In short:

- Zero-based budgeting, a governmental spend strategy from the 1970s, is making a comeback as a business budgeting tactic.

- The approach, which requires justification for all expenses each new budget period, has a checkered past and presents the potential for major wins in present times.

- We identify the common pitfalls with the original approach and how to avoid them in your reconceptualization of zero-based budgeting.

Along with bell bottoms, hoop earrings and shaggy fringe bangs, another ‘70s trend looks to be making a resurgence in recent years: zero-based budgeting (ZBB). And, like shaggy bangs, it’s hard to pull off.

ZBB is a budgeting process that starts with a completely blank slate. Fans say it’s helpful in keeping extraneous costs from creeping into the budget. Critics say it’s unrealistic, for a host of reasons.

And so the question arises: Is ZBB the long-sought panacea for business budget woes — or too extreme a strategy to execute successfully?

Get an overview of zero-based budgeting

What Is Zero-Based Budgeting?

Zero-based budgeting is an accounting strategy that involves developing a financial budget “from zero” for each new period. ZBB allocates funding based on program efficiency and necessity rather than budget history. As opposed to traditional budgeting, no item is automatically included in the next year’s budget. In ZBB, budgeters review every program and expenditure at the beginning of each budget cycle. They must justify each line item — and its contents — in order to receive funding.

The line item might say the department requires four staff members — but can the job be done with three? Costs that cannot be rationally justified get the axe.

Traditional Budgeting vs. Zero-Based Budgeting

| Traditional Budgeting | Zero-Based Budgeting |

|---|---|

| Based on prior year’s budget | Starts from zero |

| Only new expenses need to be justified | Every expense must be justified |

| Based on historical information | Based on industry norms and best practices |

| Simpler strategy | More complex strategy |

How Zero-Based Budgeting Works

ZBB works for businesses trying to gain control over their budgeting because it relies on justification and approval for each budget item in each new budgeting period. However, due to the implementation, it’s often a tedious budgeting strategy and requires quite a bit of effort and research than traditional budgeting.

Zero-based budgeting is less about cutting spending overall and more about prioritizing the projects and departments that deserve funding based on company goals. Each budgeting period, the bookkeeping team sits down and creates a brand new, “from scratch” budget based on the income and expenses for that period. Each dollar in the budget is allocated to a certain project, department or category.

Because the budget starts from zero each month, businesses have flexibility to assign more or fewer dollars to each category as goals change, revenue fluctuates, and expenses change.

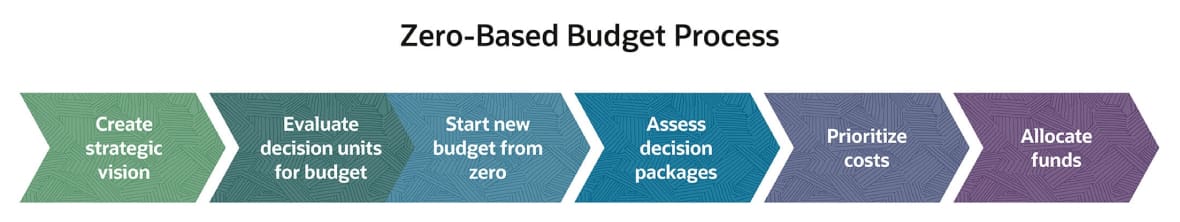

Steps of Zero-Based Budgeting for 2022

- Create a strategic vision for ZBB: Identify cost targets, relevant KPIs and goals.

- Evaluate business units to select ZBB candidates (also referred to as “decision units,” or any organ of the business that operates independently with its own budget).

- Start selected budgets from scratch (i.e., from zero).

- Each decision unit provides “decision packages,” which break down each activity in terms of its objective, funding needs, justification in the context of company goals, technical viability and alternative courses of action. Evaluate each proposed item to determine its value-add to the company and whether the entire cost is justified. What does the expenditure bring back to the company?

- Prioritize costs based on company goals. Reduce or cut expenses in areas that no longer produce significant value.

- Allocate funds among areas that are productive and aligned with the business’s growth drivers.

