Without paying employees properly, they won’t stick around for long. But calculating and considering compensation for employees is more than just accounting for an hourly wage. There are health benefits, retirement options, paid time off (PTO) and other factors that all go into calculating the cost to cover employee compensation. Some of the costs are direct, like the salary you pay. And others are indirect, like sick time offered. Whatever the breakdown, creating competitive compensation packages is vital to attracting and retaining a productive workforce.

What Is Employee Compensation?

Employee compensation is the term used to describe the salary and/or wages plus the benefits employees receive from their employers. This includes both direct compensation in the form of salary and incentive pay and indirect compensation, such as the employer-paid portions of insurance, retirement and PTO. Benefits continue to make up an ever-increasing part of total compensation. Just two decades ago, about 20% of compensation typically came in the form of benefits, and now that’s closer to 30%.

Compensation vs. Remuneration

Employee compensation is commonly referred to as remuneration in the United Kingdom and some other areas of the world. But it is the same concept.

How Is Employee Compensation Used in Business?

Companies use total compensation to compete with others in their industries so they can attract and retain people who will help them achieve their goals. Forward-looking companies often frame compensation in terms of total rewards – which broadens the definition beyond salary, wages and benefits to include well-being, recognition and professional development.

Why Is Employee Compensation Important?

Employees come to work because they’re compensated. And that compensation includes salaries and wages, as well as benefits like health insurance coverage. In the U.S., about 70% of private sector workers have access to medical benefits through their employers. Matching contributions to retirement accounts or other plans are also key components of compensation packages.

All these benefits and pay add up to try and attract and retain the best workers possible. If people are able to receive a much better compensation package from another workplace, they’re likely to leave. There are engagement efforts, such as professional development and creating an attractive workplace culture that can help encourage employees to stick around. But compensation is one of the best recruitment and retention tools available.

Correct and fair employee compensation is also crucial for statutory and regulatory compliance. Noncompliance will cost businesses. There are minimum wage laws, overtime regulations and penalties for some businesses if they do not offer health insurance plans for employees — and depending on the size of your business, you may be required to provide it.

What Components Are Included in a Compensation System?

