Payroll management is a crucial and often challenging task for businesses because of the diverse ways different employees can be paid. Even a small staff may have employees with different wages, hours, benefit packages and pay structures. And when businesses make errors during payroll, employees lose trust, financial records become inaccurate and the business may even incur legal penalties.

Accurate payroll processes start even before taxes and retirement plans come into play. Prior to calculating all the deductions and withholdings that determine how much money the employee will “take home,” businesses must first calculate the number at the top of an employee’s pay stub: gross pay.

What Is Gross Pay?

Gross pay is the total income an employee earns before subtracting any deductions, whether for taxes, health insurance premiums or retirement savings contributions. This total may come from one income source or may combine multiple sources, depending on the employee and the terms of employment. For example, a contract worker may earn $1,000 for one job and $3,000 for another from the same company, earning $4,000 in total gross pay. On the other hand, a worker may earn several types of income over the same pay period. If a restaurant employee earns $2,000 in regular wages, a $1,000 holiday bonus and $350 in tips in the same pay period, their employer must include all of these amounts to accurately calculate their total gross pay ($3,350 in this case).

By accurately determining what is and isn’t included in gross pay, businesses can more effectively communicate wages and the terms of employment to both current employees and job candidates. They also can use gross pay as a foundation for forecasts and budgets during financial planning, calculating expected wage expenses, benefits costs, tax obligations and more as percentages of gross pay.

It’s important to note that the term “gross income” is commonly used to describe both an employee’s gross pay and a business’s gross profit, the revenue left over after subtracting the direct expenses of production from product sales. This article focuses on gross pay for employees and relevant payroll processes.

Key Takeaways

- Gross pay encompasses all forms of an employee’s earnings before subtracting deductions; it’s the starting point for all subsequent payroll calculations.

- It must comply with labor laws, such as minimum wage and overtime rules.

- Businesses must accurately calculate and record every earnings component that contributes to gross pay, including regular wages, overtime, tips, bonuses, commissions and any other employee compensation.

- Payroll errors can erode employee trust and even cause legal consequences.

- While some companies still manage payroll manually using spreadsheets, many require a scalable solution, such as dedicated payroll software, third-party payroll services or more sophisticated business technology. These tools help streamline payroll processes, minimize errors and provide valuable insights for decision-making.

Gross Pay Explained

Because gross pay encompasses all of an employee’s earnings, from base wages to bonuses and beyond, both employees and employers use it as the starting point for salary discussions and benefit calculations. Employees view gross pay as the real, full value of their compensation. This understanding helps them plan finances and gain a clear view of their compensation package — even if all of it doesn’t end up directly in their bank accounts. Employers use gross pay when they create new jobs, offer promotions, set budgets and manage payroll. Some very small businesses can manage payroll manually. But as a business grows beyond just a handful of employees, payroll processing rapidly grows more complicated, so they rely on software or third-party payroll services.

Businesses must carefully manage gross pay, as miscalculations can have far-reaching consequences — from disgruntled staff and budgetary discrepancies to legal action. A small-business owner who overlooks overtime payments during a busy season, for example, will likely end up with underpaid employees, inaccurate financial statements and potential penalties from regulatory agencies. Even if the mistake is identified and rectified, employees may remain distrustful and less willing to cover critical shifts in the future, affecting revenue potential and customer satisfaction. Businesses with multiple employee classifications, such as hourly, salaried and contracted workers, may find juggling these calculations especially challenging. This is because these factors can add complexity, time and opportunities for mistakes. Businesses with complex payroll rules can leverage automation and software tools to track and automatically apply preset limits and calculations for workers in specific categories. Owners, accountants and payroll teams use these tools to ensure accurate pay records. Such records are helpful for maintaining positive employer-employee relations — and are a legal requirement under the Fair Labor Standards Act (FLSA).

Main Components of Gross Pay

Gross pay is more than just a figure on a pay stub; it’s the total of various earnings that an employee may be entitled to. This section covers the key elements that typically constitute gross pay and the differences among them.

