There’s a lot going on under the hood of today’s point-of-sale (POS) systems. Besides processing purchases, they provide insights into sales trends, employee productivity, inventory levels, customer preferences and more. A modern POS system with omnichannel capabilities can improve operations, integrate with other business systems, boost profitability and be a differentiator for many vertical industries, from ecommerce startups to salons and restaurants.

Consider a footwear retailer with both online and brick-and-mortar operations. A customer browsed online, found shoes she wanted but didn’t complete the order because her size was out of stock. A few days later, the customer walks into a store — which just that morning received the desired shoes in her size.

With an omnichannel POS system, associates could be equipped with mobile devices that tie into current inventory and offer to find the shoes in the back room. That’s a win for the customer, the salesperson and the business. Even better, a customer-facing mobile application could allow shoppers to browse available sizes and styles when they walk into a store, eliminating the need for salespeople to shuffle back and forth to check stock.

What Is Point of Sale (POS)?

Point of sale is the moment in which a customer pays for goods or services. That process will be more secure and smooth with a point-of-sale (POS) system. At a basic level, a POS system consists of hardware and software that work together to process and track transactions. They're used by businesses ranging from neighborhood florists to restaurants to national grocery chains. Companies with offline and online sales favor POS systems that integrate with their ecommerce platforms.

POS hardware includes terminals with displays, receipt printers and signature-capture capabilities that process transactions as well as add-on tools such as barcode scanners, scales and printers able to generate receipts and labels.

Tablets and smartphones are increasingly used as the primary hardware device for POS systems.

What Is Point-of-Sale (POS) Software?

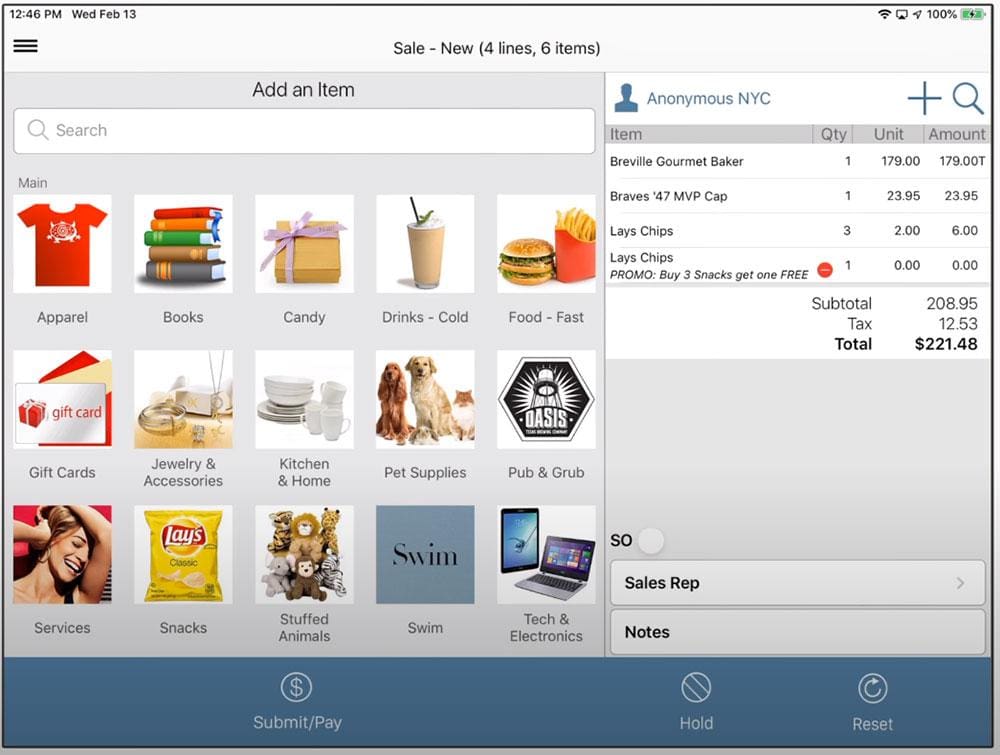

POS software is the engine that allows POS hardware to complete transactions. At a minimum, this software calculates the price of the product or service being purchased plus all relevant taxes and fees, processes credit card payments and issues receipts either physically or via email. In addition, today’s POS software can track and report on sales trends, inventory levels and employee hours. Some optionally capture customer information, such as email addresses, which can be added to the customer record and used for marketing initiatives.

