Global sourcing has come to resemble a high-wire act in a tempest. Companies find themselves in a perpetual state of rebalancing their supply chains as they are buffeted by geopolitical crosswinds, market uncertainty, and rapid technological shifts. Every sourcing decision presents strategic trade-offs: Offshore, low-wage production or domestic, automated manufacturing? Long supply lines or closer proximity to customers? The political risks of one country or another’s? Making the wrong choice can lead to a big drop in operational efficiency, customer satisfaction, or profitability. This article delves into global sourcing, how it is changing, and what companies are doing about it.

What Is Global Sourcing?

Global sourcing involves selecting and managing international suppliers of the raw materials, components, services, and final products that bring a business to life. Companies run complex supply chains as the backbone of global sourcing, including the organizations, people, activities, information, and resources needed to store and carry goods efficiently across vast distances and international borders.

Many companies have been restructuring their supply chains in recent years, following decades of globalization. This trend is accelerating: 57% of companies said they planned significant changes to their supply chains in 2025, according to a global survey by the WTW consultancy, while 36% reported fine-tuning and 7% were embarking on complete overhauls. These companies are investing in restructuring to increase supply chain resilience and reduce risk as they strive to keep costs competitive.

Key Takeaways

- Global sourcing strategies have shifted from a singular focus on low costs to a more balanced approach that also emphasizes supply chain resilience.

- Businesses are actively diversifying their supplier locations across offshore, nearshore, and onshore locations to counter risks from geopolitical tension and regional disruptions.

- Integrated digital technologies, such as ERP systems with AI capabilities, are assuming a larger role in managing today’s complex supply chains.

Global Sourcing Explained

“Global” was once nearly synonymous with China, which until recently accounted for about one-third of all manufacturing worldwide. But now, international sourcing is becoming increasingly diverse, introducing trends like nearshoring to lure production away from China and closer to a company’s neighboring regions. This restructuring of global sourcing has many catalysts, including rising production costs in China, supply chain disruptions caused by extreme weather, and volatile tariffs and trade tensions.

A survey of US and European manufacturers by the Capgemini Research Institute shows how the map of global sourcing is being gradually redrawn. In 2025, 41% of manufacturing facilities were onshore, 22% nearshore, and 37% offshore, the survey found. In the coming three years, onshore operations are expected to rise to 48%, Capgemini says, while nearshoring increases slightly to 24% and offshoring drops to 28%.

Is Global Sourcing the Same as Outsourcing?

The terms global sourcing and outsourcing are distinct, yet overlapping. Global sourcing involves procuring goods and services abroad, including situations where a company opens its own plant in another country. Outsourcing refers to delegating entire business processes to another company—often in another country. Outsourced manufacturing combines both concepts.

Nor is sourcing the same as procurement, though the terms are often used interchangeably. Specifically, sourcing is a strategic set of processes for identifying and selecting suppliers of goods and services. These activities lay the groundwork for the day-to-day, transactional procedures involved in procurement.

Why Does Global Sourcing Matter?

Global sourcing is an important factor in determining business performance, especially in manufacturing. The cost of manufacturing inputs, including materials, labor, transportation, and factory overhead, can impact a company’s top-line revenues as well as bottom-line profits.

US manufacturers have seen those input costs rising in 2025, according to S&P Global, in part due to tariff increases. When tariffs go up, companies must choose among three difficult responses: absorb the costs by reducing their operating margins, increase prices to their customers, or negotiate new supplier agreements with lower prices. The Federal Reserve reported that about half of companies pass the full increase to customers—a response that poses significant risks to top-line sales in competitive markets.

The National Association of Manufacturers reports that US manufacturers have a pessimistic growth outlook amid global trade tensions, a reduction in available inputs, related delays and cancellations of investments, and a pause in hiring.

This challenging environment puts pressure on companies to restructure, automate, and otherwise rethink global sourcing to eke out whatever advantages they can.

Benefits of Global Sourcing

Global sourcing is the only option for companies in some cases, such as for those importing coffee beans or rare earth minerals that are only found in certain world regions. In other cases, companies choose to source internationally to benefit from labor cost savings, cheaper raw materials, flexible production capacity, specialized skills, or government incentives. In the manufacturing industry, sourcing in another country can help establish a foothold to pave the way toward selling into that market or region. These and other benefits are detailed below:

- Lower production costs: For decades, companies have tapped into the lower labor costs, cheaper raw materials, and economies of scale afforded by offshore arrangements, such as contract manufacturing. Over time, however, the benefits of doing so have diminished, especially in light of higher foreign wages, the imposition of new tariffs, and increasing transportation costs and disruptions. Now, although cost remains a top priority, companies have been rebalancing their sourcing strategies to emphasize both supply chain resilience and savings.

