Trend analysis is like looking at old family photos to predict what your newborn daughter will look when she grows up. In the business world, companies use it to detect historical patterns and anticipate future behaviors that can help them grow — only the pictures are in the form of past data that analysts use to identify trends that can inform strategic decisions across various business challenges, whether in finance, manufacturing, marketing or environmental and socioeconomic beliefs. But while trend analysis can provide invaluable insights for business forecasting and strategic planning, it demands meticulous discipline and analytical expertise to harness effectively.

For businesses eager to embrace this powerful business intelligence tool, it’s crucial to understand its wide range of potential applications, its benefits — and its limitations. With a concrete framework, organizations in different sectors can use trend analysis to set themselves up for long-term strategic growth.

What Is Trend Analysis?

Trend analysis is a statistical approach to identifying patterns or changes in data over time. It’s used to help predict future business dynamics and inform decision-making. Whether used for finance, marketing, supply chain management, economics, healthcare or environmental sciences, it can be a useful tool for any organization looking to build evidence-based strategies based on historical precedents.

But trend analysis also has limitations. For instance, past trends don’t always accurately predict future outcomes due to unforeseen variables or changes in conditions. To ensure a well-rounded approach to strategic planning, it’s wise to use trend analysis in conjunction with other analytical tools and up-to-date market intelligence.

Key Takeaways

- Trend analysis is a systematic process that uses statistical techniques to identify historical patterns and project future outcomes based on that data.

- Its data-driven foundation can help businesses, investors, scientists and policymakers make more informed strategic decisions.

- Different types of trends — including upward, downward, horizontal, short-term, long-term and seasonal — have distinct implications for strategic planning and operational decisions.

- Effective trend analysis necessitates beginning with manageable objectives, using the right tools, understanding the analytical context and objectively interpreting results.

- Despite its value, trend analysis has limitations, including data constraints, the potential for oversimplification, the impact of external influences and the risks inherent in subjective interpretation.

Trend Analysis Explained

Trend analysis operates on the principle that historical data patterns offer valuable insights into future market developments. It can be an effective tool to help organizations stay relevant and competitive in their industries. For example, an ecommerce company specializing in consumer electronics might analyze sales data to forecast demand for different product categories. Discovering an upward trajectory of interest for smart home devices might predict a coming mainstream consumer shift toward household automation. Armed with this insight, the company can strategically adjust its inventory and marketing efforts to capitalize on this growing interest.

Trend analysis employs a variety of statistical methods, each offering different lenses through which to view data. Time-series analysis, for example, examines data points collected at regular intervals to discern trends and patterns over time, often laying the groundwork for trend analysis. Meanwhile, regression analysis delves into the relationship between a dependent variable, such as sales volume, and one or more independent variables, like price, to uncover how they interact and affect each other.

In practice, the ecommerce company might use time-series analysis to get a macro view of sales trends over time. But to get more granular insights into the effects of specific actions, such as how price adjustments or marketing campaigns affect smart home device sales, regression analysis may be applied. Together, these two trend analysis techniques can offer a comprehensive view of past performance and future potential, empowering the company to tailor its strategies more effectively for inventory management, marketing and pricing.

Advantages of Trend Analysis

Discoveries that emerge from trend analysis can provide a multitude of strategic benefits, from enhancing decision-making with historical data findings to optimizing resource allocation. Trend analysis often serves as a compass for future planning, guiding businesses through the complexities of market understanding, performance analysis and financial management. Among the key advantages of trend analysis:

- Informed decision-making: Trend analysis makes it possible to translate empirical data and past behaviors into actionable knowledge, so that businesses can make decisions grounded in evidence rather than intuition and conjecture. This can lead to a deeper understanding of business cycles and more reliable outcomes. By analyzing sales trends, a company could decide to phase out underperforming products and redirect its resources toward future growth. Whether it’s used to make decisions about how to optimize product lines, adjust marketing tactics or improve business forecasts, trend analysis can turn past data into a valuable asset for future planning.

- Strategic planning: Developing forward-thinking strategies that anticipate how businesses can align goals with expected market conditions and consumer behaviors is integral to strategic planning. The foresight offered by trend analysis plays a key role here, as it can reveal potential opportunities and threats and help business leaders devise proactive strategies for long-term success. A tech firm, for instance, might use trend analysis to predict the next wave of innovation and start developing new software to stay ahead of the curve — perhaps by investing in artificial intelligence while remaining watchful of the associated regulatory landscape.

- Performance analysis: Trend analysis provides a historical perspective essential for gauging an organization’s performance over time. By using operational analytics and tracking key performance indicators (KPIs) against historical data, for instance, businesses can get a clear view of progress in specific areas, from overall operational efficiency to sales growth and customer satisfaction. This data can then be used to identify best practices, pinpoint opportunities for improvement and benchmark against competitors. For organizations committed to continuous improvement, ongoing trend analysis is key to driving greater and greater operational efficiency and effectiveness.

- Market understanding: Businesses can use trend analysis to garner deeper understanding of customer behavior, market demand, competitive landscapes and even socioeconomic trends. With that superior market understanding, they can better adapt their products and services to meet evolving needs and identify untapped or emerging market segments. Trend analysis can also help companies identify new opportunities for innovation and growth in response to other external influences, like disruptive technologies or regulatory shifts.

- Financial management: Trend analysis can benefit financial management teams in a variety of ways. It can be used to help financial leaders forecast revenue streams, anticipate market fluctuations and manage budget allocations with greater precision. It can also help them project future financial conditions, assess the viability of proposed investments and manage risk. Perspectives gained from trend analysis help businesses ensure their liquidity and maintain their financial health by making proactive adjustments, such as preparing for an economic downturn or reallocating funds toward a worthy capital investment.

