When it comes to customer demand, Steve Jobs famously said, “Our job is to figure out what they’re going to want before they do.” Jobs’ position is that Apple needed to “read things that are not yet on the page.”

Demand forecasters attempt to do exactly that by using predictive analysis techniques to spin data about past and present sales into predictions of what customers will want in the future. But generating predictions is only the beginning. Demand forecasting success demands that those insights inform decisions about product direction, pricing, company expansion, hiring, and more—and that those interpreting results don’t fall into the trap of simply trying to deliver faster horses.

What Is Demand Forecasting?

Demand forecasting is the process of predicting what customers’ appetite will be for existing products or services, determining what adjustment you should make, and what new offerings will spark interest. But predicting what people will want, in what quantities, and when is no small feat. For example, timelines can be very specific, “Should we ship more chips on Friday than Thursday?” Or they can span a period of time, such as “between now and a month from now” or “over the course of the next calendar year.”

If the forecast is for a particular product sold by one company, as is often the case, then the demand forecast produces the same practical result as a sales forecast for that product. In other cases, demand forecasting will be more generalized, at a product-category level. Think, “How many luxury sedans will Americans buy this year?” Or more broadly, “How many automobiles?”

Demand forecasters use a variety of techniques to make their prognostications; which is best depends on the case or scope, as we’ll discuss. We’ll also touch on the underlying principles that make for success.

Key Takeaways

- Demand forecasting is used to predict what customer demand will be for a product or service, with varying levels of specificity.

- Accurate, timely forecasts are invaluable for both businesses and their customers.

- There are many different methods, both qualitative and quantitative, for creating and improving forecasts.

- Data, software, and analytics are increasingly crucial to get demand forecasts right.

- It’s not enough to produce solid forecasts; the best forecasters also communicate the strengths, assumptions, and limitations of their predictions.

Demand Forecasting Explained

Demand forecasting is a broad topic, and practitioners view it through a variety of lenses. Some think of it as using past and current sales data to estimate future customer demand. But that implies you can’t forecast demand for a new product, which is inaccurate. Meanwhile, economic forecasters might operate under the unstated assumption that demand forecasting is strictly about aggregate consumer demand, which ignores issues of importance to businesses trying to predict demand from its customers.

Confusion is understandable. The important thing is, regardless of context, demand forecasting is fundamentally about predicting what people are going to want, how much, and when.

For the rest of this article, the “demand forecaster” will be a business, individual, or team working on behalf of a business that cares about serving customers and growing the company. But we won’t make any blanket assumptions about what kind of data is available or on what level the forecaster is focusing, from single store to entire economy.

Video: What Is Demand Forecasting?

Why Is Demand Forecasting Important for Businesses?

Demand forecasting is important for businesses because identifying expected demand levels for your product or service means you can prepare. Forecasts don’t need to be perfect to be extraordinarily useful. Even directionally accurate forecasts can be a big help—simply knowing if demand will go down a lot, up a lot, or stay about the same gives businesses time to prepare, whether that means tightening their belts, expanding a production line, or staying the course.

Efficient inventory management relies, in part, on good demand forecasts. Insufficient inventory will not only leave customers dissatisfied and cost you revenue, but if it happens enough or on an important enough occasion for a customer, it can result in lost future business as well. But overstocking is costly in terms of storage and logistics and could leave some inventory unsold for a long time—or forever, resulting in a total loss of investment. So finding the right inventory balance is an indispensable aspect of a good demand forecast.

Demand forecasting is particularly important for growing businesses, especially small and midsize ones. Businesses of stable size and sales don’t face the same risks and variation in outcomes that a company trying to grow quickly must prepare for, and mistakes in forecasting are more easily absorbed by a larger enterprise than a small one. Improper scaling is a major cause of failure among startups, and flawed demand forecasting can lead to just that by not preparing the company to fill a big order or by causing it to scale too rapidly to meet demand that doesn’t materialize.

Either way, the bad forecast causes the company to eat up its runway—the number of months it can operate before running out of money—by burning through the cash it needs to survive.

What Factors Impact Demand?

Before you can predict demand accurately (detailed in the next section), you must first understand its drivers. They fall into two main categories: one that influences demand itself and the other that affects a company’s ability to predict demand. Although companies may not be able to control some of the individual factors that follow, they can position themselves to respond quickly.

Factors Within the Company’s Control

Marketing, increasing access to goods, and pricing are all examples of factors within a company’s control that can impact demand. For example, a new advertising campaign could bring in new customers. If a fast-food restaurant chain promotes the launch of a new sandwich, it will likely sell more soda and French fries as customers come in to try the sandwich.

A new-store opening should also raise your demand forecast, as a new set of customers will now have access, or at least easier access, to your products. Even a company’s presence that doesn’t explicitly “sell” can drive demand: Tesla sells cars online but found that opening physical showrooms increased demand in surrounding areas. In addition, product pricing also influences demand; the lower the price, the more apt customers are to purchase in greater quantities (and vice versa).

Customer Factors

Factors specific to current and potential customers also impact demand. Loyal customers tend to stay that way unless something happens to ruin their experience. Happy customers generate referral business and post positive reviews, the aggregate of which could boost demand, sometimes even driving viral growth.

Another important customer-specific factor relates to how well your offering solves a specific pain point—and whether potential buyers know that. If awareness of your solution is low, demand can grow significantly with effective marketing efforts.

Macro Trends

Broad trends and events that have nothing specifically to do with your company will affect demand. If customers start eating better, your fast-food business may face a drop in demand unless you start offering healthier options. If a global pandemic grinds business travel to a halt, it doesn’t matter how much customers prefer your airline over your competitor’s—they’re not flying. Macro trends can result from one-time events, like a pandemic; ongoing trends, like an aging population; and seasonal changes.

One-offs

Demand forecasting usually factors historical data in its predictions. But one-off events can skew data-driven forecasts. If your product saw a weeklong spike in sales after Oprah mentioned it on her show, the company probably doesn’t want to include that data to create next year’s projections because it’s not likely to happen again.

Likewise, a natural disaster that closed a main product distribution center probably won’t reoccur, so the related dip in sales should be smoothed out or otherwise discounted. One-off events can be forward-looking as well. If you know in advance that your brand will be featured on a television show or that you’ll be closing some stores for remodeling and training, you can incorporate those events into your forecast in a way that doesn’t change the overall trajectory of your projections going forward.

