Operational metrics and key performance indicators (KPIs) allow a business to measure the status of its operations and strategies. Learn which KPIs to track and what they can tell you about the health of your operations.

What Are Operational Metrics?

Operational metrics are indicators that measure a business’s performance. These numbers provide a snapshot of key processes like production or sales calls.

Operational metrics tracking shows how well the company performs these processes. The data may measure efficiency, productivity or quality. For production, this might be units manufactured per day or week. For sales calls, it could be calls per hour per employee. For customer service, it could be how often issues are resolved on the first attempt.

Key takeaways:

- Businesses need both operational metrics and KPIs.

- Evaluate operational performance by comparing KPIs to objectives.

- Dashboards make it easy to see how efficiently a company is functioning.

What Is an Operational KPI?

An operational key performance indicator (KPI) shows how well a company executes its day-to-day work.

Often, a company tracks operational KPIs in real time. Performance on these KPIs affects the company’s competitive position and profitability. Operational efficiency KPIs provide a way to determine if a company is controlling costs and not wasting time, materials and labor, which is at the heart of operational efficiency.

Difference Between Strategic KPIs and Operational Metrics

Metrics and KPIs are often conflated, but they’re not the same thing. Metrics refer to any data a company watches to understand its performance and perhaps improve. KPIs are a specific category of metrics that are of particular interest to the organization, and they usually have clear goals, which is not always the case with metrics. All KPIs are metrics, but not all metrics are KPIs.

More specifically, operational metrics give nearly real-time feedback on the business, while strategic KPIs show progress toward big-picture goals over time. Businesses need to watch both. Operational metrics are often tied to processes that are critical to a company keeping its doors open and remaining solvent. Certain operational metrics could be tied to strategic KPIs that upper management and executives will pay attention to. They could include hiring workers, producing goods and delivering orders to customers.

Strategic KPIs shift more slowly as a company executes and shifts its long-term strategy. Changes may only become visible over quarters or years.

Why Tracking Operational Metrics Is Important

Tracking operating metrics is critical for businesses. They show how core operations are functioning as they happen. The most important KPIs for an operations department can reveal major problems so a company can quickly correct them.

If trends are negative, leaders can dig deeper to understand why. Then they can make changes to turn the issue around. If the operational metric is positive, operations managers can do more of what works. That can make the business more efficient and profitable.

How to Evaluate Operational Performance

Use a four-step process to evaluate operational performance.

- Pick meaningful KPIs for operations. You can gather them into a dashboard of operational measures for an instant view.

- Identify your current performance.

- Compare them to your goals. Does this performance meet your objective?

- If the answer is no, dig deeper. Find out which aspects of the operation are underperforming.

Andy Neely, author of Business Performance Management, concluded five key areas affect business performance: quality, speed, flexibility, dependability and cost. Neely said those areas could guide evaluation in fields such as supply chain and government.

The most prominent evaluation methods are balanced scorecard and objectives and key results (OKRs).

Balanced Scorecard

The best-known evaluation tool is the balanced scorecard, a framework David Norton and Robert Kaplan introduced in 1992. It looks at four areas of a business — learning and growth, processes, customers and finance. Companies can use operational metrics to quantify performance in these areas.

Objectives and Key Results

Objectives and key results (OKRs) is an alternate method that has grown increasingly popular recently. OKRs originated with the concept of management by objectives, created by Peter Drucker in the 1950s. Intel integrated this into OKRs in the late 1960s, and Google adopted the system early in its history. Since then, the use of OKRs have become more widespread in the tech industry.

With OKRs, businesses set a target — the objective — that directs where they want to go. Instead of numbers, they use themes such as growth through acquisitions. Key results are measurable outcomes needed to achieve the objective. For example, identifying five acquisition targets.

Initiatives are the work that will lead to the key results. For example, an initiative might be to set up a team to research acquisition targets.

Key Operational Metrics by Department

Leaders can assess performance objectively with key operational metrics. Each industry and department look at different metrics related to their work to measure operational performance.

The data from metrics helps managers spot problems and correct them early. Using the right metrics enables better decision-making. The operations management metrics examples below look at the most important KPIs in different domains.

Marketing Operations KPIs

Marketers use KPIs to see if their efforts to appeal to prospects and customers are effective. Metrics show the cost of attracting a prospect and converting them into a customer. Marketing KPIs also quantify how much value the marketing team adds to the business.

Marketing operations cover the activities of the marketing team. But marketing operations are also a function within the team. The role manages technology and coordinates the team’s processes. A marketing operations specialist acts like a project manager.

Cost Per Click (CPC)

In online advertising, this shows how much the advertiser pays on average when a user clicks on the company’s pay-per-click ad.

Cost per click = Ad campaign cost in dollars / Total number of clicks

CPC Example: A lawn mower maker runs an ad campaign on a search engine. The company targets people who search for the term “best electric lawn mower.” The company spends $1,000 running its ad. About 650 people click on the ad.

