Closing the books is a critical accounting process for many reasons. Namely, doing so leads to the creation of all-important financial statements that guide strategy and help an organization's leaders measure progress against business goals, calculate cash flow projections and make budgeting decisions. Key stakeholders outside of the company — such as analysts, investors, auditors, lenders and regulators — also look to these statements to understand a company's financial position.

But as any accounting will tell you, the financial close process is a painstaking process. At many companies, finance teams gather at the end of the month, quarter and year to wrangle transactional details to arrive at a single version of the financial truth.

What Is the Close Process?

The financial close process involves recording all of a company's financial activity over a given period of time. The close process takes place at regular intervals — typically at the end of the month, quarter and year. The end result is a series of financial statements that provide an accurate picture of an organization's financial health.

Businesses often feel pressure to close the books and create financial statements quickly, but the desire for speed must be balanced with the need for accuracy. Some companies struggle with dispersed or inaccessible data, manual processes and lack of standardization, which can complicate and drag down the close process. However, the most effective companies create standardized procedures and take advantage of automated accounting software to streamline the financial close process and improve accuracy.

Key Takeaways

- The financial close process is an essential business activity that produces timely, accurate records of an organization's financial performance during a particular accounting period.

- The close process takes place at regular intervals — usually monthly, quarterly and annually.

- Key internal and external stakeholders rely on the financial data resulting from the financial close process to perform analyses and make strategic decisions.

- Financial software and other automation tools streamline many of the tedious aspects of the close process, reduce errors and free up accounting teams to focus on higher-level work.

Close Process Explained

The financial close is a critical business process that leads to the delivery of financial statements, which reflect a business's financial position during a given accounting period. The purpose of the close process is to set financial records in stone.

Closing the books at a regular cadence — monthly, quarterly or yearly — is necessary for effective business management and success. The financial statements produced during the close process are especially valuable when they provide accurate and timely insights, which demands painstaking attention to detail within a narrow window of time. For organizations that don't use effective technology and streamlined processes, closing the books can be a labor-intensive, inefficient and fragmented exercise.

Why Is the Close Process Important?

Closing the books is an essential activity for any business, since it creates a consolidated and accurate record of financial activity over a particular reporting period. Both internal and external stakeholders rely on the financial statements that the close process generates:

- Business leaders, board members and managers require regular, accurate accounting of financial activity to conduct financial analyses, forecast expenditures, manage budgets, generate key performance indicators (KPIs) and benchmark their companies' financial performance against competitors.

- External stakeholders, such as investors, lenders and analysts, look to the financial statements produced during the close process to assess a company's financial performance. And government agencies can require companies to provide certain financial information during the close process to comply with regulations.

The financial close process is so important to many businesses that they track the cycle time for closing the books as a KPI for the finance group. The goal is not only to provide this critical information in a timely manner to inform decision-making, but also to free up accounting resources to perform higher-value work.

10 Steps for the Close Process

The specific tasks involved in the month-end close process can vary from company to company, depending on the type of accounts and transactions involved, plus industry standards and regulatory requirements. However, the process generally follows a common workflow that comprises these 10 steps.

1. Record All Revenue and Incoming Cash

As a first step, the accounting team will record any money that's earned during an accounting period, taking into consideration all revenue sources — everything from product sales to consulting services — and looking for any loose ends to tie up. For example, if the company failed to invoice a customer for work done during the accounting period or a client has neglected to make a payment, those issues will need to be addressed and properly recorded.

2. Update the Accounts Payable

In conjunction with recording revenue, the accounting team will also need to record any expenses that were incurred during the accounting period, including payroll, contractor payments, notes payable interest expenses and taxes. At this stage, the team will make sure to cross-check these liabilities with those recorded in the general ledger and ensure every expense has been accounted for.

3. Review Balances and Adjustments From the Prior Period.

In addition to making sure all financial activity from the current period has been recorded, the accounting team will want to examine balances and adjustments from the prior period for incurred expenses and prepaid assets. For example, if a business paid its six-month insurance premium in January, it is recorded as a prepaid asset and amortized through June.