Omnichannel POS software helps businesses operate more efficiently and profitably by centrally managing orders no matter where they originate from and orchestrating fulfillment from multiple locations. Capabilities to look for include tracking and updating changes in inventory levels, adjusting pricing based on sales or discounts, accommodating the needs of B2B customers and capturing loyalty information.

Some POS software can integrate with the company’s back-end business systems, such as accounting software to produce accurate, up-to-date financial reports.

Key Takeaways

- Today’s POS systems do more than process customers’ transactions, although that remains a critical capability.

- A POS system comprises software that processes purchases, integrated with hardware, such as display screens, receipt printers and barcode scanners.

- The software in cloud-based POS systems is increasingly accessed via the internet, which allows for easier updates and maintenance and a lower upfront investment.

- Mobile POS systems, typically using a tablet or smartphone to process transactions, are growing in popularity.

- Companies that serve customers in physical stores and online require POS systems that integrate with their ecommerce platforms and are able to pull information from a single database for inventory, pricing and customer records.

Point of Sale (POS) Explained

The term “point of sale,” or POS, refers to a system of integrated hardware and software that allows businesses to process transactions efficiently. In addition, POS systems provide capabilities that can help business owners improve their operations — think tracking sales granularly using stock-keeping units (SKUs) and reporting on inventory levels and employees’ sales to calculate commissions where applicable.

How Do POS Systems Work?

When a customer has selected an item to purchase, it is entered into the POS system, typically by scanning a barcode or manually entering a product code. The system then calculates current prices for all items plus applicable sales taxes, fees and deposits. The customer decides on a payment method, and the system completes the transaction.

Once the transaction is complete, the POS system can either print a receipt or email it to the customer.

What Does a POS System Do?

Fundamentally, a POS system processes and records sales transactions and provides receipts. But omnichannel POS systems that are natively tied to your operational business solutions do much more.

Data analysis: POS systems record sales granularly and can provide data for sales trend analysis, helping the business determine optimal pricing and stocking levels, market more effectively and optimize supply chains.

Inventory tracking: POS systems also track inventory levels and may issue alerts when inventory reaches a certain threshold and it’s time to reorder products before stock-outs occur, potentially impacting customer satisfaction.

HR & payroll assistance: Some POS systems allow hourly workers to clock in and out and calculate sales by employee or commissions earned.

In addition, robust POS systems also accept and process returns and keep per-SKU pricing up to date to reflect sales or discounts. Systems that integrate with ecommerce platforms empower retailers to adopt the popular BOPIS, or buy online, pick up in store, model.

Why Are POS Systems Important?

POS systems enable businesses to quickly and accurately process and record customers' purchases. While it’s possible to handle sales manually, doing so would be inefficient and prone to errors and fraud. Customers have become accustomed to being able to quickly complete their purchases, sometimes with contactless payment options, and are unwilling to go through a lengthy, manual checkout process.

For the business, POS systems help identify both which products are most popular and should be reordered — maybe in larger quantities — and those that aren't selling well and perhaps should be discontinued, discounted or supported with additional marketing.

POS systems also reduce fraud. Because they automatically track sales, POS systems can spot and flag unauthorized transactions or unapproved discounts. And by securely handling sensitive data, like credit card numbers, POS systems assist retailers in maintaining compliance with Payment Card Industry Data Security Standard (PCI DSS) and other regulations and reduce the risk of customer information being compromised.

POS systems automatically calculate relevant sales taxes and fees; integration with accounting systems make it easier for retailers to generate the records needed to make timely, accurate tax payments.

When Does a Business Need a POS System?

Any business that needs to process customer transactions quickly, accurately, securely and efficiently will benefit from a POS system. If a retailer accepts credit card payments, the PCI DSS standard requires POS software in order to transform cardholder data into secure payment transaction requests.

But there are cases where companies may choose to go beyond a basic system. These include:

A need to track commissions or sales by employee: Most POS systems generate info on employee hours worked for use by payroll systems. Beyond that, some can attribute total sales by employee to help store managers understand which sellers are most effectively helping customers. A POS system is also critical in businesses that calculate commissions on sales.

Marketing teams wanting to track customer interactions: Many POS systems help businesses hone their marketing efforts by capturing information, such as customer loyalty numbers or email addresses, that can be used to build a unique customer profile. This data helps teams develop personalized campaigns, including generating recommendations in an ecommerce system based on items purchased in store.