CPC = $1,000 / 650 = $1.54

Cost Per Acquisition (CPA) / Customer Acquisition Cost (CAC)

This KPI measures how much you spend to get a new customer. A customer can be defined as someone who made a purchase or took another action, such as filling out a form. CPA looks at the cost per buyer. CPC only measures if the user clicked on an ad, not what they did after that.

Cost per acquisition = Ad campaign cost / Total number of new customers

CPA/CAC Example: A company that sells budgeting software runs an online ad campaign that costs $10,000. Out of a total of 5,000 people who click on the ad, 3,250 sign up for the software.

CPA = $10,000 / 3,250 = $3.08

Return on Advertising Spend (ROAS)

This shows how much revenue comes in per dollar you spend on advertising. If you track ROAS per campaign, you can see which ads and campaigns drive the best results. Your target for ROAS will vary based on your profit margin and costs. A common goal is for every dollar spent on advertising generate at least $4 of revenue.

Return on advertising spend = Revenue / Advertising cost

ROAS Example: A retailer promotes sweaters with emails and pay-per-click advertising. The campaign costs $40,000. This includes costs like staff salaries and ad placement. By tracking clicks, the retailer sees customers buy $280,000 in sweaters and other items.

ROAS = $280,000/$40,000 = 7

Time to Payback

This KPI quantifies the months it takes to make back money spent on acquiring a new customer (the customer acquisition cost discussed earlier). When you hit the payback point, you break even. Software-as-a-service (SaaS) companies use this metric frequently, and all companies want to hit the payback point quickly.

If it takes a long time to reach payback, either your CAC is too high, or revenue per customer is too low. This indicates you should make changes to move those numbers in the right direction.

For subscription-based companies, the formula is as follows. Other companies would use customer lifetime value and length of relationship in months instead of annual recurring revenue and 12 months:

Time to payback = CAC / [(Annual recurring revenue per customer / 12 months) x gross margin]

Time to Payback Example: A video gaming platform spends $100 acquiring a new customer. A customer spends $250 on average a year in subscription fees and in-game purchases. The company has a gross margin of 75%.

Time to payback = $100/[(250/12) x 0.75] = 6.4 months

Marketing-Originated Customer Percentage

Marketing-originated customer percentage shows how much new business stems directly from your marketing. You measure the ratio of new customers that began as a lead developed by marketing. This number compares marketing success to methods such as cold calls.

Marketing-originated customer percentage

=

Number of marketing-originated customers / Total customers x 100

Marketing-Originated Customer Percentage Example: A computer manufacturer has an active marketing department and sales teams. Its CRM software records how each customer enters its pipeline. In a year, 3,500 new customers come in via marketing. Another 11,750 come from sales. The total number of new customers is 15,250.

Marketing-originated customer percentage = 3,500/15,250 = 23%

Retail Operations KPIs

Retailers track KPIs for sales, inventory, pricing and profitability. Doing this in real time helps them spot problems quickly and can prevent unnecessary costs and wasted time.

Learn how retailers are adapting operations to a changing competitive landscape in this article.

Stock Turnover Rate

This KPI measures how well a retailer manages its inventory. The rate shows how many times a retailer replaces inventory in a year. Product cost and shelf life play a role in this — for example, milk turns over more than new cars do. But low turnover can signal inventory or pricing problems. (For more on inventory management KPIs and metrics, see this guide.)

Stock turnover rate =

(Cost of goods

sold / [(Beginning inventory + ending inventory) / 2]) x 100

OR

Stock turnover rate = [(Average inventory

value / Cost of goods sold) x 365] x 100

Stock Turnover Rate Example: A musical instrument store’s cost of goods sold for the year was $850,000. Its starting inventory was $2 million. Ending inventory was $500,000. It turned over 68% of its inventory.

Stock turnover rate = $850,000 / [($2,000,000 + $500,000)/2] x 100 = 68%

Sell-Through Rate

This metric shows how much inventory has sold as a percentage of the amount bought from suppliers in a month. The number tells a retailer if its inventory levels are too high or too low. A high sell-through rate can also mean the price is too low. You can calculate this on a unit or dollar basis.

Sell-through rate = (Sales in month/Month beginning inventory) x 100

Sell-Through Rate Example: A bicycle store started the month with 200 bikes in stock. It sold 50 bikes.

Sell-through rate = (50 / 200) x 100 = 25%

Average Order Value/Average Purchase Value

This number gives a retailer information on how much its customers spend in a single purchase. The retailer can use these insights to adjust marketing, pricing and inventory.

Average order value/Average purchase value = Total sales / Total transactions

Average Order or Purchase Value Example: A candle retailer has $350,000 in total sales in a month from 15,000 transactions.

