Navigating the professional services business model can feel like walking through a maze where the walls shift with every step. Where traditional businesses, like manufacturing, follow a mostly linear path from production to sale to revenue recognition, professional services organizations, such as law and accounting firms, must navigate a more fluid mix of three specific variables: project-based time and expenses, revenue recognition, and billing and collections schedules. The constantly shifting timing of each variable can make it difficult for services firms to predict cash flows and record revenue. In addition, professional services projects, with their mix of project schedules, client expectations and variable billing structures, are subject to additional shifts in client needs and project scope, as well as the inherent unpredictability of knowledge-based deliverables.

All of the above often puts a strain on accounting departments, requiring a constant recalibration of data gathering, reconciliation and reporting to ensure accurate financial statements, smooth invoicing and billing, and satisfied customers. This calls for specialized accounting tools and practices tailored to manage the nuances of professional services deliverables.

This article explains the nuances of professional services accounting, the challenges these nuances create and how best practices and technology can help service firms make accounting more efficient and accurate.

What Is Accounting for Professional Services?

Accounting for professional services firms is the process of capturing, summarizing, analyzing and reporting on financial transactions to provide financial clarity, showcase stability, comply with regulations and guide strategic decisions. If that definition seems like it could apply to any industry, you’re correct. Professional services firms do, indeed, use the same accounting principles as industries that produce physical products. However, they employ different accounting processes. That’s because professional services business models revolve around constantly shifting resources, projects, contracts and client relationships. Every advisory given, hour consulted or project completed has a monetary implication attached, and capturing these details correctly helps to ensure the firm’s longevity and sustain trust with clients.

Integral to professional services accounting are processes like revenue recognition, which, given the service-oriented nature of the industry, might span prolonged periods or depend on project milestones. These accounting processes also include managing accounts payable and receivable, expense tracking, payroll processing and financial reporting. With the fluctuating scope of projects and client-specific demands, professional services accounting necessitates a keen eye and adaptive approach.

Key Takeaways

- Professional services firms have complex business models that involve human capital–based value, project- and time-based service deliveries, and fluid revenue streams.

- As a result, professional services firms often face accounting challenges related to fluctuating cash flows, complex revenue recognition, advances and retainers, and forecasting and budgeting.

