Healthcare financial professionals are rewriting the playbook for how to forecast demand and care-delivery requirements in an increasingly complex and uncertain market. COVID-19 tore up the old playbook. Healthcare CFOs are now contending with a long list of enduring and emerging challenges: staff shortages, industry consolidation, supply chain disruptions, resurging patient volumes, cost pressures, proliferating care-delivery models and ongoing regulatory change — not to mention the potential for sudden, unexpected spikes in Healthcare needs.

Better, more dynamic forecasting can act as a key differentiator for physician practices, health systems, hospitals and other Healthcare organizations, supporting executive decision-making to improve their financial performance while they deliver high-quality Healthcare.

What Is Healthcare Forecasting?

To project patient demand, disease trends, costs and other variables, Healthcare financial professionals make forecasts by modeling potential outlooks and scenarios using multiple data sources. Healthcare forecasting can improve a provider’s planning and budgeting for patient volume, care-delivery expenditures, staffing and the other fundamentals of running a Healthcare organization.

No CFO can predict the future, but forecasting can help to anticipate the possibilities and plan for different scenarios. Ideally, this means that, “regardless of what the future looks like, you’re on it,” said Financial Modeling Institute Executive Director Ian Schnoor in a recent podcast. “You can manage it, you can help control it and you can bring it to the rest of the team’s attention.”

Key Takeaways

- Healthcare financial professionals are transitioning away from relying heavily on forecasts based on historical data.

- They are enhancing forecasts with real-time data from inside and outside their organizations — and forecasting more frequently during the fiscal year.

- Centralized data collection and aggregation in Healthcare organizations provide the foundation for modern forecasting.

Healthcare Forecasting Explained

Forecasting fulfills many needs in healthcare — not just for financial management but also to help clinicians decide on a course of treatment or to inform government agencies that are setting public health policy. This article focuses on financial forecasting for efficient and effective healthcare operations and administration.

Financial forecasting works much the same in healthcare as in any industry, as a foundation for managing supply and demand. The differences in the healthcare industry include the volume and complexity of data to be analyzed, the current state of forecasting and the high stakes of patient outcomes.

Consider the wealth of data being tapped during the ongoing transition of patient information from paper charts to electronic health records. This huge volume of information is just one of the often-siloed sources of data that contributes to healthcare forecasting hardships, along with very large and sometimes confusing financial models. Many other sources of data and complexity add to those challenges, including:

- Clinical data, such as length of stay and readmission rates.

- Finances, covering revenue, expenses and cash flow.

- Patient volume and its implications for staff time and room availability.

- Insurance claim data, including frequent changes to Medicare reimbursement rates and their potential impact on costs.

- Cost accounting, amid inflation.

- Demographics, such as population age and prevalence of chronic diseases.

- Regulatory changes, in everything from sterilization standards to data privacy rules.

High data volume and complexity are the main reasons why healthcare providers lag behind other sectors in using financial forecasting. Other reasons range from tight budgets to a conservative culture that defers change to avoid harming patients or risking legal liability.

The Importance of Forecasting in Healthcare Financial Management

Forecasting and financial modeling can help healthcare providers make more confident decisions and deliver quality care efficiently. That’s essential to healthcare financial management, because both operational and financial performance are under stress today in the sector.

In 2023, the U.S. spent an estimated $14,570 per person on healthcare, according to the Peter G. Peterson Foundation—more than any other wealthy country. Yet, the U.S. industry generally performs worse by common measures, such as life expectancy, infant mortality and diabetes management.

In addition, healthcare providers’ operating margins are generally slim. For instance, Kaufman Hall’s National Hospital Flash Report cited a 1.3% year-to-date median operating margin in July 2023. Among the report’s recommendations: “Collecting data and using it to inform process improvement: Hospitals need to quantify lengths-of-stay and related data, and more importantly, use this data to make change.”

The story is similar at physician- and hospital-owned practices, such as primary care medical groups. Nearly nine in 10 practices have seen their year-over-year operating costs increase in 2023, according to the Medical Group Management Association (MGMA). Advice from the association includes equipping practice decision-makers with dashboards of routinely updated management metrics to inform operational and strategic decisions.

4 Key Healthcare Forecasting Strategies

Until recently, healthcare financial professionals have leaned more heavily on historical data when forecasting. Now they are expanding their capabilities to use dynamic forecasting so they can more rapidly adjust plans, thanks to real-time data and insights. Finance departments are best able to evolve in this direction by synchronizing planning and budgeting within enterprise resource planning (ERP) systems. They use four key forecasting strategies: driver-based planning, rolling forecasts, scenario planning and zero-based budgeting.