A desire for consistency: For businesses with multiple locations, a POS system ensures consistent pricing across stores; when integrated with an ecommerce platform, retailers can also eliminate cases of the same product being priced differently online versus in store.

Inventory challenges: POS systems with integrations into back-end business systems can take advantage of a unified database to track inventory across all locations. If one store runs out of an item, the sales staff or customers can check elsewhere for the product and have it shipped, maximizing sales.

Going national or global: No company can negotiate the tangle of state and local sales tax laws — much less international currency conversions and global taxation — without a robust POS system.

Benefits of POS Systems

As discussed, because they accurately and efficiently process and record transactions, POS systems enhance customer satisfaction, save employee time, reduce errors, ease tax accounting and minimize fraud.

In addition, they:

Help retailers become truly omnichannel: Today’s shoppers want personalized experiences that provide some level of consistency whether they’re shopping online or in store. That means omnichannel retailers must align inventory and pricing but also pull in order history, support tickets and preferences to create an experience that increases customer loyalty.

Help brick-and-mortar sellers differentiate themselves: With advances in technology, even the smallest retailers can use their POS systems to add modern “bells and whistles,” such as real-time visibility into inventory and customer history, that equip store associates with the information necessary to upsell/cross-sell and make smart product recommendations.

Capture more data and use it smarter: With a POS system, retailers can gain insight into individual store performance, customer buying habits, performance of team members, what SKUs are growing and waning in popularity and inventory glitches that could indicate supply chain disruptions. They can keep a close eye on the inventory KPIs that matter.

Gain robust integrations: Data from POS systems may be automatically synchronized with the company’s enterprise resource planning (ERP) system, to track in-stock items, pricing and store performance, as well as with customer relationship management (CRM) systems to keep track of buyer preferences, lifetime value and more. This makes the most of investments in business systems.

On-Premises POS vs. Cloud POS: What Are the Differences?

POS systems can be either on-premises, meaning hosted on a server and network the business owns, or cloud-based, in which the employees access the system over the internet. The optimal approach will depend on the business, but there are a few key differences to consider.

On-Premises POS Systems

On-premises POS software is hosted in the company’s own central data center or individual stores. The company or a contractor manages data storage, security, hardware upkeep and software maintenance.

Because the business is responsible for maintaining the software, it may need a dedicated IT staffer or specialized contractor. As for security, because the system is contained within the business’s network and not necessarily accessible remotely, it offers greater control over security. However, the business must continually invest in protecting its data to thwart ongoing risks.

The initial investment tends to be greater for on-premises than with a cloud-based system, because the business must purchase additional server and networking hardware to power their POS devices and integrate licensed or custom software with their bespoke solution. Maintenance charges may be significant.

The business needn’t rely on an internet connection to keep the system operational.

Cloud-based POS Software

Cloud-based POS software is accessed over the internet and integrates with the POS hardware in use by the retailer. It’s generally purchased in an “as a service” subscription model, sometimes with an upfront setup fee. Because the business doesn’t have to purchase specialized hardware, pay for a maintenance contract or develop the software itself, the upfront investment tends to be lower than it is with on-premises solutions.

Typically, updates are automatically rolled out to all stores by the software provider; so each location always has the latest version. Ongoing maintenance is less intensive than with on-premises systems because most of that work falls on the vendor.

Cloud-based systems require a reliable connection — if the internet goes down, the system may not work. And, retailers are responsible for assimilating POS hardware with software and managing user access.

Cloud-based POS systems are growing in popularity thanks to the lower investments of time and money and the fact that they won’t quickly become outdated like an on-premises system.

On-Premises vs. Cloud POS Software

| On-Premises | Cloud |

|---|---|

| Retailer purchases one-time licenses as required based on locations, sales, employees using the system or other criteria then pays maintenance fees. Generally CapEx. | Retailer purchases subscriptions based on locations, sales, employees using the system or other criteria. Software provider keeps the system current. Potentially a one-time setup fee. Generally OpEx. |

| Retailer purchases hardware on which to run the software and hires staff or engages services provider to maintain and secure the system. | The software provider hosts the software and is responsible for the systems on which it runs. |

| Retailer is responsible for controlling end user access to the system. | Retailer is responsible for controlling end user access to the system. |

| Data is stored on premises and must be backed up regularly. | Data is stored by the cloud provider, which manages backups. |

| Data is accessible only when users are connected to the on-site POS system. | Data is accessible to authorized users wherever there is an internet connection. |

One significant consideration is compliance with the PCI DSS standard, which requires that sensitive data be encrypted when sent over public networks. So both on-premises and cloud-based POS systems require secure connections to credit card processors.

