If yours is a cash-and-carry business, in which all customers pay up-front for goods and services when they receive them, you don’t need to read this article. But, if like most business-to-business companies, you extend credit to customers and send them invoices to pay later, read on. Sooner or later, some percentage of customers end up never paying — and you’ll have to deal with bad debt.

This article examines how bad debt happens, how it affects businesses and their finances, and how businesses can manage and limit bad debt.

What Is Bad Debt?

Bad debt occurs when a company determines that money owed to it will never be collected. It could be because a customer becomes bankrupt or otherwise insolvent, or it could be due to a dispute over an improper invoice or the quality of goods or services. For example, a company might deliver products only to face a customer’s dissatisfaction, leading to a dispute and refusal to pay. If resolution efforts falter, the company must classify the outstanding amount as bad debt.

Accounting standards require that uncollectible debts be classified as bad debt not merely on the basis of an expectation but because of evidence or reasonable assumptions. Then, the amount of the bad debt must be written off from the company’s accounts receivable ledger. That would lower the company’s reported net income for the period in which the bad debt is discovered, unless there is a mechanism to mitigate the impact.

Bad Debt vs. Bad Debt Expenses

Bad debt expense is the accounting mechanism that mitigates the impact of bad debt on net income. While bad debt represents the actual loss incurred when a debtor’s payment is uncollectible, bad debt expense is an accounting estimate for potential defaults on credit sales. It reflects a company’s reasoned anticipation of accounts that are likely to become bad debts. Bad debt expense reduces profits on the income statement by either establishing or adding to an allowance for doubtful accounts, which is a contra-asset on company balance sheets that acts as a safeguard against potential losses. By offsetting future bad debt write-offs against this allowance, companies avoid “surprise” losses in future fiscal periods. Instead, a company’s books reflect the estimated bad debt expense in the same fiscal period as the revenue associated with it, so their financial statements more accurately reflect their financial health. This approach reflects accounting’s matching principle, one of the core principles of public accounting standards.

Properly accounting for both bad debt and bad debt expense and proactively managing accounts receivables allow companies to present a transparent picture of their financial health and make well-informed decisions on credit risk management.

Key Takeaways

- Bad debt occurs when a company determines that money owed to it will never be collected, often due to customer insolvencies or disputes.

- Businesses write off bad debt, lowering their reported net income.

- Bad debt can hamper a business’s cash flow, operations, creditworthiness, reputation, legal compliance and strategic options.

- But companies can minimize bad debt by establishing strong credit policies, improving customer credit assessments, stipulating more stringent credit terms and proactively managing accounts receivables.

- Good accounting software can help manage bad debt by automating accounts receivable processes, providing real-time analytics and freeing finance teams to strategically analyze credit risks and improve collections.

Bad Debt Explained

Bad debt crystallizes from doubtful to definite when certain signals suggest that a receivable has gone beyond recovery. A common trigger is bankruptcy. If a customer files for bankruptcy, the likelihood that they’re going to pay plummets. Similarly, a customer ignoring multiple calls and emails is a strong indicator that they’re not going to pay. Beyond these obvious scenarios, companies will often set a bad-debt policy based on accounts receivable aging. For example, if an account remains unpaid for more than 180 days, a company may decide to write it off. This policy is not just an attempt to save time but a strategic decision, acknowledging that the resources spent on collection could outweigh the money recovered.

These triggers mark the reclassification of receivables from doubtful to bad debt, ending collection efforts and starting the write-off process.

Bad Debt vs. Good Debt

In business finance, not all debt is created equal. Good debt is strategic, taken on to finance investments or purchases that contribute to a business’s growth. Conversely, bad debt is tied to purchases or expenses that don’t generate long-term value or growth.