From Oval Office to Drive Thru

This budgeting relic from the ‘70s has a far-out origin story. A young Texas Instruments executive(opens in a new tab) created zero-based budgeting, then catapulted to surprising fame — book deal(opens in a new tab) and People Magazine article included — after Jimmy Carter pushed for its usage as governor of Georgia and then as president of the United States.

ZBB faced mixed, but largely negative, reviews from the federal government. A 123-page report by the Association of Government Accountants(opens in a new tab) deemed it a “limited” budget-making tool and recommended it be cut back rather than expanded.

The Reagan administration dropped ZBB, and the practice went largely unheard of until multibillion-dollar Brazilian investment firm 3G Capital(opens in a new tab) converted it into a business cost management approach. The firm notably implemented it at some of its major portfolio companies like Kraft Heinz(opens in a new tab), Anheuser-Busch InBev(opens in a new tab), Burger King(opens in a new tab), Tim Hortons(opens in a new tab), and Popeyes Louisiana Kitchen.

Seems like the food industry is a fan. But will zero-based budgeting work for you?

The Challenges and Benefits of ZBB

“When it’s applied clumsily, ZBB can have a demoralizing impact that distracts the organization from growth and value creation,” a Boston Consulting Group report(opens in a new tab) concluded.

BCG found that while cuts could be impressive, it was tough to find evidence of accelerated growth in response. In fact, it found several companies actually lost revenue in response to heavy-handed cuts.

Traditional ZBB became especially popular among consumer product companies, particularly in the big food sector. Some found success via drastic cost savings: For instance, Tim Hortons operations improved after implementing ZBB(opens in a new tab). Selling, general and administrative expenses fell 32%. The chain’s cost-of-sales dropped almost 1.6%. The company funneled some of these savings into needed innovation like new menu items and stores in nontraditional urban areas.

However, other companies have stumbled over cost savings into some unintended side effects after using ZBB. One major food manufacturer experimented with radical cost cutting and achieved the desired savings, but its performance soon suffered. Shares fell to a record low, brands saw major write-downs, and dividends were cut. Analysts concluded the dismal performance was a direct result of prioritizing big cuts over growth.

In the mid-late 2010s, it became clear that proponents of ZBB were victims of a common pitfall: They were more focused on profit margins than bolstering their brands, reinvesting in their businesses and keeping up with consumer preferences.

“At some point, having best-in-class margins doesn’t matter if the sales growth doesn’t eventually come,” Guggenheim analyst Laurent Grandet told Reuters. A major food CEO concurred, telling the Wall Street Journal(opens in a new tab), “You can’t save your way to prosperity.”

Common Pitfalls of Traditional Zero-Based Budgeting

- Deep cuts across the board — regardless of justification

- Lack of buy-in across the organization

- Failure to reinvest savings in the business

- Focus on short-term (margin growth) over long-term (revenue growth, brand equity, innovation)

- View of ZBB as a cost cutting measure, not a value management strategy

- Treating ZBB as a one-and-done exercise — no monitoring after-the-fact

- Getting bogged down in spreadsheets or paper budgets

Advantages of Zero-Based Budgeting

- Encourages mindfulness about where money goes

- Reduces wasteful spending

- Can increase progress toward goals

- Beneficial for businesses with unpredictable income, like startups

- Prevents the misappropriation of funding when budgets gradually increase

How to Implement ZBB in Your Business

“The challenge of ZBB is that it has been considered by many as a panacea, like a magic bullet, so it has been misused,” Omar Aguilar, a strategic cost leader at Deloitte, told WSJ.

Of course, there is a correct way to utilize ZBB. And as your company deals with COVID-19, this new method of cost and value management may be an especially good fit.

Several focus areas can help you successfully execute ZBB for 2022 and beyond:

ZBB is a budgeting culture shift

Perhaps the least technical but most integral step toward ZBB success involves changing how your company views the strategy. Instead of an aggressive cost-cutting tactic that is interventional in nature, introduce ZBB as a culture shift. The strategy isn’t about slashing and burning. It’s about identifying unproductive costs and redirecting them, particularly when resources are limited.

Questions to ask include:

- In which areas is the company spending and why?

- Is the business directing its limited resources toward its growth drivers?

- Is there spending that used to create good value but now just goes towards low-margin products or outdated strategies?