Factors Impact the Demand Forecasting Process

The process of forecasting involves gathering data, making educated guesses about the underlying real-world forces that produced that data, and then making some assumptions about how those forces will and won’t change in the future. No matter how sophisticated your data and quantitative methods are, within each step is a host of factors that can impact demand forecasts.

Data

You’ll never have perfect data to input into forecasts. If you’re lucky, you’ll have high-quality past sales data, but even that can only go so far because things change between when the data was collected and when you’re making your forecast. And sales data tells you about current and former customers, but not future customers.

Some companies go out of their way to get information on those prospective customers, from running marketing experiments to deploying focus groups and surveys. But not every company has great access to target customers, and not every set of target customers has the time or inclination to help. For example, selling new ideas to medical practices is notoriously difficult because busy physicians don’t typically take the time to participate in market research.

Underlying Forces

Once you have information, you’ll start synthesizing it, making observations, and identifying the patterns created by the real-world forces that produced your data. To generate a demand forecast, you’ll have to make projections using simplified models or procedures that require assumptions about those forces. If you use a linear growth model, but demand growth is actually lumpy, your forecast will be good only to the extent that those lumps work out to approximate a straight line when projected over time.

In many cases, models that work well over shorter periods grow increasingly inaccurate over longer time horizons, as the difference between the model and the underlying reality grows larger the further out you forecast.

Future Uncertainties

Even if you do have complete, accurate data and your model perfectly captures all relevant underlying forces, you still have to assume that the truths you’ve uncovered will hold in the “undiscovered country”—Shakespeare’s term for the future. That’s a big assumption. A lot can change, from a new competitor to unexpected positive press to a global pandemic to a viral moment on social media. And these changes aren’t easy to anticipate or describe. For example, your next cohort of new customers may have a lower propensity to recommend your product to friends than your previous cohorts, a common phenomenon because early adopters are often the most excited. Multiple subtle changes like that add up over time and change the trajectory of demand.

7 Demand Forecasting Types

Demand forecasting has a large umbrella that covers many different approaches, models, and formulas. The lion’s share of those are captured in one or more of the following six types of demand forecasting, which fall along three meaningful dimensions: passive versus active methods, short-term versus long-term horizon, and internal versus external focus from the business’s perspective.

-

Passive Demand Forecasting

With passive demand forecasting, companies create a “set it and forget it” forecasting process that’s largely or completely automated. The forecast incorporates historical and other data that the company collects, and projections are based on patterns and trends that have held up over time and are expected to continue doing so. This is not a good method for fast-growing companies or those in markets with a lot of activity and disruption. Purely or mostly passive forecasting is best for companies with stable sales and consistent growth in non-volatile markets.

-

Active Demand Forecasting

Active demand forecasting is at the opposite end of the spectrum from passive. In active demand forecasting, forecasts are customized, draw from information sources not easily assimilated by computers, use specialized knowledge, and pick statistical techniques appropriate to the situation each time without automatically defaulting to what was done previously. For fast-growing companies in dynamic marketplaces, some degree of active forecasting is necessary because past performance just isn’t enough to predict future results.

-

Artificial Intelligence Forecasting

Though they’re technically active forecasting, the advent of artificial intelligence (AI) and machine learning (ML) methods shows promise in making forecasts more adaptable. While it’s always wise to have a human involved in the forecast—and to intervene in the case of one-offs—passive demand forecasting may have a wider role to play going forward. To some extent, it’s already proliferating, as software is automating forecasting processes for companies that use an ERP system. Such use cases may have started out as passive but now might best be classified somewhere between passive and active forecasting.

-

Short-Term Demand Forecasting

Short-term demand forecasting is exactly what it sounds like, though different companies have different cutoffs for what qualifies as “short.” Usually, “short-term” means within the next quarter to a year, though it can be used much more granularly—for example, forecasting weekend sales based on a trailing year of trends, or forecasting sales for an upcoming holiday weekend based on the last three years of data for that weekend.

-

Long-Term Demand Forecasting

Long-term projections are measured in years and aren’t likely to be as accurate as short-term forecasts. Not only will some assumptions about the world eventually prove untrue, but internal business decisions will be made that no one saw coming, no matter how well decision-makers collaborated with forecasters.

Still, just because a forecast is not completely accurate doesn’t mean it isn’t useful. Long-term demand forecasts can be used for making roadmaps that posit where things might go under different sets of assumptions, and they help planners think through “what if” kinds of questions to prepare for a range of possible outcomes. In such situations, long-term forecasts only need to be a little bit accurate to help with planning.

-

Internal (Micro-Level) Demand Forecasting

In this case, “micro” doesn’t mean tiny; it’s the micro from microeconomics—the field of economics focused on the behavior of companies and consumers. These forecasts use firm-level data and data about a firm’s customers to predict demand for particular products and services. Data will often include historical sales, past and current financial metrics, and sales team projections.

-

External (Macro-Level) Demand Forecasting

Macro-level demand forecasting is useful to incorporate larger trends and more pervasive factors into an organization’s planning and projections. Is the industry growing or struggling? Are core customers getting wealthier or feeling the pinch of hard times? Is competition driving down margins, or is innovation adding value and driving margins up? Not every firm’s forecasters can answer all of the macro-level questions they care about. But there are other sources of this information, ranging from publicly available data sources to detailed sector forecasts published by research groups.

Macro-level forecasts of consumer demand can help guide decisions about business expansions or help weigh risks and trade-offs, such as whether to invest more in an existing product versus launching a new one.

Not every forecast or forecasting process will fall neatly into one of these types. Some will be best categorized as halfway between two types, while some may be expansive enough to include both ends of one or more types. There are also other dimensions along which one can classify demand forecasts and forecasting processes; qualitative versus quantitative is a common one, though the best forecasts often include both types of methods.

Benefits of Demand Forecasting

Demand forecasting has several key benefits. Not all of them will be realized by every company, but businesses that use demand forecasting well should enjoy several of the following returns on their investments.

