Just as manufacturing involves the assembly of many moving parts to make a product, a manufacturing budget involves the assembly of every estimated direct and indirect expense into one comprehensive document intended to help the business achieve its objectives. But, despite the best plans, stuff happens. Costs for raw materials and shipping, to name two, fluctuate. Staff members come and go. Overhead expenses, like rent and utilities, rise and fall. The good news is that all the data analysis and planning that went into establishing the budget in the first place can help manufacturers quickly spot and manage these inevitable changes. This guide to manufacturing budgets details the many items they cover, benefits and challenges, how to create one and related tips.

What Is a Manufacturing Budget?

A manufacturing budget is a detailed financial document that shows all planned revenues and expenses related to the production process during a specific time period. It covers direct costs, such as raw materials and labor, and indirect overhead costs, such as utilities and rent. By laying out all the numbers, a manufacturer can determine how to best allocate its resources, direct funding and, ultimately, maximize profitability. The budget is based on forecasted costs and revenues, and those forecasts will likely have built-in contingencies and/or regular and flexible adjustment periods based on market uncertainties. As real results come in and forecasts are adjusted, however, static budgets may need to be recalibrated to ensure that the business’s expectations remain aligned with current market conditions and realistic goals.

Key Takeaways

- There are several types of manufacturing budgets that each cover different aspects of producing goods, from direct production costs to finished inventory.

- Creating a manufacturing budget requires an intensive planning and implementation process, emphasizing data-driven estimates and regular performance tracking to improve future operations.

- Effective manufacturing budgeting can bring many benefits, but also many challenges. Understanding the benefits and challenges can help manufacturers choose the right budgets and best practices to suit their organization’s needs.

Manufacturing Budgets Explained

A manufacturing budget itemizes expenses and revenue sources, but, bigger picture, it serves as a statement of strategic priorities that set forth exactly where each dollar of internal investment will go. Indeed, the budget is considered the first year of a manufacturer’s longer three- or five-year strategic plan. The manufacturing budget is typically divided into three primary categories: direct materials, direct labor and manufacturing overhead. Direct materials are used to produce a product. Direct labor refers to the workers involved in producing a product. Manufacturing overhead covers the indirect costs tied to the manufacturing process. (More on all of these soon.)

The manufacturing budget starts with revenue projections. By forecasting sales for the upcoming financial period, budgeters can plan how many goods will need to be produced to meet that demand. Then they can analyze how much it will cost to produce those goods and how much revenue and profit those goods will bring in. Together, direct and indirect costs help manufacturers plan their production schedules, which, in turn, set benchmarks and timelines for finished inventory and sales, generating the revenue that will finance the ongoing manufacturing operation. Manufacturers can use this data to analyze holistic, overarching budgets to inform big-picture strategies. Then they can zoom into more focused, compartmentalized budget categories to monitor performance and make adjustments.

Components of a Manufacturing Budget

Every budget should reflect the manufacturer’s distinct priorities and strategies. Most manufacturing budgets comprise several focused budgets that group together specific types of major manufacturing expenses. This makes for easier comparisons against prior budgeting periods, benchmarks and competitors to assess whether they are meeting expectations.

Direct Materials Budget

The direct materials budget focuses on the acquisition and management of the raw materials needed to make sellable goods — for example, flour for bread or diamonds for rings.

- Estimation of raw materials: The manufacturer must estimate the right quantity of material it needs on hand to meet production demands. Overstocking ties up cash, increases carrying costs and could lead to dead stock, while understocking can cause missed sales and customers’ defecting to the competition. Leading manufacturers use sophisticated software, often part of a larger enterprise resource planning (ERP) system, to increase the accuracy of their estimations and create budgets that more closely align with planned demand.

- Price considerations: The price manufacturers pay for raw materials is an important budget consideration, especially during inflationary periods. This also informs how much a manufacturer should charge for its products. Budgets help business leaders see where its costs are increasing and need to be addressed, such as by reducing production for lower-margin goods or finding new suppliers when existing contracts become too expensive.

- Inventory planning: Comparing the overall production budget with inventory levels and sales metrics can help managers see when production is falling short of demand or should be reduced to prevent overproduction. In this way, budgets help manufacturers meet demand as efficiently as possible.

Direct Labor Budget

The direct labor budget plans the costs associated with workers who are directly tied to the production process. Direct labor, along with raw materials, typically makes up a significant part of a manufacturer’s expenses.

- Estimating labor hours: The foundation of a direct labor budget is the accurate estimate of the number of labor hours needed for production, based on production requirements and the efficiency of the workforce. Shifts should be assigned to match budgeted demand and inventory output, with the goal of preventing costly staffing shortages or overstaffing.