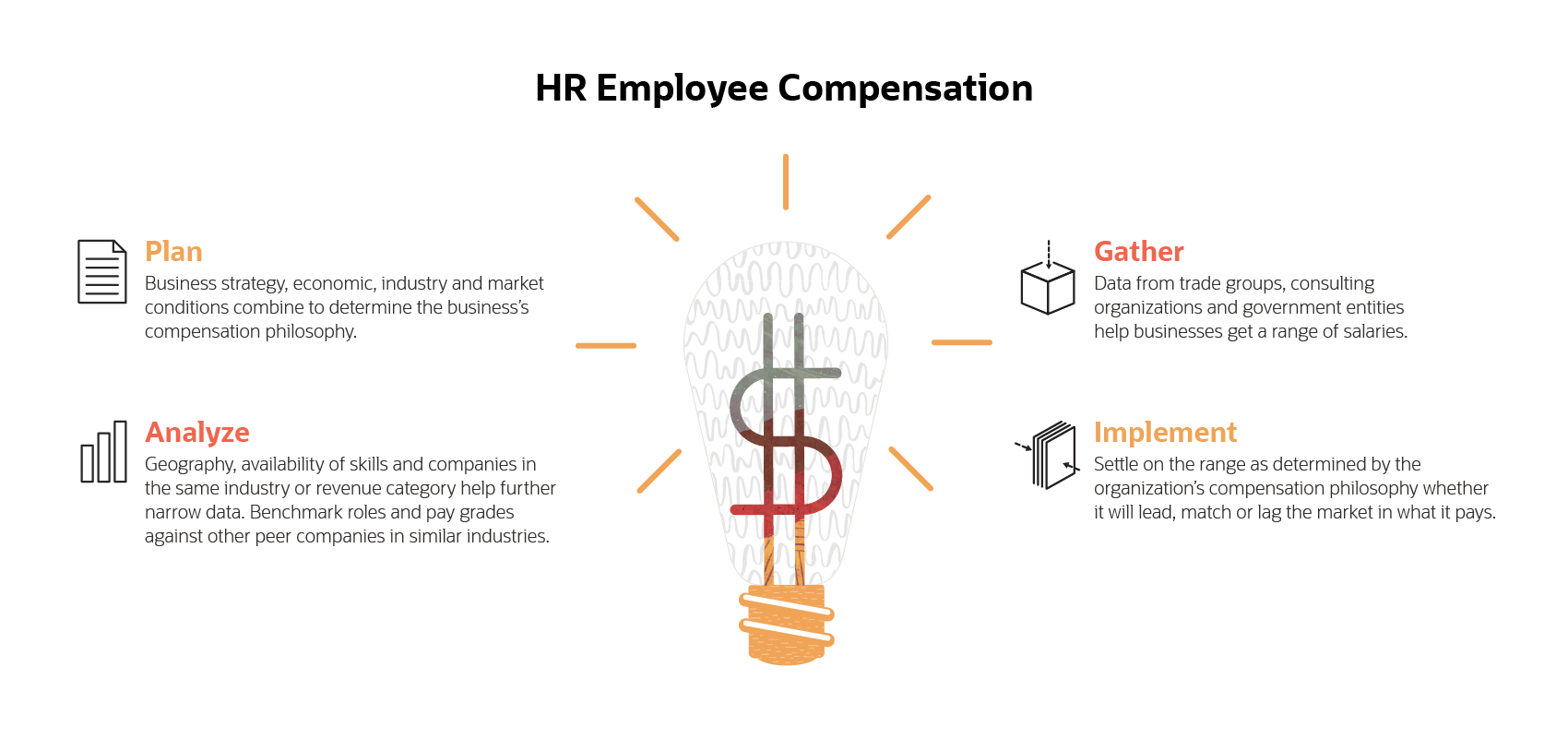

A compensation system focuses on how a business will structure its direct compensation schedules including base pay, shift differential and incentive pay and overtime. The Society for Human Resources Management (SHRM) recommends considering the following steps when developing a compensation system.

Examine external market data to see what peer companies are paying for similar positions. Some common sources include the Bureau of Labor Statistics, consulting companies and trade organizations. Decide if you want to follow a lead, match or lag compensation strategy. Matching the market means pay that’s about mid-market, with around half of similar organizations paying less and around half paying more. A market leader pays more than 75% of others in similar positions. Companies taking a market lag position pay more than only 25% of other organizations with similar positions.

- Benchmark specific roles, departments or teams, as well as your overall compensation costs against similar companies.

- Develop pay structures by creating job grades and calculating pay ranges with minimum, mid and maximum pay points.

- Calculate the costs of the pay structures based off the number of employees you have or anticipate having in each pay grade.

- Implement and continually evaluate your pay structures.

How Is Employee Compensation Determined?

When considering your compensation plan, you’ll need to think about strategy, available talent, market position and competition. Market and government data can give businesses a sense of the range of salaries for specific roles. While HR takes the lead in determining compensation, it’s crucial to gather input from the executive leadership team on guiding strategic factors, competitive factors and more. Consider demographics, such as where your company is located and your industry. And look at companies in the same category of revenue, as well as availability of skills and competition for top talent.

What Are the Different Types of Employee Compensation?