4. Reconcile All Accounts

Next, it's time to reconcile all business accounts, including cash, checking and savings accounts, credit cards and prepaid accounts. Cash is often the easiest to process, since shortfalls or overages can be quickly identified and corrected. At this stage, accountants will cross-reference statements with receipts, bank records and any other outside sources. Some businesses may have intercompany accounts, so it's important to ensure that payables and receivables match between the various business entities.

5. Manage Fixed Assets

Fixed assets, such as equipment, vehicles and property, add long-term value to the business, so accounting will need to record any depreciation or amortization related to these assets.

6. Review Inventory

Similarly, inventory must be factored into the financial close process. Periodically, the inventory noted in the accounting records will need to be reconciled with a physical count of items.

7. Assemble Financial Statements

The next step in the financial close process involves preparing financial statements. This can be done with a spreadsheet or, ideally, by using automation software. Financial statements include an income (or profit and loss) statement, cash flow statement and balance sheet.

8. Conduct a Pre-close Review

Financial statements should be reviewed by the accounting team and key stakeholders. To ensure that the assessment is unbiased, reviews should be conducted by those not actively involved in the close process.

9. Finalize Reports

Once the proposed financial statements have been reviewed, the accounting team can complete any necessary reporting for management and pull together any documentation required for auditing and regulatory reporting.

10. Prepare for the Next Close

The accounting team will close the books to reset income statement accounts to zero and lock in balance sheet accounts at the end of the period. The finance team can address any issues or concerns that arose during the close in order to improve and streamline the process for the next accounting period.

Close Process Challenges

The financial close can be a grind, given the requirements to deliver accurate results on time and in compliance with all internal policies, accounting standards and regulatory requirements. Businesses that have not created standardized processes or invested in automation software typically find the process especially stressful. Some of the major challenges of the close process include:

- Lack of standardization and interdepartmental cooperation. Accounting teams need accurate data to create reliable financial statements. If a business has not developed clear processes to produce that data companywide, then, for example, finance teams charged with closing the books may have to chase down information from other departments.

- Ensuring accuracy. Financial statements are only as reliable as the data used to produce them. Organizations with more manual processes for tasks like customer invoicing and expense reporting may be more likely to encounter errors when closing the books. Moving away from error-prone spreadsheet calculations and using automated processes can improve accuracy.

- Time pressures. Closing the books can be a time-consuming process, yet the sooner the organization's leaders have access to financial insights, the better. Managing the tension between meticulous review and the need for speed can be tough to balance.

- Data issues. Missing or low-quality data can plague the financial close process. Inaccurate invoices, unrecorded payments, duplicate or incomplete data can cost a business time during the financial close.

- Disparate systems. Many organizations use a variety of software programs in different parts of the organization, creating challenges for the accounting team in tracking down the data required to close the books. Lack of integration among systems increases the likelihood of errors and delays.

- Insufficient resources. The close process involves several repetitive tasks, including double-checking data. Businesses that lack the right tools to streamline tedious tasks will experience more strain during the close process, and the resulting financial analysis could be at risk for more errors and delays.

Close Process Best Practices

Creating an effective financial close process is important. Companies can adopt a number of best practices to elevate their performance and streamline the process.

- Never forego accuracy for speed. Closing the books can be time-consuming, and finance teams face significant pressure to produce an analysis quickly. However, financial statements are so integral to decision-making that accuracy must be a top priority. While the financial close process can take a week or longer, organizations that automate most tasks close their books within four to six days after the period ends — and they don't sacrifice accuracy for speed.

- Focus on efficiency. Accounting teams should streamline the close process as much as possible to stay on schedule. To make the process more efficient, businesses can set realistic timelines, proactively offer solutions to common challenges and remove roadblocks. They can also embrace process improvements, like continuous accounting, using technology to perform close tasks on a daily or weekly basis, rather than completing all transactions at the end of the accounting cycle.

