Payroll management is a key component of any business’s operations, one that directly affects both the employer’s and employees’ financial well-being. But calculating payroll can be a tedious, time-consuming process because of the host of factors that influence payment methods at every level — from industry to position, and even to individual employees. Because of this, businesses must carefully consider how every payroll decision they make will impact both their own bottom line and their employees’ bank accounts. This is especially true during tight or volatile economic periods, when competitive wage rates and labor costs can fluctuate quickly, such as during the dramatic spikes and drops in median income that occurred between 2020 and 2023, according to U.S. Bureau of Labor Statistics and St. Louis Fed data.

As businesses evaluate the financial nuances of their payroll systems, they must also maintain compliance with all relevant tax and labor regulations. At the heart of these complexities is one central metric — net pay. This article will explore net pay, how to calculate it, how it affects employers and employees, and more.

What Is Net Pay?

Net pay is the amount of money employees receive after their employer subtracts taxes, benefits, retirement contributions and any other mandatory or voluntary deductions from their gross pay. For this reason, net pay is commonly referred to as take-home pay. Businesses must understand the ins and outs of calculating net pay, as employers are typically responsible for accurately subtracting these deductions. Whether the payroll team is made up of in-house experts or staff aided by payroll software, or is outsourced to a third-party service company, businesses must follow all local, state and federal regulations. If payroll errors occur, companies may face time-consuming error analysis, eroded employee trust and/or financial and legal penalties.

Companies should be aware that some people and financial documents refer to net pay as net income. However, net income may also refer to the overall revenue left over after a business pays its obligations for a financial period, as shown on the bottom line of the income statement. This article only focuses on the net pay that employees earn from their work.

Key Takeaways

- Net pay is the compensation employees receive after their employer subtracts all deductions. Many businesses rely on payroll software or third-party service providers to simplify payroll management.

- To calculate net pay, payroll staff starts with an employee’s gross pay and subtracts all deductions, including taxes and healthcare and retirement contributions. Employers must diligently follow rules dictating which deductions are post-tax and which lower an employee’s taxable income.

- Understanding net pay is essential for both employers and employees. Employers must comply with legal standards, while employees rely on net pay for their financial well-being and for its contribution to their job satisfaction.

Net Pay Explained

Understanding net pay is vital to both employees’ financial health and a business’s ability to manage the payroll process. Employees base their budgeting and financial planning on their net pay, as it represents their real spending power. A new employee, for example, should realize that a weekly salary of $1,000 does not typically translate to $1,000 in their bank account at the end of every week. By knowing what impacts their net pay, employees can set realistic paycheck expectations and budget and plan accordingly.

Employers, meanwhile, need to understand net pay to accurately contrast budgeted labor costs with direct effects on employees’ financial well-being and morale. Though businesses will have limited say with regard to some deductions, such as Social Security and other taxes, they can influence net pay through the voluntary employee options they offer, including retirement contributions and healthcare costs. With clear policies and transparent net pay calculations, employers can work together with employees to balance labor costs with overall employee satisfaction.

Net Pay vs. Gross Pay

To calculate net pay, businesses start with another payroll metric — gross pay. Gross pay is an employee’s total compensation before any deductions are taken. Total gross pay includes wages, salaries, overtime pay, commissions, bonuses, tips and any other supplemental income; it does not include mandatory deductions, such as taxes. To calculate gross pay, employers must follow some legal standards, including minimum wage and overtime rules. Gross pay is often used by businesses and workers as the starting point for salary negotiations, job listings and pay comparisons. In contrast, net pay subtracts deductions, reducing gross pay to the amount of money the employee will take home in a paycheck or by direct deposit.

When discussing compensation and resolving conflicts, all parties should be sure they’re using the same metrics to minimize misunderstandings. Employees and employers can locate gross and net pay amounts on a pay statement or pay stub. Gross pay typically sits above the list of deductions, while net pay sits below. Together, these metrics give a more detailed view of pay than either measure alone can provide.

The Differences Between Gross and Net Pay

| Gross Pay | Net Pay | |

|---|---|---|

| Purpose | Show an employee's total compensation. | Shows the amount an employee takes home after subtracting all deductions. |

| Includes | Wage based on an hourly rate or salary plus any additional earnings. | Gross pay minus all tax and benefit deduction and withholdings. |

| How I'ts used | For salary negotiations, job comparisons and employeer labor expense budgeting. | For an employee's personal financial planning and budgeting. |

| Relationship to taxes | Starting point for calculating employee and employeer tax obligations. | N/a; taxes already deducted. |

| Location on pay sub | Usually the top number, shown before any deductions. | The bottom number, below all deductions and withholdings. |

| Regulatory | Must follow labor laws, including minimum wage and overtime rules | Must include all legally required all employee elective deductions. |

How to Calculate Net Pay

For any business, calculating net pay is a fundamental payroll function, and employers must calculate it carefully and accurately to ensure fair compensation and compliance with all relevant laws.

