Stagflation is a rare economic phenomenon that combines two or three negative economic trends that normally do not occur together: high inflation, poor growth and rising unemployment. It has only occurred two or three times in the past 100 years. But when stagflation does arrive, it is very hard to overcome because the monetary policy tools typically used to defeat one of those trends tend to make the others worse. Stagflation can create so much misery for the people living through it that economists actually call one tool they use to measure it the “Misery Index.”

During early 2022, as this article was being prepared, inflation was high and economic growth was slowing, setting the stage for stagflation’s potential return.

What Is Stagflation?

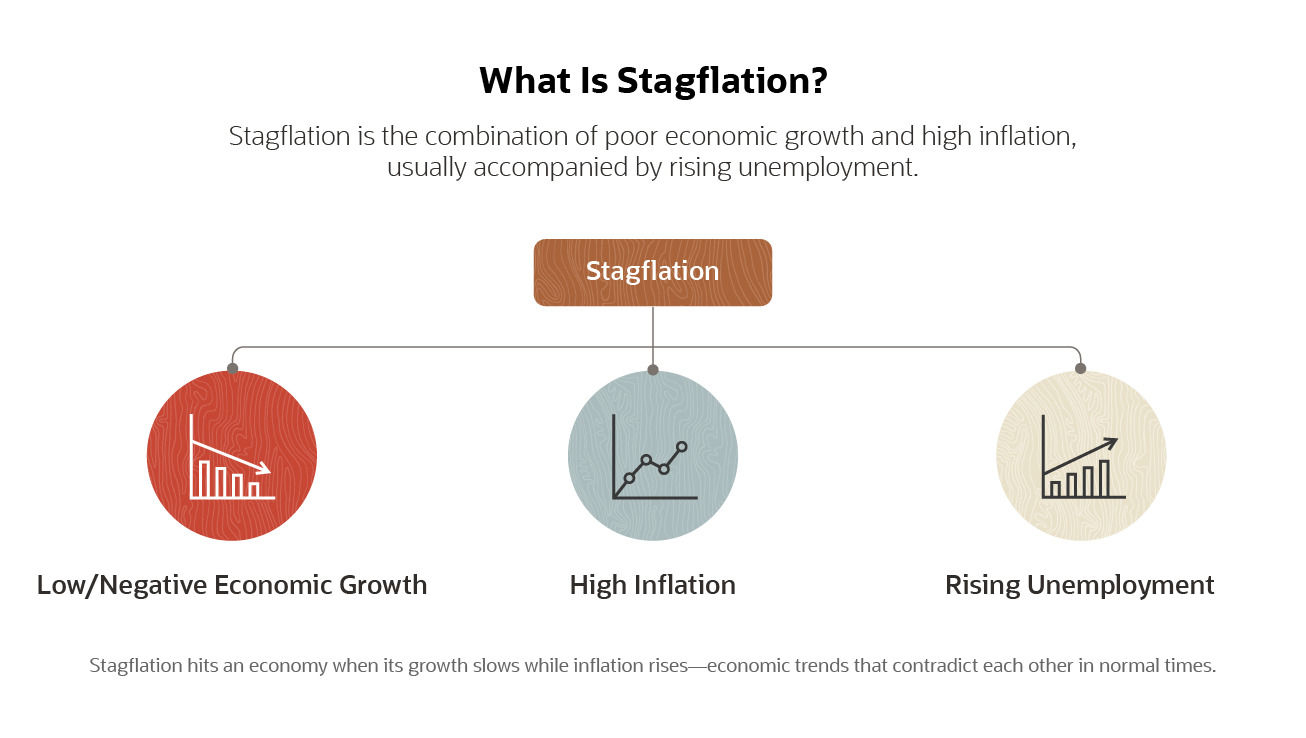

“Stagflation” is a portmanteau word combining “inflation” and “stagnation.” An economy in stagflation has high consumer price inflation, low economic growth and, usually, rising unemployment. The word was coined by the British politician Iain Macleod in 1965(opens in new tab) to describe the state of the U.K. economy at that time; it was subsequently adopted by U.S. politicians to describe the U.S. economy of the 1970s. Stagflation is highly unusual because high inflation and low economic growth are contradictory trends — inflation, by its nature, typically occurs alongside economic booms.

