Every business that allows customers to buy products and services on credit faces the possibility of not getting paid. This can result in diminished sales and profits and unrecouped costs for goods and services that have already been delivered. It also places businesses in the precarious position of having to press customers to pay for their purchases without damaging their relationships. Yet, the longer a debt goes unpaid, the more challenging it can become to collect what is owed. The time period during which a business awaits payments is known as debtor days, and it’s a metric that requires careful monitoring if a company is to maximize cash collection, improve cash flow and protect its bottom line.

What Are Debtor Days?

Debtor days are the length of time it takes for a business to get paid by a customer. Unlike cash sales, which are instantaneous, cash collection for sales made on credit lags receipt of the good or service bought. Debtor days commence on the date the business issues an invoice for a sale made on credit and accumulate until the customer’s payment is received. For example, a credit sale that is made on April 13, invoiced on April 15 and for which payment hits the business’s bank account on May 30 equals 45 debtor days. Is that number good? The answer depends on the invoice’s payment terms, industry norms and, importantly, whether the business is set up to withstand the wait. As a general business rule, fewer debtor days are most desirable.

Key Takeaways

- Debtor days represent the time between when a business issues a customer invoice and when it receives payment.

- Fewer debtor days can reduce bad debt expense and increase the business’s cash flow.

- Optimizing controllable influences on debtor days helps increase collection efficiency.

- Average debtor days vary by industry.

- Automated billing and accounts receivable (AR) reporting are primary tools to manage and reduce debtor days.

What Do Debtor Days Measure?

Debtor days is an efficiency metric that indicates how quickly a business collects payment from its customers and can access the funds. Quicker access improves the business’s liquidity and makes it easier to meet short-term obligations, such as paying for inventory purchases and payroll. Conversely, longer debtor days can strain the business’s cash flow and create problems managing its working capital.

Debtor days is one of several ways to refer to the length of time that elapses between when a business issues an invoice and when it collects the payment. Other terminology for debtor days include days sales outstanding (DSO), debtor collection period, average collection period, creditor days, accounts receivable turnover days and accounts receivable days.

Importance of Debtor Days Ratio

Collecting payment for credit sales is critical to both a business’s profitability and its cash flow. Plain and simple, unpaid invoices represent lost revenue. However, an uncollected sale is even worse for profitability than no sale because the expenses to produce and deliver the product or service have already been incurred. From a cash flow perspective, the business relies on its customers’ payments to keep its business cycle moving forward: buying goods and materials, paying employees, growing the business and keeping the proverbial lights on. During long stretches of nonpayment, the business’s cash position can become tight or inadequate, prompting it to tap into costly credit lines or causing business interruptions. The longer credit sales go unpaid, the more time, effort and cost the business incurs for collection efforts, while the likelihood of collection goes down.

How to Calculate Debtor Days

For a single transaction, a business can calculate debtor days just by ticking off the calendar the days between the date of the invoice and receipt of the payment. At a broader level, the business’s overall average debtor days for all open accounts receivable (AR) is the metric to monitor. It can be calculated for any time period — a month, quarter or year — using the following formula:

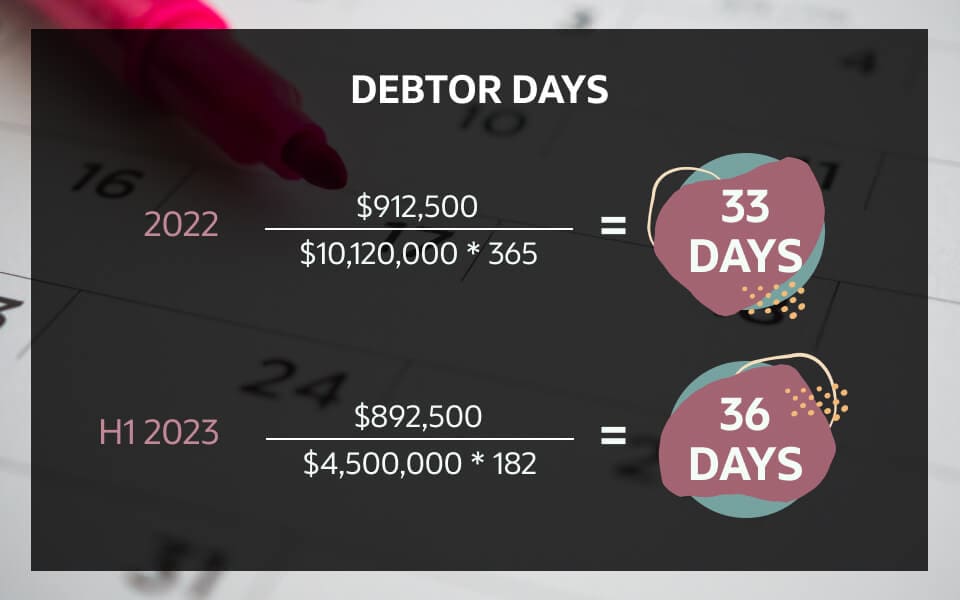

Debtor days = (average accounts receivable / sales) × days in period

The debtor days formula consists of three variables:

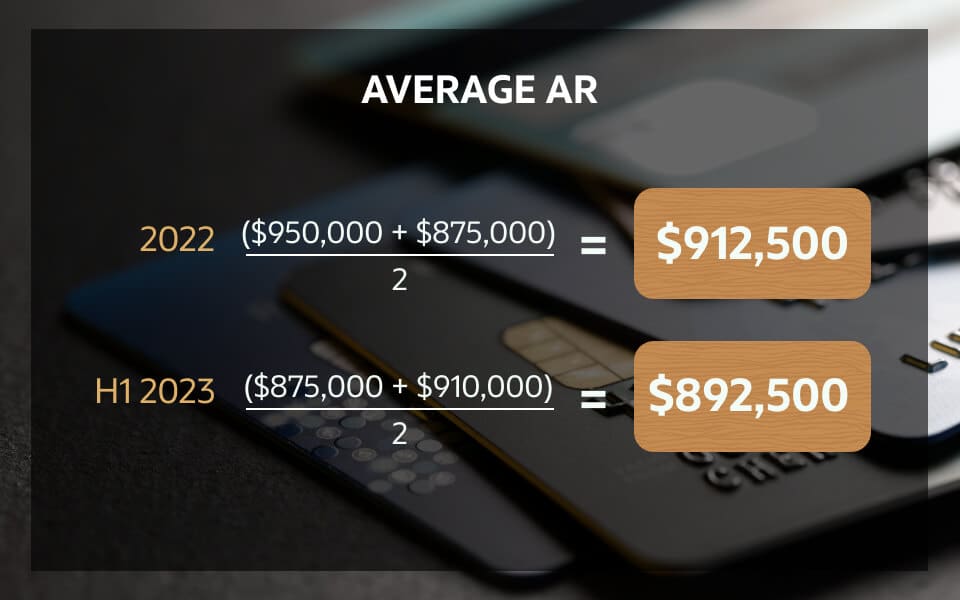

- The average accounts receivable (AR) variable is calculated by adding the total AR balances at the beginning of the period and at the end of the period and then dividing that sum by two. The AR balances are available on the business’s balance sheet or in its general ledger. The formula for average AR is: Average accounts receivable = (beginning AR + ending AR) / 2.

- The sales variable is based on the total value of credit sales between the dates of the beginning and ending AR. It ignores cash sales.

- The variable for the number of days in the period should align with both the average AR and sales time frame — commonly 30, 90 and 365 days, for monthly, quarterly and annual calculations.

Debtor Days Example

The following example demonstrates how debtor days are calculated using the formulas above.

SMR Emporium is a hypothetical distributor of vintage music that sells vinyl albums to boutique retail music shops. Lately, SMR’s cash flow has fallen short of expectations, and collection efforts have become more difficult. In order to objectively analyze the overall trend, SMR’s CFO needs to calculate the average debtor days in the first half of 2023 as compared with the full year of 2022.