Average purchase value = $350,000/15,000 = $23.33

The next month the retailer launches a promotion. Customers who buy three candles get one free. Sales totaled $750,000 from 15,000 transactions. Customers liked the promotion and bought more.

Average purchase value = $750,000/15,000 = $50

Sales Year-Over-Year

This KPI shows if sales are growing and is a critical measurement of a company’s health and can help shape its priorities moving forward.

Sales year-over-year =

[(Sales this

year – sales for the same period last year) / Sales for last year] x 100

Sales Year-Over-Year Example: A hardware store sold $2 million worth of goods in September last year. A hurricane struck the community this August. In September, residents bought building supplies to repair damaged structures. Sales totaled $4 million. Sales grew 100% year-over-year in September.

Sales year-over-year = [($4,000,000 – $2,000,000) / $2,000,000] x 100 = 100%

Human Resource Operations KPIs

Human resources (HR) departments use KPIs to assess worker productivity and job satisfaction. These metrics also shed light on quality and company culture.

Absenteeism Rate

This KPI measures unexcused worker absences. Absenteeism does not include approved sick days or vacation.

Staff may be absent due to family problems, drug/alcohol issues, burnout or job hunting. Partial absences include late arrival, early departure or extended breaks. Absenteeism disrupts normal operations and can harm trust. It may signal a need for culture or management change.

Absenteeism Rate = [(Average number of employees in period x missed workdays) / (Average number of employees x total workdays)] x 100

Absenteeism Rate Example: A lumber mill started the month with 75 employees. It hired five people during the month. One worker retired. At the end of the month, it had 79 employees. Average those by adding the start and end numbers, then divide by two to get 77.

Then count the number of workdays in the month. In this example, there were 22.

Now determine lost workdays due to absenteeism. One employee missed two days, and another missed one day. A third worker left four hours early one day (half of an eight-hour workday). The total time missed is 3.5 days.

Absenteeism rate = [(77 x 3.5) / (77 x 22)] x 100 = 15.9%

Overtime Hours

Many countries, including the United States, have laws around overtime work, or hours beyond the standard workweek. In the U.S., employers must pay workers 1.5 times regular pay after 40 hours in a week.

In many fields and for most salaried staff, unpaid overtime is common. Calculating overtime pay is complex. State and industry-specific laws, as well as union contracts, all play a role. The easiest way to prevent mistakes is payroll software. Make sure all staff use the system to track work hours, so you know when overtime costs are rising.

If overtime is excessive, you may need to hire more workers. Or this may signal a need for new workflows or cross-training staff.

Average weekly overtime = Weekly total overtime hours / Weeks in period

Overtime Hours Example: An insurance company employs 500 claims processors. Usually, 10 to 20 workers claim overtime hours each week. An HR specialist adds up overtime hours in the quarter. The total is 784, and a quarter has 14 weeks.

Average weekly overtime = 784/14 = 56 hours

The insurance company sees overtime averages more than 40 hours. This means it has enough work to justifying hiring at least one more claims processor, and would be more economical than paying overtime.

Employee Turnover Rate

This KPI tells you how frequently staff leave your company. Compare your rate to that of similar companies to see if it’s unusually higher, which can indicate problems in your work environment. High turnover may be a sign of poor work-life balance or bias, or your salaries may lag competitors’. High turnover is especially worrisome when it affects key personnel such as those with technical skills. Even if turnover isn’t high, understanding the typical hiring needs of the business helps HR improve recruiting.

Employee turnover rate =

(Number of

employees leaving / Average total number of employees) x 100

Employee Turnover Rate Example: A consulting firm employed an average of 360 employees in the year (starting number plus ending number divided by two). During the year, the firm lost 17 consultants.

(17 / 360) x 100 = 4.7%

Employee Efficiency Metrics

Employee efficiency metrics measure worker productivity. Looking at volume is part of this. But quality counts too. For example, a support desk worker may handle a high number of calls, but if they resolve very few of the issues, they were not truly efficient.

Common efficiency KPIs include:

- Average time to complete a task

- Percent of tasks completed within goal time

- Error rate

- Revenue per employee

- Volume of simultaneous tasks

- Resolution rate

Let’s break down the average time to complete a task.

Average task time = Total task times / Number of repetitions

Employee Efficiency Metrics Example: Using specialized machinery, a foundry makes iron castings to precise customer specifications. The foundry sets a maximum acceptable defect rate of 1%.

Software records how long workers take to set up the casting equipment. Only production runs that meet the quality standard are included. Over a year, 12,000 setups take 276,000 minutes.

Average task time = 276,000/12,000 = 23 minutes

The foundry can use this benchmark to assess worker efficiency.

Quality of Work Metrics

Quality can be hard to translate to numbers. For jobs where accuracy is important, error and defect rates can help measure quality.