Benefits of demand forecasting include:

-

Informed Scaling

For businesses focused on growth, scaling at the wrong pace is an enormous risk. Grow too slowly and you risk failing to meet obligations or customer needs, and those kinds of failures can be fatal to a young company. But growing too fast is expensive, burning cash and dramatically shortening a company’s runway. The pace of scaling has been a make-or-break factor for many a startup. Good demand forecasting can help reduce those risks and provide guidance when making decisions about how fast to grow operational capacity.

-

Budgeting and Financing

Accurately forecasting customer demand leads to budgets that help companies better prepare to meet those needs. How much will you invest in inventory, in expanding production, in new hires and equipment? These investment decisions must be made ahead of demand growth. For fast-growing companies, there may not be enough room in the budget to accommodate growth in demand unless that budget factors in a good demand forecast.

Demand forecasting that can help companies tell the difference between “this is a temporary spike” versus “this is our new normal” will help companies make decisions about borrowing or finding investors to finance growth. Robust demand forecasts can also help convince lenders and investors that providing financing is a good idea.

-

Inventory Management

Demand forecasting can produce substantial benefits for companies that manage inventory. This applies to traditional types of inventory, like consumer packaged goods; perishable inventory, like fresh fruit; experiential inventory, like rounds of golf; and even in some senses, services inventory. For example, consulting companies can use demand forecasting to make decisions about how to allocate human resources and whether to hire more people.

Specific inventory management benefits include:

- Reducing storage costs/cost of carry: Good demand forecasts help companies avoid ordering or producing too much, which costs money for the extra units and for storing them.

- Reducing backorders/stockouts: On the other end of the spectrum, good demand forecasts can reduce the chances of an out-of-stock event that results in unhappy customers, backorders, and in some cases, lost sales and customers.

- Efficient reordering and restocking: Short-term demand forecasting is especially useful in deciding when and how much inventory to keep in stock. Forecasted demand is a key input in calculating a reorder point. Even a few days’ advance notice of what might be an unusually busy or slow weekend can help businesses save money.

- Improved inventory positioning: As forecasts get more detailed, you can use them to make more precise decisions. A simple forecast showing company-wide sales is useful for senior management, but one that drills down into geographic variations in demand can help better position inventory in warehouses and stores, reducing the probability of localized stockout events while also lowering logistical costs like storage and shipping.

- Better revenue management: Not every business deals in physical inventory. If you’re selling nights in a hotel room or rounds of golf on a course, you’re likely using revenue management techniques to set pricing and promotions in response to demand. Demand forecasts are crucial for these businesses, and good forecasting can be the difference between success or failure of the entire business.

-

Better High-Level Decisions

Good demand forecasts can give business leaders insight into some of the most important decisions they make. Do we stop offering a product, launch a new version, or stay the course? Which new product space do we enter, if any? Which new geographic market do we enter, if any? All of these and more can be informed by good demand forecasting at both the micro and macro levels.

Challenges of Demand Forecasting

Demand forecasters face many challenges, ranging from trivia, “semantics in this field are often muddled,” to formidable, “predicting the future is hard”. Here are four common challenges that forecasters should be aware of because they’re often substantial — and surmountable, with the right preparation.

-

Data Wrangling

Ideally, all the data a forecaster needs will be high quality and easily accessible. But even if a company maintains all the needed data internally, it’s not always a simple task to get your hands on it. Data management tasks that should take hours can wind up taking weeks, especially in companies with legacy systems or that acquired or merged with other companies. Such organizations often have different groups running software systems that don’t talk to one another and don’t report data in combinable ways.

-

Selection Bias

When forecasters collect information from people, be they customers, experts, or sales teams, they rely on cooperation. If the people who choose to participate are systematically different from the ones who don’t, the forecaster may have introduced substantial bias into a key input. For example, customers are more likely to talk to a company if they’ve had a very good or very bad experience; experiences that were just acceptable or unmemorable don’t motivate as much participation. By the same token, salespeople may be more likely to share good predictions than bad ones, leaving the forecaster with an overly rosy picture of expected upcoming sales.

-

“Bad” Recordkeeping

When starting a demand forecasting effort, historical data is very helpful. But that data was probably not collected with forecasting in mind. The formats in which the data was recorded, along with choices about how the data was collected and stored, may prove incompatible with the demand forecasting technology. Worse, maintaining records and ensuring their accuracy may not have been a priority, especially if nobody knew at the time that the data would be needed for forecasting purposes. In some companies, it may be that errors were fixed later in a subsequent process, such as when making sure financial statements are completely accurate, but no one went back to update the original raw data.

-

Pivoting

Demand for a product is partially driven by how that product—and the company—is managed and presented in the market. Forecasting consumer demand for something specific requires not just understanding customer needs, but also having information about the company or companies serving those needs. If your company prides itself on being nimble and changes course quickly, it may be difficult to forecast consumer responses to such actions.

How to Forecast Demand: A Basic 6-Step Process

There’s no single universally agreed on way to go about demand forecasting, and different situations lend themselves to different processes. For example, data cleaning and validation can be a critical step in some forecasting processes, while other forecasters may get high-quality data from elsewhere in the company that’s ready to use immediately.

Organizational structure can make some kinds of coordination and information gathering easy, or structure can make getting data difficult or even impossible. And while considerations of politics and etiquette, such as getting buy-in, aren’t technically necessary to generate quantitative projections, in some organizations they’re crucial to success.

There are, however, some consistent features of successful ongoing forecasting efforts. The following six steps should apply to almost every demand forecast team, whether it’s building something simple for the first time or running a complex set of ongoing forecasts.

-

Identify the Goal(s) of the Forecast

Being clear about goals will provide guidance on many subsequent decisions. Without clarity on goals, the rest of a forecasting process’s design is just guesswork. The first aspect of defining a demand forecast’s goals answers the question, “What type of forecast are you creating?”

How will the forecast be used, and what should the output look like? What’s the time horizon, and how granular do the time periods need to be? How specific does it need to be with regard to attributes like geography? Is it better for the business to be conservative or ambitious? These questions help to shape the forecast’s process design.