- Resource optimization: By identifying and understanding resource-allocation trends, businesses can strategically adjust their resource deployment to make sure they aren’t over- or under-resourcing key areas. This can, in turn, save money and boost operational efficiency. For instance, in manufacturing, trend analysis can forecast the need for raw materials, allowing for just-in-time inventory that reduces holding costs without risking stockouts. In human resources, it can be used to inform workforce planning by aligning staff levels with anticipated demand.

How to Perform a Trend Analysis

Conducting a trend analysis requires a systematic approach to understanding historical data and forecasting future possibilities. The following seven steps provide business analysts with one well-structured approach they can use to more precisely identify organizational objectives and the best path to success.

-

Define the Objective and Scope

The first step in performing trend analysis is to define the objective and scope. This sets the stage for targeted, effective analysis. First identify what you want to achieve with the analysis by setting clear, measurable goals — be it understanding consumer behavior, forecasting financial performance, monitoring performance metrics or projecting product demands. Scope will determine which market segments, time periods or data categories should be included. Narrowing the focus helps keep the analysis manageable and relevant to your objectives. Whatever the goal and scope, a well-defined foundation will guide the selection of relevant data, the best analytical methods and tools to use and how to implement findings.

-

Collect Data

Conclusions drawn from trend analysis are only as reliable as the data being analyzed, so collecting high-quality, relevant data from trustworthy sources is pivotal. This step demands meticulous attention to detail to ensure the data is current, reliable, consistent and pertinent to the defined objectives and scope of the analysis. For example, a business aiming to understand its pricing strategy according to consumer behavior trends might gather sales figures, customer feedback and market research reports. Digital tools can significantly aid this process; customer relationship management (CRM) systems, for instance, can provide a wealth of data on customer interactions, while financial management software can make it easy to leverage financial data, such as revenue trends and profit margins.

-

Choose the Right Tools and Techniques

Once you know what data to collect, the next questions are where to store it and what techniques should be used to analyze it. Consider the strengths and limitations of each tool and technique to make sure the ones you choose align with the analysis’s objectives and can handle the data complexity. Regardless of the chosen tools, it’s increasingly common for companies to store trend analysis data in a cloud-based platform with scalable storage, easy accessibility and the power to process large datasets.

Dedicated statistical software is often used to parse through complex quantitative data and support sophisticated analyses, such as predictive modeling. For simpler analytical tasks, like basic financial analysis, spreadsheets are often sufficient. For qualitative data, such as customer feedback or open-ended survey responses, content analysis tools that categorize and analyze text data are worth considering. These tools can help identify themes, sentiments and patterns that quantitative data alone may not reveal. Visualization tools can also help spot trends through graphical representations, making data more accessible and understandable for a variety of stakeholders — not just data analysts or statisticians.

Different statistical analysis techniques, such as time-series analysis, regression analysis and comparative analysis, should be considered as part of an approach that will provide a robust, insightful and efficient analysis. Time-series analysis is pivotal for understanding how variables change over time, making it ideal for trend forecasting. Regression analysis is key for identifying relationships between variables, which is useful in scenarios such as evaluating the impact of marketing spend on sales. Comparative analysis allows for benchmarking against competitors or industry standards.

-

Analyze the Data

This step is the heart of the analysis: processing data using the chosen methods to identify patterns, fluctuations and anomalies over time that lead to insights relevant to your objectives. It’s essential to approach this analysis methodically to make sure any patterns detected represent genuine trends rather than random variations. A good analytical process will begin to draw a narrative out of the data to not only identify the changes that occurred but also to explain why they happened.

Consider beginning the analysis with a broad overview, such as an examination of overall sales trends across several years to identify general growth or decline patterns. This high-level view can shine a light on significant shifts and/or periods of stability, offering revelations about long-term performance. Say a business identifies a general upward trend in sales. Decision-makers might then choose to examine monthly or seasonal variations to understand more granular patterns, such as which months show the strongest sales and whether these patterns align with specific marketing campaigns or external events.

-

Interpret the Results

The next step is to understand the data’s story and consider its implications. Interpretation goes beyond looking at numbers to grasp the significance of trends within broader business, market or operational contexts. This wide-lens approach is integral to accurately assessing how the trends might influence future strategies and decisions. A decline in retail store foot traffic might not solely reflect a decrease in brand popularity, for instance. When analyzed in the context of increasing ecommerce adoption and perhaps a recent spike in online promotions, it might signal a shift in purchase-process preferences among brand-loyal customers.

Note that subjectivity can skew interpretations, leading to misinformed strategic decisions, missed opportunities or misallocated resources. For example, confirmation bias — where an individual or a team might inadvertently seek out information that confirms pre-existing beliefs or desires — is common. Maintaining objectivity during this phase can help prevent bias and ensure that interpretations are grounded in data rather than assumptions or desired outcomes. One way to do so is to involve a diverse group of stakeholders with multiple perspectives in the interpretation process, which can reduce the risk that individual biases influence results or strategic plans.

-

Validate the Findings

Validating the findings is a crucial step in trend analysis to further ensure the reliability, credibility and objectivity of the results. The validation process involves cross-checking the identified trends against external benchmarks or independent data sources, such as industry market research or parallel datasets. Further validation can be achieved through peer review, where experts or colleagues scrutinize the analysis to catch potential oversights or biases. Statistical tests can assess the significance of the findings, ensuring that the observed trends are not merely due to chance. Together, these methods of validation — from external comparison to rigorous statistical evaluation — act as critical safeguards against potential biases or errors that may have infiltrated the data collection or analysis phases.

For example, if a trend indicates consumers are significantly shifting toward purchasing sustainable products, it would be wise to corroborate the finding with industry reports on sustainability trends or consumer surveys conducted by environmental organizations. Such cross-verification helps to make sure that the observed trends are representative of broader market movements and not just isolated incidents.