- Create and enforce standard accounting procedures. Creating well-documented, step-by-step procedures ensures that the financial close process goes smoothly. This should include a standardized process for collecting the data that feeds into the financial close, including inventory valuations and expense reports.

- Invest in automation. The more manual steps a company takes, the longer the process takes and the more opportunities for human error while entering data or making calculations in spreadsheets. Finance teams can take advantage of advancements in financial software that enable them to collect data, perform calculations and produce reports more quickly and accurately.

- Streamline data access. To close the books, the accounting team will need access to data from across business units. Giving authorized users on the finance team secure access to this data will allow them to gather information when they need it.

- Consider continuous accounting practices. Many organizations have seen value from implementing continuous accounting to perform several transactions in the financial close process throughout the accounting period, rather than waiting until it ends. Tasks like reconciling accounts are integrated into day-to-day activities. This more evenly distributed workload can reduce stress for employees, decrease errors and provide managers with more up-to-date financial information throughout the accounting period.

- Create a collaborative working relationship with other departments. Finance leaders can foster strong partnerships within the organization to ensure that other departments understand the importance of the financial close and cooperate with providing the necessary data.

- Improve the close process over time. Holding team meetings post-close can be helpful to review which procedures worked and which didn't. The team can assess its performance, relying on KPIs like cycle time, and discuss what can be done to improve the efficiency of the process in the future.

