What’s on the horizon for your business? Will you need to hire new employees? Invest in new capital expenditures? Or maybe even consider opening a new location? Financial projections provide insight for small businesses and startups planning for the future, as well as giving potential lenders and investors the data and information needed to understand your business.

What Are Financial Projections?

A financial projection is what your business expects to happen, based off hypothetical situations using the facts and data you have available. A financial projection is often prepared to present a course of action for evaluation. It’s a type of pro forma statement. Some examples of pro forma financial statements include projected income statements, balance sheets and cash flow statements.

Projections are based on financial modeling techniques and provide the answers to questions that may come from lenders, investors or other business stakeholders. Essentially, these statements are an answer to the questions, “If we lend you this money, what will you do with it? And how will you pay it back?”

Key Takeaways

- Financial projections translate business goals into concrete financial terms by testing the impact of various scenarios on financial performance.

- Projections typically include income statements, cash flow statements, balance sheets, revenue and expense forecasts, and break-even analyses.

- Businesses use projections to allocate resources, secure funding, identify potential cash shortfalls, time investments, and set realistic performance benchmarks.

- Regular comparison between projected and actual results helps businesses adjust projections and strategies over time.

- Modern financial tools can create sophisticated projections that automatically update as internal and external conditions change.

Financial Projections for Small Businesses Explained

Financial projections establish baseline expectations for a business’s strategic planning process by translating its goals and operational plans into quantifiable financial outcomes. By analyzing different potential scenarios, stakeholders can visualize the company’s future financial position based on a variety of assumptions and their possible outcomes. Unlike historical financial statements that focus on the past, projections show where the business is heading, acting as both a roadmap and warning system for potential challenges.

In practice, financial projections function as dynamic frameworks, rather than static predictions, and financial teams often adjust them as real results come in. Decision-makers use ongoing and fluid projections to continually test various business scenarios before committing additional resources to initiatives, such as determining if a new product line will be profitable, how many units must be sold to break even, or if the business can sustain increased staff during expansion. These forward-looking capabilities turn abstract plans into concrete financial terms that businesses can measure and adjust over time to improve performance.

Why Are Financial Projections So Important for Startups and Small Businesses?

Financial projections help you see when financing needs arise, along with the best times to make capital expenditures. They help to monitor cash flow, change pricing, or alter production plans.

Projections provide all the minutia that lenders might need to better understand your business, including how it obtains revenue and where it spends money. Additionally, if your business is ever the target of an acquisition, the financial statements help potential buyers evaluate its worth.

Subtle differences exist between the terms projection and forecast, but both describe predictions of future financial performance using financial models. A financial forecast presents predicted outcomes based on the conditions expected for your business. Projections are financial statements that present an expected financial position given one or more hypothetical assumptions.

For example, Linda’s Linens is growing its sales volume 10% each year, and that growth has been steady for the last 18 months. After examining the financial forecast, it’s reasonable for Linda to assume that growth will continue, and she should plan accordingly. This helps her with inventory planning, hiring decisions, and marketing budget allocations.

Linda is considering opening a second location. Before she talks to a bank, she prepares a financial projection to show a “what if” demonstrating possible growth with a new location opening on the other side of town. The hypothetical new location in the financial projection is what makes it different from the sustained growth she might reasonably suspect in the financial forecast.

What Are Financial Projections Used For?

Financial projections help realize possible potential in your business. What might happen if you receive outside funding? Or purchase additional equipment? This is where you get to be creative and explore what the future of your business might look like. Financial projections are typically used for:

- Business plan: Financial projections and business plans go hand-in-hand. It’s a way to show that your company is stable and is financially successful. It’s a good practice to provide quarterly or monthly projections for the first year and annual projections for the four years after that. These include projected income statements, balance sheets, cash flow statements, and budgets for capital expenditures. You should be able to explain projections and match them to funding.

- Investors: Your potential investors want to know if the business will make money and when they can expect a return on their investment. Some common benchmarks to watch for include expected time to profitability, sales in years three and five, and data showing numbers within the context of your industry.

- Loans and lines of credit: These are the most common sources of external funding for small businesses. Securing a Small Business Association loan requires a thorough understanding of your finances to show the lender plans for using funds and paying back the loan.

- Know your business: Financial projections show discipline in financial management—and better financial management leads to a much higher chance of business success. By using a financial model to make financial projections, you can see if, when, and whether your business will make a profit. You’ll have a better understanding of your cash position to make better decisions about when to hire more people, buy more inventory, or make capital investments.

The Building Blocks of Financial Projections

Financial projections are built on several key components that work together to provide a comprehensive view of a company’s future financial health. These building blocks form the foundation for making informed business decisions, securing funding, and planning for growth. The following are the five essential elements that make up robust financial projections:

- Income statement: An income statement is a financial document that forecasts your company’s revenues, expenses, and profits over a specific period. It helps you understand your potential earnings and identify areas where you might need to control costs or boost sales.

- Cash flow statement: A cash flow statement predicts the inflow and outflow of cash in your business. It helps you anticipate potential cash shortages, plan for large expenses, and make sure you have enough liquidity to keep operations running smoothly.

