Retail businesses are under continuous pressure to plan, adjust and react swiftly to swings in the market. Strong financial management is integral to their success. Retailers that are able to accurately forecast product demand, manage their cash flow and set smart pricing strategies, to name just a few important aspects of financial management, will be in the best position to meet their customers’ omnichannel expectations and grow their business. This article explains the ins and outs of retail financial management, key metrics to gauge performance and best practices to help retailers master their approach.

What Is Retail Financial Management?

Financial management is the operational backbone of a successful retail company. It encompasses the many financial processes needed to run the business, from budgeting and cash flow management, to forecasting and planning, to inventory management and risk analysis. The goal of retail financial management is not just to drive sales and meet demand in the short term, but to also build a scalable operation that can grow and evolve with customers and drive long-term return on investment (ROI).

The challenge for many retailers is to manage their financial operations efficiently as they grow and increase in complexity. This requires a more unified and agile approach to financial management, powered by exact data that supplies key insights into financial performance. The result is better-informed business decisions that keep retailers on an upward trajectory.

Key Takeaways

- Retail financial management oversees the many financial processes involved in running a retail operation.

- The core components of retail financial management include budgeting, profitability analysis and inventory management.

- Retailers should monitor a number of key metrics, including gross margin and sell-through rate.

- Technology has had a strong impact on financial management.

Retail Financial Management Explained

How much should a retailer charge for its products? Does it have enough cash coming into the business to cover a slow period? Can it invest in a new product line or location? Effective financial management provides retail finance leaders and business owners with the data they need to properly plan their operations and fulfill their long-term strategic objectives.

Real-time data about liquidity, profitability and cash flow can guide retail CFOs as they plan out their investment strategies and optimize expenditures. For example, granular insight into fluctuating material and supply chain costs might prompt a retail business owner to rethink her company’s pricing strategy in order to preserve its profit margins as the cost of doing business rises.

The importance of robust financial management also extends to compliance and governance. The ability to track and assess the performance of every financial operation makes reporting simpler and more accurate, giving retail businesses peace of mind that their operations meet every obligation to regulators and investors alike.

Overview of Retail Financial Operations

Retail financial operations cover a broad spectrum. They include everyday financial processes, such as forecasting, planning and budgeting; logistical processes, such as inventory management; and more strategic processes, such as profitability analyses, pricing strategies and risk management. It stands to reason that retailers will have different financial management priorities based on their sizes, operating models and specific goals and needs. However, every retail organization must align its financial management approach to its specific objectives if it’s to operate smoothly, meet customer demand and drive sustainable growth.

Roles and Responsibilities in Retail Finance

The roles and responsibilities dedicated to retail finance are typically contingent on the size of the business. The smaller the retailer — in terms of headcount and/or annual revenue — the more likely financial responsibilities will fall to the owner or perhaps a bookkeeper or accountant. Even at midsize retailers, finance employees may take on multiple roles to optimize costs. But as the business grows (and possibly becomes public), so too will its need for a dedicated finance team composed of multiple players, each with a dedicated role to play.

- Chief financial officer (CFO): At the top of the financial management pyramid sits the CFO. The CFO drives the retailer’s strategic direction, oversees financial activities and represents the financial department’s interests in the boardroom.

- Financial controller: Reporting to the CFO, a financial controller oversees day-to-day accounting and reporting to ensure the business complies with retail industry regulations.

- Financial analyst: As the title suggests, a financial analyst analyzes the business’s finances, not only to assess how the company is doing at the moment, but also for reporting, forecasting, financial modeling and helping management teams in their strategic decision-making.

- Cost analyst: Also true to its name, a cost analyst examines the costs associated with the retailer’s products and operations. Goals include identifying areas to reduce costs, streamline processes and consider what-if scenarios.

- Merchandise planner: Large retailers might employ a merchandise planner to optimize their product assortment, with responsibilities that include inventory management, allocation and replenishment, demand forecasting and performance analysis.

- Financial systems analyst: Technology is integral to modern retail success. Whether part of the finance team or technology team, a financial systems analyst ensures the retailer’s software and systems support the business’s financial data and processes.