-

Report and Implement Findings

The final step in trend analysis is to effectively communicate and put the findings to work. Reporting should be clear, concise and successfully translate complex data into actionable insights that can guide decision-making. This often involves crafting visual representations, such as graphs and charts, to help all stakeholders — not just analysts — quickly comprehend patterns and trends. Visual aids should be complemented by written reports or presentations that detail the context, methodology, findings and implications. These written elements are essential for providing the depth and rationale needed to understand the logic behind strategic recommendations.

Implementation requires integrating these insights into business strategy and operations, which may involve setting new targets, adjusting plans or initiating specific projects in response to the identified trends. It’s crucial that this step also includes a plan to monitor the impact of the changes and adjust course as necessary. If trend analysis reveals a growing consumer preference for eco-friendly products, for instance, a company might decide to develop and market a new line of more sustainable products. The company might also implement a dashboard that tracks KPIs related to the new product line, as this could provide ongoing insight into the success of the strategy and inform necessary tweaks or additional actions.

Types of Trends

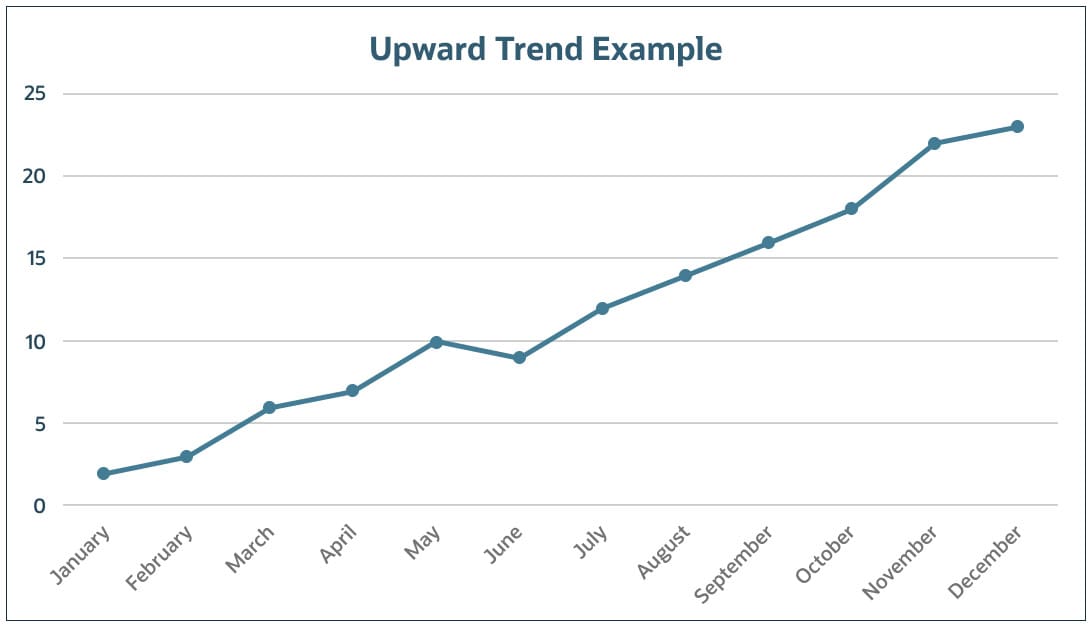

Understanding and recognizing different types of trends is important when interpreting data that will inform business decisions. Trends can be upward, indicating growth; downward, suggesting decline; or horizontal, showing stability. They can also be categorized by duration, such as short-term fluctuations or long-term shifts, and by pattern, like seasonal variations.

Upward Trends

An upward trend shows a sustained increase in the value of a variable over time. Businesses generally hope for an upward trend to manifest as a consistent rise in sales, which suggests growing consumer demand and a healthy market presence for their products or services.

Upward trends can enable businesses to capitalize on positive momentum by exploring new market opportunities or expanding operations. For example, a notable, sustained increase in sales of organic products might reflect a shift in consumer priorities toward health and sustainability. This observation could then inform strategies for new-product development and targeted marketing to take advantage of those evolving preferences. Upward trends are also relevant for investors, for whom an upward trend in stock prices usually signals a bull market and the potential for substantial returns. In the healthcare sector, an upward trend in patient admissions could indicate a growing need for specific healthcare services or facilities.

But upward trends aren’t always ideal. An upward trend in product returns or service complaints could indicate quality control failures, misalignment with customer expectations or issues with product design, for instance. Context is key.

