Recessions can be trying times for businesses. Economic recessions are periods of business contraction that interrupt the natural growth of an economy, cause unemployment to rise and often force businesses to downsize or even close. They can range from short dips in an otherwise strong growth pattern to more long-lasting and severe downturns. Economists watch many indicators to identify different types of recessions and their respective recoveries. A recession may fall into several categories at once depending on the factors influencing its shape, which is in turn defined by the magnitude of the falloff in economic activity, how much of the economy is affected by the falloff and how long that falloff lasts.

No matter what type of recession an economy faces, understanding the similarities and differences among the various types will be crucial for any business trying to prosper — or merely survive — during the downturn.

What Are the Types of Recessions?

Recessions are defined by how they alter the growth trajectory of an economy. A recession’s ultimate type may not be clear at its beginning because the primary way economists classify recessions is by the shape their recoveries take. Some of the most common types of recession recoveries are V, U, W, L and K, named after the look of the graphs that result when gross domestic product (GDP) is plotted over time, starting from the onset of the recession and extending through its recovery. Many recessions fall under multiple types, especially when looked at more deeply — by industry, for instance, or according to the ways different demographic groups or companies are affected. For example, after the COVID-19 economic shutdown in 2020, which caused a recession whose official timing extended from February to April of that year (the shortest on record), some industries were able to move to remote work and function close to normally, creating a V shape. But industries that could not, like live entertainment, had a much slower recovery, so the ultimate shape of that recession may look like a K, with different sectors turning around at different times and recovering at different rates.

When short-lived recessions end, they can lead to an expansionary period that “catches up” to previous projections and gets the economy back on the same track. For example, the 1973-1975 recession in the U.S. fits that bill. However, not all recessions are short-lived, and some permanently alter the economy’s growth path. Indeed, in many countries, like the U.K., the 2008 financial crisis is still felt today, as their economies remain smaller than they would have been if that recession hadn’t happened.

Key Takeaways

- A recession is a period of shrinking in an economy, usually tied to rising unemployment and negative growth in GDP and income.

- The primary way recessions are categorized is by the shape of their recovery. Not all recessions are uniform, and different sectors of the economy may be affected quite differently.

- Recessions are often linked to their causes, like an increase in interest rates, a large change in spending habits and consumer confidence or disruptions in supply chains.

- The full picture of a recession often isn’t clear until it ends.

Recessions Explained

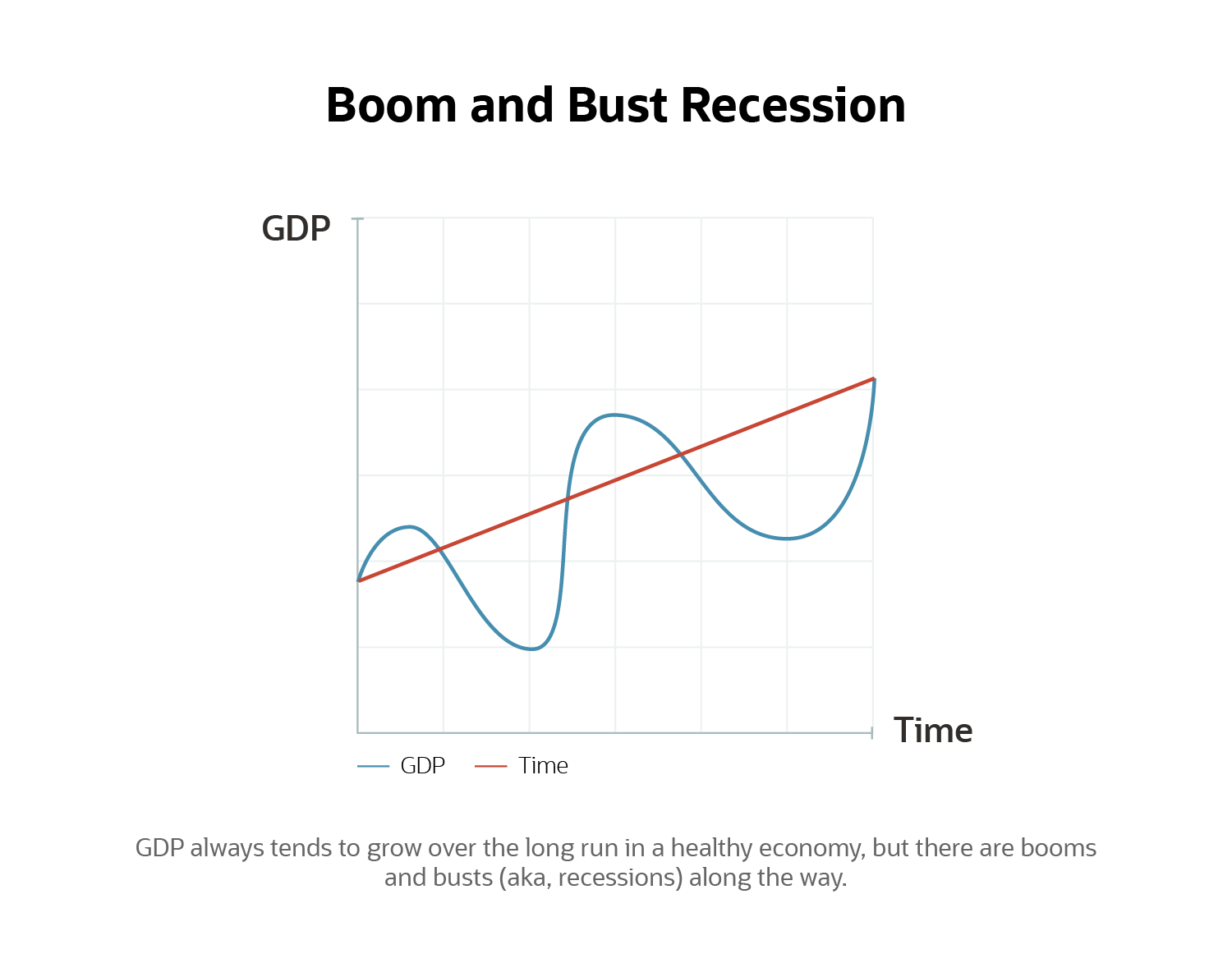

Over the long term, the output of a modern economy tends to grow. But that doesn’t mean it grows in a simple straight line. Generally, economies follow business cycles that fluctuate between peaks and troughs or booms and busts, like a wave tilted upward or a Slinky going up a flight of stairs (if such a Slinky were possible). When a trough lasts long enough to have an impact on the overall growth of an economy, it is considered a recession. Some recessions last years, others only a few months. There are many models for declaring a recession, like the Sahm Rule, which is based on unemployment averages, or models that look at changes in GDP. The U.S. organization that “calls” recessions — the National Bureau of Economic Research (NEBR) — looks at a wide spread of factors across the economy to determine the “three Ds” of a recession: “depth, diffusion and duration”.

