Financial statements are valuable for examining a business’s past performance. But when businesses are making important decisions about their future, pro forma financial statements are what they need. Pro forma statements illustrate what a business’s financial position would look like after a hypothetical event, such as “what if” it bought another company, took on new debt, discontinued a product, reorganized operations — or all of the above. Knowing how to create pro forma financial statements and when to use them — and understanding their limitations — is essential for business managers who are guiding their companies into the future and for investors deciding where to place their bets.

What Is Pro Forma?

The term “pro forma” comes from Latin, meaning “for form.” Various types of pro forma documents are used by businesses, including pro forma contracts, schedules, invoices and plans. While different in purpose, they all share the underlying perspective of being based on an anticipated event or transaction. For example, a pro forma contract is a working draft of terms negotiated between parties before inking the formal, final agreement. Similarly, a pro forma schedule is a timeline of tasks expected to occur based on an anticipated event. The preparer of pro forma information has to understand the timing and impact of the pivotal event and then map out all the associated details that come before and after the event, prior to its occurrence.

What Are Pro Forma Financial Statements?

Pro forma financial statements are a specific version of the statements that present an alternate reality to the company’s actual financials, based on a specific event that is under consideration. Various business events can prompt the need for pro forma financial statements, including acquisitions, divestitures, changes in debt, taking on new partners, going public and launching or discontinuing product lines.

Typically, the balance sheet and income statement are the two financial statements prepared “pro forma,” although cash flow statements are sometimes included. A pro forma balance sheet shows hypothetical balances for assets, liabilities and equity after the impact of the contemplated event. For instance, an acquisition pro forma balance sheet would combine the financial positions of the two companies and present them as one, incorporating situation-specific adjustments. A pro forma income statement for a company considering discontinuing a product line would show revenue, expenses and net income “as if” the product line no longer existed for a certain period. Pro forma financial statements often imagine a period in the future but can also present an alternative scenario for a past period.

Key Takeaways

- Pro forma financial statements are adjusted historical financial information that shows the effects of a significant proposed event, as if the event had actually occurred.

- They aim to present and explain all the important impacts of the event on the business, based on management’s presumptions.

- Comprehensive pro forma income statements and balance sheets, along with other more narrowly focused pro forma statements, are used for various purposes, from managing a business to selling it.

- While valuable, pro forma statements are not compliant with U.S. Generally Accepted Accounting Principles (GAAP), and they present other limitations that are inherent in building hypothetical scenarios.

- Creating pro forma information to support business decisions requires meticulous modeling, best supported by advanced technology and high-quality data.

Pro Forma Financial Statements Explained

Although pro forma financial statements are hypothetical, and therefore not GAAP-compliant, many business stakeholders rely on the information in them to make significant decisions. As a result, various standards-setting organizations have issued guidelines for pro forma financial statements to follow. The U.S. Securities and Exchange Commission (SEC) publishes guidelines for pro forma financial statements for large public companies, as well as a scaled-down version for smaller reporting companies (which may or may not be publicly traded). The SEC rules set the conditions for when pro forma financial statements are required for public disclosure in various SEC filings and provide a framework for their format, as follows:

- An introductory paragraph that briefly describes the instigating event.

- A pro forma condensed balance sheet.

- A pro forma condensed statement of comprehensive income for a specified period.

- Explanatory footnotes that provide background and calculations for the adjustments made to historical periods to reflect the impact of the pro forma event(s).

The SEC’s use of “condensed” means that the financial statements should be presented in a summarized format, rather than the detailed format used in annual or quarterly reports. This is to highlight the most significant information, making it easier for investors and other readers to understand the impact of the event on the company’s financial position and operations.

Private companies don’t need to follow the SEC rules. Instead, the American Institute of Certified Public Accountants provides general suggestions regarding transparency, disclosures and other responsibilities of CPAs who are engaged in reviewing or compiling pro forma statements for an employer or a client.

How Are Pro Forma Financial Statements Used?

