In corporate boardrooms and at kitchen tables, retailers of all sizes are always planning for the future. Perhaps they’ll enter a new market, go after new customers, sell more online or maybe just be more efficient at their core business. A budget is the financial manifestation of their strategic plan for the next year. Once finalized, the budget becomes the financial yardstick by which actual results will be measured. In the retail industry, a budget is also a useful tool for managing critical operating activities, such as purchasing stock and hiring staff. Creating an accurate budget is part art, part science — and far from easy. However, the nine steps detailed in this article can help retail business leaders develop a budget that will keep their organizations on track all year through.

What Is Retail Budgeting?

Retail budgeting is the process a retail business undertakes to develop a comprehensive financial plan in advance of its next fiscal year. This plan — aka a retail budget — is typically prepared annually, outlining planned sales, costs and profitability; once finalized, it becomes the financial representation of the retailer’s business strategy and intentions. It is also the blueprint that guides day-to-day operating decisions, such as buying inventory, staffing the retail floor, planning promotions or hiring salespeople. Throughout the year, actual retail sales are compared to budgeted sales, and deviations are analyzed to understand revenue trends and adjust accordingly. Similarly, costs are benchmarked against the budgeted expenses to help optimize profitability.

Key Takeaways

- Budgets are the financial representation of a company’s strategic plan.

- Retail budgets are tools for allocating financial resources and guiding day-to-day operating decisions.

- Diligently following nine steps will help retailers create a useful and more accurate budget.

- A variety of industry issues make retail budgeting especially challenging.

- The right budgeting software can help retailers build and monitor their budget easier, faster and more accurately.

Retail Budgeting Explained

Retail budgeting sets a business’s financial goals, based on the thorough analysis of historical data in the context of current and expected future trends. Retail budgeting typically begins with estimating sales. Revenue variables, such as customer demand, sales prices, sales channel capacity and inventory availability, must first be quantified so that other variables, such as operating costs and staffing, can be estimated. All of this information becomes a budgeted income statement, which is then used to create a budgeted balance sheet and budgeted cash flow statement.

There are two primary approaches for creating budgets:

- Zero-based budgeting approach: The zero-based budgeting approach develops an entire budget from scratch. It is the most comprehensive way to create a budget and, because it’s built from the ground up, is also the most time- and resource-intensive. The zero-based budget is commonly used by retail startups and by established retailers that are introducing new business lines or have significant changes in their business models, such as shifting from physical to more online sales.

- Incremental approach: The incremental approach starts with the company’s forecast for the current period and adjusts results, based on expectations for the next year. For example, if store employees are expected to be given a 3% raise, budgeted labor costs are calculated by increasing the prior period’s payroll expense by 3%. In contrast, the zero-based approach would begin by constructing an employee roster, aggregating estimated wages for each employee and adjusting for changes in store hours, vacancies and seasonal overtime. Most established businesses use the incremental approach to budgeting.

Importance of Retail Budgeting

A budget is a financial target shared across an organization. Unlike a forecast, which is a financial document that is continually updated based on what is likely to happen, a budget is a static document that sets financial expectations for a fiscal year. Preparing one accurately and in a timely manner, as well as communicating it effectively, is important for several reasons.

Budgets create a unified purpose for the entire staff, from the top executives on down. For example, two key budgeted metrics that retail teams should work together to meet are product pricing and sales volume. A retail budget also defines areas of accountability for all functional areas, detailing targets for efficient inventory buying or careful attention to customer service, for instance. Also, as a practical matter, variable compensation plans, such as commissions for salespeople, typically are based on budget targets. And, most important, the retail budget identifies the planned profits meant to be distributed to owners or reinvested in the business, as well as the planned cash flow needed to meet obligations and commitments.

Elements of Retail Budgeting

Budgeting typically begins by creating a budgeted income statement, which captures the results of planned operations. From there, a budgeted balance sheet and cash flow statement can be crafted, both of which rely on data from the income statement.

Three key elements are involved in creating a budgeted income statement for a retailer, regardless of whether the zero-based or incremental budget approach is used. Each element requires the careful gathering of reliable data and a good command of how a retailer’s business actually works, as well as a knowledge of industry trends. The key budget elements to tackle, in sequential order, are:

-

Revenue Budget

Retail budgeting begins by setting a revenue budget, since revenue is the variable that determines many of the other budget elements. Calculating the level of planned sales requires informed estimates of all the key internal and external revenue drivers, such as sales volume, sales prices, changes in customer base, market trends and planned changes in product offerings.