Different types of recessions may vary in how much weight each of those “Ds” has. For example, the COVID-19 pandemic caused a deep drop that diffused throughout every aspect of the economy, but it did not take long, economically speaking, before some markets started bouncing back. However, that recovery hasn’t been a simple straight line, either — it varies greatly, depending on which factors or industries you look at. Other recessions, like those caused by a sudden supply shock, also can be short if the supply is restored quickly. Or, if the supply can’t be restored, they may force an economy to shift to a new path.

Many economists focus on the consumer’s role in a recession. If consumers lose confidence in the economy, they may begin saving more and reducing their spending. As less money goes to goods and services, businesses may need to cut their own spending, including by lowering wages and trimming their workforces, contributing to rising unemployment and less spending power among consumers — and thus continuing the downward portion of a business cycle. In the same manner, inefficient spending practices can lead to a similar outcome: If consumers or businesses stop spending money effectively, they can end up taking on more debt than they can handle or expanding into a wider territory than their business model can realistically support should the economy’s growth slow down. This creates bloated businesses and can cause debt defaults and business failures and, if widespread enough, could impact the economy.

Many of the recessions discussed below have similar indicators, characteristics and causes, but no two recessions are exactly alike. Realistically, there’s no single golden reason why a recession does or doesn’t occur. Economies are enormous constructs with many factors constantly fluctuating, creating ripples that may dissipate quickly or travel far. It’s only when they grow and combine that they can have a noticeable impact. Economist Irving Fisher notes this(opens in new tab), explaining that economic systems contain “innumerable variables”, and that the assumption that any one factor, or only a few factors, have led to a recession usually creates an incomplete picture.

Types of Recessions

While there are myriad interconnected factors that can cause recessions, many follow patterns, like the booms and busts of the business cycle. Understanding some standard recession types can help a business leader understand what is causing a recession and how to weather or find opportunities in the recession.

Boom and Bust Recession

Most economies bounce up and down while their overall growth increases, like a rope coiled around a handrail on a flight of stairs. As an economy “booms”, or runs above its expected long-term growth rate, it often experiences inflation. To try to control inflation, a central bank or other government oversight agency will often implement policies to “cool” the economy and prevent overheating. These policies usually include raising interest rates, lowering government spending or raising taxes. This can reduce overall spending and shift consumer priorities to saving money and paying off debts, which can cause a recession, or “bust.” The 1990-1992 recession in the U.K. was a bust that followed a boom in the late 1980s.

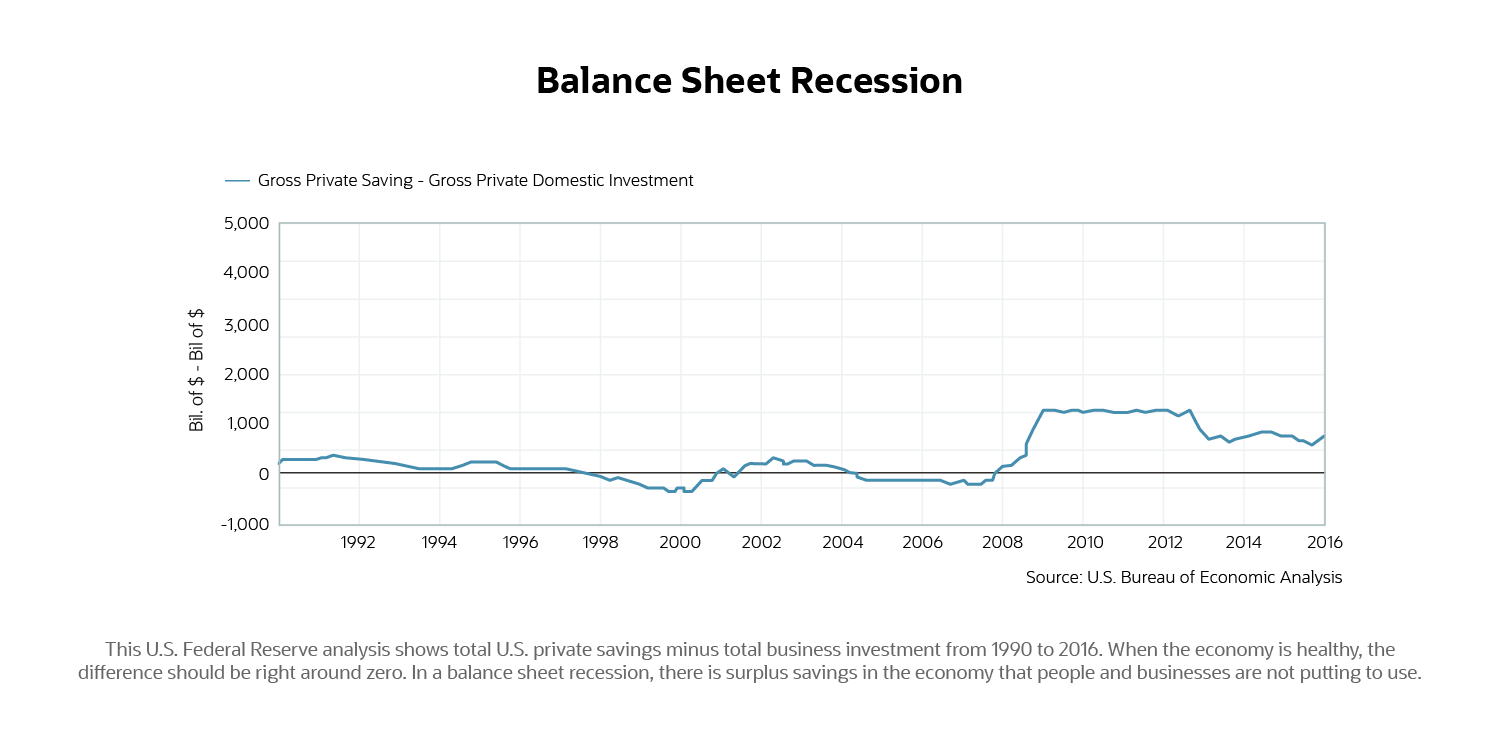

Balance Sheet Recession

A balance sheet recession, coined by the economist Richard Koo, usually happens when an economy is overburdened by debt. In normal times, the money people and businesses save with financial institutions is loaned out by those institutions to other people and businesses, keeping the economy humming along. A balance sheet recession is caused when business and consumer spending habits shift due to concern about high debt, and everyone begins to slow spending at the same time to prioritize paying down debts in order to “clean up their balance sheets.” A balance sheet recession can be difficult to get out of, as increases in government spending or lower taxes can continue to incentivize borrowers to pay off high debts rather than spend. Similar to what happens when a drop in consumer confidence shifts consumers’ priorities, if everyone is saving, less money is going toward expansion, which can extend the recessionary period.

Japan’s “Lost Decades” recession of the 1990s after its real estate bubble burst was a balance sheet recession, and slow growth continued to plague Japan’s economy decades after the start of the decline as businesses continued to pay down debts, even when interest rates fell as low as 0%. In fact, Japan’s long-term GDP growth has never fully recovered from that recession. Koo coined the term when analyzing Japan’s recession, and later applied it to the Great Recession of 2008.