Pro forma financial statements normally come into play to show the impact of a possible business event, as part of the process of deciding whether to pursue that event. For example, a lender may want to examine pro forma financial statements that incorporate the new debt as part of a credit analysis for approving a loan. Pro forma financial statements aid decision-making and reduce business risk by portraying a scenario that hasn’t yet happened.

Here are 15 ways pro forma financial statements are used.

- Examine debt refinancing and short-term impact: Pro forma financial statements can show the potential impact of taking on new debt or changing the terms of existing debt. The pro forma adjustments could, for example, highlight the effect on net income of changes in interest expense and financing charges. They are also useful for evaluating potential changes in leverage ratios, such as the debt coverage ratio, which measures a company’s ability to generate sufficient cash flow to cover its debt obligations.

- Assess impact of one-time large purchases: Management may create pro forma financial statements when considering a significant purchase or investment, such as a manufacturer buying new factory equipment. The pro forma statements would include the new asset(s) and recognize the proposed method of payment (cash or financing). Management would estimate increased production capabilities based on the purchase and project how they translate into additional sales and profit. The pro forma statements would help management evaluate the potential return on investment.

- Assess mergers and acquisitions in company strategy: Corporate executives, investment bankers, lawyers and company owners or shareholders rely on pro forma financials to show the would-be results of business combinations. The pro forma financials do more than simply add the financial statements together; they adjust for expected deal synergies, restructuring, cost savings and strategic changes. They’re used in multiple ways, such as to set deal structure, establish valuation, get owner/shareholder buy-in and for regulatory compliance, when required.

- Understand budgetary effects of leases: Similar to new debt and large purchase events, pro forma financial statements can model the effect of new or renegotiated leases. Lease contracts, such as for equipment, vehicles or retail space, would prompt pro forma adjustments related to cash flow, net income and possibly assets and taxes. Company management then uses the pro forma financial statements to evaluate the prospective budgetary impact for the term of the lease.

- Create sales and budget projections: Projections, by definition, are “what if” scenarios. Sales projections and budgets can be thought of as pro forma documents because they’re based on planned activity for a future period. Sale projections consider expected market conditions and the business’s go-to-market strategy. Changes in either can be modeled using pro forma financial statements to show the potential effect on revenue and expenses. Management uses these statements to help allocate resources and refine sales strategies.

- Compile profit/loss projections: Unlike a forecast, which represents the most likely future results, projections can be built using any assumptions. Pro forma income statements can outline the potential change to profitability based on changing other variables. Often, multiple pro forma income statements are compared side by side to examine various different scenarios. They can also be used for earning projections for external stakeholders.

- Translate data into cash flow projections: Pro forma balance sheets and income statements can be used to create pro forma cash flow statements. Cash flow projections are useful for proactively managing a company’s liquidity and working capital, especially for companies considering a debt refinancing.

- Recognize company assumptions: The process of creating pro forma financial statements requires company management to codify and document various underlying assumptions that they may not even know they have. This provides business leaders with better clarity about the variables affecting their business model and encourages them to challenge the validity of their assumptions.

- Compare balance sheets: Comparing pro forma balance sheets against historical balance sheets is a useful way to track potential changes in financial position for a particular event, clarifying the before and after. In addition, comparing multiple pro forma balance sheets can be helpful for evaluating the outcome when several options are being considered, such as when prioritizing different capital expense opportunities.

- Conduct financial ratio analysis: All the metrics and key performance indicators that are important to a business can be calculated through the pro forma financial statements. Applying financial statement analysis to pro forma financial statements provides insights into liquidity, leverage, efficiency, valuation and profitability metrics before and after a hypothetical event.

- Inform strategic decision-making: Managers use pro forma financial statements to guide the company into the future. Pro forma statements help quantify, as much as possible, the results of strategic decisions, such as making acquisitions or capital purchases. A commonuse is to “see on paper” the results of a potential restructuring of the organization to help evaluate the cost/benefit of the change.

- Demonstrate financial status excluding specific programs or departments: Pro forma financial statements can be prepared to exclude any item that might be obscuring a particular objective. Perhaps there is interest in seeing “what if” a certain product line was discontinued or branch office shuttered? Or, more broadly, would a smaller but better-focused company be financially healthier?

