High inflation can wreak havoc on people’s lives, entire countries and, sometimes, the whole world. Over the course of history, it has done so multiple times. That’s why many business managers, government policymakers and even everyday consumers worry about inflation, keep a watchful eye on it, and have invented dozens of different ways to measure it.

But what exactly is inflation? How is it measured — and can it be controlled? This article provides plain-spoken yet comprehensive answers to these and related questions.

What Is Inflation?

Inflation is a rise in the general level of prices in an economy. It’s really that simple, despite the intricacies of its consequences. Inflation can also be defined as a decline in the purchasing power of money because when prices rise, people must spend more for the same goods or services. Some economists define inflation as an increase in the money supply that is not matched by an increase in economic output.

Key Takeaways

- Inflation is the rate at which prices in general are rising. It is also the rate at which the purchasing power of money is falling.

- Inflation is typically measured using indexes such as the Consumer Price Index (CPI).

- Inflation is caused by too much money chasing too few goods. This can be because banks, governments or central banks have injected money into an economy that is already at full capacity, because a negative price shock damages supply chains, or because of a wage-price spiral.

- Low, stable inflation is good: It keeps the economy humming along and interest rates positive.

- High inflation can make people poor and destroy confidence in the currency.

- Central banks use monetary policy to keep inflation close to a target rate, typically 2% per year. The principal tool they use for this is interest rates.

Inflation Explained

The prices of goods and services are constantly changing. This happens for a variety of reasons: changes in consumer demand, improved production technology, supply-chain disruptions, or price swings in raw materials. At any moment, some prices are rising while others are falling. If more prices are rising than falling, or if price increases are larger than price drops, there is likely to be inflation.

Importantly, inflation is the rate at which prices in general are rising. It is typically expressed as a percentage change in the average price of goods and services relative to a reference year. Deflation, the opposite of inflation, is the rate at which prices in general are falling. Inflation is also the rate at which the purchasing power of money is falling. When there is inflation, each dollar buys fewer and fewer goods and services. So inflation can be expressed as the rate of change in the value of the dollar.

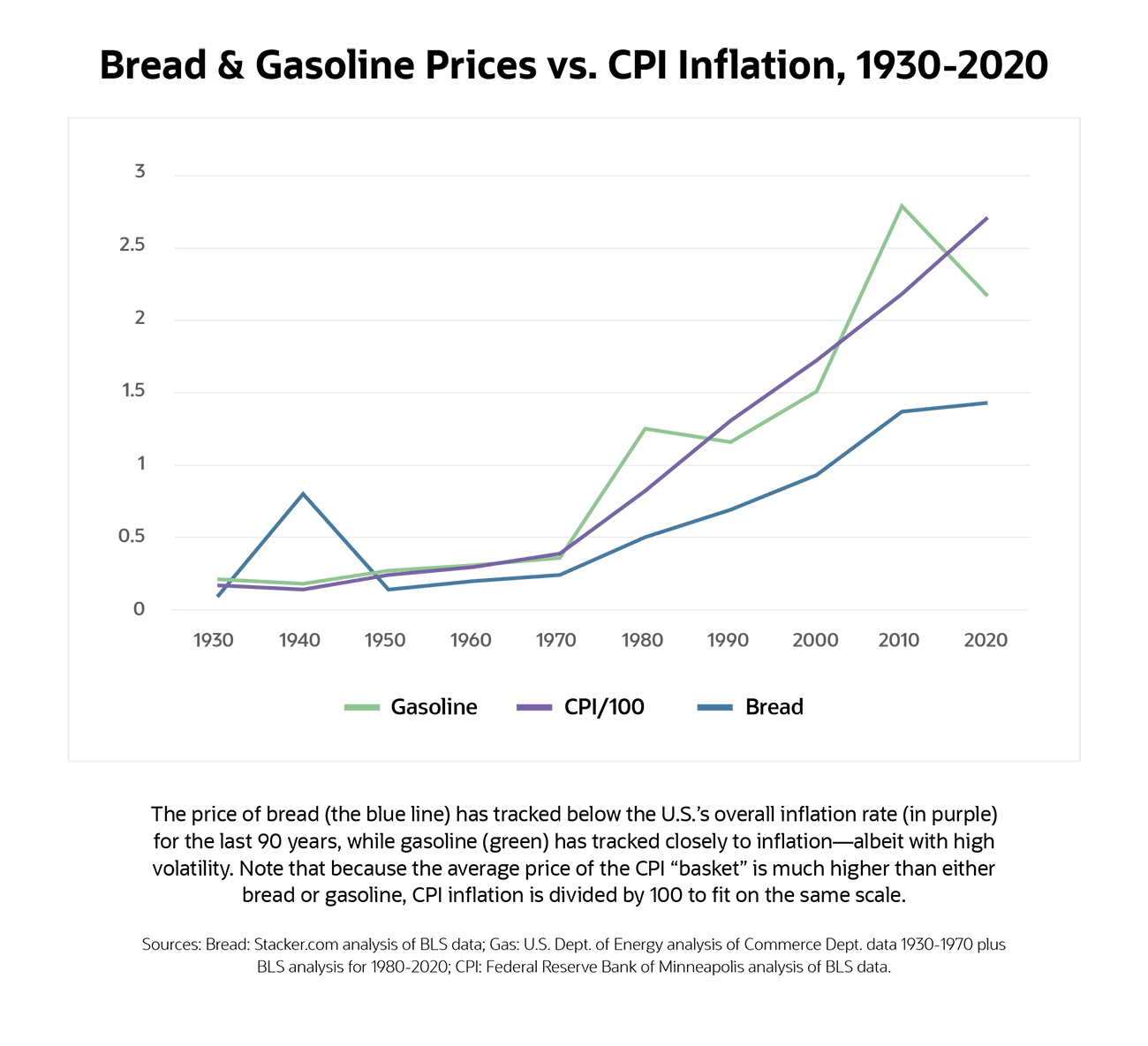

Inflation is typically measured using indexes such as the Consumer Price Index (CPI). These record price changes in a “basket” of goods over time and, from it, calculate the rate at which the average price of the basket is rising or falling. The composition of the basket is often weighted to reflect the importance of the individual goods or services in the economy.