Stagflation vs. Inflation: Inflation is defined as a rise in the general level of consumer prices. Stagflation is the combination of generally high and rising consumer prices with low, absent or even negative economic growth.

Key Takeaways

- Stagflation is the combination of high consumer price inflation and stagnant economic growth, usually accompanied by rising unemployment.

- It can be caused by a supply-side shock, such as sharply rising oil prices, or by poor economic policies, such as too-high government spending or too-low interest rates.

- A wage-price spiral is typical of stagflation caused by poor monetary policy.

- The “Misery Index,” which combines inflation and unemployment, is a measure of stagflation.

- The best-known example of stagflation occurred during the 1970s in the U.S. and U.K. Other examples include the period after the 2008 financial crisis in the U.K.

- Curing stagflation can be difficult if it has become entrenched.

Stagflation Explained

It’s possible for an economy to have both high inflation, as measured in the U.S. by the Consumer Price Index (CPI), and strong economic growth, measured in terms of gross domestic product (GDP). This typically happens in developing nations with young populations. It’s also possible for an economy to have neither CPI inflation nor GDP growth, as has been the case in Japan for over a quarter of a century. Neither of these conditions is stagflation.

For there to be stagflation, there must be both CPI inflation and poor or absent GDP growth. It’s even possible for a stagflationary economy to be in recession, which means GDP growth is negative despite high inflation. This happened to the U.S. economy in the mid-1970s. In most recorded instances, stagflation is accompanied by rising unemployment.

How Does Stagflation Work?

Stagflation combines inflation, which lowers the purchasing power of money, with poor productivity, which lowers economic growth. It has been described as causing “misery” because the money people have buys less and less, causing their real cost of living to rise, while the economy’s low productivity and high unemployment prevent their wages from rising to compensate. Stagflation erodes people’s income and savings while causing businesses to hold down wages and hold back on investments and hiring.

In the early 1970s the American economist Arthur Melvin Okun invented the so-called “Misery Index,” which measures the economic distress stagflation causes when inflation and unemployment combine.

What Causes Stagflation?