- Balance sheet: A projected balance sheet provides a snapshot of your company’s expected financial position at a future date. It outlines anticipated assets, liabilities, and equity, helping you gauge the overall financial health and stability of your business.

- Revenue and expenses: Detailed projections of your expected income sources and costs provide the foundation for other financial statements. These forecasts help you set realistic goals, identify potential issues, and make informed decisions about pricing, marketing, and resource allocation.

- Break-even analysis: This calculation determines the point at which your total revenue equals your total costs. Understanding your break-even point helps you set sales targets, price products effectively, and assess the viability of new business ventures or expansions.

7 Steps to Building a Financial Projection for Your Startup or Small Business

Some common scenarios for projections are monthly projections for year one, quarterly for the next two years, and annual thereafter. To build out your financial projections and make them as useful as possible, consider including the following:

- Sales revenue estimates

- Cost of sales or cost of goods sold (COGS)

- Operating costs

- Capital expenditures

- Gross margin by product line

- Sales increase by product line

- Interest rates on debts

- Income tax rate

- Accounts receivable collection plan

- Accounts payable schedule

- Inventory turnover

- Depreciation schedules

- Usefulness or depreciation of assets

Financial projections will usually have a detailed view in a spreadsheet, as well as a summary of some of the most important information. To create this, your business will need a financial model, or a summary of your company’s expenses and earnings. Let’s look at the seven basic steps for building financial projections.

-

Create a Sales Forecast

What’s driving your sales? That’s where you should start with your projections. For example, if you have a subscription-based web business, correlate sales with estimated website traffic, and conversion rates with the source of traffic. Consider a project management platform that sees 1.5% of its traffic from organic Google searches turn into paying customers. The same project management company should also identify conversion rates for customers who land on the site from ads. This estimates the volume of new customers generated by an increased ad spend or increased organic search traffic. And finally, the platform should track their churn rate, or how many customers don’t renew their subscription.

For a business that sells physical products, the sales forecast should estimate the number of units it will sell and the price per unit. It’s also helpful to see where and how the items are being sold: How many stores are carrying the products? How are each of those stores performing? The company should factor in things that might affect sales like seasonality. For example, more ice cream and sunscreen are sold in the summer. Is there a seasonality to your product?

-

Create an Expense Budget

Expenses will include the costs associated with sales, as well as operating expenses. To forecast cost of sales or COGS, take the current information on the income statement about product cost, fulfillment expense, customer service, and merchant fees. Express assumptions about potential changes as a percentage of revenue. Apply the same idea to operating expenses. Consider the impact of changes for elements such as headcount, salaries, and benefits, as well as expenses like advertising and rent, everything expressed (with the exception of headcount) as a percentage.

-

Create the Income Statement Projection

Link those assumptions to formulas built in the income statement. The financial model will forecast revenue, net revenue, COGS, gross profit, gross margin, operating expense, operating profit, and operating margin. The output of the financial model is the projected income statement.

-

Create the Cash Flow Projection

The projected income statement shows you, as well as potential lenders and investors, if the company is profitable and/or when it’s expected to make a profit. The cash flow projection shows your cash position and provides a more detailed view of monthly inflows and outflows of cash for a specific period of time—three months, six months, 12 months, etc.

-

Create the Balance Sheet Projection

While the cash flow projection highlights cash influxes and dips, the balance sheet shows or projects the worth of your company at any given time. Cash flow projections appear on your balance sheet as assets. On the liabilities side of the balance sheet, you’ll list things like accounts payable and debt.

-

Use Projections for Planning

Projections are important when seeking new funding or exploring capital expenditures. For planning, projections help with analyzing the impact of different business strategies. For example, what if you charge a higher or lower price? What if you’re able to collect invoices faster? Running and testing these various numbers shows how such decisions could affect finances.

Projected financial statements also help you prepare for best and worst case scenarios. Projected financial statements can drill down to the product level and identify when it will be profitable, when to ramp up production, or even when production no longer makes business sense.

-

Monitor

By comparing projections against actual results you can see if you’re on target or need to adjust to reach them. Consider purchasing accounting and planning software for financial projections. Tracking performance is much easier and quicker with dashboards and charts that can show you at-a-glance information.

Example of a Small Business Financial Projection

Shine, a hypothetical family dental office, created a three-year financial projection to secure a small business loan for expanding its office into the adjacent suite. Its projection estimated $600,000 in annual revenue for the first year, based on seeing eight daily patients at an average per-patient revenue of $300. Year two and three projections showed a 20% annual growth as brand recognition is expected to increase from a new marketing strategy and patients taking part in a referral program. The business then extrapolated these projections through core financial documents—the income statement, cash flow statement, and balance sheet.

- The income statement projection showed a first-year net loss of $30,000 turning to a $60,000 profit in year two as the adjacent suite was used to see more patients on a standard day.

- The cash flow projection revealed a potential risk: Despite projected profitability, the business will likely face a $40,000 cash shortfall in year two due to the timing difference between expanding equipment purchases and patients paying their bills for their end of the year checkups. The business decided to increase its desired loan size to cover this shortfall.