But it’s also common for people to use the price of individual goods to indicate inflation. For example, The Economist magazine devised the “Big Mac Index(opens in new tab)” to measure the purchasing power of money in different countries by comparing the U.S. dollar price of a McDonald’s Big Mac hamburger in each country. The magazine describes the index as “a lighthearted guide to whether currencies are at their ‘correct’ level,” which is a reference to the economic theory of “purchasing power parity.” The theory holds that foreign currency exchange rates will adjust to keep the “real” price of a standard product (in this case, a Big Mac) the same in every country where it is sold. Looking at how the dollar price of a Big Mac changes in the U.S. over time can also give a rough indication of how inflation is affecting the purchasing price of the dollar. But the rising price of a Big Mac could be fully offset by falling prices in other goods — for example, technology products — leaving inflation unchanged or even declining. So no individual product can be a reliable guide to U.S. inflation.

However, certain goods and services are so widely used in the economy that changes in their prices can significantly affect inflation. For example, this chart shows how the prices of gasoline and bread correlate with U.S. CPI inflation.

Causes of Inflation

Inflation is often described as “too much money chasing too few goods.” Such an imbalance can occur because aggregate demand has risen due to injections of money into the economy by banks, central banks and/or governments or because aggregate supply has fallen due to rising production costs. The first is known as demand-pull inflation and the second as cost-push.

There is a third type of inflation, called “built-in” inflation, which is self-perpetuating. This is the most dangerous type of inflation since it can become hyperinflation.

Demand-Pull Effect

Demand-pull inflation happens when consumer demand for goods and services exceeds the ability of the economy’s supply side to deliver them. This is known as a “consumer boom” and is typically fueled by a large rise in bank lending, usually as a result of interest rate cuts by the central bank and/or lending deregulation. It can also be triggered by tax cuts, welfare benefit increases and “helicopter drops” that put unearned money directly into people’s pockets.

In cash-based economies, central bank money printing has also caused demand-pull inflation. However, the extent to which the modern equivalent, “quantitative easing” (QE) — when a central bank purchases securities to stimulate the economy — causes demand-pull inflation is unclear and disputed.

Demand-pull inflation dissipates naturally if suppliers can respond to higher demand by increasing production. However, if the economy is already running at full capacity, then the only solution is to reduce demand. This typically means raising interest rates to increase the cost of borrowing, which will lower consumption. Increasing taxes and/or cutting benefits can also reduce demand-pull inflation.

Cost-Push Effect

Cost-push inflation happens when the cost of production inputs, such as raw materials and labor, rise. Higher input costs decrease the aggregate supply of goods and services in the economy, but demand for those goods and services doesn’t immediately fall, so prices rise. Economic theory says that cost-push inflation should be short-lived, since consumers will respond to higher prices by buying fewer goods and services, in turn forcing businesses to reduce prices and thus bringing inflation down. However, when cost-push inflation affects goods and services for which demand is inelastic, such as gasoline or healthcare, demand falls for other goods and services instead. So it’s possible to have rising inflation in essential goods and services simultaneously with falling inflation in nonessential goods and services, such as hospitality and leisure, and rising unemployment in those sectors. When cost-push inflation in essential goods and services causes other sectors to experience heavy discounting, business failures and rising unemployment, the result can be stagflation or even a recession.

Built-In Inflation (Wage-Price Spiral)

Built-in inflation is a self-perpetuating feedback loop. The way it has historically happened is that strong labor unions negotiate high wage increases with employers, which then pass the cost on to customers in the form of higher prices. But the higher prices raise the cost of living for employees, so labor unions negotiate more wage increases, which the employers again pass on to customers. As the feedback loop develops, labor unions and employers start agreeing to wage increases in anticipation of rising prices. So a wage-price spiral develops. The period between wage rises and price rises becomes shorter and shorter and the rises larger and larger. The result is runaway or accelerating consumer price inflation.

The key aspect of built-in inflation is expectations. When people expect prices to rise, they demand higher wages to compensate. When employers expect wages to rise, they mark up their prices to compensate. When central banks talk about inflation expectations becoming “unanchored,” what they mean is that people are starting to expect wages and prices to rise faster than the central bank’s target inflation rate.

Runaway or accelerating inflation erodes savings and discourages investment for the future. When inflation reaches 50% per month, it is known as hyperinflation — an extremely destructive form of inflation that rapidly destroys an economy. Famous examples of hyperinflation include Germany in 1923 to 1924 and Zimbabwe in 2007 to 2009.

The History of Inflation

While some sources discuss the history of inflation by starting with ancient examples, these are not comparable to the modern monetary phenomenon known as inflation. For example, the “debasement” of Roman silver coins that supposedly contributed to the empire’s fall wasn’t “inflationary”; instead, it was the result of systematically reducing the silver content of the coins and thereby their value, without affecting the nominal value of silver. The coins were considered worthless simply because they included less of the hard asset they were supposed to contain. In addition, inflation examples before 1900 lack sufficient documentation or modern statistical methods.

We do know, however, that inflation has historically been a problem that governments have tried hard to solve, most often by pegging their currency to a hard asset such as gold and imposing restrictions on banks. For example, during the American Civil War, the governments of both sides issued paper money to pay for the war. As a result, inflation in the North rose to an estimated 80%, and in the Confederacy to over 5,000%. After the war, to bring inflation under control, Congress passed the 1873 Coinage Act that effectively pegged the U.S. dollar to gold.

