This article offers a comprehensive guide to retail benchmarking. Learn why the practice is valuable and how you can use it to gain a competitive edge. Plus, find a list of key retail benchmarks to measure.

In this article:

What Is Retail Benchmarking?

Retail benchmarking is the process of evaluating how effectively a business attracts and retains customers compared to competitors. It leverages internal metrics, competitor analysis, and historical or third-party data for a comprehensive assessment.

This practice provides valuable context for understanding key performance indicators (KPIs) that businesses should monitor for continuous improvement. To learn more about KPIs and their relationship to benchmarking, check out our detailed guide on business KPIs.

Key Takeaways

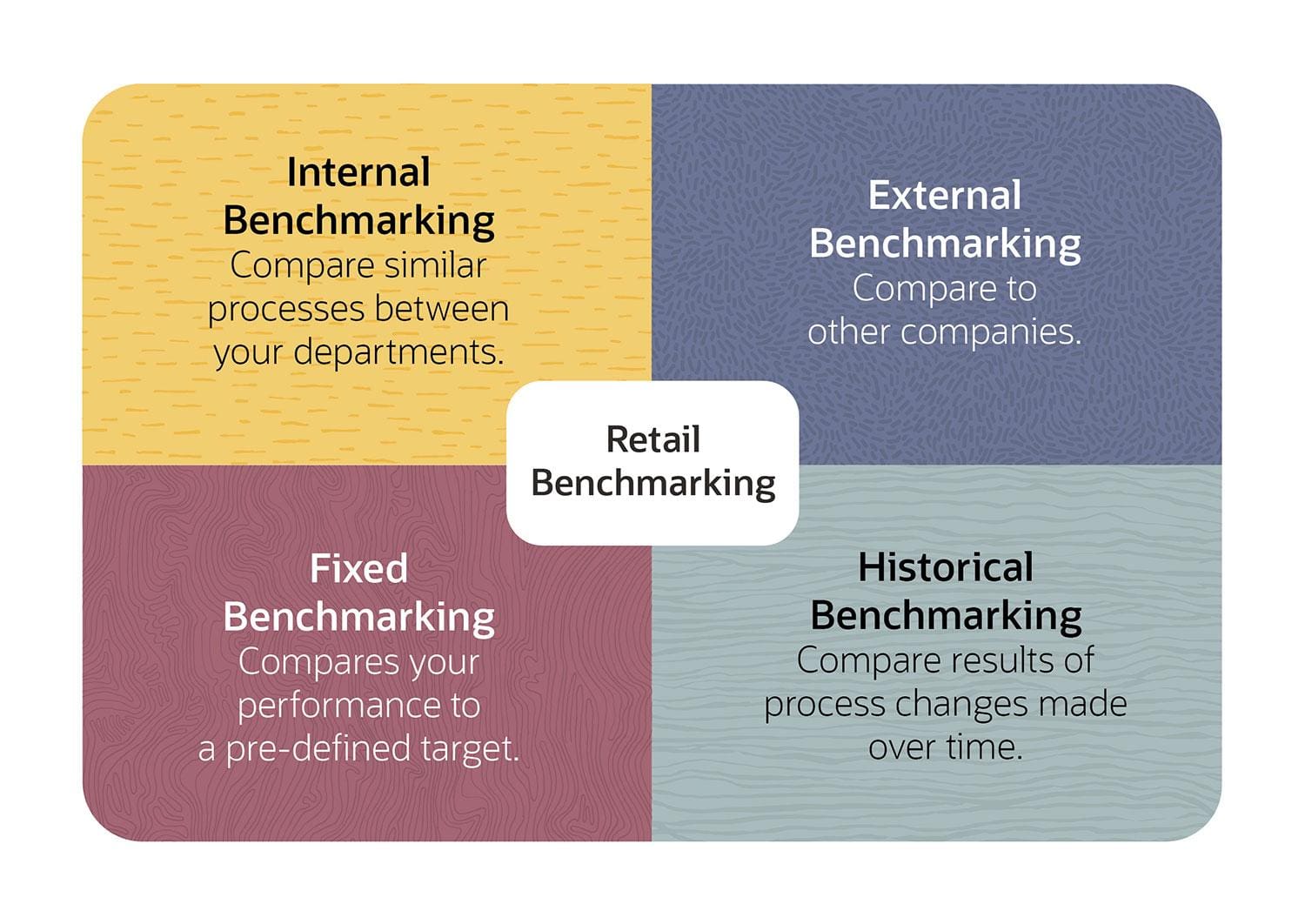

- Retail benchmarking includes four approaches: external or competitive, internal, fixed and historical.

