Everyone knows that sinking feeling when they look at their paychecks and see a big chunk of change deducted for Uncle Sam. For businesses that handle payroll manually, calculating employees’ payroll taxes typically elicits the same level of enthusiasm. But even if they outsource the critical task to a payroll service or use an automated payroll system, employers should still understand the different types of taxes to withhold, which ones they must contribute to or pay in full out of their own revenue and the basic calculations.

What Is Payroll Tax?

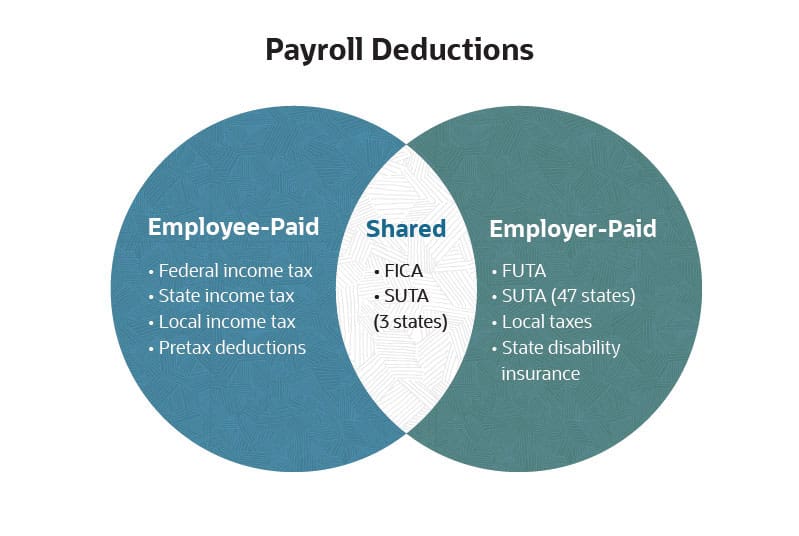

Payroll tax is a catchall term that includes all of the taxes paid on employee wages. There are two types, employee-paid taxes and employer-paid taxes.

- Employee-paid taxes: These are the taxes an employer withholds from employees’ paychecks to remit to the government on the employees’ behalf. They include federal, state and local payroll taxes.

- Employer-paid taxes: These are the taxes an employer pays to the government out of the employer’s own revenue, such as unemployment taxes and half of Medicare and Social Security taxes.

Key Takeaways

- Every employee must pay payroll taxes, including federal and state income taxes, Social Security and Medicare.

- Employers are responsible for withholding payroll taxes from their employees’ paychecks and sending the money to the government.

- They must also match certain tax contributions, such as for Social Security and Medicare, and pay for others entirely.

- Calculating payroll tax is a multistep process that follows one of two methods.

Calculating Payroll Tax Explained

When a business pays its employees — whether they are salaried and paid by the hour — it withholds a portion of their taxable income and sends the funds to the government on their employees’ behalf. The business is also required to pay specific payroll taxes out of its own revenue for every employee. Payroll taxes include:

- Federal income tax. This tax is based on a percentage of an employee’s gross income less pretax deductions, such as for medical benefits. Employees are solely responsible for paying federal income tax.

- FICA tax. FICA stands for the Federal Insurance Contributions Act. This is a tax for Social Security and Medicare. The employer must match the same amount that its employees pay with money from its own revenue.

- FUTA tax. FUTA stands for the Federal Unemployment Tax Act. Employers are 100% responsible for paying this federal tax, which is used for unemployment insurance and to fund state employment agencies.

- State and local income taxes. Forty-one states collect income tax from workers. Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming are the exceptions. Whether local taxes are collected depends on where an employee lives.

- SUTA tax. SUTA stands for the State Unemployment Tax Act. This is a state tax that only employers pay, except in Alaska, New Jersey and Pennsylvania, where employees are partially responsible and employers remit on their behalf.

- State disability insurance. A few states — California, Hawaii, New Jersey, New York and Rhode Island — require employees to make payroll contributions for programs that support employees if they become disabled while employed at their jobs. Employers are not required to contribute to state disability insurance.

Of note, businesses are not responsible for handling payroll taxes for independent contractors. IRS Publication 15-A(opens in a new tab) provides guidance on determining whether a worker is an employee or an independent contractor, though generally speaking anyone who gets a Form W-2, Wage and Tax Statement, is an employee.

How to Calculate Payroll Tax

When first starting out with just a few employees, a company may handle payroll, including calculating payroll taxes, manually. But as the business grows, it will likely become more practical to outsource the job to a third-party payroll service or turn to software that automates the payroll process and scales with the business.

Still, it’s a good idea for any business to understand the costs behind and the basics of calculating payroll tax, at the very least so they can accurately budget for payroll. The first step is to determine the percentage of an employee’s wages that must be withheld for income taxes. Then FICA and FUTA taxes have to be calculated (more on this later).