The basic net pay formula is:

Net pay = Gross pay – Deductions

Despite this seemingly straightforward formula, calculating net pay can be intricate and time consuming because of the differences in deductions, which often vary for each individual employee. This section will dive into the five steps payroll teams use to make sure they accurately calculate net pay every time.

-

Determine Gross Pay

First, payroll must determine an employee’s gross pay. This figure should include wages tracked by the employer, such as salary and bonuses, and any additional wages self-reported by employees, including tips and gratuities. For salaried workers, employers should calculate gross pay by dividing the annual salary by the number of pay periods. For hourly workers, they should multiply the total number of hours worked by the hourly rate. Payroll teams should adjust wage rates to reflect any special hours, such as holiday, hazard or overtime pay. Companies often leverage accounting software or a more comprehensive enterprise resource planning (ERP) system to track workers’ hours and rates and automatically calculate gross pay.

-

Subtract Pretax Deductions

Employers subtract certain deductions from gross pay before any tax calculations are made, essentially lowering an employee’s tax rate. This can benefit both the employer and employee by lowering tax liabilities and maximizing take-home pay. These deductions typically include contributions to specific health insurance plans and retirement accounts. However, regulatory agencies set the rules and limits regarding pre-tax deductions, such as the annual limit to 401(k) contributions established by the Internal Revenue Service (IRS). Therefore, employers should stay informed about any recent adjustments to local laws and guidelines before making these deductions.

-

Calculate and Subtract Taxes

After employers account for pre-tax deductions, they can then calculate taxes on the remaining income. These typically include Social Security, Medicare and federal, state and local income taxes. Businesses must carefully calculate these taxes, as their employees’ deductions can vary based on withholding status, tax brackets and any applicable tax credits or adjustments.

This process can be especially challenging for companies with multiple compensation models and employees with varied income types, such as contracted work or bonuses, which are all taxed differently. Additionally, companies operating in different regions must take particular care to follow local regulations, as some states have their own required deductions — such as New York’s paid family leave insurance. Regardless of the complexity of a business’s tax process, payroll staff must be sure to follow up-to-date tax policies and accurately track deductions. Both employees and employers will need accurate year-end tax statements to file their taxes. Many companies prefer to use software to quickly generate these statements after a financial period has ended.

-

Subtract Post-Tax Deductions

Employees may have deductions that do not reduce their taxable income. These deductions may include certain insurance and retirement contributions, such as funds going to a Roth IRA; wage garnishments; or job-related expenses, such as union dues and uniform expenses. Because healthcare costs and retirement contributions can fall under pre- or post-tax classifications, employers must carefully categorize these deductions and apply them properly to avoid financial or legal consequences. As with other payroll calculations, employers should be aware of current limits and rules regulating post-tax deductions and accurately track them throughout the fiscal year.

-

Calculate Net Pay

It’s finally time to calculate thfe pay period’s bottom line: net pay. After adding up all prior deductions, the payroll team then subtracts them from the employees’ gross pay. This calculation reveals the amount of money that employees will actually take home. But this isn’t the end of the payroll process. The Fair Labor Standards Act requires businesses to maintain accurate employee information, including hours, pay, all deductions and more, for at least two to three years, depending on the record type.

What Does Net Pay Mean for Employers?

To employers, net pay means more than a number on their employees’ paychecks; it also reflects a company’s commitment to payroll accuracy and compliance with tax and labor laws. While gross pay enables employers to plan and budget for labor costs, net pay shows how those costs directly impact employees. As a result, both parties can sustain effective communication when negotiating salaries, benefits packages and other terms of employment. Similarly, employers should realistically assess how both gross and net pay will change as they create new positions, offer raises and promotions and modify benefits. This assessment is important for balancing competitive job offerings with control of labor expenses. Additionally, any changes in benefits, such as rising healthcare costs, directly affect both the employer’s expenses and employees’ net pay. Since these deductions don’t factor into gross pay calculations, it’s essential for businesses to monitor employees’ net pay levels to fully grasp the financial impacts of these decisions.

