This guide on inventory turnover goes beyond simple inventory control processes. It provides business professionals with terms, formulas, ideal ratios, examples and expert guidance to help master inventory turnover.

Included on this page:

- Inventory turnover formulas and calculations

- Why your business needs to understand inventory turnover

- Which inventory turnover ratio is ideal for your business

What Is Inventory?

Inventory is the stock that a company holds and considers assets. Inventory includes raw materials, works in progress and finished goods. In accounting terms, inventory is the value associated with stock that accountants list on the balance sheet of financial statements.

Companies control inventory using different methods, formulas and procedures in their accounting. For example, they could account for their goods using a periodic inventory system or on an ongoing basis, known as a perpetual inventory system. For more details on a periodic inventory control system, read “Periodic Inventory System: Is It the Right Choice?” To learn more about a perpetual inventory control system, read the “Definitive Guide to Perpetual Inventory.” For more information on inventory control, see the “Essential Guide to Inventory Control.”

What Is Inventory Turnover Ratio?

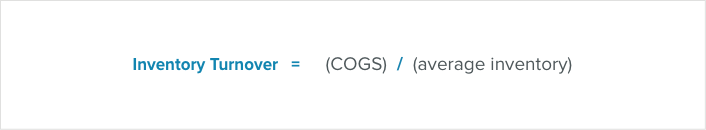

Inventory turnover ratio measures how well a company manages its stock, which is the number of times the inventory sold over the year. This efficiency ratio shows the cost of goods sold (COGS) divided by the average inventory amount for the period.

Companies sometimes use an inventory turnover ratio, also called inventory or merchandise turns, when applying for loans to show the bank the stock value. Primarily, accountants use the inventory turnover ratio to help the company make better stocking decisions and thereby manage inventory better. Companies also compare this metric to historical turnover ratios, planned ratios and any relevant industry averages to see how competitive a business is in the marketplace. Note: Industry averages vary with the type of business.

Inventory turnover analysis and interpretation shows a company how efficient it is in sales and stock purchasing. This metric can be used, for example, to help calculate bonuses for personnel involved in those functions.

How to Use Inventory Turnover

When using

inventory turnover ratios, companies should decide which standard they want to achieve. Many

companies prefer an inventory turnover ratio higher than the industry standard. Regardless,

companies should balance this important metric with what makes them a success.

When using

inventory turnover ratios, companies should decide which standard they want to achieve. Many

companies prefer an inventory turnover ratio higher than the industry standard. Regardless,

companies should balance this important metric with what makes them a success.

Jake Rheude, Vice President of Marketing with Red Stag Fulfillment, an order and ecommerce fulfillment service, explains, “the current trend in the industry is one-day fulfillment. Many of my customers want a plan to provide this, but being successful is more about balancing inventory in the warehouses than developing sophisticated systems. Some businesses are doing very well and may not understand what it costs for them to compete and how exponentially expensive it can be.”

For instance, a manufacturing company calculates its inventory ratio as 10.0 using its sales figures and 4.5 using its COGS. The calculation with sales figures takes into account market inflation, while the COGS does not. Accountants must calculate either formula within the same period, usually the trailing 12 months. Comparing these metrics to competitors in the market may demonstrate that the company is not turning over inventory as quickly or that it is selling quicker than its peers.

How Does Inventory Turnover Affect Liquidity?

Inventory turnover shows the liquidity of a company, or how quickly it can sell its inventory without it losing value and pay off short-term debts. Stock is the least liquid asset, so calculating how quickly it can sell demonstrates the company’s financial health.

Accountants choose the liquidity measure based on a company’s type of inventory. They can use the current inventory ratio or acid-test ratio calculations. The acid-test disregards a company’s harder to sell assets, most of which will be inventory, and uses the balance sheet data instead. Both compare the assets to liabilities. If the ratio is more than 1.0, accountants see the business as liquid. If this ratio is less than 1.0, accountants consider this business illiquid.

Limitations of Using Inventory Turnover

The main limitation of using the inventory turnover ratio is that it only gives an average number of times the company sold its inventory. This average can hide important details, such as which best-selling items made up most of the actual sales.

An inventory average accounts for products that are poor and excellent sellers by showing the company’s overall sales as somewhere in the middle. Having more details on the sales of specific products helps the company make better decisions. When looking at industry ratios, companies must compare themselves to businesses that sell similar products. Further, they should drill down into the details of the product types.