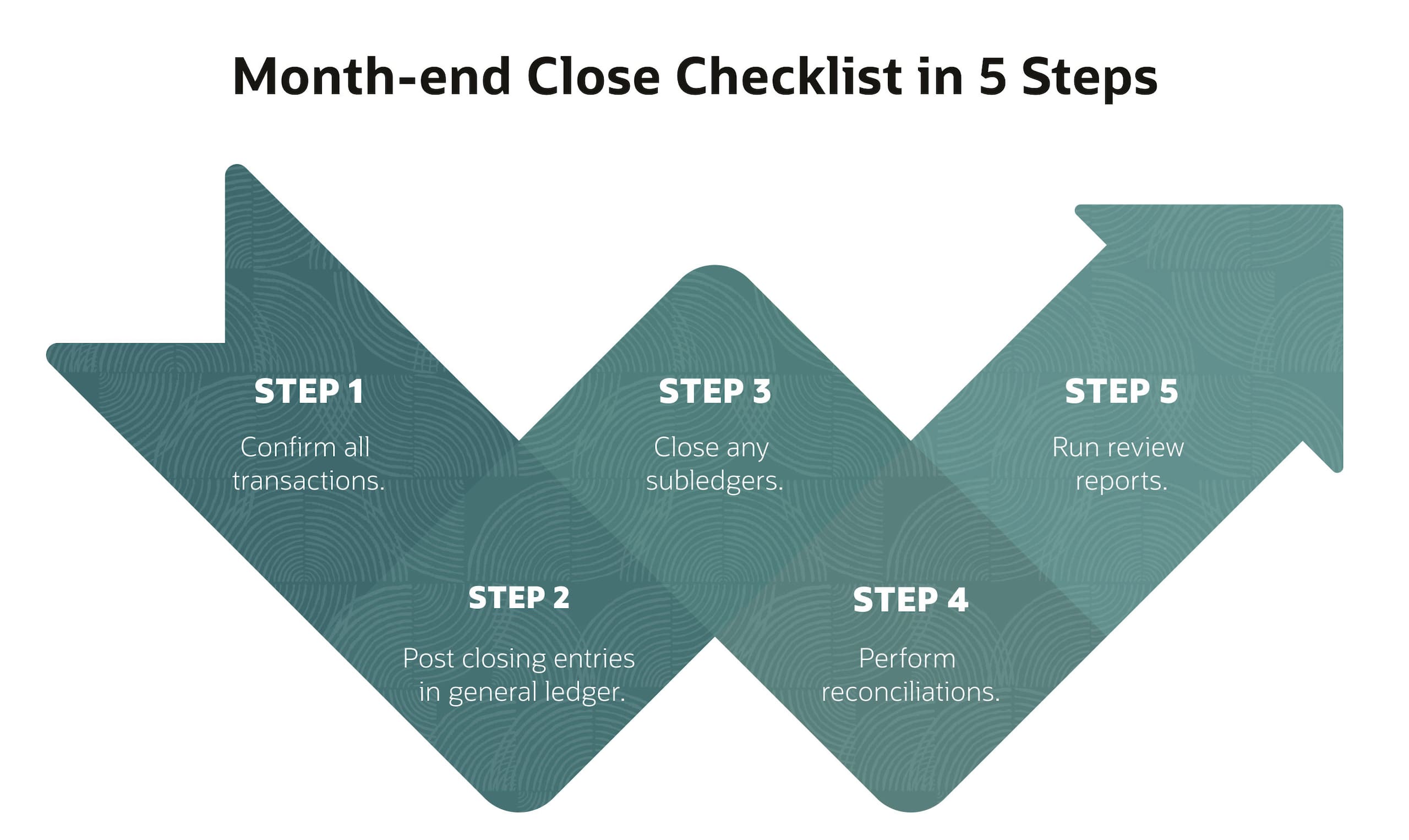

Close Process Checklist

Just like the old carpentry proverb says to measure twice and cut once, it's important to check and recheck data to make sure nothing gets missed. The close process is complex, and completing all the necessary steps in a matter of days can create significant pressure. The checklist below can help to ensure that no tasks are inadvertently skipped along the way.

Confirm all transactions.

The accounting team will want to ensure that all timesheets and expense reports have been submitted and approved, verify that all accounts payables (AP) bills and accounts receivable (AR) invoices are compiled in the accounting system, generate all recurring invoices, record all invoice payments and post all credit and debit card transactions.

Post closing entries in general ledger.

The general ledger consists of raw accounting entries that record all business transactions in sequential order by date. The accounting team will post depreciation, amortization or other expenses and revenue; include accruals, deferrals and reversals; review revenue recognition; and ensure the accuracy of all records.

Close any subledgers.

The accounting team will close all subsidiary ledgers.

Perform reconciliations.

The accounting team will reconcile all bank statements, charge accounts, prepaid accounts, fixed assets, deferred revenue accounts and inventory. They will need to reconcile AP aging and AR aging reports with the subsidiary ledger, as well as reconcile the subledger with the general ledger.

Run review reports.

Before finalizing the financial close, the accounting team will run the financial statements, including the income statement, balance sheet and cash flow statement, and perform a variance analysis to review the difference between planned and actual numbers.

Tips to Make the Close Process More Efficient

Organizations often struggle through an ineffective and disorganized financial close process every month. However, businesses can take steps to eliminate some of the challenges for their accounting teams and enable the quicker delivery of financial statements. Here are some actions that companies can take to streamline the close process.

-

Identify the bottlenecks:

The first step is to look at the current accounting procedures to identify pain points. Is the accounting team waiting until the end of the month to perform account reconciliation? Do employees and vendors have to complete multiple manual tasks to submit invoices and expense reports? Once the organization has pinpointed the main bottlenecks, it can begin to address them by, for example, adopting continuous accounting practices or instituting standard operating procedures to handle invoices and expense reports.

-

Use templates and checklists:

Assuming everyone knows what their responsibilities are and what tasks must be completed can be a recipe for a rough financial close. The most effective financial close process includes standard accounting procedures and clearly defined roles. Accounting leaders can document the steps in the process, then assign responsibilities and deadlines to employees. Creating templates and checklists to ensure everyone involved in the close process follows specific, clear processes can increase productivity and reduce errors.

-

Consolidate all transaction categories:

Closing the books requires data from every department that influences revenue, from sales to shipping, as well as information on fixed assets and inventory. Waiting for information from other departments and gathering data from disparate systems can lead to delays and frustration. Organizations can reduce this friction by:

- Centralizing transactions in a single location. Accounting software solutions can pull data from different systems and consolidate transactions in one place. Using a single system makes it easier for the accounting team to obtain necessary financial information on demand, generate reports and close the books more quickly and accurately.