- Real estate analyst: Surprised? A retail business with its eyes on expansion might also hire a real estate analyst to scope out potential store locations, manage properties and handle lease agreements.

Common Challenges in Managing Retail Finance

Retail financial management has many moving pieces, from day-to-day accounting tasks to strategic financial planning around peak selling periods, like Black Friday. The challenge for many retailers is to unify, simplify and gain visibility across all of their financial operations to keep operations on track 24/7.

Arguably, retailers’ biggest challenge stems from reliance on slow, resource-intensive manual financial processes that inhibit timely decision-making based on the latest data. Another challenge retailers face is limited access to financial data. This is especially difficult in siloed organizations, where operational and financial data sit in disparate systems. Data analysis turns into a painstaking, fallible process that becomes more of a time drain than a strategic value-add.

The combination of manual processes and siloed data underscore a third overall challenge for retailers: ensuring data accuracy and management. Manual record-keeping inevitably leads to duplicated data entry, transposed figures and mistakes when calculating financial metrics — the consequences of which could lead to overspending and expose retailers to regulatory and reputational risk.

Core Components of Retail Financial Management

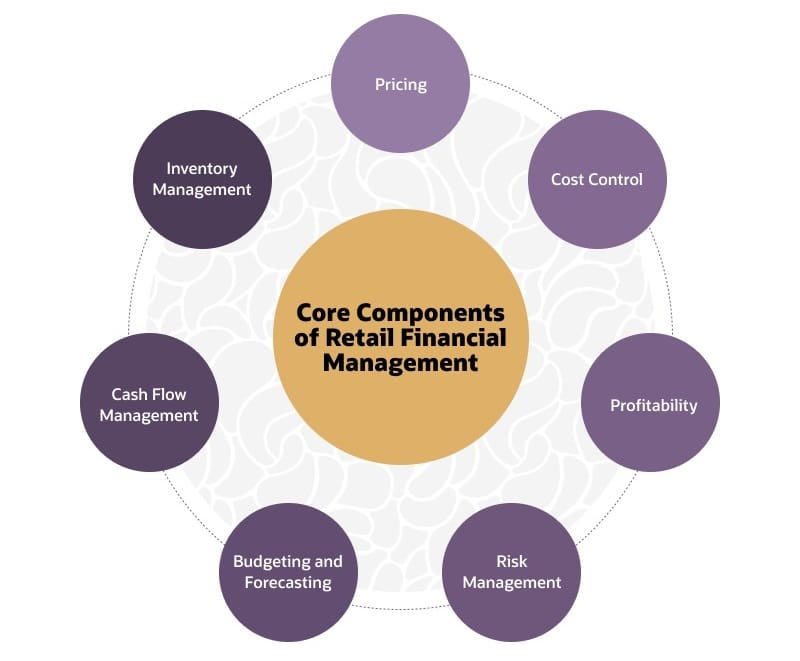

A retailer’s financial operations are multifaceted, ranging from planning and forecasting to compliance and risk management. Yet all types of retailers, big and small, must closely oversee seven core components of retail financial management if they’re to drive growth and strengthen their customer relationships, while keeping their costs and risk in check.

Budgeting and Forecasting

A retail budget sets guardrails for spending over a fixed period of time. By estimating how much money the business will earn and spend on its fixed and variable expenses, a retailer can best determine how to allocate its funds for a given quarter or year to achieve its business goals. A forecast, on the other hand, draws on a mix of historical transaction data and market information to help the retailer predict what will likely happen with its sales and in the broader market. Forecasts help financial managers determine whether their business goals are likely to be met and if they must make any adjustments to get there. Budgeting and forecasting work together and are essential to all retail businesses, ensuring they are in the best position to capitalize on present and future opportunities.

Cash Flow Management

A retailer’s vitality depends on its ability to make more money than it spends. Cash flow refers to the money that flows in and out of a retail organization. An indicator of liquidity, cash flow comes from operating, investment and financing activities. The timing and management of cash flow is paramount so that the retailer has enough cash available to cover its short-term obligations and also invest in new opportunities.