-

Gross Profit Margin Calculation

The next key element is determining the gross profit of the budgeted revenue. Gross profit is the amount of revenue left over after deducting a retailer’s direct cost of the product, aka cost of goods sold (COGS) in accounting. A retailer applies a budgeted gross margin (gross profit represented as a percentage of revenue) to the budgeted revenue to determine the budgeted gross profit. Producing the budgeted gross margin requires examining the current COGS and identifying and quantifying any anticipated changes. This is a critical part of retail budgeting because COGS is usually one of the retailer’s largest costs. In the retail industry, COGS typically includes the cost of buying the merchandise and getting it ready for sale.

-

Cost Estimation

After calculating gross profit, other costs are layered into the retail budget. Each cost is estimated using the appropriate data. Some costs vary based on the revenue budget, such as cost of shipping to customers, store utilities and seasonal labor. Other costs are fixed, such as rent and salaries; discretionary, such as marketing and product development; and nonoperating expenses, such as loan interest and income taxes. All of the costs must be estimated and included for the retailer to arrive at a complete budgeted income statement.

Different Types of Retail Budgets

Within the overall budget, a retailer may develop individual budgets for specific aspects of the business. These “sub-budgets” can be especially useful for creating accountability and focus for departmental managers. They should also align with the overall budget and company strategy. The right technology can make parsing and aggregating the following types of budgets easier:

-

Operating Budget

As the name implies, an operating budget deals with a company’s core business activities. For retailers, this budget focuses on product sales, COGS, selling and administrative expenses. It’s typically used by company executives and leaders of the sales, inventory and marketing teams.

-

Cash Flow Budget

A cash flow budget lays out a company’s planned cash inflows and outflows over a period of time. It’s an important tool for ensuring that the business has an adequate cash balance to meet its obligations, such as payroll and buying inventory. In addition, by breaking down the cash flow budget by month — known as “calendarization” — business managers can foresee when they might need to rely on financing to cover times when cash flow is expected to be insufficient, like during a retailer’s off-season.

-

Financial Budget

A financial budget is a catchall title for a company’s overall budget and the three budgeted financial statements. The financial budget includes a budgeted balance sheet, which reflects planned management of assets, liabilities and changes in equity. The budgeted balance sheet incorporates into its equity section the net income or loss shown on the budgeted income statement. And the budgeted cash flow statement reflects the effect on cash balances of planned changes in the budgeted balance sheet and income statement. The overall financial budget is mostly used by company leadership and financial-planning and -analysis teams for comparisons to actual results.

-

Sales Budget

A sales budget is a more detailed version of the revenue budget. It looks at the various revenue variables at a granular level, such as sales volume, product mix, pricing and discount strategies. It also breaks down the sales budget by period, such as monthly, weekly or daily, factoring in the timing of marketing and promotional campaigns, as well as seasonality.

-

Purchase Budget

A purchase budget ensures that the company has the appropriate materials and inventory to fulfill the budgeted sales. A purchase budget shows the planned timing and cost of merchandise purchases. It also includes estimates for any needed equipment, such as new order-fulfillment technology, racks and fixtures or warehouse needs. The purchase budget is important because overstocking drains resources (cash flow), and understocking can cause missed sales; getting it right means correlating with several other budgets.

-

Overhead Budget

An overhead budget shows planned expenses for costs that support the business; it can be thought of as a complement to the operating budget and is a helpful tool for monitoring and controlling actual expenses. A typical retail overhead budget includes administrative expenses, such as rent, insurance, taxes, store cleaning and maintenance, as well as other miscellaneous expenses. Retailers also include technology costs, such as point-of-sale systems and security, in their overhead budgets.

-

Labor Budget

Labor costs are another large expense for retailers. Creating a labor-specific budget can be a helpful way to manage these outlays. A labor budget includes the costs of acquiring, training and paying employees, as well as ancillary labor costs, such as uniforms and employee benefits. Labor budgets are sometimes created by using a historical percentage of sales, as an alternative to the zero-based and incremental approaches. This cost-of-sales approach is especially helpful for retailers with high employee turnover and consistent staffing needs.

-

Static Budget

A static budget refers to the nature of the budget itself, rather than the type of business activity it captures. Static budgets are set in advance and then used as a benchmark to measure actual activity. Static budgets are also used to allocate resources. Unlike flexible budgets and forecasts, which are updated periodically to reflect internal and market changes, static budgets — as the name implies — remain the same.