Another thing to consider when formulating goals is specificity. How much confidence do you need to have in the forecast? What kinds of assumptions need to be tested as much as possible, and which are you comfortable not spending time and money on? Some managers might tell forecasters, “Be as accurate as possible with everything all the time,” but then not provide the time and resources to do so. Forecasters must be clear with themselves and stakeholders about trade-offs. Is it worth paying for an expensive dataset to improve a macro-level forecast? Is it worth surveying 1,000 people instead of 100 to get more specificity on preferences? These are the kinds of questions that can only be answered in the context of the forecast’s goals.

The ultimate answers for all of the above can be found by considering the question: What does the forecast need to do? If a company is thinking of entering a new market, it might need to know if demand is there, but knowing exactly what that demand is won’t help make the binary decision to enter or not any better than knowing “demand is big enough.”

-

Determine What Information You Have and What You Can Get

Demand forecasts require information. Sometimes that looks like mountains of quantitative data from databases, spreadsheets, and ERP systems; sometimes it looks like qualitative opinions from experts. And there are many types of information in between. Some forecasting processes rely exclusively or primarily on one source and make adjustments using other information. But before you can design a forecasting process, you need to know what kind of information is available.

Companies doing a good job at other data-heavy tasks are likely already tracking information useful for demand forecasts. Past sales data is a great start, especially if it’s high quality and contains information about specific times, locations, and/or customers. For macro-level forecasting, publicly available data in the United States can be a great start—many government agencies maintain and update freely available datasets.

For an ongoing forecasting process, however, you don’t need to stop at data that’s quick to find and free. You may be able to add data fields to the list of information the company tracks automatically, and then you’ll have augmented data going forward. This could mean adding to the information tracked by inventory management software, or maybe just adding a question to customer satisfaction surveys that are already sent out regularly.

Some information requires more effort to collect. For example, some forecasters have standing meetings with the marketing department or send out regular surveys to get outlooks from the sales team or macro-level predictions from experts. Meanwhile, there are whole companies in the business of providing datasets and reports on markets and consumer segments, and some companies find it worthwhile to buy such information to augment their internal efforts.

If you’re having trouble narrowing down what counts as a potentially useful source of information, you can come back to this step later, or over and over again, when you know more about what’s required to achieve your goals. While an up-and-running forecasting operation won’t need to do this step from the beginning every time, it’s useful to occasionally check in on the available information sources, as new resources become available over time.

-

Set and Execute on a Data Collection Plan

If it were just a matter of deciding to download data, this wouldn’t need to be a separate step. For companies that collect everything they need automatically, there isn’t a lot of work to do here once the key decisions are made. But collecting new kinds of data can be a whole endeavor unto itself. Running surveys and focus groups isn’t prohibitively complicated for many companies, but it’s not trivially easy, either, to create data-gathering processes that yield useful results with every cycle. Sometimes trial and error is the only way to know for sure if a survey question can predict consumer behavior in a useful way, while conversations with current and potential customers may be the best way to learn about the things you don’t even know you should be asking about on surveys. These efforts are often best coordinated with other departments in the company, as forecasting is not the only valuable use of such surveys and conversations—it may not even be the most valuable use. Coordinating on information gathering allows you to learn more while also sharing resources with other teams.

-

Apply Appropriate Forecasting Methods to the Information

Once you have the information you need, you can generate a forecast by applying one or more of the quantitative and qualitative forecasting techniques discussed in the next section. But it’s not always clear which method is best suited to your business and market. With quantitative methods, you can use “backtesting.” In other words, if you want to use this year’s data to predict next year’s demand, run a test of various forecasting methods using last year’s data to predict this year’s demand, comparing each to what actually happened. You may also consider testing two-year-old data to predict last year’s demand, if you have sufficient historical data to conduct two years’ worth of backtesting.

For qualitative methods, it’s more about thinking through how demand for your product or service changes and which people have the best information and insights to help you.

It’s important to note that, as you’re selecting which methods can get you to the goals you set in Step 1, you may find the need to revisit Steps 2 and 3. If you don’t have the proper information to determine what you decided was needed in Step 1, you need to get more information. It may be that the information you need is extremely difficult to get, is prohibitively expensive, or simply doesn’t exist, in which case your goals may need to change.

-

Interpret Results in Context

When you produce a forecast, numbers alone aren’t enough to convey the findings to all relevant stakeholders, especially if they’re not familiar with the methods and information sources involved. Forecasts are guesses—educated guesses based on data and math, but guesses all the same. Help your audiences understand the forecast better, and become more sophisticated forecast consumers, by including contextual information and answers to questions they may not know enough, or feel comfortable enough, to ask.

Your forecast report should include answers to all these questions: What do you, the forecaster, think will happen relative to what the numbers say? How precise do you think your estimates are? What’s the margin of error/confidence interval? What critical assumptions did you make, and how would the results likely change if your assumptions are wrong? A critical assumption worth sharing can be one that’s incredibly important to the forecast’s results or one that’s moderately important but more likely to be wrong. What information did you not include that may be important? What are the most likely ways you could be wrong? And, if you’ve been doing this for a while, how accurate have similarly generated forecasts been in the past?

-

Track Your Results—and Iterate

Keep track of what you predicted and what happened. Learn from every mistake, error, and oversight. Identify where forecasts failed due to completely unpredictable events. Be clear with yourself and stakeholders about how accurate your forecasts are and how much they can be relied upon to make decisions. And always look for ways to improve.

10 Demand Forecasting Methods

There are many different methods forecasters use to predict demand. Some companies may find that a single simple method, such as making a trend projection based on past sales data, is more than sufficient. Other companies may employ complicated mixed-method approaches that combine large data collection efforts with ML techniques at the core of quantitative analytics.