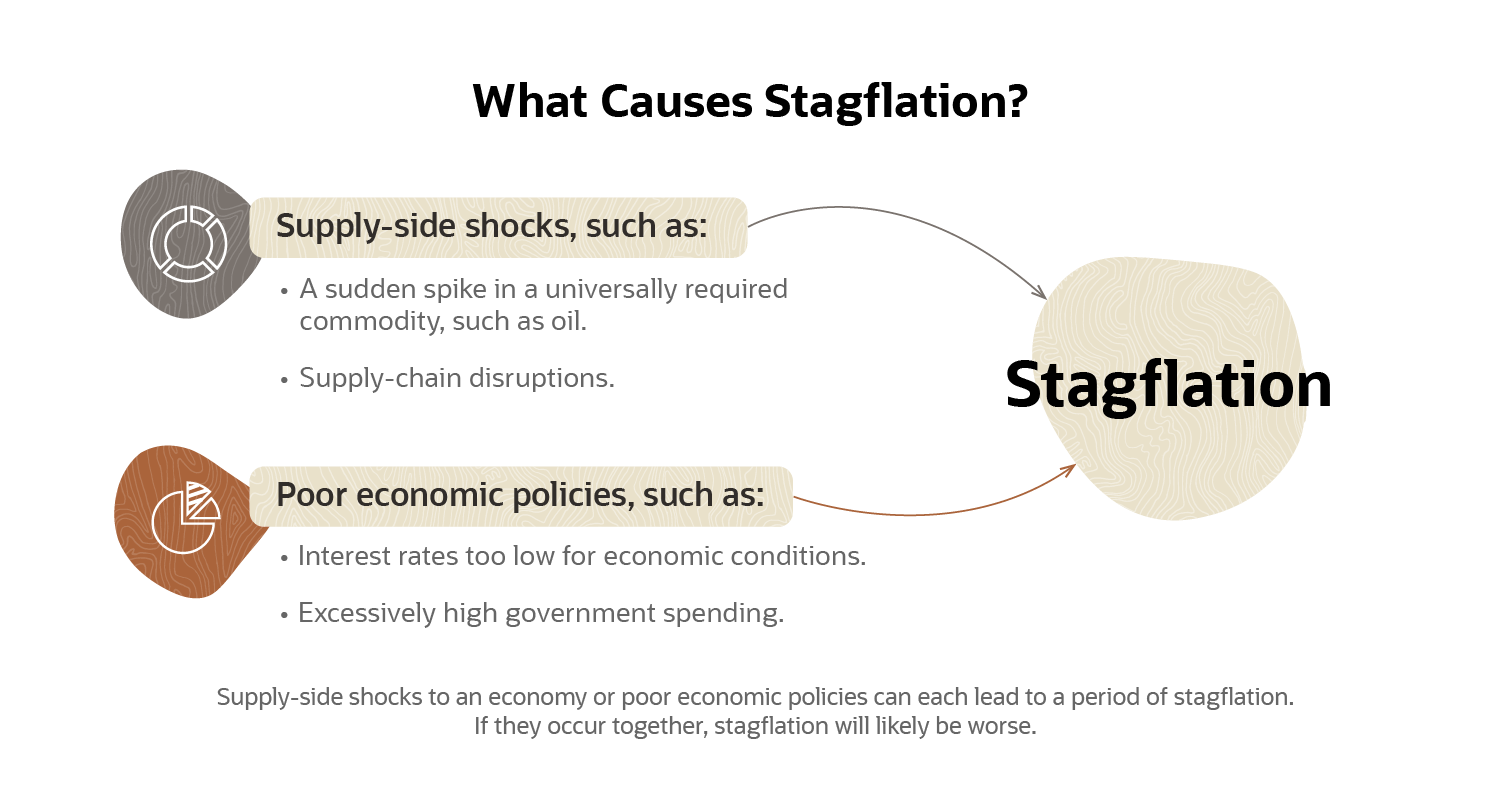

Economists identify two main causes of stagflation: supply-side shock and poor economic policies. These events can occur independently, but they can also occur together and reinforce each other.

-

Supply-side shock. This is typically a sharp rise in the global price of some essential commodity, such as oil. Oil is a good example because higher oil prices increase costs for virtually all businesses. In turn, businesses typically pass higher costs on to consumers in the form of rising prices and to workers in the form of lower wages and/or layoffs. As a result, both inflation and unemployment rise. Falling real incomes force households to cut back spending, particularly on nonessential goods and services, which causes economic growth to slow or fall. In response, businesses reduce output to maintain the high prices needed to cover the cost of the oil price shock. In this scenario, the fundamental cause of the stagflation is the oil price shock; unemployment and/or under-employment, falling real incomes and stagnant output are the result.

The U.K. experienced this example of supply-side shock stagflation in 2010 to 2012, when high oil prices raised inflation sharply, peaking at 5.2% in September 2011. The U.K. economy slumped, though it did not quite sink into recession: GDP growth fell from 1.9% in 2010 to 0.7% in 2012. Unemployment, already elevated because of the 2008 financial crisis, rose to 8.5% by the end of 2011.

Supply-side shock inflation typically dissipates when commodity prices stop rising, though because commodity contracts typically have long lead times, the price shock can take a year or more to unwind. In the example above, the oil price stopped rising in April 2011, but the U.K. economy remained in stagflation until 2012.

Supply chain disruptions, such as what happened in the COVID-19 pandemic, can also cause stagflation. Sharp rises in shipping, railroad and haulage costs can be passed on to customers and workers in the same way as commodity price shocks. Even if the shock itself is transitory, the ensuing stagflation can take a year or more to unwind due to long lead times on shipping contracts.