- Retail benchmark frameworks provide standard definitions and measurement units for tracking metrics. Third-party consultants often have their own frameworks for measuring competitive benchmarks.

- Benchmarking can help retailers find ways to improve customer service, management, marketing, merchandising and sales.

Why Conduct Retail Benchmarking?

You conduct retail benchmarking to identify areas for improvement. The right metrics and retail key performance indicators (KPIs) can impact your business’s growth and help to identify new opportunities. Ongoing measurement against those metrics can then show how process and practice changes affect performance.

Benefits of Retail Benchmarking

The benefits of retail benchmarking include comparisons of company performance — both internal and with competitors. Results can help identify how to change processes and determine the rights systems to implement to become more successful and competitive.

Added below are some additional retail benchmarking benefits:

- Provides third-party insight into your performance compared to other companies.

- Helps you find performance gaps and plan for improvement.

- Supports goals and targets that measure performance.

- Promotes a framework for establishing consistent procedures and practices.

- Encourages the pursuit of continuous improvement.

Areas That Retail Benchmarking Can Improve

Areas that retail benchmarks can improve include customer service, management, marketing, merchandising, store plans and sales. Some benchmarks can be unique to the business and many change as the company grows and evolves.

-

Sales effectiveness:

Sales effectiveness measures a sales representative’s performance. With this metric, you can spot gaps in the skill sets of sales staff. Sales effectiveness also indicates territories that may require reps with specific talents or experience.

-

Merchandising effectiveness:

Merchandising effectiveness calculates how many in-person or online visitors buy items. It can also reveal the success of stock displays and customer service. Effective presentations encourage customers to purchase goods.

-

Marketing effectiveness:

Marketing effectiveness gauges the success of a go-to-market strategy to reach target customers. Proper marketing effectiveness should lower the costs required to gain new sales and increase the value of each transaction.

-

Management effectiveness:

Management effectiveness in retail tracks how well you improve productivity. Measuring management effectiveness can demonstrate whether a company has made the right choices in hiring and training staff. This benchmark also informs retail inventory management.

-

Market basket analysis:

Retailers look at market basket analysis to track which items customers buy together. This metric is a critical benchmark for showing unexpected retail trends. These findings can reveal a store’s keystone products (i.e., those they can sell for twice the wholesale cost).

-

Customer rewards programs:

Benchmarking of customer rewards programs can help measure customer retention. These metrics can track the performance of participation rates in rewards programs and redemption rates for coupons and special offers, for example.

What Are the Types of Benchmarking Used in Retail?

The main types of benchmarking used in retail are internal, external or competitive, fixed and historical. Here are some examples of each how they apply to the retail industry:

-

Internal Benchmarking

Internal benchmarking compares how different departments in one company perform across common processes. Businesses can then implement the best practices they learn from benchmarking in other departments.

As an example, a restaurant chain’s management may compare statistics among franchises. The franchise with the highest Net Promoter Score® may train other franchises in customer service.

-

External/Competitive Benchmarking

External or competitive benchmarking compares the performance of one company with those of other companies. Internal company data is often confidential, making it difficult to find. Sometimes organizations agree to share data. Usually, you’ll need to employ the services of a dedicated company that specializes in gathering data to create industry benchmarks.

For example, if you’re reviewing your sales processes, you would want to benchmark your industry's time to close a sale. If most companies have a faster closing rate, you would research their sales tactics and apply some of those practices to your business.

-

Historical Benchmarking

In historical benchmarking, a company measures current performance to past measurements. They are looking to see whether changes have improved operations. For example, a company may track how many parts it makes before and after it changes its production procedure or gets a new piece of equipment.

-

Fixed Benchmarking

Fixed benchmarking gauges performance against a preset internal target. Companies use fixed benchmarking to test products and to evaluate customer satisfaction responses.

For example, you set a target benchmark for your Net Promoter Score to be over 50 after launching a cutting-edge new product. You know your current NPS score was under the industry average of 44, and you’re evaluating if the new product lifts your overall customer satisfaction rating.

Common Retail Industry Benchmarks

Common retail industry benchmarks show the metrics of your competitors. They help you understand the value of sales-related and overhead investments. Retail benchmarks focus on sales statistics, customer behavior, marketing and fulfillment metrics.

Sales per Square Foot

Sales per square foot describes your store’s income for your entire retail space. This calculation includes both sales space and fitting rooms, stock room and receiving and other areas. This benchmark indicates how efficiently you use space.

The sales per square foot metric can identify opportunities to improve inventory management, layout and merchandising.

Sales per Transaction

Sales per transaction is the number of items a customer buys each time they shop with you. A high sales per transaction number suggests you understand your customer well because they like your products or services.