If sensitive customer information is stored on premises, it must be encrypted “at rest,” that is, when stored within the network. Cloud POS system providers have experience with PCI DSS and can assist with compliance.

Examples of a Point-of-Sale System

While all POS systems perform the same essential functions of completing and recording transactions, they can be tailored to the needs of specific businesses. For instance, a grocer's POS system likely would include the ability to weigh items, while a spa's POS system might allow customers to schedule appointments. A POS system at a restaurant may allow customers to add their tips on-screen. Some also suggest tip amounts, such as 20% of the order total.

Types of POS Software

All POS software has two facets: The interface used by store associates and the back end, which is where the actual transaction processing happens. Depending on the robustness of the software, the back end also delivers native data analysis and/or integrations with ERP, CRM, accounting, inventory and other business systems. POS software can be delivered in various models.

On-Premises

As discussed, on-premises POS systems run on the company’s own network. In some cases, a server, perhaps located in a back office, stores all the POS transactions handled by multiple terminals on the sales floor. On-premises systems are installed on a retailer’s own hardware systems and managed by its IT staff or contractor. There is typically a large upfront investment for the software licenses and hosting infrastructure plus ongoing outlays for software maintenance as well as data storage, security and backups. In addition, companies may incur costs to remain compliant with PCI DSS and other regulatory standards related to safeguarding customer credit card and other data.

Cloud-based

POS software, like many business software programs, is increasingly hosted in the cloud and delivered in an as-a-service model. The vendor takes care of maintenance and upgrades. Because sales and inventory data are stored in the cloud, these systems more easily handle a mix of online and brick-and-mortar sales because data is available anywhere, and integration with an ecommerce platform is simpler.

However, these systems do require a reliable internet connection and ongoing subscription payments. And, retailers still need to secure their POS interfaces and control access.

Additional types

-

Mobile POS (mPOS): In a mobile POS (mPOS), a tablet or smartphone is used to process transactions. These systems often require only a modest initial investment in a consumer-grade device plus a card reader dongle, which has made them a very popular “starter” POS for smaller retailers or those that operate outside, such as food trucks or vendors at craft fairs or farmers’ markets. But mobile devices are valuable add-ons for more robust POS systems, too — think supplying our shoe store associates with tablets that show exactly what sizes and styles are in stock, updated in real time.

Typically, mPOS systems are cloud-based, making software updates relatively straightforward. However, standalone mPOS systems may be less powerful than traditional — and more expensive — POS systems. Because they work wirelessly, a reliable and secure Wi-Fi network is essential.

-

Desktop: Some POS systems allow companies to use a desktop computer via a local application and store POS data on that computer or upload it to a central database.

-

POS apps: Mobile apps, typically available through application marketplaces, can quickly turn a smartphone or tablet into a POS system. Some may require additional hardware, like a credit card scanner.

-

Online systems: These systems allow a business to access its POS software through the internet.

-

Open-source POS: Open-source POS software is built using code that’s freely available under an open-source license that allows code to be used under defined terms and conditions. Open source software is generally significantly less expensive than proprietary systems, although it may have less functionality, and hardware integration, security and support may involve additional costs and require specific expertise. Check the full total cost of ownership.

-

Multichannel POS: These POS systems draw from a single database for sales and inventory. This helps ensure consistent pricing and accurate information on inventory levels across multiple channels, including online marketplaces, ecommerce sites and in store. A must for omnichannel sellers.

-

Terminal POS: This type of POS is commonly found in retail stores. These systems combine hardware, such as cash drawers, a screen or monitor, a printer and a barcode scanner, with software that processes transactions.

-

Retail POS: Like any POS system, these on-site systems handle and track customers’ purchases. Some also incorporate capabilities specific to retail environments, such as the ability to create gift registries or track inventory across multiple locations. Many can integrate with ecommerce platforms.

-

Specialized POS systems: These function similarly to all other POS systems but may include features unique to various vertical industries. For example, a hospitality provider POS may be able to activate keycards, while an auto dealer may look for robust inventory tracking, specialized staff and commission management and interfaces with manufacturers’ systems.

