High transaction volumes, large numbers of products, and stiff competition make accounting especially important—and challenging—for consumer packaged goods (CPG) companies. In CPG, accounting touches every aspect of business operations, including the supply chain, and provides crucial financial information for CPG decision-makers. Successful inventory management and pricing strategies, for example, depend on accurate accounting data. But the industry’s historical reliance on spreadsheets and manual processes means errors are common.

Let’s examine how accounting works in CPG, the key financial statements and metrics that CPG companies should use, and some common mistakes to avoid.

What Is CPG?

Consumer packaged goods refers to products that customers buy, consume, and replenish on a regular basis, such as food and beverages, clothing, cosmetics, cleaning products, batteries, and toilet paper. Retailers from big-box stores to grocers and pharmacies sell these products, and CPG companies face stiff competition to get goods onto retailers’ shelves and into the hands of consumers. Consequently, CPG companies position their products with distinctive packaging, pricing strategies, advertising, and promotions, all with the intent of building long-term brand loyalty.

Key Takeaways

- CPG companies take a specialized accounting approach that accommodates the complex relationships among the finance, inventory management, and go-to-market activities that they experience.

- Mistakes in any of those areas can lead to inaccurate financial reporting.

- Beyond the standard financial statements, CPG accounting teams monitor the financial health of their businesses with inventory valuation reports, cost of goods sold (COGS) statements, and other tools that provide industry-specific insights.

- CPG finance teams often rely on software to manage complexity by automating processes and reporting and aggregating data from multiple sources.

- Technology helps them reduce errors and produce more accurate forecasts.

Accounting for CPG Explained

CPG accounting is intricate and time-consuming, involving multiple types of financial statements and key performance indicators (KPIs). CPG companies typically manage a broad range of stock keeping units (SKUs) and complex sales, distribution, and promotional agreements while also navigating competitive, always-evolving markets.

Tracking and storing multiple product lines adds challenges to inventory management, for example, when perishable goods with strict expiration dates and products that experience seasonal demand fluctuations are involved. Supply chains can be vast, not only on the supply side but also because many CPG companies require networks of distributors and retailers. Revenue recognition and cash flow management tend to be more difficult than in other industries because of the unique pricing structures, discounts, and promotional allowances of each CPG sales channel—not to mention the increasingly prevalent direct-to-consumer approach. Moreover, CPG companies that rely on manual processes and spreadsheets to handle accounting often introduce errors into the process and find their scalability limited.

But following CPG-specific accounting best practices and using the right software can help CPG companies address these challenges, improve how they track and allocate costs, monitor sales and profits, and produce consistent cash flow.

Why Is Accounting So Important for CPG?

CPG-specific accounting practices are vital for many companies because they provide excellent visibility into inventory, pricing, sales, profits, and taxes—and they do it at the fast pace that CPG companies need to be competitive. Inadequate accounting can lead to inconsistent cash flow, pricing errors, lower sales and profits, and compliance and regulatory issues. Companies that follow accounting best practices are better equipped to compete today, and they are in stronger positions to grow in the future, too.

And make no mistake, the CPG industry is extraordinarily competitive. For example, research from Bain & Company found that, in the first half of 2024, the top 50 global brands posted only 1.2% year-over-year revenue growth, but smaller and less established companies captured 40% of the market’s overall growth.

In such a competitive environment, CPG businesses require an in-depth understanding of their real-time finances so their decisions about how to procure, market, and sell their products will be well informed. Access to such comprehensive information helps CPG companies develop precise forecasts, identify revenue-generating opportunities, and cut inefficient spending. For example, not all sales channels rack up similar costs. Distribution and wholesale channels have built-in markups, and selling directly to big-box stores and other major retailers comes with unique pricing and trade spend considerations. And while the rise of direct-to-consumer sales creates the potential for higher gross profits, it also requires significant new investments in marketing, logistics, and customer service. In many ways, each channel is like its own business within the business. Without precise accounting for every area, CPG companies can easily overspend in the wrong places.