In other roles, employers may judge quality based on customer, peer, manager and subordinate feedback. A company might ask a customer if they would refer friends to the person. That is a variation of the Net Promoter Score, a trademarked metric.

A business could judge a middle manager’s work quality by how well she prioritizes her time and projects.

Error rate = (Number of errors / Number of instances) x 100

Quality of Work Metrics Example: A package delivery firm wants every parcel to go to the correct address. The company assesses driver quality partly on delivery error rate. It sets a 3% error rate as the highest it will accept.

In a month, a driver delivers 3,500 packages. Of those, 103 go to the wrong addresses. Two of those do not count because they had the wrong addresses and were not the driver’s fault.

Error rate = (101 misdelivered packages / 3,000 packages delivered) x 100 = 3.4%

That means the driver exceeded the acceptable error rate this month.

Sales Operations KPIs

Many companies depend on sales teams to generate revenue. KPIs track how effectively sales departments and sales representatives drive revenue.

Deals Closed YTD

This metric looks at how many sales occurred in the year to date. The manager compares this to prior years’ numbers for the same period to determine if the number of sales are rising or falling. The year-to-date figure can be dollars or units.

Deals closed YTD = Quantity or value of deals for month + Quantity or value of deals for all other months in period

Deals Closed YTD Example: At the start of March, a car dealership adds up the number of cars sold in January to the number sold in February for the sales year to date.

120 sold in January + 175 sold in February = 295 cars sold YTD

Number of Customers

These metrics demonstrate the potential size of a market or the rate at which existing customers stop doing business with you.

Customer base shows how many current customers a company has. You can easily count the number of current customers. Then define the target audience by geography and other attributes by looking at the characteristics of your current customers. This requires research and some assumptions. The process varies by product and industry, so there is no one formula for this metric.

Number of Customers Example: A pizza restaurant is considering a second location. Its current location draws diners mostly from a 10-mile radius. Families with children and income of $80,000 or more frequent the restaurant. The business serves about 37,000 diners a year, which is about 20% of the population of 185,000 in the 10-mile radius.

The owners look at census and school district data for neighborhoods that do not overlap with the 10-mile radius of the first pizzeria to select a spot for a second location. They focus on an area mostly populated by young middle-class families, which has a population of 225,000 within a 10-mile radius. Applying the 20% standard from their first restaurant, the potential customer base is 45,000.

Customer churn rate: This is the rate at which customers stop doing business with a company in a specific time period. This is an important metric for subscription businesses.

In this formula, you do not count any sales to new customers during the period. You want to measure attrition of current customers.

Customer churn rate = [(Customers at start – customers at end) / Customers at start] x 100

You can also use dollar revenue for this calculation.

Customer Churn Rate Example: A wine club company had 1,500 customers at the start of the month and 1,350 at the end.

Churn rate = [(1,500-1,350)/1,500] x 100 = 10%

Number of Opportunities

This KPI is the total number of accounts or people that meet the characteristics of your typical buyer. Employees usually need to communicate with the lead to determine if it is qualified.

A sales rep will ask if the potential customer needs the product and has an interest in it. Is it a good fit? For example, is the complexity and cost reasonable for the lead’s budget and capacity? Does the product solve any of the buyer’s problems? If the answer to any of these is no, the lead is no longer qualified and the account stops being an opportunity.

To calculate the number of opportunities, add up the qualified leads in the pipeline or subtract disqualified leads from qualified leads.

Number of Opportunities Example: The sales manager of a company that makes security systems for large buildings looks at each rep’s pipeline. The manager sees a total of 4,000 accounts near the top of the funnel.

Of these, 3,800 plan to break ground on a building in the next six months. That is the typical buyer profile. Among them, 3,730 of the building projects have a budget of $10 million and above. But only 3,660 have a need for sophisticated security (those that do not are disqualified).

Opportunities = 3,800 – 140 = 3,660

Lead-to-Opportunity Ratio

This metric compares total leads to qualified leads. The number indicates if your marketing targets the right customer. It also tells if leads who are unlikely to buy clog the sales funnel.

Lead-to-opportunity ratio = (total opportunities/total leads) x 100

Lead-to-Opportunity Ratio Example

A company that manufactures commercial espresso machines has 250 inbound leads in its sales funnel from people that filled out a form on the website asking for a brochure. There are another 175 outbound leads. Sales reps called these accounts, and they want to learn more.

During the qualification process, it turns out that 90 of the leads cannot afford the $17,000-plus price tag. Another 30 do not have sufficient counter space. That leaves 335 qualified leads or opportunities who plan to buy a machine and fit the buyer profile.

Lead-to-opportunity ratio = (305 / 425) x 100 = 71.8%

Lead Conversion Rate

This KPI measures the percentage of leads that result in a deal.