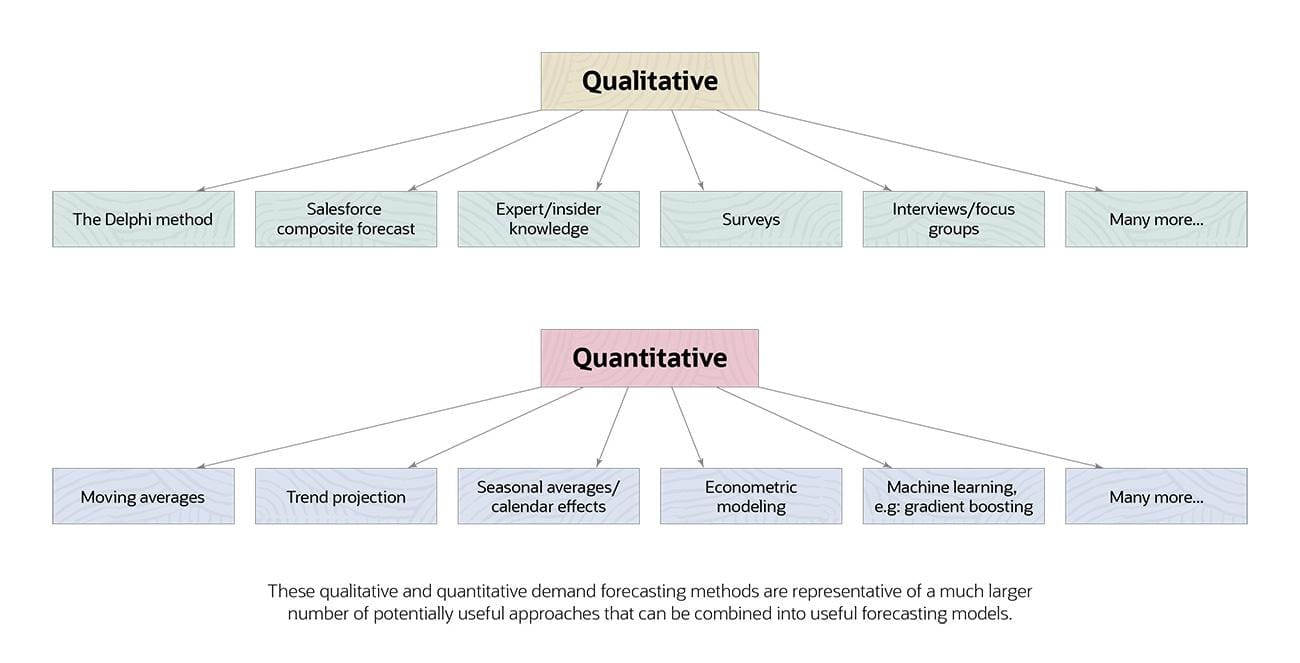

The following 10 demand forecasting methods, split evenly between qualitative and quantitative approaches, is a good representative sample of the variety of available techniques.

Qualitative Demand Forecasting Methods

It may seem counterintuitive to use qualitative methods to come up with a forecast that’s inherently numerical, even if some “qualitative” methods wind up producing quantitative numbers in the end. But forecasting from quantitative historical data alone works only as long as the future changes little from the past—and when was the last time that happened? Employees, experts, and customers have knowledge of events and plans that haven’t produced numbers yet, so despite great advancement in data collection and analytics technologies, qualitative methods continue to play a prominent role in demand forecasting. Here are five examples:

-

The Delphi Method

The Delphi method, or technique, is mostly used for macro-level forecasting. In it, a panel of experts work on a question, or parts of a larger question, independently and then share their work with one another as an input to create or revise answers. The Delphi method is not exclusive to forecasting, but it has been used successfully for forecasting since the 1960s.

-

Salesforce Composite Forecast

The theory behind this method is simple: Because their livelihoods depend on it, salespeople know what’s up. They talk to customers and potential customers all day, operate in every region where you sell, and know the intricacies of the business better than your data could ever capture. And, customers share plans and feedback with their account reps. To create a salesforce composite forecast, aka a sales forecast, simply ask your sales teams how much they realistically expect to sell over the time period you’re interested in, and then add up the answers.

Adjustments should be made for sales made through other channels and biases in sales forecasts; you’ll quickly learn which salespeople are forecasting with an overabundance of optimism. This method is common and useful enough that functionality for creating these polls is built into many inventory management platforms. If your company doesn’t have salespeople, this won’t work as described, though there may be a department whose personnel have comparable knowledge and could be similarly polled, such as a customer success or support team.

-

Expert/Insider Knowledge

Some factors that impact demand are known to certain people but don’t yet appear in datasets. Fashion trend experts may know in advance if next season is likely to be good or bad for the type of clothing you sell. Company insiders may know that your summer spike last year was unusually high due to good press and/or one big account that isn’t likely to repeat. The world is full of exceptions to patterns. The only way to incorporate that information into your forecasts is to talk to the people with the information and use sound human judgment in revising forecasts accordingly.

-

Surveys

These are useful tools for learning about customers, and many companies use them. The easiest way to find out if customers are going to buy more of your product or refer your services to a friend is often to simply ask them. It may not be immediately obvious how to translate survey-based scores into forecasts, but over time you can see how changes in scores correlate with changes in customer behavior. Surveys can provide advanced warning of spikes and dips in demand as customers report better or worse experiences.

-

Talking to Customers via Interviews and Focus Groups

While surveys are a good way to get a lot of customers to tell you a little about their thoughts and experiences, focus groups and interviews are a good way to get a smaller number of customers to tell you a lot. You can learn details about their experiences with your products and intentions about referring or repurchasing, as well as what else they or their friends might use to solve the problem your product addresses. They can reveal things you wouldn’t think you need to ask in a survey, and they can provide an early warning if your product is getting later in its lifecycle or if a competitor’s product is a bigger threat than you realized. Just be sure to follow best practices for market research when running focus groups and interviews, or you could wind up polluting your data with biased information.

Quantitative Demand Forecasting Methods

Quantitative methods are the core of most demand forecasting efforts. The simpler efforts are often almost purely quantitative, involving basic projections from past sales data with some human judgment layered on top to account for important factors not otherwise captured. The most sophisticated methods also use ML and AI techniques.

Here are five examples of quantitative forecasting methods ranging from simple to complex. All leverage historical demand data to project future demand.

-

Moving Averages

A moving average is a calculation that takes the mean of a number over a trailing time period. A seven-day moving average of sales would be the average daily sales over the past week. A seven-day moving average will smooth out spikes and dips common over days of the week, and a 28- or 35-day moving average will smooth out monthly cycles. It’s useful to use multiples of seven in order to make sure you have the same number of each day of the week in your average, otherwise intra-weekly patterns could introduce noise. Moving averages are inherently backward looking, but they help identify patterns and create visualizations and trend lines that are easier to process with the human eye. They also won’t move much based on one aberrant day, so shifts in a moving average are more likely to be meaningful than shifts in daily numbers.