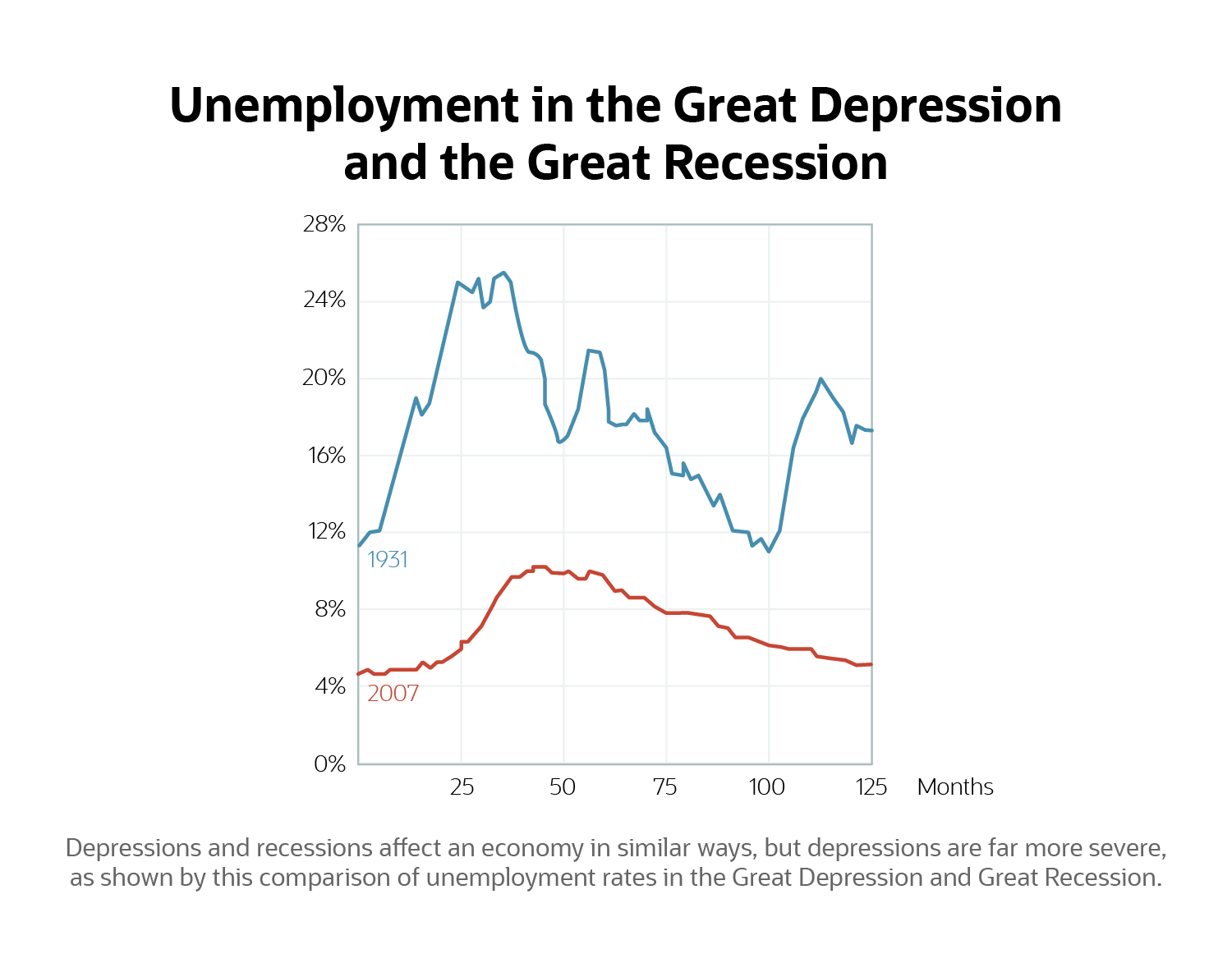

Depression

When a recession lasts years or decades, it may be upgraded to a depression. Depressions generally have the same characteristics as a recession, but they’re more extreme. GDP losses of over 10%, unemployment levels close to or above 30% and a major restructuring of the economy can result; most depressions lead to lower growth over an extended period of time. During the Great Depression of the 1930s, policies like the New Deal restructured how the economy functioned and many regulations from that time are still in use today.