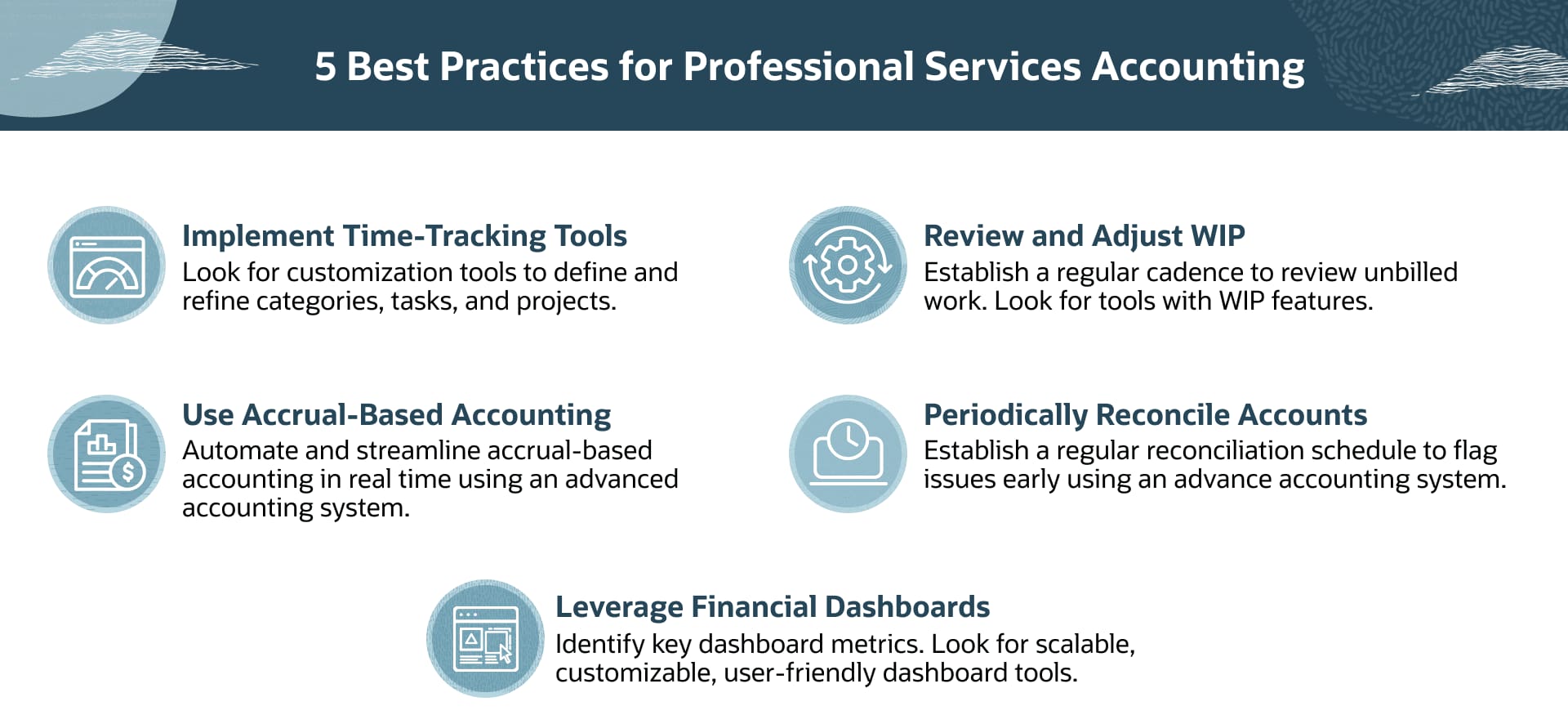

- Best practices to manage these challenges include implementing time-tracking tools, reviewing work in progress and using accrual-based accounting methods.

- To manage accounting processes, services firms should look for software that includes automated invoicing and billing, advanced reporting and analytics, and integrated project management.

Accounting for Professional Services Explained

Professional services firms face accounting challenges distinct from traditional product-based businesses, primarily because their revenue is typically derived from services based on time, expertise and relationships. As such, accounting processes for professional services face several multilayered hurdles. One example is revenue recognition, which is the point at which a firm can record earning revenue for financial reporting purposes. When should a law firm, for example, recognize revenue for a case that spans months or even years? How does a consulting firm account for a project that continually evolves, based on client feedback? Such scenarios call for an intricate understanding of when and how to account for revenue, expenses and income. Additionally, professional services contracts often contain clauses pertaining to payments contingent on results, outcomes or client satisfaction, adding layers of unpredictability to the accounting equation.

The Financial Accounting Standards Board provides guidance for some of the unique circumstances surrounding professional services accounting, such as rules for contracts with customers and deferred costs. But the many nuances of the services industry underscore the importance of specialized accounting processes that ensure that firms recognize revenue correctly, manage cash flows efficiently, price services appropriately and maintain compliance with various tax and regulatory standards. Accurate accounting provides insights into profitability and operational efficiencies to help stakeholders make informed decisions. To tackle their accounting challenges, many firms rely on industry-specific accounting systems tailored to handle service-centric financial intricacies with precision.

Characteristics of Professional Services Accounting

Professional services organizations often grapple with the challenges of accurately capturing expertise-driven value and fluctuating project timelines. The following characteristics are hallmarks of the professional services business model and have the greatest impact on accounting processes.

Intangibility and Uniqueness

Because professional services firms sell knowledge, expertise and time, rather than physical merchandise, the value they offer rests on the service quality, effectiveness and outcomes they achieve. Not only is this business model unique compared with, say, manufacturing and retail, but within each professional services company, almost every service rendered is also unique. In the accounting profession, for example, a company might offer tax advisory services to multiple clients, but the specific tax strategies devised for each client could differ because of each client’s distinct financial landscape. As a result, otherwise straightforward accounting processes, such as service delivery, revenue recognition and the valuation of intangible products, can be difficult to assess, standardize or bill.

Close Client Relationships

Unlike industries where interactions might be transactional, in professional services the relationship between provider and client is usually more personal. Each client engagement requires a thorough understanding of a client’s competitive position, objectives and pain points. Over time, this deep understanding builds a bond solidified with each successful outcome and challenge met.