Federal income tax withholding is calculated using one of two methods: the wage bracket method or the more complicated percentage method. Both require information from an employee’s Form W-4, Employee’s Withholding Certificate, and their gross pay.

Wage Bracket Method

The wage bracket method is used to determine withholdings for salaries up to $100,000. It is based on an employee’s marital status and pay period. The wage bracket method relies on wage bracket tables to determine the exact amount of income taxes to withhold. The specific calculation steps depend on whether the employee’s W-4 was issued before or after 2020. It’s important to note that each main step comprises a series of “mini” steps, as well. (IRS Publication 15-T(opens in a new tab) drills down on each.)

For W-4s from 2020 or later, the four main steps to calculate payroll taxes are:

- Adjust the employee’s wage amount. The employee’s adjusted wage amount is calculated based on the employee’s total taxable wages for the payroll period and the number of payroll periods the employer has per year.

- Figure the tentative withholding amount. This is calculated by using the employee’s marital status and the employer’s payroll period to determine which wage bracket method table to use in Publication 15-T.

- Account for tax credits. The employee may be eligible for tax credits listed on their W-4, such as the child tax credit or the earned income tax credit, which lessen how much tax is owed for the current pay period.

- Figure the final amount to withhold. This step adds any taxes to be applied based on elections the employee made on their W-4 to withhold additional taxes, such as for pension or annuity payments.

For W-4s from 2019 or earlier, the two main steps to calculate payroll taxes are:

- Figure the tentative withholding amount. This is found using the employee’s marital status plus the employer’s pay frequency to determine which wage bracket method table to use. It’s then calculated using the employee’s total taxable wages and withholding allowances.

- Figure the final amount to withhold. This step adds any taxes to be applied based on the election to withhold additional taxes on the employee’s W-4.

Percentage Method

The percentage method is used when an employee’s annual wages exceed the maximum amount found in the wage bracket method tables. This requires more calculations than the wage bracket method so is used more frequently by employers working with automated payroll systems or third-party payroll service providers. Like the wage bracket method, the steps for calculating payroll taxes using the percentage method depend on whether a W-4 was issued pre- or post-2000. In either case, the main steps are mostly the same, though there are more smaller steps. (Again, IRS Publication 15-T(opens in a new tab) lays out the specific details of each step.)

Components of a Pay Stub

A pay stub is typically attached to an employee’s paycheck (digital or paper), detailing wages, the amount withheld for payroll taxes and the number of hours worked. Employers have some freedom to choose what to put on their employees’ pay stubs, but individual states may have specific requirements by law.

A typical pay stub contains the employer’s name, the employee’s name and Social Security number, the pay period, number of hours worked, overtime and tips if applicable, and gross and net pay. It also lists withheld income taxes — federal and, if applicable, state and local income taxes — Social Security and Medicare (FICA), unemployment tax (SUTA) and state disability insurance. In addition, voluntary deductions are itemized, such as for a 401K plan, healthcare plan and life insurance. All dollar amounts are presented two ways: per check and year to date.

Wages

Wages are monetary compensation that employers pay employees in exchange for services performed over a specific time period. Wages typically include an employee’s salary, vacation pay, bonuses and commissions — all of which are subject to payroll taxes. Other types of taxable compensation are employee stock options, health savings accounts and transportation benefits.

Income Tax Withholding

Income tax is precisely what it says: tax on income, which employers withhold from employees’ paychecks and remit to the government on their workers’ behalf. Employers are not required to withhold income taxes for independent contractors, who must pay them on their own. Employers calculate federal income tax withholdings using either the wage bracket method or the percentage method, as described above.

FICA Withholding

The Federal Insurance Contribution Act (FICA) requires employers and employees to split the cost of taxes that go to Social Security and Medicare. Employers typically withhold 6.2% of their employees’ wages for Social Security and 1.45% for Medicare, match the amount from their own revenue and remit the total to the federal government. FICA is reported annually on Form 941(opens in a new tab), Employer’s Quarterly Federal Tax Return, and is due on the last day of the money following each quarter. The IRS has special rules to determine when the tax payment needs to be remitted.

FUTA

The Federal Unemployment Tax Act (FUTA) requires businesses to shoulder the cost of unemployment insurance — 6% of an employee’s wages up to $7,000 annually. The amount comes out of the company’s revenue. Most states offer up to a 5.4% FUTA tax credit, which means employers wind up paying only 0.6%. FUTA is reported quarterly on Form 940(opens in a new tab), Employer’s Annual Federal Unemployment (FUTA) Tax Return, and is due on the last day of the month following each quarter.

Deductions

Withholdings are sometimes confused with deductions. Withholdings are taxes like income tax, social security, and medicare that employers deduct from their employees’ paychecks and remit to the government. Generally, the IRS determines the amounts withheld. Deductions, on the other hand, refer to employee-elected and paid-for benefits and donations, such as for health care and retirement plans. Employers take the amounts out of employees’ paychecks before calculating their taxes. Doing so lowers a person’s income, which may reduce the amount of income tax they have to pay.