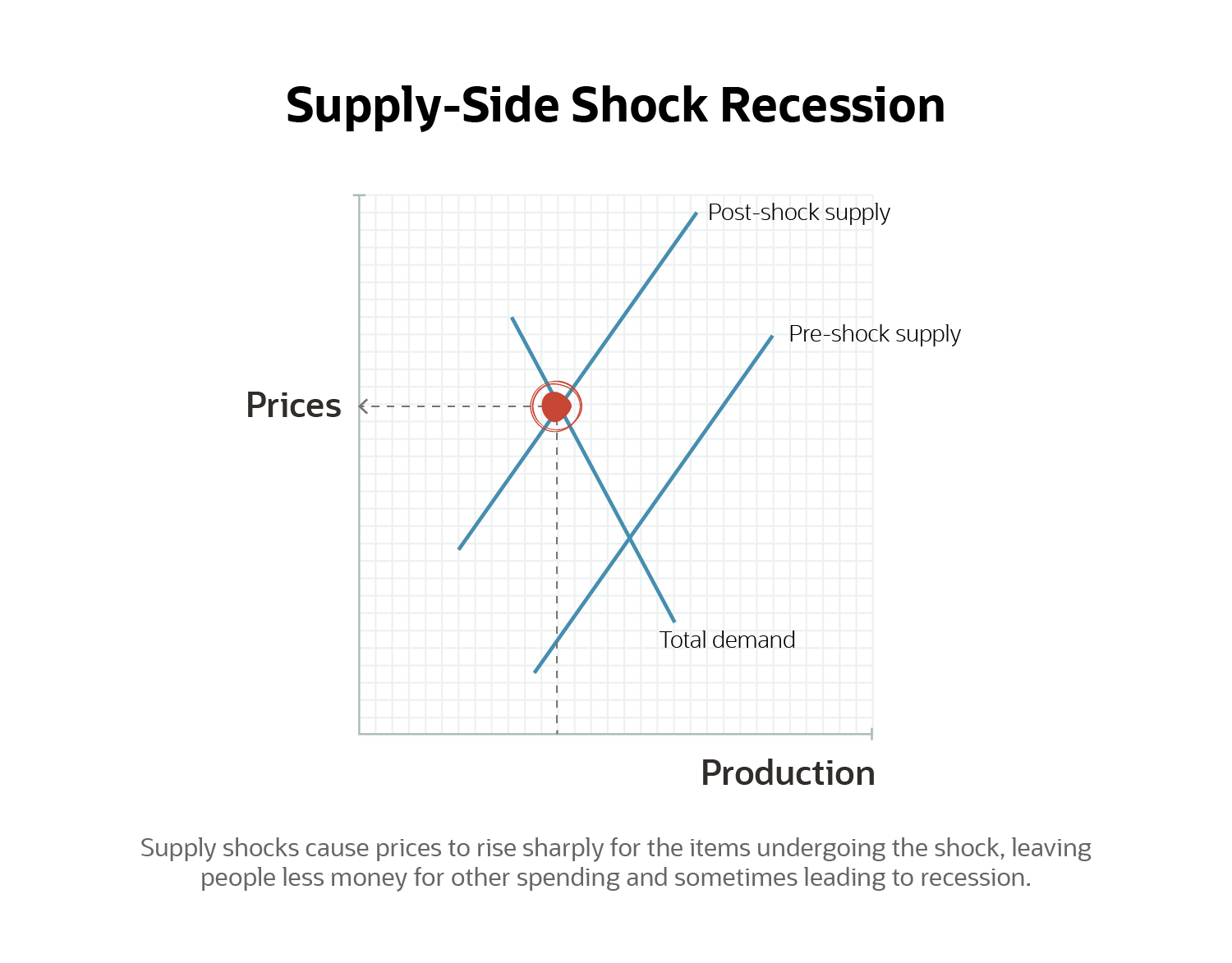

Supply-Side Shock

Global events, like wars, natural disasters or public health crises, can cause a large shock to domestic or international supply chains and push an economy into a recession. For example, in the 1970s, oil prices skyrocketed and businesses and consumers were forced to spend more on oil-based products, including gasoline, which left them less to spend in other areas, leading to a recession. These types of recessions may not last long if the supply is reestablished quickly. But if not, as with the continuing supply issues caused by the COVID-19 pandemic, the effects of the supply shock can be felt for years. They can also lead to a permanent shift toward diversifying supply chains or altering how goods are used, like an oil crisis leading to larger investments in alternate fuel sources such as natural gas or solar energy.

Types of Recession Recoveries

Recessions can’t be fully understood or classified until they’re in the rearview mirror, sometimes not until the next recession has begun and the full picture of the previous recession is in view. Think of someone writing a note: It’s difficult to tell if a letter is a V or just the first half of a W until the pen lifts off the page and begins the next letter.

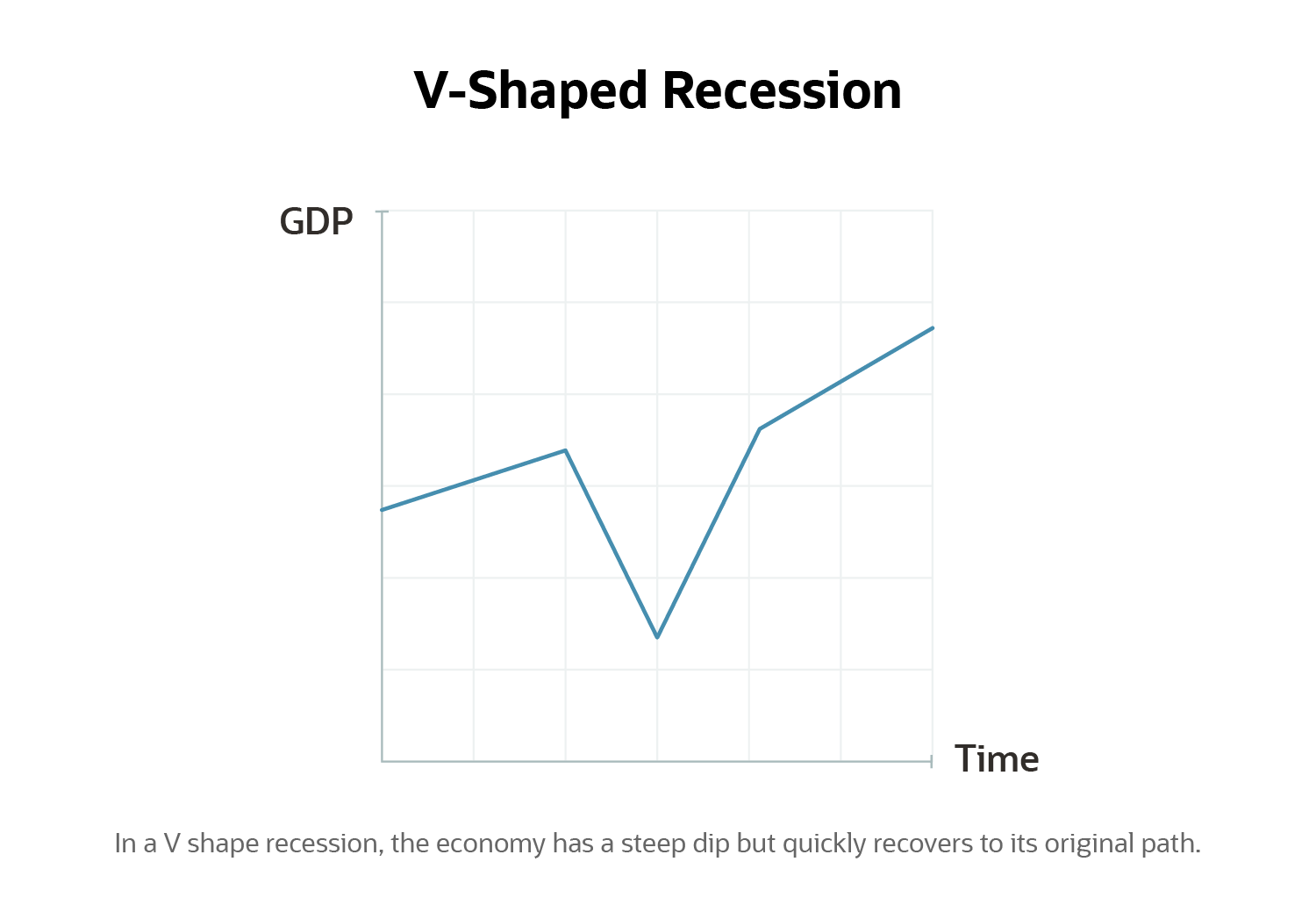

V-Shaped Recession

V-shaped recessions don’t last as long as other recessions, even after a steep drop, and they tend to have the smallest long-term impact on overall GDP growth. Growth bounces back to previous trends after the recession, which is usually caused by a short-term interruption, like a fixable supply chain problem or a seasonal shift for a region. The 1953 recession in the U.S. was caused by a rise in interest rates to stave off feared inflation after the Korean War. When inflation was not as high as expected, financial reserves were made available and interest rates dropped, which led to the return of demand less than a year later. Such a swift rebound to the economy’s prerecession growth path is considered a V-shaped recovery.