But such intimacy doesn’t come without its challenges, particularly when it comes to accounting. In fact, close client relationships can sometimes be a double-edged sword. For example, disagreements or unforeseen obstacles can strain the relationship, potentially jeopardizing future business. In addition, this closeness can result in “scope creep” when a client becomes too comfortable with a service provider and requests additional services without a corresponding adjustment in fees. This can skew profitability metrics and make project accounting challenging, due to difficulties in tracking billable hours accurately or allocating costs efficiently. Close relationships can also cause conflicts of interest. For example, if a client is going through a financial hardship, the close relationship might tempt the service provider to extend lenient credit terms, potentially affecting the firm’s cash flow.

High-Knowledge Intensity

Professional services clients pay for professionals’ intellectual prowess and insights. This knowledge-centric model presents intricate accounting challenges because professional services offerings aren’t tied to physical products and are, therefore, fluid and often customized to individual client needs. For example, a professional services firm’s primary assets are human expertise and time, making it difficult to determine the actual cost of service delivery. What’s the value of seasoned expertise versus a junior employee’s work? What’s the value of a consultant’s years of industry networking? As mentioned previously, because services are knowledge-based and often rendered over extended periods, pinning down the exact moment to recognize revenue is challenging. High-knowledge intensity can also make it difficult to price services. For example, two professionals in the same firm might approach a problem differently, based on their distinct knowledge subsets. However, this can complicate standardized pricing models, posing challenges in financial forecasting and consistency.

Tailored Service Deliveries

Clients of professional service firms aren’t seeking off-the-shelf remedies; they require specialized advice and strategies tailored to their specific circumstances and objectives. As a result, professional services firms must devise a fresh, tailored approach for almost every new client engagement, making each transaction distinct and leading to often complex accounting challenges. Standardized pricing models rarely apply, because the depth, scope and nature of services can vary dramatically across clients. In addition, determining fair value for bespoke offerings can be tricky, requiring a balance of expertise, time and resources. Tailored service deliveries also often involve phased or milestone-based billing. For example, an IT consultant might send an invoice after each software module is developed or after achieving specific project milestones. Accounting for phased revenues, aligning them with actual service progress and ensuring accuracy can be challenging.

Time-Based Revenue

In professional services, every hour spent by an expert translates to insights, strategies or solutions, each with a distinct value. And because there’s no tangible product to wrap this value up in a neat box for billing purposes, professional services firms often package and bill the value of their services based on time, also known as billable hours. Each additional hour of service not only increases costs but also amplifies the value delivered to the client.

But accurately logging, tracking and billing every minute spent on a client’s project can be daunting. For example, consider a law firm working on a high-profile case. Overlooking even a few hours in an engagement can translate to significant revenue losses. Further complicating matters is the variability of hourly rates. A senior consultant’s hour will invariably be priced higher than a junior’s. As a result, accounting teams not only need to tally hours, but they must also ensure correct rate application for every employee involved. Once again, revenue recognition is an issue. If a consultancy undertakes a six-month strategy project for a client, when should it recognize the revenue? As the project progresses, upon milestones or once the engagement concludes?

Key Accounting Concepts for Professional Services

The following concepts form the foundation of professional services accounting methods. As such, they provide a basis for the key features service firms should consider when evaluating consulting and technology platforms to improve their accounting.

Revenue Recognition

Revenue recognition refers to the rules and methods firms adopt to determine when and to what extent revenue is recorded in their financial statements. Revenue recognition can pose challenges for professional services firms because engagements can span weeks to months. Expertise, time and value, however, are delivered throughout the project, not merely in the final result. Professional services firms often use one of the following three methods for revenue recognition:

- The percentage of completion method allows firms to recognize revenue based on the progress of a project, as opposed to only when it’s completed. This is a popular approach in professional services due to its alignment with the ongoing delivery of value. However, while it provides real-time financial insights that enhance cash flow forecasting, it also requires vigilant tracking and can inflate revenue if not applied carefully.

- The completed contract method defers revenue recognition until a project is fully executed. Though less popular than some other recognition approaches, it simplifies accounting by sidestepping interim assessments. It offers clarity and ensures that revenue matches deliverables, but, of note, it may not capture real-time financial positions, potentially skewing short-term profitability views.