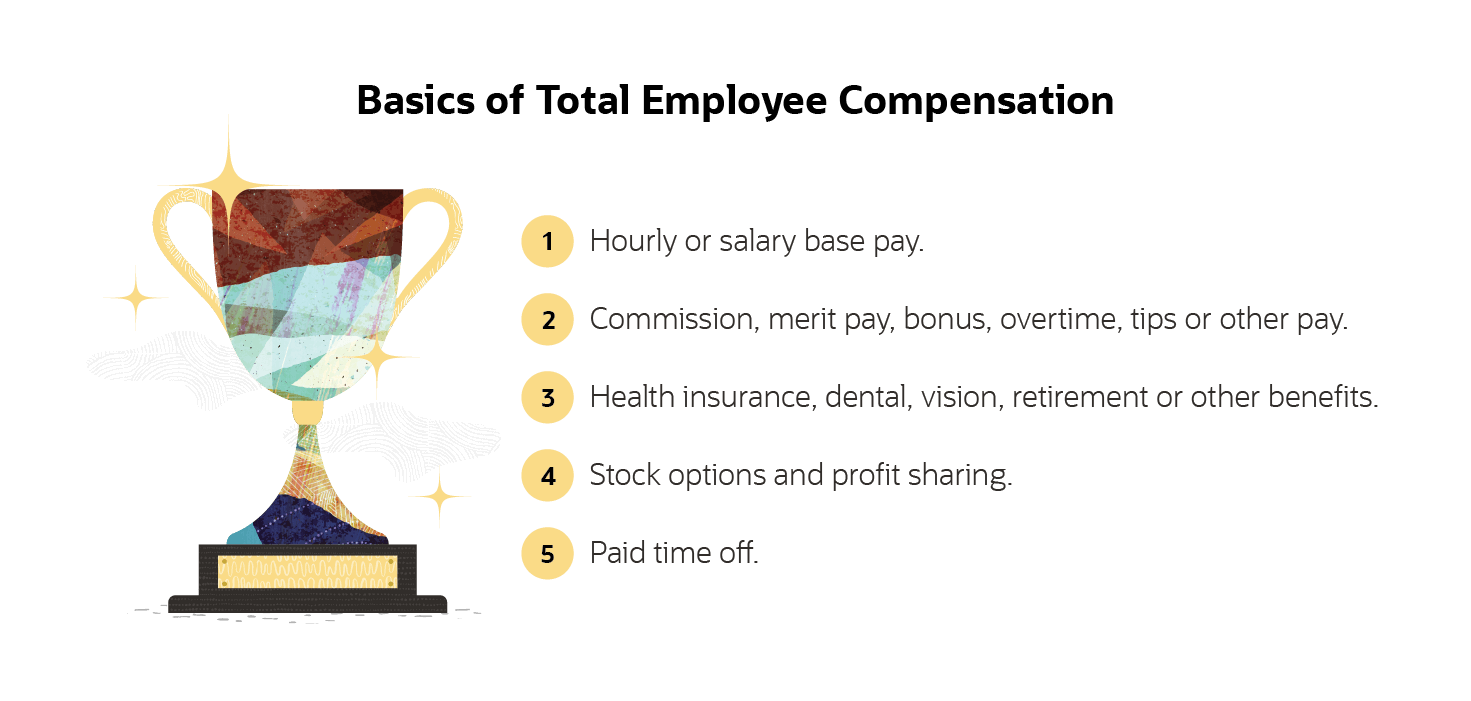

Some employees tend to think of compensation only as salary. Many organizations have had success in driving more transparency around total compensation by issuing compensation statements to employees. Helping workers understand total compensation packages can help reduce employee turnover in some cases because they better understand what salary or compensation package it would take to lure them away. Put monetary value to the different types of compensation which include:

-

Direct Compensation

Money paid to employees as salary and wages, commissions and bonuses is direct compensation. This includes:- Base pay: An employee’s base pay is the hourly rate or

weekly,

monthly or annual salary.

- Hourly: Some workers earn an hourly rate for their labor. Under the Fair Labor Standards Act (FSLA), hourly workers are generally considered non-exempt employees and are entitled to overtime pay at a rate of 1.5 times the amount of their hourly rate for each hour worked over 40 hours a week.

- Salary: Workers who earn a set amount annually for their labor are considered salaried employees. Under the FLSA, they are exempt employees and do not earn additional wages for time worked over their set number of hours per week.

- Bonuses: A form of direct compensation that isn’t guaranteed and is usually paid after the employee completes some milestone or event is a considered a bonus. There are many different kinds of bonuses. Some employees are eligible for a performance-related bonus per language in their employment contracts, with the full amount they’re eligible for typically a percentage of their base salary. Companies can also opt to pay a holiday bonus at the end of a calendar year, for instance, based on the company’s annual performance as a whole.