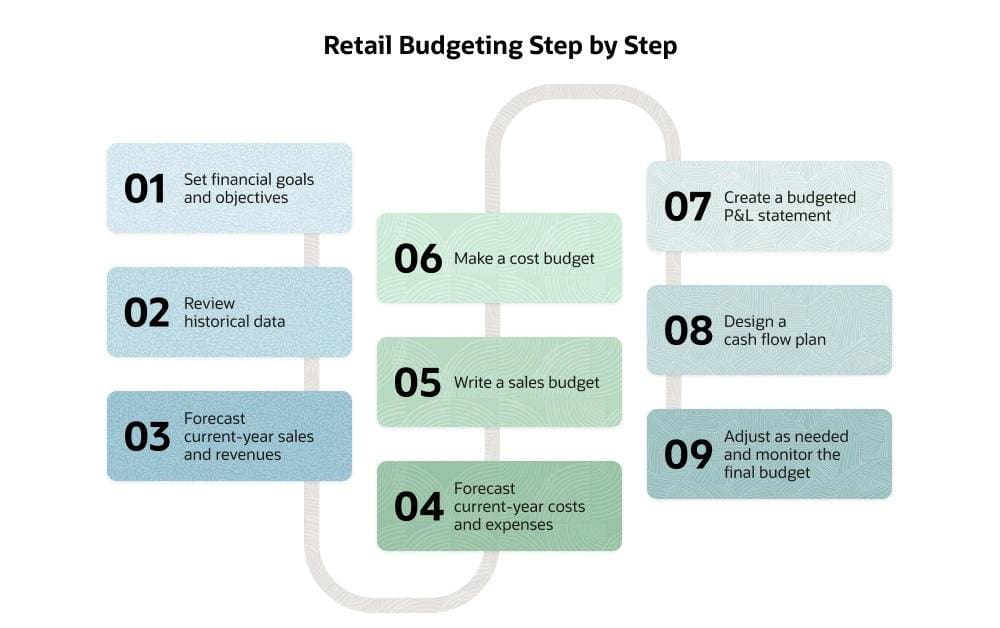

Retail Budgeting in 9 Steps

Creating a retail budget is a multistep process. Depending on the source, the exact number of steps differs, mostly because some are combined. However, the more important factor is the order of the steps (as well as the thought processes behind them). Budget usefulness is directly affected by data quality — as the old saying goes, “garbage in, garbage out” — and the level of diligence applied to its creation.

1. Setting Financial Goals and Objectives

Before diving into “the numbers,” the first step in creating a budget is for company leaders to agree on the future goals and objectives. A budget should reflect the retailer’s strategic plans, such as expected openings or closings of stores, alterations in the product line or changes to sales channels (launching an ecommerce store, for example).

2. Reviewing Historical Data

Once expectations are set, it’s time for the retailer to gather the necessary data that will inform the budget numbers. This step includes looking at historical data to see what has been working and to understand key metrics, such as gross profit margin. It’s also important to identify and parse out nonrecurring events that may be skewing the historical data, like a snowstorm in the prior year that forced store closures. This step also includes collecting external information, such as market trends, that might impact the business.

3. Forecasting Sales and Revenues

Step 3 focuses on forecasting sales and revenue for the current year, which will be used as a base for budgeting for the next year. This is especially critical when using the incremental budget method, which applies a growth rate over the current-period in order to budget sales. But it’s equally as important in other budgeting approaches because it adds current-year metrics to the historical ones.

4. Estimating Costs and Expenses

Similarly, estimating the balance of the current year’s costs and expenses will provide full-year forecasted spending levels. These can be used as a starting point for the following year’s budget, as well as to provide more current efficiency metrics, such as COGS.

5. Write a Sales Budget

Now it’s time for the retailer to develop the revenue budget and the related, even more detailed sales budget. Being as specific as possible, such as identifying revenue by product or store, makes future variance analysis more meaningful. It’s equally valuable to get sales budget buy-in from all relevant managers.

6. Make a Cost Budget

The cost budget takes into account all the planned spending for the budgeted period, including COGS, labor, overhead and other expenses. It’s beneficial for the retailer to compare the individual expenses in the cost budget to internal and external retail-industry benchmarks.

7. Create a Budgeted P&L Statement

By bringing together the budgeted revenue and budgeted expense components, the retailer can create its budgeted income statement (aka the profit-and-loss, or P&L, statement). The P&L should be reviewed for reasonableness by comparing it to prior periods, allowing for changes in strategy and any nonrecurring events. Additional items that affect the P&L, such as expected gains or losses on planned asset sales or expected changes in interest expenses from retirement or extension of debt, should be included. The annual budgeted P&L can then be calendarized by breaking it down into quarters, months or even weeks.