- Offer enhanced financial picture accuracy: Pro forma financial statements can exclude unusual events — or “accounting” events — that distort actual financials, thus showing a clearer picture of a company’s operations. For example, the receipt of a large, nonrecurring legal settlement might be adjusted out of the cash account on a pro forma balance sheet in order to evaluate the company’s true working capital. Pro forma financials might also be adjusted to eliminate the effect of potentially distorting accounting items so as to uncover a purer look at operations. For instance, accounting rules require manufacturers to record inventory write-downs if the current market value of inventory falls below its original cost. So, business managers might prefer to use pro forma financial statements that exclude this distortive “accounting” item when developing budgets for the next fiscal year.

- Benchmark for performance evaluation: After an event occurs or a decision is made, it’s common to compare actual results to those hypothesized in the pro forma financial statements. Using metrics derived from the pro forma statements, results that are at variance with actual performance can be identified, analyzed and explained. This can help improve future performance and/or help the finance team get better at preparing pro forma information.

- Motivate staff: Sometimes it’s easier and clearer to use pro forma information to set goals and targets, rather than complex, full financial statements. A pro forma income statement that focuses solely on revenue targets or gross margins on particular products might motivate staff to achieve company objectives. “What if” scenarios that illustrate bonus and commission payouts for various possible performance levels are commonly used by human resource and compensation departments.

Types of Pro Forma Financial Statements

Pro forma analysis can take many forms. Some look exactly like standard financial statements, while others can be in whatever form fits the business’s objective for creating them. This freedom arises because pro forma financial statements and schedules are not bound by GAAP, since the very nature of being hypothetical, rather than based on historical information, means they can’t be GAAP-compliant. For this reason, it’s essential to label all pro forma analysis as such to avoid confusion with actual historical information.

Nonetheless, it’s common practice to treat pro forma financial data using GAAP methods. This practice makes pro forma statements easier to compare with historical statements and uses conventions that are well understood by business managers. Said another way, pro forma financial statements should use the same accounting language; they just tell a fictional story rather than a factual one.

Here are seven common types of pro forma financial statements.

-

Pro Forma Income Statement

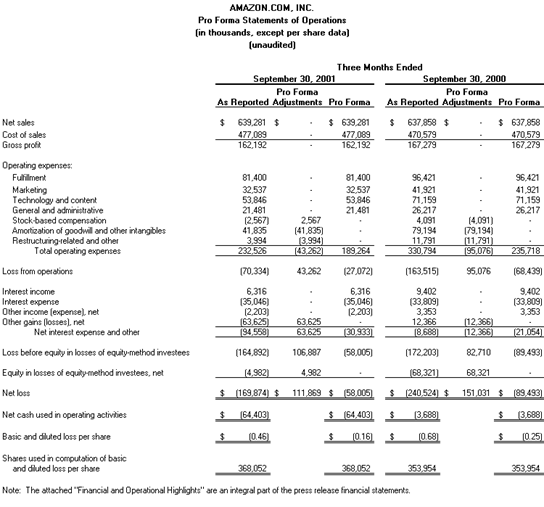

A pro forma income statement presents the hypothetical results of operations for a fiscal period, as if a possible event had actually occurred. For public companies, it should present pro forma revenue, expenses, net income and earnings per share. It may also be prepared to exclude certain historical items — for example, removing activity from a product line that the company is considering discontinuing.

A pro forma income statement is one of the two primary pro forma financial statements required by the SEC for significant events. It’s typically set up using standard income statement line items but with three columns instead of one: historical (as reported), pro forma adjustments and the pro forma result for each line item. The income statement can cover any fiscal period, appear as full or “condensed” (aka summarized), be shown in comparison to another period and/or be “common sized” (that is, expressed as a percentage of total revenue rather than as absolute dollar amounts to make it easier to compare the relative size and importance of each item).