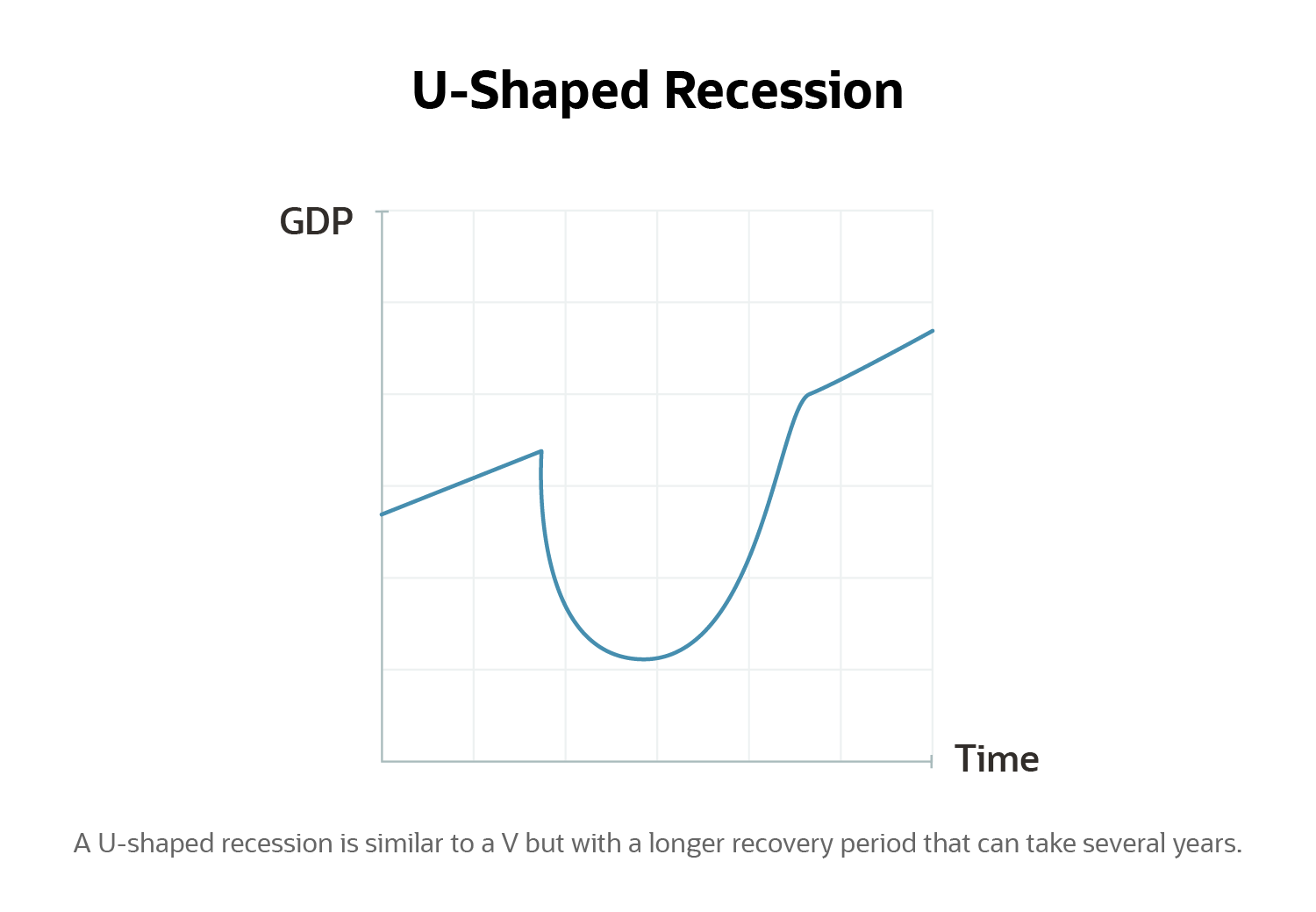

U-Shaped Recession

A U-shaped recession bounces back to its original growth path but only after a longer period of decline and/or stagnation than that caused by a V-shaped depression. The trough of the GDP curve stretches out longer than in a V-shaped recession, even if it shows some small growth in the interim, before eventually climbing back to the original growth expectations. The U.S. had a U-shaped recession in 1973; GDP did not return to its prerecession peak until 1976.