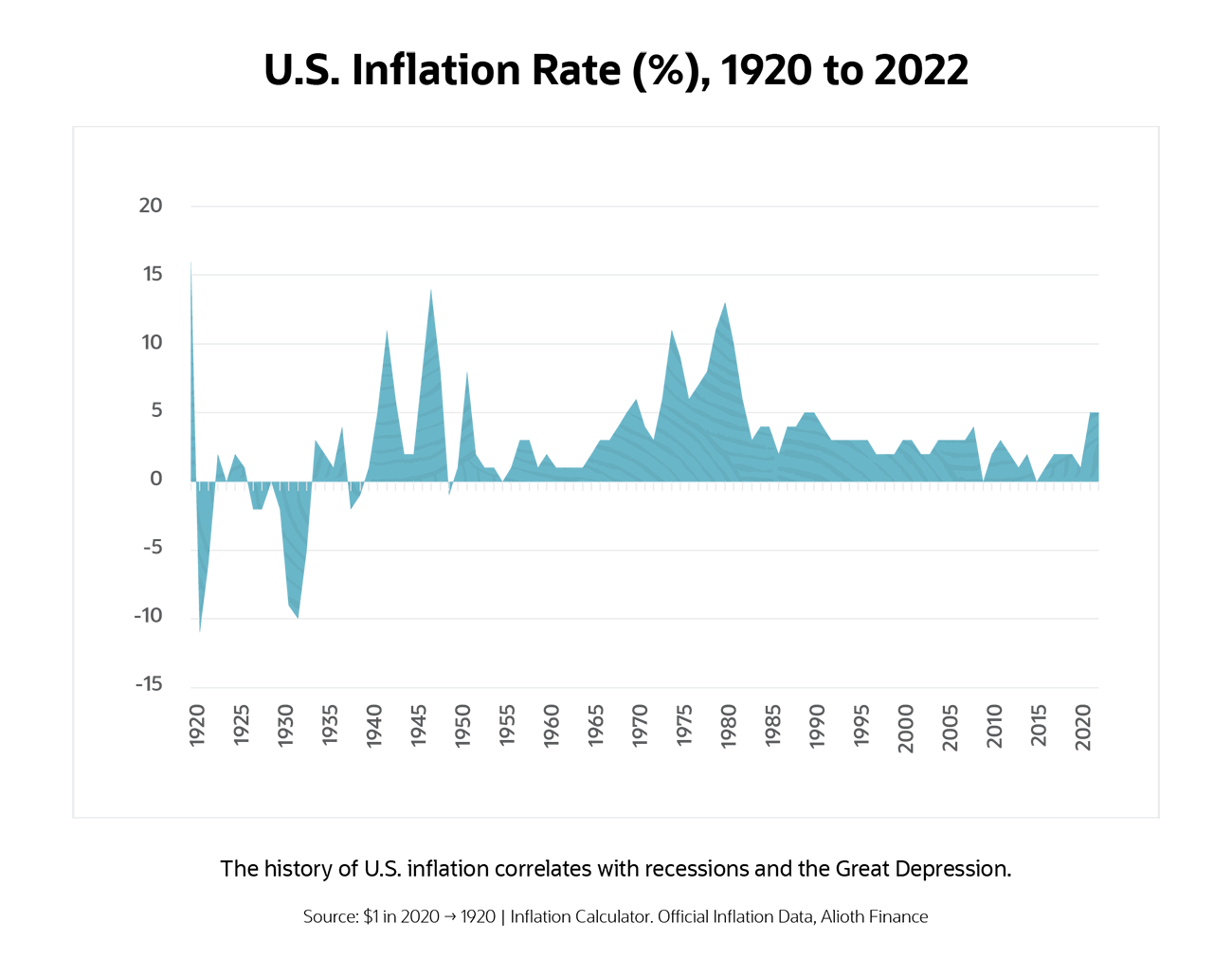

The chart below illustrates the history of the modern inflation phenomenon in the U.S., from 1920 to 2022. It starts with just a glimpse of the inflation of the World War I period. But the most striking feature of the early 1900s was how deflationary it was, with inflation rates far below zero. These deflationary periods coincide with a deep recession in 1921, a smaller one in 1926 to 1928, the Great Depression in the early 1930s and another recession in 1937.

After that came the enormous inflation caused by World War II. The Bretton Woods accord (discussed in the coming “Controlling Inflation” section) brought a period of relative price stability in the early 1950s, but inflation started to rise again in the mid-1960s because of the Vietnam War and the U.S.’s growing trade deficit. Because inflation was already high, the suspension of the gold standard is not obvious in the chart. But the two oil price shocks of the 1970s can be clearly seen: the first, in 1973, sparked by the Yum Kippur War, and the second, in 1979, sparked by the Iranian Revolution.

Since that time, inflation has been remarkably calm compared with earlier years. The period from the early 1990s to the financial crisis of 2008 is known as the “Great Moderation” because inflation stayed low and stable. And the 2010s have been a period of disinflation.

Where will inflation go in the 2020s? Many experts believe the 8.5% inflation in early 2022 may be the peak for now. But predicting is hard, and the experts have been consistently wrong about inflation in recent years.

Types of Price Indexes

The price indexes used to measure inflation fall into two main types: consumer price indexes and producer price indexes. Consumer price indexes are the most widely used; when people speak of “inflation,” they usually mean inflation as measured by a consumer price index. Central bank inflation targets are typically expressed in terms of a consumer price index — though not usually the Consumer Price Index (CPI). Some versions of consumer price indexes used by central banks exclude volatile products, such as energy and food.

Producer price indexes provide information on the cost pressures in the economy that could result in changes to consumer price indexes.

Consumer Price Index

The U.S. Bureau of Labor Statistics (BLS) defines the CPI as “a measure of the average change over time in the prices paid by urban consumers for a market basket of consumer goods and services.” In addition to consumables, the CPI includes rents (even “imputed rents” for homeowners — an estimation of what they would pay to rent the home they own); utility fees, such as water and sewage charges; and essential services, such as healthcare. It also includes sales and excise taxes, though not income taxes. It doesn’t include investment products, such as stocks, bonds and life insurance.

The contribution of each item in the basket to the CPI is weighted by its relative importance to the U.S. economy or, for a regional CPI, to the region’s economy. The BLS periodically adjusts both the composition of the basket and the weights assigned to the goods and services in it to take account of changing consumer tastes, seasonal effects and improvements in product quality. This is known as “hedonic adjustment.”

The BLS reports two nationwide versions of the CPI: CPI-W, the Consumer Price Index for Urban Wage Earners and Clerical Workers; and CPI-U, the Consumer Price Index for All Urban Consumers. CPI-U is the more comprehensive measure, covering 88% of the U.S. population. The BLS also produces CPI figures by region and metropolitan area, and by type of product.

Other countries similarly use consumer price indexes to measure inflation. European Union (EU) countries use the Harmonized Index of Consumer Prices (HICP), standards for which are set by the EU’s statistical agency, Eurostat. The U.K. produces two CPIs, one based on the EU’s HICP standard and the Consumer Prices Index Including Owner Occupiers’ Housing Costs (CPIH), which includes homeowners’ housing costs but not house prices. For developing countries, the International Labor Organization (ILO) sets international standards for calculating the CPI, and the International Monetary Fund (IMF) provides guidance.