-

Restaurant POS: An example of a specialized POS, these systems often incorporate features unique to restaurant settings, like reservations and seating charts. For instance, some directly transmit servers' orders to the kitchen, so the staff can immediately start preparing them. They help track restaurants’ critical KPIs.

Key POS System Features

While different POS systems offer varying capabilities, most business owners can leverage the following features:

Inventory management: A POS should improve inventory management, tracking stock levels as products are sold, helping management determine, among other things, the popularity of various items and when to reorder. Bigger picture, a POS is the “front line” data gathering mechanism to feed into inventory analysis efforts — that is, the study of how product demand changes over time. This analysis helps retailers order the right goods and project what customers will want in the future.

Employee management: Many POS systems function as time clocks and can track employees’ hours. If employees are paid commissions or the business needs to track sales numbers, companies need to make sure these capabilities are included.

Customer management: Some systems can process and store customer information, such as sales histories, annual spend, loyalty program tiers and contact information. This can help businesses segment audiences and personalize their marketing campaigns to increase customer lifetime value.

Integrated payment processing: Most POS systems include an integrated payment-processing function. When customers pay with credit cards, their card data feeds directly into the POS, boosting efficiency and accuracy. Without this, the card data must be entered manually.

Credit card processing: The credit card reader captures information from customers’ credit cards and transforms it into a format that can be encrypted and transmitted to a credit card processor while remaining in compliance with PCI DSS.

Sales reporting: Some POS systems track sales, including by department, product or another metric. This helps businesses identify their best (and worst) sellers and determine when to reorder inventory, among other functions. For instance, if the system shows that a dozen blue T-shirts are sold each week, and only five are on hand, you need to submit a new purchase order ASAP.

Order management: An order management system, or OMS, provides a single, centralized system for managing orders from all sales channels — store, web, call center, mobile and kiosk — and enables BOPIS. Because it handles all the functions involved in fulfilling a customer order, an OMS enables employees and customers to track orders and delivers reporting so sellers can track their own critical retail KPIs.

Key Components of a POS System

As with software, the hardware components in a POS solution will vary depending on business needs. The following are common to most solutions:

Monitor or register screen: This provides a visual record of the transaction as it occurs, allowing customers and sales associates to see items as they’re rung up, as well as taxes and the total bill.

Barcode scanner: These devices scan the barcodes on products to record prices and sales by SKUs. Scanners accelerate the checkout process and enhance pricing accuracy.

Cash drawer: While consumers increasingly use credit cards to make their purchases, cash still accounts for about one-quarter of transactions, according to the Federal Reserve. In transactions of under $10, customers use cash nearly half the time.

Credit and debit card reader: Most POS systems today incorporate some sort of card reader. Often, the reader is a separate device, so customers can insert or swipe the card themselves. Newer systems incorporate contactless "tap to pay" capabilities that sync with chip cards, phones and wearables.

Receipt printer: The receipt printer, as its name indicates, prints customers’ receipts. While many POS systems can now send receipts via email, many customers prefer physical slips.

Scale: For some retailers, such as grocery stores, the POS system includes a scale that weighs products and calculates the price accordingly.

Label printer: Like scales, these systems are often used in grocery stores, such as at a deli counter or salad bar, where price labels with barcodes need to be printed, sometimes by customers, at the time the item is selected and before it goes to the register.

History of POS Systems

Until close to the turn of the 20th century, businesses handled customers’ purchases with paper and pen. The process was slow, mistake prone and offered little protection against fraud.

That began to change when inventor James Ritty patented a mechanical cash register in 1883. The machine recorded each purchase at Ritty’s saloon, enabling both customers and the owner to check every transaction. He later sold his invention to John Patterson, who would go on to found the National Cash Register (NCR) Company. NCR remains in business today and makes, among other products, POS systems.

About a century later, in 1970, IBM introduced an electronic cash register. This allowed businesses to ring up customers’ purchases more accurately and quickly. In 2002, the first cloud-based POS system was introduced in the United Kingdom. Over the past several decades, POS systems have continued to evolve and advance. The features offered by today’s systems dramatically improve many businesses’ operations.

Buying the Best POS System

There is no single point-of-sale system that will be the best option for every company. But the following steps can help you choose one that works for your organization:

- Set a budget and choose the right pricing structure: Start by determining how much you can afford to invest in a system. Think about whether you want to make a larger capital expenditure for on-premises system licenses or would prefer to take advantage of a subscription model.