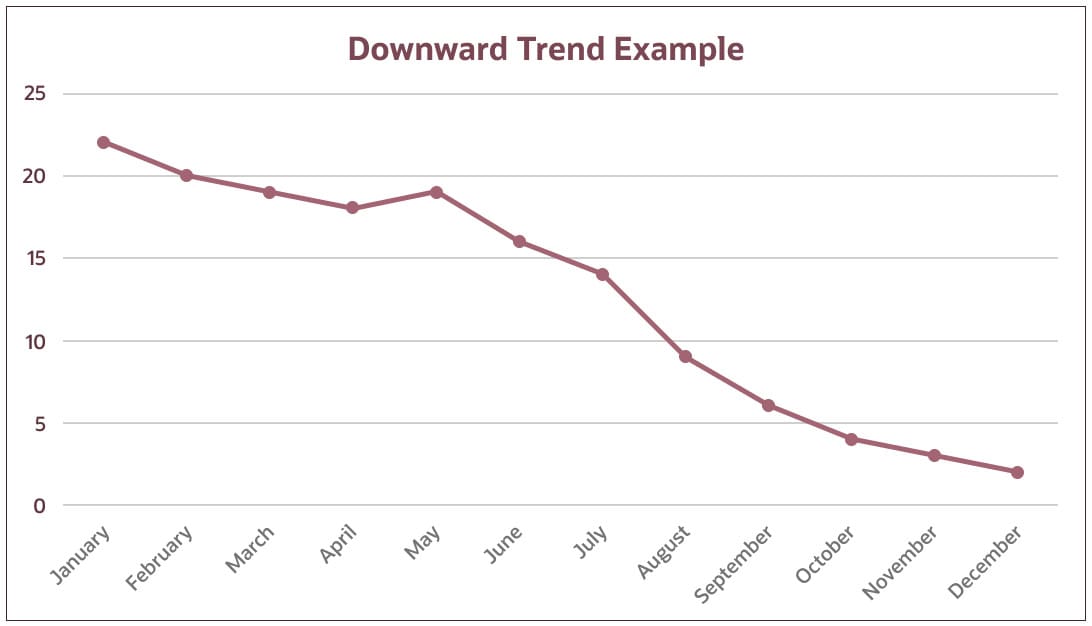

Downward Trends

Contrary to an upward trend, a downward trend indicates a consistent decline in a particular variable over time. This usually marks a potential challenge or area of concern. For example, a sustained drop in sales figures might suggest a decrease in consumer interest or an increase in competition. To regain lost market share, the company may need to reassess its product offerings, marketing efforts or customer engagement strategies to identify areas in need of innovation or reinvigoration.

Identifying downward trends is essential for timely intervention. Strategic adjustments, such as reallocating resources or pivoting to a new business model, can help organizations reverse negative trajectories and mitigate potential losses. This proactive approach enables businesses to adapt to changing market dynamics and sustain their competitive edge.

However, it’s worth noting that a downward trend isn’t always bad news. A downward trend in operating costs, production costs or overhead expenses can signal improved efficiency and cost management within a company, potentially leading to higher profit margins. Similarly, a downward trend in carbon emissions, waste production or resource consumption can reflect successful implementation of eco-friendly practices and progress toward sustainability goals. Again, context is key.

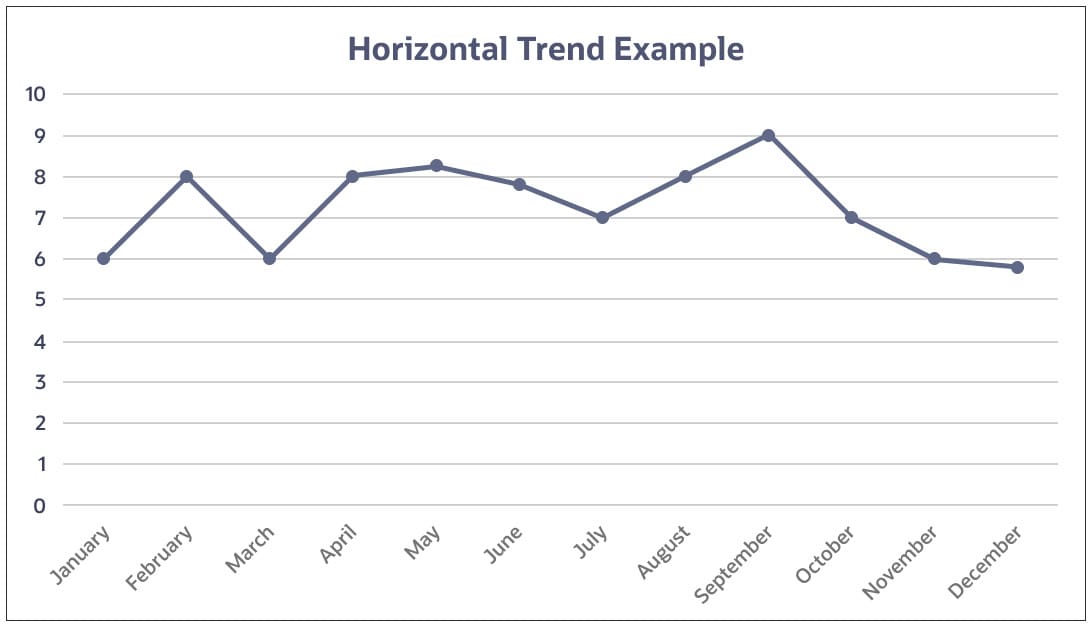

Horizontal Trends

A horizontal trend represents a period where the value of a variable remains relatively stable, without a clear indication of an increase or decrease over time. This stability often reflects a state of equilibrium, such as when production levels in manufacturing match market demand. In operational contexts, consistent performance metrics might suggest that processes are functioning smoothly. That said, it could also signal stagnation, underscoring a possible need for innovation to foster growth or improve efficiency.

Identifying horizontal trends and investigating their underlying causes helps decision-makers determine whether to maintain the status quo or implement strategies to stimulate change. In scenarios where market conditions are volatile due to economic fluctuations but a company’s performance remains stable, it may be better to stay put. For example, if a business consistently meets its revenue targets amid economic downturns, the company’s strategy may be effectively mitigating risk. Conversely, in a rapidly growing market, a horizontal trend in revenue might prompt a company to reassess its growth strategies. It might ramp up marketing efforts or innovate in its customer experience to differentiate itself from competitors, for instance.