- Commissions: Many roles work on a commissions-basis, in which the employee receives a base salary and compensation based on a set commission. This is common in sales and recruiting roles. A recruiter may get a percentage of the salary of hires once they hit a certain quote, and a salesperson might receive a percentage of every deal closed. There are different commission structures, including a tiered structure where salespeople are rewarded for reaching milestones, rather than just a flat percentage of sales.

- Tips: Employees who receive more than $30 a month in tips customarily and regularly are considered tipped employees. The Department of Labor says that an employer of a tipped employee is only required to pay $2.13 per hour in direct wages if that amount combined with the tips received at least equals the federal minimum wage. Many states, however, require higher direct wage amounts for tipped employees.

- Overtime: Employers are required by the FLSA to pay non-exempt employees a rate of not less than time and a half their regular hourly rate for hours worked over 40 a week. The FLSA does not require overtime pay for work on weekends, holidays or regular days of rest, unless overtime is worked on such days.

- Merit pay: Also known as pay-for-performance, merit pay is a raise in base pay based on a set of criteria determined by the employer. It differs from a cost-of-living adjustment or pay increase because it is performance-based and individual.

- Base pay: An employee’s base pay is the hourly rate or

weekly,

monthly or annual salary.

-

Indirect Compensation

Indirect compensation is payment that is not in the form of cash. This can include:- Benefits: Recall that total compensation is on average in the U.S. roughly 70% salary/wages and 30% benefits. Benefits can include health insurance, dental insurance, retirement benefits in the form of 401K matches and more. The cost to employers of providing health benefits for employees is significant and has topped the list of problems and priorities for small businesses for decades.

- Stock options or profit sharing: Giving employees a financial stake in the company is a common way for new businesses and startups to build total compensation packages for employees. Employee stock options offer the employee the right to purchase a set number of shares at a specified price for a fixed period of time. Profit sharing awards employees a percentage of the company's profits.

- Vacation/paid time off: Companies can award employees with paid time off that they either get upfront every year or accrue each month or pay period. Many companies link the latter to the number of years served – employees with a longer tenure accrue vacation at a faster rate.

- Sick time: Currently there is no federal law mandating paid sick leave. The Family and Medical Leave Act (FMLA) does mandate unpaid leave and job protection for serious illnesses and to care for family. But several states are beginning to mandate paid sick leave – including New York.

- Other: Companies may opt to include tuition reimbursement, licensing and training opportunities and more as part of compensation negotiations.

-

Non-financial Compensation

- Flexible work hours: One of the most popular benefits is flexible and remote work. While not part of compensation, per se, it can be a part of hiring negotiations and can sometimes be stipulated in employment contracts.

Base Pay vs. Total Compensation

Base pay is the core payment employees receive for their work – usually their hourly or salary pay. Total compensation includes the base pay, as well as all the other benefits employees might receive, including medical benefits coverage paid by the employer, paid leave, disability insurance, life insurance and retirement benefits. Some companies also include educational assistance programs, learning and development offerings and even relocation expenses in their total compensation statements.

Employee Compensation and Regulations

The major laws governing wage and hours worked are administered by the Wage and Hours Division of the Department of Labor. These laws include the Fair Labor Standards Act (FLSA), which requires employers to pay covered employees who are not otherwise exempt at least the federal minimum wage and overtime pay, as well as payment for rest breaks (breaks lasting less than 20 minutes). Different states have laws regarding minimum wage, paid time off and more that may require companies to take more actions not required under federal law. Payroll and HR should also be mindful of shifting state requirements when it comes to mandated paid leave. For instance, New York recently enacted a law requiring most companies to provide at least 40 hours of paid sick time to employees in a calendar year.

Compensation and Employee Engagement

There’s little doubt that the ability to be paid more elsewhere drives employees to leave companies. What’s less clear is to what degree being paid well is related to employee engagement. Employee engagement is about more than just if employees are satisfied. Some employees are entirely satisfied with showing up to work, doing the bare minimum and collecting a paycheck. Instead, engaged employees are supported, challenged and connected to your business and its success. Engagement occurs when employees feel valued, happy and fulfilled, and are invested in your business’s long-term success.