A loan to expand operations is considered good debt because it’s an investment in the company’s future. Similarly, upgrading equipment or technology to improve productivity, acquiring another business to expand market share or funding research and development for innovative products or services are all good business reasons to take on debt. But high-interest loans or cash advances used to cover short-term cash flow issues; loans for depreciating assets, like vehicles; or consistent borrowing to cover operating expenses, such as rent, utilities or payroll, are considered bad debt. This debt does not contribute to the business’s long-term success. Instead, it can reduce net worth, disrupt cash flow, constrain growth and, if it becomes unmanageable, even threaten the business’s survival.

Responsibly managing debt is crucial to a business’s long-term growth and financial health.

Common Types of Bad Debts

Just as people can accumulate debt for bad reasons — for example, running up credit card balances to support unsustainable lifestyle choices — businesses can, too. Any kind of debt can strain a business’s resources and impair its financial health, but with business bad debt, there is no offsetting strategic gain. Here are three of the most common types of business bad debt.

Credit Card Debt

Credit card debt is often considered the worst form of bad debt for businesses because it comes with very high interest rates and fees, making it an expensive way to finance operations or purchases. Credit cards can, however, be used strategically for very short-term purposes because they don’t incur interest until after a grace period that customarily lasts for one month. But if a business is carrying credit card balances from month to month to finance core operations, it can be just as unsustainable as it is for individuals who run up their balances to support a lifestyle they cannot afford. High interest charges will reduce a business’s net income and become a burden on cash flow.

Uncollectible Receivables

Accounts receivable that are deemed uncollectible become bad debts. It can happen occasionally for any of a large number of reasons, from bankruptcies to business disputes. As long as it stays at a low level, it’s not a problem. But a consistently high rate of uncollectible receivables is cause for concern because it usually means that something is amiss in the organization’s sales process, credit policies, management of receivables or in its accounting procedures in general. Ultimately, losses from uncollectible receivables become financial losses that reduce cash flow and profitability.

Business Loan Guarantees

When a business guarantees a loan for another company and that company defaults on the loan, the guaranteeing business (the “guarantor”) is required to make the loan payments. Those payments become a new debt owed by the guarantor, for which it gets no strategic value. The only positive thing you can say about it is that the guarantor can claim the payments as a business bad debt deduction on its income taxes, if certain criteria are met.

Key Contributors to Bad Debt for Businesses

For most businesses, uncollectible receivables are far and away the largest source of bad debt, so that is the focus of the rest of this article. Identifying and understanding the factors that contribute to uncollectible receivables can help businesses significantly reduce bad debt. Here are the primary factors that can lead to uncollectible receivables.

- Inadequate credit assessment: When businesses grant credit to customers without conducting comprehensive credit checks, it’s almost inevitable that the business is taking on more risk than it anticipates. A portion of that risk eventually translates into bad debt.

- Poor credit terms and conditions: Similarly, overly generous credit terms increase the likelihood of bad debt. So do confusing payment terms or vague/unclear invoice terms, such as “due upon receipt.”

- Economic downturns: Recessions can impair customers’ ability to pay their debts, creating a ripple effect of rising bad debt for businesses throughout the economy.

- Business distress: Even in good times, any individual business can experience financial instability that causes it to prioritize certain payments over others, potentially increasing bad debt.

- Fraudulent activities: Fraudsters, whether inside a business or external to it, often initiate transactions using fake identities or shell companies, or they deliberately provide inaccurate financial statements to obtain high credit. In none of these cases do the fraudsters ever intend to pay the bill.

- Changes in market demand: Shifts in customer demand can turn receivables into bad debts, particularly if a business’s products or services become obsolete. When a customer is no longer planning to buy from a business, they have less incentive to pay an old bill.

- Ineffective debt collection processes: Poor debt collection practices can lead to a buildup of overdue accounts and days sales outstanding (also known as “debtor days”) that turn into bad debt. These practices might relate to items such as those described in Nos. 1 and 2 above, or range from inadequate communications with debtors to not considering alternative payment methods to not segmenting delinquent accounts by age, customer history, etc.