This pro forma income statement, from an actual SEC filing, shows the results of operations before and after a potential event in a way that is easily trackable. To fully understand what the statement illustrates, it should be read in conjunction with the accompanying explanatory notes. -

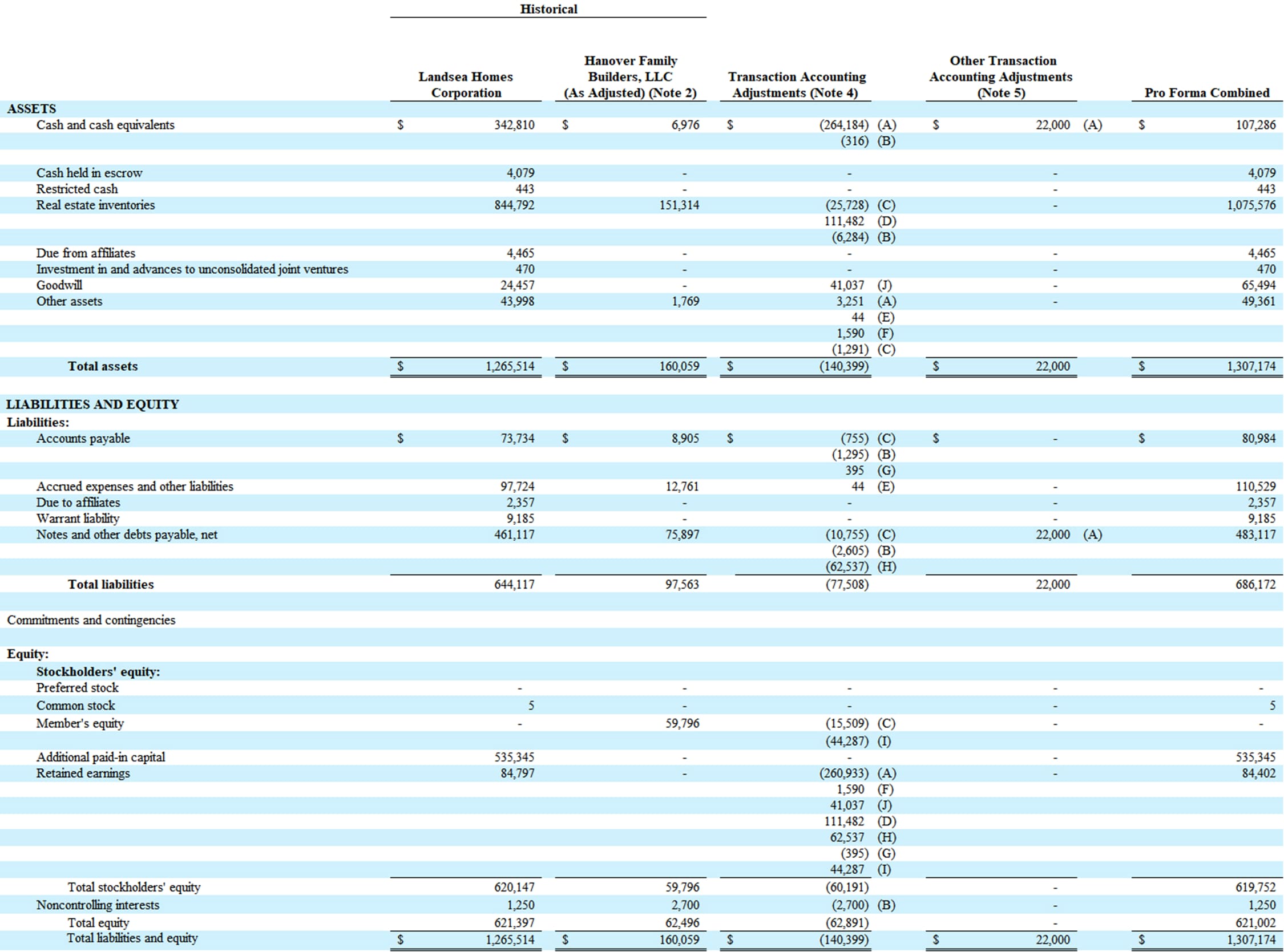

Pro Forma Balance Sheet

A pro forma balance sheet — the other pro forma financial statement required by the SEC to illustrate potential material events — shows the hypothetical financial position of a company as of a specific date, as though an event has already occurred. The pro forma balance sheet provided as an example, below, illustrates the impact of a pending acquisition. It presents pro forma assets, liabilities and equity in the same format as a standard balance sheet, but with columns added to show the pro forma adjustments and the resulting pro forma balances. Pro forma balance sheets can also be prepared to exclude certain historical items, such as assets the company plans to sell.