Rock-solid accounting helps CPG companies ensure compliance with applicable laws and regulations, such as Securities and Exchange Commission (SEC) requirements for public companies, and that they adhere to loan covenants and provide transparent reporting to shareholders. Strong inventory accounting is essential for companies selling perishable goods because it directly supports compliance with rules from the Food and Drug Administration and other agencies. Good accounting data can even have a role in mitigating risk from advertising claims, because carefully tracking product costs and other data can provide the evidence necessary to validate those claims.

Key CPG Financial Statements

Financial statements provide a comprehensive, structured view of any company’s financial health. The income statement, balance sheet, and cash flow statement are the standard documents that all accounting teams use to monitor their profitability, financial position, and cash management. For CPG businesses, additional internal documents, such as inventory valuation reports, profitability analysis reports, and COGS statements, provide additional insights into revenue, expenses, and assets.

- Income statement: An income statement shows a company’s revenue, expenses, and net income over a particular fiscal period, illustrating the business’s overall performance. For external reporting, such as an SEC filing, an income statement contains basic information on revenue, COGS, and selling, general, and administrative (aka SG&A) expenses. CPG companies attach notes and supporting schedules to provide industry-specific information, such as concentration of customers, inventory data, and sales by division.

- Balance sheet: A balance sheet provides a point-in-time snapshot of assets, liabilities, and equity, which helps a business understand its financial position. Inventory is the largest asset on most CPG companies’ balance sheets, and tracking it helps them better manage the amount of working capital they have available to invest. Other assets include cash on hand and accounts receivables, plus all property and equipment that the business owns. Liabilities include accounts payable, loans, taxes, and other debts. Equity refers to the owners’ stake in the company, whether ownership is private or public, plus any retained earnings from prior periods.

- Cash flow statement: This statement documents the cash and cash equivalents that a company takes in and pays out through its operations, investments, and financing activities. Cash flow statements let companies project how long they can finance operations, based on their cash on hand and their forecast of future cash flows. This is especially important in CPG, because the cash conversion cycle (CCC)—how long it takes to convert cash into inventory and back into cash again—can be quite long.

- Cost of goods sold (COGS) statement: A COGS “statement” is not an official, externally published financial statement. It’s a COGS report for internal decision-makers that provides detailed information about a CPG company’s expenses relative to the amount of goods it has sold during a fiscal period. It usually compares the cost of produced goods to the revenue they generated, enabling more strategic decision-making around pricing and helping businesses identify production and procurement inefficiencies.

- Inventory valuation report: This report, too, is for internal purposes, as are the two that follow. This one assesses a company’s inventory levels and the value of those goods. Two common methods for calculating inventory value are first in, first out, or FIFO, which assumes the first goods produced or procured are the first sold, and last in, first out (LIFO), which values inventory as though the newest goods are sold first. Another method, weighted average costing, is based on the average cost of each good. The information in a company’s inventory valuation report directly affects its COGS.

- Profitability analysis report: Profitability analysis reports assess CPG companies’ margins, usually zeroing in on the top profit-driving products, segments, and customers. They use both quantitative and qualitative analyses to identify areas of inefficiency and overall trends, so businesses can uncover new opportunities to increase their bottom lines. A key focus is on rebates, discounts, slotting fees, and other trade spend, which represents a significant portion of CPG costs and heavily influences profitability.

- Budget vs. actual report: This type of variance analysis compares planned financial performance with actual results. It’s a crucial element for CPG companies, which must deal with sometimes volatile raw material costs, fluctuating seasonal demand, and competitive pricing pressures. Companies use these reports to monitor the effect of promotional activities on sales and profitability; track raw material cost variances to adjust pricing or reformulate products, if necessary; adjust inventory levels based on actual vs. forecasted sales to optimize working capital; and several other analyses.

Accounting Metrics and KPIs for CPG

CPG businesses track many KPIs to garner deeper insights into their performance. Armed with the right metrics, companies can make decisions that increase their profitability, inventory efficiency, and optimize cash flow.