- Setting labor rates: Labor rates are the wages paid to staff. They vary depending on a worker’s skill level, prevailing market rates, local labor laws and regulations and other industry-specific factors. Fair and clear labor rates are essential to retaining workers and maintaining high employee morale — along with the productivity that often accompanies it. Budgets must also consider the impact of labor rate changes, including contracted raises for union workers, merit-based raises, cost-of-living adjustments and increasing benefit costs. Manufacturers must balance the costs of labor with the risks of understaffing to find the labor rates that work best for them.

- Productivity rates and overtime: Productivity rates measure the average output per labor hour; it can be calculated for an individual product, a product line and/or overall production. Monitoring these rates over time can help pinpoint inefficiencies and bottlenecks and inform corrective measures. For manufacturers with peak production seasons or that otherwise deal with big swings in demand, the budget should make provisions for estimated overtime expenses, which can increase labor costs considerably if not carefully managed.

Manufacturing Overhead Budget

The manufacturing overhead budget covers the indirect costs attributed to production, such as administrative expenses, rent, utilities and depreciation of manufacturing equipment. Some manufacturers, especially smaller companies without a long list of diverse costs, may choose to include direct materials and labor in their overhead budgets, rather than separating those costs into their own individual budgets.

- Fixed and variable overheads: Fixed costs, such as rent and insurance, remain relatively constant, regardless of how many goods are produced. They are easier to budget for because they are predictable and rarely change unexpectedly. Variable costs, on the other hand, fluctuate with production. They include utilities and nonmanufacturing supplies, such as shipping materials, and need to be estimated while planning the budget. It’s important to remember that these overhead costs are related only to the manufacturing facilities. The rent, utilities and other costs for nonmanufacturing locations, such as sales offices and corporate headquarters, are not included in this budget.

- Allocation bases: Many manufacturers distribute their indirect costs across their goods, typically per unit produced, to gain a more precise picture of the total cost of goods relative to production. Doing so also brings greater accuracy to key metrics, such as profit margins and break-even points, so that business leaders better manage costs and set pricing strategies.

- Activity-based costing insights: Activity-based costing links indirect activities with the goods they create to better distribute overhead costs. For example, if a factory uses 2,000 labor hours over an average month and that labor directly leads to a $10,000 utility bill, the overhead for electricity is $5 per labor hour ($10,000 / 2,000 hours). And if a product takes three hours to assemble, the utility overhead for this product is $15 ($5/hour x 3 hours). This can be added to the other costs of production (both direct and activity-based) to calculate the overall budget allocation per good produced.

Production Budget

The production budget details the quantity of units that the manufacturer plans to produce over a given period. This budget can be used to align sales tactics, inventory allocation and projected revenue with production schedules.

- Estimating total units to be produced: The total unit production estimate is based on starting inventory, the number of semi-finished goods (also known as works in progress) in possession, sales forecasts and planned final inventory. These figures should be contextualized with the expected revenue over the budgeted period. Too many units produced can take resources away from higher-margin or more in-demand goods, while stockouts can push customers to the competition and put a dent into revenue. Production capacity and other constraints, such as raw material scarcity, may also provide challenges outside of the production budget’s scope.

- Aligning with sales and inventory forecasts: Production schedules and inventory counts should be aligned with the timing of budgeted sales to ensure that enough inventory is on hand to meet demand, while also using revenue from sales to continue funding production throughout the financial period. To maintain that close timing, the production budget should be updated and reforecast whenever sales and inventory forecasts change. Precise and realistic estimates, often calculated through sophisticated forecasting software with real-time data access, help manufacturers improve their overall production schedules to meet demand and minimize waste. If initial estimates were off or market conditions change, budgets need to be quickly adjusted to minimize the impact on the manufacturers’ ability to efficiently meet demand.

Ending Finished Goods Inventory Budget

The ending finished goods inventory budget combines all of the costs that contributed to the final inventory count at the end of a financial period; it likely includes much of the information found in the above budgets. However, the finished inventory budget specifically focuses on the value of inventory as an asset (something the company owns and that holds economic value). This information appears on the manufacturer’s balance sheet, one of several core financial statements. The finished goods inventory budget helps guide future production schedules and tracks how closely inventory levels align with sales.

- Estimating the necessary ending inventory: The budgeted final inventory count is determined through a combination of sales budgets, production volume and existing inventory levels. Other factors may influence the need for an atypical inventory level, such as stockpiling goods before a seasonal demand peak.