-

Trend Projection, Curve Fitting and Simple Regressions

A lot of forecasting tools and advice talk about “trend projection” as a technique, but it’s really a family of techniques. There are lots of ways to project a demand trend, many of which require making an assumption about the shape of future demand. Ordinary least squares regression—aka, simple linear regression or best-fit line—is a common starting place; it assumes that the underlying trend is a straight line.

You can use different shapes than straight lines to do trend projections, but the results are very sensitive to the type of model you choose. For example, if you’re opening stores at a constant pace, a straight line may do a good job at forecasting your sales, as a steadily expanding footprint should drive demand growth in a linear fashion. High-growth startups, on the other hand, can see sales grow much more rapidly, and a polynomial projection might work better, not to mention finally giving you the chance to apply what you learned in middle school about quadratic equations. Products growing virally can have an even steeper growth curve and may be best modeled as exponential growth. Be careful about projecting too far into the future, though, as the “present trends continue” assumption is riskier to make with each passing month and year.

-

Seasonal Averages/Calendar Effects

The month of the year, the weather outside, and the day of the week can all impact demand. Likewise, holidays can produce demand shifts that trend projections and moving averages can’t predict. By considering calendar effects, you can get much better forecasts. This might mean knowing that jacket sales rise in the winter, especially in December as people buy Christmas gifts, and then plummet very specifically on December 25 every year as holiday shopping largely ends. This information won’t appear anywhere in the trailing 11 months, but by looking at the previous December you can get clues as to what will happen next December. By combining these known factors with other simple trend analyses, you can get some surprisingly good results. For example, knowing how this year’s fall compares to last year’s fall may tell you how this year’s December will compare to last year’s December.

-

Econometric Modeling

Typically used for more advanced regressions, “econometric modeling,” along with “econometric methods” and “econometric techniques,” are phrases that forecasters and business writers use to refer to a lot of different things. Econometrics is essentially how economists use statistics to test hypotheses and model data, and a lot of the techniques are forms of regression analysis. Many of the more advanced forms of regression-based forecasting fall under this heading, as do techniques used to test hypotheses about relationships between variables in data.

One famous use of econometric analysis involves measuring the effect on employment of raising the minimum wage by studying what happens on either side of a state line when one state raises its minimum wage and the other doesn’t. This approach can be adapted to study all sorts of policy changes, and businesses can use it to project what might happen if a policy from one state is adopted by another, or if a local policy is set to become a national one. By understanding how a new factor you can see coming will impact your business, you can then incorporate that understanding into your overall forecast.

Importantly—and despite the name—econometric modeling is not about applying economic theory to consumers to predict how demand will change. Applied econometrics is a purely data-driven pursuit that focuses on using regression analysis to isolate the relationship between factors. If you do a deep dive in econometrics, remember that as a forecaster, your job is to describe data and predict the future. While using econometrics to better understand the relationships between variables can be extremely useful for a forecaster, it is not the end goal.

-

Gradient Boosting and Other Machine Learning Tools

Gradient boosting is part of a family of ML techniques designed specifically for prediction tasks. It combines many simple models into one larger forecast. The idea is that while simple models are often wrong, they may be capturing important information. So intelligently using an ensemble of weaker statistical models can extract insights and create amalgamated results better than any of the models could do independently.

An advantage of this technique is accuracy, but a drawback is that it’s hard to explain why the model produces the results it gives. The larger point, though, is not to recommend gradient boosting in particular, even though it may be a great fit for some forecasters. Rather, it is to provide an example of how ML techniques are improving the demand forecasting toolbox. Research in ML and AI is progressing rapidly, and new techniques are being developed all the time for gleaning insights from large amounts of data that used to be intractably convoluted.

Demand Forecasting Models

Demand forecasting models are mathematical constructs that describe data and the relationships between variables in order to produce guesses about future demand. Models can be spreadsheets or equations or something else, but they’re specific to your business’s data, situation, assumptions, and the methods used to create them.

Businesspeople without statistics PhDs may feel justifiably confused on hearing “techniques,” “methods,” and “models” used somewhat interchangeably. Colloquially speaking, that’s usually fine—most of the time it’s easy to decipher what someone means from context. But when speaking technically about quantitative demand forecasting, and data analysis in general, there’s an important difference: Techniques and methods are what you use on data to generate models.

Here’s an illustrative example. A company has 100 stores and is opening new stores at the rate of one per month. Every store has monthly sales of $20,000; so, at time = 0, the company has $2 million in monthly sales ($20,000 * 100 stores). This trend is modeled very well by a straight line, so you decide that your method is going to be a linear trend projection, specifically an ordinary least squares (OLS) regression. An OLS regression will describe your data using a line. In the y = mx + b format you may have learned in school, where m is the slope and b is the y-intercept, if you use sales as “y” and time in months as “x,” the equation looks like this:

Monthly sales = $20,000 * Months since start + $2,000,000

That equation is the model predicting the company’s future monthly sales, which you generated using linear regression (the method). The model predicts that at the end of the first year, monthly sales will be $2,240,000 ($20,000 * 12 = $240,000 + $2,000,000).

Demand Forecasting Tools

Companies often use a combination of forecasting tools—ranging from focused applications to comprehensive enterprise systems—to analyze their historical data and market trends, identify patterns, and make predictions. The right combination will depend on the company’s size, industry, specific forecasting needs, budget, and existing systems’ integration capabilities.

- AI/ ML tools help forecasters analyze data sets too large or complex for traditional methods, often identifying subtle correlations between variables. These tools continuously learn and improve over time, making them particularly valuable for businesses with complex product portfolios or rapidly changing customer bases.

- Business intelligence (BI) platforms analyze and organize companywide financial and operational data into accessible visualizations that can be understood by stakeholders who don’t have a strong forecasting or data analysis background. These platforms automatically track and report key metrics, allowing forecasters to fold up-to-date trends and patterns into their demand predictions.

- Advanced analytics use statistical models to generate regression analyses, time-series forecasts, and scenario models. Forecasters can use these techniques to test different assumptions, conditions, and variables and to predict results. These models typically provide confidence intervals and validation measures that instill faith in a forecast’s reliability and potential variations.

