It’s a fact of life for any business that sells physical products: The amount of inventory it physically has on hand is less than the amount of recorded inventory — and it’s not because the inventory was sold. The loss is called shrinkage. Even when a business tracks and manages its inventory well, some items will invariably go unaccounted for due to theft, fraud, damage during manufacturing or shipping, spoilage, recording errors or a host of other unfavorable reasons. The consequences are grim, too. Shrinkage also shrinks a business’s profits and may necessitate price increases to make up for the loss, which, in turn, could hurt customer retention.

What Is Shrinkage?

Shrinkage is an accounting term that describes the difference between inventory that is recorded and what is actually in physical inventory, indicating a loss in inventory. Think of a grocery store that logs 500 cans of chicken broth valued at a total $250, only to find 400 cans ($200 worth) during a physical count, though none were sold. The $50 worth of 100 missing cans is referred to as shrinkage. They weren’t sold, so what happened to those cans? It’s possible the cans were shoplifted. Perhaps the employee who received the shipment recorded the wrong number of cans. Or maybe the supplier never sent the right amount in the first place. But make no mistake: Shrinkage is a key issue in retail, but no industry or supply chain touchpoint is immune. For example, any waste of materials that results during a manufacturing process is a form of shrinkage. So are perishable items that expire enroute to a restaurant. And all have the same detrimental effect on a company’s profits.

Key Takeaways

- Shrinkage is the difference between recorded inventory and actual inventory.

- Inventory lost to shrinkage results in lost profit.

- Shoplifting, vendor fraud, employee theft and administrative error are some causes of shrinkage.

Shrinkage Explained

Shrinkage, sometimes referred to as “shrink,” is a cost of doing business that can be easily overlooked because it tends to occur in small increments over time. However, shrinkage does add up — to the tune of $95.4 billion in losses in 2021 for the retail industry alone, according to the National Retail Federation’s “2022 National Retail Security Survey.” Smaller businesses will feel the resulting losses in profitability to a higher degree than their larger counterparts.

Because some shrinkage is inevitable, businesses will have to determine what they consider to be an acceptable amount of loss. The answer will vary by industry and from one business to the next. In retail alone, the average shrink rate in 2021 was 1.4%, according to the NRF study. But generally speaking, a furniture manufacturer, for example, would expect to experience less shrinkage than a deli because much of the deli’s food is perishable. In addition, one deli may tolerate a 5% shrinkage rate while another sets a 3% cap.

This is why it is important for businesses to track their shrinkage rates over time, to determine what is typical. It’s also important to factor for shrinkage when deciding how much inventory to order. For example, to fulfill an order for 50 new office desks, the aforementioned furniture manufacturer may want to order an additional 10% worth of mahogany to account for waste due to cutting mistakes and wood imperfections.

Why Is Inventory Shrinkage Important?

Every time inventory can’t be accounted for or occurs from known causes, a business loses money — not only the cost of acquiring the inventory itself, but also the profit that would have come from selling it. It may also mean the business could face a stockout by running out of inventory. And if it can’t meet demand, it could potentially lose customers to competitors. Shrinkage can also force a business to raise its prices to compensate for losses, which can also drive customers away. Finally, shrinkage can lead to new expenses. For example, some businesses might choose to invest in surveillance equipment and security guards to combat shoplifting.

Smart businesses factor in shrinkage as part of their costs and plan accordingly. That means baking extra into their budgeting and product ordering processes to keep themselves covered.

How to Calculate Inventory Shrinkage

Calculating inventory shrinkage is just a matter of subtracting physically counted inventory from the amount of inventory you should have. The calculation is the same for determining financial loss, for which the dollar value of counted inventory is subtracted from the inventory’s documented “book value.” For example, if an office supply store records a shipment of 50 new laptops (worth $50,000) but has only 45 (worth $45,000) on hand, the five missing laptops, worth $5,000, represent shrinkage. For accounting purposes, the business must create a journal entry that records the $5,000 loss as an expense.