Inventory Management

No retailer wants to carry too much inventory or be caught shorthanded. Either scenario has a negative impact — loss of revenue and customers if demand can’t be met due to understocking, or added expenses from inventory carrying costs, markdowns and write-offs due to overstocking. Good inventory management involves planning for and tracking the right goods and the right quantities of goods from the moment they’re ordered until they’re sold, be it online or in-store. American public companies also need to track inventory as a matter of compliance to meet the requirements of the Security and Exchange Commission (SEC) and the Sarbanes-Oxley (SOX) Act.

Pricing Strategies

Setting the right price for a retail item involves a delicate balance of factors that ultimately impact a retailer’s bottom line. A retailer must be careful that what it charges will cover both its direct costs, which are tied to the products it produces, acquires and sells, and its indirect costs, such as rent and utilities, while simultaneously setting prices that also reflect market demand, competition and consumer habits. An optimal pricing strategy maximizes a retailer’s revenue and ensures profitability without scaring off customers or compromising the way they perceive its brand.

Cost Control and Reduction

The more a retailer can reduce its business expenses — without sacrificing quality, of course — the better able it can maximize its profit margins. Cost control involves closely tracking spending to identify processes that can be optimized, uncover issues that result in unnecessary expenses, such as overstaffing, and make the appropriate decisions. For example, a retailer that sees a significant increase in the cost of last-mile delivery for goods ordered online could opt to find a less-expensive logistics provider or shift its strategy to drive in-store sales.

Profitability Analysis

Profit is the revenue that remains after a retailer pays its business expenses. Profit indicates that the company is making money, which can be used to grow the business. Analogous to spend analysis — the process of examining spending with suppliers to identify patterns and trends to help control costs — profitability analysis allows retailers to scrutinize their profit margins and identify where to streamline or reduce their costs to maximize profits even further.

Profitability analysis can also inform a retailer’s pricing strategies. For instance, if a product suddenly costs more to source, market and ship, the retailer may adopt a dynamic pricing strategy and adjust the price of its products in line with these variables to maintain a healthy profit margin. Of course, it will need to balance any price increases with the potential reduction in demand that may follow.

Risk Management

From data privacy and regulatory compliance to supply chain disruptions, economic shifts and cybersecurity threats, the risks of financial, legal or reputational loss due to poor financial management are a constant for retailers. In addition, every single manual process, such as accounting and inventory management, poses a threat to data accuracy, which can result in misguided financial decisions. While retailers can’t eliminate all financial risks, they can manage them with proper planning and controls in place.

Key Financial Metrics for Retailers

The best way for retailers to assess their financial performance is by tracking key metrics that provide an objective view of how well they’re managing their resources, generating revenue, controlling costs and showing a profit. The following six metrics are important to monitor, for both internal and reporting purposes.

Gross Margin

A retailer’s gross margin, also known as the gross profit margin, refers to the percentage of revenue that remains from sales after subtracting the direct costs associated with producing a particular product. These costs are known as the cost of goods sold (COGS). The metric reflects how well the retailer is generating revenue. The formula for gross margin is:

Gross margin = (net sales – COGS) / net sales x 100%

Operating Margin

Operating margin is the percentage of profit a retailer makes on every dollar of sales after subtracting COGS and day-to-day operating expenses, such as marketing, selling and shipping costs, and overhead costs like rent, utilities and salaries. In short, operating margin measures the efficiency of operations and their impact on profitability. The formula for operating margin is:

Operating margin = operating income / revenue x 100%

Inventory Turnover

Inventory turnover is the speed at which items move in and out of a retailer’s inventory over a given period of time. It’s an efficiency metric that links the rate at which a retailer purchases inventory to its sales and doesn’t necessarily reflect the health of the business. For instance, a car dealership might have a slower inventory turnover than a local dress shop yet have a stronger, healthier business with greater customer demand. The formula for inventory turnover is:

