other areas of the business to drive growth. For example, they can conduct in-depth AR reporting and analysis to uncover new sales opportunities, or they can pull payroll data to substantiate human resources’ staff retention strategy.

6. Enhances Security

Automated systems have full, real-time visibility into a company’s accounting processes, so they’re far better equipped to protect against security threats and fraud. In particular, automated accounting tools that use machine learning (ML) and AI can enhance security in ways that simply wouldn’t be possible using manual processes by monitoring transactions and spotting potentially suspicious anomalies that would go unnoticed by human security analysts or auditors. And when compared to using paper files, manilla folders, and metal storage cabinets, cloud-based software offers a far more effective way to store, organize, and secure data—especially in light of regulations that may require businesses to keep these records for a decade or more.

7. Eases Data Access

Automation allows accounting teams to quickly find and access the data they need, when they need it, because it eliminates having to look through multiple spreadsheets one at a time—or worse, poring through stacks of paper that may be stored in different offices or even different buildings. With automated accounting, users can search for data as easily as they search for files on their own computer. Most automated systems allow users to search by file name, document owner, creation or last modification date, or specific information, such as all files mentioning a specific customer. This turns a manual task that could have taken hours into one that takes minutes or even seconds.

8. Clarifies Audit Trails

Streamlined data access provided by accounting automation improves the auditing process. From a tax perspective, small businesses and self-employed individuals should keep their tax records for at least three years, according to the Internal Revenue Service. That’s a lot of paper documents to store in what likely isn’t a lot of physical space. Finding and making sense of all that information, as in the case of an audit, can be an arduous job. Accounting automation helps companies with their recordkeeping by creating clearer and more easily discoverable audit trails. For instance, instead of rifling through drawers looking for folders from a specific time frame—which often contain files and data that auditors don’t need, such as confidential customer information—finance teams can conduct targeted searches that provide auditors with the exact information they’ve requested.

9. Encourages Collaboration and Transparency

By serving as a centralized repository for all finance data with clearly defined workflows, automated accounting systems foster a culture of transparency and make it easier for multiple departments to collaborate. Going back to an example from earlier, automation eliminates the multiple rounds of emails typically involved in submitting, approving, and reimbursing expense reports. Having one unified, cloud-based system enables employees, their managers, and accounting teams to share and act upon data in real time in a standardized way.

Additionally, with automated accounting, finance teams can quickly create and share dashboards with relevant stakeholders, providing real-time visibility into the financial health of the business. There’s no more scrambling to export data from multiple systems and put together ad hoc reports whenever an executive has a question about specific metrics.

10. Enhances Reporting and Analysis

Using real-time dashboards generated by automated accounting systems, finance and other business leaders can make better, more proactive decisions and strategically plan for the future. Accountants and others in the finance department will benefit from enhanced reporting and analysis capabilities, because they make it easier to identify and act upon trends. Without automation, accounting teams usually have to wait until the end of the month or quarter to distill important insights. And sometimes those delays can be costly. Consider an unexpected drop-off in revenue that starts mid-month. If it’s not discovered until the monthly close, that’s over two weeks’ lost income—and it will be too late for the company to do anything about it.

11. Ensures Compliance

Automated reporting and analysis makes it easier for businesses to maintain regulatory compliance. Not only does automation provide real-time visibility into potentially noncompliant activity, such as a data leak, it helps finance teams accurately compile the documentation required to demonstrate compliance, such as for tax returns and financial statements. Companies can also use automated accounting systems to automatically enforce compliance with internal policies across various workflows. For example, if a junior manager tries to approve an invoice but only senior managers and above are allowed to do so, the system can reject and reroute the approval to the appropriate team member.

12. Improves Employee Morale

Despite fears that automation and AI will claim people’s jobs, these technologies actually have the potential to improve the work accounting teams do, for all the reasons mentioned above. In fact, the economy is expected to add 91,400 accounting jobs between 2023 and 2033, according to the Bureau of Labor Statistics. That’s a 6% increase, which is higher than that for the average job. There will always be opportunities for highly skilled finance professionals to help companies better serve their customers, improve their bottom lines, and grow. By eliminating repetitive, time-consuming tasks, automation frees accounting teams to do more valuable and interesting work, such as data analyses and customer service. This allows employees to be more engaged and energized about their roles and careers.

Accounting Functions That Can Be Automated

Accounting automation brings benefits to any customer-, employee-, or supplier-facing function that finance teams touch. Some areas are better candidates than others, however, based on their importance to the company and how impactful automation’s advantages can be. Here are the most salient accounting processes businesses should consider for automation.

