The world has generally enjoyed low inflation over the past 30 years or so. Only a few developing countries, notably Venezuela, Argentina and Zimbabwe, have experienced hyperinflation — an economic situation so destructive that some economists have called it "when money dies." In most countries, inflation-targeting central banks have kept inflation under control, helped by globalization and floating foreign currency exchange rates that serve to tame external price pressures. But since the COVID-19 pandemic and the start of the Ukraine war, high and accelerating inflation has reappeared in developed economies for the first time since the 1970s. Could Western countries such as the U.S. also experience hyperinflation?

What Is Hyperinflation?

Hyperinflation is a devastating and often permanent collapse of the value of money — so much so that a major book about Germany's famous bout of hyperinflation in 1922-23 was entitled, "When Money Dies." Hyperinflation is characterized by extremely rapid price increases in all goods and services. In the worst-known cases of hyperinflation, prices doubled in days or even hours. When prices rise this fast, people rush to spend their money as soon as they get it. As a result, the velocity at which money circulates in the economy rises exponentially, feeding the price rises. Hyperinflation is thus also known as "hypervelocity."

It's important to distinguish between high inflation (say, 10% or slightly more per year) and hyperinflation. In a seminal 1956 study, National Bureau of Economic Research (NBER) economist Phillip Cagan defined hyperinflation as Consumer Price Index (CPI) increases exceeding 50% per month. For comparison, the U.S. Federal Reserve's CPI inflation target is 2% per year. Countries can experience high inflation for years without it developing into hyperinflation. For example, Argentina's inflation rate has exceeded 25% per year since 2017 and twice topped 50%. But it hasn't yet shown the exponentially rising prices characteristic of hyperinflation. Argentina last experienced hyperinflation in 1989-90, when the International Monetary Fund (IMF) estimates prices soared by 2,600% per year.

Monetary economist Cullen Roche defines hyperinflation as "a disorderly economic progression that leads to complete psychological rejection of the sovereign currency." He argues that hyperinflation is a fundamental breakdown of trust in government and its institutions. His view is echoed by the Bank for International Settlements, which noted in a June 2022 paper(opens in new tab) that hyperinflations "typically follow periods of major political upheavals and a generalized loss of confidence in institutions."