- ERP systems connect real-time inventory management, production planning, and sales data to eliminate data silos and communication delays that can compromise forecast accuracy and timeliness. This integrated approach is especially valuable when manufacturing companies are coordinating production schedules with anticipated demand.

Demand Forecasting Examples

Demand forecasting is used in every major industry. In some sectors, like consumer packaged goods, the forecasting challenge is fairly straightforward and the time horizon doesn’t need to be long for a forecast to be extremely useful. If you’re a farmer deciding between growing corn and soybeans, you really care about the price you can receive for each, but that’s a function of what the demand will be like at harvest time. In an extreme case, makers of Scotch whisky are getting started on beverages today that won’t be sold for a decade or longer since aging whisky for 12 or 18 years before bottling is common.

Hotels and airlines invest heavily in demand forecasting, but since they don’t have much day-to-day control over the quantity of available rooms and seats, respectively, they respond by changing prices to rise and fall with what they think the demand will be. You can tell if a hotel caters mostly to business or leisure travelers based on whether it’s more expensive during an average week (business travelers) or an average weekend (leisure travelers).

Producers of expensive durable goods tend to find demand forecasts especially helpful. Major economic trends can be quite informative in predicting how many people might want to buy a car or a dishwasher next year, so both micro- and macro-level forecasts are useful. The time horizon is long enough with yearly cycles that these companies can’t just look at last month’s sales, but close enough so that there’s a reasonable chance of accuracy—unlike our distiller friends in Scotland.

The biggest challenges are often not in executing a demand forecasting strategy or method, but in picking the right approach to a situation. The following examples illustrate common demand forecasting challenges and how they were resolved.

Example: Forecasting Demand During a Pandemic

A business has been steadily expanding its retail footprint for years, and linear trendlines, with slopes modified to reflect specific plans for expansion, have done a good job of forecasting demand. In recent years, however, the entire industry has seen a sharp, sustained rise in online purchasing, so results from the company’s brick-and-mortar outposts are no longer a reliable predictor of sales.

The company wants to forecast each retail channel’s future performance but doesn’t know if its long-term historical data will speak to customers’ rapidly changing behaviors. The company therefore decides not to rely solely on quantitative analysis of internal data as it has in the past. It adds the Delphi method this year, enlisting a panel of experts to help think outside the box and provide direction on what might happen next.

Example: Smoothing Wild Demand Swings

A company that sells cold-weather sports equipment and clothing is experiencing very volatile sales. Day-to-day and month-to-month sales can rise by 300% and then fall by 80%. It wants to use forecasts to improve planning for years to come, but how do you plan for demand that swings so wildly?

While any set of historical data is going to contain variance, there may be predictable patterns that can help an analyst cut through the noise. The company decides to employ a combination of quantitative methods designed to smooth out and explain the variation. The first method is moving averages. Using a seven-day moving average in sales data can mute the noise created by effects that depend on the day of the week. Every day’s datapoint becomes an average figure that incorporates one of each day of the week. Effects driven by the differences between weekends and weekdays are no longer part of the variation.

Next, the company seasonally adjusts the data, which dampens the impact of a busy holiday season due to gift giving versus a slow summer due to the weather making their products temporarily unusable for most of their customer base. From there, the company can apply other projection methods with much more confidence in the resulting annual forecasts.

Demand Forecasting Best Practices

The most insightful forecasts prioritize data quality and consider diverse stakeholder needs to make sure predictions directly support broader business strategies. By following the structured methodology, companies can consistently create reliable predictions.

-

Use Both Qualitative and Quantitative Approaches

Take into account both quantitative “hard” data and qualitative “soft” insights to assess expected market shifts, competitor strategies, or consumer preferences. Detailed data builds a strong foundation for forecasting, but expert opinions from sales teams, industry specialists, economic experts, and customer-facing employees can bring real-world context into forecasts that validate or add nuance to forecasts that data may miss.

-

Maintain Consistent and Complete Data

Establish clear data governance practices to standardize how departments collect, store, and process information. Regularly scheduled data audits also help identify and address any discrepancies or gaps that can skew forecasts, such as duplicate entries, missing values, or inconsistent formatting. Document anomalies or one-time events that might distort historical patterns, adjusting forecasts and data protocols accordingly to minimize future inaccuracies.

-

Reduce Manual Errors With Automation

Automated systems do away with much of the manual entry—and subsequent calculation errors—than when handled manually, thereby giving analysts more time to interpret forecasts and execute strategies. Integrated forecasting software automatically aggregates information from multiple sources and normalizes data with consistent calculation methodologies, flagging potential anomalies for review. Furthermore, automated reporting capabilities reduce translation errors when generating reports and communicating their findings to stakeholders.

-

Align Forecasting With Strategic Goals

Define how forecasts will inform specific business decisions, such as inventory investment, capacity planning, or market expansion initiatives, before beginning the forecasting process. This alignment keeps forecasting efforts focused on critical metrics and timelines that drive tangible business outcomes rather than unusable insights, such as expected sales for discontinued products or long-term demand for a soon-to-be-closed retail location.

-

Collaborate With Different Teams

Incorporate diverse, companywide perspectives throughout the forecasting process—sales teams for customer purchasing patterns, marketing for upcoming promotions, operations for supply constraints, and finance for market conditions, for example. Regularly scheduled collaborative meetings provide forecasters with the context they need to make deeper, more accurate predictions and can help build interdepartmental trust in forecasts, increasing buy-in and use.

Demand Forecasting Trends

The main trends in demand forecasting, now and for the foreseeable future, emerge from information technology. The main thrust of these trends is clear: more data and more computer analysis of that data, bolstered by more intelligent, collaborative, and powerful tools. Two points to keep in mind when forecasting demand alongside these trends are:

- Good data management and software are more important than ever.

- Don’t neglect human factors and inputs because computers can’t know things that people know but that aren’t in the data yet.

Our ability to collect data has been rising rapidly for years, as computers became ubiquitous and data storage costs plummeted. Companies now have software systems to track more than ever before, and with cloud storage, data warehouses, and data lakes, they can keep records indefinitely. Hardware systems have added to the data troves, as companies can track locations better than ever with GPS and RFID technology and even use software-enabled cameras to automatically check on inventory and operations.