Pay Schedule

A pay schedule — also called a payroll schedule — establishes how often a business pays its employees. The four most common types are weekly, biweekly, bimonthly and monthly. Some state laws regulate when an employer is required to pay its employees, so options for payroll schedules in those states are more limited. For example, New York’s Department of Labor has a mandatory minimum requirement that manual workers are to be paid on a weekly basis.

Local Factors

Local payroll taxes — also known as municipal taxes — are based on where a business’s employees work and live. They’re collected only in states that collect a state income tax and go toward funding schools, community improvements and other local endeavors. Whether employers are required to contribute to their employees’ local payroll taxes depends on the municipality, so it’s important to check with local tax departments.

How to Calculate FICA

The FICA tax funds Social Security and Medicare. Employers withhold the dollar amount their employees must pay, match that amount and remit the entire payment to the IRS.

- Social Security. Employees are required to pay 6.2% of their taxable income for Social Security. For example, if an employee earns $1,000 in one paycheck, the employer withholds $62 and adds another $62 out of its own revenue, for a total of $124 sent to the IRS. In 2022, annual Social Security contributions were capped once an employee earned $147,000; in 2023 the cap has been increased to $160,200. This maximum amount is called a wage-based limit.

- Medicare. Employees are required to pay 1.45% taxes for Medicare, and the employer must match that amount. Otherwise, the deduction works the same as it does for Social Security. If an employee earns $1,000 in a paycheck, the employer withholds $14.50 for Medicare, matches the same amount from its revenue and remits a total of $29 to the government. For any employee who makes over $200,000, the employer is required to withhold from the employee an additional 0.09% in income for Medicare — but it doesn’t have to match the amount.

How to Calculate FUTA

FUTA taxes are employer-paid payroll taxes — employees do not contribute. Employers are required to pay 6% in taxes on each of their employees’ first $7,000 in wages. Most states have a FUTA credit of 5.4%, so employers wind up paying only a 0.6% FUTA tax per employee.

Stop Stressing About Payroll With NetSuite Financial Management

Employers always have the option to manually calculate payroll taxes, but the more employees a business has and the higher their salaries are, the more complicated, time-consuming and error-prone the payroll process becomes. Keeping track of the due dates for all the different kinds of payroll tax can also be a burden on employers, which face up to a 15% penalty for remitting taxes late.

These are some of the reasons why many employers choose to use automated payroll software, namely NetSuite’s SuitePeople Payroll. The SuitePeople Payroll System significantly reduces the amount of time it takes for a business to run payroll, calculating how much in payroll taxes should be deducted from employees’ paychecks and then matching and/or remitting the funds to the government on time. The solution is configurable to a business’s payment schedule, handles direct deposit and creates payroll reversals, if necessary. It also displays detailed payroll data on easy-to-read dashboards and, like NetSuite Financial Management, automatically updates the general ledger in real time.

Calculating payroll taxes can be complicated. Whether a business handles the job manually, outsources it or turns to an automated payroll system, the business will need to understand exactly how much in payroll taxes it’s responsible for, both for compliance and its own financial purposes. This knowledge is also important to be able to answer employees’ questions about their paychecks.

Payroll Tax Calculation FAQs

What is employee payroll tax?

Employee payroll tax includes contributions to federal, state and local income tax, as well as Medicare and Social Security. Employee payroll taxes are withheld by their employers, who remit the funds — at times, matching them — to the government on their employees’ behalf.

What is payroll tax percentage?

The payroll tax percentage is the percentage of an employee’s wage that is collected for payroll tax. The actual percentage varies depending on the type of payroll tax and the employee’s tax bracket.

What is the formula for calculating payroll tax?

The formula for calculating payroll tax depends on which payroll tax is being calculated. The dollar amount will depend on an employee’s gross pay less their deductions. From there, the specific payroll tax percentage is applied.

How do I manually calculate payroll taxes?

Federal income taxes can be calculated manually using either the wage bracket method or the percentage method. The wage bracket method uses referencing tables to determine withholding for employees with salaries under $100,000; it is the simpler method of the two because no additional calculations are required. The percentage method is used by employers that outsource their payroll systems or use automatic payroll programs to calculate withholdings.

How much payroll tax is taken out of my paycheck?

The amount of payroll tax taken out of a paycheck depends on your gross pay. For Social Security, you’ll owe 6.2% of your gross wages up to $147,000. For Medicare, it’s 1.45%, plus an additional 0.09% if you earn over $200,000.

What is the percentage of federal income tax withheld?

The percentage of federal income tax withheld depends on what tax bracket an employee’s wages fall under. The percentage starts at 10% and rises along with salary.