- Decide what capabilities are essential: For instance, if you operate both online and in physical stores, you'll need a system that can integrate with your ecommerce platform. Will you need specialized hardware, such as ruggedized scanners or the ability to print labels?

- Choose the best pricing structure for your needs: If you pay upfront and then own the system, you'll be able to use the system for as long as you need. However, you may need to pay for updates regularly and eventually replace it with a more modern solution. If the system is sold on a lease arrangement, you'll need to discuss the lease structure and any fees before you can estimate the ongoing investment. Cloud software is often sold on a subscription basis.

- Identify the payment methods you accept: Any system today should accommodate chip-enabled credit and debit cards. Increasingly, systems will need to accept contactless payment methods as well, so watch for those capabilities.

- Test the system: Do a pilot to determine how user-friendly the system is for both employees and customers. Can associates quickly look up products or enter discounts? An investment in a system with better ease of use can save employees and customers significant time.

- Review how the system tracks sales: The features required may vary from one business to another. A repair shop may need a system that allows it to keep an order open until all repairs are complete, while a full-service restaurant may want to integrate with specialized bar- and kitchen-management systems.

- Identify integration capabilities: Find out how easily the POS system integrates with vital business software, such as ERP, CRM, accounting, payroll and inventory management. A straightforward integration not only saves time, it may boost your ability to generate a range of helpful reports. Plus, POS systems that can execute both physical and online sales can enhance the buying experience and more accurately track inventory, among other benefits.

- Evaluate support and training options: These services from the vendor can help ensure the POS system runs smoothly and efficiently. That’s why it’s important to understand the level of support offered, and if it comes with an extra cost. Companies may also need to hire an IT support provider.

- Examine the system’s security: It should safeguard credit card and other sensitive data and generate audit trails that help with researching problems. Certified PCI DSS compliance is a must.

- Consider additional capabilities that may be useful: If you sell in multiple states or globally, you'll want a system that can calculate taxes in various jurisdictions. Features like tracking sales by product or the ability to support a loyalty program can help you run the business more effectively.

Grow Your Business With NetSuite

This solution unifies physical and digital shopping on a single platform through a connected POS system that drives a more satisfying shopping experience for the customer and a more profitable one for the retailer. With a single platform that works online, in stores and in call centers, NetSuite SuiteCommerce provides a personal, simple shopping experience and lets associates engage shoppers, facilitate sales and optimize inventory.

Today's POS systems offer numerous functions that can help businesses not only process customers' purchases efficiently, but better manage sales, inventory and customer relationships. Ideally, the system integrates with your ERP software so all this information is collected and analyzed in one place. These capabilities can help businesses thrive in an increasingly competitive environment.

Point of Sale (POS) FAQs

Q: What is a POS?

A: A POS system combines hardware and software that allows businesses to efficiently process and track sales transactions. They're used by a range of companies, including mom-and-pop restaurants, dentists' offices and large national retailers.

Q: Are cash registers POS systems?

A: Cash registers can be considered an early form of POS system, as they allowed business owners to complete and track sales in a more efficient manner. However, today’s POS systems offer additional capabilities. For instance, some can track sales by product, calculate employees’ sales commissions or allow customers to add tips.

Q: How do POS systems work?

A: The customer's items are entered into the POS system, usually by scanning a barcode or entering a product code. The system then calculates the prices. The customer decides on a payment method, and the system accepts the payment. Once the transaction is complete, the POS system may either print a receipt or email one to the customer.

Q: What are the benefits of a POS system?

A: The most relevant benefits of a POS system include:

- Enabling businesses to quickly and accurately complete and track customers’ purchases.

- Helping businesses track sales of different products. POS systems used for online sales can often calculate different metrics, like the percentage of abandoned carts. With this information, the business can take steps, such as streamlining the checkout process, to reduce this number.

- Reducing employee theft by automatically tracking sales.

- Providing records that help in filing timely, accurate tax returns by tracking sales and taxes.

- Functioning as time clocks, enabling employees to clock in and out.

- Ensuring consistent pricing across multiple locations.

Q: What’s the difference between on-premises and cloud-based POS systems?

A: POS systems can be hosted either on the business's own network (on-premises) or based in the cloud (cloud-based) and accessed over the internet. The best approach will depend on the business, but generally speaking, cloud systems have lower upfront costs and can be implemented faster. On-premises solutions, on the other hand, give the company more control over data and system security.