- Time and material contracts recognize revenue based on hours worked and expenses incurred. This method, widely embraced in the industry, provides transparency and aligns charges directly with efforts. Yet, while it allows for flexible billing, the absence of fixed fees can lead to unpredictability for clients and sometimes results in disputes over hours or rates claimed.

Work in Process (WIP)

In professional services, “work in process” (WIP) is a method of accounting for unbilled services or engagements still in the process of completion. It represents the value of the work done but not yet invoiced to the client. It’s a crucial component of professional services accounting, offering insights into a company’s anticipated revenue and current profitability, which, in turn, assists with financial visibility, resource management, client management and risk mitigation.

WIP is complicated by the nature of professional services projects, which are tightly bound to time, effort and expertise. For example, if a consulting project is 70% complete, it doesn’t necessarily mean 70% of the total fees can be recorded as WIP. Various phases of a project may carry different values, making the process of valuation more difficult. WIP values can also be inadvertently inflated. For example, when a firm estimates hours for a project and accounts for it as WIP, but then the project is completed faster than anticipated, the previously recognized WIP becomes overstated. This could require adjustments to financial statements to avoid misstatements. There’s also the challenge of timely billing and revenue realization. If a company has multiple projects marked as WIP, but delays in client approvals or project changes stall the billing process, cash flow, revenue forecasts and even collectability could all be negatively affected.

Deferred Revenue

Deferred revenue refers to funds that are collected in advance of being earned. For example, a legal firm might receive an advance payment for a case it will be handling for the next six months. Deferred revenue is a liability because it represents a firm’s obligation. Recognizing this payment as revenue prematurely, however, could distort the financial position of the firm, leading to misinterpretations about earnings. As a result, the company may defer the recognition of some revenue to coincide with delivery.

Many industries contend with deferred revenue, but the often-custom nature of professional services delivery adds wrinkles to the process. For example, a marketing agency that defers revenue for a six-month campaign might face unexpected changes in scope, client demands or deliverables. These developments can impact when revenue gets recognized, therefore requiring diligent monitoring and potential adjustments to ensure accurate financial statements. Managing deferred revenue also demands rigorous cash flow forecasting. If an architectural firm receives a substantial up-front payment for a yearlong project, for example, it must make sure the cash covers ongoing expenses throughout the project duration, especially if the next substantial payment might not come until project completion.

Unbilled Revenue

Unbilled revenue represents the earnings a firm has recognized for services rendered but has not yet invoiced to the client. It is typically the result of the contractual nuances and custom nature of service delivery. Professional services hinge on deliverables, staggered milestones and sometimes-subjective client evaluations. This variability in project timelines and client-specific agreements can lead to substantial and prolonged unbilled revenues. For example, a law firm might have accumulated significant hours on a case but waits for a specific milestone before sending an invoice. Though similar in concept, unbilled revenue is not the same as WIP, which refers to the value of work initiated but not completed.

Unbilled revenue requires careful project management and tracking of unbilled hours or services to ensure that nothing falls through the cracks. In addition, significant unbilled revenue can paint a misleading picture of a firm’s financial health. If a firm recognizes significant revenue but hasn’t billed or collected it, cash flow can become constrained.

Direct and Indirect Expenses

Direct expenses refer to costs that can be easily tied to a specific project or client. For instance, travel costs incurred exclusively for a client project are a direct expense. On the other hand, indirect expenses, also known as overhead, are costs that are not directly attributable to any single project but support overall business operations. Rent for the office, utilities or general administrative salaries are classic examples.

The specific accounting hurdles created by direct and indirect expenses in professional services revolve around if and how these expenses ultimately get billed to a client. For example, if a consulting firm purchases specialized software for a project (a direct expense) but also uses it for internal purposes (an indirect expense), billing the client becomes more complex. Typically, services firms will allocate a portion of the software cost to the client based on the usage or value derived for its project, while absorbing the remaining cost as an operational expense.

In addition, labor — the largest, often direct, expense for a professional services firm — is more difficult to account for than most other industries because of the constant variability of billable hours and hourly rates in services engagements. Services firms also must account for the indirect costs associated with employee downtime or training, which add further layers of complexity. If not managed effectively, labor costs can also create cash flow challenges because services firms typically bill labor costs according to customized contract terms, which can differ from the schedules that firms pay their resources. As a result, firms could find themselves paying for resources well before those costs are reimbursed by clients.