-

Salary or Hourly Wage

Hourly workers’ gross pay is directly tied to the hours they work and their hourly pay rate. Conversely, salaried workers — also called “exempt” — earn fixed compensation that must remain the same from one pay period to the next, regardless of the number of hours worked. FLSA rules govern how both hourly and salaried employees must be compensated for their work, including overtime.

For most job descriptions, businesses express salaries as an annual sum and hourly jobs as an hourly rate. Regardless of which payment structure a business uses, these two categories typically make up the majority of an employee’s gross pay. Whether salaried or hourly, gross pay is customarily calculated and paid to employees at regular intervals. The United States has no countrywide requirement for that interval, but the most common pay periods are weekly, biweekly, semimonthly and monthly. Some states dictate pay periods, which are tracked by the U.S. Department of Labor(opens in a new tab) (DOL).

-

Overtime

Overtime pay is a form of compensation that employees earn when they work beyond the standard 40-hour workweek. Mandated by the FLSA and local labor laws, employees working overtime typically earn a higher wage rate, normally 1.5 times their regular hourly rate and sometimes double. By working overtime, hourly workers can significantly increase their gross pay, especially during busy seasons or when labor is scarce. Because of this, businesses must carefully track and plan overtime shifts or they risk skyrocketing labor costs. Businesses should be aware of relevant DOL rules that regulate when employers are required to pay overtime, such as when a worker’s salary is below a minimum rate, to ensure that employees are being compensated appropriately. Some states also establish their own overtime regulations, so businesses should check for those, too.

-

Bonuses and Commissions

Any employee bonuses or commissions must be included in gross pay. Common bonuses include one-time payments either for achieving certain milestones or at specific times, such as holidays or at annual performance reviews. Commissions are ongoing payments calculated as a percentage of sales made by an employee or in accordance with other performance metrics. Not every industry offers bonuses or commissions, but those that do usually include them as part of a larger compensation model that must be planned and monitored carefully. By strategically offering bonuses and commissions, businesses can create incentives for exceptional work and boost employee morale.

-

Other Earnings

Other earnings that contribute to gross pay include tips, gratuities, holiday pay, fringe benefits, severance packages and any other additional earnings. Payroll managers must include these earnings when calculating gross pay, as they will likely still affect tax withholdings and other payroll deductions. Unlike most other forms of compensation, employees are responsible for tracking tips, which differ from gratuities under the FLSA. Gratuities, such as an automatic charge added to the bill of large restaurant parties, are considered to be under the control of employers and subject to withholding tax, while tips are not. Employers should effectively communicate the rules and regulations for these earnings to employees so that everyone is on the same page and accurately tracking gross pay.

By tracking all income and emphasizing transparency when calculating gross pay, employers can make certain that they are following all relevant labor laws, including minimum wage requirements and overtime rules. Aided by a clear and well-managed payroll system, businesses can effectively protect the overall financial well-being of both staff and the company.

How to Calculate Gross Pay

Calculating gross pay can vary in complexity, depending on the type of job involved. For companies with only salaried employees and no overtime or bonuses, payroll managers can typically calculate gross pay in one simple step. But for businesses with more complex compensation models, such as those with multiple types of commission payments or performance-triggered bonuses, managers will likely spend more time running the numbers — or leveraging payroll software or an enterprise resource planning (ERP) system to run the numbers for them.

The general formula for gross pay is:

Gross pay = Regular earnings + Overtime pay + Bonuses + Commissions +Other earnings

For many workers, some of these income categories are $0 for every pay period. But both employees and employers should be aware of them, as compensation can change over time and even one-time payments must be factored into the total. More specific formulas for hourly and salaried employees are shown below.

However they pay their workers, employers should develop a clear payroll process tailored to the specifics of their workforce. This establishes accurate and timely pay cycles, helps maintain high employee morale and creates a foundation for dispute resolution. The payroll process should be regularly assessed, both as the company grows and changes and to stay compliant with changing labor laws and best practices.