This pro forma balance sheet combines asset, liability and equity balances for a proposed acquisition. Adjustments should be trackable and described in the Explanatory Notes. -

Pro Forma Cash Flow Statement

Pro forma cash flow statements resemble their standard counterparts more than the other pro forma statements. This is because, although the pro forma cash flow statement shows hypothetical future cash positions, the pro forma adjustments that anticipate those positions are made, separately, in the pro forma income statement and balance sheet and are reflected only in the pro forma cash flow statement. This is similar to standard historical cash flow statements, which are also interrelated with the income statement and balance sheet and rely on data from them. Like a standard statement, a pro forma cash flow statement organizes projected cash inflows and outflows into three categories: operating, financing and investing. It’s particularly important when managing working capital, for startups and to potential lenders, but it is not required by the SEC. Typical pro forma cash flow statements cover several future periods and are formatted in the same way as a cash flow forecast, although the information is based on projections, rather than on a likely forecast scenario.

Example of a Pro Forma Cash Flow Statement

Company ABC Pro Forma

Cash Flow Statement

Quarter Ended June 30, 2023Pro Forma Pro Forma Pro Forma Pro Forma April 2023 May 2023 June 2023 Total Opening Cash Balance (as reported) $ 3,500 $ 250 $ 2,300 $ 3,500 Pro Forma Cash Inflows: Cash Sales 3,000 2,000 4,000 9,000 Credit Sales Collections 8,000 14,000 10,000 32,000 Bank Interest - - - - Revolving Loan Proceeds - 5,000 - 5,000 Asset Sales - 100 - 100 Tax Refunds - 500 - 500 Misc Cash In 50 50 50 150 Total Projected Cash In 11,050 21,650 14,050 46,750 Pro Forma Cash Inflows: Payroll 6,000 6,000 6,000 18,000 Rent 1,500 1,500 1,500 4,500 Inventory Purchases 5,000 7,500 5,000 17,500 Utilities 750 750 750 2,250 Tax Payments 1,300 3,500 - 4,500 Revolving Loan Payment - - 2,500 2,500 Misc Cash Out 50 350 75 475 Total Projected Cash In 14,300 19,600 15,825 49,725 Net Cash Flow $(3,250) $2,050 $(1,775) $(2,975) Pro Forma Closing Cash Balance $250 $2,300 $525 $525 A pro forma cash flow statement shows sources and uses of cash for any number of future periods. -

Pro Forma Capital Expenditure Budget

A pro forma capital budget is not a stand-alone financial statement; it is prepared to yield information that will be fed into the pro forma balance sheet and income statement. It outlines the projected capital expenditures a company expects to incur in the future, the related depreciation expense and the net book value of long-term assets, such as property, plant and equipment. Pro forma capital budgets are prepared in conjunction with a company’s long-term strategic plan.

-

Pro Forma Sales Forecast

Projected sales revenue is a key metric on a pro forma income statement. A pro forma sales forecast aims to predict a company’s future revenue using pertinent assumptions. There are several methods for projecting sales for future periods, starting with a trend analysis that extrapolates from a company’s own historical sales and then factors in specific market expectations for the business and the overall industry. Trending can be done for the whole company or per product, business location, customer, salesperson or sales channel, among other options. Some companies may take multiple approaches to create a more fine-grained forecast: market sizing, for example, in which analysts estimate the company’s market share and marketing growth to forecast future revenue; and surveys, in which you simply ask for estimates from sales managers, channel partners, top customers, etc.

Beyond quantitative analysis, pro forma sales forecasts often consider qualitative elements, including anticipated changes in customer behavior, the competitive landscape and go-to-market strategy, as well as the macroeconomic and regulatory climate. Regardless of method, it’s a best practice to document assumptions and data sources used to develop the projections, so that any variances in future actual performance can be better understood. Forecasting sales should be tailored to each individual company, but some common approaches are highlighted in the following table.