Inventory shrinkage can also be calculated as a percentage that, over time, reveals patterns and trends that may need to be addressed by procedural changes. To calculate the percentage of shrinkage, divide total shrinkage by total sales. Using the previous example, divide $5,000 by the total inventory book value ($50,000) and multiply by 100. This equals (an alarming) 10% shrinkage.

Inventory Shrinkage Formula

Inventory shrinkage is the difference between the amount or value of inventory recorded in a business’s accounting records (book inventory/value) and the amount or value actually in stock (actual inventory/value). The formula to calculate shrinkage value, as described in the previous section, is:

Shrinkage = Inventory book value – inventory actual value

Shrinkage = $50,000 - $45,000 = $5,000

The same formula can be used to calculate inventory shrinkage for the number of units:

Shrinkage = 50 - 45 = 5 units

The formula for calculating the percentage of shrinkage — again, using the previous example — is:

Shrinkage percentage = (Shrinkage value / book value) x 100

Shrinkage percentage = ($5,000 / $50,000) x 100 = 10%

Types of Shrinkage

Shrinkage is a type of inventory carrying cost that, like shrinkage itself, can decrease a business’s profitability. Inventory shrinkage occurs across numerous industries and at any point along the supply chain. Each link in the chain will typically pass along the loss in the form of higher prices to the next, which means that customers at the very end bear the biggest burden.

Manufacturer

Shrinkage at a manufacturer can slow or halt production if, for example, the manufacturer has fewer raw materials on hand than its inventory records reflect. The manufacturing process itself typically leads to some waste, also known as spoilage, that can’t be recycled for another purpose. Another possible cause of shrinkage, particularly where wood is stored, could be termites, which damage and ultimately destroy the material. That would be bad news for our furniture manufacturer mentioned above.

Vendor

Let’s say our furniture manufacturer completes the order for 50 new office desks and ships them to the office furniture supplier that ordered them. Upon arrival, the desks are carried off the truck. One is dropped and cracks in half, while another mistakenly gets left behind. The supplier is down two desks. Before long, three companies order 15 desks a piece. The supplier sends them out, but instead of having three desks left as reflected in its records, it only has two. Shrinkage strikes again, this time because of an employee with sticky fingers. This cycle begins again as the three shipments leave the supplier’s premises.

Retail

In retail, the average shrink rate in 2021 was 1.4%, or $94.5 billion, with external theft like organized crime the leading cause, according to the 2022 NRF survey(opens in a new tab). When this percentage is put into dollar amounts, that’s nearly $100 billion in losses. Shoplifting and employee theft make up the largest portions of shrinkage here. Other contributors include errors in ringing up customers, abuse of employee discounts and administrative errors that can include pricing errors and inventory counting errors.

Restaurant and Hospitality

Ingredients expire, unusable portions of ingredients are discarded, the bartender overpours, customers send back their orders for something else, a refrigerator breaks and its contents spoil, a case of wine goes missing — the list goes on for restaurants, which regularly contend with inventory shrinkage (and ensuing write-offs). In addition, a small portion of inventory often arrives already unusable. These losses are exacerbated by the rising costs of food and beverages, combined with supply delays and shortages — a reality for 96% of restaurant owners, according to the National Restaurant Association’s “2022 State of the Restaurant Industry” report.

Causes of Shrinkage

Businesses will be hard-pressed to take measures against inventory shrinkage without first identifying its causes. Among the reasons for shrinkage are:

-

Theft/shoplifting:

Inventory can be stolen at any point in the supply chain, internally by employees and externally by customers. In retail, for example, theft accounts for 65.5% of all shrinkage, according to the NRF survey. One type of internal theft, called point-of-sale (POS) exceptions, is a subtle form of shrinkage in which employees give others their discount, falsify prices and steal cash from the register. Another form of theft is return fraud, which occurs when a person steals a product or buys it with counterfeit money or a stolen credit card and then returns it for a refund.