Lead conversion rate = (Deals in period / Leads in period) x 100

Lead Conversion Rate Example: The espresso machine maker in the prior example conducts demonstrations and espresso tastings with the 305 accounts. This persuades 212 of them to make purchases.

Lead conversion rate = (212 / 335) x 100 = 69.5%

Logistics Operations KPIs

Logistics managers use KPIs to gauge the efficiency of key processes. These include various steps in the supply chain, including transportation, warehousing, distribution and delivery.

Delivery Time

Getting orders to customers quickly is vital. Knowing how long it takes from order to delivery is the first step. A company can use this information to provide an expected delivery date, which can help the customer decide whether to purchase the item.

Going forward, the company needs to track on-time delivery (OTD). This measures how many orders arrive when promised.

On-time delivery = (Number of on-time orders / Total number of orders) x 100

Delivery Time Example: An after-market auto parts manufacturer promises orders will be delivered in three days. Of 4,065 orders in the month, 75 are late. That means 3,990 are on time.

On-time delivery rate = (3,990 / 4,065) x 100 = 98.2%

Bear in mind that numbers can hide problems. For example, order processing took longer than it should, but the company upgraded to express shipping to deliver the products on time. The on-time rate looks good, but the extra expense is an issue.

Transportation Costs

Freight cost per unit shipped is the most important metric.

Freight cost per unit = Total cost / Number of units

A company should track this metric for each of its product categories.

Transportation Costs Example: A furniture company makes dining room tables and chairs. It sells sets as well as tables and chairs separately. Shipping costs for 226 sets were $118,000 last year, while costs for 298 chairs were $33,972.

Dining room set freight cost per unit =

$118,000 / 226 = $522

Chair freight cost per unit = $33,972 / 298

= $114

Order Accuracy

This metric looks at how common mistakes are in orders. This includes wrong and missing items, as well as address errors. Errors are not only costly, but disappoint customers.

Order accuracy = (Number of orders without errors / Number of orders) x 100

Order Accuracy Example: A rug manufacturer fulfilled 7,800 orders in a year. Of those, 681 had an accuracy issue such as wrong color, style or quantity. That means 7,119 were accurate.

Order accuracy = (7,119 / 7,800) x 100 = 91.3%

Capacity Utilization

This number demonstrates how much transportation, storage or other capacity a company uses out of the total resources available. Low capacity utilization represents waste.

Capacity utilization = (Capacity used / Total capacity available) x 100

Capacity Utilization Example: A company’s 150 trucks can hold 50,000 pounds of product each. In the month, 983 shipments totaled 36.4 million pounds or an average of about 37,000 pounds.

Capacity utilization = (37,000 / 50,000) x 100 = 74%

Inventory Accuracy

Inventory accuracy is an indicator of how closely inventory records match what is actually on the shelves. You can measure this in dollar terms, location and units. Each looks at the variance as a percent of the total.

Inventory accuracy = [1– (Variance / Reported number)] x 100

Inventory Accuracy Example: An ecommerce company does a physical inventory count. It finds 250 units of a certain SKU. The inventory system says there should be 273 of this SKU, a variance of 23.

Inventory accuracy = [1 - (23/273)] x 100 = 91%

IT Operations KPIs

IT operations metrics look at the frequency of technology issues and their duration. They also show how quickly technicians respond to problems.

Total Tickets vs. Open Tickets

This metric compares the total number of trouble reports to those still outstanding at the end of a period.

Total tickets vs. open tickets = (Number of unresolved issues / Total issues over time period) x 100

Total Tickets vs. Open Tickets Example: A corporate help desk gets 2,450 calls in the month it launches a new time-tracking system. At the end of the month, 833 tickets are still open.

Total tickets vs. open tickets = (833 / 2,450) x 100 = 34%

Ticket Response Time

Ticket response time calculates how long users have to wait on average after reporting a problem before a technician responds, excluding automated responses.

Ticket response time = Total time elapsed between report and response / Number of reports

Ticket Response Time Example: Depending on the volume of issues, a help desk takes from a minute to two days to respond. In the month, users contacted the help desk 3,487 times. They waited a total of 52,305 minutes.

Average ticket response time = 52,305 minutes / 3,487 tickets = 15 minutes

Resolution Rate / Average Handle Time

These KPIs look at how frequently and how quickly technicians fix problems.

Resolution rate calculates how many tickets are resolved in a set a period of time.

Resolution Rate = (Fixed tickets / Received tickets) x 100

Resolution Rate Example: A support agent gets 78 tickets in one day. At the end of the date, 71 are closed.

Resolution rate = (71 / 78) x 100 = 91%

Average handle time (AHT) is most often used in call centers. It measures the average length of time spent talking and on hold, plus after-call actions the agent performs.

Average handle time = (Talk time + hold time + after-call tasks) / Total number of calls

Average Handle Time Example: An agent handles 748 calls in a month. A total 3,304 minutes are spent on hold. A further 4,920 minutes are spent talking. Then the agent spends 2,992 minutes when she hangs up making notes in the system and doing other tasks, for a total of 11,216 minutes handling calls.