- Legal and regulatory limitations: Certain laws that are in place to protect consumers can handcuff businesses trying to limit bad debt risk. The laws don’t cause bad debt, but they can reduce the effectiveness of certain collection practices. Bankruptcy laws, for example, may prioritize what types of debts get paid. Consumer laws protect personal data, like credit history, so a business may not be able to do a full credit check on a customer before doing business with them. Other laws are meant to avoid customer harassment (like aggressive collection efforts) and might make a business wary about how hard it pursues debts.

- Operational inefficiencies: Inefficiencies anywhere in customer interactions — from establishing credit limits for the customer to making a sale, processing the invoice and then collecting payments — can indirectly contribute to the accumulation of bad debt. For example, if a salesperson makes a sale, delivers the product but doesn’t bring the paperwork to the accounts receivable department for three weeks, that operational inefficiency causes the invoice-aging clock to start way behind where it should be. Statistically, the more a debt ages, the less likely it is to be paid.

The Impact of Bad Debt

Bad debt does more than dent a company’s finances. It can ripple across all areas of the business, affecting everything from daily operations to long-term strategy. Customers’ failure to pay their balances can set off a chain reaction that hinders growth, strains relationships and may even threaten the viability of the business. Here are seven ways in which bad debt can harm a small business.

Cash Flow Disruptions

Cash flow disruption is one of the most immediate effects of bad debt. When expected payments fail to materialize, businesses may struggle to meet their own financial obligations, such as paying suppliers, employees or rent. This can lead to a cycle of late payments and mounting debt, making it difficult for the business to operate effectively or invest in future growth.

Operational Impacts

Operational impacts are, essentially, an extension of the cash flow disruption: If you don’t collect enough cash from your customers, you can’t keep your own lights on or pay your own employees and suppliers. So, operational functions take a big hit when bad debt causes a disruption in cash flow that hampers day-to-day duties. Without sufficient working capital, businesses may face challenges in stocking inventory and maintaining equipment, too.

Financial Health Deterioration

Bad debt can erode a company’s financial well-being. Most often, this happens gradually, though it can also occur rapidly and/or reach a critical point suddenly. Uncollected receivables represent lost revenue and negatively impact key financial ratios, such as the accounts receivable turnover ratio, current ratio, quick ratio and debt-to-equity ratio. This deterioration can make the business less attractive to investors and lenders, reducing access to funding for growth or expansion. Also, keep in mind that the product or service was already delivered, so the business suffers a “double whammy” of not collecting payment and also having to pay its own cost of goods sold. That’s worse than never making the product to begin with and accelerates financial health deterioration. In the worst cases, bad debt will be reflected in weakened balance sheets and profit margins, potentially pushing a company toward insolvency.

Creditworthiness and Borrowing Capacity

Accumulating bad debt can tarnish a company’s creditworthiness, resulting in increased borrowing costs or limited access to financing. Poor collection rates and aging receivables are red flags for lenders, which are, therefore, more likely to charge higher interest rates or demand more stringent borrowing terms — or deny credit altogether. These red flags also restrict a small business’s ability to use invoice factoring, in which a business sells its accounts receivables to a “factoring” company that pays the amount up front and takes over responsibility for collecting from customers. Businesses with poor-quality accounts receivables due to bad debt will find it more difficult to engage a factor.

Reputational Harm

If a company allows bad debt to get so far out of hand that it is affecting operations and diminishing creditworthiness, the ripple effects can extend to reputational harm, both within its industry and among its customers. That can mean diminished trust from customers, suppliers and investors, which customarily translates into lost business opportunities. In extreme cases, where the business itself gets a reputation for nonpayment, legal action or public backlash may ensue.