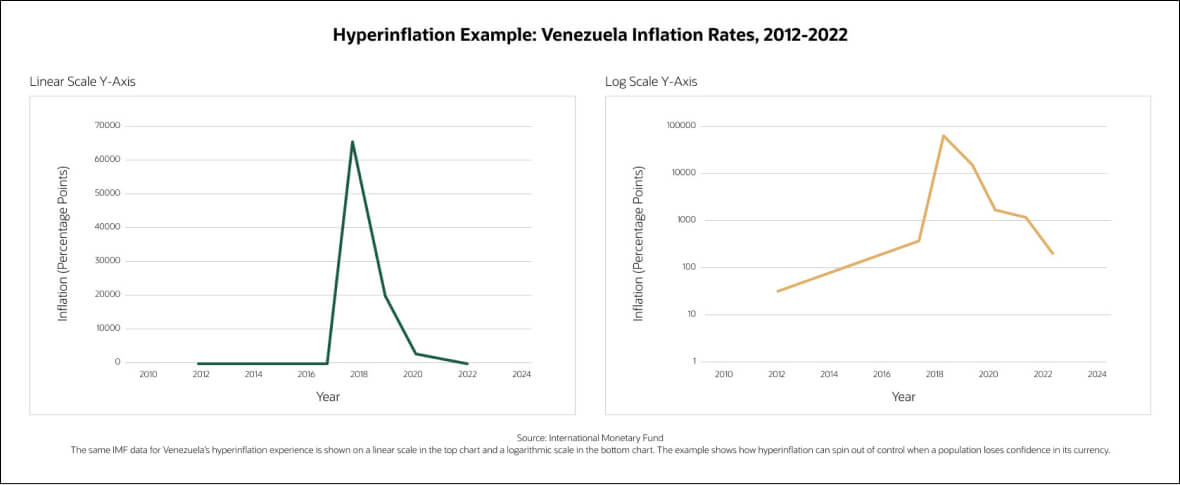

Fortunately, hyperinflation is a rare phenomenon. In 2013, Cato Institute economists Steve Hanke and Nicholas Krus published a list of 56 known instances of hyperinflation(opens in new tab), the first of which was in France in 1796. Hanke later added Venezuela's recent hyperinflation (see chart below) to the list, bringing the total of known instances to 57. The World Bank has warned that because of the war with Russia, Ukraine may also be on the brink of hyperinflation.

Key Takeaways

- Hyperinflation is generally defined as price increases of 50% or more per month, but in the worst-known cases prices have doubled in days or hours.

- Hyperinflation happens only when people lose all confidence in a government and its institutions, usually in the aftermath of political or economic upheaval.

- Hyperinflation literally destroys a country's currency, which must be replaced with a new currency pegged to a benchmark of stable value before the hyperinflation can be brought under control.