Average handle time = (3,304 + 4,920 + 2,992) / 748 = 15 minutes per call

Mean Time to Recover (MTTR)

This metric represents the average length of IT outages. This covers the time from the first report until the system is fully operational again. That includes diagnosis, repair and testing.

MTTR = Total minutes from failure to recovery / Total number of incidents

MTTR Example: A company’s network was down a total of 803 minutes in a month. There were 14 outages.

MTTR = 803 / 14 = 57.4 minutes

MTTR can also stand for mean time to repair. This is similar to mean time to recover, except the clock does not begin until repair work starts. In the above example, let’s say it took 105 minutes for technicians to respond, then 250 minutes to diagnose, and repairs lasted 448 minutes.

Mean time to repair = 448 / 14 = 32 minutes

System/Technology Downtime

This KPI indicates system reliability. It represents the percentage of time that the system was not working.

The inverse of this shows the uptime percentage, or the percentage of time the system was working.

Percentage downtime = (Total seconds or minutes of downtime in period / Total seconds or minutes in period) x 100

Technology Downtime Example: An ecommerce website goes down during a busy holiday shopping period. Over seven days, the site was down 5,867 seconds. In the seven days, there were 604,800 seconds total.

Percentage downtime = (5,867 / 604,800) x 100 = 0.97%

KPI and Metric Management Through Business Dashboards

A business dashboard gathers KPIs in a central place. Teams can use interconnected operational metrics and KPIs to manage and improve performance. Every dashboard should include metrics that measures progress toward a team’s main strategic goals, as well as indicators of real-time performance.

Types of Business Dashboards

-

Marketing Operations Dashboard

A general marketing operations dashboard includes customer acquisition cost, cost per click, marketing-originated customer percentage, traffic sources, click-through rate and bounce rate.

-

Human Resources Operations Dashboard

An HR operations dashboard covers headcount, absenteeism, overtime recorded, turnover rate, average time to fill a vacancy and compensation metrics.

-

Sales Operations Dashboard

Keep close tabs on sales by monitoring leads by source, win/loss ratio, opportunities by pipeline stage, average sales cycle duration and percentage of sales that are new business.

-

IT Operations Dashboard

Cover average application load or response time, uptime, service-level agreement (SLA) performance, number of security vulnerabilities and mean time to repair.

-

Logistics Operations Dashboard

A logistics dashboard can monitor order accuracy, average delivery time, inventory turnover, on-time percentage, transportation cost and volume of shipments.

-

Customer Service Operations Dashboard

This includes ticket volume, average response time, customer satisfaction rate, average handle time, percent resolution on first call and Net Promoter Score.

How to Select Operational Metrics KPIs

Operational metrics and KPIs help companies improve performance. By choosing the right KPIs, a company sees the true state of its business, which helps the organization make better decisions.

Technology has made data collection easier. As a result, many companies are inundated in data. Remember: KPIs are more than just data. They show business performance related the most important strategic objectives.

Tips for Selecting the Right Operational Metrics for Your Business

Organizations must identify the right operational metrics to track in order to realize the true value of this reporting. Here are tips to narrow down the list.

-

Make sure KPIs link to strategic business goals

Match KPIs to the organization’s most important goals. KPIs should help move the needle on the things that matter most. Pick one or a few clear goals, then pick a KPI directly linked to them. The metric should make it clear where the company stands in relation to the goal.

-

Use both short- and long-term goals

Choose a mix of operational metrics and KPIs that shed light on immediate and more distant objectives. Look at both near- and long-term objectives for balance.

-

Look at your industry

A B2B business and a consumer-packaged goods company will track different metrics. A SaaS firm will follow subscription metrics such as churn, while a brick-and-mortar retailer needs to know foot traffic or sales per square foot.

-

Make the metrics actionable

Pick metrics that will inspire people to action and can be improved. And make sure there are adjustments that will improve the KPI.

-

Measure metrics at the right frequency

Track operational metrics by hour, day or week. This will help the company see if there is an improvement or decline in its performance.

-

Make sure primary KPIs are easily measurable

Don’t pick a KPI that is difficult to track. If data is not readily available, staff may estimate it and there’s a greater chance it’s inaccurate. And data gathering could require too much time and focus, so the KPI becomes a distraction.

-

Look at ranges and ratios

Set goals that aim for a percentage improvement or change in the ratio between two metrics. Fixed goals may turn out to be unrealistic or too easy. Alternately, team commitment drops when it hits a number. Percentage and ratio goals require staff to focus on improving processes.

-

Provide broader context

Select metrics that you can put in context. This means having a basis for assessing the numbers. For example, compare a sales rep’s close ratio to the team average. Or compare customer satisfaction this month to last month. Industry benchmarks can also provide context. This helps staff see that objectives are not arbitrary or unrealistic.