- COGS: This metric tallies all direct and certain indirect expenses related to making or buying products that a company sold during a fiscal period. For CPG companies, COGS should include the cost of all raw materials and components, factory labor, manufacturing overhead, and any items purchased for retail. Because COGS includes indirect production costs (such as manufacturing overhead), its value is influenced by the company’s chosen cost allocation method. For example, a shampoo manufacturer probably purchases the bottles in which it packages the shampoo, which is included in COGS. But the shampoo’s COGS would not include the costs of packing and shipping inventory out of the warehouse, which are considered selling costs. The formula for COGS is the value of inventory at the start of a period, including finished goods, raw materials, and works in progress, plus the cost of purchases during that period that are directly related to acquiring or producing goods, minus the ending inventory balance.

- Gross margin: Also known as gross profit margin, this is the percentage of sales revenue that remains after subtracting COGS. It measures a CPG company’s efficiency in using labor and supplies to produce goods. To calculate gross margin, subtract COGS from revenue to get gross profit, divide by revenue, and multiply by 100 to get the percentage.

- Operating profit margin: Unlike gross margin, operating margin factors in all business operating expenses and thus provides a more comprehensive view of a business’s efficiency than gross margin. It helps CPG companies evaluate the impact of marketing and advertising spending on overall profitability, assess the efficiency of distribution networks and supply chain management, compare performance across different product lines or geographical regions, and inform decisions on product mix, pricing strategies, and cost-cutting initiatives. Operating margin excludes nonrecurring gains and losses as well as taxes and other items outside the normal course of business. To calculate operating margin, first find operating income (revenue minus operating expenses), divide it by revenue, and multiply by 100.

- Trade spend ratio: This KPI tracks the efficiency of spending on promotional activities, such as sales discounts, rebates, and in-store displays, as well as retailer incentives. CPG companies use it to evaluate the effectiveness of different promotional strategies, decide how to allocate marketing budgets across products and channels, identify potential areas of overspending or underspending, and benchmark their performance against industry standards and competitors. To calculate trade spend ratio, divide the total amount of promotional spending by total sales and multiply by 100.

- Days sales outstanding (DSO): This measurement of the average number of days it takes a company to collect payment after a sale is particularly important for CPG companies, which tend to experience a high concentration of sales coming from a handful of large customers. If one retailer starts taking longer to pay, it can significantly hurt cash flow. To calculate DSO over a specific period, divide the average accounts receivable by the amount of sales made on credit, then multiply the result by the number of days in that period.

- Inventory turnover: This KPI tracks how many times a company’s inventory is sold and replaced over a specific period. It is used to assess a company’s inventory management efficiency, which is especially vital for CPG companies managing perishable goods and seasonal products. Business managers rely on it to make informed decisions about stocking and to improve inventory management overall. To calculate inventory turnover, divide COGS by the average value of inventory for the period. A higher ratio generally indicates better performance, but the optimal rate varies by product category and other factors.

- Sell-through rate: One of the most crucial inventory management metrics, sell-through rate measures the percentage of inventory that a retailer sells compared with the amount it receives from a manufacturer over a specified period. It tells CPG companies how well their products are selling at the retail level so that they can adjust production or promotional activities to more closely align supply and demand. Calculate this rate by dividing the number of units sold by the number of units received.

- Return on assets (ROA): Businesses use this ratio to determine how efficiently they use their assets to generate profit. A CPG company would use it, for example, to evaluate its investments in production facilities, distribution networks, and brand assets, and to inform asset allocation decisions, such as whether to invest in automated manufacturing technology or acquire warehouse facilities to expand distribution. To calculate ROA, divide net income by the average balance of all assets over a period.

- Cash conversion cycle (CCC): Also known as the cash cycle, CCC tracks liquidity and cash flow efficiency by measuring the number of days elapsed from the time inventory is purchased until the cash from its sale is collected. CPG companies can use it to look for issues—and improvements—in their inventory management, sales, and customer collection processes, and to highlight areas in which to strengthen their supply chain operations. The CCC formula relies on three metrics: days inventory outstanding (DIO), which is the average length of time inventory is held before it’s sold; DSO, the average length of time it takes to collect payment from a sale (discussed above); and days payable outstanding (DPO), the average length of time it takes a company to pay suppliers and vendors. To calculate CCC, add DIO and DSO and then subtract DPO.

