The 2020s have been tough on supply chain operations. Pandemic-driven disruptions receded a couple of years ago, only to be followed by climbing prices and recurring storms, strikes, shortages, and other stoppages across the global supply chain. Yet supply chain professionals haven’t been sitting idly by, leaving their businesses at the mercy of external forces. Rather, they’ve restructured and digitized their supply chains for greater resilience to contend with their new reality. The outlook for 2025 calls for more of the same challenges. In parallel, though, many companies’ digital initiatives will come to fruition, minimize those challenges’ impact. This article lays out supply chain trends for the year to come.

Key Takeaways

- The supply chain challenges of the 2020s are here to stay in 2025.

- But digital mitigation strategies could reach a tipping point.

- Artificial intelligence is a top trend in companies’ efforts to mitigate disruption and uncertainty.

12 Supply Chain Trends to Know in 2025

The 2024 Supply Chain Stability Index has shown “tremendous improvement and increased supply chain stability overall, with several variables still driving continued fragility.” As evidence of growing strength, its authors at the Association for Supply Chain Management (ASCM) point to the comeback of just-in-time inventory approaches in parts of the supply chain, after a few years of piling up “just-in-case” stocks.

But new challenges also emerged, such as strains at the border between the U.S. and Mexico, where many U.S. companies have been relocating some of their sourcing from China to “near-shore” factories. Looking ahead, the rapid uptake of artificial intelligence (AI) stands out as one of the most promising supply chain trends, ASCM said. Here are a dozen supply chain trends to know in 2025.

1. Restructuring for Resilience

Experts see a long-term realignment of supply chains in progress, as companies develop the mindset, tools, and resources to tackle modern supply chain issues. U.S. and global companies have been forced to reevaluate their global supply chains due to rising geopolitical tensions, volatile prices, and transportation bottlenecks. In recent years, many businesses have added alternative suppliers to increase operational resilience. This includes a multishoring strategy that combines sourcing from nearby countries (near-shoring and on-shoring) with continued use of suppliers in regions such as Asia (far-shoring).

A survey by the U.S. Chamber of Commerce revealed that over 90% of American companies are already implementing a supplier diversification model or planning to do so soon. Similarly, more than 75% are seeking to mitigate the impact of disruptions in any single geographic region by working with suppliers from various parts of the world.

Expanding supplier networks is a significant undertaking, not only initially, but over the long term because it requires ongoing management of more vendors. In other words, vendor diversification adds supply chain complexity in return for greater resilience. The value of this trade-off remains to be seen, with some companies recently reconsolidating supplier relationships to cut costs and simplify operations. Others have looked to technology, such as supplier relationship management (SRM) systems, to tilt the balance in their favor, leaning more heavily into digitally transforming their supply chains for greater resilience.

2. Rebalancing Inventories

Companies have been recalibrating their inventory management strategies since 2020, when many began stockpiling goods during the pandemic. After a hiatus, however, they reprised the “just-in-time” approach of lowering costs by holding less inventory. In 2025, many are choosing to carry a balance of just-in-time and safety stocks—in what some are calling “just-right” inventories—while keeping an eye on potential disruptions, economic fluctuations, and uncertain consumer spending trends.

“Companies can’t respond to instability simply with buffer inventory … which adds an extra burden of working capital on their backs,” according to an article in the Harvard Business Review (HBR). “When the competitive race is this intense, companies shouldn’t handicap themselves.”

Instead, digital tools can provide much more visibility into what’s happening in supply chains to track supplier risk, provide real-time updates on inventory location en route from its source, and confirm its status in the warehouse, reducing the likelihood of stockouts. Digitization can also facilitate even leaner inventory management models, such as dropshipping, where retailers themselves do not hold the inventory but trigger a shipment from a third party to the customer once a product is purchased. In another supply chain trend, AI-driven forecasting and replenishment tools are also being adopted to optimize inventory management

3. Digitizing Operations

Increasingly, the ability to harness the power of supply chain data determines a company’s ability to operate efficiently and compete successfully. Supply chain digitization promises to deliver benefits including improvements in the customer experience, speed to market, higher profit margins, and faster response to disruptions and market changes.