Wholesale Price Index

A wholesale price index measures the changes in the price of goods sold in bulk and traded business-to-business. Many countries use wholesale price indexes as an indicator of inflationary pressures. The World Bank produces wholesale price indexes for many countries using a standardized methodology. In the U.S., however, the Producer Price Index (PPI, discussed next) is seen as a more accurate tool to measure wholesale transaction value.

Wholesale price indexes measure the change in price of wholesale goods since a reference year to give a percentage rate of inflation. For example, the World Bank currently uses 2010 as its reference year. The index for the reference year is taken to be 100: Any increase or decrease in the average price of wholesale goods since that year increases or reduces the index.

Here’s an example to show how the World Bank wholesale price index works, using hypothetical numbers for simplicity. Suppose that the average price of wholesale goods in 2010 was $5,000, but, by 2019, the average price had risen to $7,000. The increase in the average price is $2,000 spread over 10 years. So the inflation rate is 2,000 divided by 5,000 divided by 10 times 100, or 4% per year.

Producer Price Index

The Producer Price Index (PPI) is a family of indexes that measure the input costs for domestic businesses. It is thus a complement to the CPI, which measures the prices that the customers of domestic businesses pay for goods and services. The difference between the PPI and the CPI shows the extent to which cost-push inflation is feeding through into consumer prices or, conversely, the extent to which demand pressures are encouraging businesses to increase markups.

The BLS’s family of PPI indexes numbers close to 10,000. Producer prices are classified by industry, by commodity and by “commodity-based final and intermediate demand” (FD-ID), which groups products based on “the amount of physical processing or assembling the products have undergone.” Underlying this classification are the prices of nearly 10,000 individual product and product groups, which the BLS obtains through business surveys and reports monthly.

Other countries similarly produce PPI indexes.

Commodity Price Index

A commodity price index tracks the market prices of a basket of commodities. Commodity groups typically included in a commodity price index are energy (e.g., oil, gas, coal), metals (base and precious) and agriculture (grains, soft products such as coffee and sugar, livestock). Since commodities are essential inputs to production, commodity price indexes can help predict cost-push inflation. Commodity prices also feed into wholesale price and producer price indexes.

Commodity price indexes are created and managed by major banks and central banks, asset managers, exchanges, credit ratings agencies and market analysts. The World Bank and IMF also manage commodity indexes.

Personal Consumption Expenditures Index

The Personal Consumption Expenditures (PCE) index is one of several indexes produced by the U.S. Bureau of Economic Affairs (BEA). Like the CPI, it records changes in the prices of goods and services paid by U.S. urban consumers. However, it differs from the CPI in several respects. Its basket of goods and services contains different items, and even where the items are the same as those in the CPI basket, the weights assigned to them may differ from those used in the CPI. The prices the BEA uses to calculate the PCE index are based on business surveys rather than surveys of consumers, and it also uses a different index-number formula — the Laspeyres formula, rather than the Fisher-Ideal formula the BLS uses to calculate the CPI. International observers view it as a peculiarly American “quirk” to have two government agencies compete in providing extremely similar versions of the same statistics.

Core Price Index

Some of the products included in the PCE basket, such as oil and foodstuffs, tend to have volatile prices. So the BEA also produces a version of the PCE index that excludes these volatile items. This is known as the “core” PCE index and is the Federal Reserve’s preferred measure of inflation. In other words, it is the core PCE, not the regular PCE or the CPI or anything else, that the Fed looks at to determine whether the economy is close or far from the 2% annual inflation rate it hopes to achieve.

Other central banks similarly use core versions of consumer price indexes that exclude volatile items. This is because central banks aim to control inflation over the medium term, so they need to “look through” temporary swings in consumer prices that don’t affect inflation’s general trend.

Formulas for Measuring Inflation

Inflation is measured as the change in the value of the dollar over time or as the percentage increase in prices, either from the previous year or from a past reference year.

Percent Inflation Rate

Calculating a percentage inflation rate requires choosing a price index, such as the CPI or PCE, and deciding on the period you want to measure. You can calculate inflation rates monthly, quarterly, annually or for longer periods.

Annual percentage rates are the most commonly reported — both average annual rates (i.e., the average rate of inflation for one full year as compared to the prior full year) and monthly year-over-year rates (i.e., the inflation rate for any month compared to the same month last year). Month-over-month rates — the average inflation rate in March, say, as compared to February — are also widely used, especially when inflation is high. In March 2022, for example, the U.S. CPI percentage inflation rate was 8.5% higher compared to March 2021, marking the biggest annual jump since 1981. The inflation rate in March 2022 over February 2022 was 1.2%.

The formula for calculating the percentage CPI inflation rate is:

Percentage inflation = (CPI at end of period - CPI at start of period)/CPI at start of period x 100

So, for example, to calculate the annual percentage CPI inflation rate for 2021, you subtract the CPI in December 2020 from that in December 2021, then divide the result by the CPI in December 2020 and multiply by 100. According to the St. Louis Federal Reserve(opens in new tab), the U.S. CPI in December 2020 (baselined at 1982 to 84) was 261.564, and the CPI in December 2021 was 280.128. Thus, the U.S. annual percentage CPI inflation rate for 2021 was (280.128 – 261.564)/261.564 x 100 = 7.097%.

The same calculation can be used to find the year-on-year percentage inflation rate for, say, May 2020 to May 2021 or the quarter-on-quarter percentage for April to June 2022 versus January to March 2022. Just feed the appropriate CPI figures into the formula.

Change in Dollar Value

Calculating inflation as the change in dollar value means working out how much the dollar’s purchasing power has fallen. The starting point is again a price index, such as the CPI. The formula for calculating the change in dollar value is:

Change in dollar value = CPI at end of period/CPI at start of period x 100

Suppose we want to know how much the purchasing power of the dollar has fallen since 2010. The St. Louis Federal Reserve tells us(opens in new tab) that the CPI for our start point, January 2010, is 217.488 and our end point of – let’s say - January 2022 is 281.933. We can now calculate the change in the dollar value as 281.933/217.488 x 100 = 129.63.