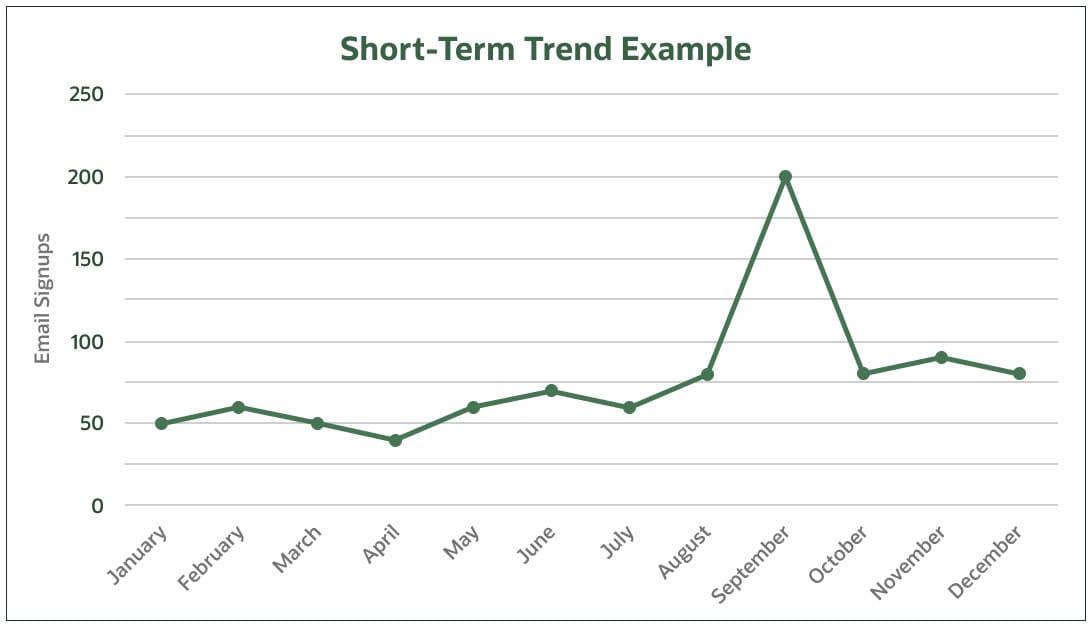

Short-Term Trends

Short-term trends are brief fluctuations in data. They can last from a few days to several months and are often driven by temporary events or seasonal factors. Examples of short-term trends include sudden spikes in retail sales during holiday seasons or quick drops in stock prices triggered by short-lived market panics. Sometimes, though, short-term fluctuations serve as early indicators of more significant, longer-term movements. For businesses, identifying these trends is critical for determining whether immediate risk mitigation is necessary or an opportunity to capitalize on quick gains is present.

With short-term trends, even more care than usual must be taken in the analysis to distinguish a genuine trend from mere noise in data. Consider a retail company that observes a sudden increase in online sales. By analyzing this trend in the context of current events, such as an unplanned social media influencer endorsement, the company can discern whether the spike is a short-term reaction likely to revert or a sustainable increase in customer interest. This way, analysts and decision-makers can make sure their strategies aren’t hastily altered in response to what may be fleeting or misleading patterns.

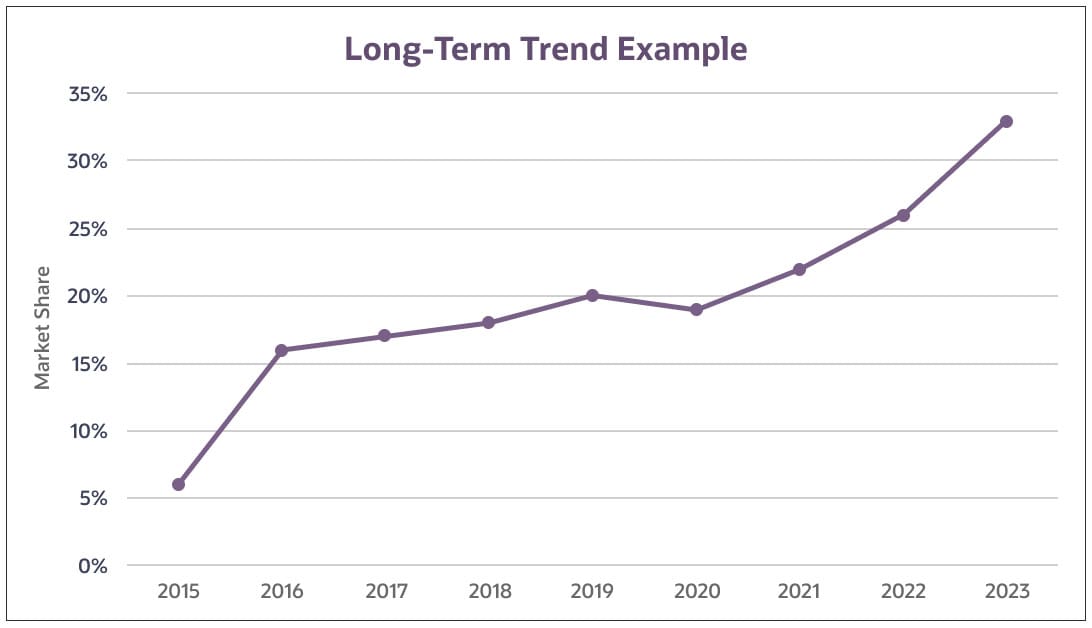

Long-Term Trends

Long-term trends reflect sustained movements in data over extended periods, typically a year or more. Because these trends tend to indicate deep-rooted changes in markets or consumer behaviors, they can shape a business’s strategic direction and long-term goals. Identifying and understanding long-term trends can help businesses stay in sync with macroeconomic developments and societal shifts, as well as formulate strategies that will drive growth over many years.

For instance, a consistent rise in remote work could lead companies to invest in digital collaboration tools. Likewise, a steady increase in the use of renewable energy sources over a decade would reflect a significant shift toward sustainable practices, potentially influencing an energy company’s decision to adjust its investment strategy away from fossil fuels and toward wind, solar, hydro and geothermal energy alternatives.