In a 2024 survey by the Harris Poll, companies said they are focusing on the following solutions as they digitize their operations: AI-driven demand forecasting, cloud-based supply chain management platforms, flexible transportation management systems, customer-centric order management systems, real-time inventory management systems, and collaborative supply chain networks.

Solutions like these can only be effective if they are working with reliable, accurate data. So digitizing the supply chain requires investing in rigorous data management practices and technologies to clean, validate, and maintain data quality. Many investments in supply chain transformation have not yet achieved their strategic objectives, the Harris Poll found, although 2025 could be a turning point, when supply chain initiatives begin to yield the hoped-for returns.

4. Deploying Cloud-Based Solutions

The cloud is firmly established as the standard platform for most supply chain software, according to an annual survey by Material Handling Industry (MHI), a leading trade association. MHI projects that cloud computing and storage will reach an 82% adoption rate in the next few years.

Pervasive cloud computing is laying the foundation for several supply chain innovations. For instance, so-called mesh technology enables the capture and combination of data from multiple supply chain systems to create a “digital twin,” meaning a virtual replica that can be used to facilitate decision-making and intelligent orchestration of operations. In another example, inventory data can be combined with readings from transport vehicles to confirm delivery schedules and avoid stockouts

At the staff level, the cloud enables supply chain managers to access critical information wherever they happen to be—not inconsequential in what is often a 24/7 operation. Companies can also benefit from a growing range of cloud-based software-as-a-service (SaaS) offerings, such as packaged solutions that let users compare freight forwarders and manage storage.

5. Collecting and Analyzing Big Data

Companies today can collect and combine massive amounts of supply and demand data from myriad sources, including Internet of Things (IoT) devices throughout the supply chain, historical purchasing records in their enterprise resource planning (ERP) systems, weather reports, market research, and customer feedback. In polling by the American Productivity & Quality Center (APQC), supply chain managers chose the combination of big data and advanced analytics as the most impactful supply chain innovation through 2027.

The collection of big data in the supply chain is accelerating with the rollout of high-speed, low-latency wireless technologies, such as 5G mobile networks, which can operate inside factories and warehouses and also provide nationwide coverage of vehicles in transit. These networks connect IoT sensors and other devices for applications including instantaneous tracking of inventory levels to avoid stockouts, the rerouting of goods in transit along the fastest route, and cold chain monitoring to ensure the safety of perishable goods. They also lay the foundation for automating many of these tasks, with minimal staff intervention.

What’s more, analyzing big data delivers a boost to companies’ demand forecasting for better supply chain planning. In a case study of an electric vehicle manufacturer published by MHI, demand forecasting provided a 20% improvement in accuracy to inform planning. With a better understanding of demand for different car configurations from running analytics on cars sold, locations, pricing, promotions, and other data points, the company improved planning to achieve benefits including faster processing, inventory replenishment, and order fulfillment.

As seen below, AI has arrived on the scene to supercharge the predictive modeling of big data on customer preferences, market changes, and other supply chain drivers.

6. Upgrading With Artificial Intelligence and Generative AI

A 2024 Economist Impact survey showed that fully 98% of executives have embraced AI to transform at least one aspect of their supply chain management. The rapid uptake of AI since generative AI exploded onto the market in the late 2022 underscores its current ranking by the Harris Poll as the top priority in supply chain management to enhance efficiency and decision-making.

That said, market observers say that most businesses are unsure exactly what to do with AI. For instance, many GenAI efforts are still being piloted, according to Deloitte, and a large majority of survey respondents have moved no more than 30% of their GenAI experiments into full production.

Yet the potential is clear across many domains. The Economist Impact survey showed 40% of companies applying AI to optimize customer experience, 35% to forecast demand, 35% to optimize inventory levels, and 35% to identify potential supply-chain disruptions. Early adopters reported a 34% cost reduction in overall supply chain operations and a 32% enhancement in supply chain planning. The list of applications goes on, according to the HBR article, including the identification and evaluation of potential suppliers and the ability to propose risk-mitigation strategies based on multiple scenarios.

A Boston Consulting Group report predicted that AI will assume an even larger role in supply chain operations in coming years, as supply teams come to trust its autonomous decision-making capabilities. AI provides real-time decision support that is dynamic, self-learning, and capable of crunching unstructured and structured data—all of which means that AI can predict, recommend, or even automate decisions for demand planning, sourcing, and optimizing operations based on inputs ranging from social feeds, emails, and texts to GPS readings, orders, and consumer trend reports. In MHI’s poll, 40% of companies said they expect AI to deliver a competitive advantage.