Gross Pay for Hourly Employees

To calculate hourly employees’ regular gross pay, multiply the number of hours worked by the hourly wage. For higher-rate overtime or other special hours, such as hazard or holiday pay, use the same formula — hours multiplied by the appropriate rate. Because of the differences in hourly rates, businesses must carefully track and label their employees’ work hours to maintain accurate compensation. Many employees clock in and out with digital software to effectively and automatically track hours and minimize manual errors when calculating pay.

The general formula for hourly employees’ gross pay can be written as:

Gross pay = (Regular hours x Hourly rate) + (Overtime hours x Overtime rate) + (Special hours x Special rate)

For example, consider an hourly retail worker during the busy holiday season. Typically, they earn $20 an hour for a standard 40-hour workweek. However, due to increased customer demand, they worked 52 hours this pay period, including four regular overtime hours (time and a half, or $30 per hour) and eight holiday pay hours (double the usual rate, $40 per hour).

Payroll can calculate their gross pay for the week like this:

Gross pay = (40 regular hours x $20) + (4 overtime hours x $30) + (8 holiday hours x $40) = $1,240

Gross Pay for Salaried Employees

Employers pay salaried employees a predetermined amount that is usually consistent from one pay period to the next. Payroll managers calculate this by dividing the annual salary by the number of pay periods in a year. For example, monthly payments would be one-twelfth of the annual salary, while weekly gross pay would be the salary divided by 52.

It’s important to include additional earnings, such as bonuses or commissions, when calculating salaried employees’ gross pay. These extra earnings can significantly impact gross pay in a given pay period. By accurately tracking additional earnings, businesses certify that salaried employees are properly compensated for all aspects of their employment and account for all their payments.

The general formula for salaried gross pay is:

Gross pay = (Annual salary / Number of pay periods) + Additional earnings

A salaried worker earning $52,000 a year and paid biweekly, for example, would earn $2,000 ($52,000 / 26) for each period’s gross pay. If they earn a performance bonus of $1,500 in one pay period, their gross pay would increase to $3,500.

Gross Pay vs. Net Pay: What’s the Difference?

Gross pay and net pay are both important employee compensation metrics. While gross pay solely reflects earnings, net pay factors in all deductions, including income taxes, Social Security taxes, retirement savings contributions and other withholdings. The resulting net pay is the amount employees actually see in their paychecks or deposited into their bank accounts — which is why it’s called “take-home” pay.

Employers and employees typically think of gross pay, rather than net pay, during salary negotiations and job comparisons because it gives a more objective look at the value of their labor, as it’s based only on pay and time. Employers use gross pay as the starting point to calculate their total labor cost for budgeting and forecasting purposes, after adding percentages for the employer’s share of certain withholding taxes, benefits, and retirement savings matches, if any. Additionally, businesses use gross pay to show compliance with minimum wage and overtime laws. Employees, meanwhile, use net pay to plan their personal finances and disposable income.

Employees and employers customarily find both gross and net pay on pay stubs and in payroll records. Both financial metrics are often calculated and tracked with the aid of specialized payroll software, third-party payroll companies or as part of a larger ERP system. If businesses discover any discrepancies between gross and net pay calculations, it can signify an error in the payroll process and should be addressed immediately. Otherwise, it can lead to tax compliance issues or incorrect wage payments.

The Differences Between Gross and Net Pay

| Gross Pay | Net Pay | |

|---|---|---|

| Purpose | Shows an employee's total compensation. | Shows the amount an employee takes home after subtracting all deductions. |

| Includes | Wages based on an hourly rate or salary plus any additional earnings. | Gross pay minus all tax and benefit deductions and withholdings. |

| How it's used | For salary negotiations, job comparisons and employer labor expense budgeting. | For an employee's personal financial planning and budgeting. |

| Relationship to taxes | Starting point for calculating employee and employer tax obligations. | N/a; taxes already deducted. |

| Location on pay stub | Usually the top number, shown before any deductions. | The bottom number, below all deductions and withholdings. |

| Regulatory considerations | Must follow labor laws, including minimum wage and overtime rules. | Must include all legally required and employee elective deductions. |

Gross Pay Example

To illustrate gross pay calculations, a sample of the top section of a hypothetical retail worker’s pay stub is shown below. The sample shows four weeks of pay — two weeks of standard full-time work, one week with a holiday bonus and five hours of overtime, and one week with overtime and holiday pay.