- Valuation considerations: Along with quantity, the value of the inventory itself must be considered. Inventory value is calculated using all of the component costs, including direct labor, direct materials and manufacturing overhead. Inventory valuation methods, such as first in, first out (FIFO); last in, first out (LIFO); and weighted average cost, allow for an accurate calculation of the cost of goods sold (COGS) and the expected gross profit margin. This is especially important when establishing selling prices. The number of units of unsold inventory also uses the same value for inclusion on the balance sheet.

Cost of Goods Sold Budget

The COGS budget lists the planned costs associated with direct materials, direct labor and manufacturing overhead to be included on the company’s overall budgeted income statement. The budgeted COGS is only for goods expected to be sold during the financial period, as opposed to the unsold goods that remain in ending inventory. By comparing budgeted COGS figures to actual results, analysts can gain a detailed picture of the gross profit and cash flow for products and identify areas to cut costs and/or raise margins.

- Compilation of direct materials, direct labor and manufacturing overhead costs: The COGS budget specifically focuses on sold goods, ignoring unsold inventory and stockpiles for future periods.

Manufacturing Budgeting Process

Just as they do when producing products, manufacturers must take great care when creating their budgets. A rushed or disorganized budget can lead to missed opportunities, misallocated resources and assorted errors caused by using inaccurate data. The following 17 steps instruct manufacturers about how to create, review and refine their budgets to optimize operations and achieve their planned goals.

-

Set Objectives Based on Company Goals and Plans

As a first step, manufacturing leaders should consider the company’s overall strategic plan and what they intend to achieve during the budgeting period. These objectives will impact budgeting assumptions and decisions, including resource allocation and investments, and help the business more effectively communicate their intentions across the organization.

-

Assess the Sales Forecast

Sales levels and timing are essential parts of any budgeting process, informing every proceeding step. The sales forecast estimates the volume and prices of the goods the company anticipates selling within the budgeted period. This leads to the overall expected revenue that will be used to fund the rest of the manufacturer’s expenses. Budgets are developed using historical sales data, market analyses and trending sales patterns. Further, they become the basis for future forecasts by adjusting as results come in. This regular reassessment is necessary to ensure the forecast’s alignment with actual and likely sales performance in light of evolving market conditions, especially for manufacturers operating in volatile demand markets.

-

Create a Production Budget Based on the Sales Budget

The production budget starts with the optimal inventory level and adds in other factors, such as access to labor, raw material availability and any capacity constraints that might impact the pace of production. It also allows for some flexibility to adapt to possible production setbacks, such as an equipment malfunction or unexpected material scarcity. And like forecasts, production budgets are likely to be adjusted as actual performance is monitored and market conditions evolve. Depending on the industry and customer demand, some manufacturers prefer to have a large stock of finished inventory, also known as safety stock, on hand, while others prefer a just-in-time production schedule to reduce carrying costs and align more closely with sales expectations.

-

Estimate the Quantity of Raw Materials Required

Raw materials are the inputs used for producing goods. These purchases typically make up a large portion of the manufacturing budget, so accuracy is especially important to minimize waste while meeting production deadlines. The order size and order rate for raw materials depend on several key factors, including the lead time for sourcing materials, quality control processes and storage costs. This budget will likely include some flexibility and safety stock to cover any supply chain disruptions, demand spikes or damaged/missing shipments.

-

Estimate the Number of Labor Hours Required

Once raw material costs are estimated, the question becomes: How many labor hours will it take to turn those materials into finished goods? Labor is another significant portion of the manufacturing budget that must be carefully estimated, based on workforce productivity, labor availability, the manufacturing schedule and the possibility of overtime, the latter of which can send costs soaring. The labor budget should also take into account typical labor turnover and any planned changes in production schedules.

-

Forecast Both Variable and Fixed Overhead Costs

Variable overhead costs, such as incoming delivery expenses, fluctuate in proportion to production volumes, so they should be monitored regularly and reforecast as the period continues and actuals are recorded. Fixed overhead costs, such as rent and salaries, remain steady, regardless of output, so they are more easily calculated and need minimal, if any, budget adjustments along the way.

-

Determine How to Allocate Overhead Costs to Products

Forecasted overhead costs can then be allocated to products to determine the overall cost per good. That, in turn, enables the manufacturer to set prices, calculate gross margins and track how costs will affect profitability in the upcoming financial period. Some allocation methods include distributing overhead costs per dollar spent on direct costs, cost per hour of direct labor or cost per good produced.