Inventory turnover = COGS / average inventory

Sell-Through Rate

Sell-through rate compares the volume of goods a retailer sells over a given time period to the volume of inventory it bought from its suppliers during that same period. It is a critical efficiency metric that reflects the speed at which retail stock becomes revenue. By focusing its inventory purchases on high sell-through items, the retailer will ensure its shelves and warehouse are stocked with popular items that drive the most sales. The formula for sell-through rate is:

Sell-through rate = (# of units sold during a given time period / # of units received at the start of period) x 100

Same-Store Sales

Same-store sales compares an individual retail store’s sales performance for a given time period with the same period the previous year. This is a key metric for all sizes of retailers to gauge their performance and adjust their strategies to meet their business objectives. Retail chain operators also monitor same-store sales so they know how well their various locations are performing, which stores present the biggest opportunities for further growth and whether they should open new locations or focus on strengthening their existing retail network. The formula for same-stores sales is:

Same-store sales = (current period sales / prior period sales) – 1

Return on Investment (ROI)

ROI is a common financial metric used by virtually every business to evaluate the incremental income it generates from a given investment. For instance, a retailer that invests in warehouse robots to speed up its inventory processes stands to generate additional revenue because it can handle more customer orders and therefore sell more goods. The formula for ROI is:

ROI = net return on investment / cost of investment x 100

Note that net return refers to the total incremental income that a company has generated as a result of its investment minus the materials, personnel and other costs associated with generating that revenue. In the case of our warehouse robots, net revenue would be calculated as the additional sales revenue generated since implementing the robots, minus the cost of purchasing, operating, upgrading and troubleshooting the technology.

Regulatory Considerations in Retail Finance

As players in a major global industry, retailers must comply with a number of regulations to ensure they operate legally, responsibly and in the best interest of their customers. Failure to comply can result in legal and financial consequences, as well as reputational damage. Here are three of the main regulatory issues that retailers must consider.

Sales Tax Implications

Sales tax is a type of consumption tax set by states and countries and added to the price of products. Retailers must ensure compliance with their tax obligations across every business function, location and jurisdiction in which they operate, which can become understandably complicated in a world of global ecommerce. The sales tax rate in America alone varies from 2.9% to 7.25% across the 50 states. Add to that the variations in value-added tax (VAT) and goods and supply tax (GST) rates between countries, from 10% in Australia to 27% in Hungary, and the scope of this challenge becomes apparent.

Data Security and Privacy

The rise of ecommerce and digital business models has opened the data floodgates, bringing with it unprecedented opportunities for retailers to better understand their consumers and tailor their offerings to them. But with this newfound access to people’s data has come regulatory concerns about how to responsibly handle and protect the information.

Most notably, data protection laws such as the General Data Protection Regulation (GDPR) and California Consumer Privacy Act (CCPA) have established standards for data privacy and management that every business must abide by. The mandate for retailers is to gain visibility and control over their data practices using standard definitions, policies and procedures. In addition to meeting regulatory requirements and shielding their businesses from data breaches, a more robust approach to governance also improves data quality, which in turn drives better decision-making across the organization.

Accounting Standards and Reporting Requirements

Most companies in the United States must follow strict accounting standards, and retailers are no exception. The two most common accounting standards are the Generally Accepted Accounting Principles (GAAP), which is the official accounting standard in the United States, and the International Financial Reporting Standards (IFRS), which are used in more than 120 countries. Companies must produce financial reports in accordance with one or both of these standards, as well as any others specific to the countries in which they operate, and maintain a clear audit trail. Publicly traded retail organizations must also comply with SEC rules and regulations.

Retail Financial Management Best Practices

A retailer’s approach to financial management is influenced by a host of internal and external factors that shape its strategies, including customer mix, business model, size and profitability goals. However, all retailers can benefit from the following four best practices.

Set clear financial goals and objectives.

Whether it’s reaching a certain sales target, cutting internal costs or improving cash flow, there are many financial objectives a retailer can pursue to enhance its performance and drive success. Of utmost importance when setting a financial goal is for the retailer to be specific. It’s not enough to say it wants to boost sales; rather, by how much? Only then will it be working toward a truly measurable goal, with planning tailored to meeting a specific amount. In addition, a goal should be grounded in reality, taking into account the retailer’s historical performance, economic forces and what it can feasibly achieve. Every company would love to double its profits overnight, but achieving that is a whole different story.