Pro Forma Sales Forecast Methods and Approaches

Method Approach Trending historical sales By product

By location

By customer

By sales person/channelMarketing Sizing Current Market Share

Future market share

Estimated market growthSurvey Sales management

Channel partners

Industry leaders

Top customersA pro forma sales forecast aims to predict company revenue for future periods through use of one or more of these methods and approaches. -

Pro Forma Cost of Sales

Pro forma cost of sales is a component of a pro forma income statement. In this case, business analysts project the direct costs to produce a good (or service) based on the hypothetical sales included in the pro forma sales forecast. The projections include the costs of raw materials, labor and manufacturing overhead. The pro forma cost of sales calculates these expenses to help verify that the gross profit on the pro forma income statement is accurate. By itself, a pro forma cost of sales analysis allows management to A/B test the impact of changing any one of these inputs before committing to the change, such as switching to a new materials supplier. In addition, pro forma cost of sales is commonly used to model the financial impact of changes in operating procedures, such as outsourcing or automation, and is a beneficial way to gauge the impact of new labor contracts, returns on investment in production equipment, changes in raw materials and inventory management.

10 Factors Commonly Included in a Pro Forma Cost of Sales

1. Raw material costs and estimated quantity 2. Direct labor hours and hourly wages 3. Subcontractor costs 4. Factory utilities 5. Delivery costs of raw materials 6. Depreciation of production facilities and equipment 7. Tools and parts 8. Storage costs 9. Merchandise purchased for sale 10. Supplier discounts These contributors to the cost of producing a good or service are estimated and included in a pro forma cost of sales. -

Pro Forma Break-Even Analysis

Break-even is the point at which revenue exactly equals expenses — there is no profit or loss. It’s important for any business to understand this balance, especially if it desires to end up on the profit side of the equation. Pro forma break-even analysis is a common part of business planning, especially for startup companies and new-product launches. Calculating the hypothetical break-even point helps companies establish minimum thresholds and goals that inform managers’ decisions about committing resources. Common use cases for pro forma break-even analysis include setting funding for new businesses, modeling potential changes in product pricing and ensuring production capacity. A version of pro forma break-even analysis, called cost-volume-profit analysis, is used to model “what if” scenarios by adjusting hypothetical changes in product costs, volumes sold and profit. Pro forma break-even analysis is a quantitative calculation that does not infer whether there is demand for the product or service.

Example of a Pro Forma Break-Even Analysis

Acme Industries, Inc.

Pro Forma Break Even AnalysisFIXED COSTS $3,000,000 Sales Price per Unit $12 Variable Costs per Unit $5 UNIT CONTRIBUTION MARGIN $7 BREAK-EVEN POINT (units) 428,571 BREAK EVEN POINT (dollars) $1,000 A pro forma break-even analysis shows the hypothetical level of revenue and unit volume at which there is no profit or loss.

Limitations of Pro Forma Statements

Although pro forma financial statements and analyses are helpful tools, they have some serious limitations. The very purpose of pro forma statements — to answer “what if” questions — should prompt a healthy dose of skepticism. Even the most meticulously prepared pro forma statements are hypothetical, so it is helpful to use other analyses and independent facts in conjunction with them. Among the key limitations of pro forma statements are:

- Based on assumptions and estimates: Pro forma information is rooted in historical data but relies on assumptions about the future. Unanticipated events can cause pro forma information to become inaccurate, including shifts in the economy, geopolitical events and unforeseen crises, like fires and pandemics.

- Lack of standardization: Pro forma financial statements can never fully comply with GAAP because they are based on the future. While pro forma creators typically try to apply GAAP methods to the information, there is no obligation to do so. Therefore, pro forma statements lack the quality control that comes from standardization.

- Potential for misrepresentation: Due to the difficulty of accurately predicting the future and the lack of standardization, pro forma information has the potential to be misleading, either intentionally or unintentionally. The SEC monitors pro forma information for this possibility and penalizes and/or fines companies when it finds pro forma information that it considers to be intentionally misleading. But it has more limited jurisdiction over private companies.