8. Design a Cash Flow Plan

A cash flow plan shows the cash inflows and outflows during the budgeted period, as well as expected cash balances. Designing a cash flow plan helps company management make arrangements for periods when cash balances may be insufficient — for example, by setting aside excess cash when cash flow is positive or setting up credit facilities for when cash balances may be low. The cash flow plan uses the expected cash balance at the beginning of the budget period, then relies on the information in the calendarized P&L to determine the running cash balances throughout the budgeted year.

9. Monitoring and Adjusting the Budget

Most budget processes are iterative, necessitating rounds of fine-tuning to ensure that relevant managers are on board with the plan. Once it is finalized, the budget becomes static and any future adjustments become part of the company’s forecast documents, rather than part of the budget. Monitoring actual results as compared to the budget requires an ongoing effort to create a culture of accountability. Measuring performance should be done at regular intervals so as to track progress and raise alerts regarding any necessary course corrections.

Common Retail Budgeting Issues

Budgeting for any business is partly artful judgment and partly data-driven science. The retail industry faces several endemic challenges, especially for retailers selling to consumers (as opposed to other businesses). Some common budgeting issues are discussed here.

Inventory Management

The budget serves as a road map for inventory purchasing by showing when sales are expected to be higher and lower. It gives inventory buyers advance notice of when to stock up and when to allow inventory levels to whittle down. Budgets help inventory managers balance the company’s ability to fulfill customer demand, yet not waste resources by overstocking. However, customer demand can be fickle, and even the best sales budgets carry some amount of risk. In addition, certain unknowns, such as losses from theft (aka shrinkage), obsolescence and damaged inventory, are hard to estimate and may not necessarily follow historical trends.

Supply Chain Management

The supply chain supports inventory purchasing, which, in turn, supports sales. Challenges in the supply chain can create a domino effect that can shatter even the best planned budget. Potential product shortages, fluctuating costs and unstable global sourcing are difficult to include in a budget.

Financial Uncertainty

It’s important to consider the macroeconomic environment when preparing a retail budget. Consumer spending is susceptible to fluctuations in inflation, interest rates, unemployment and real wages, among other factors. Documenting the financial assumptions underlying a budget can help ensure appropriate diligence and also serve as an early alert system if actual events begin to unfold differently.

Cash Reserves

The need for cash reserves is pervasive among most industries but is more acute for retailers. This is the result of traditionally small profit margins and the uncertainties of consumer behavior. Preparing and monitoring a cash flow budget can help company leaders build and manage cash reserves.

Profit Margins

Retail profit margins are complex and notoriously thin, so even a small difference in profit margin can create significant variances. Complications related to pricing strategy, discount policy, changes in COGS and competitive pressure can challenge budgets and impact profit margins.

Operating Costs

Retailers have a variety of operating costs, which also complicates budgeting. Budgeting for disparate operating costs (such as rent, security, marketing, insurance, utilities, technology and customer service) takes time to estimate because the costs are subject to different dynamics. As such, budgeting for numerous distinct items requires a high level of business acumen that will be specific to the way the retailer operates.

Losses

Unfortunately, unanticipated losses are common in the retail industry and present a significant budget challenge. Small shifts in the many revenue and expense variables mentioned previously can create significant swings in profitability and losses. This is especially true for seasonal retail businesses, which have a limited period during which profitability can offset losses during the rest of the year.

Labor Expenses

A common challenge for budgeting labor expenses arises when there is a disconnect between retail scheduling systems and financial systems. For example, a labor budget that is created based solely on the general ledger account balances may not necessarily be in sync with the way employees are scheduled to cover the retail floor.

Importance of Accurate Retail Budgeting

It’s inevitable that the future won’t unfold as planned, throwing off even the best-prepared budget. However, for a budget to work as intended, it’s important for it to be created using accurate data that supports the many embedded assumptions. Large retailers may have a team of financial analysts available to pore over accounting data and industry trend reports to inform their budget estimates. Smaller business leaders, who tend to wear many hats, may lean more heavily on customized dashboards and automated reports from their financial and POS software. But regardless of the size of the retail business, there’s no sense in setting a budget that isn’t as accurate or realistic as possible.