This means that what $100 could buy in January 2010 now costs $129.63. Or, putting it another way, $1 now is only worth just over 70 cents in 2010 terms. The dollar has lost nearly 30% of its value since January 2010.

Benefits of Inflation

-

Inflation encourages people to spend instead of saving, since the value of savings is eroded over time. Low, stable inflation also encourages people and businesses to invest in assets, such as stocks and real estate, whose value tends to rise faster than inflation. And some inflation is needed to keep interest rates positive. So many economists regard some inflation — say, the 2% per year targeted by the Fed — as a good thing.

-

Inflation is also good for households, businesses and governments that are carrying debt, provided they have the income to service the debt as interest rates rise. When inflation rises, the value of the dollar falls. So although you still owe the same nominal amount of dollars, the real value of your debt falls.

-

Similarly, inflation can be good for businesses that are carrying inventory because they’ve already paid their suppliers (so their production cost was fixed in the past) but can now charge customers higher prices.

Drawbacks of Inflation

-

Inflation reduces the living standards of anyone whose income is nominally fixed, such as retirees. Many governments provide index-linked Social Security payments for retirees and welfare benefit recipients, but the indexing doesn’t always cover the full amount of the inflation loss.

-

Inflation also reduces the living standards of people who lack the bargaining power to negotiate higher wages in response to higher prices.

-

Inflation erodes the value of cash savings — rapidly, when inflation is high. Thus, it discourages people and businesses from saving, which can make them less resilient to economic downturns.

-

Runaway inflation can trigger runs on banks, capital flight across borders and frenzied buying of gold, valuables and big-ticket items.

Measuring Inflation

In addition to consumer and producer price indexes and their like, there are several other ways of measuring inflation. Some, like the GDP deflator, are entirely different ways of looking at inflation; others, like region- and asset-specific views, are suited to special purposes. And historically, the methodology underlying official government inflation indexes has changed in ways that not all experts think wise.

GDP Deflator

Instead of using a basket of goods and services, the GDP deflator (also known as the implied deflator or GDP price deflator) measures inflation by calculating the difference between nominal and real GDP.

Nominal GDP (NGDP) is the dollar value of all goods and services sold in the economy over a certain time — a month, a quarter or a year — based on the market prices during that period. If nominal GDP increases relative to past periods, that could be because more goods and services are being sold at the same price or because the same number of goods and services are being sold at a higher price. Typically, an increase in nominal GDP arises from some combination of higher sales and higher prices. The GDP deflator removes the effect of higher prices, leaving only the increase in GDP arising from higher sales of actual stuff — what is known as “real” GDP (RGDP). It does this by calculating the dollar value of total sales in the current year using prices from a reference year. The difference between this calculated value and current NGDP is the GDP deflator.

The formula to calculate the inflation rate implied by the GDP deflator is:

(GDP deflator for current year - GDP deflator for prior year)/GDP deflator for prior year x 100

The table below illustrates the formula using hypothetical numbers for simplicity, with “year 1” as the reference year. So, for example, the inflation rate for year 3 is calculated as 106.857 - 102.875 = 3.982; 3.982/102.875 = 0.0387; 0.0387 x 100 = 3.87%.

| Year | Total sales | Average $ price | NGDP | RGDP | GDP deflator | Inflation rate % |

|---|---|---|---|---|---|---|

| Year 1 | 80 billion | 175 | $14 trillion | $14 trillion | 100 | 0 |

| Year 2 | 85 billion | 180 | $15.3 trillion | $14.875 trillion | 102.875 | 2.875 |

| Year 3 | 90 billion | 187 | $16.83 trillion | $15.75 trillion | 106.857 | 3.87 |

| Year 4 | 95 billion | 195 | $18.525 trillion | $16.625 trillion | 111.42857 | 4.278 |

| Year 5 | 100 billion | 200 | $20 trillion | $17.5 trillion | 114.2857 | 2.564 |

Regional Inflation

Regional inflation can differ significantly from nationwide inflation, depending on the economic characteristics of the region. Knowing the inflation rate in their specific areas can be very useful for local policymakers to help them develop local policies to offset inflation’s effects and shield the vulnerable.

The BLS produces monthly CPI inflation reports(opens in new tab) for the four census regions of the U.S.: Northeast, West, Midwest and South, and for three metropolitan areas. Less frequently, it also produces CPI data for 20 other metropolitan areas. Statistical agencies in other countries similarly produce regional breakdowns of CPI data. For example, Eurostat produces an HICP report for each EU member state.

Historical Inflation Measurement Changes

The way we measure inflation has changed in the past few decades, and this has proved somewhat controversial (at least among economists and statisticians).

The problem concerns the method by which the CPI is calculated in the U.S. Originally, the CPI was determined by comparing the price of the same basket of goods and services across two different time periods. But in 2002, the BLS began adjusting the composition of the basket and the relative weightings of the items twice a year to maintain a constant “standard of living.” Some economists think the BLS’s adjustments amount to manipulation of the figures to allow the U.S. government to report a lower CPI. They want to return to the historical methodology that keeps the basket of goods and services constant.

Economists who disagree with the change have published alternative CPI reports using the historical methodology. They say that the change in methodology reduces the government’s reported rate of CPI inflation by five percentage points or more. If that were true, for example, the 8.5% CPI inflation reported in March 2022 would have been reported as slightly more than 13.5% had the methodology not changed.

Asset Price Inflation

Asset prices are not included in CPI inflation. But since, in the current era of QE in which central bank monetary policy raises asset prices, some investors and economists now believe that asset price inflation should be included. They argue that excluding asset price inflation enables central banks to claim that monetary policy is not inflationary, despite evidence that it raises asset prices. And they also point out that since a far larger proportion of the population now own assets than was the case 50 years ago, asset prices have become much more important to people than they were in the 1970s.

Opponents of this argument say that asset prices should not be included in the CPI because they are investments, not consumption goods. Rising prices in consumption goods make people poorer unless their incomes rise in line. But rising asset prices make the holders of those assets richer, not poorer. However, they do increase wealth inequality because those who don’t own assets find it increasingly hard to save up enough to buy them (though the CPI is not a tool to measure changes in relative wealth).