- Exclusion of one-time items: It’s common for pro forma information to carve out unusual or nonrecurring items to reveal the essence of ongoing operations. However, excluding unfavorable items can become a slippery slope due to the lack of rules around what can and cannot be excluded and what financial information is attributable to the excluded item.

- Not audited or regulated: Pro forma financials are not GAAP-compliant and therefore cannot be independently audited. The most rigorous practice that can be performed is an examination, which is limited to simply confirming that the pro forma statements accurately reflect management assumptions by verifying calculations and bookkeeping of the pro forma adjustments. This provides no assurance that the assumptions are valid. In terms of regulation, the SEC only monitors pro forma information included in SEC filings. All other pro forma analyses are outside their scope.

- Ineffectiveness in predicting long-term performance: Pro forma projections are complex, and even small errors can compound when extrapolated over time. The further into the future the pro forma projects, the more likely it is to prove inaccurate.

- Does not reflect actual cash flow: Pro forma cash flow may reflect ending cash balances that are significantly different from actual cash in the bank. A business can’t pay bills with pro forma cash.

- Limited usefulness in volatile markets: Some industries are more sensitive to changes in market conditions than others. For example, the financial services industry is highly affected by changes in interest rates, foreign exchange rates and the stock markets. Other industries are intrinsically unpredictable, such as technology and healthcare. Pro forma information can become irrelevant more quickly in industries such as these.

How to Create a Pro Forma Statement

Creating pro forma financial statements and analyses requires proficiency with modeling tools and reporting software. It also demands a deep understanding of the intricacies of company operations and accounting policies, together with industry knowledge. Most often, cross-functional teams collaborate to create pro forma information. The process is outlined in the following eight steps.

-

Gather and Analyze Historical Data

Begin by gathering historical accounting data from closed financial periods, starting with past income statements, balance sheets and cash flow statements. These are the jumping-off points for creating both prospective pro forma statements and pro forma statements that recast a past period. From there, analyze trends and identify any supporting data needed for the task.

-

Develop Realistic Assumptions

Define the important assumptions that will shape pro forma extrapolations, which will differ depending on the objective of the pro forma project. For example, the assumptions related to a new-product launch might include market size, product pricing and expected sales growth. Develop each assumption using the most reliable quantitative data. Clearly define the assumptions and ensure that they align with internal strategic planning. For instance, coordinate the timing of pro forma online sales with the relevant technology deployment plan. Whenever possible, use more conservative assumptions in order to ground the estimates. This means using the lower end of sales estimates and the higher end for costs.

-

Forecast Revenue and Expenses

Create a sales pro forma forecast to generate revenue projections for each of the periods included in the pro forma analysis. Using this information, identify the associated expenses needed to fulfill the revenue. This is often done at a high level of abstraction — for example, using the percentage of sales method, which estimates categories of expenses, such as cost of goods sold, as a proportion of sales. Then, apply those percentages to the future pro forma revenue levels. Alternatively, pro forma expenses can be built from the ground up, layering all the estimated expenses using historical values derived from department managers and quotes from vendors. Finally, identify and calculate all nonoperating income and expenses, such as interest from investments, administrative costs, interest expense, taxes and technology.

-

Adjust for Nonrecurring Items

It’s important to identify and adjust for any nonrecurring items in historical data that might skew trending for the future. Alternatively, it’s important to anticipate any future nonrecurring items and evaluate the merits of including them. Often, the very reason to create pro forma financials is to present a version of history that excludes nonrecurring items. Examples of nonrecurring items are restructuring charges, write-downs of inventory/assets/goodwill, litigation, accounting policy changes and gains/losses from asset dispositions.

-

Assemble Pro Forma Statements

The next step is to assemble the pro forma statements using Excel templates or automated reporting software. The statements can be prepared for full years or interim periods, such as monthly or quarterly. It’s common practice to present three years of pro forma data for external readers, like investors and lenders. SEC rules regarding the number of fiscal periods to present and certain specifics about how to present them differ according to type of transaction, size and industry of the reporting entity, and the published historical financial statement. Another part of this step is to put together the introductory paragraph and explanatory notes that will accompany the pro forma financial statements. The introductory paragraph must describe the nature of the event, the periods affected and the entities involved.