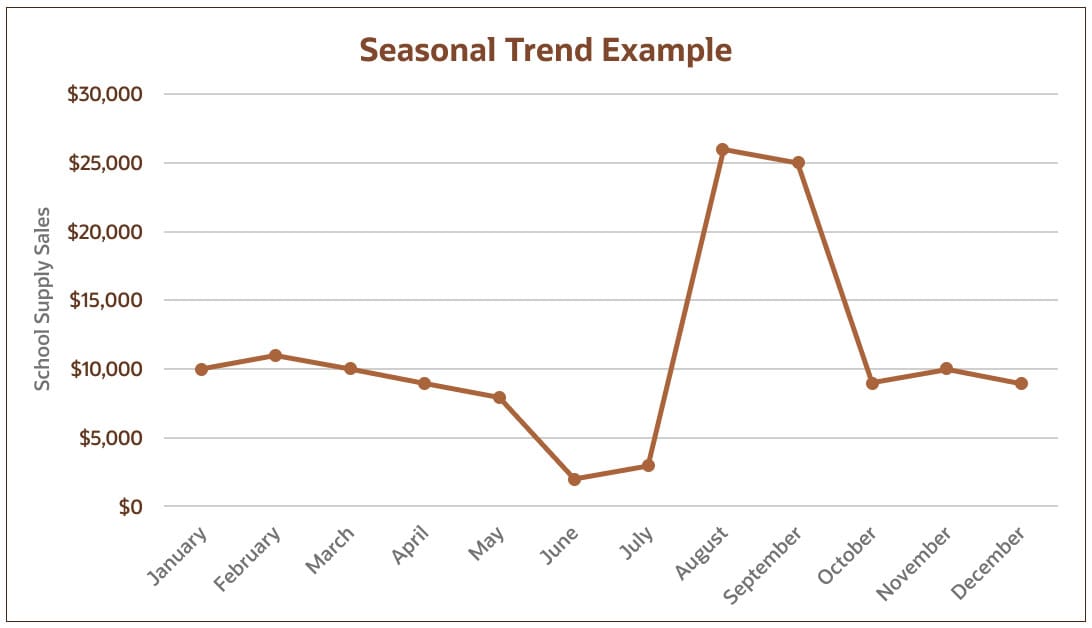

Seasonal Trends

Seasonal trends are periodic fluctuations that occur at regular intervals due to seasonal factors. While these trends are typically short-term, lasting a few months at a time at most, they recur predictably. For example, clothing retailers often experience a surge in bathing suit sales as summer approaches and winter coat sales as temperatures drop. Such patterns necessitate careful inventory planning to meet heightened demand. Similarly, restaurants often see an uptick in patronage during holidays when people are more likely to dine out and celebrate, such as Valentine’s Day and Mother’s Day. In turn, restaurants need to carefully plan to have enough staff — and food supplies —to accommodate these seasonal peaks.

Recognizing seasonal trends allows businesses to tailor their strategies for year-round profitability and operational efficiency. This might involve adjustments, such as hiring seasonal labor during peak periods or scheduling maintenance during an off-season.

Trend Analysis Best Practices

Best practices set the stage for an accurate and actionable trend analysis that can significantly inform business strategy for the better. They include starting with small, focused goals, accurately interpreting trends and their implications and having a deep understanding of the industry and market context to maintaining objectivity throughout the process.

- Start small: With more and more data to interpret, trend analysis can seem like a complex endeavor. Starting small with narrow, focused projects can help analysts zero in on specific areas without becoming overwhelmed by the breadth of data. A growing business might begin by analyzing trends within a single product line rather than its entire product range. This approach not only makes the task more manageable, but it also provides a focused context for learning about trend analysis and how to refine the process before scaling up to more comprehensive analyses. Overextending the scope too early can also lead to superficial results that miss nuances.

- Understand the context: Industry and market context provides a backdrop against which trends can be analyzed. A declining trend in social media engagement could be cause for concern in the tech industry, for example, seemingly signaling a shift in user preferences or platform saturation. But in the context of healthcare, a similar downward trend could reflect a successful campaign to reduce screen time for vision and mental health reasons. Fully grasping the context of the data — and considering the broader economic, social and technological environment — can help analysts garner more nuanced insights that ensure strategic decisions are based on accurate and comprehensive interpretations of the data.

- Stay objective: Objectivity is necessary to ensure accuracy, but humans are, by nature, subjective beings. Confirmation bias, for example, can lead teams to favor information that confirms their preconceptions, potentially resulting in flawed decisions. If a team strongly believes in its product, for instance, and sales peak in a particular quarter, they might attribute the success to product quality alone. An objective analysis, however, would look at all potential factors, such as seasonal demand and marketing campaigns. Analysts and decision-makers must therefore be aware of their own biases and the influence of preconceived notions, as this subjectivity can skew data interpretation. To stay objective, it’s key to rely on the data itself — rather than the outcomes one hopes to find.

Trend Analysis Examples and Uses

Exploring the practical applications of trend analysis across various fields helps to build a more thorough understanding of its capabilities. From informing business decisions and financial forecasts to optimizing healthcare management and educational methodologies, trend analysis can help organizations leverage historical data for predictive insights, fostering innovation and strategic responses to changing patterns and demands.

-

Business and Market Trends

Trend analysis can transform data about consumer behavior, market demand and competitors into actionable business intelligence that drives growth and innovation. Retailers, for instance, use trend analysis to anticipate seasonal fluctuations in consumer demand, which informs their inventory management and promotional strategies. Some companies analyze consumer spending patterns to determine the best time to launch products or sales promotions; others analyze sales trends to identify products that are gaining or losing market traction.

Businesses also track external economic factors, such as interest rates, inflation rates or shifts in consumer confidence. This data can be used to forecast market conditions and strategically adjust operations to mitigate risks, such as supply chain disruptions, or to capitalize on emerging opportunities, like low interest rates.