-

Track trends, not just numbers

Use metrics to see if the company is progressing. Look at the direction and speed of change over time. Is a move in the wrong direction a one-off event? The trend should be improvement. If not, changes are in order.

-

Choose metrics appropriate for company stage

A mature multinational corporation should track different KPIs than a startup. The mature company might target small efficiencies because that will make a big difference given its large volume. The startup, on the other hand, needs to watch numbers that ensure its business remains viable.

-

Ensure departments feel their KPIs are relevant

Pick KPIs that are meaningful to your target audience. The finance department needs metrics specific to its activities, just as IT does. Ask for input from staff about which actions and metrics are most relevant to department goals.

-

Build simple, easily sharable dashboards

Use business systems and analytics tools to put KPIs into one graphical view. This makes trends visible in an instant, making it easier for employees to understand and increasing the chances they monitor these numbers closely.

-

Educate everyone on their KPIs and all KPIs

Make sure all employees understand their own KPIs, as well as the top KPIs for the whole company.

-

Keep KPIs limited to key metrics, not all metrics

The availability of data makes it tempting to try to track everything. But resist that — too many metrics will devalue the effort and staff will lose focus.

-

Measure the ROI of KPI

Calculate the value of KPI changes. For example, show the increased revenue that resulted from higher traffic to your website. This connects KPIs to the rest of the business.

-

Roll out slowly and build advocates for KPIs

At the start, employees may worry metrics mean more work or that the company is constantly looking over their shoulder. Start small and encourage staff to share ways that KPIs help.

-

Only use metrics that can be impacted

Do not set KPIs that staff have no control over. This sounds simple, but a common mistake is targeting a KPI that a department cannot directly influence or that depends on macro factors. For example, do not ask the customer service department to reduce complaints about order mistakes.

-

Ensure the data is trustworthy

Confirm that the data really reflects what you think it does. Also, make sure the numbers do not contain errors. Check that data collection is consistent. Data anomalies due to collection errors can throw off KPIs.

-

Use both forward- and backward-looking KPIs

Track some KPIs that help forecast and others to gauge performance. Forward-looking metrics are data such as sales opportunities in the pipeline. Backward-looking metrics include profitability over the past year. Both are valuable, but don’t overlook the importance of metrics showcasing current performance.

-

Do not neglect quality and satisfaction metrics

Metrics on quality and customer satisfaction are harder to gather than quantitative indicators. But to have a balanced view of its business, a company needs both. Qualitative measures include brand perception, Net Promoter Score and employee satisfaction. Surveys and focus groups help a company track these items.

-

Avoid vanity KPIs

Resist the temptation to track metrics that impress but do not provide meaningful insights. An example of a vanity metric is app downloads. How many of those users became paying customers? Similarly, page views do not mean much when the bounce rate is high.

-

Skip metrics that can be manipulated

Some numbers can be easily manipulated and are therefore not effective indicators of underlying performance. The number of sales calls made is an example of this — sales reps can make meaningless calls to boost this KPI.

-

Be careful about linking a KPI to an incentive

In some fields, pay bonuses or salary increases are always tied to metrics. But this may lead some staff to juice the numbers. An example of this would be a car salesman who on the last day of the month sells a car below cost to meet a monthly target. Think carefully when using this incentive.

-

Try a system

A few methods of narrowing KPIs are available. The TIE system limits KPIs to those that are trackable, important and explainable. IPA is similar but focuses on those that are important and have potential improvement and authority (authority means staff has permission to improve them). AARRR, otherwise known as Pirate Metrics, is often a relevant approach for new online ventures. It stands for acquisition, activation, retention, referral and revenue.

-

Don’t only measure financial and customer KPIs

Data related to sales and finance are the easiest to track, and many organizations restrict their KPIs to these areas. But other attributes may have equal or greater influence on your goals, like employee satisfaction, safety, environmental and quality KPIs.

-

Beware unintended consequences

Think through your KPI selections carefully to make sure they will not backfire. For example, by making the employee retention rate a KPI, you could encourage managers to keep bad employees. Or a financial services company may target sales per branch, but to hit targets, employees deceitfully sell products to customers who do not need them. An airline’s effort to increase on-time performance could prompt baggage handlers to stop loading late suitcases. Ask questions such as: Could this sabotage another result? Will this prompt anyone to game the system? Will this encourage a quick, short-term fix? Will it hurt cooperation? Will it create more waste? Could this embarrass anyone?

What Is Operational Excellence?

Operational excellence is when a business executes its strategy more consistently and effectively than competitors. Companies seeking this type of excellence are always trying to improve.

There is no agreed-upon definition of operational excellence. Lean management theory says operational excellence is when every person in the business can see how value flows to the customer and works to improve that delivery.