Sales per Employee

Sales per employee is the average of the number of sales a company makes divided by the total number of employees. The higher the sales per employee, the better the business is typically doing and the more efficient its staff.

Sales per Employee Hour

Sales per employee hour or sales per labor hour can show if your labor budget is too high or low. You can also think of sales per employee hour as indicating the rate of return on your employees.

Sales per Working Capital Invested

Sales per working capital or net sales to working capital reveals how much money a company needs to spend to maintain a certain level of revenue. The ratio calculates how much money is invested in inventory and accounts receivable. This benchmark is measured against historical and competitive data.

Sales per Marketing Activities

The sales per marketing activities metric helps you see what marketing efforts generate revenue. Marketing metrics, such as overall impressions, may not coincide with sales.

You can compare some marketing tactics with sales. These metrics include cost per lead (CPL), return on marketing investment, lead and traffic conversion rates and more.

Sales per Promotional Investment

The sales per promotional investment metric calculates the return on each campaign. The metric tracks which campaigns or channels are most profitable. For example, you might calculate the return for online and offline campaigns.

Marketing as a Percentage of Revenue

Marketing as a percentage of revenue, or marketing expense to revenue, shows how much you spend on marketing relative to total sales. These expenses include your budget for online and print campaigns, branding consultants and sales staff. It can help organizations understand whether they should increase or decrease their marketing budget.

Order Fulfillment Cycle Time

The order fulfillment cycle time metric gauges how long it takes for customers to receive an item or service after placing an order. The metric indicates the efficiency and effectiveness of a company’s processes and supply chain.

Customer Conversion Rate

The customer conversion rate represents how effective you are at getting potential customers to perform a certain action. Conversion rates help shed light on how you’re approaching prospects, the value of discounts, campaign timing, inventory selection and more.

Customer Average Spend

Calculate customer average spend by multiplying the average amount spent per purchase over the course of a year by annual average customer purchase frequency. This metric provides insight into marketing, merchandising and customer shopping behavior.

Basket Size

Average basket size (ABS) measures the number of items sold for each transaction through any channel, like ecommerce or brick and mortar. The metric can inform why the average order value (AOV) is increasing or decreasing.

Average Ticket Dollar Value

The average ticket dollar value shows the average amount each customer spends per visit. This metric is beneficial when analyzing profitability and sales.

Inventory Turnover

How slowly or quickly a company sells and refills its stock is inventory turnover, and its usually measured on an annual basis. Understanding turnover is important because inventory ties up cash until it sells and occupies shelf and warehouse space, which adds to overhead costs.

Ideal turnover rates vary among industries and products. Slow turnover rates may indicate that stock is unpopular or priced too high. High turnover rates may mean you purchased too little inventory, which will increase your shipping costs.

What Is the Average Inventory Turnover for the Retail Industry?

The average inventory turnover rate for retail varies greatly by industry. Many people cite an average inventory turnover target between two and four. However, if your product is perishable, it could be much, much higher. That’s part of why, in retail, benchmarking against direct competitors is important.

Retail Industry Inventory Turnover

| Foundational | Competitive | Best in Class | Transformative | |

|---|---|---|---|---|

| Inventory Turnover Rate | <5.9 turns | 5.9 turns | 7.3 turns | 9 turns |

Average Inventory Shrinkage

The average inventory shrinkage metric tracks stock lost through theft, damage or loss.

Gross Profit Margin

The gross profit margin benchmark calculates money left from product sales after subtracting the cost of goods sold (COGS). The metric shows a company’s financial health and indicates how efficiently it manages labor and resources.

Gross Margin per Square Foot

Gross profit margin per square foot takes gross profit margin for the year and divides it by the square footage of a company’s facilities. This benchmark indicates how efficiently a company generates sales, which affects decisions to decrease or increase space or add locations.

Overhead Percentage of Sales

Overhead percentage of sales calculates how much a company spends to display goods and serve customers, including all expenses other than the salaries and benefits of staff. The lower the overhead rate, the more efficient the business.

Operating Margin

Operating margin describes a company’s profit on sales after expenses and is a crucial measure of business efficiency. High operating margins suggest a company is productive and managed competently. Ideally, operating margins increase over time.

Return on Invested Capital

Return on invested capital (ROIC) is a measure of profitability. ROIC describes the money left after a company pays returns to investors, known as equity capital and debts.

Warehousing Cost as a Percentage of Revenue

Warehousing cost as a percentage of revenue divides warehouse costs into total company revenue. Warehouse costs include receiving, storing, sorting and other related expenses. High rates suggest waste such as excessive manual processes, overstaffing or a lack of trained staff.