-

Financial Analysis

While investors might analyze historical stock performance trends to identify patterns that could influence future stock prices, businesses use trend analysis to review their financial data in search of trends that could affect their future operational and financial health. For example, a business might observe a consistent upward trend in material costs, which could inspire it to seek alternative suppliers or adjust product pricing to preserve margins. Or, by analyzing cash flow trends, a business could figure out how to manage its liquidity while making strategic investments, such as expanding operations or entering new markets.

-

Healthcare

Healthcare decision-makers use trend analysis in a variety of ways, such as to track treatment effectiveness, patient outcomes and disease prevalence. They also use it to manage costs and forecast future public health trends. For instance, public health officials might use trend analysis to monitor chronic disease incidence rates to guide resource allocation toward prevention and treatment programs. Or hospitals might analyze patient readmission rates to identify patterns that lead to changes in discharge planning or patient education.

By analyzing these trends, healthcare providers can better prepare for seasonal illnesses, manage staffing requirements and improve patient care. Moreover, trend analysis can influence health policy development. For example, evidence-based findings around the impact of lifestyle changes on public health can shape decisions on healthcare funding and initiate public health initiatives, such as wellness education programs.

-

Manufacturing and Supply Chain

Manufacturers use trend analysis at both high and low levels. At a high level, trend analysis helps manufacturers enhance their production processes, optimize inventory, forecast demand and manage logistics. But they also drill down into nitty-grittier use cases, such as predicting machine failure rates to help schedule predictive maintenance and reduce downtime. Or they may analyze production cycle times to spot bottlenecks and adopt strategies to better manage production capacity.

In manufacturing supply chains, trend analysis can predict demand surges so that manufacturers can optimize inventory to avoid stockouts or overstock situations. Analysis of historical shipping data can improve predictive models for future freight volumes, making it easier to optimize routing and, ultimately, reduce transportation costs. Trend analysis can also help companies develop more resilient supply chains by rightsizing inventory buffers to mitigate the effects of supply chain disruptions.

-

Technology and Web Analytics

Technology is a rapidly evolving sector. Trend analysis can be used to track tech advancements and adoption rates to help companies keep up or, ideally, stay ahead. For instance, increasing mobile device usage steers companies to prioritize mobile-first strategies for their websites and other digital products, rather than focusing exclusively on desktop versions. Or a software company might analyze user interaction data to determine the most- and least-used features in their app, and then use that knowledge to enhance features that better align with those preferences.

In web analytics, companies use trend analysis to examine traffic patterns, session duration and conversion rates, helping to identify the digital marketing strategies that are working or need adjustment. For example, a steady increase in traffic following a website redesign can validate the effectiveness of the changes, whereas a drop in traffic might indicate issues with site navigation or search engine optimization. Similarly, trend analysis can reveal the highest- and lowest-performing content to guide future content strategies.

-

Environmental and Climatic Studies

Scientists and environmental experts use trend analysis in a variety of ways. In climate studies, it’s used to track changes in global temperatures to better understand and predict climate changes. This can involve analyzing decades of temperature data to identify warming trends and their potential impact on ecosystems. Trend analysis also plays a pivotal role in environmental conservation, such as monitoring species population data to support the protection of endangered species and analyzing land-use changes, including deforestation rates. For instance, satellite imagery can reveal trends in forest cover over time, providing insights into how these trends affect biodiversity and climate. This information is crucial for informing conservation efforts, guiding further research and influencing policy decisions.

Businesses, especially in sectors like agriculture and real estate, might leverage this environmental data to make informed decisions: Farmers might choose crops more resilient to changing conditions, for example, while real estate developers might choose to build in areas with lower risk of climate impacts.

-

Social and Economic Research

Social and economic research extensively employs trend analysis to uncover patterns that can influence societal dynamics, policy formulation and even business strategies. Economists, for instance, analyze long-term employment trends not only to gauge job market health but also to predict future workforce needs in certain industries. This can, in turn, influence educational policies and training programs to better equip the workforce with skills relevant to emerging industry needs. Economists also study consumer spending trends to better understand economic cycles — an understanding that can then guide fiscal policy.

In social research, trend analysis is used to examine shifts in demographics, migration patterns and housing trends. These observations can inform urban planning, guiding the development of infrastructure, social services and housing planning to better meet changing community needs. Trend analysis can also explore changes in societal values and behaviors, contributing to public health strategies and social welfare initiatives.

Businesses can tap into this social and economic data to inform market-entry strategies, product development and corporate responsibility initiatives. A retailer might use demographic trend data to tailor its product lines to the needs of an aging population, for instance.

-

Education

Trend analysis is applied to improve education initiatives, from refining teaching strategies to evolving curriculum development. For example, educational institutions might analyze trends in student performance to identify areas where learners consistently struggle, suggesting a need for targeted interventions. If analysis reveals a year-over-year decline in math proficiency, a school may choose to implement innovative teaching methods or introduce supplementary support for students to help boost math skills.

Trend analysis can also inform resource allocation, highlighting the need for technology enhancements, the introduction of extracurricular programs or the expansion of teaching staff. For example, a high student-to-teacher ratio, combined with subpar test performance, could indicate the necessity of hiring additional teachers to afford students more personalized attention.

Limitations of Trend Analysis

While trend analysis is a powerful and versatile forecasting tool, it’s not without its limitations. Past trends may not always be a reliable predictor of future events due to the dynamic nature of markets and external factors. Analysts must carefully consider the following constraints to ensure a balanced approach to strategic planning.

- Predictive limitations: Historical trends do not guarantee future performance; they simply suggest possible outcomes. A business that experiences consistent sales growth for several years isn’t guaranteed to grow indefinitely. Unforeseen market disruptions, such as a new competitor or a change in consumer preferences, can send customers elsewhere. While trend analysis can be a valuable tool to inform strategy, it should be used in conjunction with other analytical methods and business intelligence strategies to help business leaders make well-rounded decisions.