- Improved supply chain resilience: Globally diversifying geographic regions can improve supply chain resilience, although not without introducing other challenges. Geographic diversification can alleviate risks from regional disruptions, such as natural disasters and tariff changes, and give businesses more flexibility in responding to demand fluctuations. At the same time, however, new risks emerge, such as compliance burdens and currency fluctuations. Bottom line: More than 9 in 10 US executives stressed the importance of diversifying manufacturing and supply chains in the Capgemini report.

- Increased supplier network: Global sourcing is often a way of adding alternative suppliers to reduce the risks to business continuity that come from depending on any single vendor. Hand in hand with geographic diversification, supplier diversification can add resilience in situations where one supplier encounters financial difficulties, for example, or experiences disruptions in its own supply chain. In a 2025 survey by the Chartered Institute of Procurement & Supply, respondents said that diversifying suppliers is their top business continuity strategy. As a supplier network grows, though, company executives must also double down on supplier relationship management to oversee the quality and reliability of new supply lines—especially in fragmented supply chains that incorporate inputs from multiple countries into a single product.

- Access to specialized suppliers: Expanding a company’s supplier network is also a global sourcing strategy for accessing specialized skills and goods that are unavailable domestically. For instance, a luxury automaker might source its leather interiors from Italy, its precision instruments from Germany, and its infotainment software from Silicon Valley.

- Expand into new markets: Sourcing locally in a foreign country can pave the way for selling into that market. For starters, the market intelligence and relationships acquired through sourcing can eventually feed into a go-to-market strategy. In-country sourcing can also aid in meeting local content requirements that are imposed by some countries and in reducing the import duties on final products.

- Harness competitive edge: Companies compete on price, quality, reliability, speed to market, and other attributes that can all benefit from a diversified global sourcing strategy. Experts say the key lies in “rightsourcing” through careful selection and management of alternative suppliers from diverse world regions. For example, a food and beverage company might import coffee beans from Colombia, Ethiopia, and Vietnam. That way, if a poor harvest affects one region, the company can shift its sourcing to another venue to maintain a steady supply of quality coffee at reasonable cost.

Challenges in Global Sourcing

There is risk in every sourcing decision. At a time when so many companies are revising global sourcing strategies, some are trading one set of challenges for another. A timely example is Mexico, where many US companies have relocated production from China to benefit from its proximity and preferential trade terms under the United States-Mexico-Canada Agreement. Yet the nearshoring influx has increased the cost of labor, warehousing, and industrial space, according to the Council of Supply Chain Management Professionals. Proposed new US tariffs risk further erosion of the country’s cost advantages. Meanwhile, Mexican regulatory requirements are also on the rise. For these and other reasons, Mexico ranked first in the Proxima consultancy’s 2025 Global Sourcing Risk Index.

More generally, the challenges in global sourcing include:

- Logistical complexity: The inherent complexity of global sourcing has been increasing as companies diversify the locations and suppliers they rely on. Despite a diversification goal of increasing supply chain resilience, related challenges arise with the addition of each new supply line, including variable lead times, new customs risks, and higher administrative overhead.

- Regulatory challenges: Each country traversed by a supply chain upholds different standards and regulations, spanning contract law to employment and labor standards. Manufacturers usually need to manage a heavier regulatory burden than other types of companies, including environmental standards, product safety certifications, and rules of origin for materials.

- Cultural barriers: The various languages, cultures, and communication styles encountered in global sourcing can strain supplier relationships and pose operational risks, such as production delays and quality issues.

- Tax compliance: Tariffs are taxes, and a survey by the West Monroe consultancy ranked them far ahead of any other supply chain issue in the first half of 2025. Other levies, such as European value-added taxes, local corporate taxes, and customs fees at national borders, mount up, creating significant compliance challenges in global sourcing.

- IP security: Global sourcing exposes intellectual property to theft, especially in countries with lax IP protections. The more suppliers and subcontractors in a supply chain, the greater the risk of accidental or intentional misuse of proprietary designs, processes, or formulas. For instance, some contract manufacturers have reportedly replicated designs and produced extra units of items to sell to their own customers.