A further problem with including asset prices in the CPI calculation is that asset prices are extremely volatile, so including them would make it harder to use the CPI as a medium-term inflation gauge. Central banks already use versions of the CPI that exclude other volatile prices.

Issues in Measuring Inflation

Official measures of inflation are frequently criticized. The most frequent accusations are that they are too low or that they exclude key items, such as house prices.

Do official measures reflect reality?

Official measures of inflation can be lower than the inflation perceived by households. This is partly because of perception bias — people are more likely to notice a rising price than they are a falling one, and official measures are averages of many prices. Also, people don’t typically consider discounting and special offers in their view of inflation, but statistical agencies do. Another problem is that households’ individual “baskets” of goods and services can differ considerably from the baskets constructed by statistical agencies based on survey information about consumer preferences.

Official inflation measuring relies heavily on producer and consumer surveys. It is complex and subject to frequent revisions, and although statistical agencies such as the BLS try to explain how the index weightings and hedonic adjustments work, it’s fair to say that most people don’t understand them. Therefore, when official figures appear to differ considerably from households’ own experiences, it’s perhaps not surprising that some people think the figures are manipulated.

Nationwide measures of inflation such as the CPI also suffer from the fact that local inflation can differ considerably from the average for the country. In poor areas, particularly, effective inflation can be quite a bit higher than the official rate because people spend more of their incomes on essential goods whose price tends to rise and less on technological items that may fall in price.

Should inflation include housing prices?

The second major criticism of inflation measures is that they exclude items of crucial importance to people’s lives, notably asset prices — and house prices, in particular. The CPI does include rents, and some versions of it also include “imputed rents,” which are the estimated rents that those who own their own properties (with or without a mortgage) aren’t paying. But house prices aren’t included because a house is considered an asset, not a good. However, many people, particularly those who are struggling to buy a house, argue that house prices should be included in official inflation measures.

Unemployment and Inflation

High unemployment is a sign that the economy is operating below capacity. When unemployment is high, therefore, raising aggregate demand by cutting interest rates and injecting money into the economy through policy actions like QE encourages businesses to hire more people to produce the goods and services consumers want. Thus, stimulating aggregate demand reduces unemployment rather than causes inflation. Any short-term demand-pull inflation dissipates quickly as production increases.

However, if unemployment is low, raising aggregate demand by cutting interest rates and injecting money into the economy merely encourages producers to raise prices, while employers must compete for scarce labor by raising wages. Stimulating an economy that is at maximum capacity thus risks the development of a wage-price spiral. So policymakers must identify the minimum level of unemployment at which inflation remains stable. This is known as the “non-accelerating inflation level of unemployment” (NAIRU).

New Zealand economist Alban William “A.W.” Phillips developed a model — the Phillips curve — that describes this trade-off between inflation and unemployment. In the 1960s, it was thought there was a firm inverse correlation between inflation and unemployment — the higher unemployment was, the lower inflation would be. However, the stagflation of the 1970s showed that inflation and high unemployment could co-exist. So the Phillips curve model has since been augmented to take account of people’s expectations about inflation.

During the mid-2010s, when both inflation and unemployment were very low, some economists started to think that the Phillips curve no longer applied in Western economies. However, the resurgence of inflation in the aftermath of the COVID-19 pandemic has brought the Phillips curve once again to the fore.

Monetarism and Inflation

The monetarist revolution of the late 1970s introduced a radical new way of explaining and controlling inflation, explained by this famous quotation by economist Milton Friedman: “Inflation is always and everywhere a monetary phenomenon in the sense that it is and can be produced only by a more rapid increase in the quantity of money than in output”.

In this view, the way to control inflation is to control the supply of money. In the early 1980s, Federal Reserve Chairman Paul Volcker put Friedman’s ideas into practice, restricting the supply of money in the economy by sharply raising interest rates. Volcker’s medicine ended the stagflation of the 1970s, though it caused a deep recession and high unemployment. Since then, central banks have controlled inflation by managing the supply of money, either indirectly by means of interest rates or — since the Great Recession of 2008 — directly through QE.

The monetarist view of inflation rests on the Quantity Theory of Money, which relates money to output using the equation MV = PY, where M is the quantity of money, V is the velocity of money (the rate at which it changes hands), P is the price level and Y is output. In the equation, velocity (V) is considered a residual that can only be deduced from the behavior of the other variables, so most economists treat it as fixed. So the equation formalizes the argument that if the economy is at full capacity — i.e., Y cannot increase — then an increase in the money supply, M, must mean higher prices, P. Therefore, if there is inflation, the solution is to reduce the money supply.

However, some economists now criticize monetarists for treating all inflation as demand-pull, being unduly pessimistic about the ability of businesses to respond to inflationary pressures by increasing production, and failing to recognize any role for fiscal policy in the management of inflation.

Controlling Inflation

There are several ways of controlling inflation. Currently, the most popular one in developed countries is monetary policy, but fixed exchange rates are widely used by developing countries. Wage and price controls have largely been superseded by monetary policy, and the gold standard is now a thing of the past.

Monetary Policy

Central banks use monetary policy to keep inflation close to a target rate, typically 2%. However, they take a medium-term view of inflation, rather than responding to every short-term blip. They use a range of indicators analyzed together to deduce the likely path of inflation, including GDP, unemployment, wages and market-based expectations of future inflation.

The principal tool central banks use to control inflation is interest rates. When inflation is rising above the target rate, central banks raise interest rates to increase the cost of borrowing and thus discourage households and businesses from borrowing money to buy goods and services. Fewer sales calms down price rises and thus reduces inflation.

Conversely, when inflation is falling below target, central banks cut interest rates to reduce the cost of borrowing and thus encourage households and businesses to borrow money to buy goods and services and, in the case of businesses, to invest for the future. As demand for goods and sales rises, so do prices, thus bringing inflation back to the target. However, when inflation is falling below the target and interest rates are already close to zero, central banks use additional tools such as QE to encourage borrowing and spending in the economy.

Fixed Exchange Rates

For a small country with a history of currency instability, pegging the currency exchange rate to another stronger currency — typically the dollar or the euro — can be a way of preventing inflation. Bulgaria, for example, which experienced hyperinflation in 1996, hard-pegs its currency to the euro.