Best Practices for Professional Services Accounting

Adhering to best practices is the first step in maintaining tight control over accounting processes and workflows. The following tips can help professional services firms establish a strong framework that enables consistent oversight to mitigate risk.

Implementing Time-Tracking Tools

The adage “time is money” rings especially true for professional services organizations. Because invoices for professional services engagements are often based on billable hours, every moment spent on a client’s project carries inherent value. This business model demands tools to ensure that the value of time is neither overlooked nor underestimated. But inaccurate time-tracking for professional services isn’t just about missing out on billable hours; it also includes misallocating resources, misjudging project timelines and the possibility of misquoting clients on pricing. This can lead to strained client relationships and financial discrepancies that can hurt credibility.

Time-tracking tools that prioritize customization are essential. A tool that allows a firm to define and refine categories, tasks and projects creates a granular view of time spent. In addition, integration capabilities play a critical role. For example, a time-tracking tool that seamlessly integrates with accounting and billing software will streamline processes and reduce the need for manual data entry, minimizing errors.

Regularly Reviewing and Adjusting WIP

As discussed earlier, WIP provides a snapshot of the value of ongoing projects that haven’t yet been billed or recognized as revenue, which yields insights that can help with operational decision-making. Because the value of professional services projects lies in nonphysical products, such as expertise and billable hours, recognizing and valuing WIP requires a keen understanding of each project’s scope, including the time and resources invested in it. Too much WIP can sometimes lead to delayed billing, if payments are due at completion. This can create cash flow constraints and impair client relationships should unexpected invoices appear long after services have been delivered. It can also lead to misstatements of a firm’s financial position.

To avoid these issues, establishing a regular cadence of reviewing WIP, such as in regular financial meetings, to foster collaborative discussions is advisable. In addition, advanced accounting systems with capabilities for real-time WIP tracking and automatic adjustments can be beneficial. It’s also important to maintain clear communication channels between accounting teams and frontline service delivery teams so that financial teams are apprised of any project developments that might influence WIP valuations.

Using Accrual-Based Accounting

The accrual-based accounting method mandates that revenues and expenses be recorded when they’re earned or incurred, rather than when cash changes hands. This can offer a truer representation of financial health for professional services firms, where services are delivered over extended periods, and invoicing can occur at subsequent milestones or project completion. Accrual-based accounting captures revenue continuity that cash- or transaction-based accounting doesn’t, avoiding potential cash flow misinterpretations. For example, large inflows of cash at the beginning of a lengthy project may be misleading when there are underlying, unmet, long-term financial obligations or vice versa. This could result in cash flow misinterpretations and ill-informed business decisions.

Accrual-based accounting requires timely and accurate entries for all transactions. It’s also wise to regularly reconcile recorded accruals with actual cash flows to detect and rectify discrepancies. Accounting systems can automate and streamline accrual-based accounting by capturing and recording transactions in real time, guaranteeing consistency across an organization. Many systems also offer robust audit trails to trace transactions and enhance reconciliation processes by comparing accrual records with bank statements.

Performing Periodic Reconciliation of Accounts

Speaking of which, periodic reconciliation is the practice of verifying and correlating figures among different sets of financial records to verify that every financial transaction, such as billable hours, expenses and revenue, aligns accurately across all ledgers and account statements. Since many professional services firms deal with multiple clients, contracts and billing structures, discrepancies across statements aren’t uncommon. Frequent reconciliations keep a finger on the pulse of all financial activity, flagging potential issues early and avoiding inaccuracies or inconsistencies in financial reporting that can erode client confidence or lead to compliance issues. The higher a company’s transaction volume, the more often reconciliations should occur.

Advanced accounting systems can automate reconciliation processes, making them more efficient and less prone to human error. Building a culture of transparency and diligence, where staff is encouraged to record financial transactions promptly and accurately, is also a good idea.