One factor with compensation that does affect engagement is transparency. When employees are aware of how pay decisions are made and details about total compensation, they’re more likely to think they are fairly paid. Communicate your compensation structure and philosophy with your employees. Help them understand pay scales and grades, and the best way to move up the ladder to boost their compensation. This can be just one of many ways to motivate employees.

How Do HR Departments Calculate Employee Compensation?

There is no one way to calculate employee compensation, but the steps below will help guide HR in determining employee compensation ranges and implementing the plan.

- Research

Most companies base their pay grades and ranges on market data, with pay ranges and pay grades being the most popular ways to structure pay. The U.S. Bureau of Labor Statistics provides free data on compensation ranges(opens in new tab) and collects data for geographic areas, industry and occupations. Its database also collects and provides data on access to benefits. There are other sources of compensation information that will prove useful in benchmarking roles and setting ranges that require membership or payment – including the SHRM and the American Management Association (AMA). Compensation consultancies can also provide insight and more details. - Previous wages

Using previous wages as a factor in determining compensation is not a best practice because of the potential pay inequities it persists, and in many states, it is illegal. Some state and local governments, including Connecticut, Massachusetts and Vermont, have adopted laws that prohibit companies from requesting salary history information from job applicants. - Budget/profitability of the company

The company’s financial status and stage of growth plays a huge role in determining what compensation philosophy the company adopts – whether it’ll pay above market rates, at market rates or below them. Salary budgets are also impacted by economic conditions. - Benefits

Benefits packages are a part of compensation packages, so help employees understand the company’s costs behind benefits to show how the benefits are a part of overall compensation. Show them exact figures. Family premiums on employer-sponsored plans are on average around $21,000 annually, and employees on average contribute about $5,500. Share the amounts you pay in benefits, taxes and other costs to help employees understand the total compensation amount. - Performance-based incentives

Many organizations use performance-based pay increases as a component in their employee retention strategies and track retention and turnover as key HR metrics. The best policies are clear and communicated well to employees so they understand exactly how they can earn performance-based pay rewards, when available. It’s important for front-line employees to understand the policies; and it’s important that management does too, so they can support their teams and support company priorities. And finally, be sure you’re able to back up any performance-based incentives and make good on pay owed to employees.

How to Develop an Employee Compensation Plan

Determining the organization’s compensation philosophy is the first step in forming a solid compensation structure by which to calculate compensation and benefits.

The Small Business Administration (SBA) offers the following simple guidelines:

- Define the jobs. Prepare job descriptions. Include the job title, reporting structure, primary functions and any other job requirements.

- Evaluate the jobs. Firms with fewer than 100 employees can begin the process of determining the monetary worth of roles by ranking them in terms of difficulty and level of responsibility. Group jobs with similar scope and level of responsibility in the same pay grades and organize those by level. For a company with 100 or fewer jobs, 10 or 12 levels is ideal.

- Price the jobs. This is where market research, industry and government data come into play, and perhaps where the business may look to a pay consultancy for help.

- Design levels and ranges. With that data and rankings, organizations can begin to design pay levels and ranges of a minimum, mid and maximum rate for every role in the business. Typically, the minimum rate is 85% of the midpoint rate for the position and maximum rate is 115%.

- Implement the plan. Organizations must then apply that plan to how they will pay and increase pay for employees. This could involve some or all of the following: merit pay increases, increasing pay via promotions, increases based on skill competencies, increases based on tenure and increases based on cost-of-living adjustments (COLA).

- Communicate the plan. This is the step most often missed by employers – but it is the most crucial. Remember that transparency about why employees are make what they do and ways to earn raises and promotions correlates with higher employee engagement – to some extent, even more than a pay increase itself. Start by providing the tools and information so managers can communicate clearly about the compensation structure. After a plan is in place, make sure to follow through with promotions, raises, bonuses and commissions.

Compensation Plan Example

There is no standard way to come up with a compensation plan for a business – it depends on the business strategy, the economic conditions, the industry and more. What is an example of compensation? One example of a compensation plan would be to consider the pay grades, pay levels and individual positions of a specific department. Let’s use an HR department for an example.