- Opening access to information. Organizations can also give authorized accounting users direct and secure access to systems where transactional data is stored so they don't have to rely on other departments for information.

-

Back up the data:

Loss of financial data can have a devastating impact on the financial close process. Paper-based financial processes can exacerbate this risk. Using digital accounting software provides greater protection, and companies can back up data securely in the cloud.

-

Implement account period cutoffs:

Accounting teams should specify a date that signifies the end of the current accounting period, so any transactions that occur afterward are carried forward to the next period. Communicating and enforcing these cutoff dates companywide prevents situations where the accounting team has to wait on late-arriving invoices, expense reports and other documents.

-

Automate your accounting cycle:

Automating as much of the accounting cycle as possible is a powerful way to save time and prevent errors during the close process. Accounting software can automate numerous tasks, including journal entries, account reconciliations, variance analysis and intercompany transactions.

How to Close With NetSuite

Accounting teams that are tired of chasing down information, manually entering and re-entering data, and wrangling with spreadsheets every month can take advantage of enterprise tools that remove many of the headaches involved in the financial close process. With NetSuite Financial Close Management, businesses can significantly improve the financial close process by implementing business accounting technology, like cloud-based financial management software that can integrate with other enterprise resource planning (ERP) software, including NetSuite ERP.

NetSuite financial management and accounting software automates much of the financial close process, which eliminates major pain points and also helps to increase the timeliness and accuracy of financial reporting. The accounting team can manage revenue recognition, depreciation and other key accounting procedures within a single system, improving access to the data they need, as well as facilitating the flow of financial information across the organization. In addition real-time dashboards provide up-to-date financial information to inform business strategies.

Businesses need to be meticulous about the financial close process to make sure the data is accurate, yet at the same time companies are eager to complete the process swiftly, since they rely on the resulting financial statements to make strategic decisions.

Finance leaders can create a more efficient financial close process by taking advantage of leading-edge technology, process automation and best practices. Accounting software, as part of an integrated ERP system, can accelerate the financial close process, increase the accuracy of the analysis and free up the organization's accounting professionals to focus on higher-level planning and analysis.

Close Process FAQs

What is a monthly close?

A business's monthly financial close refers to all the financial and accounting tasks that take place leading up to, and including, closing the books for the preceding month.

What is important in a monthly closing process?

The financial close process creates a consolidated and accurate record of financial activity over a particular accounting period that many stakeholders rely on to make decisions. The accounting team must perform these accounting procedures and produce the resulting financial statements in a timely and reliable manner. As such, the most critical aspects of the monthly reporting process are accuracy, efficiency, speed and repeatability. If tension exists between accuracy and speed, then accuracy must win. However, accounting procedures can be streamlined and automated so that accounting teams are less likely to have to sacrifice one for the other.

How long should a month-end closing process take?

How long it takes to close the books depends on the business and industry, the complexity of its financial situation, the size and experience of its accounting team, and the software and tools it uses to perform the associated accounting procedures. A financial close can take a week or longer to perform, but organizations that automate most tasks close the books within four to six days after the period ends.

What are the 10 steps in the closing process?

The specific tasks involved in the month-end close process may vary from company to company, depending on the type of accounts and transactions, industry standards and regulatory requirements. However, the process generally follows these 10 steps: recording all sales/revenue and accounts receivable transactions, updating accounts payable, reviewing balances and adjustments from the prior period, reconciling all accounts, reviewing fixed assets, recording inventory valuations, assembling financial statements, conducting a preclose review, finalizing reports, and closing accounts and preparing for the next close.

What is the goal of the closing process?

The goal of the closing process is to set in stone a single version of the financial truth for a company. The financial close includes the accounting procedures involved in recording a company's financial activity over a given accounting period. The close process takes place at regular intervals — typically at the end of the month, quarter and year — and produces financial statements that provide an accurate picture of an organization's financial health.