When designing compensation packages, businesses should address the challenges that come with managing net pay calculations. This is especially important for growing businesses, as simple payroll solutions — such as manual calculations or spreadsheets — may become cumbersome and time-consuming as the workforce expands. Growing businesses often implement more scalable solutions, including outsourcing to third-party payroll companies or implementing ERP software, to ensure that they are complying with current regulations and paying employees appropriately, regardless of variances from worker to worker.

What Does Net Pay Mean for Employees?

Before net pay amounts are finalized, employees must choose which, if any, voluntary deductions to include, such as retirement savings or contributions to healthcare plans. With careful planning, employees can redirect portions of their day-to-day income into long-term investments to build a sustainable financial future.

Net pay can also contribute to job satisfaction and employee morale. While job listings tend to focus on gross pay, applicants are often more concerned with what they will find in their paychecks. To build trust and transparency, employers should clearly communicate how net pay is determined, especially when employees are enrolling in or adjusting their benefits and/or voluntary deductions. In this way, employees can be better informed and prepared when seeking new positions, choosing if and when to change jobs, and planning their own financial futures.

Factors Affecting Net Pay

Several factors affect net pay, and the impact each has varies from employee to employee. To ensure accurate payroll, employers must accurately track the following factors as compensation packages and regulations evolve.

- Tax laws: Generally, the most significant deductions are taxes, including federal, state and local income taxes. Taxes also include Social Security and Medicare contributions and any local tax programs, such as disability insurance. The IRS and local governments regularly adjust tax rates and regulations, so staying current with IRS guidelines and local tax codes will help businesses make sure they’re withholding the correct amounts. Additionally, an employee’s tax status can change, such as when they reach a new tax bracket or a married couple begins filing jointly, and businesses need to adjust deductions accordingly.

- Benefits: Employee benefits, such as healthcare and life insurance, can be sizable deductions when net pay is calculated. Many employers offer multiple benefit options that employees can choose among, with each presenting a different level of impact on their net pay. Employers should clearly explain the different offerings so that employees can make well-informed decisions that align with their financial goals. This explanation should also specify whether these deductions are pre- or post-tax, to ensure accurate net pay calculations.

- Employee circumstances: Personal factors, including retirement contributions, wage garnishments or changes in filing status, also play an important role in determining net pay. And companies that hire diverse workers, such as non-employee contractors, will have to use different deductions when calculating net pay. Therefore, businesses should carefully track their workforce to make sure every worker is being accurately compensated.

Net Pay Example

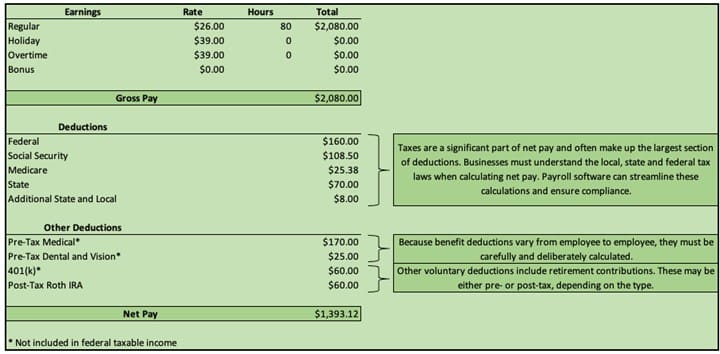

For an example of net pay, consider the pay statement above, which represents a full-time marketer on a biweekly pay schedule. The step-by-step breakdown for calculating their net pay looks like this:

- First, multiply the hourly rate ($26) by the hours worked in this pay period (80) to calculate gross pay ($2,080).

- Then, subtract all pre-tax deductions. For our hypothetical marketer, these deductions include three types of medical insurance and a 401(k) retirement contribution. After considering these deductions, the employee’s taxable income falls to $1,825 [$2,080 — ($170 + $25 + $60)].

- Next, calculate the taxes to withhold. These include federal and state income taxes, 6.2% for Social Security, 1.45% for Medicare and any additional local or state taxes.

- The last step before calculating net pay covers any other post-tax deductions, such as wage garnishments or retirement contributions. This worker contributes $60 to a Roth IRA every paycheck.

- Finally, subtract all these deductions from gross pay to calculate net pay. For this pay period, our marketer will take home $1,393.12.