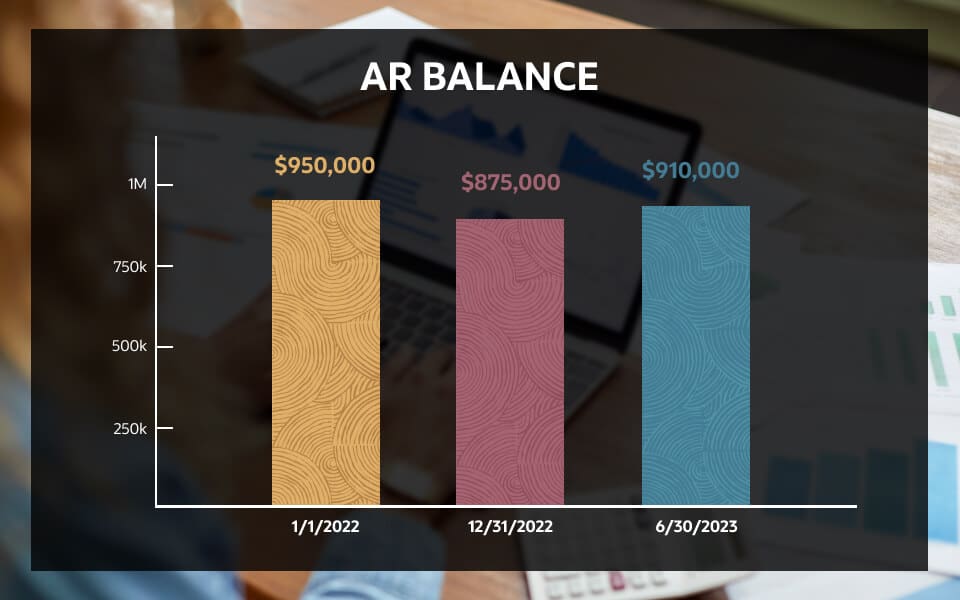

First, he gathers the following data from the business’s balance sheets and its general ledger:

Next, he determines total credit sales for each period:

The CFO then calculates the average AR for each scenario:

Now he is able to determine the number of debtor days:

Indeed, SMR’s average debtor days increased by three days, from 33 in 2022 to 36 in the first half of 2023. This means that SMR is waiting almost 10% longer to receive payment from its retail store customers. In terms of dollars and sense, had the debtor days stayed the same as 2022 (33), the AR balance on June 30, 2023, would have been lower, at $781,000, because SMR would have collected $129,000 ($910,000 – $781,000) more in cash payments.

This example illustrates how even a small difference in debtor days can have a significant influence on a business’s cash flow.

Debtor Days Calculator

Debtor days can be calculated at any time, for any period. It’s a good idea for businesses to monitor this metric closely and keep an eye on trends over time. A best practice is to use automated software that includes debtor days on real-time dashboards, along with AR aging reports, which categorize open AR that have become past due. This downloadable debtor days calculator will also be helpful.

Determine Debtor Days at a Glance

Average Debtor Days by Industry

The average debtor days in the full year of 2021 was 40.6, according to a long-running study of 1,000 companies across 50 industries by The Hackett Group. However, it’s important to note that debtor days vary significantly across industries, stemming from the nature of the underlying business. For example, the retail industry tends to have lower debtor days due to a high volume of sales and lower invoice values, as compared with the construction industry, where high-priced, long-term projects are typical.

The following table is a summary of the median debtor days for selected industries, demonstrating the wide range of “typical” debtor days. Keep in mind that the median is the midpoint of the data, where an equal number of companies in each industry have debtor days above and below the median, rather than the mean, or simple average, of the debtor days.

Median Debtor Days by Industry, Full Year 2021

Source: ReadyRatios (opens in a new tab)

| Industry Title | Number of Companies | Median Debtor Days |

|---|---|---|

| Food Stores | 32 | 4 |

| Hotels, Rooming Houses, Camps, And Other Lodging Places | 69 | 19 |

| Petroleum Refining And Related Industries | 38 | 25 |

| Wholesale Trade-non-durable Goods | 123 | 26 |

| Furniture And Fixtures | 29 | 30 |

| Amusement And Recreation Services | 85 | 34 |

| Motion Pictures | 61 | 37 |

| Personal Services | 54 | 40 |

| Paper And Allied Products | 41 | 45 |

| Communications | 225 | 45 |

| Electric, Gas, And Sanitary Services | 310 | 47 |

| Health Services | 137 | 51 |

| Business Services | 1247 | 57 |

| Engineering Accounting Research, Management, And Related Service | 189 | 65 |

| Building Construction General Contractors And Operative Builders | 48 | 83 |

Factors That Influence Debtor Days

Debtor days can increase or decrease for a variety of reasons, some of which are controllable and in the business’s best interest to fine-tune in order to maximize payment collection and cash flow. At the same time, certain external forces, such as industry practices and the overall economy, are less controllable and can also impact debtor days.

Early Payment Discounts

Early payment discounts are incentives for customers to pay their invoices before they come due. In exchange for a small discount off the total price — typically 1% to 2% — a business can greatly reduce the time and effort it takes to get paid. For example, the business could offer select customers an early pay discount if payment is made within 10 days of invoicing, rather than its standard 30-day payment term. These discounts can go a long way toward reducing debtor days and even overall delinquencies because they set an earlier payment reference point for customers. Before offering an early payment discount, the business should assess whether the lost revenue will be offset by the benefit to cash flow.

Billing Errors

Billing errors slow the collection process and increase debtor days. Sending invoices to the wrong customer contact, listing incorrect quantities or prices or not supplying the proper supporting information, such as customer purchase order numbers or shipping documents, are just a few mistakes that can delay payment. Resolving errors and disputes takes time and effort for both the customer and the business, but it’s the business’s cash flow that suffers the consequences as it awaits payment. A few ways to proactively set up the invoicing process to help reduce debtor days — beyond simply reducing billing errors — are to use short standard payment terms (30 days rather than 60 or 90 days), clearly note payment terms on contracts and invoices, offer multiple payment methods and send invoices in a timely manner, such as with e-billing.