At the same time, advancements in ML and AI are giving people the capabilities they need to process that growing sea of information. We have access to statistical techniques that would be impossible to do by hand even once in a lifetime but which we can now run daily on vast amounts of data. AI and ML have become more accessible and responsive over time, unlocking new ways to customize analysis and learn not just what the data can predict but how each factor contributes to every prediction. Companies can use these tools, often trained on internal data, to run more complex what-if scenarios than traditional methods, creating sophisticated digital twins for specific processes. This advanced modeling helps forecasters predict demand more accurately and assess how different demand levels will impact the supply chain, revenue, workflows, and more.

How to Choose Demand Forecasting Software

Choosing demand forecasting software is primarily about finding a good match for your business. If you work in an industry with specific software tailored to your needs, like hotel management, you may want to opt for something customized to the questions and data you’re most likely to have. But whether you choose a generic system or a product designed for a specific industry, you want software that’s appropriate to the size of your business, can scale with the business’s ambitions, and can integrate with other data sources and tools.

ERP systems that provide inventory management services also have demand forecasting capabilities. Organizations that use ERPs may want to make sure they can easily export relevant data to other analytical systems because not every system has everything you might need built in. A system that helps with data collection, such as by hosting a sales forecast poll, may be a big asset, as well, if that’s something you intend to do.

Whatever software is chosen, it’s important to know what’s “under the hood.” Don’t treat forecasting software like a magic box. You need to know the methods being applied so you can understand the inputs and assumptions being used. That way you can think intelligently about what’s missing and what might happen if assumptions turn out wrong. You’ll also be a far more effective communicator and decision maker, or adviser to decision-makers, if you understand what’s going into forecasts.

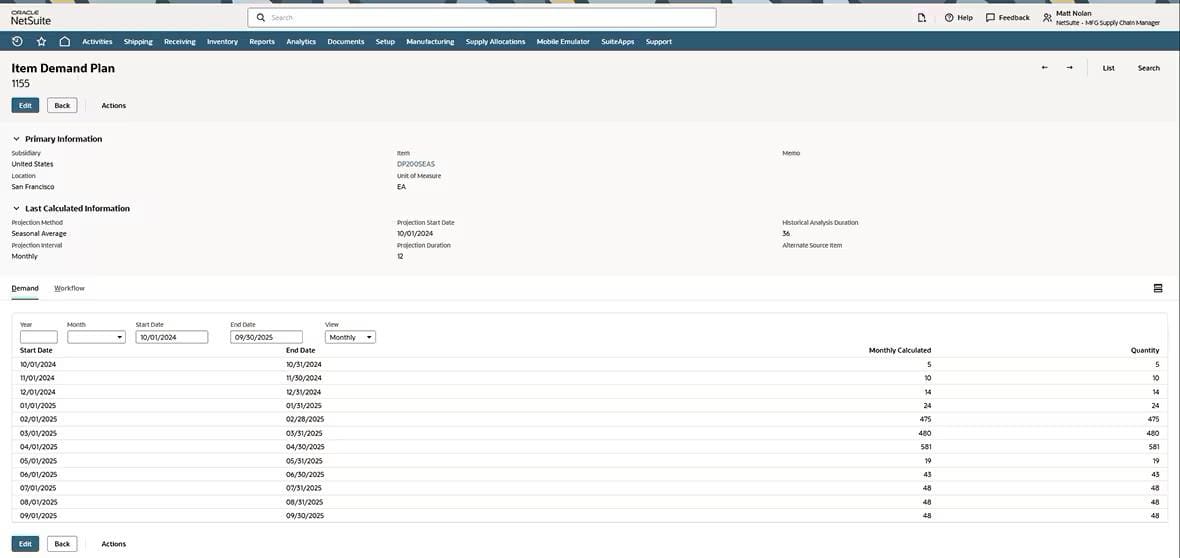

Make Demand Forecasting Easier and More Accurate With NetSuite

NetSuite Demand Planning can make forecasting easy by integrating with NetSuite’s inventory tracking and management functions. A lot of the data needed for a quantitative demand forecasting approach will already be in the system, which can automatically perform many of the methods described in this article.

Another key advantage is that NetSuite’s ERP platform can be tailored for a small business and then scale up as the business grows. NetSuite’s demand forecasting system also makes sales forecasts easy by providing an interface for salespeople to enter information that goes straight into the forecasting system. Good demand forecasting helps businesses meet customer needs while operating more profitably.

NetSuite’s Demand Dashboard

Demand forecasting is an important business function that helps companies see into their futures. There are many different types of demand forecasts, and even more methods a forecaster can use—or combine—to create high-quality forecasts. But every approach requires gathering information and applying sound mathematical methods to take what we know today and predict what customers will want in the future.

Demand Forecasting FAQs

What are demand forecasting methods?

Demand forecasting methods are the specific techniques used to predict demand for a product or service, or category of product or service. They include purely quantitative methods, usually based on historical data, as well as qualitative and mixed-method approaches, such as surveys and expert opinions.

What are the types of demand forecasting?

Demand forecasting is often divided into types along different dimensions. These dimensions can include how much human involvement there is in generating the forecasts (passive versus active), what kind of data and methods are being used (quantitative versus qualitative), the time horizon being examined (long term versus short term), and more. You can also get more granular and define types by specific methods used. There are as many “types” as there are useful distinctions to make between forecasting processes.

Why is demand forecasting important?

Demand forecasting is essential for business planning, especially when companies must decide how quickly, or slowly, to scale. When scaling, a company must meet increased demand, and demand forecasting becomes a crucial tool for avoiding costly mistakes. For example, having too much inventory on hand is expensive and ties up resources, while not having enough leaves customers unhappy and results in potential revenue loss.

What are the basic steps of demand forecasting?

Different forecasting processes will have different numbers and types of steps, so there is no broad consensus answer to this question. But most good frameworks include some version of the following steps: (1) identifying the goal of the forecast, (2) figuring out what information you have and can collect in service of that goal, (3) deciding which pieces of information are worthwhile to gather and include, (4) applying appropriate forecasting methods to that information (though the methods will inform which information you gather, so these last two are interdependent), (5) interpreting the results in context, and then, finally, (6) keeping track of results so you can test their accuracy and improve going forward.