- Quality control: Likewise, quality control becomes more challenging in relation to complex global sourcing strategies. Close oversight and tracking are required to avoid inconsistencies in materials, workmanship, and adherence to specifications.

Global Sourcing Examples

Global sourcing needs differ by industry. For instance, manufacturers’ supply chains are more intricate than those of wholesalers, retailers, or service companies. Manufacturers typically source wide arrays of raw materials, components, and equipment to produce final products, with each input subject to stringent quality control, technical specification, and regulation. By contrast, wholesalers and retailers source finished products, and service companies source software and outside services, such as marketing.

Likewise, the restructuring of global supply chains varies, based on companies’ priorities in the face of changing conditions in different world regions. Here are three examples that align with current trends:

- Geographic diversification: Lego, the Danish toy company, sells into more than 130 countries worldwide. It added a second Asian factory and regional distribution center in Vietnam in 2025, in addition to those it operates in China, and it announced plans to open a new North American center in the US in 2027, in addition to Mexico. The company, which also manufactures in Europe, cited a diversification strategy that locates production and distribution closer to major markets to accelerate delivery and increase supply chain resilience. Observers also placed Lego’s moves in the context of tariff-related trends, such as expansion by many manufacturers into Vietnam amid high US tariffs on China.

- Automation: With one of the world’s largest international supply chains, Walmart is working to optimize its global sourcing with automation tools, including agentic AI—software that can act on its decisions, rather than only make recommendations. Now live across Costa Rica, Mexico, and Canada, Walmart’s new intelligent systems are predicting demand, rerouting inventory, reducing waste, and simplifying individual tasks, the company says. Examples of the tools the company is rolling out include generative AI to help identify trends so that popular ideas are turned into products on store shelves in as little as six weeks. Smart cameras and real-time performance tracking orchestrate inventory and use agentic AI to automatically redirect products before stockouts occur.

- Domestic reshoring: Amid tariff turmoil and other ongoing supply chain disruptions, companies like Bath & Body Works are sourcing more domestically than ever before. The US retailer of personal care products and fragrances says it has become more agile in responding to shifting consumer demands in recent years by moving much of its offshore manufacturing closer to its Ohio headquarters. Today, 80% of its supply chain is in the United States. In a recent investor presentation, the company used its signature foaming soap product to illustrate its increased speed to market. Previously, bottles came from Canada, pumps from China, and soap from Virginia—a process that took 12 weeks to complete and deliver to its Ohio distribution center. Now, with all steps consolidated among suppliers in Ohio, production and delivery are completed in only three weeks. The company’s US reshoring also helps to lessen its exposure to tariff volatility.

Global Sourcing Best Practices

Global sourcing strategies are multifaceted. Companies group the products and services they need into categories defined by their relative importance to the business. Components or materials that are critical to a company’s operations or competitive success receive more hands-on treatment, such as rigorous supplier selection and relationship management, to uphold quality control and collaborate on problem-solving. On the other hand, commodity items are more often selected on a cost basis.

Companies assess sources based on their products’ landed cost, or total cost of ownership, which—in addition to the purchase price—includes transportation, tariffs, insurance, and currency exchange considerations. They vet suppliers’ financial stability, production capacity, quality control systems, and ethical standards using a combination of market research and third-party audits.

Beyond these basics, global sourcing best practices can be summarized as follows:

-

Develop Sourcing Strategy in Conjunction With Business Objectives

More than half of companies in 2025 assigned top priority to improving alignment of supply chain planning and goals with their organization’s overall business strategies to spur success, according to the WTW report. Whether a business aims to compete on cost, accelerate its speed to market, safeguard quality, or drive innovation, sourcing plays a key role in meeting strategic goals.

For example, if a company aims to undercut its competitors on price, the primary sourcing objective would be to secure materials and services at the lowest total landed cost. For leadership in quality, cost might take a back seat to selecting suppliers with high standards, implementing rigorous controls, and closely monitoring them.

-

Thoroughly Evaluate Potential Suppliers

In global sourcing, finding the right suppliers is Job #1—and it’s getting harder. Companies today must engage more suppliers than ever to reinforce supply chain resilience, sometimes keeping alternative vendors on standby. This growing roster of supplier relationships adds complexity, requiring supplier selection processes that are watertight, documented, and repeatable.