Implementing Financial Dashboards for Real-Time Overview

Implementing financial dashboards that provide a real-time overview of financial activity paves the way for swift decision-making and proactive financial management. Dashboards offer graphical representations of critical financial data, allowing firms to access instant insights that can increase agility in response to market shifts. This is especially important for professional services firms, which need to visualize often complex data streams — from billable hours to resource allocation to project milestones. Without real-time financial insights, discrepancies can escalate into more significant problems, including a loss of competitive advantage.

The first step in building effective dashboards is to identify key metrics that serve as pillars, such as revenue per consultant, profit margin and accounts receivable aging. Engage with stakeholders to determine what data they need. Once metrics have been established, look for scalable, customizable and user-friendly dashboard tools that can adapt with growth. Real-time data is invaluable, but systems should also provide historical comparisons to identify trends, challenges and growth areas.

Challenges in Accounting for Professional Services

The unique characteristics of professional services firms described above often manifest themselves in the following challenges. Especially when evaluating potential technology solutions, it’s important to understand how vendors address these challenges.

Fluctuating Cash Flows

Despite having completed projects, professional services firms often must wait for client approvals or subsequent project phases before invoicing, leading to potential delays in cash flow. Inconsistent cash flow can have several consequences. For example, delays in client payments could leave some firms unable to meet operational expenses or payroll obligations. It could also hinder long-term planning, capital investments or the ability to secure financing.

To manage fluctuating cash flows, professional services firms need to be proactive. Rigorous contract management can establish clear payment terms and regular invoicing schedules. Building and maintaining strong client relationships can shorten the time from service delivery to project approval and revenue realization. Diversifying client portfolios can also prevent delays with one client from crippling cash flow. Additionally, predictive analytics technology can help anticipate potential cash flow disruptions, allowing firms to plan accordingly. Finally, establishing an emergency fund or having a credit facility in place can act as a buffer during lean periods.

Complexity in Revenue Recognition

The complexity of revenue recognition in professional services accounting has been a common thread throughout this article — and for good reason. With so much of a firm’s value tied to milestones, retainers, multiphase projects and sometimes ambiguous deliverables, precisely determining when a service is deemed “delivered” and when revenue from that service can be officially recognized isn’t easy. Inaccuracies can have a ripple effect throughout an organization, spreading from ill-informed decision-making, financial misreporting, unhappy stakeholders and annoyed clients to compliance violations and potential negative impacts on business valuation.

Professional services firms can minimize revenue recognition complexity by establishing clear contractual terms with clients regarding deliverables and payment schedules. In addition, robust accounting systems that cater specifically to professional services can automate and streamline the recognition process. Training accounting and billing teams in the latest revenue recognition standards also goes a long way toward compliance with evolving accounting guidance. What’s more, periodic internal audits can help identify and rectify anomalies in revenue recognition, to keep financial statements accurate and trustworthy.

Managing Client Advances and Retainers

Client advances and retainers are a somewhat idiosyncratic occurrence in professional services, functioning as up-front payments or security deposits that signal a commitment from both the client and the service provider. Inaccurate accounting of these payments, however, can lead to premature revenue recognition, which can skew financial reports. In addition, mixing advanced funds with general business accounts can blur financial clarity and potentially lead to misuse or misallocation of client funds. Without careful tracking, discrepancies between agreed-on services and actual deliverables can also arise, eroding client trust.

To mitigate these risks, professional services firms should adopt a proactive approach from the start. Clear contract terms with clients, in regard to a retainer, scope of services, and conditions for refunds or additional charges, will deter ambiguity. Regular reconciliations between advanced funds and earned revenue can also identify discrepancies quickly, allowing for timely corrections. In addition, a separate bank account exclusively for retainers and advances ensures that funds remain isolated from general business operations. Finally, robust accounting systems can automate the process, allowing accurate tracking of each advance against its corresponding service.

Forecasting and Budgeting

The inherent variability of both revenue and expenses in professional services poses distinct accounting challenges. Fluctuating work volumes and project-based billing make it challenging to predict future revenue streams with accuracy. In addition, because professional services firms rely on human capital to generate value, expenses are tied to talent acquisition, salaries, retention and training, all of which can vary based on market conditions and specific strategies. Inaccurate forecasts and budgets can lead to overstaffing or understaffing, misallocation of resources, liquidity issues and unforeseen cost overruns or delays that can jeopardize client relationships.