Simplify Your Payroll With NetSuite Financial Management

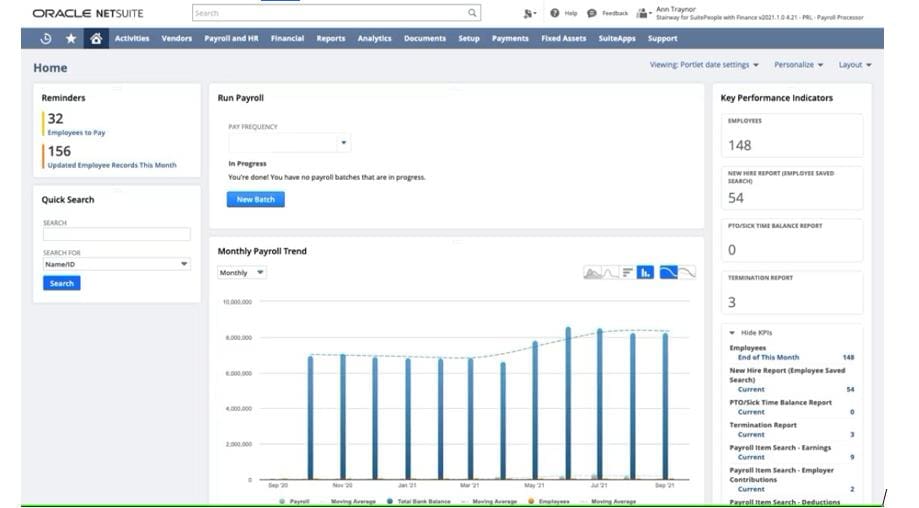

As businesses grow, their financial systems must scale to keep up with the increasing complexity of managing a growing workforce. NetSuite’s SuitePeople Payroll solution simplifies the payroll process, ensuring accuracy and compliance with ever-changing tax laws and regulations. With SuitePeople Payroll, companies can automate their calculations to minimize errors when calculating dynamic compensation figures, including net pay. By streamlining payroll with NetSuite, companies can free up their staff’s valuable time for more complex problems and strategic business activities.

With NetSuite’s comprehensive solution, companies can also seamlessly integrate payroll with other core functions, such as human resources and financial management, to provide a unified view of the business. Business leaders can leverage this centralized data center to enhance decision-making and operational efficiency. SuitePeople Payroll also has built-in, detailed reporting and analytic capabilities, giving decision-makers actionable insights into how payroll affects overall business performance and cash flow. With NetSuite, businesses can confidently manage their payroll to ensure that they pay their employees correctly and on time, every time.

At the end of a pay period, employers and their employees want to be confident that hard work translates to accurate compensation. But maintaining an accurate payroll demands more than just multiplying pay rates by hours; it requires a meticulous net pay process that accounts for various deductions, including taxes, benefits, retirement contributions and more. However, because each employee’s financial situation is unique, a tailored approach to net pay calculations becomes necessary. By emphasizing precision and efficiency when calculating net pay, businesses can ensure accuracy and compliance with evolving tax laws and labor regulations, even as employment terms change and new positions are created.

Net Pay FAQs

What is the meaning of net pay?

Net pay is the amount of money an employee receives after their employer subtracts all deductions from their gross pay, including taxes and benefits.

What is an example of net pay?

Net pay calculations start with gross pay. Say an employee’s gross pay is $1,000 per week. After their employer deducts $200 for taxes and $50 for the company’s health insurance plan, the employee receives $750. This $750 is their net pay.

Is basic salary net or gross pay?

Basic salary is the initial amount agreed upon by an employer and employee at hiring or when renegotiating compensation. Employers and employees typically refer to gross pay when discussing basic salary.

Is net pay what you get paid?

Net pay, also known as take-home pay, is the amount that an employee will actually collect in their paycheck or direct deposit. While their employer pays the full gross pay amount, some goes toward taxes, retirement plan contributions, healthcare and other deductions.

What is net salary?

Net salary is the amount of money an employee takes home after their employer subtracts all deductions. Salaries are often based on annual pay and divided by the number of pay periods, while hourly wages are based on hours worked for that particular pay cycle.

What is my gross pay?

Gross pay is the total amount earned before subtracting any deductions, such as taxes, insurance premiums and retirement contributions. Gross pay includes wages, salaries, commissions, tips, bonuses and any other income.

What is net income?

Net income is the total earnings after deductions and expenses are subtracted. Individuals often refer to net income as net pay or take-home pay. For businesses, on the other hand, net income describes the profit remaining after subtracting all expenses, taxes and other obligations from total revenue for a financial period.

Is net income yearly or monthly?

Both employers and employees can calculate net income for any period, such as monthly or yearly. Both parties can use annual income to compare different compensation models or year-over-year earnings. Monthly income, on the other hand, can help budgeters forecast incoming and outgoing funds for the month. Businesses and individuals can customize their parameters to calculate the most relevant metrics for their purposes.