Industry Differences

Industry differences impact average debtor days, but they are an external factor over which businesses have less direct control although they do need to account for them. Some industries, for example, have a high incidence of cash payments and short credit payment terms, resulting in lower average debtor days. Other industries with long product delivery timetables tend to have longer payment terms, resulting in higher average debtor days. Industry payment conventions, such as retainers, progress billing, upfront deposits and back-end balloon billing due at the end of a project, impact the number of debtor days. So does the sales transaction channel: Enabling customers to pay electronically can decrease the number of debtor days, since that form of payment tends to have shorter collection periods.

Macroeconomic Conditions

At the broadest level, poor macroeconomic conditions can have an undesirable effect on debtor days. When lenders tighten the reins and reduce available credit, customers may have to slow down making payments, resulting in increases in debtor days for purchases. In turn, a business’s incoming cash flow might slow, causing it to slow down its own payments on B2B purchases.

Going against the grain of industry norms can be difficult, but understanding them and optimizing the controllable factors can help a business keep its debtor days as low as possible.

Credit Practices

Credit practices have an indirect but significant impact on debtor days. Customers who are more creditworthy tend to pay their bills promptly and on time. Assessing the credit profile of new customers prior to doing business together is an important step in determining whether a business should extend trade credit and how much to extend. Rigorous credit practices, which support lower debtor days, help reduce the incidence of customers who cannot pay or struggle to pay on time. Beyond initial credit reviews for new customers, it’s good business practice to periodically review active customers to make sure their payment history and credit arrangements remain in good standing.

Improve Debtor Days With NetSuite

Reducing the number of debtor days means getting paid faster and improving cash flow. Automating the invoice, credit and collection functions with a tool such as NetSuite Financial Management is a primary way to accomplish that. The automated billing from NetSuite Accounts Receivable software sends invoices to customers quickly and accurately, reducing payment delays due to billing errors. It also automatically sends timely payment reminders and dunning notices. When combined with customizable AR aging reports and real-time, role-based AR dashboards, businesses are better able to manage the entire AR collection process, reducing debtor days and bad debt expense. And by getting more cash in house more quickly, they become better able to fund future growth.

Debtor days is an efficiency metric that measures the time between when a business issues an invoice and when it receives customer payment. Keeping debtor days as low as possible helps reduce the likelihood of nonpayment and improves cash flow. Several controllable factors can be managed to achieve that goal, within the context of industry norms. Even a small change in debtor days can make a big difference in profitability and cash flow.

#1 Cloud

Accounting Software

Debtor Days FAQs

What is a good amount of debtor days?

Debtor days refer to the length of time it takes to get paid by a customer. The optimal number of debtor days depends on the invoice’s payment terms and industry norms.

Should debtor days be high or low?

As a general rule, fewer debtor days are better from a seller’s perspective because it means quicker access to cash.

Why are debtor days important?

Collecting payment for credit sales is critical to a business’s profitability and cash flow. Longer debtor days means that credit sales remain open for longer periods — i.e., they haven’t been paid — causing more collection effort and cost while the likelihood of collection goes down.

Why do debtor days increase?

Several factors can cause debtor days to increase. Billing errors cause payment delays while disputes are researched and resolved. Additionally, giving trade credit to noncreditworthy customers or giving too much trade credit can cause customers to become overextended and slow to pay. Macroeconomic factors, such as a recession, can also cause debtor days to increase.

What is a good debtor ratio?

Debtor ratio is another term for debtor days. A good debtor ratio varies based on the invoice’s payment terms and industry norms. A 40-day debtor ratio is favorable in an industry with a median in the 80s and 60-day invoice terms, such as the construction industry. The same 40-day debtor ratio is problematic in an industry with a median in the 20s and 30-day invoice payment terms, as in certain petroleum sectors.

What’s the difference between debtor days and days sales outstanding?

Debtor days and days sales outstanding are efficiency metrics that measure the same thing: the time between a business’s issuing invoices and collecting payment from customers.

What are average debtor days?

Debtor days are the length of time it takes for a business to get paid by a customer for a sale made on credit. Debtor days are calculated as the time between when an invoice is issued and when the customer’s payment is received. Average debtor days refer to the overall average debtor days for all open accounts. It can be calculated for any period — a month, quarter or year.

What does a decrease in debtor days mean?

A decrease in debtor days means that a business is collecting customer payments more quickly. It also means that the business has faster access to cash, which can be used to fund future business cycles.