7. Automating Operations

The Harris Poll cited companies’ top motivations to automate their supply chain as improving accuracy, providing consistent quality, and maintaining a competitive edge, followed closely by the desire to enhance supply chain visibility, increase speed of response, and meet customer expectations.

Supply chains have many moving parts, and companies are determined to automate as many of them as possible. That means replacing manual processes with digital processes, from the procurement office to the factory floor to the customer’s door. Staff intervention is then focused on exceptions in otherwise standard operating procedures that include sourcing and ordering raw materials and components, transporting them, producing goods for sale, delivering them to customers, and handling any returns.

The technologies used to automate supply chains have evolved and proliferated over time, from barcodes and robotic arms in the mid-20th century to today’s AI-powered inventory management and drone deliveries. Benefits include the reduction of human error while inputting data, an increase in response times, and the alleviation of staffing issues amid the current labor shortage.

Picture a supply chain in which orders are automatically generated as sensors report dwindling stocks in inventory—and then robotic process automation (RPA) enters the data needed to pay invoices. Imagine that progress reports on raw materials in transit are available at the stroke of a key, along with recommendations about how to handle any transport issues or rescheduling production.

Applications like these illustrate automation in cloud-based, end-to-end supply chains. They show what’s possible when supply chain tools are integrated with a company’s ERP or other production systems—and leveled up with AI analysis and prediction software—to streamline operations and enhance decision-making.

Yet most businesses still haven’t sufficiently integrated their physical supply chain processes with digital data and tools. That’s changing in 2025. As an example, APQC reported that nearly a quarter of companies have implemented RPA in logistics and warehousing, with another two-thirds planning to do so.

8. Gaining Visibility, Traceability, and Transparency

Achieving end-to-end visibility ranked as a top driver for digitally transforming supply chains, according to the MHI survey, followed by related goals like resiliency, efficiency, and sustainability.

Supply chain visibility remains a work in progress for most companies. More than four in 10 said they had no visibility or were “largely unclear” about the operations of even their tier 1 suppliers, according to a report from consultancy KPMG. In addition to hindering operations, this relative obscurity compounds the pressures that companies face to provide transparency about their supply chain operations to regulators, environmentally conscious customers, and other stakeholders. They can only provide partial insights, especially regarding the outer layers of their supplier networks, including the tier 2 suppliers from whom their own suppliers source.

Public pressure to increase traceability and transparency is mounting in the run-up to 2025. Companies are preparing for regulatory requirements ranging from environmental reporting at the Securities and Exchange Commission to affixing digital product passports, replete with details on sustainable and ethical sourcing, under new European Union rules. At the same time, consumers are clamoring for similar information on the products they purchase.

Among the many digital supply chain technologies being deployed to address such needs, AI-enhanced supply chain transparency can help trace raw materials to their sources, identifying any unusual patterns as it checks for sustainable and ethical production in far-flung locales. Blockchain, with its centralized digital ledgers, can also improve compliance, for example, by providing a transparent, immutable record of the provenance of raw materials to ensure integrity in sourcing. Gartner predicts mainstream adoption of this type of application over the coming five to 10 years.

9. Improving Risk Management

In the Harris Poll, 87% of executives agreed that safeguarding their supply chains against unforeseen disruptions was a top priority. Yet only about 40% of them said they feel adequately prepared for risks such as trade wars, regulatory changes, and cybersecurity attacks. Meanwhile, in late 2024, the Federal Reserve’s Global Supply Chain Pressure Index—a composite summary of potential supply chain disruptions—was creeping upward.

In terms of regulatory risk, for instance, businesses face fines, reputational damage, and other consequences if they fail to comply with rules like the California Transparency in Supply Chains Act, which addresses forced labor; the U.S. Food Safety Modernization Act, which aims to prevent foodborne illnesses; and the European Union’s Deforestation Regulation (EUDR), which prohibits the sale of commodities linked to deforestation.

Traceability and transparency measures such as those described in the previous section can help improve regulatory compliance and reduce other types of risk. Yet preemptive scenario planning is also needed to avoid making urgent decisions with limited information or options in the heat of a supply chain incident, according to Gartner. In 2024, the vast majority of Gartner survey respondents considered scenario planning to be a low-cost technique with moderate to high impact in containing supply chain risk.