For example, the rates of turnover in a car dealer may be slower than in a business that sells automobile parts. Cars are a high-ticket item and sell periodically (i.e., a slow turnover). Auto parts have a faster turnover due to their lower cost and repeated sales. Further, comparing sales of cars and parts, even in the same business, will give an average that does not really represent the business. If the company calculates by product type, it will see what is happening with its inventory. Companies can manipulate the inventory turnover rate by offering sales or discounts, even if these cut into their profitability and provide little return on investment (ROI).

What Inventory Turnover Measures

Inventory turnover measures whether a business has excessive inventory as compared to how well it is selling. Investors and creditors can use the rate of inventory turnover as an efficiency ratio when comparing businesses in the same industry or when considering whether to extend funding.

This rate also provides a metric about specific product effectiveness. The accountant can measure this rate for each product type, especially when companies are testing new product lines.

Rheude says, “I have seen a lot of companies test out product lines in the warehouse by using a hybrid of drop-shipping and their regular inventory. They may not make a profit, but they are testing the market in a way that mitigates their risk.”

These metrics help capture the success or failure of a new product line.

Retailers with fast inventory movement outperform their peers because the longer an item is in storage, the higher the cost a retailer pays in holding, decreasing the item’s value. One example of an industry that is successful with this process is fast fashion. Companies like Zara and H&M keep their inventory low and constantly restock, taking the products from design to rack in about three weeks. Their planning and customer response are based on their industry analytics. Their high turnover takes full advantage of the constant change in the fashion industry.

Overall, higher turnover rates are better, but, unless they are in fast fashion or other industries with generally high turnover, they may signal sales and purchasing are out-of-sync. High turnover rates can also represent a need to replenish inventory more frequently to meet demand. Customers will go elsewhere when what they want is unavailable.

Rheude worked with a metal detector manufacturer and shared an example of unforeseeable market events.

“When someone found gold in a remote African area, all of a sudden they had huge bulk orders of metal detectors to Africa,” he says. “There was no way to predict this, but then the manufacturer was scrambling to take advantage of the market.”

How to Find Inventory Turnover

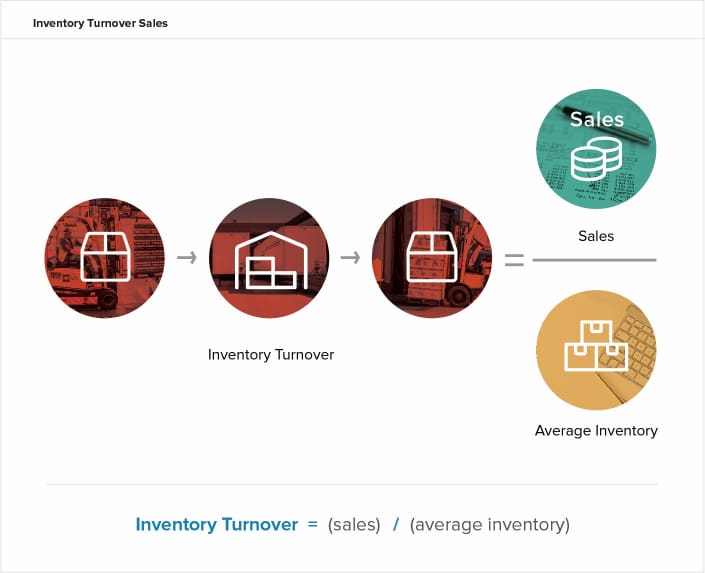

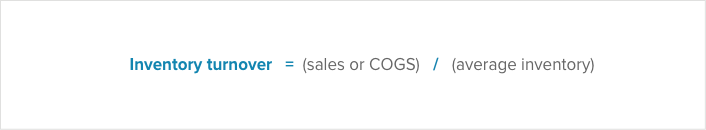

There are two ways to find the inventory turnover ratio: divide market sales or the cost of goods sold (COGS) by the average inventory. The number from each equation is the amount of times stock is turned over in a given period.

Both methods take data strictly from one period. The method that uses COGS appears more accurate since sales figures usually include an additional markup over their cost for the goods’ market value and thereby may inflate the data. In both methods, the average inventory removes any seasonal sales effects. For example, a holiday home store may have increased sales during winter and decreased sales during the summer months. Using the average sales removes the spike that occurs from seasonal trends.