Perform regular financial reporting and analysis.

Financial reporting is the process of communicating a company’s financial performance to internal and external stakeholders. One important, standardized way a retailer can share its key financials is through three core financial statements — the income statement, balance sheet and statement of cash flows — which are released quarterly and/or annually and analyzed by retail owners, management, regulators, investors and lenders to inform their decisions. Financial statements must be prepared in conformance with accounting standards, such as (GAAP and IFRS.

Build a robust financial team.

A financial team plays a crucial role in managing a retailer’s financial health and success. Retail CFOs, finance VPs and their teams bring strategic insight about their companies’ financial performance to the boardroom, helping to shape business and investment strategies, create and guide budgets and streamline processes for cost effectiveness. Smaller retailers may not have the luxury of a dedicated team, but that doesn’t mean they can’t manage their finances effectively. Outsourcing, consulting with financial advisers and implementing user-friendly accounting software are all viable options.

Improve and innovate.

Retailers operate in an incredibly fast-paced and competitive industry. From new purchasing models to rapid swings in customer behaviors, the only way to thrive is to evolve and innovate. In addition to adopting new technologies to improve the customer experience on the front end, retailers should also embrace this spirit of continuous improvement in their financial operations. This can have a direct impact on critical business functions, including demand forecasting and inventory management.

Technology in Retail Financial Management

Technology is inextricably linked to the retail sector. Trends like the rise of ecommerce, the merging of in-store and digital sales channels and the growing popularity of cryptocurrency have reshaped the industry. One look at Blockbuster, and the risk of falling behind is clear.

The importance of technology in retail also applies to back-office operations. The use of data analytics, integrated performance dashboards and real-time data helps retailers monitor their operations, react to change quickly and make sound business decisions that can lead to growth. Here are some important technology trends that retailers need to know about.

The Impact of Ecommerce on Retail Finance

The shift to ecommerce, accelerated by the effects of the COVID-19 pandemic, has opened new financial opportunities for retailers — especially smaller businesses with newfound access to global customers. Ecommerce has also brought with it new challenges. For example, the ability to reach more customers and sell through more channels beyond a physical location has added more sources of revenue, but the logistics of managing cross-channel sales and fulfillment has put serious pressure on retailers’ supply chains and inventory strategies. Ecommerce has also broadened the field of competitors for retailers, with implications for their pricing and marketing strategies, to name a few.

The Use of Point-of-Sale (POS) Systems

A point-of-sale (POS) system is a combination of hardware and software that retail associates use to ring up sales, take customer payments and accept returns. A POS device can be a fixed register at a checkout line or a mobile device, like a tablet, which accelerates the transaction process by enabling associates to engage with customers anywhere in the store. Advanced POS systems provide visibility into a customer’s previous omnichannel interactions with the business, which can lead to a more personalized customer experience.

Advancements in Accounting and Finance Software

Retailers’ financial processes have come a long way since the days of paper-based records and spreadsheets. Instead of spending hours on basic, manual tasks, like data-entry and record-keeping, retailers are increasingly turning to accounting and financial software to automatically record transactions, manage their payables and receivables, collect taxes, close their financial books and speed up financial reporting. Cloud accounting software ups the game with real-time access to financial data, allowing retailers to accelerate these core financial processes while staying compliant and maintaining the highest standards of data quality.

Retail-specific accounting platforms integrate inventory management, POS and omnichannel support tools, among others, in the cloud, automating repetitive accounting tasks, such as the creation of journal entries or account reconciliation. Instead of spending hours collecting, combining and analyzing data, finance teams can focus on details like trends analyses, which deliver strategic value to decision-makers and other business stakeholders.

Leverage of Data Analytics for Decision-Making

Data analytics involves collecting and analyzing retail and customer data, and then using the insights to optimize strategies and improve business outcomes. Data analysis can be used to improve forecasting, influence product mix and deliver personalized marketing campaigns to help retailers predict, prepare and proactively adjust their operations to suit the needs of their customers and the realities of the market over time.