-

Forecast Nonmanufacturing Costs

Even though nonmanufacturing costs are not included in COGS, they still account for a large portion of the overall budget. They include marketing, sales and administrative overhead expenses that, to be sure, can add up. Finance teams often look here first when trying to contain costs, but they must be careful not to overtighten these budgets: Sales and marketing are still major drivers of revenue, and the business may struggle to meet its budget goals if revenue drops.

-

Consolidate These Costs to Calculate the Total Cost of Producing the Items

All the costs discussed above come together as the total cost of producing goods. This holistic cost perspective shapes decisions regarding pricing, profitability and cost containment strategies and contributes to other useful key profitability measures, such as operating margin and core business profitability. The total cost budget is a useful performance benchmark for future analysis of actual productivity.

-

Determine the Cost of the Anticipated Inventory at the End of the Budget Period

Now that the full production schedule has been budgeted, the inventory volume and value at the end of the budget period can be calculated. The budgeted ending inventory combines all inventory at the beginning of the period, semi-finished goods, raw materials and goods scheduled for production, reduced by planned sales. The budgeted value of ending inventory is included in the budgeted balance sheet.

-

Compile All the Prepared Budgets to Project a Comprehensive Income Statement for the Budgeted Period

Once all revenue and cost budgets are established, projected financial statements can be drafted, typically starting with the income statement. Also known as the profit and loss (P&L) statement, this statement offers a granular view of budgeted revenues, costs, gains and losses, all leading to the net profit or loss for the period. The income statement is frequently the first place that internal management and external analysts look to assess a company’s financial health.

-

Calculate Planned Revenues and Total Expenses to Estimate the Forecasted Profit or Loss

During the creation of the budgeting income statement, budgeted revenues will be combined with the expenses explored above, along with additional gains and losses from nonrepeating or atypical financial moves (such as a merger or lawsuit) to produce the budgeted net income or loss — the literal bottom line of the income statement. While a few periods of net loss are not necessarily signs of financial trouble, ongoing net losses mean serious changes must be made to increase revenue or reduce costs if the manufacturer is to remain sustainable.

-

Analyze Expected Cash Inflows and Outflows

With budgeted revenues and expenses in hand, a budgeting balance sheet can be created and then used to create a budgeted cash flow statement. This is a crucial step because revenue and expenses are typically recognized when earned and incurred, rather than when cash actually changes hands. This difference in timing is especially important for manufacturers that buy and sell on credit, because cash exchanges may lag. This gap in time could create a cash crunch or liquidity crisis even in the face of high sales if bills and COGS come due before customers pay their invoices. By creating a budgeted cash flow statement, often using accounting software, manufacturers can better plan their cash flow to ensure that their obligations are paid on time and business continuity is maintained.

-

Review and Adjust the Budget With Key Stakeholders

Before the budget is finalized, key stakeholders should be brought in to review and, if necessary, adjust the budget. Department heads, project managers and executives, alike, can shed light on potential areas for refinement and anything else that may have been missed by financial professionals unfamiliar with the nuances of the day-to-day operations. This step also helps to reinforce that the budget aligns with the manufacturer’s big-picture goals and can be realistically implemented in the expected time frame. Additionally, managers — the people who will be directly accountable for implementing the budget — appreciate the opportunity to address questions and concerns before the budget is finalized, cultivating a culture of transparency so that all parties know exactly what is expected of them and how best to proceed.

-

Periodically Compare Actual Performance Against the Budget

Just because the manufacturing budget has been approved and put into motion doesn’t mean the budgeting process has ended. Few, if any, budgets are perfect, and reality often throws a wrench into even the most meticulous plans. From unexpected supply chain issues to evolving customer preferences, budgets are useful benchmarks to monitor and measure during the financial period. Regular comparisons between the budget and actual results through analysis of key performance indicators (KPIs), such as unit cost and maintenance costs, can alert management to areas of underperformance or unexpected shifts, informing adjustments and future operating strategies.

-

If Discrepancies Arise, Determine the Cause and Adjust Operations

When actual costs don’t match their budgeted amounts, manufacturers must first identify the root cause through a process known as variance analysis. Only then can they recalibrate operations to realign performance with budgetary expectations or inform relevant parties as to why forecasts need to be modified. For example, let’s say the supply of a raw material has become limited, so a vendor doubles its prices midway through the month. The sooner the manufacturer identifies the increase, the sooner it can try to solve the issue by changing its order volume, renegotiating terms or finding a new supplier. If none of these options can reduce costs, managers will have to adjust the forecast to address this shift in expenses. The budget enables discrepancy management like this and ensures that forecasts of likely results remain accurate. It also helps the company to be more aware and responsive to changes and challenges in the manufacturing landscape.

