Businesses that want to be profitable must first carefully account for every expense in order to price their products and services properly. However, some expenses are more nuanced than they appear. One example is product shipping, where transportation is just part of the picture, especially when importing and exporting is involved. These nuanced expenses, collectively known as landed cost, can chip away at a business's profitability if not properly recognized.

What Is Landed Cost?

Landed cost is the sum of all expenses associated with shipping goods to their final destinations, whether that means onto shelves in a warehouse or store or straight to a customer's doorstep. The concept may sound like a case of simple addition — and sometimes it is that straightforward — but often there are many “extras” to account for and analyze, especially when working with companies in other countries. Cost for transportation aside, these extras include packaging expenses, taxes, insurance fees, customs duties, currency conversion, crating, storage and any other charges incurred along the product's journey. Whether you're a supplier or a buyer, understanding landed cost has important implications for purchasing, pricing and profitability.

Key Takeaways

- Landed cost is the total cost to ship a product to its final destination — though it is not part of COGS. It includes transportation, taxes, payment processing and other possible fees.

- Understanding and tracking landed cost becomes more critical when doing business internationally, which involves customs-related costs, exchange rates and other fees.

- When shopping around for products, keep in mind that higher landed costs can diminish any savings gained from a low per-unit price.

Landed Cost Explained

Landed cost, also known as total landed cost, represents all expenses involved in a product's delivery to its final destination, whether by land, sea or air. Landed cost includes the per-unit cost of a product, freight, taxes, import and export duties, insurance, payment processing and handling fees, exchange rates and storage fees. These costs will vary from one country to another, or based on the time of year, how much is being shipped and other factors. Of note, landed cost reflects direct costs only, and it is not a component of cost of goods sold (COGS).

Why Is Landed Cost Important to Businesses?

Landed cost itemizes every fee involved in transporting a product through the supply chain to its end destination. In the world of global trading, factoring for landed cost is especially crucial, given the many expenses embedded in the international shipping process, such as customs and currency conversion. Landed cost is important to businesses because it impacts:

-

Product pricing:

If a business doesn't account for landed cost, it may not charge enough for its products to cover all shipping expenses.

-

Profitability:

Incorrect product pricing, in turn, can decrease profit margins because the business will have to "eat" those expenses.

-

Purchasing decisions:

From a buyer's perspective, it's important to understand landed cost when comparing competitive offerings. For example, a product that costs less to purchase per unit from overseas than domestically may seem like the better deal — that is, until international freight fees, customs charges, cross-border taxes and insurance are tacked on. Such costs can take a sizable bite out of a business's budget.

-

Shipping decisions:

Monitoring landed cost over time can help a company identify opportunities to reduce shipping expenses. Perhaps choosing a different shipping company or different mode of transportation can lower expenses. Or maybe the time is ripe to renegotiate with a carrier on volume shipping deals and discounts.

8 Factors of Landed Cost

Landed cost can add up quickly, especially for businesses that import and/or export products. Landed cost incorporates various fees, not all of which may apply to every business or shipment.

-

Shipping/freight cost:

This is the price of physically transporting a product to its destination, whether by land, air or sea. It makes up the bulk of landed cost.

-

Insurance and compliance costs:

Insuring merchandise protects a business if its goods are stolen, damaged or lost en route to their destinations. Insurance costs vary, depending on the type and value of the goods being shipped.

-

Customs and import costs:

Each country has different custom-related fees, taxes, regulations and possible licensing requirements for importing goods. In addition, fees such as value-added tax (VAT) can vary, depending on the type of product or service.

-

Handling and payment processing fees:

Shipments may be subject to special handling surcharges that cover the costs of packing and storing an order, as well as fees for processing credit and debit card payments.

-

Export license:

U.S. businesses that export goods typically don't need an export license to do so, though some additional costs may still be involved. Check the product's Export Control Classification Number (ECCN) to determine requirements.

-

Demurrage fees:

Shipping lines charge a penalty, or demurrage, fee for full containers sitting inside a port or terminal for longer than the free time allotted.

-

Exchange rates:

Currency rates are fluid and should be monitored when planning long-range product pricing.

-

Port charges:

Port charges cover the use of a port's facilities. A shipment's early or late arrival or its cancellation can affect charges.