Hyperinflation Explained

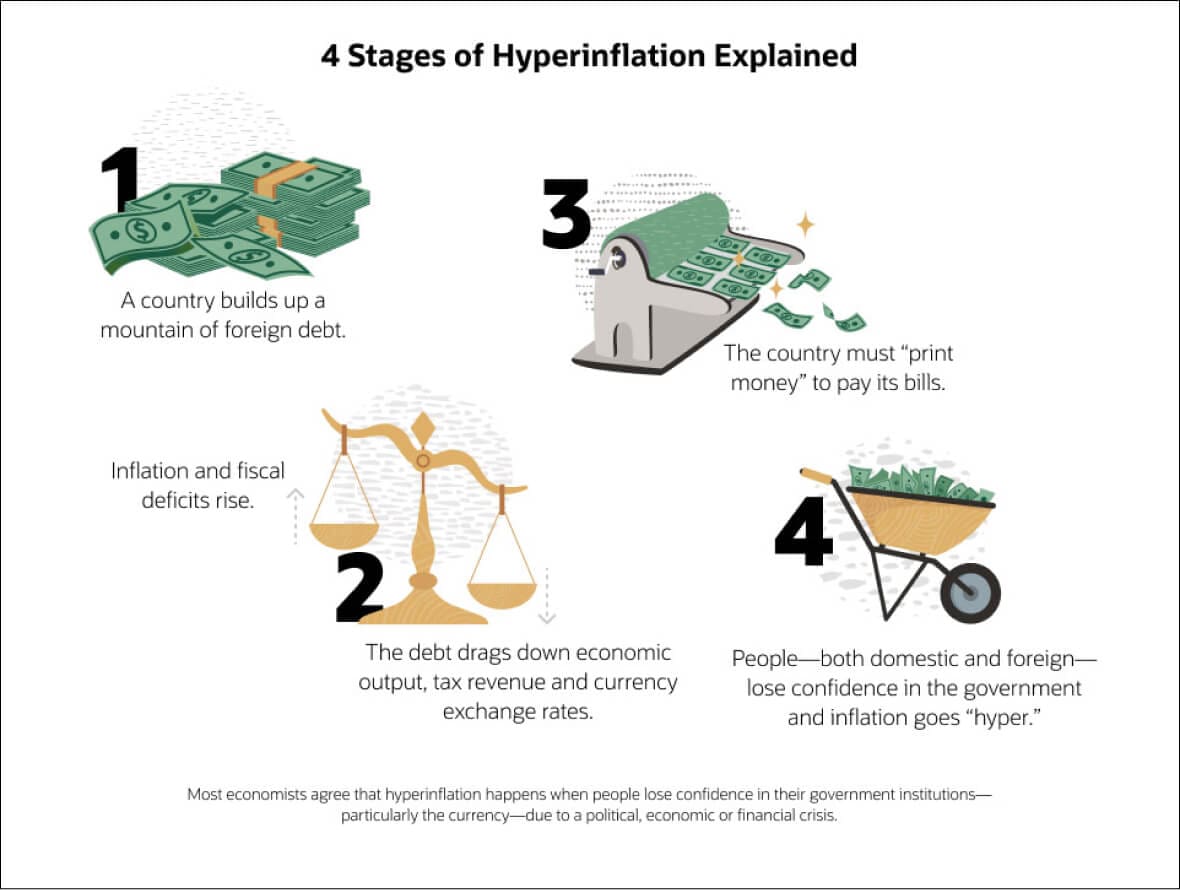

A key reason hyperinflation is so rare is that, before it can happen, a country must experience a series of financial crises without effectively managing them. There are generally four stages in the run-up to hyperinflation:

Stage 1:

The country builds up high levels of debt, either private, public or both. Some or most of this debt is denominated in foreign currency(opens in new tab), perhaps because of a long-term trade deficit or from financing a war.

Stage 2:

A crisis — political, economic or financial — severely damages the country's productive capacity. This causes government tax income to fall, which, in turn, causes the fiscal deficit to widen sharply. As a result, the country's sovereign currency exchange rate starts to fall relative to other countries' and inflation starts to rise.

Stage 3:

The economic crisis and rising fiscal deficit damage confidence in the government, which loses its ability to borrow from financial markets or from its own citizens. So it chooses to "print money" via the central bank to finance its obligations.

Stage 4:

As the money printing becomes widely recognized, the last vestiges of confidence in the government is destroyed. The currency exchange rate collapses. Hyperinflation takes off.

It's worth remembering that hyperinflation is quite different from high inflation. Business strategies exist for dealing with high inflation. But with hyperinflation, prices rise exponentially — they're out of control. The chart, in the previous section, of Venezuela's recent bout of hyperinflation presents a sense of what that can mean.

Further, hyperinflation, with its combination of economic crisis and runaway inflation, may sound similar to stagflation, but the two are entirely different economic phenomena. Stagflation is the combination of inflation and low or no economic growth, usually accompanied by high unemployment. While hyperinflation destroys a country's currency and sometimes its government, stagflation merely makes people's lives miserable as the inflation erodes the value of their money and the lack of economic growth limits their ability to make more. Recessions can come during periods of stagflation, but they don't always.

What Causes Hyperinflation?

As with many macroeconomic phenomena, there are multiple theories as to what causes hyperinflation.

Hyperinflation is often blamed on "money printing." The quantity theory of money says that an out-of-control money supply is a recipe for very high inflation, especially if the supply side of the economy is too weak or too restricted to increase output. Economists call this type of inflation "too much money chasing too few goods." Images of wheelbarrows full of currency and walls papered with banknotes during hyperinflationary episodes of the past give credence to this argument. But although excess money is undoubtedly a feature of hyperinflation, the fact that hyperinflation failed to appear in any Western country during the decade-plus of quantitative easing since the Great Recession began in 2008 calls into question whether it is the sole, or even the primary, cause.

Deficit monetization, which occurs when bonds issued by the government in an effort to reduce a budget deficit are purchased by the country's central bank, is another cause of hyperinflation cited by economists. In his book "Monetary Regimes and Inflation," which studies 30 hyperinflation episodes, economist Peter Bernholz concluded that hyperinflations "are always caused by public deficits which are financed by money creation." Cagan's 1956 study of hyperinflation assumes that monetizing government deficits triggers hyperinflation by destroying people's willingness to hold the currency. And in 1982, economists Thomas Sargent and Neil Wallace showed that a central bank forced to monetize deficits would be unable to control inflation.

Deficit monetization is undoubtedly characteristic of hyperinflation. When a country's currency "dies," the government becomes unable to borrow from financial markets or tax its own citizens and must either turn to its central bank to finance its deficit or default on its obligations. And a government that is unable to raise the money to turn on the lights will inevitably force its central bank to print money to pay for the electricity.