-

Perform Sensitivity Analysis

It’s helpful to challenge the pro forma statements by conducting sensitivity analyses. This process looks at the effect of changing one input variable while holding all others constant. When analyzing changes in key assumptions, it may become apparent that certain linkages need further adjustment, such as in revenue or production capacity.

-

Review and Refine

It’s a best practice to take some time to review and refine the pro forma financial statements. This includes verifying mechanical issues, like calculations, and ensuring consistency across all of the pro forma documents, including supporting schedules, such as a pro forma capital budget. It also involves checking the linkages between the pro forma statements, such as the roll forward of one period’s net income from the income statement to the next period’s retained earnings on the balance sheet. Additionally, this step includes refining the assumptions used in the pro forma, since it’s common to receive new or updated information during the course of creating the statements.

-

Document Assumptions and Methods

It’s helpful to document all assumptions, methodologies and sources of data used in creating pro forma statements in order to inform future analyses, such as comparisons to actual results. It’s also a requirement in SEC filings and a common practice in non-SEC situations. A document, called the Explanatory Notes, aims to provide transparency about these elements so that stakeholders can understand the basis of the projections. These notes describe the assumptions and methods used for each adjustment shown in the pro forma balance sheet and income statement. Other details, such as any considerations paid/received for acquisitions/dispositions and the nature of nonrecurring items, should also be disclosed in the Explanatory Notes.

Manage Your Pro Forma Financial Statements With NetSuite

Pro forma financial statements and analyses are incredibly valuable tools that help business managers, investors and other stakeholders envision the impact of significant events on a company before they happen. But a lot of information and work goes into creating useful pro forma statements — so attempting it with spreadsheets increases the potential for error and inefficiency. Using automated accounting software, such as NetSuite Financial Management, streamlines the process and means that more time can be spent refining assumptions and managing the significant events. Gathering historical data is infinitely easier when all the history is available in a single database, and NetSuite’s multidimensional analysis feature comes in handy when granular details are needed. Real-time data ensures that any trend analysis draws from the most current information, limiting the potential for extrapolation errors. The combination of customizable reporting and available scenario planning and modeling makes creating pro forma financial statements easier and faster, and all but eliminates calculation errors.

Pro forma financial statements reflect “what if” scenarios for anticipated events, such as acquisitions, divestitures, changes in debt, taking on new partners, going public and launching or discontinuing product lines. They are valuable tools for both internal and external stakeholders, helping people envision the financial impact of such events. There are various types of pro forma statements, including comprehensive pro forma income statements and pro forma balance sheets, as well as focused statements, such as pro forma sales forecasts and pro forma capital expenditure statements. The process for creating pro forma financial statements requires meticulous modeling techniques and extensive business acumen. Using the right software allows more time for fine-tuning assumptions, improving the value of these important tools and maximizing the business’s opportunities for the future.

Pro Forma Financial Statements FAQs

What is the difference between pro forma and prospective financial statements?

Prospective financial statements are prepared for future periods, such as a budget or forecast, rather than standard financial statements that are prepared using actual historical information. Prospective financial statements are based on management’s plans and expectations of likely results. Some pro forma financial statements can be considered prospective if they are for periods in the future, such as after an anticipated event happens. However, some pro forma financial statements are not prospective, in that they are an alternate view of a past period that has been adjusted for an event, such as removing the effects of a nonrecurring accounting event in order to develop a view of more “typical” results.

Do pro forma statements have to comply with GAAP?

No, pro forma statements cannot comply with U.S. Generally Accepted Accounting Principles (GAAP) because they are based on hypothetical assumptions, rather than historical facts. However, in practice, pro forma creators typically try to apply GAAP methods as much as possible to the pro forma information for purposes of familiarity and comparison, although there is no obligation to do so.

What are pro forma financial statements not used for?

Pro forma financial statements are not used for most recurring regulatory compliance or official reporting purposes. Nor are they used for independent audits and tax returns.