-

Driver-based planning:

Driver-based planning connects financial forecasts to operational drivers within a framework that is defined by management’s strategic objectives — an important improvement over the separate reporting of financial and operational information. It also relies more on value-based drivers — both internal and external to the organization — instead of trying to adhere to a multitude of static annual budget line items.

Basically, driver-based planning is a cause-and-effect exercise in which analysts look closely at financial statements and ask, “What’s driving this line item?” For example, internal healthcare revenue drivers might include measures of billing and collections efficiency. External cost drivers could include analysis of wage competition among healthcare organizations for physician recruitment.

Driver-based planning lays the groundwork for rolling forecasts, scenario planning and, overall, more rapid assessments of the impact of internal and external changes on financial performance.

-

Rolling forecasts:

Since 2020, the Healthcare Financial Management Association (HFMA) has been documenting healthcare providers’ pivot away from static forecasting that is based solely on historical budget data. That was the year when hospital revenue streams were disrupted by sudden suspensions in elective procedures, among other financial jolts to the healthcare system. In the past few years, rolling forecasts have gained ground in healthcare finance departments as a way to address the ever-increasing pace of change.

Conventional wisdom now has it that annual budgets — and the assumptions that went into them — are already outdated by the time they’re created. Instead of basing operations on a single, unchanging forecast for the year, rolling forecasts enable healthcare organizations to retune their assumptions and resource allocations closer to real time.

Here’s roughly how rolling forecasts work:

- Start with historical performance.

- Add internal and external financial drivers to the forecast, from the driver-based planning process described above.

- Make financial projections for a set time frame, such as the coming 12 to 18 months.

- Revisit these projections on a schedule, such as every month.

- Compare actual performance at the end of each month, for example, and adjust operational plans and resourcing accordingly.

- Repeat the process according to a schedule, such as monthly.

Some healthcare CFOs are using rolling forecasting to complement their annual budget processes or only for some functions, while others are using it as a wholesale replacement.

-

Scenario planning:

Scenarios are possible futures that could impact an organization. Scenario planning identifies these possibilities, analyzes each one’s potential impact and develops contingency plans for managing any related opportunities and challenges.

Advisers at Gartner recommend clarifying the implications, risks and opportunities of plausible scenarios and then adjusting strategy, goals and operations. Then, they say, “translate these into action plans by deciding which levers (e.g., people, processes, systems, budget) you should pull to meet business needs, manage risks and capitalize on opportunities.”

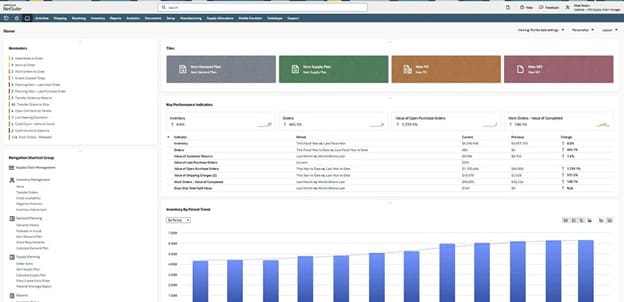

This NetSuite dashboard provides a centralized view of key business metrics, including reminders, quick access tiles, inventory levels, order status, purchase order values, work order completion, and an inventory trend chart. -

Zero-based budgeting:

Typically, each year’s budget for the functions within an organization is based on the one from the previous year, plus an incremental increase. But zero-based budgeting starts each year from scratch, requiring every function to justify all needs and costs, starting from a “zero base.”

Zero-based budgeting is a controversial technique to be approached cautiously, in part because it involves a very time-consuming analytical process of justifying both old and new expenses. But it may be a more effective approach for identifying cost drivers than traditional budgeting. Some organizations use it only in one or more selected functions at a time, if at all.

Healthcare Forecasting Challenges

Healthcare CFOs are increasing their investments in strategic planning tools and predictive analytics. But many are still hindered by disconnected systems and outdated processes, including a stubborn reliance on spreadsheets, which compounds the forecasting challenges described below.

- Data inaccuracy: Ninety percent of healthcare executives reported that

they had lost revenue

because of inefficient data use, according to a survey by Intelligent Medical Objects

(IMO), a healthcare data

company. For the finance team, aggregating data from different departments can become an

exercise in parsing

input that is outdated, incorrect, incomplete, duplicated or inconsistent in format and

definition.