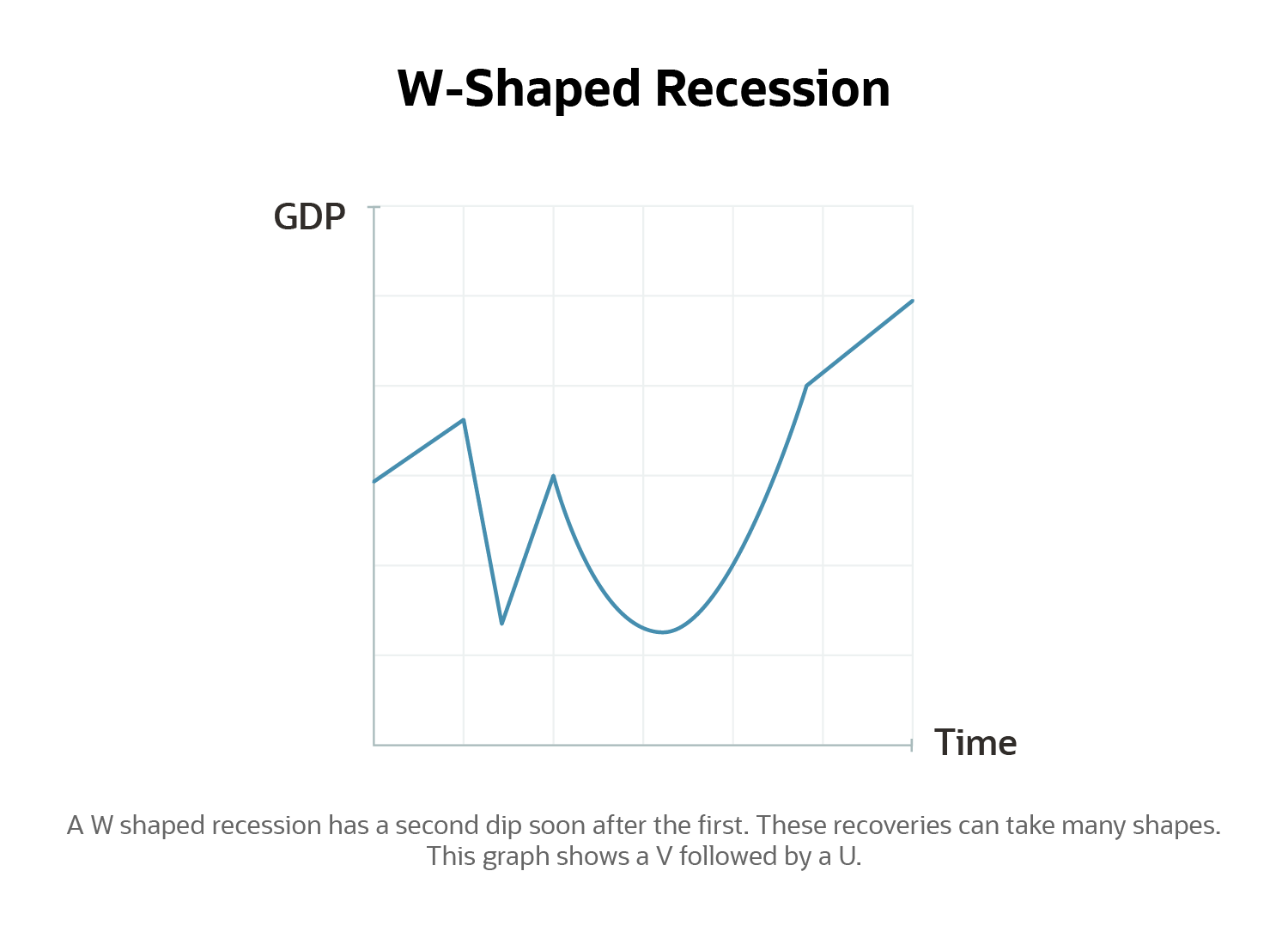

W-Shaped Recession

A recession that has a second dip after a recovery begins is a W-shaped recession. These can have a larger impact on consumer confidence because the second drop causes many consumers to hesitate longer than they otherwise might have before starting to spend money again, for fear of yet another dip in the future. Despite the look of the letter W, W-shaped recessions don’t always look like two Vs. For example, in early 1980, the American economy had a short V-shaped dip before climbing back up only a few months later. But in 1981, the second dip that completed the W lasted over a year and, by itself, looked closer to a U.

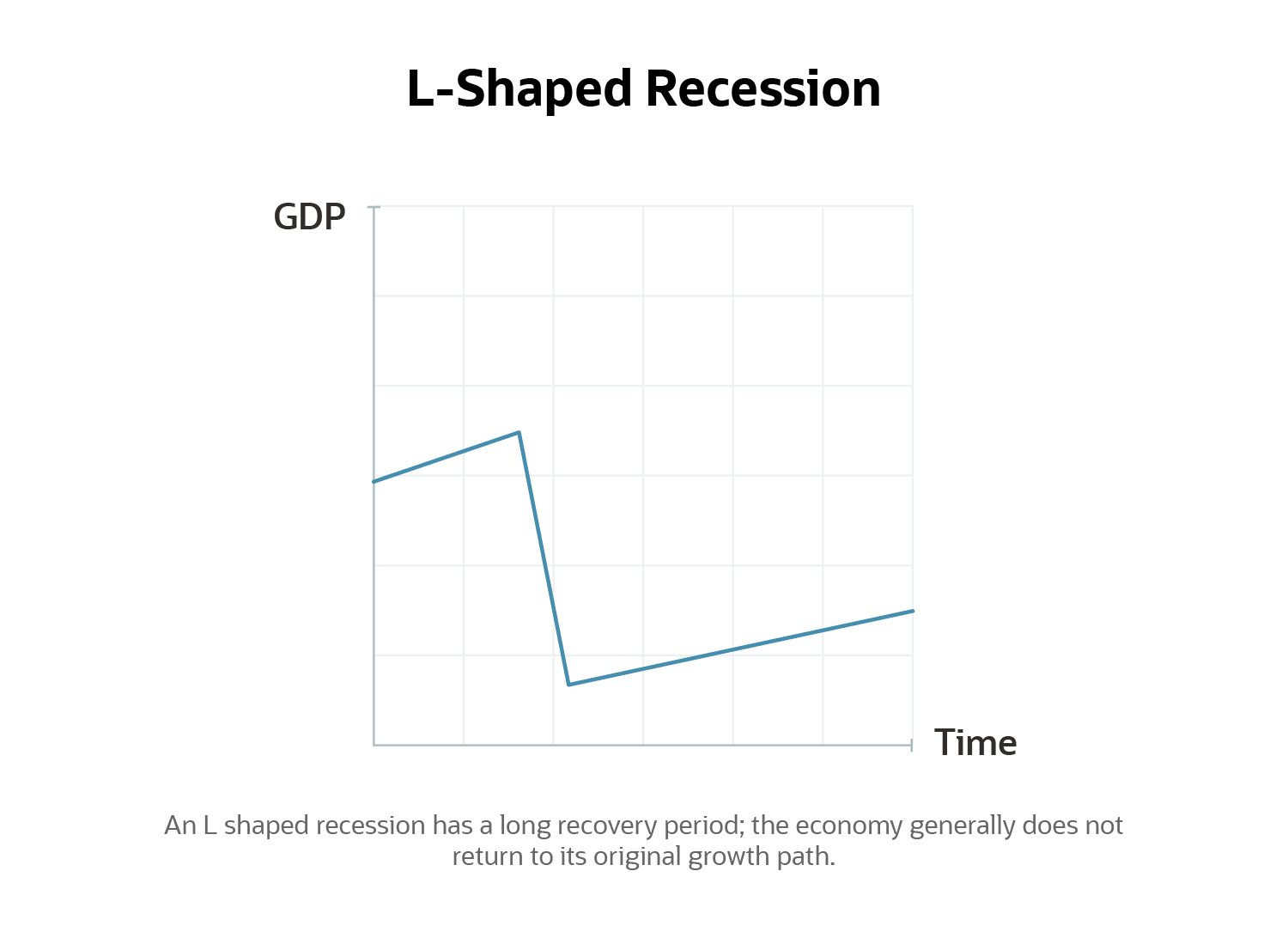

L-Shaped Recession

L-shaped recessions can be the most worrying: They have long-term impacts on growth, permanently lowering GDP’s growth trajectory and often approaching depression levels. Economic recovery is slow, unemployment remains high and investments stay low. Greece’s 2008 recession is considered an L-shaped recession or depression, as GDP growth consistently stayed under 2%, and was often negative, for over a decade.