-

Spoilage:

Any business in the food service industry, such as food manufacturers, restaurants, bars and grocery stores, can expect shrinkage. Food and beverages expire if not used or purchased within a short window of time and have to be disposed of. Another way inventory expires is when it becomes obsolete, such as when a fashion trend goes out of style.

-

Human error/accidents:

Mistakes happen. Improperly packed products break on the way to a vendor, a bookkeeper incorrectly records newly arrived inventory, a cashier rings up the wrong amount for a product, a shopper damages a shirt while trying it on, a waiter drops a tray full of food — the list goes on. The more tasks that are handled manually, the greater the chances errors will occur.

-

Vendor inaccuracy:

Vendor fraud can be caused by a fraudster posing as a real vendor and submitting phony invoices. It can be a legitimate vendor that deliberately bills for more than what it delivered. It can also come in the form of double billing, with the second payment going to an employee in charge of issuing payments.

Impacts of Shrinkage

Shrinkage is a multibillion-dollar problem that isn’t going away. Its impact can manifest in many unfavorable ways, including:

Loss of Profit

Shrinkage increases a business’s cost of goods sold (COGS) and reduces its profit margin. Having to reorder inventory to replace what has disappeared also hurts the bottom line, as do lost sales from not having enough items in stock to meet customer demand.

Increased Costs

Shrinkage leads to a variety of additional business expenses, the most obvious being the cost to replace lost inventory. Addressing and/or fixing the causes of shrinkage also add up. For example, if a sizable portion of shrinkage at a retail store is due to shoplifting, the business may need to invest in more security cameras and other technology. These increased costs chip away at profit.

Price Increases

Some businesses decide to increase the price of their products to make up for profit lost to shrinkage. In other words, they’re passing on their costs to the next stop in the supply chain. This can be a risky move, however, if it prompts customers to take their business elsewhere.