Gross Pay Example for A Retail Worker in December 2023

| Pay Period Start: | 12/4/2023 | 12/11/2023 | 12/18/2023 | 12/25/2023 |

|---|---|---|---|---|

| Pay Period End: | 12/10/2023 | 12/17/2023 | 12/24/2023 | 12/31/2023 |

| Rate: | $20 | $20 | $20 | $20 |

| Hours: | 40 | 40 | 40 | 40 |

| Overtime: | 0 | 0 | 5 | 4 |

| Holiday: | 0 | 0 | 0 | 8 |

| Bonus: | $0.00 | $0.00 | $1000.00 | $0.00 |

| Gross Pay: | $800.00 | $800.00 | $1950.00 | $1240.00 |

This representative example of gross pay can help employees and employers visualize why and how the employee’s gross pay changed from week to week. Employees can use this to better understand fluctuations in their pay, while employers can use it to track changes that will be reflected in adjusted withholdings and deductions. In this example, the employee can see higher earnings, while the employer will deduct more taxes from the last two pay periods due to the higher income.

Gross Pay Calculator

Manually calculating payroll week after week becomes cumbersome and time consuming, even before considering the deductions that turn gross into net pay. But, due to the repetitive nature of these calculations, payroll teams can save time by automating them. Modern payroll technology can help further, by automatically incorporating accounting formulas and/or processes that correctly follow up-to-date labor regulations and laws.

Businesses with smaller workforces and/or simpler compensation models can use spreadsheets to calculate gross pay, as illustrated in our downloadable gross pay calculator template(opens in a new tab). This template has embedded formulas to automatically multiply hours worked by the regular wage rate and add it to overtime (paid at 1.5x the regular rate), holiday pay (2x the regular rate) and bonuses. Once downloaded, you can customize the template to reflect your business’s pay rates or add additional earning categories.

Larger or more complex businesses will likely need a more scalable payroll solution than spreadsheets. Some businesses outsource this work to third-party payroll providers, which can save time and ease the burden on internal staff. Other companies leverage technology — such as standalone payroll software or payroll management tools built into a larger accounting or ERP system — to automate calculations and minimize errors. These platforms often come with built-in data analytics tools that business leaders can use when making decisions to improve the payroll process. When choosing a payroll method, businesses should make sure their chosen solution is compatible with existing systems, such as those used in human resources. Additionally, payroll security is imperative, especially when using a third-party service, as payroll records include sensitive information about both employers and employees.