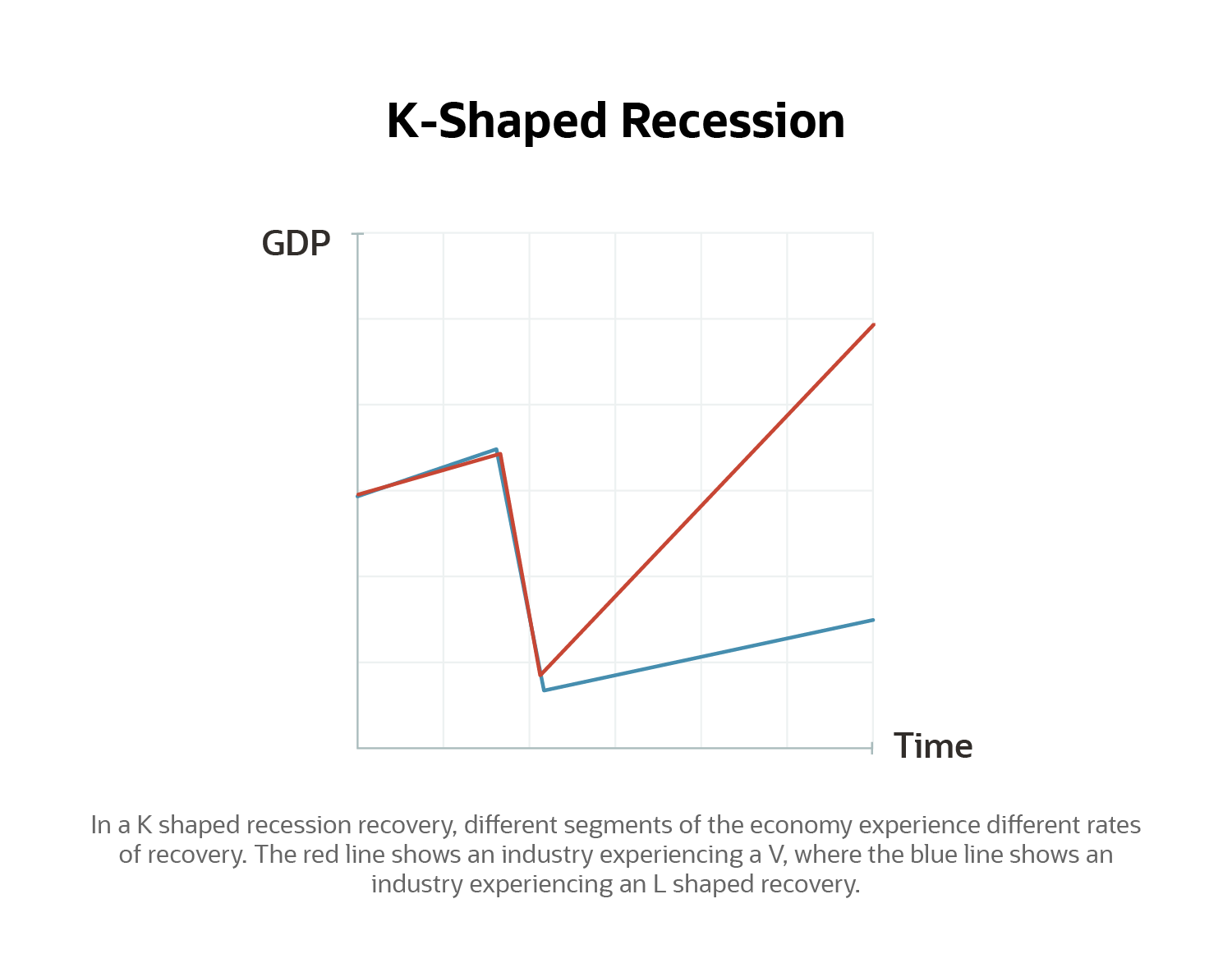

K-Shaped Recession

A K-shaped recession has different recoveries in different parts of the economy. One group may experience a V- or U-shaped recovery, while another may experience a slower recovery or a longer period of negative growth. The groups can be separated along industry, class, generational or demographic lines. Often, the recovery doesn’t create these dividing lines, but strains already existing economic differences among the groups. The recovery from the February-to-April 2020 recession caused by the COVID-19 pandemic is considered by many to show a K shape, as the stock market and industries that benefit from remote work rebounded significantly quicker than many other industries, like in-person dining or live entertainment.

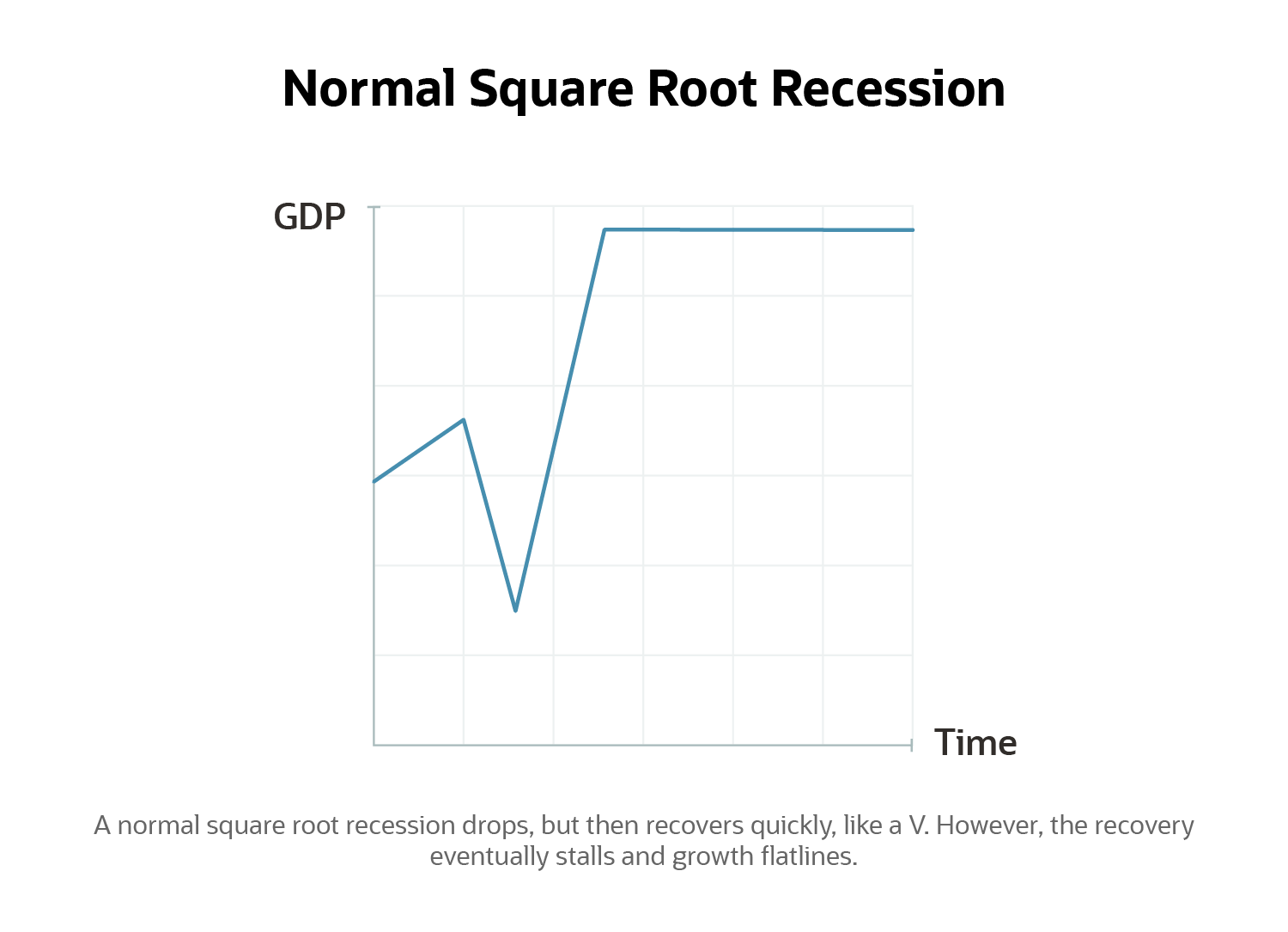

Normal Square Root Recession

The graphed curve of a normal square root recession looks like the “radical” symbol in mathematics that indicates the square root of a number. The recovery ends up higher than the original, due to a heightened period of growth, but does not continue that trend and flattens out for a period. The flattening period is usually due to some external force preventing growth from continuing, like a supply constraint.