Blockchain and Cryptocurrency in Retail Finance

In response to customer demand, retailers have begun to accept cryptocurrency payments in exchange for their products. That said, the value of cryptocurrencies like Bitcoin fluctuates significantly, so this practice has seen limited adoption. More interesting to many retailers is blockchain, the distributed ledger technology behind cryptocurrencies. With every transaction across their operation tracked, recorded and secured, retailers can better protect consumers, make their supply chains more efficient and securely manage their contractual obligations.

Benefits of Retail Financial Management Software

Retailers must manage more sales channels, new points of sale and increasingly complex financials every day. On a logistical level, they also need to manage more suppliers and fulfillment partners as their operations expand and become more complex. Financial management software is key to managing this growing complexity. From accounting to planning to reporting, financial management software seamlessly integrates every application in a retailer’s back office so it can seamlessly run its entire business using a single platform.

Improve Insight and Operations With NetSuite

NetSuite for Retail is ideally suited to the challenges of modern retailers. A single comprehensive, cloud-based platform that works across all sales channels, NetSuite for Retail integrates financial management, inventory and order management, ecommerce, customer relationship management, POS and business intelligence functionality, providing retailers with real-time visibility across the entire business. The solution presents key financial metrics in easy-to-read dashboards, empowering stakeholders to make timely, data-driven decisions about many different aspects of the business.

From material sourcing, to warehouse strategies, to fulfillment, NetSuite provides retailers with many opportunities to streamline and optimize their financial management processes. Retailers, including Alton Lane and PlaqueMaker, have used NetSuite to diversify their business and scale their operations to become more efficient and fuel record growth.

Financial management drives profitability, informs strategic decisions and underpins stability and growth in today’s competitive retail market. By following best practices, building a solid finance team and embracing cloud-based software to manage their financial operations, retailers can turn what was once a tedious, manual process into a strategic value-add that fuels better customer service and improved investor relationships and, most importantly, leads to sustainable growth.

Retail Financial Management FAQs

What do you mean by retail financial management?

Retail financial management refers to the many financial processes involved in running a successful retail operation. These include accounting activities like budgeting, logistical tasks like inventory planning and purchasing, and strategic activities like data analysis, reporting and pricing strategies.

How does budgeting and forecasting play a role in retail financial management?

Budgeting allows retailers to lay out a plan and goals for an upcoming financial period. In parallel, forecasting provides retailers with a view of what is likely to happen during that period. Forecasting informs budgeting, ensuring spending plans align with what the future will likely bring.

What are emerging trends in retail financial management?

Current trends in retail finance management include the rise of cross-channel sales, also known as omnichannel sales; the integration of point-of-sales systems with back-end enterprise resource planning (ERP) systems; and the emergence of cloud-based financial management platforms that align and unify complex financial processes.

How can a retail business prepare for the future of retail finance?

To prepare for the future, retail businesses must ensure their operations are both agile and scalable. Cloud-based financial management software ticks both of those boxes, allowing retailers to manage their finance operations via a single platform no matter how big or complex their organizations become.

What impact does effective retail financial management have on the sustainability and growth of a business?

Effective retail management is directly linked to long-term business growth. The ability to forecast, plan and accurately report on their performance gives retailers crucial insight into where and how they can optimize their operations, from inventory management to last-mile fulfillment.

What are the 3 types of financial management?

Financial management can be grouped into three categories. The first is capital budgeting, which identifies where capital funds should be spent to drive growth. The second is capital structure, which determines the best way for a business to pay for its operations and growth, be it a loan, external funding or selling equity, among other tactics. The third category is working capital management, which ensures that a company has enough liquidity to pay for its daily operations, for instance to pay employee wages.

How do you manage retail finances?

Managing retail finances requires teams to track, monitor and optimize financial performance across multiple functions. The more efficient way to gain control over these complex tasks while minimizing risk and human error is to use financial management software.

What are the financial objectives of retail management?

The goal of retail management is to drive revenue, profit and growth while optimizing operating costs. Additional objectives include inventory optimization, cash flow management and operational efficiency.