- Break-even analysis: This analysis finds the break-even point for a new product—that is, the point at which the revenue the product generates covers its total costs. CPG companies can use it to estimate the sales volume needed to recover production costs, make pricing decisions, plan production, and manage fixed and variable costs. The formula for calculating the break-even point is fixed costs divided by the result of price per unit minus variable cost per unit.

- Revenue by product: CPG companies use this metric to track how much money every product generates. Identifying the best-selling and most profitable products allows them to better optimize their product mixes and make more informed decisions about whether to advocate discontinuations.

- Revenue by channel: Similarly, this KPI tracks how much money a business makes from each of its distribution channels, such as wholesale, retail, and direct-to-consumer. This data helps CPG companies optimize their distribution strategies and more quickly adapt to changes in consumer preferences.

- Return rate: CPG businesses use this metric, a key indicator of customer satisfaction and product quality, to identify and address problems that hurt their revenue and profitability. Thus, analyzing and understanding return rates is a key factor for creating accurate budgets and forecasts. To calculate return rate, divide the number of returned products by the number of products sold.

Top CPG Accounting Mistakes to Avoid

Accounting mistakes distort financial reports, misrepresent profitability, and can threaten a CPG company’s liquidity. Incorrect inventory valuation, cost allocation, or trade spend accounting can generate false insights that companies then utilize, resulting in ill-informed decisions. And worse, they may lead to compliance issues that incur costly penalties. Here are the top accounting missteps CPG businesses make.

- Inaccurate inventory valuation: There are multiple inventory valuation methods, and the wrong choice can negatively affect other areas of accounting. For example, LIFO can render balance sheets outdated. It also becomes challenging to accurately quantify inventory, because counting is often a manual process that covers multiple locations. As a result, incorrect valuations are common. Technologies, such as barcode scanners and RFID tags, help improve tracking accuracy.

- Poor cost allocation and lack of COGS tracking: Cost allocation factors into several important CPG KPIs, including gross margin and inventory turnover. Failure to properly assign manufacturing, distribution, and marketing costs to goods makes it difficult to identify the most profitable products. Similarly, not tracking COGS—by monitoring direct and indirect production costs and accurately distinguishing between the two—means companies don’t get an accurate picture of their expenses.

- Ignoring trade spend accounting: CPG businesses often struggle to account for the reductions in revenue or increases in expenses that come from promotions, volume discounts, slotting fees, and chargebacks from retailers and distributors. Not properly accounting for trade spend can artificially inflate reported revenue and profitability, and can distort forecasts.

- Revenue recognition errors: Revenue recognition is particularly challenging for CPG companies because they must estimate returns, discounts, and bulk purchase incentives at the time of sale—before these events occur. They record these estimates as reserves, which reduce their reported revenue, and later adjust them based on actual outcomes. Inaccurate reserves can lead to misstated financial statements. Because these allowances and discounts are classified as reductions to revenue, rather than as expenses, they directly affect revenue reporting, potentially misleading stakeholders.

- Cash flow mismanagement: Accurate tracking and management of working capital is a must in the CPG industry. Delayed retailer payments, high up-front materials costs, and heavy payroll expenses often complicate cash management, making it hard to know how much cash is coming and going, and when. Additionally, accrual accounting creates timing issues between reported profitability and cash flow. A business that appears profitable based on the revenue it has earned may actually struggle to make supplier payments or cover operational costs. Seasonal demand fluctuations and promotions can further intensify cash flow pressure.

- Sales tax compliance issues: Businesses that sell products to customers residing in several states, either online or from physical stores, are responsible for collecting taxes on those sales. That process gets increasingly complicated with each new state a company does business in, because they all have different rates and rules for which products are and aren’t subject to taxes. Miscalculating or failing to properly remit multistate sales taxes can result in fines and other penalties.