Forecast and Budget More Accurately With NetSuite

Creating a budget is much easier and more accurate when the effort is supported by the right software. NetSuite Financial Management, features a planning and budgeting module that reduces the time needed to gather historical financial and operational data because it is integrated with NetSuite Enterprise Resource Planning (ERP). And because the budget is in one centralized place, the system fosters cross-functional collaboration and transparency, which is so critical for success. Specialized solutions, like NetSuite for Retail, help ease the unique challenges that retailers face, such as demand forecasting, inventory management and oversight of omnichannel sales. In addition, customized, role-based dashboards provide access to actual metrics that track performance against the budget, across all levels of the retail business.

Budgets are an important financial management tool for all businesses. There are different ways to approach budgeting, but all require a significant amount of data gathering and analysis. For retailers, budgeting is even more critical because it unites disparate operating areas and gets teams in sync. Applying rigor and diligence to the process is especially vital, because thin profit margins leave little room for error. The right software helps make retail budgeting and the ongoing monitoring of actuals easier, faster and more accurate.

Retail Budgeting FAQs

How do you plan a retail budget?

Developing a retail budget consists of the following nine steps:

- Setting financial goals and objectives.

- Reviewing historical data.

- Forecasting sales and revenue.

- Forecasting costs and expenses.

- Writing a sales budget.

- Making a cost budget.

- Creating a budgeted P&L statement.

- Designing a cash flow plan.

- Monitoring and adjusting the budget.

What role does data analysis play in retail budgeting?

Considerable analysis of both internal and external data is necessary to create a high-quality retail budget that can be a useful financial management tool. Much of the analysis involves looking at historical company data to see what has been working and to quantify key metrics to be used for estimating future results. These metrics are used in conjunction with information from outside the company, such as industry and macroeconomic trends.

What is the impact of market trends on retail budgeting?

Market trends are an important factor to consider when building a retail budget. Macroeconomic trends, changes in inflation, interest rates, unemployment and changes in real wages can have a significant impact on consumer (customer) spending. Industry trends, such as seasonality, shifting customer preferences and changes in sales channels, are all key variables to consider when developing a business’s strategic plan and the resultant budget.

What is the future of retail budgeting with advancements in technology?

Retail budgeting has been historically arduous, given the decentralized nature of multiple store locations, warehouses and disconnected accounting systems. Today’s budgeting technology has revolutionized and improved every step in the budgeting process. For example, gathering historical data is much easier with integrated ERP software. Cross-functional collaboration is easier when using cloud-based planning and budgeting tools, and it enhances buy-in and transparency. Going forward, specialized solutions purpose-built for retailers will help ease unique industry budget challenges, such as more precise demand forecasting and inventory management, and estimating revenue from omnichannel sales.

What is a budget in retail?

A retail budget is a financial plan that represents a retailer’s business strategy for the next fiscal year. It is usually developed annually, before the start of the next fiscal year, showing planned sales, costs and profitability over a 12-month period.

What are 4 methods of budgeting?

Four common methods of budgeting are:

- Zero-based, which builds the entire budget from the ground up. Commonly referred to as “blank sheet,” this approach is the most comprehensive and time-consuming.

- The incremental approach applies growth rates to the current-year forecast or actuals to determine the budget for the next period. This is a common approach for established businesses.

- Activity-based budgeting begins with a top-line revenue target and builds a minimalistic budget that supports that goal. It’s a popular approach in the manufacturing industry and for businesses undergoing transformative changes.

- Value proposition budgeting can be thought of as a budgeting filter that challenges the effectiveness and efficiency of every item in a budget. It’s particularly useful for businesses looking to cut spending.

What are the 7 types of budgeting?

Within a master budget, many different types of “sub-budgets” can exist. The exact nature of the budget types can vary by industry, but they should always align with the master budget and company strategy. Seven types of budgets used in the retail industry are:

- Operating budgets, which deal with a company’s core business activities, including product sales, COGS, selling and administrative expenses.

- Cash flow budgets, which show a business’s planned cash inflows and outflows for a period of time.

- Financial budgets, which include a budgeted balance sheet, income statement and cash flow statement.

- Sales budgets, which look at the variables underlying the budgeted revenue amount, such as sales volume, product mix, pricing and discount strategies. It also breaks down the annual sales budget into smaller time spans, such as monthly or weekly.

- Purchase budgets, which help a company plan inventory buying so it has the appropriate materials and inventory to fulfill budgeted sales.

- Overhead budgets, which deal with all the planned expenses not included in the operating budgets, such as rent, insurance, taxes, store cleaning and maintenance and other miscellaneous expenses.

- Labor budgets, which include a company’s planned spending to recruit, train and pay employees, plus any ancillary labor costs, such as uniforms and employee benefits.