-

Review the Effectiveness of the Budget and Refine the Process

By assessing the effectiveness of their budgets after the budgeting period ends, manufacturers can improve the accuracy and usefulness of future financial strategies. By comparing budgeted figures with actual results, budgeters can investigate the reasons they fell short. Perhaps assumptions were wrong, some figures were inaccurate or missing critical information or processes were done differently than originally planned. By addressing the root causes of these inaccuracies, future budgets will ideally be more accurate and adhere closer to reality.

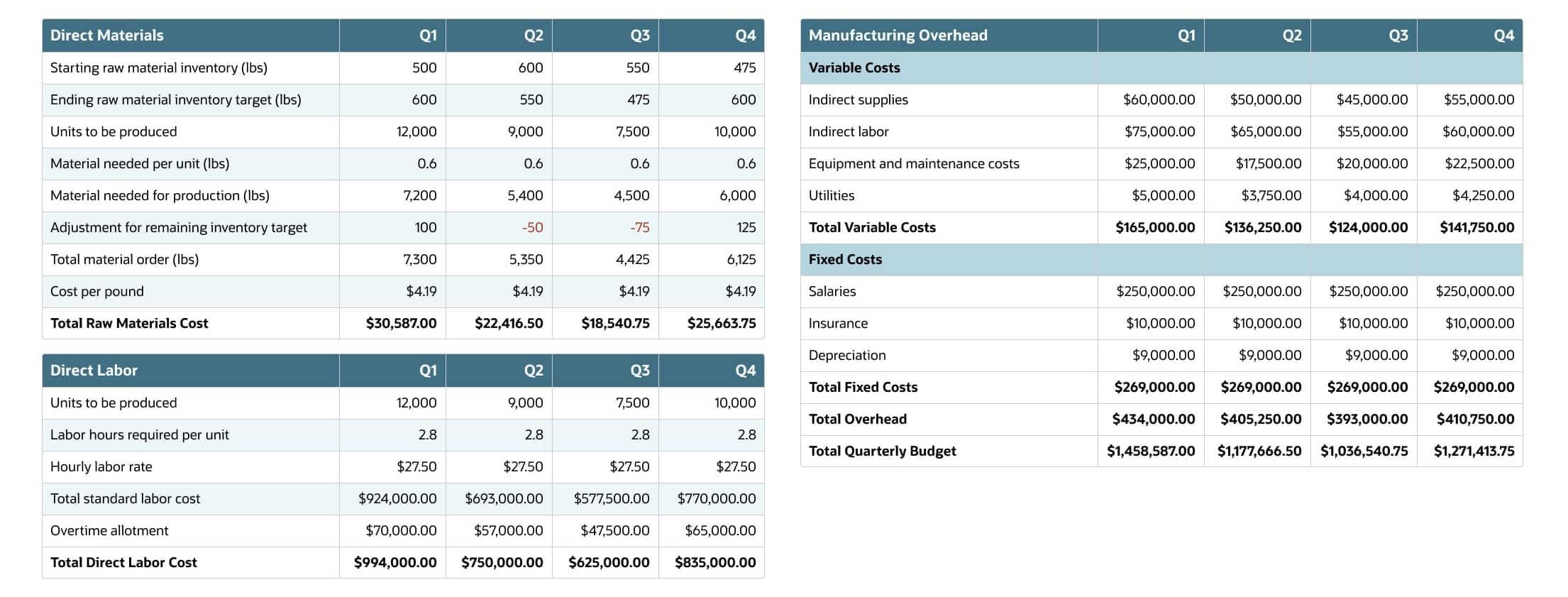

Manufacturing Budget Example

A hypothetical lighting manufacturer, Manual Fixtures, is creating its budget for the upcoming year. It decides to craft four quarterly budgets side by side to see how production — and with it, inventory, supplies and, ultimately, costs — will fluctuate throughout the year, as there tends to be a seasonal order increase in the first and fourth quarters. Using the targets shown below, departments can plan their production schedules and labor shifts to balance their spending and production goals. During the implementation phase, accountable staff will use more granular budgets for direct materials, direct labor and overhead to allocate resources and prioritize goals. However, these overviews provide managers with a valuable overarching target to inform their spending strategies for the year. Additionally, decision-makers will likely compare actual performance with the budgeted expectation.

Manual Fixtures Manufacturing Budget FY 2024

Benefits of Manufacturing Budgeting

A well-crafted budget does more than just plan a manufacturer’s finances. It also increases manufacturers’ visibility into their planned operations to better allocate resources, optimize processes, reduce costs, improve collaboration, plan contingencies and more. The following 11 benefits can help manufacturers of all sizes get the most out of their budgets.