10. Stepping Up Sustainability With Circular Supply Chains

The supply chain is responsible for the vast majority of greenhouse gas emissions produced by consumer goods companies. Facts like these are driving companies to step up their environmental sustainability efforts and implement “circular economy” supply chains.

Determining a company’s climate impact is basically a data issue, according to the Boston Consulting Group, since most companies cannot directly measure their emissions. Instead, they apply accounting rules and emission factors to their transactions data to assess and address any significant shortcomings under compliance deadlines. Those deadlines are expected to arrive with increasing frequency in 2025, under U.S. and global rules just coming into effect. And regulators are not just targeting emissions. For example, a California law is gradually requiring single-use packaging to be recyclable or compostable, with 100% compliance expected by 2032.

Fixing the problems identified across emissions, material waste, and water consumption is often a matter of adopting circular economy supply chain strategies. These include designing products for longevity; implementing systems for collecting, refurbishing, and reselling used products; and reducing and recycling packaging and other waste materials.

Circularity is gaining popularity worldwide, according to the “Circularity Gap Report 2024”—but it is falling short on action. Still, 85% of Harris Poll respondents reported that regulatory pressures were speeding up their organization’s progress toward implementing sustainable supply chain solutions.

11. Retooling for Customer-Centric Supply Chains

With an uncertain outlook for consumer spending in 2025, companies are moving customer-centricity up the list of supply chain management priorities to compete effectively for their business. Customer-centric supply chains focus on delivering a high degree of customer satisfaction and retention as well as profitability. But it’s not just about promising same-day delivery or letting customers track their purchases while in transit. Consider the farm-to-table movement in dining, with many in the restaurant business revamping their sourcing of ingredients while also demanding detailed information from their suppliers to share with diners about the environmental or organic qualities of their products. Transparency is also driving change in fashion industry supply chains, due to consumer concerns about forced labor, carbon emissions, and more.

Technologies such as IoT sensors and SRM software underpin the visibility and traceability required in these scenarios. Other digital attributes of a customer-centric supply chain include accurate demand forecasting and personalization. AI increasingly comes into play, in examples including the use of customer segmentation tools for better targeting and automated in-stock alerts that notify customers when an item is back in stock.

12. Providing Workforce Training

Going into 2025, persistent labor shortages remain stuck on companies’ list of business challenges. The vast majority are also investing in automation to minimize related issues.

The MHI report illustrates how supporting workers with technology can improve the situation. In a case study of a specialty material company’s digital transformation, production and delivery speeds improved thanks to GenAI.Prior to the new way of doing things, employees who had questions during production, transportation, or inventory had to stop whatever they were doing and spend an unpredictable amount of time finding the information they needed to continue. Now they can use a conversational GenAI model to consult any of thousands of digital documents that have been organized into a single curated library. With easy access to data, knowledge, and coaching, they can make better plans, handle exceptions quickly, improve forecasting accuracy, and otherwise level up their individual performance. The company improved operational efficiency by up to 15%, according to MHI.

Meanwhile, companies also continue the gradual rollout of labor-saving technologies, such as RPA, to automate data entry, order processing, and other tasks; warehouse automation for picking, packing, and transporting goods in a warehouse; AI-powered predictive maintenance; and remote trouble-shooting.