Legal and Compliance Risks

Bad debt can bring on a variety of legal and compliance risks, which differ depending on the industry a business is in and its circumstances. In general, companies that violate credit and collections regulations face fines, penalties and lawsuits. In certain regulated industries, such as financial services and healthcare, exceeding specified bad debt thresholds or failing to comply with standard debt collection practices can trigger regulatory challenges. But negligence in credit and collection duties can also lead to legal complications in the form of lawsuits from shareholders, partners and other creditors who believe management is failing in its fiduciary responsibilities.

Furthermore, high levels of bad debt can create accounting challenges, such as sloppy or inadequate recordkeeping, which can be a compliance issue in itself. Good accounting software, especially as part of an overall enterprise resource planning (ERP) system, can help small businesses manage accounting and regulatory challenges by consolidating critical company and customer information into a single database, often hosted in the cloud. Once companies establish their regulatory framework, an ERP system can automatically monitor and verify compliance in daily operations, reducing the risk of errors and penalties.

Strategic Constraints

Finally, bad debt can constrain a company’s strategic options, limiting its ability to fund new initiatives or adapt to changing market conditions, due to the financial burden of unrecovered debts. With constrained cash flow and reduced borrowing capacity, businesses may be unable to invest in new products or take advantage of emerging opportunities, leaving them vulnerable to competition and reducing their long-term growth potential.

Preventing Bad Debt

The best approach small businesses can take to manage bad debt is to implement proactive policies and practices that prevent it from happening in the first place. Such preventive measures reduce the likelihood of customers defaulting on payments and protect businesses’ financial health. Coupled with efficient billing and accounts receivable processes, it can help companies maintain healthy cash flows and focus on growth opportunities.

Here are eight key strategies for preventing bad debt.

- Thorough credit checks: A meticulous review of potential customers’ credit histories can identify high-risk clients and avert future bad debts. By assessing a customer’s creditworthiness, businesses can make informed decisions about that customer’s credit limits and payment terms. Regular credit monitoring of existing customers can also help detect any changes in their financial situation that may inhibit their ability to pay.

- Clear credit policies: Transparent — and stringent — credit policies set firm guidelines for credit transactions. They foster consistent practices, set clear customer expectations and help businesses avoid extending credit to high-risk customers. Credit policies should define minimum requirements for credit approval, such as credit scores, payment history and financial stability. Setting appropriate credit limits based on a customer’s creditworthiness can further lower the risk of bad debt.

- Efficient billing practices: Streamlining the billing process is essential for preventing bad debt. Customer invoices should be accurate, clearly itemized and sent promptly. Electronic invoicing and payment options can expedite the process and reduce the likelihood of errors or delays. Regularly following up on overdue invoices and maintaining open communication with customers can help resolve any issues promptly.