-

Forecasts Revenues, Expenses and Profitability

The detailed nature of the budgeting process provides manufacturers with a deeper understanding of their revenues and costs. This insight helps them identify opportunities for cost reduction and/or growth-related investments. Ongoing monitoring and evaluation of these costs can also point to outdated or inefficient processes that need to be improved or eliminated. Additionally, this increased visibility can help foster a culture of responsible spending, ensuring that parties at all levels are on the same page and working toward the same goals.

-

Provides a Road Map for Allocating Resources

Budgets help manufacturers set priorities and create road maps for realizing them. Manufacturers must carefully allocate resources to ensure that every department is able to operate effectively without accruing waste or taking needed funding from other areas. These allocations are often determined through collaboration among financial professionals, department heads and stakeholders to give everyone a realistic view of budget limitations and how best to use available resources.

-

Identifies and Monitors Cost Centers

Not everything in a manufacturer’s budget impacts gross profit; some areas, such as human resources, IT and even the budgeting process itself, are necessary costs of doing business, outside of the actual manufacturing of goods. These areas are known as cost centers, which must be included in the overall income statement. Cost centers should also be monitored to make sure they are operating efficiently. For example, an HR department can measure cost per employee and the talent turnover rate to assess how effectively the department is using its resources to achieve its goals.

-

Helps Plan Production Volume Based on Sales Forecasts

A budget acts as a bridge between sales and production by linking planned sales with the expenses required to meet demand. Sales budgets are crucial, but without a sense of production capabilities and available resources, they may not be realistic. On the other hand, production targets can be useful for a growing manufacturer, but without data to plan sales, the manufacturer may be producing goods that sit on shelves and never recouping its costs. Manufacturers should merge these metrics to create a realistic and aligned production schedule for the future.

-

Establishes a Benchmark for Comparison

Budgets are more than plans for the future; they also serve as progress checkpoints throughout the financial period and beyond. Budgets are rarely perfect, and deviations can tell decision-makers much about the inner workings of the operation. By studying where a budget fell short and comparing it with actual performance, the manufacturer can determine where it needs to adjust operations to achieve its financial goals.

-

Ensures Financial Decisions Align With Strategic Goals

Budgets help plan routine operations and set up long-term objectives. For example, the planned profits from this year may be the funds needed for future investments, whether they’re minor purchases or major equipment overhauls and real estate investments. Similarly, budgets help companies allocate their resources and plan ahead for large investments that are strategically important but may not increase output or profit immediately. Through careful allocation of funds and long-term planning, budgeting can help manufacturers more easily achieve their big-picture goals without leaving day-to-day operations underfunded.

-

Ensures Better Cash Flow Management

Budgets help manufacturers establish detailed plans for incoming and outgoing cash based on planned revenue and direct and indirect costs analysis. This allows analysts to take a more proactive approach when managing cash flow to meet obligations and maintain business continuity, even during slow periods. This is especially critical for manufacturers that pay bills or invoice customers with credit terms, as thoughtful payment timing can be the difference between business growth and missed bills and production disruptions. With detailed budgets, manufacturers can better predict when cash will come in and how and when it will be spent.

-

Anticipates Risks and Develops Mitigation Strategies

A well-developed budget can be the foundation for creating projections that model “what-if” scenarios, such as a supply chain disruption, fluctuating material costs and demand shifts. Once these risks are identified, contingency plans and mitigation strategies can be created to map potential outcomes and minimize their impact.

-

Provides Valuable Data for Improved Decision-Making

Managing every expense accrued by the manufacturer over a financial period can be challenging for even the savviest financial team. Many use multiple budgets — ranging from broad overviews to department-specific and itemized lists — to organize finances into easy-to-understand reports, creating a reliable foundation for decision-making that aligns with strategic objectives. And after estimates are made, the budgets can serve as performance benchmarks to track progress and strengthen future decisions.

-

Offers Insights Into Areas for Improvement

The process of cataloging and analyzing every expense and revenue source to create the manufacturing budget can uncover inefficiencies and waste. By combing through expense reports and inventory counts, for example, the finance team may note that labor costs have increased without a proportional increase in output. Upon further inspection, the manufacturer could discover that an inefficient production process has created a bottleneck, and workers are taking longer to produce the same number of goods. By addressing this bottleneck, perhaps by investing in new equipment or restructuring the workflow, labor costs can be reduced and productivity can go up without negatively impacting output.