However, some economists dispute that deficit monetization is the primary cause of hyperinflation. Roche argues that both deficit spending and hyperinflation are the consequence of other factors. "Hyperinflations have generally occurred in nations with rampant corruption, war, regime change, a ceding of monetary sovereignty, output collapse or other extreme exogenous factors," he says.

Hyperinflations are strongly associated with war, particularly for those on the losing side. Hanke & Krus's list of 57 hyperinflations reveals that there were clusters of hyperinflations after both World War I and World War II and also during the Yugoslav civil war. The most famous hyperinflation in history, that of Germany's Weimar Republic in 1922-23, was consequent to its defeat in World War 1 and the punitive terms of the Versailles Treaty. The worst-recorded hyperinflation occurred in Hungary in 1945-46 after its defeat and occupation by the Soviet Red Army.

Hyperinflations are perhaps even more strongly associated with political chaos. The biggest cluster of hyperinflations occurred after the dissolution of the Soviet Union, which abruptly cut the economic lifelines of former Soviet states, leaving them with worthless currencies and rapidly collapsing output. For example, the IMF reports that Latvia's economy shrank by 50% between 1991 and 1993. The governments of these newly independent countries had little choice but to monetize deficits, with hyperinflationary consequences. Almost all former Soviet states, including Russia itself, experienced hyperinflation between 1992 and 1995.

"Modern money theory" economists Phil Armstrong and Warren Mosler disagree with the thesis that deficit monetization through money printing is the cause of hyperinflation. They identify the principal cause of hyperinflation as a currency exchange rate collapse in a country that has high foreign-denominated debt. They also hold that money printing to finance government expenditure and meet workers' real wage expectations is the consequence, not the cause. In their analysis of Germany's Weimar Republic hyperinflation(opens in new tab), they argue that if the government had refused to pay the higher prices caused by currency depreciation of the mark, there would be no hyperinflation. However, this would usually mean debt default and a drastic fall in living standards.

Hyperinflation Effects

Given its "death of money" moniker, it comes as no surprise that hyperinflation has devastating economic, social and political consequences. As hyperinflation takes hold in a country, its currency exchange rate collapses, causing the price of essential imports to skyrocket, which, in turn, accelerates domestic inflation. Consequently, businesses become unable to pay for raw materials and parts, and investment fails as capital flees the country in search of safer havens. The government's tax revenues fall, and it becomes unable to borrow in its own currency either externally or from its own citizens. It prints money to obtain essential foreign exchange, pay its workers and pay for essential services. This fuels further price rises, setting up the rapid acceleration that is characteristic of hyperinflation.

As prices rocket, the value of savings falls. To protect their savings as best as they can, people exchange them for foreign currencies or valuable goods, such as gold and jewels. As hyperinflation gathers speed, people start to exchange their wages and savings for anything that will hold its value better than the currency. There are runs on banks. People start to hoard nonperishable goods, causing shortages. If the government attempts to hold down prices, black markets proliferate.

Money printing can maintain workers' wages for a while: Venezuela's government raised its minimum wage by 289% in 2021, its fourth consecutive year of hyperinflation. But eventually, there is a brutal downward adjustment of real wages that destroys living standards. Rapidly increasing poverty is thus the inevitable result of hyperinflation, followed by starvation as wages fail to keep up with food prices. Worse, in a full-blown hyperinflation the government is unable to maintain public services, so the death rate from illnesses rises, as does infant mortality.

Politically, opposition to the government increases, sometimes violently. Hyperinflation often ends with regime change and an IMF economic bailout program.

Hyperinflation Examples

The earliest recorded example of hyperinflation occurred during the French Revolution. The paper currency issued by the revolutionary government, the "assignat," hyperinflated due to distrust of paper money and a fear that the unstable revolutionary government would collapse, especially after the outbreak of war with other European powers. In 1796 the assignat was replaced with land warrants, but these too failed to gain traction with the population, so the government reintroduced a metallic currency.