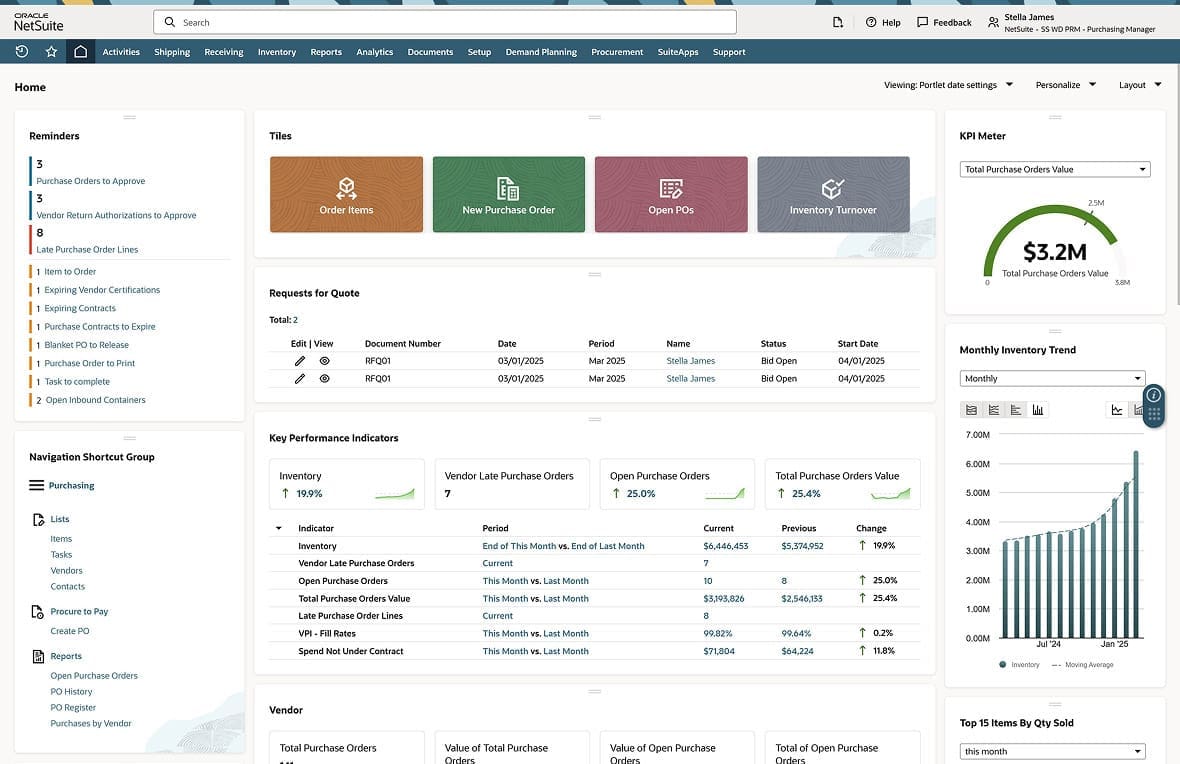

Selecting vendors is both an art and a science. While personal connections and business sense help, companies should also use systematic methods—searching industry directories, reading reviews, and analyzing scorecards or dashboards to compare vendors’ strengths and weaknesses. Companies have also started to deploy procurement software with AI capabilities that can provide superior predictive analytics, better recognize spending patterns, analyze contract language, and automate the continuous monitoring of suppliers’ financial health, geopolitical risks, compliance issues, and performance metrics. The desired traits in suppliers, ranging from cost and compliance to communications and customer service, should be codified in service level agreements with the chosen partners.

-

Build Strong Supplier Relationships

Supplier relationship management lies at the core of global sourcing. After identifying the right suppliers to meet strategic needs, companies need to collaborate effectively with their vendors to control costs, minimize disruptions, and meet other operational objectives.

Digitizing supplier relationship management represents a best practice that can reduce risks, including delivery delays, stockouts, and quality problems; protect production schedules; and improve the likelihood that products and services will be delivered on time and to specifications. Using shared vendor portals and dashboards can elevate essential communications, paving the way for stronger collaboration, innovation, and constructive problem-solving between companies and their suppliers.