-

Encourages Collaboration Between Departments

Budgeting typically requires department representatives to work with stakeholders and financial professionals, often through a budget proposal process. But budgets can also encourage interdepartmental communication to create a more holistic view of the company’s financial needs and goals. Departments can work together to share resources and learn from the successes and failures of different cost-cutting strategies. This collaboration can spread to create a more integrated operational environment throughout the organization, reducing delays and miscommunications.

Challenges in Manufacturing Budgeting

The sheer volume and diversity of information required to create a detailed manufacturing budget is challenging in and of itself. Here are five more significant challenges that manufacturers are up against when crafting their budgets.

-

Volatility in Raw Material Prices

Manufacturers’ costs are often at the mercy of external factors, and one of the biggest drivers of unexpected costs is rising raw material prices. If a supplier changes its prices in the middle of a budgeted period, for example, a manufacturer can experience an unplanned cash crunch or a production slowdown to compensate for higher costs. However, an unexpected price drop isn’t always good news for the manufacturer when it leads to a swift decrease in competitors’ prices that undercut its own, resulting in a decrease in revenue that overshadows any savings from the lower material prices.

-

Labor Market Unpredictability

More stringent labor regulations or labor shortages can leave manufacturers short-staffed, potentially leading to a drop in production, high overtime costs, increased recruitment and training expenses and decreased product quality while new staff is brought up to speed – especially after an increase in minimum wage or a collective bargaining agreement, both of which can raise the cost of bringing in a new hire. Manufacturers must monitor their employee turnover rate and, if it’s increasing, investigate any issues that are driving valuable team members away. Indeed, the 2022 Deloitte Manufacturing Supply Chain found that 53% of the more than 200 U.S.-based manufacturing executives surveyed listed “talent shortage” as a key challenge. This unpredictability also applies to contracted work, which requires regular monitoring to keep labor costs in line with the original estimation.

-

Changing Regulations and Compliance Needs

Manufacturing regulations can evolve due to shifts in government policies, safety standards, environmental impacts or trade agreements. When rules change, manufacturers may be required to invest in new technologies, modify production workflows, retrain staff or implement additional safety measures, all of which can take a significant bite out of their budgets. Additionally, manufacturers may be required to conduct audits and generate documentation to prove compliance, which also costs money and can slow operations. The manufacturing budget should include some flexibility for evolving compliance standards, as failure to comply could lead to financial and legal consequences, as well as reputational harm.

-

Technological Disruptions

Despite their many benefits, advancements in technology — such as new automated factory machinery — often require significant capital investments and staff training that, without careful planning, can drain a budget. Additionally, new technologies can initially lead to operational disruptions, downtime or decreased production efficiency, which can be difficult to predict or budget for and could lead to a loss in revenue and an opportunity for competitors to pounce.

-

Global Supply Chain Complexities

Manufacturers that source components or materials must contend with supply chain complexities, such as currency fluctuations, delivery delays, geopolitical upheavals and changes in customs and trade regulations. Even disruptions that don’t directly impact a manufacturer or its suppliers, such as a natural disaster or global health crisis, can have rippling effects throughout the entire supply chain, affecting the availability, shipping speed and pricing of raw materials. To meet these challenges, manufacturers are wise to implement robust risk management strategies and build contingencies into their budgets.

Tips for Effective Manufacturing Budgeting

Crafting a budget can be a time-consuming process, even for experienced manufacturers. Having an established workflow helps. These seven tips can help manufacturers prepare.

7 Tips for Effective Manufacturing Budgets

-

Start With the Current Year’s Forecast

The current budget provides a solid foundation of historical data and performance. Detailed analysis of both can reveal areas of success and failure and help identify root causes to inform the upcoming budget. This retrospective approach — balanced with current and predicted market forces — provides a realistic assessment of resources, expenses and revenue streams.

-

Account for Indirect Costs

If a manufacturer focuses on its direct costs only, such as labor and materials, it may be missing a significant pool of costs, such as rent and utilities, so its goods may not be as profitable as they seem. A holistic view of costs during the budgeting phase helps inform accurate pricing policies to maintain, or even increase, profit margins. It is also critical to the overall financial health and competitiveness of the manufacturing operations.

-

Adopt a Rolling Forecast Approach

A rolling budget, also known as continuous budget, regularly adds on a period of time, such as a month, to the end of the budget as another month ends to continually represent a fixed period of time, such as 12 months. It is a useful tool, especially for manufacturers in volatile or dynamic markets or amid economic and price uncertainty, allowing them to incorporate real-time data and extend the team’s line of sight by another month or years two and beyond of the longer strategic plan.