Version-control issues also arise when forecasting relies on a manual process of using

spreadsheets and

exchanging them via email.

Mistakes like these can lead to inaccurate financial forecasts and faulty decision-making, not to mention cost increases. From the CFO’s perspective, data aggregation and verification are among the most time-consuming tasks in forecasting. Data needs to be accurate and transparent, from a centralized source, so that the finance team can easily collaborate with other parts of the company.

- Rapidly changing healthcare landscape: The pace of change in the healthcare industry is matched only by its complexity, with aging demographics, rising costs, industry consolidation and a host of other factors coming into play. CFOs and their organizations need to continuously map and remap responses to multiple intersecting challenges. The outcomes of their scenario planning exercises could include strategies for cost-cutting, service line rationalization, new staffing and compensation, among other options.

- Regulatory changes and uncertainty: Healthcare is highly regulated, of course, and that’s unlikely to change anytime soon. This outlook promises continued regulatory uncertainty, which surveyed CFOs identified as a top threat. The implications for financial forecasting can be significant. Consider a single example: the Value in Health Care Act of 2023. If passed, it would reinforce Medicare’s move to incentivize value-based care over a fee-for-service model. The bill could impact healthcare finances in many ways by changing financial incentives, payment models and risk management, while increasing the need for data and analytics. A 2023 HFMA survey of finance executives found most of them unprepared for such a fundamental shift. More generally, ongoing scenario planning for regulatory change needs to consider the possible financial impacts of decreased reimbursements, increased compliance costs, new care mandates and other changes.

- Technology complexity: “It’s no secret that healthcare provider organizations have some of the most complex technology infrastructures of any industry,” IMO states in its report. So, while technology is part of the solution for aggregating and analyzing data for healthcare forecasting, it can also be part of the problem. Fully 98% of IMO survey respondents said their organizations must improve the way they leverage healthcare data. But 84% cited difficulty integrating the multiplicity of systems and vendors they use. HFMA identifies more technology challenges: determining cost, predicting implementation outcomes based on a fixed cost and the length of time healthcare organizations take to decide on implementations. All these challenges are compounded by today’s shortage of IT and data analytics professionals. CFOs are taking these challenges head on. In a Deloitte survey of healthcare CFOs, nearly 60% said they plan to increase capital expenditures on data and interoperability tools.

Healthcare Financial Forecasting Best Practices

As healthcare forecasting evolves to meet the needs of a changing environment, adopters of innovative methods, such as driver-based planning, rolling forecasts and scenario planning, should incorporate the following best practices:

- Understand historical data: While forecasting should not be based solely on historical data, it still plays a crucial role. Historical data can provide baseline comparisons, for example, or feed into scenario planning by supplying evidence of how a particular driver affected finances in the past.

- Use the right forecasting models: Forecasting needs to be timelier than merely forwarding a projection of historical performance. It’s not realistic to expect past trends and patterns to continue to be unaffected by changing business, policy and technology trends. For example, telehealth, home patient monitoring and other trends have recently contributed to rising unpredictability in demand for emergency room visits, doctor’s office appointments and other care metrics. That’s why rolling forecasts are so well suited to the healthcare sector.

- Consider external factors: To be meaningful, rolling forecasts need to be informed by value-based drivers reflecting changes in external market forces, as well as internal operational changes. For instance, inflation is bound to have an impact on costs, but how much? Forecasting and plotting scenarios for different inflationary levels can help healthcare providers plan for high, medium and low inflation. The same goes for real-world medical data, such as epidemic curves.

- Regularly update your forecasts: Healthcare providers adopt rolling forecasts as a moving window that resets each month or quarter so that it always covers the following 12 months or more. This keeps them on top of current developments inside and outside their organization. And, in fact, some organizations reforecast more frequently. Healthcare CFOs have many reasons for building more timeliness and agility into their forecasting and planning. For example, healthcare companies with complex debt structures should use rolling forecasts to closely monitor cash flows. Otherwise, they may fall out of compliance with loan covenants, such as maintaining a certain days-cash-on-hand level — and may default on their loan.

- Involve multiple departments: Financial forecasting should draw on people and data from across healthcare organizations, but it’s often viewed as burdensome by all but those in the finance department. Old-school annual planning processes using spreadsheets have proved particularly laborious, taking three or more months to complete. And, in the end, many department managers have found little value in them. More timely and automated forecasting can accelerate and streamline the process, helping to ease the burden on departments. At the same time, relying on more real-time and real-world data can inject forecasting with greater value for departments, making them more eager to engage.