Technology can play a pivotal role in managing forecasts and budgets. For example, artificial intelligence (AI) and machine-learning tools can analyze past trends, current data and market dynamics to generate more accurate revenue forecasts. Rolling, or dynamic, forecasts are another critical way to build agile and responsive financial outlooks despite shifting conditions.

Professional Services Accounting Technology

Technology continues to improve accounting efficiency and accuracy. In particular, professional services firms should consider cloud-based solutions offering integrated capabilities across finance, human resources (HR) and project management — all tailored to professional services challenges — to synchronize accounting activities seamlessly.

Cloud-Based Accounting Platforms

Cloud-based accounting platforms make professional services accounting both convenient and efficient. An important benefit of cloud-based technologies — in which real-time financial information can be accessed anytime via an internet browser — is that decision-makers can glean insights instantaneously, enhancing responsiveness to emerging financial scenarios. Cloud-based technology also helps remote teams, enabling them to access information anywhere, anytime. In addition, cloud-based accounting systems often use sophisticated algorithms and customizable features that help professional services firms handle challenges, such as project-based billing, fluctuating cash flows and intricate revenue recognition rules.

When evaluating cloud-based accounting systems, professional services firms should prioritize project accounting features that can continually monitor and capture all costs and billable hours. Automated invoicing and detailed expense-tracking can also minimize human errors and ensure adherence to revenue recognition standards. In turn, this can elevate profit margins by providing timely billing and optimal resource allocation. Also advantageous are solutions with seamless integration capabilities, such as enterprise resource planning (ERP) systems that link accounting systems with other critical business software, such as customer relationship management (CRM) or HR, to build a holistic understanding of financial positions.

Automated Invoicing and Billing Systems

The process- and people-based nature of professional services creates myriad accounting challenges that are ripe for automation. For example, professional services firms contend with intricate billing structures, such as hourly rates, fixed fees or milestone-based billing. With these arrangements, manual invoicing and billing not only consume significant time, but they are fraught with potential errors. Streamlining these processes with automated billing means that every service rendered will be accurately billed, reducing revenue leakage. Additionally, professional services firms often juggle numerous clients simultaneously, making it difficult to keep track of unique client specifications, from payment terms to invoicing formats. Automated invoicing allows customization by client so that each invoice adheres to specific client mandates, enhancing client satisfaction and minimizing disputes.

When assessing automated invoicing and billing systems, professional services firms should seek a versatile system that can be customized to handle diverse billing arrangements, from retainer-based models to project-based billing. Integration capabilities with other accounting and project management tools can also build a consolidated, real-time database across critical activities. Applying real-time analytics to data provides insights into outstanding invoices, payment trends and client-specific metrics and empowers firms with actionable intelligence to optimize their billing operations.

Advanced Reporting and Analytics

One of the inherent challenges professional services firms face is the fluidity of their operations. With multiple projects running concurrently, each with its own billing structure, resource allocation and profitability metrics, gaining a consolidated view becomes a formidable task. Advanced reporting and analytics address this by synthesizing data to create a holistic snapshot of financial health. Reporting and analytics tools arm firms with actionable intelligence about trends, inefficiencies and areas of potential growth.

Professional services firms will benefit most from reporting and analytics tools with a high degree of customization, so they can tailor reports to the specific needs of their diverse clients and projects. In addition, real-time data processing allows firms to remain proactive, able to adjust in the moment and not in hindsight.

Integration of Project Management and Accounting Software

Professional services accounting is a delicate mix of dynamic project activity and financial tracking. Unsurprisingly, the integration of accounting software with project management systems can play a key role in streamlining operations, enabling firms to monitor project milestones, resource allocations and associated costs simultaneously. This eliminates discrepancies between project statuses and their corresponding financial representations to facilitate the alignment of billings, expenses and profitability metrics.

For professional services firms, integrated project management and accounting software should include a few key features. Robust, real-time data synchronization capability is essential so that, as projects evolve, financial implications are instantly reflected to avoid lags in billing or budget overruns. Intuitive dashboards offer a consolidated view of both project progression and financial metrics, which not only promotes internal clarity but also enhances client communication, trust and transparency. Finally, scalability ensures that, as the firm grows, the software can adapt, accommodating larger datasets and more complex project structures.