- The balance sheet projection demonstrated how the company’s asset value would increase from $975,000 to $1,124,000 over the three years, while its debt-to-equity ratio would improve as it repaid the loan.

By incorporating these projection elements alongside potential revenue patterns and break-even analysis to set daily patient goals, Shine secured its loan and established clear performance benchmarks to monitor progress. When actual patient volume exceeded projections by 15% in the first quarter, it revised its projections upward and accelerated its timeline to open a second location from year six to year five.

Benefits of Using Accounting and Planning Software for Financial Projections

Automated financial modeling provides a number of advantages, including handling more complex datasets, certain visualization capabilities, and streamlined financial projections. The following are some of the most common benefits of using accounting and planning software for financial projections:

- Connect all lines of businesses to the same data for improved control, visibility, and trust in the numbers.

- Analysis features drill into the data to understand the source of the numbers. This provides teams with more time to understand the “why” for a greater understanding of how owner decisions affect the rest of the company.

- Fast and easy what-if-scenario analysis explores different business opportunities.

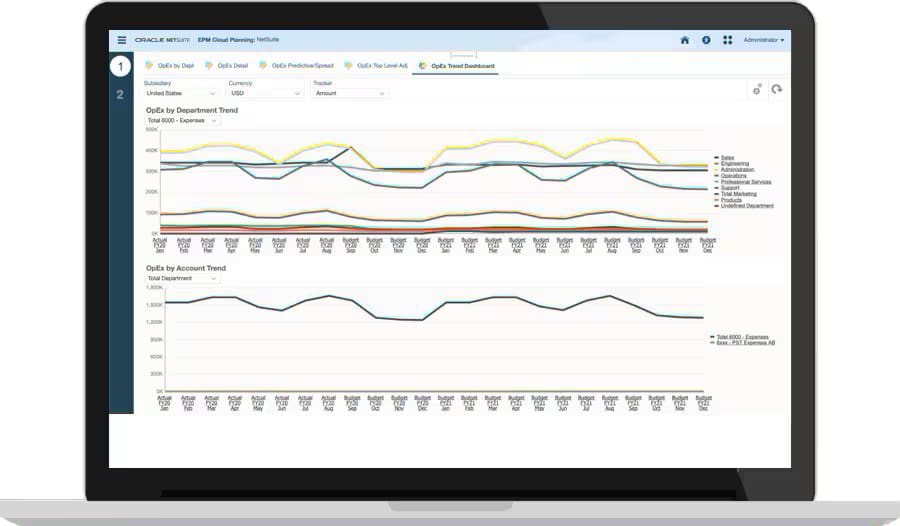

- Prebuilt reports and dashboards simplify comparisons between projected vs. actual results.

Automation can increase accuracy, save time, and analyze actual and forecasted results in charts and dashboards. With so much potential, automation is a growing trend, especially now that AI—particularly generative AI—has become more powerful and accessible. In fact, in Protiviti’s 2024 Global Finance Trends Survey Report, 34% of the surveyed global finance leaders are currently using generative AI—and of those genAI users, over half (57%) are integrating it into their financial forecasting activities. Financial planners can use these sophisticated tools to analyze much larger data sets and draw more detailed conclusions and insights than was possible with traditional automation tools.

Enhance Your Financial Projections With NetSuite

NetSuite’s integrated financial management solution replaces error-prone manual processes with a scalable unified platform that centralizes real-time, accurate financial information in one secure system. With preconfigured and customizable dashboards, users can compare performance against projections in accessible visualizations and financial reports, while automated data processes minimize errors and delays that can undermine projection accuracy and timeliness. NetSuite helps businesses keep their financial projections dynamic and evolving, unlocking flexibility and sustainable growth as real results come in.

NetSuite’s Planning and Budgeting Dashboard

Financial projections allow businesses to anticipate challenges and opportunities before they arise. Business leaders with a structured process of creating projections can gain deeper insights into their operations and market position, as well as secure funding and satisfy stakeholders. This foresight allows decision-makers to take proactive steps that improve their financial performance, rather than constantly reacting to financial stressors, such as unexpected bills, slow periods, or even sold-out inventory and understaffed shifts. As a result, businesses can better weather economic uncertainty, seize growth opportunities at the right moment, and allocate resources for the greatest returns. And with sophisticated financial tools more accessible than ever, businesses of all sizes can benefit from well-crafted projections.

Small Business Financial Projections FAQs

How long should a financial projection be?

Financial projections typically cover three to five years, with earlier years including more granular data. For example, the first year may be broken down by month, the second year by quarter, and remaining years presented annually. This provides sufficient detail for near-term planning while acknowledging that market variables and uncertainty can reduce accuracy and confidence in long-term projections.

What is the difference between a financial forecast and a projection?

A financial forecast predicts outcomes based on realistic conditions the business expects, representing a company’s most likely future performance. Conversely, financial projections present hypothetical outcomes based on one or more what-if assumptions that may or may not occur, making them more appropriate when evaluating specific business decisions or comparing alternative strategies.

What is the best chart for financial projections?

Line charts are typically most effective for financial projections as they clearly illustrate trends over time and allow for easy comparison between projected and actual results, even for non-financial experts.