-

Engage Cross-Functional Teams

Cross-functional teams comprise professionals with different types of expertise who collaborate to solve complex problems. In manufacturing, these team members can hail from production, engineering, sales, marketing, finance and the supply chain. Together they can think through the far-reaching impacts of budgeting decisions, identify areas of potential weakness and collaborate on ways to improve them.

-

Regularly Review and Adjust Forecasts

By regularly reviewing and adjusting their forecasts, manufacturers can make better decisions quickly and remain competitive amid dynamic market conditions. Manufacturers can learn from evolving consumer preferences, market pricing trends and supply chain disruptions when recalibrating their forecasts to better align production schedules, inventory levels and resource allocation with likely demand. This also can mitigate the risks associated with overproduction or product shortages.

-

Invest in Manufacturing Budgeting Software

Budgeting is a time-consuming task that can take days or weeks of manually collecting, organizing and analyzing data needed to support budget assumptions. But in the modern age of technology, manufacturing budgeting software can easily access historical data, quickly model scenarios, generate customized reports and create the budgeted financial statements in a fraction of the time. With software, the finance team can also make changes to budgets in process and more easily prepare different versions at different levels of granularity for various constituents.

-

Integrate the Budget With Overall Business Strategy

A manufacturing budget is the financial manifestation of the business’s overall strategy and goals. It keeps staff at all levels focused in the same direction and helps confirm that financial resources are allocated in ways that directly support key objectives. This comprehensive view of the manufacturing process creates a more cohesive and forward-thinking financial plan capable of addressing immediate operational needs while contributing to long-term success.

Unlock Precision and Efficiency in Your Budgeting With NetSuite

Crafting an accurate budget requires access to far-reaching real-time and historical financial data. With NetSuite Financial Planning and Budgeting, manufacturing businesses can streamline their budgeting processes by using a centralized source for data analysis and setting budget assumptions. NetSuite’s automated tools help financial professionals forecast expenses and revenue, generate reports and model what-if scenarios. This cloud-based platform facilitates collaboration among teams, fosters transparency and improves accountability, no matter where staff is located. With NetSuite’s intuitive dashboards and customizable reports, manufacturers can quickly find and share information to speed up problem-solving, as well as monitor actual results against what was budgeted.

NetSuite’s financial planning system can be integrated directly into its larger ERP system to create a unified platform where budgeting and financial management unite to eliminate data silos and enhance overall business agility. Manufacturers with flexible budgets can quickly adapt to changing customer demand and gain a competitive edge through real-time operational insights and actionable strategies that enable rapid decision-making. With NetSuite, manufacturers can spend less time crunching numbers and more time focusing on improvements and growth.

Effective budgeting helps business leaders achieve their financial objectives. In manufacturing, profitability depends on controlling direct production costs and indirect overhead. Generating accurate budgets and monitoring performance are paramount in maintaining that control. Budgets grounded in solid data and forward-thinking strategies keep production schedules aligned with budgeted sales, even during times of disruption and unforeseen expenses. They also help manufacturers better plan for future sales and inventory needs by preventing inefficient fund allocation. By prioritizing a robust budgeting process, manufacturers can strengthen their bottom lines and build long-term financial stability.

Manufacturing Budget FAQs

What are the three types of manufacturing budgets?

The three primary types of manufacturing budgets are direct materials, direct labor and overhead budgets. A direct material budget includes the acquisition of raw materials that will be used to make goods. A direct labor budget covers the costs associated with the workforce that will be directly producing goods. A manufacturing overhead budget includes indirect costs, such as administrative costs, utilities and rent, which don’t directly contribute to the production of goods.

What are the contents of a manufacturing budget?

A manufacturing budget is composed of all direct and indirect costs associated with the production of goods. They include material and supply purchases, payroll, fixed manufacturing expenses (such as rent), variable costs (such as utilities) and administrative costs. A budget organizes these costs so that manufacturers can allocate funds and other resources effectively.

How do you create a manufacturing budget?

Creating a manufacturing budget is an ongoing and dynamic process. Most budgets begin with leaders’ establishing specific financial goals for the period, followed by setting a production schedule, estimating revenues and expenses and reviewing and adjusting the budget with key stakeholders. After the budget is finalized, actual performance should be monitored to identify potential operating adjustments.

What is the difference between a production budget and a manufacturing budget?

A production budget primarily focuses on the quantity of goods to be produced and their associated costs, such as labor and raw materials, while a manufacturing budget is a broader financial plan that includes the more focused production budget and also encompasses all costs associated with manufacturing, including indirect overhead expenses. Both are used to manage costs and allocate resources, but the manufacturing budget takes a larger and more holistic view of the manufacturer’s operations as a whole.