Wage Cost Percentage to Sales

The wage cost percentage to sales metric tracks the total cost of labor relative to overall sales. Businesses should track this metric regularly to make sure it doesn’t trend too high, or too low, which could signal a need to hire more employees.

Customer Satisfaction

Customer satisfaction gauges how happy customers are with your products and services. When you understand customer satisfaction levels, you can start to improve offerings and processes.

You can track customer satisfaction through direct feedback in surveys. Or track it indirectly through customer interactions with goods and staff and customer comments on social media.

Total Cost of Doing Business as Percentage of Sales

The total cost of doing business as percentage of sales is another measure of a business’s financial health. The costs include sales and marketing, labor, materials and other expenses. A low percentage suggests the company is efficient.

What Is a Good Asset Turnover Ratio for Retail?

Asset turnover ratio compares a company’s revenue to its assets. A good asset turnover ratio for retail is 2.5 or higher.

Retail Industry Benchmark Framework Example

A retail industry benchmark framework defines standards and common processes for benchmarking. The framework specifies common units of measurement and metrics.

The Benchmark Framework

This framework offers four levels of achievement.

- Foundational: The foundational level describes businesses that are new to an activity or process or the metric. Companies at this level should prioritize process improvements.

- Competitive: The competitive level describes retail businesses that are profitable and efficient but can improve their performance. Investments in key areas can help the company reach the next level.

- Best in Class: Functions that are best in class exceed the performances of average companies of the same size and in the same industry. The business should focus on optimizing this solid foundation.

- Transformative: Transformative level metrics are the best they can be. The designation reflects efficient processes that are second-to-none and may even revolutionize an industry. Continued effort to support these measurement areas will maintain excellent results.

Retail Competitive Benchmarks

Retail metrics reveal how well a company sells its products, meets demand and provides customer service. You want to consider metrics such as gross profit margin, SG&A costs as a percentage of revenue, warehousing cost as a percentage of revenue, customer satisfaction, spend under contract, order fulfillment cycle time, marketing as a percentage of revenue, sales per square foot, total IT spend as a percentage of revenue and inventory turnover.

Examples of Retail Benchmarks

Here are six of the top competitive benchmarks in retail:

Retail Industry Competitive Benchmarks

| Foundational | Competitive | Best in Class | Transformative | |

|---|---|---|---|---|

| Order Fulfillment Cycle Time | >60 hours | 36 hours | 24 hours | <8 hours |

| Marketing as a Percentage of Revenue | >4.2% | 4.2% | 2.9% | 2.0% |

| Inventory Turnover Rate | <5.9 turns | 5.9 turns | 7.3 turns | 9 turns |

| Gross Margin | 28.0% | 30.0% | 41.4% | 58.0% |

| Sales per Square Foot | <$223 | $336 | $510 | >$595 |

| Customer Satisfaction | <70% | 73% | 86% | >86% |

How to Set Your Organization’s Retail Benchmarks

When you start to set your organization’s retail benchmarks, you must first make choices about your approach. The metrics and units of measurement you pick must reflect the unique needs of your company. Consider these recommendations:

- Use your company mission and key business drivers to decide which areas to benchmark.

- Choose metrics to track movement in critical areas. These metrics will differ between companies and may change over time.

- Choose your approach. Will you perform external or internal benchmarking or both? If you choose internal benchmarking, will you track historical changes?

- Collect benchmarking data. For retail, data may come from such sources as surveys, internal dashboards, reports, third-party benchmark providers or inventory management systems.

- Analyze the collected data to determine benchmarks.

- Plan for improvements based on your benchmark.

Why Retailers Need a Unified Cloud-Based Solution

To track benchmarks, you need volumes of accurate data. A unified, cloud-based omnichannel commerce platform combines customer and product data. Such a solution analyzes trends and patterns with a level of detail that’s not possible with manual tracking and analysis.

The right commerce solution should support ecommerce, point of sale (POS), order management, back-office functions and more (opens in a new tab). By consolidating all of that in one place, retailers can better understand customer and staff behavior to improve processes and bolster the bottom line.

NetSuite provides a centralized platform that allows retailers to quickly access the data they need for benchmarking. NetSuite’s end-to-end, unified system provides real-time insights into customers, inventory, sales, financials and more to grow the business and profits. In addition, NetSuite's Success for Retail implementation methodology takes advantage of the provider’s extensive experience with retailers to deliver a system tailored to businesses just like yours.

Benchmarking can provide context for your data and an understanding of the retail landscape that includes your peers and competitors. The right cloud-based ecommerce platform makes benchmarking easy and efficient. Benchmarking can help retailers of all sizes. It can give growing businesses a boost as they try to take the next step, while enabling more mature brands to cement their position as a category leader.