When the exchange rate is fixed, the goal of monetary policy becomes holding the peg. Domestic inflation and interest rates both move in lockstep with inflation and interest rates in the country that issues the currency to which the exchange rate is pegged. So Bulgaria’s inflation and interest rates are effectively those of the Euro area.

An even more drastic solution to the problem of currency instability and inflation is to adopt another country’s currency — known as “dollarization.” Zimbabwe brought hyperinflation to an end in 2009 by ceasing production of its own currency and adopting the currencies of several other countries, most notably the U.S. dollar, which tends to dominate the nation’s economy.

Gold Standard

Another way of preventing domestic inflation is to back the currency with some kind of hard asset. The classic version of this is the gold standard, but there have also been silver standards, land standards and grain standards — and some economists argue that the U.S. dollar has for many years effectively been on an oil standard. When a currency is fully exchangeable for a hard asset, the inflation rate is determined by the value of that hard asset.

Under a classic gold standard, maintaining balanced trade becomes the primary goal of monetary policy because a persistent trade deficit progressively drains the country of the hard assets that back its currency. In 1931, the U.K. was forced to abandon the gold standard when a sharp increase in its trade deficit threatened to completely drain its gold reserves.

The U.S. was forced off of its gold standard twice — the second time for good. The first came in 1933, due to the Great Depression. But during World War II, as inflation and volatile currency exchange rates raged alongside the war, 44 nations met in Bretton Woods, New Hampshire, in July 1944 to develop what has been known since as the Bretton Woods system of fixed exchange rates. The Bretton Woods plan brought the gold standard back to the U.S. It held until 1971, when a persistent trade imbalance drained U.S. gold reserves and the nation was forced to leave the gold standard and allow its currency to “float”.

The gold standard — and asset pegs in general — is now a thing of the past. Most developed nations have floating exchange rates, and many developing nations do too, though some peg their currencies to stronger currencies of developed nations’ economies.

Wage and Price Controls

Before the monetarist revolution of the late 1970s and the rise of inflation-targeting by central banks, wage and price controls were the preferred means of controlling inflation. Governments had “prices and incomes policies” that set and managed the prices of most products and limited the wage demands of labor unions. However, in the turbulent 1970s, these measures failed as prices were forced up by commodity price rises and labor unions refused to allow the living standards of their members to erode.

Hedging Against Inflation

Since inflation erodes savings, people are understandably keen to find ways of protecting themselves from losses when inflation begins to rise. There are inflation hedges for everyone, from investors and corporations to small businesses and households.

First, stocks tend to do better than bonds when inflation is high. Even small investors can shift from bonds to stocks to help protect against inflation. Real estate, including real estate-related products such as real estate investment trusts (REITs), is also an effective inflation hedge.

For businesses with cash to invest, U.S. Treasury Inflation-Protected Security (TIPS) bonds are probably the most reliable hedge because they protect against inflation without introducing default risk or currency risk. Inflation-protected bonds from European governments can also be reliable hedges, though there is currency risk for nonresidents. For individuals, the equivalent of TIPS is Series I U.S. savings bonds, which are indexed to the CPI and offered a 9.62% interest rate as of their last biennial adjustment in April 2022. But they can only be purchased by individuals and are subject to a cap of $10,000 per year, though legislation pending in Congress would raise that cap to $100,000.

Diversifying into global assets can protect against domestic inflation, though it can introduce currency and interest rate risk. Since Japan has had virtually no inflation for nearly 30 years, the yen and yen-denominated assets are widely regarded as good protection against inflation.

Commodities can also act as hedges against inflation, particularly cost-push inflation, but they are inclined to be volatile. Similarly, precious metals, such as gold and platinum, are often thought to be good inflation hedges, but because of their volatility they are not effective hedges on short-time horizons. Cryptocurrencies such as Bitcoin are actively marketed as inflation hedges, but their volatility is even higher than that of gold and commodities.

Examples of Inflation

Many widely cited examples of inflation are of hyperinflation, in which the purchasing power of money is completely destroyed. Often, the only solution to hyperinflation is to create a different currency.

The most famous hyperinflation, that in Germany’s Weimar Republic in 1923, produced iconic images of wheelbarrows full of banknotes and banknotes used as wallpaper. The price of a loaf of bread rose from 160 marks at the end of 1922 to 200,000,000,000 marks toward the end of 1923.

Weimar’s hyperinflation was caused by a toxic combination of high government debt and war reparations that had to be paid in gold or foreign currency. The central bank printed marks to buy gold and currency to service the debts, but as the mark’s value collapsed this eventually became impossible. After Germany defaulted on a payment in late 1922, France and Belgium invaded its principal industrial area, the Ruhr, to seize production goods as payment in kind. Germany instructed its workers to lay down their tools but continued to print money to pay them. That’s when hyperinflation really took off. By October 1923, the monthly inflation rate was 29,300% and prices were doubling every 3.7 days.

Ending the hyperinflation involved issuing a new currency, the Rentenmark, pegged to gold (though not exchangeable for it), and ceasing central bank printing of paper marks.

The U.S. has never experienced Weimar-style hyperinflation. But it did experience high inflation in the 1970s. The proximate cause of the inflation was President Nixon’s suspension of the gold standard in 1971 to protect the U.S.’s dwindling gold reserves, which were being drained by a rising trade deficit. Once it was no longer pegged to gold, the dollar’s exchange rate sank, helping to accelerate the inflation that had been gathering pace since the mid-1960s because of the cost of the Vietnam War. Then, in 1973, oil prices shot up due to an embargo by the Arab oil-producing states in retaliation for the U.S.’s support of Israel in the Yom Kippur War. High oil prices forced businesses to lay off staff, raising unemployment. The Federal Reserve, determined to meet its mandate of full employment, ignored what it thought was cost-push inflation from the oil price hike and supported the government’s expansionary fiscal policies. But unemployment didn’t fall, and inflation continued to rise, creating the unusual phenomenon known as stagflation. From November 1973 to March 1975 the U.S. was in recession despite rising inflation. Inflation peaked at 12.2% in November 1974.

Inflation vs. Deflation

Inflation is a rise in the general level of prices in the economy. Its opposite, a fall in the general level of prices in the economy, is called deflation. It’s important to recognize that prices must actually be falling for there to be deflation. If inflation is falling, but prices are still rising (if only slightly), that’s called “disinflation”.