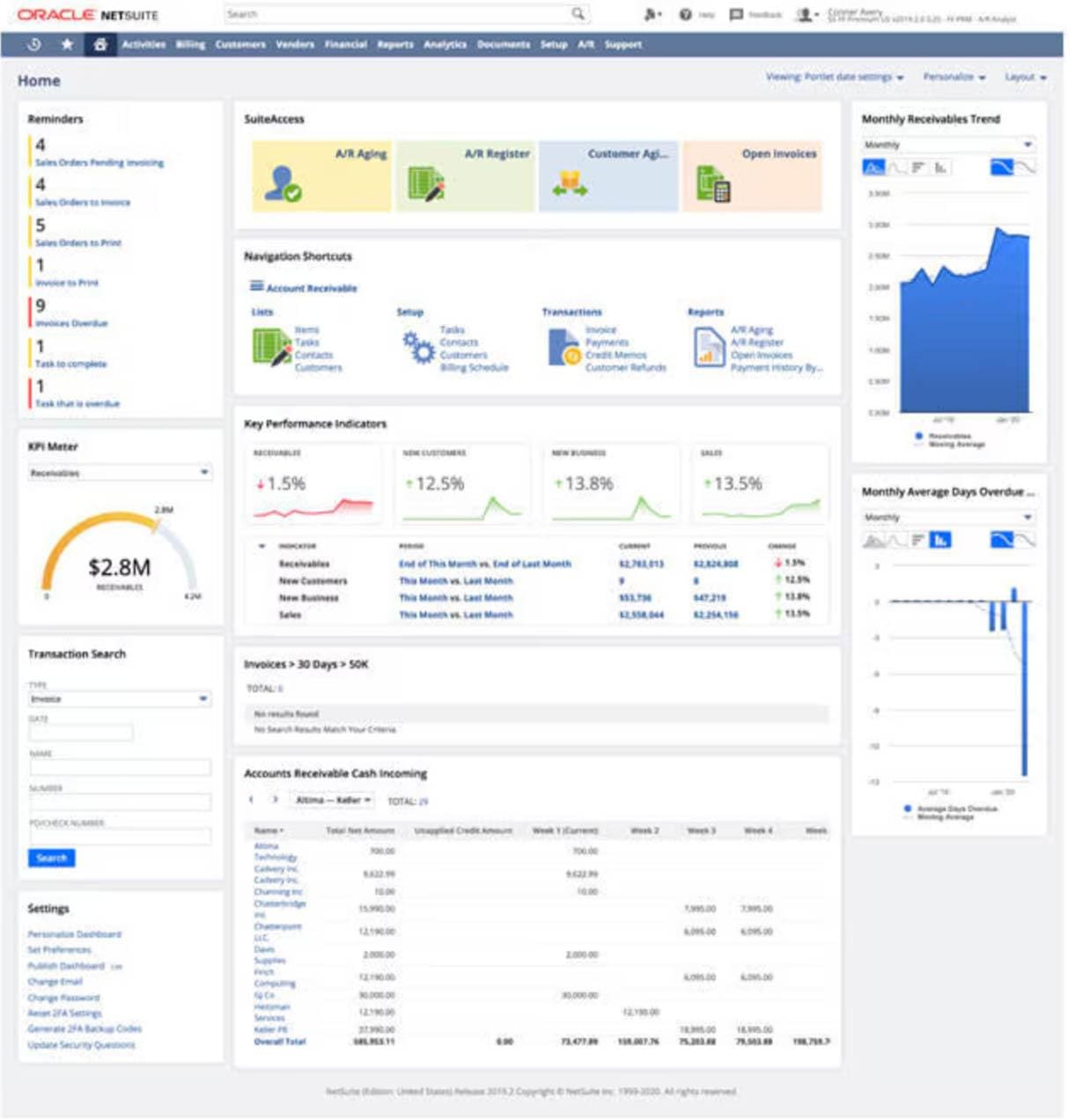

- Effective accounts receivable management: Vigilant management of accounts receivables facilitates early detection of overdue payments and fast corrective action. For example, promptly addressing invoice discrepancies can help identify and correct potential payment issues before they morph into bad debts. Good accounts receivable software should automate the process of monitoring outstanding invoices, surfacing discrepancies for reconciliation, tracking payment due dates and providing real-time visibility into the status of receivables. It should present the information in visually oriented accounts receivable reports and dashboards for accounts receivables managers, and raise alerts when payments are approaching and/or are past due.

An accounts receivable dashboard showing invoice aging, among other key performance indicators. - Proactive debt collection: Taking a proactive approach to debt collection encourages customers to make timely payments and can help prevent bad debt from escalating. This requires regularly communicating with customers about outstanding invoices, sending timely payment reminders and following up quickly and consistently when payments are overdue. Establishing a clear escalation process for handling delinquent accounts, including involving a collections agency or legal action, when necessary, also encourages customers to prioritize payment.

- Offer payment incentives: Providing incentives for early payment, such as discounts or loyalty rewards, can motivate customers to pay their invoices promptly. These incentives not only encourage timely payment but also foster positive customer relationships. On the other hand, implementing penalties or interest charges for late payments can serve to discourage customers from defaulting on their obligations.