- Weak financial forecasting: Many types of consumer goods are vulnerable to fluctuations in demand and cost caused by seasonality or other factors. Ice cream sales decrease in winter, for example, while tissue sales spike during cold and flu season. When companies don’t account for these and other variables, they create inaccurate financial forecasts that limit their ability to proactively plan for growth.

- Overlooking expiry and shrinkage: No matter how efficient a company’s inventory management is, and how effective its sales are, there are always products that end up unsold because of obsolescence, damage, expiration, theft, or other reasons. This lost inventory, known as shrinkage, must be factored into a company’s accounting. Otherwise, key KPIs, such as COGS and gross margin, will look much better than they should.

- Manual accounting processes: Relying on spreadsheets and human data entry, instead of automated accounting systems, results in a time-consuming and error-prone process that limits businesses’ financial visibility. It burdens accounting teams with repetitive tasks that hinder their company’ ability to scale and comply with industry regulations.

5 CPG Accounting Best Practices

Strong accounting practices give CPG businesses a clear picture of their finances, helping them optimize costs and reach better decisions. A well-structured chart of accounts, accurate cost allocation, and proper inventory management all contribute to stronger reporting and forecasting. This section outlines five CPG accounting best practices that companies should follow to improve their financial management—and describes the integral role played by technology and software.

- Refine your chart of accounts: CPG companies don’t have the luxury of allowing their chart of accounts (COA) to be a simple list of financial line items. Instead, it should be a blueprint that reflects in its structure of finance accounts the way the company actually does business. Within a COA’s standard structure, which groups general ledger accounts by revenue, expenses, assets, liabilities, and equity, a CPG company might want to further break down accounts by product, distribution channel, and/or geographic area, for example. The goal is to organize the COA to capture the right information, at the right level of detail, so business decision-makers can calculate key metrics more easily, forecast more accurately, and deliver smarter decisions.

- Accurately allocate costs: Cost allocation is essential in CPG because the allocation of shared indirect expenses can significantly contribute to a product’s total cost. Many companies use activity-based costing because it attributes overhead and indirect costs more accurately to specific manufacturing and production processes. By precisely allocating costs to individual products, CPG companies can more clearly identify their most profitable items and better optimize their product mixes. Accurate cost data also helps them generate better forecasts and respond more flexibly to changing market conditions—a competitive advantage in an industry where demand fluctuation is so common.

- Effectively manage inventory: CPG companies make, purchase, and sell physical products that customers buy repeatedly, so tracking them all through the supply chain is a complex endeavor. With accurate, real-time management—which is made possible by accounting software linked to an inventory management system with automated tracking technology—businesses can maintain optimal stock levels and avoid tying up capital in unsold goods. Accounting software also streamlines the process of identifying, classifying, and analyzing inventory costs. And if linked to demand forecasting through an enterprise resource planning system, for example, the inventory management system can more effectively help ensure that the company maintains the right amount of inventory to capture all available sales opportunities without overstocking.

- Monitor trade spend: Not only is trade spend a significant cost for CPG companies, it’s also challenging to account for with accuracy and precision. Failure to do so, however, can result in revenue recognition errors, incorrect reserves, and inaccurate profitability analyses. Best practices in trade spend accounting for CPG includes implementing systems to accurately capture all trade spend activities, including promotions, discounts, and slotting fees; developing metrics to measure the return on investment of each initiative, such as a lift in sales or an increase in market share; and regularly analyzing the impact of trade spend on net revenue and profitability by product, customer, and promotion type.