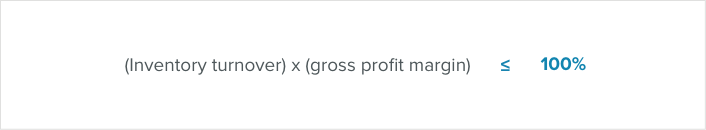

As a loose guide, companies should look to strike a balance between inventory and customer demand. Low turnover figures generally mean weak sales, too much inventory, too little marketing or obsolescence. High turnover figures mean strong sales but not enough inventory or stock shortages. Low inventory in businesses that do not turn over inventory quickly can mean lost business, such as when the demand spikes and customers must go to a competitor. As a rule, the average inventory stocked is not too high if you follow the following statement:

Inventory Turnover Formula

Companies can calculate the inventory turnover formula using information from their balance sheet and income statements. The method includes either the market sales information or the cost of goods sold (COGS) divided by the inventory.

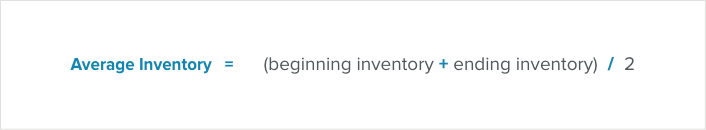

Start by calculating the average inventory in a period by dividing the sum of the beginning and ending inventory by two:

Accountants can use ending stock in place of average inventory if the business does not have seasonal fluctuations. More data points are better, though, so divide the monthly inventory by 12 and use the annual average inventory. Then apply the formula for inventory turnover:

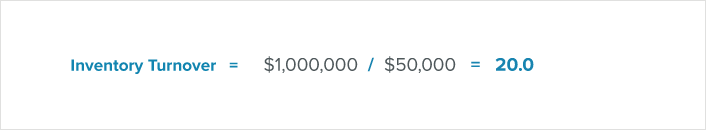

Inventory Turnover Formula Using Sales

As an example, a home goods store reported $1,000,000 in sales and $50,000 in average inventory. The inventory turnover calculation is:

This calculation shows that the home goods store turned its inventory over 20.0 times during that year.

The other inventory turnover formula uses COGS instead of sales. Using COGS removes the variation from market conditions and the fluctuations in selling prices. Firms such as Dun & Bradstreet use sales in the numerator instead of COGS because they want to account for those forces when comparing firms. The COGS inventory turnover formula is:

Inventory Turnover Formula Using COGS

For example, the same home goods store has $500,000 in COGS. With its average (or ending) inventory still at $50,000, the calculation is:

Analysis of this figure shows the company turned over its inventory 10.0 times over the year.

What’s the Inventory Turnover Ratio Average in the Retail Industry?

The industry average inventory turnover ratio for retail is based on what retailers sell. The ratio also depends on the business and sales model. The best turnover rate is one that balances the customers’ needs with the company’s ROI.

These rates will differ whether a company sells apparel, furniture, electronics, food, beauty products or vehicles. Other differentiators are whether a business operates a niche store or a large department store with multiple types of products. Since these companies specialize in finished goods, they are less complicated than other industries, but there are challenges.

In general, companies that sell high-end goods that turnover slowly have a higher inventory ratio. For example, a fine jewelry store may only sell an engagement ring once every two months. It receives a higher margin on the pieces, and the decline in the value is slow when they do not sell. These items can tie up a company’s cash flow considerably. In contrast, a fast fashion company or a fast-moving consumer goods (FMCG) company that sells inexpensive clothing or snacks moves stock at a higher volume. However, its inventory devalues almost as quickly as staff can shelve it due to consumer demand and expiration dates, respectively.

Inventory Turnover vs. Inventory Days

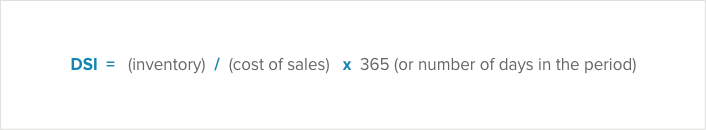

Inventory turnover vs. inventory days is a difference in inventory metrics. Inventory turnover is how many times the company replaces its inventory in a period. Inventory days (DSI) measures the days it takes to get stock to sales.