- Accounts payable: AP automation helps accounting teams simplify the entire process of receiving, approving, and paying vendor bills. The technology enables companies to electronically receive invoices, automatically code them to the correct account, and route them to the appropriate person for approval. From there, it issues and records payments, updating analytics dashboards in real time.

- Accounts receivable: With AR automation, finance teams can streamline the process of issuing invoices and collecting payments. It allows businesses to send electronic bills for goods or services received, receive and record payments against the proper accounts, and automatically send reminders for late payments. AR analytics can also proactively identify customers that are at a high risk for nonpayment.

- Payroll: Payroll is one of the most important and time-consuming responsibilities in accounting. It involves multiple functions, including tracking employees’ time at work, calculating pay, and managing taxes. Automation brings these together, helping companies pay their workers accurately and on time.

- Purchasing: Automation makes it easier for customers to order, pay for, and receive products and services from a company. On the back end, it helps companies accurately track purchases and fulfill orders in a timely fashion. The data collected from automated purchasing systems allows finance teams to make more informed decisions about pricing and overall sales strategies.

- Expense reports: Through automation, businesses can take some of the sting out of the historically painful expense reporting experience—both for the employees who have to submit the reports and the accounting teams that must process them. Automation makes it easier to match expenses with their receipts, streamline the approval and reimbursement processes, and enforce company policies automatically.

- Tax preparation: Anyone who knows anything about accounting knows that tax season is the busiest and most stressful time of the year. Manual tax preparation is laborious, and the stakes are high. Errors and incorrect filings can lead to financial penalties, audits, and more. With its ability to calculate proper deductions, detect and correct errors, and reconcile accounts, automated tax prep takes much of this burden off finance teams.

- Bank reconciliation: Reconciliation isn’t important only at tax time. Matching a company’s books with its bank statements is crucial to accurate recordkeeping. But when a business has high transaction volumes and uses multiple bank accounts, manual reconciliation becomes a time-consuming and error-prone process. Accounting automation streamlines bank reconciliation by automatically importing bank statements and matching transactions with internal records, significantly reducing the amount of manual data entry and thus improving accuracy. The system flags discrepancies for review, integrates seamlessly with ERP systems, and provides real-time updates and comprehensive reporting, allowing finance teams to focus on strategic tasks, rather than on routine reconciliation processes.

- Procurement: Automated accounting systems can create purchase requisitions electronically, route them for approval based on predefined rules, and automatically convert them into purchase orders. These systems can integrate with supplier catalogs, allowing for real-time price comparisons and inventory checks. Payment processing can be scheduled and executed automatically, with transactions recorded in the general ledger without the need for manual data entry. This automation speeds up the purchasing cycle, enhances accuracy, and improves spend visibility.

Challenges of Automating Accounting Processes

Despite its many benefits, accounting automation can pose its share of challenges. Fortunately, most of these issues have to do with implementing new technologies and adapting to new ways of working, which businesses can overcome with proper planning and support from the outset. Here are some of the most common challenges associated with automating accounting processes.

- Change management: Although manual accounting tasks are time-consuming, employees may still be hesitant to move away from them. After all, resistance to change is part of human nature. Educate employees about how automation works and show them real-world examples of how it can make their jobs more engaging, interesting, and efficient.

- Training and adoption: Employees won’t know how to use all the new software and other systems that come with an accounting automation implementation. And that likely makes them less willing to make the technology part of their daily workflows. Provide targeted training so every member of the accounting team knows how to perform the tasks they used to perform manually and understand how much easier it is to perform them with automation.

- Security and regulatory hurdles: Centralized, cloud-based accounting systems provide significant security and compliance benefits over paper-based processes, but they also pose their own challenges. Any online system is at risk of cyberattacks. And although it’s rare, errors can still happen in automated systems, which can put businesses into regulatory noncompliance. Choose cloud-based automation tools that have built-in robust security and error-correction features to minimize these risks.

- Technology and integration challenges: For accounting automation to work successfully, it has to integrate with many other business applications. Legacy systems and outdated software can hinder seamless integration with modern automation tools, requiring significant upgrades or replacements. The need for data migration and consistency across different platforms can introduce risks of errors and discrepancies, so integration with existing business software ecosystems demands careful planning to ensure compatibility and avoid disruptions. Skip the painstaking do-it-yourself approach and choose a cloud-based system that easily integrates with all accounting-related software.