- Is the company running efficiently — or is there fat you can trim?

An introduction to ZBB should be structured, outlining key metrics, training and engaging people, incentivizing participation and fostering a sense of accountability around cost management. Leadership needs to make it clear why they are using the more intensive ZBB vs. traditional budgeting. Outline how it will benefit the business, whether it be that the business is in decline and needs to right-size or facing new opportunities that require realignment in spending. This method isn’t without reason.

Ultimately, your business’s approach to ZBB will be specific to its unique growth levers, goals and circumstances. Regardless of the exact form it takes, frame ZBB as a grow-oriented culture shift, not a one-time cost cutting attempt.

Use Technology for Deeper Analysis

Beware spreadsheet syndrome. When the only technology available — or perhaps the only one used — for ZBB is Excel, teams can get bogged down by the amount of financial data (asset, liabilities, equity, income, expenses, cash flow, etc.) and operational data (inventory, suppliers, logistics, labor, etc.) they’ll need to manually gather, organize and scrutinize. After all, you need every single line item from every single unit’s budget — and insight into ramifications of each expense.

ZBB requires many complex formulas to analyze the data, like planned spending versus actual, variable versus fixed costs, and the culmination of total income and total expenses. Yet, after all that effort in spreadsheets, you still won’t get much insight into the actual cost and profitability drivers without further analysis. For these companies, gathering and analyzing all the relevant information involved in creating a budget that starts at zero can be simply overwhelming.

“[Traditional ZBB] was a multi-year, multi-unit exercise that was, by some descriptions, draconian, and also suffered from a lack of access at the time to information,” said Nilly Essaides, senior research director at The Hackett Group(opens in a new tab). “So it was like pulling teeth to get information from cost center managers.”

Using technology can alleviate at least some of that pain. Increased adoption of cloud-based ERP(opens in a new tab) solutions allows for detailed insight into the operational cost drivers, such as productivity rates(opens in a new tab) and input costs(opens in a new tab). Having a centralized system gives stakeholders at all levels deeper visibility into real-time information, leading to smarter budget planning and decisions when it comes to allocation of funds.

The insight provided on drivers of costs and profitability can be used for strategic modeling and “what if” scenarios to predict the impact of potential budget changes. Instead of making easy, lightly justified cost cuts, companies can make smart, sustainable ones based on understanding spending patterns, returns on spending and true costs across business units. For example, a cereal company might find that, as consumers desire healthier food choices, previously-successful Marshmallowy Sugar Puffs no longer command market share and margins, regardless of spending on the product. However, internally-overlooked Organic Bran Flakes are experiencing greater demand and producing better margins. This insight into the return on spend can help the company reallocate budget to the products that are aligned with external trends.

Sharpen Your Focus on a Few Areas

When it comes to budgets, it’s better to cut with a scalpel than a chainsaw. A more focused approach can help companies use ZBB tactically and effectively.

“It’s looking at the costs themselves and understanding what is material, what is volatile, and what is influenceable in this environment — and then targeting an approach. You don’t want to boil the ocean and do everything,” said Stephen Elliott, Director of Enterprise Performance Management at The Hackett Group.

According to Elliott, broadly applying ZBB across the business will require a lot of effort and produce no more benefit than a focused set of activities to really drive out costs where it’s most relevant … which is where agile implementation comes in.

Usually used in reference to technology adoption, agile implementation works in small increments to avoid overwhelming organizations. So instead of cutting across the board, you’ll prioritize one or two areas — perhaps those with consistently higher costs or high indirect costs that are not clearly understood — and roll out ZBB for those units.

For example, marketing can have significant indirect costs but also ROI models to help analyze the benefits and necessity of those expenses. A company might find some strategies aren’t profitable and put them on pause. Others might redirect marketing investments across channels and geographies based on consumer sentiment changes. Or, in a case truly relevant to today’s environment, promotional spend might be curtailed when volatile demand is outstripping available supply. Hand sanitizer: You can probably take a breather on promotional spend for a bit.