DSI is fundamentally the inverse of inventory turnover in a period but for a specific number of days. This figure is a measure in the cash conversion cycle that calculates the number of days on average that it takes a company to turn an asset into cash. Calculate annual DSI using the formula:

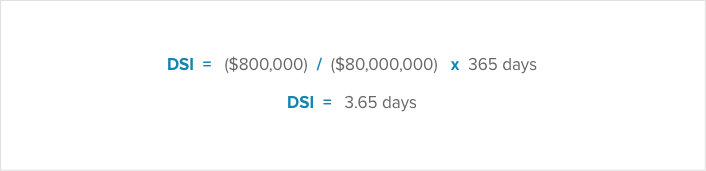

For example, a retail department store’s annual inventory was $800,000, and its cost of sales was $80,000,000. It calculates its DSI as:

This figure means it takes about four days for the department store to sell its stock overall. Drilling down into the details of each product or product type will give you a solid overall average for how long a retail store takes to sell all of its stock. Fewer days are better.

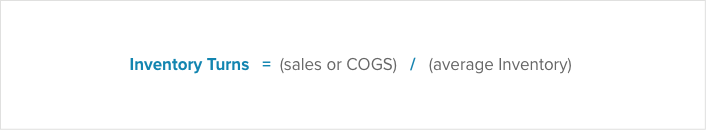

Inventory Turns

Inventory turns are how often stock moves through a business or value stream. The shorter the value stream, the quicker inventory turns. Companies calculate their stock turns by dividing the result of an inventory turnover ratio formula (COGS or sales) by the average value of inventory.

Inventory turns, as measured by the inventory turnover rate calculation, are an excellent measure of lean transformation if companies focus on an increased rate of turns instead of the number of turns. Companies, particularly those in manufacturing, can use this metric with raw materials as well as finished goods through the whole value stream.

Low Inventory Turnover Rates

Low inventory turnover rates typically show that a business has deficiencies somewhere in its stocking, sales or marketing efforts. However, low inventory turnover can be useful when the industry expects the prices on specific goods or there is a shortage of a certain product.

Inventory turnover is low when demand is low or when it will become deadstock. Goods that companies were unable to sell to their customers or use themselves are deadstock. The companies consider stock dead and remove it from sale on purpose or because it’s outdated or has become obsolete. Inventory often has a shelf life, and knowing the inventory turnover rates on these types of goods helps businesses stock more efficiently.

Businesses decrease inventory turns when they reduce inventory. As such, they also reduce their holding costs and increase their net income and profitability.

Merchandise Inventory Turnover Formula

The merchandise inventory turnover formula determines how often retail or wholesale companies purchase finished goods and resell them for a profit. These companies usually buy their products from a wide range of distributors, both domestic and international.

The merchandise inventory formula is the same as the basic inventory turnover formula. Company stakeholders should only compare the results to either previous years in the same business or businesses in the same industry. This formula helps identify business liquidity, top-sellers and the worst sellers. This formula is also useful when a company is creating plans to produce more product movement. Strategies to improve merchandise movement can include sales, giveaways, charitable donations and other purchasing incentives.

Finished Goods Inventory Turnover Rate

The finished goods inventory turnover rate in manufacturing is critical for developing pricing strategies that maximize customer demand while maintaining profitability. Marketing departments should work with the manufacturing side to match this demand, promote product turnover and prevent any stagnant inventory.

The goal for inventory turnover within an industry or sub-industry can vary widely. The most efficient firms have turnovers that are about 200-900% of their industry’s average. Independent firms compile standard turnover rates from commerce data for a variety of industries. For comparison, companies can purchase industry-standard ratio numbers—even for niche industries—inexpensively.

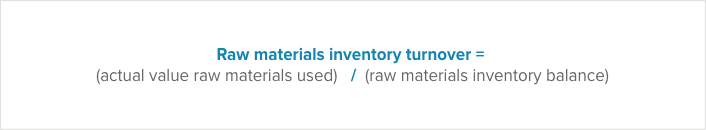

Raw Materials Inventory Turnover

The raw materials inventory turnover in manufacturing is a measure of how efficiently the company turns raw materials into finished products. Companies can use this information to improve their processes, find bottlenecks and be more competitive in the marketplace.