Germany's hyperinflation in 1922-23 is perhaps the best known and most analyzed hyperinflation. Its origin lay in the harsh terms of the Versailles Treaty, which forced Germany to cede much of its productive territory to France, Belgium and Poland and required punitive reparations to be paid "in gold or in kind." Germany, already highly indebted because of its war debts, struggled from the start to pay the reparations. Its currency exchange rate fell sharply, forcing it to print money to buy gold. In early 1923, Germany defaulted on its reparations payment. France and Belgium invaded Germany's industrial center in the Ruhr Valley to seize goods in lieu of payment. In a form of passive resistance to the invasion, German workers ceased production, while the government continued to pay their wages using money printed by the central bank. This fueled hyperinflation. The hyperinflation was eventually ended by the introduction of a new currency, the Rentenmark, which was backed by real estate mortgages and suspension of money printing and deficit monetization. In 1924, the Rentenmark was replaced with a new gold-backed Reichsmark, and the U.S. provided loans to Germany to help rebuild its economy.

Another well-known example of hyperinflation occurred in Zimbabwe in the 1990s. A government "Economic Structural Adjustment Program" seriously diminished the country's productive capacity, while sanctions imposed by the U.S., the European Union and the IMF made it more difficult for farms and businesses to obtain financing. Between 1998 and 2008, Zimbabwe's economy shrank by 50%. During that time, Zimbabwe also fought two wars. The government printed money to pay for the wars and maintain workers' living standards. Hyperinflation started in 2007 and continues today. Confidence in the Zimbabwe dollar has not returned, and the economy is now effectively "dollarized" — i.e., people there transact primarily in U.S. dollars.

Hyperinflation Remedies and Solutions

The solutions to hyperinflation are to create a new currency, adopt a different currency or credibly peg the hyperinflating currency to something solid, such as gold. Pegging the currency to gold or a stable foreign currency forces the government to stop monetizing deficits and, by reestablishing currency credibility, helps the government raise money from taxation and borrowing. Holding such a peg typically requires fiscal austerity and causes a sharp fall in real incomes.

If the government creates a new currency, it faces the challenge of getting people to adopt it. Zimbabwe has introduced five currencies since 1980, all of which ended up in hyperinflation. That's why the currency most widely used in Zimbabwe today is the U.S. dollar.

Venezuela's oil-backed Petro digital currency similarly failed to end the country's six-year hyperinflation, mostly because it's backed not by actual oil but by a price guarantee from the Venezuelan government. Government guarantees only work well when the government is trusted. Had there been a regime change in Venezuela, a government-guaranteed oil price peg might have worked. But since the government that caused the hyperinflation is still in power, the digital currency it created is not trusted by either the population or foreign investors.

Note: The bolívar, is Venezuela's primary currency, not the Petro — the Petro is essentially a cryptocurrency. While backed by the government, it has not replaced the bolivar.

Countries that have successfully replaced hyperinflating currencies include:

- France, which in 1797 replaced the paper assignat with a metallic currency.

- Hungary, which in 1946 replaced the worthless pengo with the forint.

- Peru, which in 1981 replaced the sol with the inti and then in 1991 replaced the inti with the nueva sol (renamed the Peruvian sol in 2015).

In each case, replacement of the currency was undertaken by a new government and involved a radical change in economic management.

Governments are reluctant to adopt a foreign currency, even to end hyperinflation. However, sometimes the population does this voluntarily. The reason Venezuela's hyperinflation persists despite the government's attempts to end it is that the population is increasingly adopting the U.S. dollar for everyday transactions and as a savings vehicle.

Whatever approach is taken, stabilizing the currency's exchange rate and restoring confidence in the government's economic management is essential for capital to return to the country and businesses to invest, hire and produce. Once the currency stabilizes and confidence is restored, growth can return.