For example, let’s imagine that inflation in the U.S. falls from its unusually high rate of 7.1% at the end of 2021 to a more normal 3% by the end of 2022. That’s a fall of 4.1% in the inflation rate. But at the end of 2022, prices will be 3% higher than they were at the end of 2021. That would be disinflation.

Now let’s imagine that there’s a recession in 2023 that drives the inflation rate right down to minus 2%. At the start of 2023, prices are rising. But by December, they are 2% lower than they were in January. That’s deflation.

Which is worse, inflation or deflation? It depends on your point of view. Most economists regard mild inflation as a good thing because it encourages people to spend and businesses to invest. Only when inflation gets too high do most economists see it as a problem, eroding people’s savings and reducing their standard of living. However, some economists regard any inflation at all as bad because it discourages saving. Everyone agrees, however, that runaway or accelerating inflation is terrible.

In contrast, most economists regard all deflation, however mild, as a bad thing because it discourages spending and investment. However, “Austrian school” economists say that mild deflation caused by technological advances is a sign of a healthy economy.

Everyone agrees, though, that the kind of deflationary spiral that happened after the Wall Street Crash of 1929 is devastating. It causes widespread debt defaults, bank and business failures, very high unemployment, homelessness and starvation.

Inflation and Cryptocurrencies

In the cryptocurrency world, “inflation” does not mean a rise in the price level. It means an increase in the supply of money. The concept of inflation as an increase in the money supply is borrowed from the Austrian School of economics, which dominates economic theory among cryptocurrency afficionados.

At present, however, cryptocurrencies are generally not used to purchase real goods and services. They have no real-world purchasing power and are not considered money, at least not in the U.S. Rather, cryptocurrencies are tradable goods, and like all tradable goods, when supply exceeds demand, their prices fall. Consequently, a cryptocurrency that has a limited supply and is issued at a constant rate, like Bitcoin, is valuable. Currently, the fixed rate at which Bitcoins are issued (or mined) is 6.25 every 10 minutes, and there can only ever be 21 million Bitcoins (a limit that is embedded in its source code).

Bitcoin is often described as deflationary because its supply is so limited that if it were actually used as money in an economy, there would be perpetual deflation. Many Bitcoin proponents regard its deflationary nature as its key selling point. They look forward to its widespread adoption as money because they worry that the continual injections of money central banks have been making ever since the 2008 financial crisis will eventually cause runaway inflation. Bitcoin, and other deflationary cryptocurrencies, are actively marketed as hedges against “fiat” currency inflation. Fiat currency is the money that people use to buy and sell every day; it is no longer backed by gold but comes into being on the order (fiat) of the Federal Reserve.

However, the cryptocurrency ecosystem as a whole is strongly inflationary, in money supply terms, because of the rate at which new cryptocurrencies are being produced. So-called “stablecoins,” such as Tether (USDT), USD Coin (USDC), Gemini dollar (GUSD) and Paxos Standardized Token (PAX), are typically issued in batches of millions or even billions to accommodate demand, and the whole ecosystem is growing rapidly. But as long as cryptocurrencies are not widely used to purchase real goods and services, there’s no risk that the runaway growth of cryptocurrencies will cause runaway inflation in the real world.

Inflation Calculator

The BLS hosts a CPI-based inflation calculator(opens in new tab) at its website, which lets visitors choose any month back to January 1913 to compare with any subsequent month. The link in the previous sentence shows these results: In March 2022, it would have taken $2,933.71 to match the spending power of $100 in January 1913.

Prep your business for any economic change with NetSuite Financial Management

High inflation leads to substantial economic uncertainty because the actions policymakers must take to tame inflation almost inevitably lead to an economic recession. But once armed with a solid understanding of inflation and its effects on business, well-run companies can exploit inflation’s beneficial effects and avoid its drawbacks.

Doing so requires accurate financial data and strong analytical tools that help businesses develop inflation-era plans. With the visibility into financial data and operational information provided by NetSuite Financial Management, business leaders can build the needed what-if scenarios and forecasts. Moreover, NetSuite’s real-time data and dashboards help business leaders closely follow key trends and business results, and act quickly when the right opportunities present themselves.

Conclusion

Low, stable inflation can be a boon, encouraging sufficient spending and investment to keep interest rates positive and the economy humming along. But when inflation gets out of control, the economy overheats and all sorts of things start to go wrong as the value of savings erodes and standards of living decline. However, businesses can benefit from inflation spikes by maximizing their operating efficiency, taking advantage of higher margins on inventory and strategically positioning themselves for the return of more stable conditions.

Inflation FAQs

What was the 2021 inflation rate?

Inflation averaged 4.7% for full-year 2021 as compared to 2020, according to data from the Consumer Price Index provided by the U.S. Bureau of Labor Statistics.

What causes inflation?

Inflation is caused by too much money chasing too few goods. This can be because high input costs are preventing businesses from producing enough goods and services to meet demand. Or it can be because banks, central banks or the government have injected too much money into the economy, so consumers are demanding more goods and services when the economy is already running at full capacity. When people and their employers start to expect price rises and agree to wage increases to compensate for them, there can be a wage-price spiral that causes runaway inflation.

Is inflation good or bad?

Most economists agree that low, stable inflation is good for the economy because it encourages spending and investment and keeps interest rates above zero. Inflation also erodes the value of debt, making it less of a burden for highly indebted households, businesses and governments. And businesses can take advantage of inflation to sell down inventory at a high markup, streamline their business and make efficiency improvements. Stocks and real estate can do well in inflationary times.

However, high inflation is bad for people on fixed incomes or who have cash savings because they become poorer as the real value of their incomes and savings falls. And because inflation discourages saving, it makes households and businesses less resilient to economic downturns. Very high inflation destroys confidence in the currency, the central bank and the government.

What are the effects of inflation?

Inflation erodes the purchasing power of money. Cash savings, therefore, fall in value, but so does the value of debt. People whose incomes rise with inflation don’t suffer any ill effects, but anyone on a fixed income becomes poorer. Inflation encourages spending and discourages saving. It also encourages investors to switch into inflation-resistant investments, such as stocks, real estate, index-linked bonds, commodities and precious metals.