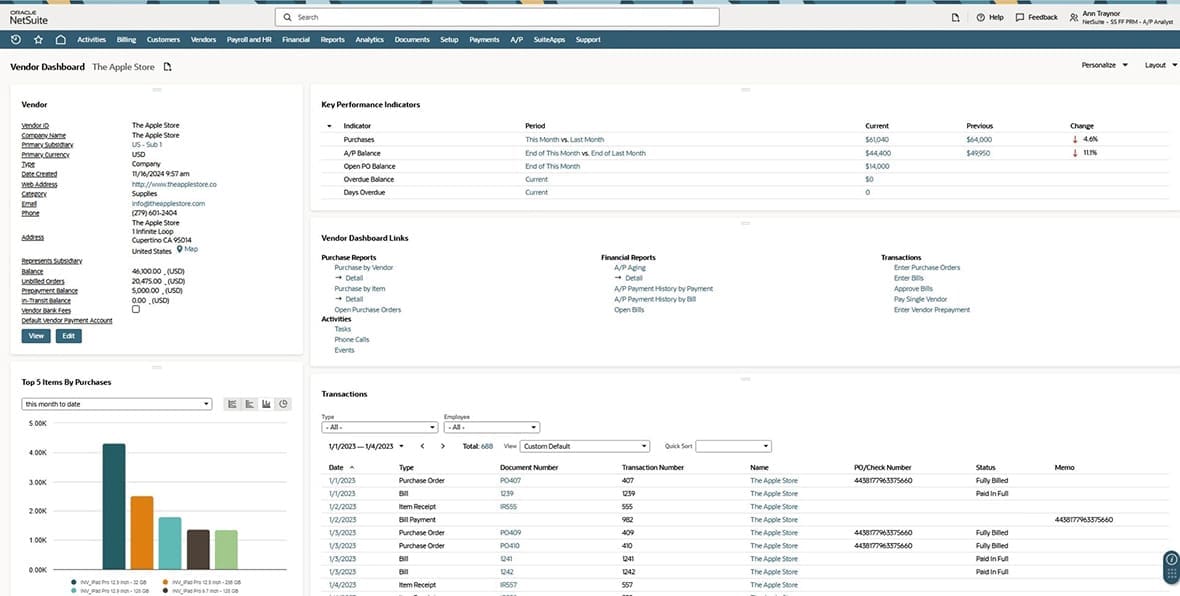

NetSuite vendor management software provides an online portal to collaborate with global suppliers—which can help companies reduce risk, improve collaboration, and support resilient sourcing strategies. -

Consider the Hidden Costs

For companies choosing to source globally, the unit price on a supplier’s quote represents only a starting point for costing. Companies must add freight charges, import duties, customs clearance fees, currency conversion costs, insurance, and compliance-related expenses and include buffers for delays in transit, port congestion, or unexpected tariff changes. Suppliers may also charge for administrative fees, excess inventory storage, logistics surcharges, and supplier change penalties. Hidden costs can also emerge in less obvious areas, such as quality issues that require rework, communication barriers that result in errors, or extended lead times that tie up working capital in excess inventory.

Conduct a thorough analysis of landed costs to reveal all potential expenses. Failure to factor in these variables early in the sourcing process could lead to budget overruns. Once suppliers are signed, routines should be followed for regular spend analyses, supplier audits, and close management of contracts.

-

Understand Cultural and Regional Norms

Diversified global sourcing exerts pressure on procurement and supply chain professionals to better understand unfamiliar cultural and regional norms. Ignorance of different languages, communication styles, and business etiquette can spawn strained relations, missed opportunities, and even contractual disputes.

Measures that can be undertaken to improve cross-cultural relations include employing multilingual staff, using translation services, and supplementing verbal communication with clear documentation. These steps help address language barriers and prevent misunderstandings. Investing in cultural intelligence and training can also aid negotiations. For example, while some cultures tend to value relationship-building and trust as prerequisites to signing contracts, others favor direct negotiations and efficiency. And it’s easy to lose sight of basics, such as time differences and local holidays, but even these can affect productivity if they delay approvals or problem resolution.

-

Enforce Quality Standards

Consistency has become increasingly elusive in diversified global supply chains. Enforcing quality standards across multiple suppliers requires rigor. Communicate clear, detailed product requirements to suppliers from the outset, covering materials, workmanship, tolerances, packaging, and labeling; all of this should be documented in contracts that avoid ambiguity.

Follow up with regular audits, inspections, and certification checks, either in person or through third-party quality assurance providers. Throughout the supplier relationship, vendor portals should capture quality measures as key performance indicators. Verifying consistency before goods are shipped reduces the risk of costly rework, returns, or reputational damage.