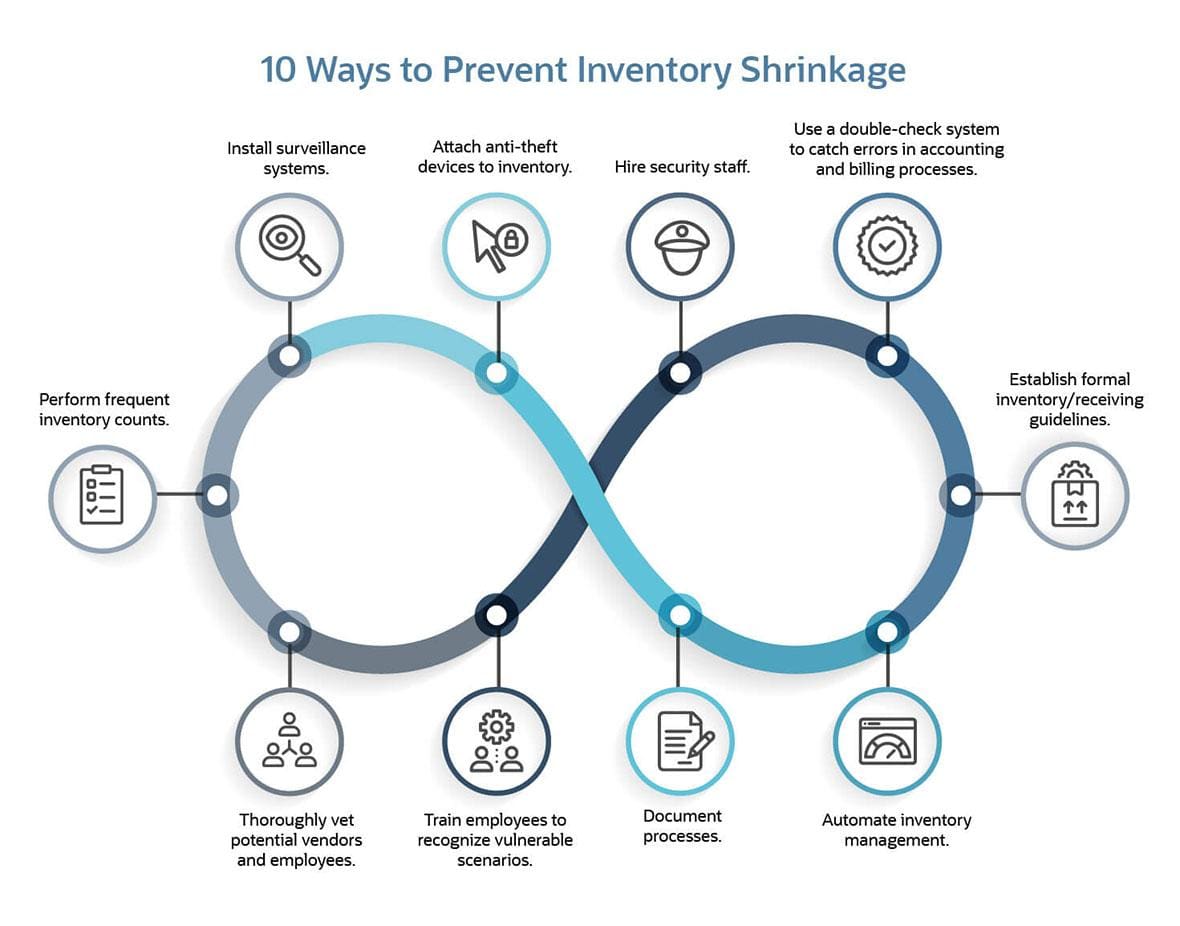

Preventing Shrinkage

Shrinkage can never be entirely prevented; this is the nature of running a business with inventory. However, it is possible to keep it under control and minimize its effects on profits. The following infographic highlights 10 ways:

Reduce Shrinkage by Automating Inventory and Reporting With NetSuite

Shrinkage is an inherent part of running a business, but with the right solution it doesn’t have to get out of control. NetSuite Inventory Management protects a business’s profitability with real-time inventory visibility across the business and at different points along the supply chain. The software automates many of the processes associated with managing inventory, including inventory tracking and tracing, replenishment and cycle counting via NetSuite Smart Count(opens in new tab), leading to greater accuracy than when handled manually. NetSuite Inventory Management also helps minimize shrinkage, profit loss and customer dissatisfaction when the items they want aren’t available. Built-in reporting features allow managers to stay on top of key performance indicators, including inventory shrinkage, lost sales ratio and gross margin percent.

Shrinkage is an inherent part of any business along the supply chain, and the losses in inventory add up over time. Real-time inventory records allow businesses to be aware of shrinkage in real-time, making it possible to keep inventory records accurate to avoid the issues above and minimize preventative shrinkage. Understanding the causes and effects can help businesses determine appropriate ways to minimize shrinkage. Automated inventory software can help spot and reduce many of the errors associated with shrinkage, providing perhaps the best protection of all: safeguarding a business’s profits.

Shrinkage FAQs

What percentage of shrinkage is caused by theft?

Theft is a dominant cause of shrinkage industrywide. In retail, for example, 65.5% of all shrinkage in 2021 was due to theft, according to the National Retail Federation.

What are acceptable levels of inventory shrinkage?

Acceptable levels of inventory shrinkage vary by industry and by individual businesses. Some industries, like food and hospitality, may be able to tolerate a higher shrinkage rate than, say, retail, though a mom-and-pop coffee shop would be less able to rebound than a restaurant chain.

How does shrinkage affect the business?

Shrinkage directly reduces a business’s profits. It can also lead to price increases to cover losses, added expenses in terms of prevention and customers taking their business elsewhere due to higher prices and/or product unavailability.

What do you mean by shrinkage?

Shrinkage, sometimes referred to as “shrink,” refers to the loss of inventory not due to sales. It’s the difference in the amount of inventory physically available and the amount of inventory recorded for accounting purposes.

What are the causes of shrinkage?

Common causes of shrinkage are internal and external theft, spoilage, errors and vendor fraud, all of which result in loss of inventory and profitability.

What is another term for shrinkage?

Shrinkage can also be referred to as “shrink,” “business shrinkage” or “inventory shrinkage.”