Drive the Outcomes to Grow Your Professional Services Business With NetSuite

NetSuite Enterprise Resource Planning (ERP) seamlessly blends operational modules, such as financial management, HR, CRM and project management, in a comprehensive solution specifically tailored to help professional services firms address their intricate accounting requirements. Because it’s cloud-based, NetSuite hosts and manages the software. Customers can add modules and features to suit their individual needs.

At the core of NetSuite ERP for professional services are integrated modules to manage key operational activities. For example, integrated project accounting and management tools track tasks and fuse financial activities with project milestones. From gauging profitability to monitoring expenses, this holistic perspective guarantees that financial data is always aligned with project status, minimizing discrepancies and bolstering profitability. With NetSuite’s dedicated time- and expense-tracking tools, employees can log their time and expenses, which are then directly routed for billing after approvals, ensuring accurate invoicing, accelerating billing cycles and positively impacting cash flow. In addition, NetSuite’s flexible billing and invoicing framework accommodates multiple accounting methods and, when coupled with its sophisticated revenue recognition capabilities, allow firms to recognize revenue based on project milestones or completion.

NetSuite ERP also features an integrated CRM module to seamlessly connect sales and client data with project metrics to build stronger client relationships, while also identifying upselling and cross-selling opportunities. An integrated HR module provides real-time visibility into resource availability and costs to optimize resource allocation, better forecast project profitability and align expertise with client needs and billing structures. NetSuite’s advanced analytics and reporting tools also drill down into business performance, from profitability metrics to operational nuances, enabling firms to pivot strategies promptly. Finally, NetSuite’s financial planning and budgeting tools can proactively anticipate future financial trajectories, making strategic decisions that support growth objectives.

British philosopher, writer and speaker Alan Watts once said, “The only way to make sense out of change is to plunge into it, move with it and join the dance.” Such is the life of professional services finance teams, which must generate calm out of the chaos of nonphysical product offerings, unpredictable revenue streams, fluctuating delivery schedules and shifting client expectations. A combination of best practices and tailored technology solutions can offer a way to navigate this intricate dance with accurate, timely and efficient accounting.

Accounting for Professional Services FAQs

What type of expense is professional services?

Professional services are part of an expense category that includes fees paid to individuals or firms with specialized expertise or knowledge. These services can range from consulting, legal and accounting to IT support and architectural design. Typically, businesses incur these expenses when they lack in-house expertise or need specialized advice or solutions. The cost is often billed hourly or through a set project fee. Recognizing these expenses correctly is vital for accurate financial reporting and tax considerations.

What’s the significance of ethical practices in professional services accounting?

Ethics in professional services accounting is vital because many financial decisions are judgment-based, such as determining the appropriate method for revenue recognition for complex contracts or evaluating work-in-progress for ongoing projects. This reliance on judgment means there’s room for bias or manipulation. Ethical standards ensure that these judgments are made with integrity and prioritize accuracy and fairness, while also building client trust and remaining in compliance with regulations.

How does accounting for professional services differ from product-based businesses?

Accounting for professional services focuses on capturing billable hours, valuing work in progress and recognizing revenue upon service delivery, often under specific contractual terms. In contrast, product-based businesses emphasize inventory management, cost of goods sold and revenue recognition upon product shipment or sale. As a result, service providers rely on timely billing and collection from clients, while product businesses often manage inventory turnover and vendor payments. The valuation and categorization of assets and expenses also vary because services businesses prioritize human capital and projects, while product businesses concentrate on physical inventory and production costs.

How to do accounting for service business?

Accounting for professional services businesses requires the thorough capturing and tracking of project-based revenue and expenses to ensure accurate revenue recognition, payroll processing and accurate financial reporting. The constantly shifting nature of professional services, however, adds layers of complexity not seen in product-based industries.

What is the legal definition of professional services?

The FindLaw Legal Dictionary bases its definition of professional services on Merriam-Webster’s: “a service requiring specialized knowledge and skill usually of a mental or intellectual nature and usually requiring a license, certification, or registration.” That definition coincides with Black’s Legal Dictionary, which states, “Services, which require a formal certification by a professional body, such as legal, medical, accounting, etc., are called professional services.” Then there’s Ballentine’s legal dictionary, which defines the term briefly as “services rendered in a professional capacity.”