In the manufacturing industry, raw materials are those components that companies input into works in progress and finished goods, such as leather into shoes. The inventory raw material turnover calculation uses the value of the actual materials used and the value of the raw materials inventory. The formula is:

For example, this year, a manufacturing company used $1,000,000 worth of materials, and its balance of ending raw materials was $250,000. The calculation is:

So, this manufacturer used and replenished its raw materials inventory four times this year. If it had seasonal manufacturing trends or erratic production, it could have used the beginning and ending raw material inventory and divided by two.

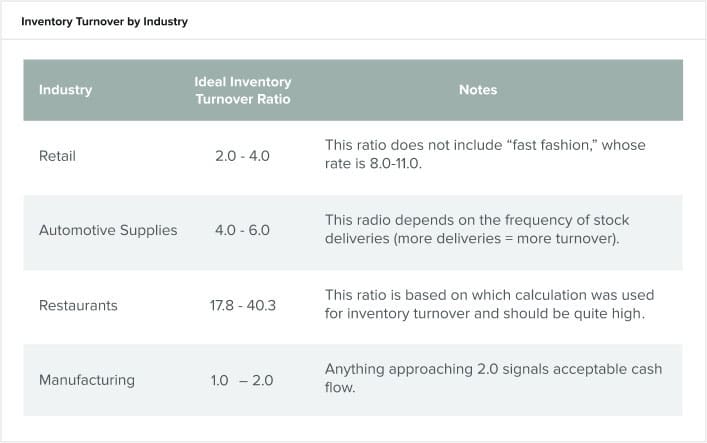

Inventory Turnover by Industry

Businesses need to compare their inventory turnover rates with brands in their vertical and price point. Inventory turnover is a key performance indicator (KPI) that is important to benchmark.

Another vital benchmark for businesses is their past performance. They should set goals around what they have achieved and want to achieve, based on planned improvements. They can set up and use flash reports or dashboards that provide a snapshot of their current metrics.

Each industry and sub-industry has different inventory turnover ratios. These ratios are not a specific guideline, but they provide information to help companies understand what they can achieve to be competitive in the marketplace.

The retail industry has a large spread in ideal inventory turnover rates, which makes sense because of the considerable differences in what retailers sell. Food should have extremely high rates of turnover because of spoilage. While expensive, large items such as cars and appliances should have low rates of turnover. For other industries, the ideal rates are generally:

Inventory Turnover Software and Open-to-Buy Systems

Some retailers choose to use software such as open-to-buy that calculates KPIs like inventory turnover. This software is a budgeting system that supports buying and replacing goods that a company integrates with its other accounting and control software.

Rheude says, “for small to medium-sized businesses, I say that irrespective of what system they use to track their inventory, they need an accurate baseline. Do not get wooed by excessive software you will not use, but build a solid foundation. You do not need a better mousetrap if you do not have mice.”

Open-to-buy software helps retailers with the procurement process, how much to buy and how to figure out which goods are performing well, all while keeping a positive cash flow. Depending on the metrics and the type of product the retailer sells, companies can tailor this software, which can be especially useful for seasonal merchandise that fluctuates over the year.

Open-to-buy software plans help retailers have the right amount of product on-hand at the right time, including what is on order, in transit and on-hand currently. The retailer uses the software to develop a plan that includes a budget and sets the turns for each item uniquely, so there’s always enough cash on hand.

Other software or technology that could revolutionize inventory forecasting and the process includes artificial intelligence (AI) and blockchain.

According to Rheude, “blockchain will eventually remove any trust issues we see now with overseas or international manufacturing because you will be able to see the ledger at a micro, per-SKU level. And AI will be able to anticipate some trends in the market that humans could never see coming.”

NetSuite Software for Managing Inventory

Effectively managing inventory turnover can affect a company’s cash flow and overall financial health. Decision-makers know that having the right tools in place that provide insight into stock and distribution can help them better manage inventory and how they meet demand. NetSuite offers a suite of native tools for tracking inventory in multiple locations, determining reorder points and managing safety stock and cycle counts. Find the right balance between demand and supply across the entire organization with the demand planning and distribution requirements planning features.

Learn more about how to manage inventory automatically, reduce handling costs and increase cash flow with NetSuite.