Prepare Your Business for Any Economic Condition With NetSuite Financial Management

Although hyperinflation is unlikely to occur in Western countries, it's not impossible. For companies doing business with developing countries, high inflation — and even hyperinflation — is a business risk that needs to be managed. The International Practices Task Force at the Center for Audit Quality produces a list of countries that are experiencing very high inflation and at risk of hyperinflation, which can help businesses prepare for potentially hyperinflationary conditions affecting their overseas partners.

Accounting and financial management software that supports multiple currencies and automates currency translation is crucial to managing the financial risks of doing business in countries with unstable currency exchange rates and high inflation. NetSuite cloud-based Financial Management software gives businesses real-time insights into their financial performance, as well as other metrics and KPIs. This helps businesses identify risks and potential threats, allowing them to take corrective action before it is too late. This combination of real-time data and sophisticated analytics is particularly important for company's experiencing turbulent economic conditions in the countries where they operate.

Hyperinflation is devastating not only to the people and businesses of the country where it's happening, but can also affect their international trading partners. Fortunately, it is rare and usually associated with major political disturbances, such as wars and disorderly regime changes. The risk of hyperinflation is low in Western countries, but businesses that have partners in countries at risk of hyperinflation need to be alert to rising credit risks and build reserves against the possibility of losses even if they are doing business in U.S. dollars.

Hyperinflation FAQs

Which countries have experienced hyperinflation?

Steve Hanke and Nicholas Krus of the Cato Institute have identified 57 instances of

hyperinflation affecting just over 50 countries (since some countries have experienced

hyperinflation more than once). Countries affected have included developed countries such as

France and Germany, but since the second World War, hyperinflation has largely been a

phenomenon of developing countries.

How can businesses prepare for hyperinflation?

Hyperinflation isn't very likely in stable Western countries such as the United States,

so doing business in U.S. dollars or other global reserve currencies such as the Euro and

the yen helps to reduce the risk of losses due to hyperinflation. If business partners are

in countries at risk of hyperinflation, it's also a good idea to keep tight control of

credit, since hyperinflation increases the risk of default.

Will the U.S. go into hyperinflation?

Although the U.S.'s high debt and large trade deficit appear to make it vulnerable to

hyperinflation, it's actually very unlikely that the U.S. will go into hyperinflation.

The reason for this is that the U.S. issues the world's premier reserve currency (the

dollar) and savings vehicle (U.S. Treasury bonds), and global markets price goods in

dollars. Only if the world decided to stop using the U.S. dollar would the country be at

risk of hyperinflation.

What was the worst hyperinflation in history?

The worst hyperinflation in history was in Hungary from 1945 to 1946, where prices doubled

every 15 hours. Second worst was Zimbabwe in 2007 and 2008, where prices doubled every day,

and third was the former Republic of Yugoslavia from 1992 to 1994, where prices doubled

every 1.4 days. The famous hyperinflation in Germany's Weimar Republic during 1922 and

1923 comes in fourth, where prices doubled every 3.7 days. Other bad hyperinflations include

Greece in 1941, where prices doubled every 4.27 days, and China from 1947 to 1949, where

prices doubled every 5.34 days.

What happens to debt during periods of hyperinflation?

Hyperinflation is beneficial to those who owe money, since the debt is "inflated"

away. However, those to whom debts are owed lose out, since any repayments they receive are

in a worthless currency. If the debt is owed in a different currency from the debtor's

own, and the debtor's own currency is hyperinflating, then the debtor will find it

increasingly difficult to make payments and may end up defaulting.

What happens to real estate during hyperinflation?

In hyperinflation, real estate becomes infinitely valuable in terms of the hyperinflating

currency. However, once the currency is stabilized, the value of real estate will stop

rising.

What will happen if there is hyperinflation?

In any country, hyperinflation is a devastating economic phenomenon in which people's

savings become worthless and incomes become insufficient to buy essential goods, such as

food. Countries that experience hyperinflation become poorer as a result.