-

Regularly Review Sourcing Strategy

Global markets experience economic, political, and technological upheavals. Individual businesses strive for innovation and growth. Consumers can be notoriously fickle. Competitors are always trying to win out. All of this means that sourcing strategies simply cannot remain static.

A structured review process conducted quarterly, semiannually, or annually can realign sourcing with changing business objectives, customer demands, and environmental conditions. One best practice involves convening a dedicated review committee of procurement and business stakeholders. For more immediacy, some companies supplement committee reviews by giving sourcing managers the authority to make tactical adjustments on the spot, based on input from vendor portals and other tools for monitoring suppliers, customers, and market conditions.

-

Understand Regional Compliance Standards

Sourcing globally requires that a company and its suppliers comply with widely varying standards for product safety, labor practices, environmental protections, and import/export documentation. At stake are regulatory fines, shipping delays, reputational damage, or worse—being barred from doing business in a particular market.

Best compliance practices include working with suppliers that hold international certifications and have a strong track record of meeting local regulations. Don’t forget to conduct due diligence on monitoring rules in both the country of manufacture and the target sales market, followed by regular compliance audits of suppliers. Compliance management software can help with tracking and adhering to regulatory changes. In-country consultants and third-party auditors can verify compliance.

How Does Technology Assist In Global Sourcing?

At its best, global sourcing runs on real-time data and analytics. Integrated ERP systems, cloud-based procurement platforms, and supplier relationship management software help automate processes and improve visibility. AI can analyze vast data sets to help companies identify the best suppliers, forecast demand more accurately, and predict potential disruptions before they occur. Blockchain supports contract management, real-time transaction tracking, and integration with suppliers.

Benefits like these can translate into measurable results. Digitized operations assist in minimizing stock levels and associated costs, and automated communications free staff to focus on exception-handling and strategic initiatives. Greater visibility reduces compliance burdens and mitigates the possibility of fines or reputational harm. Collaboration is one of technology’s most powerful advantages in global sourcing: Shared forecasts, contingency plans, and joint innovation strategies improve production planning, crisis response, and product development.

An ERP Solution That Powers Growth

NetSuite’s ERP system and software suites support global sourcing by providing many different industries—from retail ecommerce sites to building materials manufacturers—with unified, real-time visibility into supply chain operations. When selecting and managing supplier relationships, companies can process requests for quotes, establish purchasing contracts, and monitor vendor performance from a single platform. This unified approach improves communications, simplifies compliance with international regulations, and allows teams to track and adjust shipping and inventory arrangements worldwide in response to changes in demand or disruptions in the status quo. At a time of fluctuating tariffs, NetSuite’s automated landed cost and tariff management functions calculate duties, taxes, and fees associated with importing goods. Its AI analytics provide insights for decision-making—empowering businesses to scale, diversify sourcing, and remain resilient amid the complexities of global trade.

Global sourcing strategies are evolving amid ongoing economic uncertainty and shifting trade policies. The old model of chasing the lowest labor cost is giving way to a more nuanced approach that balances cost with supply chain resilience and speed to market. As a result, businesses are diversifying their supplier bases, investing in automation, and, in some cases, bringing production closer to home. Fundamental to any new model for global sourcing is a flexible, data-driven strategy that aligns directly with a company’s core business objectives.

Global Sourcing FAQs

What is an example of a global sourcing strategy?

Diversification is a trending example of a global sourcing strategy. Many companies are adding alternative suppliers located in different world regions to increase their supply chain resiliency in the face of disruptions, such as changing tariff policies, international transportation bottlenecks, and volatile costs.

How do you manage global sourcing?

Technology is improving the management of global sourcing. Cloud-based procurement platforms and supplier relationship management software help automate processes and improve visibility. AI analyzes large data sets to identify top suppliers, improve demand forecasting, and anticipate disruptions, and blockchain enables secure contract management and real-time transaction tracking. These and other tools optimize operations by reducing stock levels and costs, automating communications, and allowing staff to focus on managing by exceptions that indicate problems. Additionally, improved collaboration, facilitated by shared forecasts and contingency plans, strengthens production planning, crisis management, and innovation.

Is global sourcing a market entry strategy?

Global sourcing can give a company a foothold in a foreign market. The market intelligence and relationships acquired for sourcing locally can eventually feed into a go-to-market strategy. In-country sourcing can also aid in meeting any local content requirements and in reducing import duties on final products.