- Use technology: CFOs can use technology to their advantage by connecting operational and financial data for forecasting that can, in turn, be used to help achieve key performance indicators across the organization. Linking their budgeting and planning software with their organization’s ERP system automates and synchronizes data so that any changes made to numbers in the system are instantly reflected in reports and dashboards, and the current business situation is always clear to all. Some healthcare providers are taking the next step, moving toward using artificial intelligence (AI). A survey by MGMA showed four out of ten medical groups have added or expanded their use of AI in 2024, with many using it for scribing and diagnostic technologies. At the other end of the spectrum, many healthcare organizations’ finance and other departments still run on spreadsheets, which hinders the aggregation and analysis of data for forecasting and planning.

- Maintain transparency: Synchronizing operational and financial data by linking budgeting and planning software with an ERP system means that data from across the organization is entered in one centralized place. This creates a single, agreed-upon version of information that is kept up-to-date and made visible to all who need it.

- Train staff: Staffing is a concern in many finance departments, due to widespread shortages. And while adopting automation and centralizing data can ease some of their work burden, staff may resist the changes and cling to old ways of working with spreadsheets and email. CFOs can encourage more positive change by allocating additional resources for training and upskilling employees to adopt more efficient, effective tools.

- Validate your forecasts: Finally, to improve forecast accuracy, the finance team should regularly compare and analyze actual versus projected results and then refine forecasts as needed. If a forecast is not accurate, the assumptions that went into it should be revised and the forecast updated.

Revolutionize Your Healthcare Forecasting With NetSuite

In an environment of rapid and accelerating change, hard-to-predict swings in demand and ongoing regulatory uncertainty, healthcare organizations must be able to produce financial forecasts fast and often, using the best and most recent data. NetSuite’s cloud-based ERP system for healthcare and life sciences gives these organizations the data visibility, transparency and tools they need to tame that complexity and to plan with agility. It enables them to conduct forward-looking, actionable forecasting that helps them operate more effectively in an ever-changing environment. NetSuite’s role-based management dashboards provide real-time access to data for better decision-making from the finance team and their peers across the organization.

Modern financial forecasting and planning in healthcare no longer involve looking in the rearview mirror. It’s not enough to set a fixed annual budget, based on historical data and rapidly aging operational assumptions, and then stick to that budget for a year without adapting to the changing world. Healthcare financial professionals are evolving toward more real-time forecasting and more agile planning, and essential new modeling techniques and data technologies are helping them along in their journey.

Healthcare Forecasting FAQs

What are some of the roles that forecasting plays in healthcare financial management?

Forecasting helps healthcare providers make more confident decisions about improving their organization’s performance and delivering high-quality healthcare. Examples include understanding and managing the cost impact of regulatory change, the revenue implications of increased competition and the cash-flow impact of supply chain disruption.

What types of data are used in healthcare financial forecasting?

Various internal and external sources must be regularly mined to produce accurate, up-to-date financial forecasts for healthcare organizations. These include data from patients’ electronic healthcare records; clinical data, such as readmission rates; financial data, including revenue, expenses and cash flow; patient volume; insurance claim data; economic statistics, such as the rate of inflation; demographic information, including population age and chronic disease prevalence; and the detailed requirements of ongoing regulatory changes.

How often should healthcare financial forecasts be updated?

The timing of healthcare financial forecast updates should be determined by market volatility in a given provider’s domain. But a typical cadence is once per month or quarter, looking across the coming 12 months on a rolling basis.

What are the methods of forecasting in healthcare?

While the healthcare industry has typically leaned heavily on projecting historical data forward when conducting forecasts, modern forecasting uses more real-time data, cause-and-effect analysis of financial drivers and “what if?” analyses — in other words, rolling forecasting, driver-based planning and scenario planning.

Why is forecasting important in the healthcare industry?

The healthcare industry values forecasting to help manage the significant volatility impacting many aspects of their operations and finance, including staff shortages, industry consolidation, supply chain disruptions, resurging patient volumes, inflation, proliferating care-delivery models and ongoing regulatory change. Healthcare organizations also try to prepare for any potential future spikes in healthcare needs.

What are the three types of forecasting?

Forward-looking healthcare organizations increasingly use three techniques for forecasting and planning: driver-based planning, rolling forecasts and scenario planning. The three work best together, with driver-based planning drilling down on the root cause of financial results, rolling forecasts setting a more accelerated cadence for conducting forecasts, and scenario planning analyzing various future possibilities to manage their potential impact on performance.