-

Poor economic policies. Stagflation can be caused by inappropriate monetary and/or fiscal policy. For example, a government might increase taxes on businesses, sharply raise the minimum wage and/or increase social spending. Employers facing a “double whammy” of higher taxes and higher labor costs could raise prices for consumers, thus increasing inflation. Alternatively, a government/central bank might keep interest rates too low in an economy running close to full capacity, triggering a consumer boom that drives prices higher. Workers demand higher wages in anticipation of higher prices; employers agree to their demands without insisting on higher output to counter the increased labor costs because they expect to be able to pass those costs on to customers in the form of higher prices. Consumer prices thus rise, resulting in more wage demands. This is known as a “wage-price spiral.” Prices rise, wages rise but output stays flat, and unemployment rises among young people entering the workforce and those with casual or insecure jobs.

In the early 1970s, loose monetary policy and high government spending combined to create full employment and strong economic growth in the U.S. But prices were already rising, in part because of the suspension of the gold standard in 1971. And after the oil shock of 1973, they rose even faster. By November 1974, CPI inflation had reached 12.2% and the U.S. was in a recession, with economic growth of minus 1.9% and unemployment rising fast.

Why Is Stagflation Bad?

Stagflation is particularly bad because it combines two situations that are normally contradictory, namely rising prices and falling economic output. This squeezes the citizens in an economy experiencing stagflation because their real buying power diminishes and their salaries — and savings — stagnate or decline in value.

Exacerbating the situation is that stagflation creates difficulties for policymakers: Policies that could cure inflation are likely to worsen economic output, and vice versa.

Is Stagflation Curable?

Mild stagflation caused by a supply-side shock such as an oil price rise, as happened to the U.K. economy in the early 2010s, may cure itself once the supply-side shock passes. But other forms of stagflation can be difficult to cure.

Cutting government spending can reduce inflation, and reducing taxes for businesses can increase output. But if there is an entrenched wage-price spiral, then expectations of price and wage increases must be broken. This could mean sharply raising interest rates to eliminate the cheap money that drives the spiral. That was the shock medicine imposed by Paul Volcker, Chairman of the Federal Reserve, in the early 1980s. It cured the U.S.’s seemingly intractable stagflation, but at the price of a very deep recession and extremely high unemployment.

Signs of Stagflation

The most obvious telltale signs of stagflation are generally macroeconomic, like rising consumer prices, rising unemployment or declining economic growth.

But supply-chain shocks, such as a sudden spike in the price of oil, or global supply-chain disruptions, like those that have come, gone and come back again since the beginning of the COVID-19 pandemic, are also considered key signs because they can lead to stagflation. Similarly, extended periods of loose monetary policy, high government spending or both can portend a period of stagflation.

Examples of Stagflation

The stagflation originally described by Macleod in 1965 was a combination of low economic growth and high inflation, which he attributed to poor productivity, excessive government spending — particularly on subsidies to keep key prices down — and a stubborn trade deficit. A trade deficit happens when imports exceed exports, indicating that the economy is producing less than it consumes.

But by far the most famous example is the stagflation of the 1970s that occurred in the U.S. and U.K. In both countries, exchange rate devaluation coupled with high government spending and low interest rates generated a brief economic boom. But that boom quickly foundered as high inflation, an oil price shock and a banking crisis (in the U.K.) rapidly destroyed productivity and economic output.

History of Stagflation

The story of stagflation begins in the years following World War II, when fast economic growth and full employment were policymakers’ twin goals. Economists who had learned their trade in the Great Depression feared unemployment and recession more than inflation. The Phillips Curve model, which posits a trade-off between unemployment and inflation, appeared to show that there could not be inflation while unemployment existed. And so-called “Keynesian” economics, named after the British economist John Maynard Keynes, taught that even at full employment, inflation could be kept low by controlling prices and incomes. So achieving full employment and maximum output appeared to be possible without negative economic consequences — namely, inflation.