- Data constraints: The accuracy of trend analysis is heavily dependent on the quality and availability of data. Poor data quality — characterized by inaccuracies, inconsistencies or incompleteness — can lead to erroneous conclusions. Consider a business that relies on sales data but does not account for returns or exchanges. It may, in turn, overestimate its success and make an ill-advised decision to expand. Data availability is equally important. Poor record-keeping and data loss can make trend analysis challenging, if not impossible. Robust data management systems and practices are necessary to support data analyses so that any resulting strategic decisions are sound.

- Oversimplification and linearity: A common pitfall in trend analysis is people’s tendency to oversimplify complex data patterns, including a bias toward assuming that trends are linear — that is, that variables relate to each other in a straight-line manner and will continue to do so. Oversimplification also manifests when analysts or business managers ignore the multifaceted influences that may be operating on a given trend. The assumption of linearity can cause people to mistakenly believe that a past trend will predictably extend into the future, overlooking additional dynamics including market changes, consumer behavior shifts or emerging competitors. In fact, real-world systems are generally nonlinear, and so real-world trends are as well. A broader approach that embraces more complex models can help organizations craft more resilient and adaptable business strategies.

- External influences and variability: External factors, such as regulatory changes, technological advances, economic shifts and global geopolitical events, can all abruptly alter established trends. For instance, a telecom business might experience a boost in demand due to technological advancements in 5G networks, only to face challenges as global supply chain disruptions limit device availability. Variability also plays a role. A company that provides guided winter excursions may be accustomed to seasonal visitor patterns, but an unseasonably warm winter might lead to an unexpectedly slow season. Potential for variability, therefore, necessitates a flexible approach to trend analysis — one that considers a range of possible external factors.

- Subjectivity concerns: It’s natural to inadvertently interpret data through the lens of our own biases or expectations. But this can lead to conclusions that reflect the analyst’s beliefs rather than the actual data. For example, analysts might unconsciously overlook data irregularities that do not support their hypothesis, leading to an incomplete analysis. To mitigate subjectivity, trend analysis should be approached with a clear, structured methodology. This may include a system of checks and balances in which team members review each other’s work to ensure interpretations are based on data, not personal beliefs or implicit assumptions.

Build Your Business on NetSuite No Matter the Trends

NetSuite SuiteAnalytics reporting and dashboard solution is a comprehensive business intelligence system that empowers organizations to conduct trend analysis with precision. With real-time reporting and customizable dashboards, SuiteAnalytics equips companies with the tools they need to stay agile, rapidly make informed decisions and swiftly adapt to market changes. What’s more, SuiteAnalytics is part of NetSuite’s Enterprise Resource Planning (ERP) system, which centralizes data across the business to provide a single source of consistent high-quality information that can be accessed organization-wide. This ensures that trend analyses are based on comprehensive and accurate data sources, leading to more reliable insights.

Thanks to its scalable functionality, NetSuite is uniquely positioned to support businesses through the ever-changing landscape of market trends. Whether companies need the agility to respond to fluctuating trends in financial performance, customer behavior or operational efficiency, NetSuite can help businesses of all sizes stay ahead of the curve.

Trend analysis is the practice of collecting data over time and analyzing it to identify patterns that can predict future behavior or performance. It’s an essential component of strategic planning because it enables businesses to navigate market uncertainties and capitalize on potential opportunities. Its effectiveness, however, is contingent on the quality of data, analytical techniques and the interpretative skills of analysts.

Trend Analysis FAQs

What are the tools used for trend analysis?

Trend analysis often leverages statistical tools for data crunching, predictive models for forecasting and visualization tools for presenting data. Statistical software can make it easier to manage and run complex calculations, while predictive models can more accurately forecast future trends. Visualization tools are vital for translating data into charts and graphs that can be easily interpreted by decision-makers.

What’s the difference between trend analysis and ratio analysis?

Trend analysis and ratio analysis are both techniques used in financial analysis, but they’re quite different. In the context of financial analysis, trend analysis is used to forecast future movements in financial data by examining past trends. Ratio analysis, on the other hand, involves the calculation and interpretation of financial ratios, which are derived from the figures found in the financial statements of a company. These ratios, such as profitability ratios, liquidity ratios, efficiency ratios and leverage ratios, can help assess a company’s financial health.

What is an example of a trend analysis?

An example of trend analysis is examining a company’s sales data over several years to identify seasonal patterns and growth trends. This data can then be used to inform future sales strategies, marketing initiatives and inventory management.

How do you perform trend analysis?

To perform trend analysis, begin by defining the objective you want to achieve. Then, collect relevant data and choose the appropriate analytical tools — that is, tools that will let you analyze the data in a way that leads toward your objective. Next, analyze the data to identify trends, interpret the results and validate the findings. Finally, report and implement the insights.

What are the three types of trend analysis?

Three main types of trend analysis are time-series analysis, which looks at data points over time; regression analysis, which examines the relationship between variables; and comparative analysis, which compares trends across different groups or categories.

What is the formula for trend analysis?

Because trend analysis tends to involve various statistical methods, there isn’t a single “trend analysis formula” to use. However, a common technique is to calculate a trend percentage, or the percent change between two data points. Here’s the formula:

LIFR = Ending Amount – Starting Amount / Starting Amount x 100

The ending amount is the most recent data point in the series you wish to analyze. The starting amount is the first data point in that series.

Why is trend analysis important?

Trend analysis is important because it can help businesses and other organizations predict future patterns and behaviors based on historical data. This analysis empowers them to make more informed strategic decisions that can help them stay ahead in their respective markets.