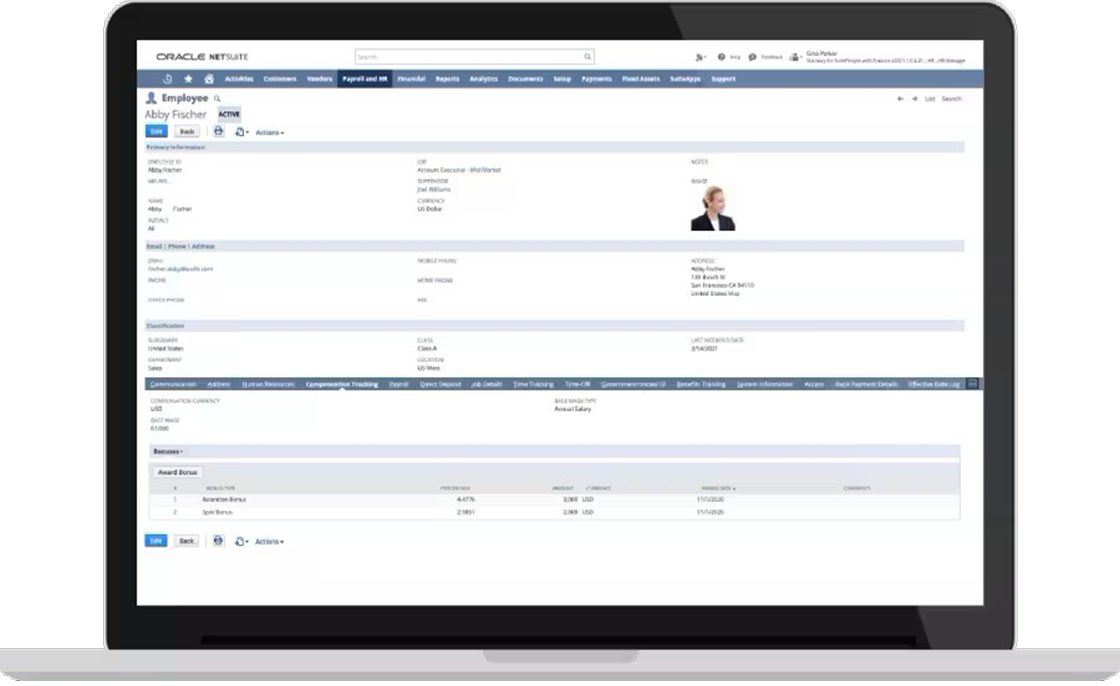

Automated, Precise Payroll Processing With NetSuite

For businesses with multiple employees — each with their own wage rates, retirement plan options, tax status and more — managing payroll can be an obstacle course of calculations. NetSuite’s SuitePeople Payroll is a comprehensive solution that allows businesses to simplify the complexities of payroll processes. By automating calculations, for both gross and net pay, NetSuite allows businesses to withhold mandatory taxes and manage employee benefit deductions while streamlining payroll tasks and ensuring accuracy and compliance. NetSuite’s real-time data tools keep financial records up to date, providing leaders, accountants and other decision-makers with immediate insights into payroll costs.

NetSuite’s cloud-based, customizable solution manages payroll for multistate employees and calculates retirement plan contributions and year-end tax filings. With NetSuite, businesses can significantly increase accuracy and reduce the time spent processing payroll, freeing up staff to focus on other tasks. NetSuite’s secure solution not only enhances efficiency but also generates detailed reports and documentation, helping businesses better control their payroll operations and decrease the risk of compliance issues.

Title: Enhance Your Payroll With NetSuite

Payroll is a cornerstone of business management, an area in which even small errors can substantially affect employee morale and legal compliance. This is especially true of errors in gross pay, the pivotal starting point for many payroll calculations. By understanding exactly what impacts gross pay — and what doesn’t — payroll teams can be confident that they’re counting all income sources, no matter how small, and applying them appropriately. A detailed payroll approach ensures that businesses are correctly paying employees and following the most up-to-date laws and regulations. Beyond that, businesses can analyze their payroll data to gain critical insights into future process improvements, more effective labor allocation and more accurate budgets.

Gross Pay FAQs

What’s the difference between gross pay and take-home pay?

Gross pay is the total earnings an employee is paid before any deductions, while take-home pay, also known as net pay, is the amount an employee receives after taxes and other deductions have been subtracted. Both amounts are indicated on a standard pay stub.

What gets subtracted/deducted from gross pay?

To calculate net pay, businesses start with gross pay and deduct federal and state taxes, Social Security taxes, Medicare taxes, retirement savings contributions, health insurance premiums and other deductions or withholdings, such as garnishments or union dues.

How do you calculate net to gross pay?

To calculate gross pay, employees can add back the deductions and taxes that resulted in the net pay amount. This calculation can be used to reverse-engineer gross hourly rates or annual salaries. This is especially helpful for workers looking for a new job that will pay them a certain take-home amount, because they can start with their needed net pay and add back any expected deductions to arrive at the gross pay they’ll need to achieve their take-home goal.

How do you calculate gross monthly pay?

Salaried employees can calculate their gross monthly pay by dividing their annual salary by 12. Hourly employees, on the other hand, can multiply their hourly wage by the number of hours worked that month to determine their gross monthly pay.

What is my gross income?

Your gross income is the total compensation you earn in a year before any deductions or taxes are taken out. Gross income includes wages and salaries, bonuses, commissions and other earnings for the pay period. It is typically found at the top of a pay stub.