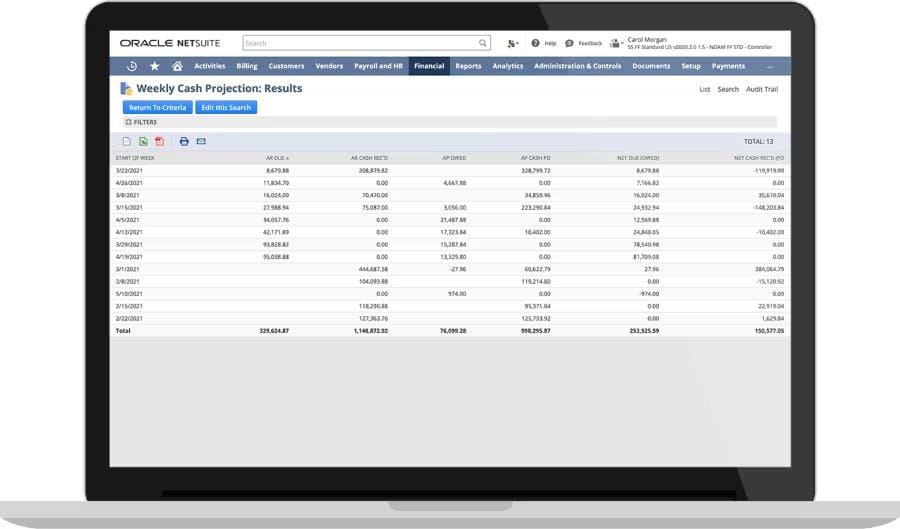

- Optimize cash flow management: Effective cash flow management is crucial to sustaining liquidity and supporting growth. This is true for any company, but for CPG firms, which often have only a few large customers, it should start with rigorous credit checks for new customers to reduce the risk of bad debt and late payments. Companies should also use accounts receivable aging reports to proactively manage collections and identify potential issues early, along with negotiating favorable payment terms with suppliers and establishing clear escalation processes for following up on overdue payments. CPG companies can also employ cash flow forecasting tools to anticipate and prepare for potential cash crunches.

How Does Accounting Software Help CPG Brands?

Accounting software helps CPG brands by streamlining financial reporting and providing enhanced, accurate visibility into core KPIs, such as profit margins, inventory turnover, and ROA. It aggregates data from multiple sources and automates complex tasks, which reduces mistakes and contributes to more accurate forecasting.

These automation capabilities enable accounting teams to process more transactions in less time, freeing them up to perform more strategic work, such as in-depth reporting and proactive planning. This, in turn, allows companies to scale without having to add staff or absorb other costs, giving them extra flexibility to compete in crowded, high-pressure markets. Accounting software also works to ensure compliance by simplifying audit trails throughout the supply chain and enforcing both internal and external financial policies.

Modernize Your Accounting Operations With NetSuite

NetSuite’s cloud accounting software can help CPG companies overcome their most pressing accounting challenges through automation and integrated financial management. It can automate inventory valuation and cost allocation by automatically tracking goods throughout the supply chain, and its built-in trade spend management capabilities help ensure accurate revenue recognition and profitability analysis. NetSuite simplifies the recording of transactions and the management of accounts payable and receivable, leaning into artificial intelligence to automate manual tasks across the accounting workflow.

Real-time visibility into cash flow, automated accounts receivable, and sophisticated forecasting tools help CPG companies better manage their working capital. And because NetSuite integrates accounting with inventory, order management, and other core business functions, it gives CPG businesses full visibility into the entire manufacturing and distribution process. In short, NetSuite can help CPG companies more strategically navigate their highly competitive markets.

Cash Flow Management With NetSuite

Consumer packaged goods businesses face increasingly complex accounting challenges that cannot be solved using manual processes. They need deep understanding of multiple financial statements and metrics, plus access to real-time data and insights so they can make strategic plans and successfully implement them. Cloud-based accounting software with advanced automation features helps CPG companies overcome these challenges, enhancing their forecasting capabilities and increasing their agility. Brands that embrace this smarter technology will be able to scale efficiently and maintain a competitive advantage.

CPG Accounting FAQs

What does the CPG stand for?

CPG stands for consumer packaged goods, which refers to merchandise that consumers frequently buy, consume, and replenish. Food, drinks, clothes, makeup, and cleaning products are examples of consumer packaged goods.

What is a CPG business model?

A CPG business model is an approach in which a company manufactures, distributes, and markets consumer packaged goods, which are sold through physical and online retail partners. Most CPG business models focus on mass-produced products that have low profit margins, and sell in high volumes, although more luxury brands have emerged in the industry in recent years.