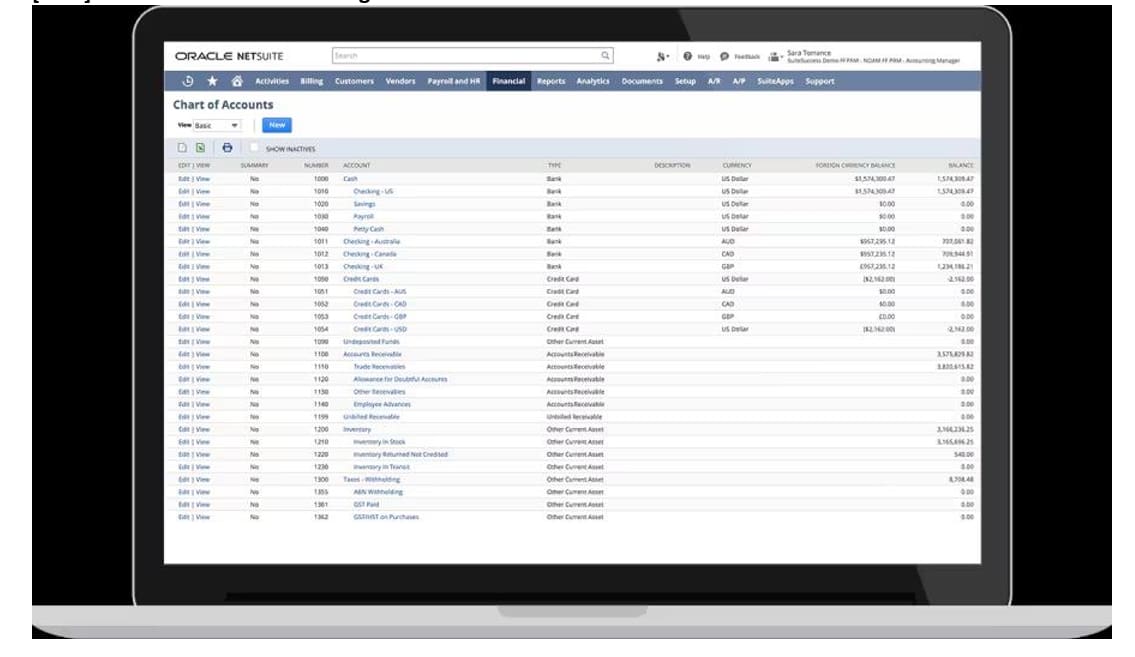

The Right Accounting Software Makes Automation Easy

Cloud-based, AI-powered accounting automation software helps businesses improve their financial controls, close the books faster, and produce more accurate reports that yield deeper insights. NetSuite Cloud Accounting Software tames common, repetitive tasks, including the monthly and quarterly close processes, accounts payable, accounts receivable, and bank reconciliation. And it provides real-time data, so accounting teams can make informed strategic decisions, quickly identify and resolve issues, and maintain regulatory compliance. Accountants, CFOs, and small-business owners rely on NetSuite for a complete view of their cash flow and overall financial health.

Automation isn’t just a helpful technology; it has become an essential business strategy that transforms the way organizations handle their financial operations. With its unparalleled efficiency, accuracy, and scalability, automation allows accounting teams to shift their focus from routine tasks to higher-value activities, such as in-depth data analyses and strategic planning, that drive business growth. Beyond the immediate benefits of cost savings and improved compliance, automation provides real-time visibility into financial data, enabling faster, more data-driven decision-making across all levels of the organization. This enhanced capability helps companies identify trends, spot opportunities, and address minor issues before they become problems.

As businesses adopt more sophisticated tools powered by AI and ML, greater accounting automation benefits loom on the horizon. These technologies will continue to streamline processes and create entirely new opportunities to improve financial planning and analysis, including AI-driven audit processes and automated financial planning scenarios that can adapt to changing market conditions in real time. By embracing automation today, companies are setting themselves up to hold a competitive advantage well into the future.

Accounting Automation FAQs

What are the benefits of technology in accounting?

The benefits of technology in accounting are derived from the automation of repetitive tasks. Accounting automation saves time, increases accuracy, improves efficiency, decreases operating expenses, enhances security, and provides easier data access and clearer audit trails.

What is the objective of automation in accounting?

The objective of automation in accounting is to complete traditional manual tasks more efficiently, accurately, and securely, freeing up finance professionals to perform more advanced work. Businesses use automation to help with accounts payable and receivable, payroll, expense reporting, and more.

How can AI help in accounting?

AI can help in accounting by automating processes, analyzing and reporting on financial data, and identifying and correcting errors to ensure compliance.