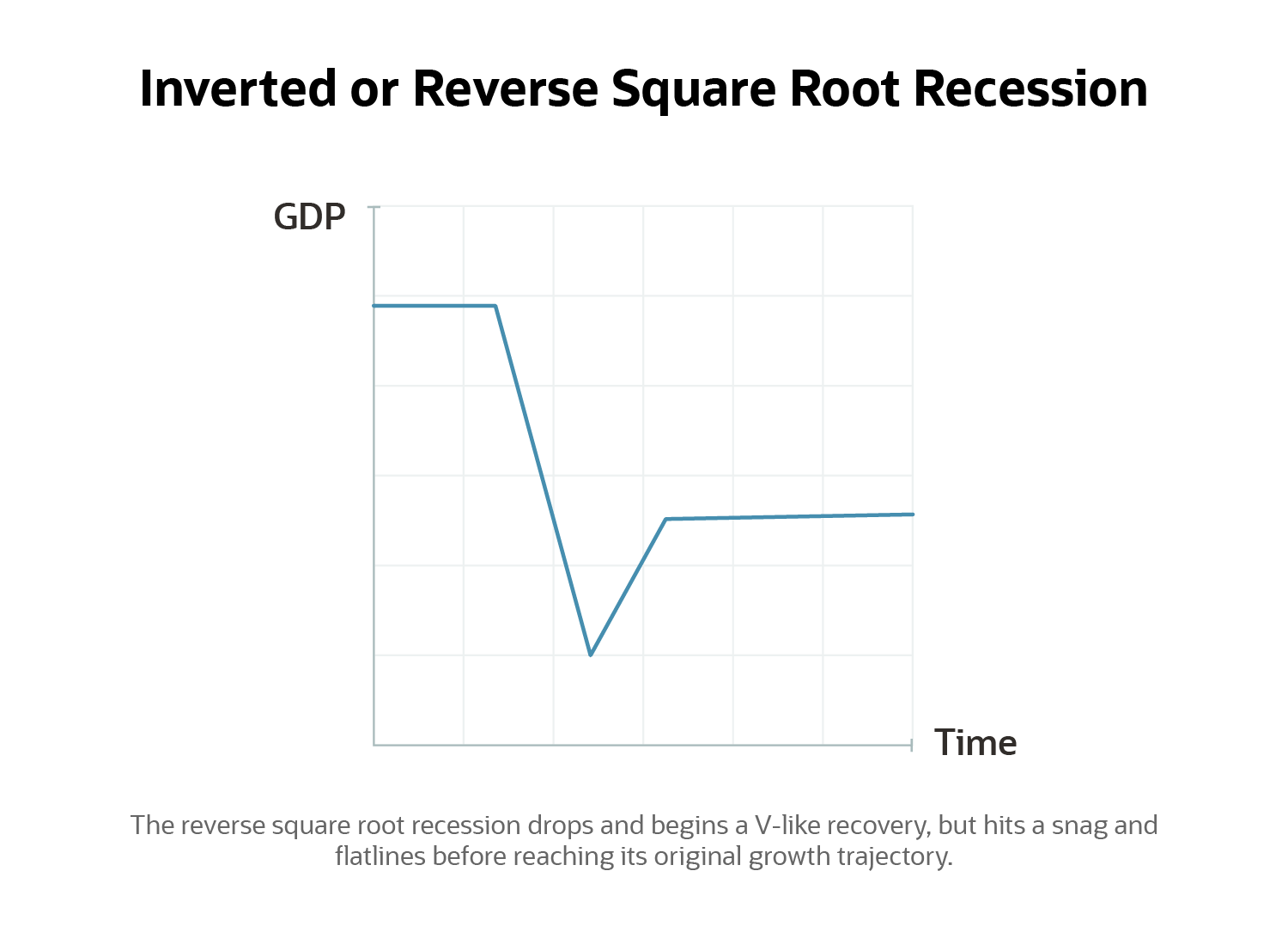

Inverted or Reverse Square Root Recession

Reverse square root recessions also have curves that look like a radical symbol, except flipped, like a mirror image. This recession starts like a V shape, with a steep decline and quick turnaround, but hits a snag on the way back up and flatlines. Following the 2020 recession, some nations have been experiencing a reverse square root recession as they partially reopen their economies but keep some pandemic limitations in place, preventing a full recovery to previous levels.

Use NetSuite to Help Your Business Weather Any Economic Situation

Recessions can be the perfect time to reassess the efficiency of your business. Cost reductions and cutting down on less profitable avenues can be a boon to a business looking to come out of a recession stronger than ever. A recession is also a great time to diversify a business model, especially into a field less affected by the recessionary economic trends. During the COVID-19 pandemic, many restaurants expanded their delivery options or offered new products that replaced services they were incapable of providing during the shutdown. Other companies moved to remote work or introduced hybrid models that increased productivity and worker loyalty, while cutting office costs. Contingency plans can help a business navigate the uncertainties of an economic downturn.

But to adapt and grow in any of these ways, a business must have high-quality financial data on which to base critical decisions. NetSuite Financial Management provides just such high-quality data and can give business leaders real-time reporting dashboards that offer visibility, as well as projections for running forecasts, before they implement new strategies.

Conclusion

Recessions can have many different causes that affect their shape, duration and subsequent recoveries. These causes can stem from economic or supply shocks, natural disasters or public health crises. Understanding the similarities and differences among the types of recessions and their recoveries can help a business prepare for the factors that may be susceptible to the most flux during a particular recession, such as consumer confidence, interest rates, prices or supply chain issues. These insights can help a business prepare for the recovery, whatever shape it takes.

Recession Types FAQs

What are 5 causes of a recession?

Recessions have countless causes, but five primary causes are: natural disasters and public health crises, global destabilization like wars, disruptive changes in technology, a sudden rise in prices for oil or other commodities and large-scale shifts in consumer confidence and spending habits.

What are the five stages of a recession?

The five main indicators of a recession are: decline of real income, rising unemployment, decrease in manufacturing output, decrease in sales and a decrease in monthly GDP.

What is the difference between recession and depression?

A depression is a more severe economic downturn than a recession. While they share many characteristics, a recession turns into a depression when GDP falls more than 10%, with widespread business failures and unemployment around or above 30%. Recessions are also shorter than depressions, which usually last several years and lead to a restructuring of the economy.

What are examples of recessions?

Some modern examples of recessions are the 2020 downturn caused by shutdowns from the COVID-19 pandemic, the 2008 financial crisis (often called the Great Recession) and the early 1980s recession that followed a disruption in the global oil supply in 1979.

What is a U-shaped recession?

A U-shaped recession is an economic downturn that eventually returns to the original growth path, but only after an extended period of no or low growth. U-shaped recoveries usually take several years.