Other advocates say operational excellence is more of a mindset. Teamwork, problem-solving and exemplary leadership drive continuous improvement.

Steps to Implement a Successful Operational Excellence System

To implement operational excellence, first establish meaningful KPIs and then improve the business in ways that move them. Build processes and systems that drive improvement. The goals at the heart of the excellence drive must align with the KPIs selected.

Tracking key performance metrics for operational excellence is also critical. Without evidence of whether a change is working, the pursuit of excellence will fade, and dashboards make the impact easy to assess.

This case study on global consulting firm Prophet shows how they made progress on achieving operations improvement.

How to Track Operational Metrics

Tracking operational metrics requires having all the necessary information in an easily accessible format. That’s why it’s much easier to monitor all your metrics with all data in a single place. An ERP system that consolidates information from across your business in a single database is usually the best way to report on and track these metrics. Your ERP solution should be tightly integrated with accounting, supply chain, CRM, HR and ecommerce solutions, giving a company everything it needs to calculate various departmental and company-wide metrics and KPIs.

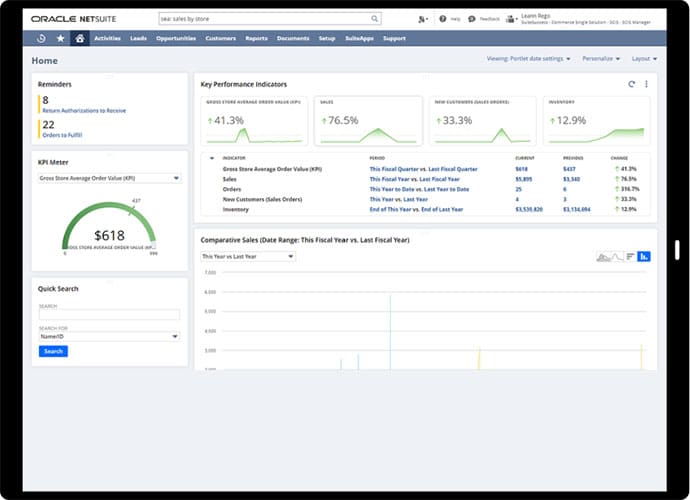

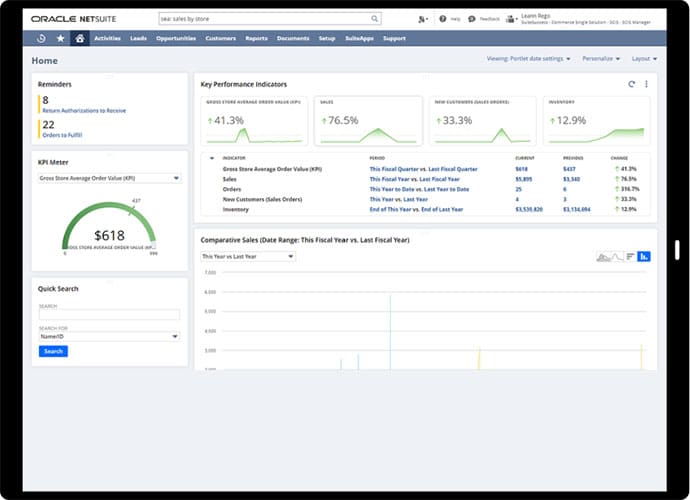

Software can automate much of the actual reporting and analysis, as well. Users can select which metrics they want to track and create dashboards that display these crucial numbers. As the ERP receives data, it will continuously update these dashboards so the business can track its progress and quickly identify any positive or concerning trends.

How NetSuite Helps You Track Operational KPIs and Metrics

NetSuite’s cloud-based ERP system provides a comprehensive platform for tracking operational metrics and KPIs across the entire organization. With NetSuite Financial Management, finance departments and CFOs have real-time insight into key finance data like recurring revenue, accounts payable (AP), accounts receivable (AR), billing and more. Meanwhile NetSuite CRM provides key customer and sales data to produce metrics like Net Promoter Score, lead-to-opportunity ratios and churn, all tied directly to the financial system of record.

For product-based companies, NetSuite’s inventory management software makes it easy to monitor metrics like turnover, delivery time and more, while NetSuite warehouse management software helps ensure efficient warehouse operations. Together, these modules can help organizations reduce costs related to procurement, fulfillment and shipping while enhancing the customer experience.

Meanwhile, built-in business intelligence and analytics deliver real-time insights via metrics and KPIs that employees need with role-based, industry-based and customized dashboards.

All businesses, regardless of size or industry, should agree on and then start tracking their most important operational metrics. They give a company a deeper understanding of its performance and help leaders determine the success of various initiatives and address any problems holding it back. When an organization tracks operational metrics across departments, it can embrace data-driven decision-making, which will ultimately increase the chance it succeeds and grows.