Stay Ahead of Supply Chain Trends With NetSuite

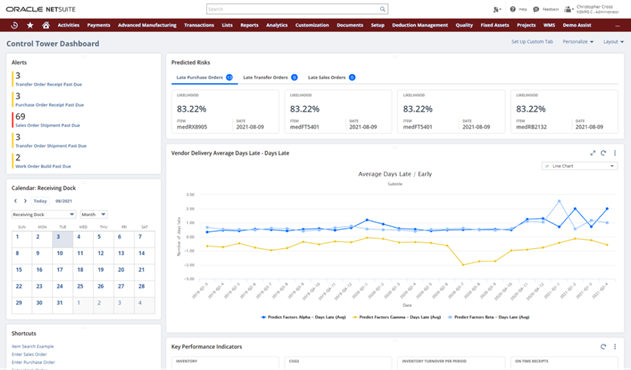

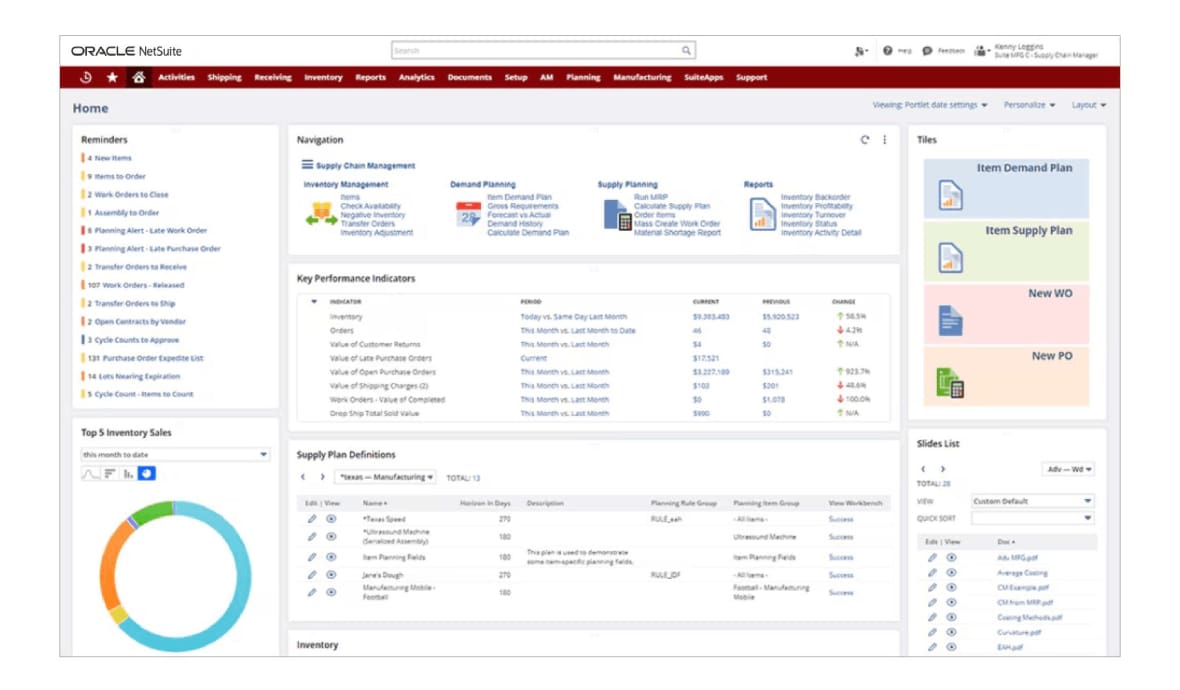

As the digital transformation of supply chains continues into 2025, success will hinge on data visibility and actionable insights. NetSuite’s supply chain management solutions provide a comprehensive view of supplier networks and product journeys, from their source through production and on to the customer. Under the umbrella of NetSuite’s AI-powered ERP, companies can integrate demand planning, procurement, inventory management, and more. The result: streamlined processes, automated tasks, and real-time visibility for better decision-making that elevates business performance.

2025 will continue to test the mettle of supply chain managers, with ongoing volatility liable to produce concurrent disruptions at many levels of supply and demand. The ability to respond, recover, and remain resilient in this environment will be determined by data and the decisions drawn from it.

Supply Chain Trends FAQs

What are supply chain trends?

Trends that are redefining supply chains today include a restructuring of supplier relationships, diversification of production locations, digitization, and artificial intelligence.

What are future trends in supply chain management?

Artificial intelligence has emerged as a defining technology trend for 2025 and beyond. It is expected to accelerate supply chain managers’ efforts to achieve resilience in an uncertain environment, converging with trends such as cloud computing, the Internet of Things, and automation.

How is the supply chain doing in 2025?

Companies’ supply chains continued to be challenged by high costs and recurring disruptions, such as storms, strikes, shortages, trade friction, and other local and global issues. Supply chain professionals have been restructuring and digitizing their supply chains for greater resilience to contend with such events.

What are the five biggest supply chain challenges?

High costs, uncertain consumer demand, labor shortages, disrupted logistics, and extreme weather are among the biggest supply chain challenges.