“One of the benefits of [a more limited approach] is that by reducing costs where it counts and producing savings, you are conscious at the same time of not cutting to the quick,” said Essaides. “You’re not hollowing out your structure by taking out [substantial] costs and ending up with the inability to grow. Instead, you’re hopefully able to not just survive but thrive in this new normal.”

Prioritize Sustainable Value Creation

As mentioned, a common mistake is viewing ZBB as simply a cost management tool instead of a technique for fundamental value management. Particularly when resources are tight, modern ZBB is about refunneling spending and investments that are not driving growth into areas with greater potential.

“This is not just cutting and slashing,” said Essaides. “It’s making sure the dollars are put to work where they should be working.”

The job isn’t done when savings are identified. Rather, that initiates a whole new step in which savings extracted through ZBB need to be carefully and consciously redeployed into another area. For some companies, that will involve installing a governance system in which executives meet to prioritize reinvestment areas and ensure savings are being spent in a disciplined way.

Companies can also institute policies, like capital budgeting processes, to keep costs down and effectively assess investments (instead of relying on gut feel(opens in a new tab)).

Monitor KPIs for Sustainability

Only about half of companies are able to sustain their cost savings from zero-based-budgeting beyond one to two years, according to Accenture research. This highlights the need for monitoring.

Applying ZBB incrementally makes it easier to monitor its effects. You need to continuously monitor KPIs to see whether cost savings are sustainable and effective. KPIs will vary based on the company and its goals, however, it is best to start with industry-accepted best practices on target KPIs.

Cost efficiency is always a concern — and will probably be even more so for the next few years as economic repercussions of COVID-19 continue(opens in a new tab). Some costs, particularly in a volatile environment, will need attention on an ongoing basis. Monitoring to ensure that costs don’t creep back up allows for companies to use ZBB only when spending gets out of line.

Instead of starting from zero each budgeting cycle, ZBB can be used periodically (think every few years) if margins go down or as a check-up to ensure budgets are lean and effective.

The Future of ZBB

In researching ZBB’s implementation in companies, we have noticed one common theme: Rarely is the strategy the proposal of the finance team. At Unilever, the CEO drove the ZBB initiative. Anheuser-Busch InBev(opens in a new tab)’s investors pushed for ZBB after InBev’s hostile takeover of the beer manufacturer(opens in a new tab).

As Elliot summarized, “A lot of these initiatives happen to finance organizations and are not really driven by organizations.”

However, in the future, there’s potential for ZBB initiatives to originate from within instead of from the top down. And with that will come a shift in perspective: CFOs will be more likely to view ZBB as a means of intelligent cost cutting(opens in a new tab) than a way to slash costs by a certain percentage.

“With the changes described in technology and then the ability to access data, there’s no reason it can’t be used [by the finance team] in a more focused way, and more selectively to drive benefit and to manage costs going forward,” said Elliott.

That doesn’t mean ZBB will immediately become the go-to method for all finance organizations. CFOs’ current concerns(opens in a new tab) like forecasting and addressing uncertainties in the market, compounded with the existing hesitation toward ZBB, might prevent the strategy’s implementation. However, The Hackett Group projects that as companies deal with longer-term economic ramifications of COVID-19(opens in a new tab), ZBB’s popularity will rise considerably.

Zero-Based Budgeting Made Easy With NetSuite

Whether you’re starting your budget from scratch or relying on a previous budget for guidance, NetSuite Planning and Budgeting accelerates this essential but traditionally time-consuming process for organizations and their departments. Integration with NetSuite Financial Management ensures all data is in sync, eliminating manual data entry and the introduction of errors that could throw off budget accuracy. NetSuite Planning and Budgeting helps control costs, with real-time visibility into actual spending vs. budgeting amounts via prebuilt dashboards. With a powerful calculation engine, this cloud-based tool also creates multiple budget scenarios, improves collaboration among budget stakeholders by connecting them within a single environment, and simplifies workforce planning. Moreover, NetSuite Planning and Budgeting seamlessly integrates with Microsoft Office tools, including Excel, via NetSuite’s Smart View for Office(opens in new tab) interface, which makes it easy to view, import, process and share data.

For more helpful information from the Brainyard and our friends at Grow Wire(opens in a new tab) and the NetSuite Blog(opens in a new tab), visit the Business Now Resource Guide.