How to Calculate Landed Cost

Once a business determines and collects individual shipping-related expenses — and not every charge listed above will be applicable — it can calculate its total landed cost. Despite its simple formula, calculating landed cost is not necessarily a quick exercise, particularly when performed manually and many products are involved. In addition, the consequences of a miscalculation can be sizable: An error that results in an underestimation of landed cost can negatively affect profit margins, while an error that results in an overestimation can lead to higher pricing that sends customers running to competitors.

Landed cost formula:

The basic formula for landed cost adds together a product's unit cost and cost for shipping, customs, risk and overhead. It looks like this:

Landed cost = unit cost of product + shipping/freight + customs + risk + overhead

where:

- Unit cost is the price of each unit of product.

- Shipping/freight costs include crating, packaging and handling.

- Customs are determined by each country, whose agencies are responsible for collecting duties, tariffs, VAT, broker fees and harbor fees associated with goods crossing into and out of the country.

- Risk fees cover insurance, compliance, quality control and safety stock, which aims to prevent a company from running out of a product.

- Overhead costs cover special handling fees, including currency conversion, bank charges, payment processing and surcharges.

Example with landed cost:

Let's examine how landed cost works with a hypothetical example of a U.S. retailer that sells women's accessories. Penny Brown, owner of "Penny's Purses," has purchased 500 handbags from a supplier in Canada at a price of $10 per unit (totaling $5,000). The import tariff is 2%, while the freight cost for the entire shipment is $1,000. Shipping insurance costs $200 for the full order, plus $5 per package shipped (assuming each package has one unit). Transactions are in U.S. dollars and include a payment processing fee of $3 per unit.

The variables to calculate landed cost are:

- Product: $10 per unit

- Shipping fee: $5 per unit

- Customs: $0.20 per unit (2% x $10)

- Insurance: $5.40 per unit [$200 insurance fee + ($5 per package shipped x 500) / 500]

- Payment processing fee: $3 per unit

Therefore, the total landed cost per unit is $10 + $5 + $0.20 + $5.40 + $3 = $23.60. That sum is the amount Penny would have to charge for each handbag, or $23.60, to break even. To make a profit, she would need to charge more.

Let's add on. Could Penny lower her costs if she were to purchase the handbags from India, where the handbag’s unit cost is $5? Yes, provided all other fees are the same. But India is much farther away than Canada, and landed cost items have higher prices.

- Product: $5 per unit

- Shipping fee: $6 per unit

- Customs: $0.50 per unit (10% x $5)

- Insurance: $14.40 per unit [$1,200 insurance fee + ($12 per package shipped x 500)] / 500]

- Payment processing fee: $6 per unit

The total landed cost per unit is $5 + $6 + $0.50 + $14.40 + $6 = $31.90.

This comparison illustrates why it's important to analyze all of the elements that go into landed cost. Despite a 50% reduction in per-unit price, all other costs associated with shipping the handbags from India to the United States makes the purchase more expensive than buying them from Canada.

Tips for calculating landed cost:

As the saying goes (or some variation thereof), your output is only as good as your input. Consider these landed cost tips:

- Have a firm grasp of all expenses. In addition to shipping, landed-cost line items may include taxes, customs, import and export taxes, storage fees and insurance. Only with this detailed assessment can a business understand its total shipping costs and then price its products accordingly to maximize profit.

- Investigate ways to lower your costs. Just as customers might compare your products and prices against competitive offerings, so, too, should you request quotes from different carriers and logistics providers to get the best shipping prices. Shipping will be your highest landed cost expense.

- Automate calculations. Manually calculating landed cost isn't necessarily difficult. But it is time-consuming — and the more products you ship, the more labor-intensive and error-prone the process becomes. Fees can fluctuate and impact profitability, too. Automation will improve the accuracy of your data, speed up calculations and improve key operational decision-making.

How to use NetSuite to calculate landed cost:

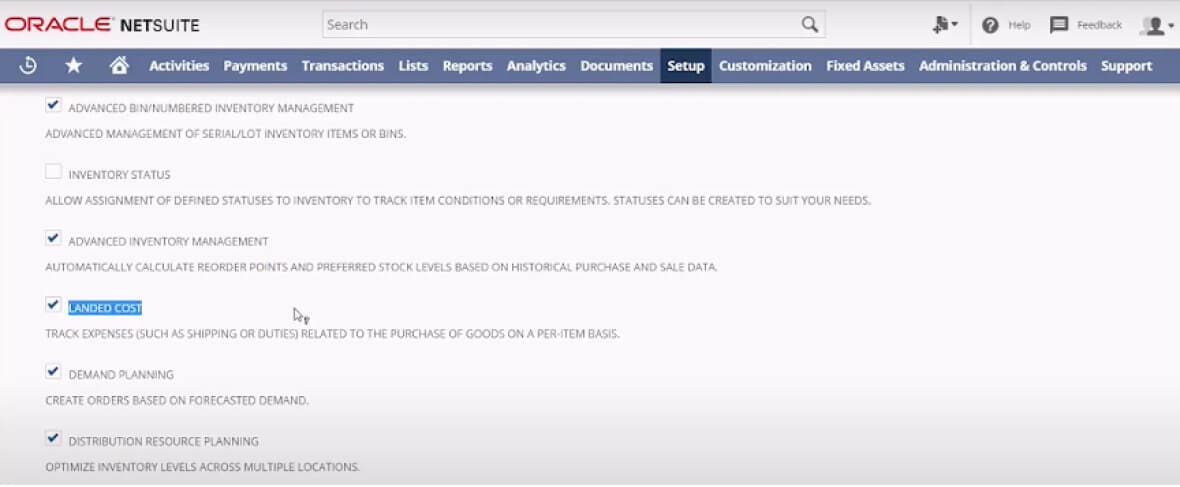

NetSuite Inventory Management helps businesses track and calculate their inventory-related expenses, including landed cost. Several preferences in the software must be enabled, starting with the landed cost feature itself, after which landed cost–related expenses can be designated, tracked and added to the value of the inventory item. This video demonstrates how to set up and configure the software's landed cost feature.

Free Landed Cost Calculator

A landed cost calculator can help a business accurately estimate its landed cost — however, ERPs and advanced inventory management systems do this within the platform. Some calculators can also compare landed cost across different countries to help determine the least expensive option.

Get the free landed cost calculator

Use our free landed calculator to determine your product's landed cost. The calculator is prepopulated with the costs from the first "Penny's Purses" example presented earlier. It also includes fields for costs that weren't applicable in that example but may be required for calculating your own landed cost.

Improve Your Landed Cost and Manage Inventory With NetSuite

Landed cost refers to all the fees incurred by a business to deliver a product to its final destination. Shipping may be an obvious cost — it certainly is the biggest — but landed cost may also include harbor fees, storage costs, import and export taxes, insurance and more. Working from a product's weight, value or quantity, NetSuite Inventory Management can automatically calculate and track fees included in landed cost, which then need to be baked into product pricing so a business can make a profit. The software also provides real-time visibility of inventory across multiple locations, optimizes inventory levels based on demand so as to avoid overordering or stockouts, and streamlines core inventory processes.

Conclusion

Seemingly small omissions of expenses can quickly add up and whittle away a company's revenue and overall profitability. That's why the meticulous tracking of landed cost — every single expense associated with shipping goods to their final destinations — is so important. Its accurate calculation can help business owners determine the best prices for their products so as not to charge too little and lose money, or charge too much and lose to the competition.

Landing Cost FAQs

Why is landed cost hard to calculate?

It's not so much that calculating landed cost is difficult — the main challenge is collecting all of the right data for an accurate calculation, especially when different countries are involved. Landed cost includes the per-unit cost of a product, plus amounts for freight, import and export duties, various taxes, insurance, processing fees, exchange rates and storage fees.

Why should ecommerce businesses calculate landed cost?

Shipping is an inherent part of ecommerce. Ecommerce businesses can quickly lose money if they don't factor in the variety of costs associated with shipping — especially when they import and/or export overseas. Landed cost includes the per-unit cost of a product, freight, taxes, import and export duties, insurance, payment processing and handling fees, exchange rates and storage fees. These costs will vary from one country to another or be based on the time of year, how much is being shipped and other factors.

How do you calculate landing cost?

Once a business determines and collects individual shipping-related expenses, it can calculate its total landed cost. The basic formula for landed cost is: Landed cost = unit cost of product + shipping/freight + customs + risk + overhead.

How does landed cost impact product pricing?

By calculating landed cost, a business can determine the true cost of a product, not just the material good itself, and then price its offering accordingly.

What is the difference between FOB and landed cost?

FOB, which stands for freight on board or free on board, is the price the buyer pays to acquire products. It doesn't include shipping or import fees. Landed cost is the sum of all expenses associated with shipping goods to their final destinations.