But inflation crept up on Western economies during the 1960s. Macleod coined his new term, stagflation, in 1965 to describe the U.K.’s rising inflation and persistently poor economic growth. Two years later, the U.K. government devalued the pound, kicking off an inflationary spiral that eventually resulted in the U.K. and other European nations abandoning the Bretton Woods exchange rate system. The U.S.’s expenditure on the Vietnam War also drove up inflation, making it increasingly difficult to maintain the dollar’s peg to gold. In 1971, President Richard M. Nixon suspended the dollar’s convertibility to gold. Many experts ascribe the high inflation of the 1970s to the suspension of the gold standard.

In 1973, the OPEC oil-producing countries imposed an embargo on the U.S. and its allies for supporting Israel in the Yom Kippur War. The price of oil skyrocketed, fueling the U.S.’s already high inflation and depressing its output. By November 1974, the U.S. was in recession and had double-digit inflation. The U.K. additionally had a banking crisis in 1973 to 1974 and a succession of extremely damaging miners’ strikes that forced the government to introduce a three-day workweek so it could ration power supplies. By 1975, U.K. inflation was touching 25% and the economy was in a deep recession. Despite government spending cuts and attempts to negotiate with labor unions, both the U.S. and U.K. remained in stagflation for the rest of the 1970s.

A second oil price shock occurred from 1979 to 1980, when a revolution in Iran deposed the Shah and its neighbor Iraq then invaded. But by this time, economic wisdom had changed. Monetarist economists schooled by Milton Friedman advocated controlling the money supply rather than prices and incomes. The U.S. Federal Reserve and the Bank of England raised interest rates to unprecedented heights, causing a deep recession and extremely high unemployment, and the U.S. and U.K. governments (led by Ronald Reagan and Margaret Thatcher) enacted supply-side reforms to reduce the burden of taxation on businesses and encourage productive activity. By the mid-1980s, stagflation had been conquered, though inflation remained elevated for some years.

After central banks adopted inflation-targeting in the early 1990s, inflation largely disappeared from Western economies. But the ghost of stagflation reappeared after the financial crisis of 2008, when high oil prices squashed a fragile recovery and very loose monetary policy raised consumer inflation. The European Central Bank (ECB) raised interest rates to counter inflation, but this is now recognized as a mistake, since it helped trigger the European sovereign debt crisis of 2012 to 2013.

Stagflation also threatened to reappear in the latter part of the COVID-19 pandemic, as high commodity prices and disrupted supply chains raised producer prices, government unemployment subsidies increased consumer spending, and loose monetary policy made money easy and cheap to obtain. However, the economy grew strongly as it recovered from the pandemic-induced recession, and unemployment fell. Many argued that inflation would prove transitory since it was mainly due to supply-side factors that would resolve themselves in due course.

Conclusion

Stagflation is extremely damaging. It erodes people’s incomes and savings, forces businesses to cut back on investments and hiring, and damages the government’s tax base. And if it becomes entrenched, it can be difficult to cure without considerable economic pain. However, central banks and governments that are alert to the risks can take corrective action before stagflation takes root.

Stagflation FAQs

What is stagflation caused by?

Stagflation can be caused by a supply-side shock, such as a sudden rise in the oil price, or by excessively loose fiscal and/or monetary policy.

What is the difference between stagflation and inflation?

Inflation is rising consumer prices. Stagflation is the combination of rising consumer prices with low, absent or negative economic growth and, usually, rising unemployment.

What caused the 1970s stagflation?

The 1970s stagflation was caused by a combination of factors: high government expenditure (notably on the Vietnam War), low interest rates, suspension of the gold standard, two oil price shocks, powerful labor unions negotiating inflationary wage rises and, in the U.K., a banking crisis.

What are the effects of stagflation?

Stagflation erodes people’s incomes and savings, forces businesses to cut investments and lay off staff, and causes general misery. The so-called “Misery Index,” which sums the rates of inflation and unemployment, is a measure of the misery caused by stagflation.