- Legal protection: Comprehensive contracts, purchase orders and/or engagement letters that include explicit payment terms can establish a legal framework that safeguards a business against bad debt. These documents should clearly outline the terms of the transaction, payment obligations and consequences of nonpayment. Requiring personal guarantees or collateral from high-risk customers can also deter bad debt.

- Risk diversification: Spreading credit exposure across a large customer base can minimize the impact of any individual bad debt, protecting a company’s financial position. Similarly, serving a diverse range of customers across different industries, geographies and business sizes can lower the likelihood of bad debt getting out of hand.

Minimize Bad Debt With NetSuite

Effectively managing bad debt is essential for the financial health and reputation of any business — not to mention its bottom line. And NetSuite cloud accounting software makes it far easier for small businesses to manage bad debt. It can automate accounts receivable processes, enabling companies to streamline their billing and collections efforts, reduce the risk of human error and ensure timely, accurate invoicing. NetSuite’s real-time financial reporting and analytics offer valuable insights into receivables aging and customer payment trends, driving proactive management of potential bad debt.

NetSuite’s credit management features empower businesses to set and enforce credit limits, perform automated credit checks and continually monitor customer creditworthiness, minimizing the chances that they will extend credit to high-risk customers. NetSuite’s automated payment reminders and customizable dunning letters help businesses stay on top of overdue invoices and encourage prompt payment. By leveraging NetSuite’s automation features, businesses can free up their finance teams to focus more on strategic bad-debt initiatives, such as analyzing customer payment behavior, identifying potential bad debt risks and developing targeted strategies to improve collections.

(Conclusion)

Bad debt poses significant risks to a small business — risks that can affect not only profitability but also the viability of the business. Negative effects of bad debt can ripple through operations, affecting cash flow, creditworthiness, reputation, compliance and strategic flexibility. Proactive policies and efficient tools can substantially mitigate these risks. Thorough credit assessments, clear policies, streamlined billing and collections, legal safeguards and a diverse customer base all help to minimize bad debt. A comprehensive approach to managing bad debt, supported by technology, helps businesses to maintain healthy cash flows and focus on growth opportunities.

Bad Debt FAQs

Is bad debt an asset or liability?

Bad debt, itself, is neither an asset nor a liability. Instead, it is an expense that is recognized on the income statement when a company determines that an account receivable is uncollectible. To comply with standard accounting principles, however, business accountants customarily plan for an anticipated amount of bad debt expense and accumulate it in an estimated allowance for doubtful accounts, which is a contra-asset on the balance sheet. It represents a reduction in the net value of accounts receivable and reflects amounts that are expected to become uncollectible.

How do you treat bad debt in accounting?

In accounting, bad debt is treated by either the direct write-off method or the allowance method. The direct write-off method involves directly removing the uncollectible amount from accounts receivable and recording it as an expense, reducing income in the period in which the receivable was deemed uncollectible. The allowance method involves creating an allowance for doubtful accounts, which is a contra-asset account that estimates future bad debts in the same period that the revenue was recognized and is used to adjust the accounts receivable balance. Most businesses must use the allowance method to comply with standard accounting principles.

Are bad debts written off as an expense or liability?

If a company uses the direct write-off method of accounting for bad debt, they are written off as expenses recorded on the income statement, reducing the company’s net income for the period in which they are recognized. Alternatively, most companies use the allowance method to create an allowance for doubtful accounts, which is considered a contra-asset account that is used to adjust the accounts receivable balance.

How do I get out of bad debt?

Getting a business out of bad debt usually involves several approaches, such as improving credit assessment processes, tightening credit terms, enhancing billing and collection practices and diversifying customer risk. It may also involve negotiating payment plans with debtors or seeking professional debt management or legal advice.

What is considered really bad debt?

Really bad debt refers to debts that are very unlikely ever to be collected. This can be due to the debtor’s bankruptcy or other financial difficulties that render them unable to pay. It can also refer to debts that a company incurs that do not contribute to the long-term value or growth of the business.