Take the following positions: compensation and benefits manager, human resources manager, management analyst, compensation and job analyst and human resource specialist.

The median salaries for a compensation and benefits manager and a human resources manager are somewhat similar — $122,270 and $116,720 respectively. Compensation and job analysts and human resources specialists are similar in salary as well — $64,560 and $61,920 respectively. Management analysts fall somewhere in the middle with a median salary of $85,260.

Those positions with similar salaries also have similar importance and responsibilities to the business. They can be grouped according to pay grades. Let’s put compensation and job analyst and human resource specialist at pay grade 1, management analysts at pay grade 2 and compensation and benefits managers and human resources managers at pay grade 3. Depending on experience, business need, economic and market conditions, the organization has established ranges on which to set base pay and guidance for increasing base pay, adding bonus potential and more.

| Pay Grade | Minimum | Midpoint | Maximum |

|---|---|---|---|

| 1 | $54,876 | $64,560 | $74,244 |

| 2 | $72,471 | $85,260 | $98,049 |

| 3 | $99,212 | $116,720 | $134,228 |

Manage Employees and Their Compensation with HR Software

When it comes to managing compensation, there are so many moving pieces, even small businesses can benefit from human capital management (HCM) software. What is HCM? It’s software to help you manage every aspect of the employee lifecycle. From recruiting to onboarding, payroll, scheduling, retention programs and performance management, HCM software provides the infrastructure for your HR team, and the communication tools to share your policies and procedures with employees. In the case of compensation, HCM helps you track pay and benefits. It can store all the information about pay grades, rates, as well as provide and clearly share with employees policies on raises, promotions and other retention strategies. HCM software will also help you track and share benefit information and total compensation amounts more easily.

When HCM is integrated with other areas of your business, it’s called a human resources management system (HRMS). With robust HRMS, your HR team won’t be operating in a silo. One of the primary benefits of HRMS software is how it can seamlessly integrate with payroll management, finance software and other areas of your company so you can better understand the broader impact of HR decisions.

And because the HCM software includes other modules, such as payroll, it makes managing complex pay structures easier for employees and employers. Complex and tiered commission structures, pay-for-performance, bonus and merit pay can all be managed from a single platform. Additionally, reports on pay and other compensation areas can all be generated from the tools and shared with management and employees.

Competitive compensation practices are crucial for success — no matter the size of your business. Without recruiting and retaining the right people, a business cannot deliver on its strategy. Develop compensation plans that fit your business needs. Include commission, merit and performance-based pay where appropriate. Consider more than just pay, and account for benefits, such as health insurance, retirement offerings and other indirect benefits, such as paid time off. Organize pay grades and structures so employees understand why they’re being paid a specific rate or salary. And finally, share that information with your workforce whenever appropriate. Use HCM software to help you track and manage pay grades, complex salary structures and to help share total compensation and benefits information.

Simplify

HR and Payroll

Compensation FAQs

What is considered employee compensation?

Employee compensation includes both direct compensation and indirect compensation. Direct compensation includes salary, wages and incentive pay like bonuses or merit pay. Indirect compensation includes employer-paid portions of insurance, retirement and PTO. Stock options and profit sharing are also forms of indirect compensation.

What is employee compensation and benefits?

Employee compensation refers to all the offerings workers receive. This includes pay, bonuses, commissions, health benefits, retirement plans and indirect offerings, such as paid time off. The term benefits is used to refer to the parts of compensation that are not direct pay, and most often benefits refers to medical and retirement benefits.

What’s the difference between compensation and workers’ compensation?

Workers’ compensation is a type of insurance that companies purchase to provide benefits to employees if they get injured on the job or suffer a work-related illness. Determining a workers’ compensation calculation requires data on the time of injury, wage earning capacity and more.

What is a compensation survey?

A compensation survey conducted by a third-party consultant can help organizations benchmark positions, define total compensation packages and ensure salaries are in line with market conditions. They look at job titles, geographic regions, employer sizes and industries. They generally report on cash compensation data.

What are the four types of compensation?

There are four main types of direct compensation: hourly wages, salary, commission and bonuses.