The hospitality industry is rife with challenges, many of which stem from fluctuating customer demand and the unreliable cash flow that accompanies it. Beyond anticipated seasonal changes, unforeseen events like flight or convention cancellations can swiftly transform an average hotel week into fully booked or unexpectedly vacant nights. And with the hotel industry market valued at $524.1 billion in 2021, and an estimated annual growth rate of 17.4% from 2022 to 2030, hotel management must have a firm grasp on their financials to meet these challenges or risk getting left behind.

With accurate and detailed financial data, typically organized into standardized financial statements, hotel managers and decision-makers can weather unpredictability and ensure that they always have the supplies and funds necessary to provide the optimal guest experience — all while finding ways to improve processes, reduce costs and increase profitability.

What Are Hotel Financial Statements?

Hotel financial statements, like other industries’ financial statements, are comprehensive documents that provide an overview of financial performance and position during a specific period. These statements give a detailed view of the hotel’s operations and profitability and help inform future prospects, decisions and forecasts.

The four primary financial statements used by hotels are the balance sheet, the income statement, the cash-flow statement and the statement of changes in equity. Each provides insights into specific aspects of financial standing and when viewed together add context and create a comprehensive snapshot of the hotel’s health. Internal analysts and stakeholders use these statements to make operational improvements and set budgets, and external parties, such as lenders or investors, rely on them to assess a hotel when deciding whether to provide funding, and how much.

Key Takeaways

- The four primary hotel financial statements are the balance sheet, the income statement, the cash-flow statement and the statement of changes in equity.

- Analysis of these financial statements helps hotel management and decision-makers improve operations, increase profitability, prepare for the future and better serve their guests.

- Accurate financial statements are crucial for hotels to weather future demand shifts, seasonality and other financial variances that create unique challenges for the hospitality industry.

Hotel Financial Statements Explained

Hotel financial statements will typically look similar to their analogs in other industries because many hotel accountants follow Generally Accepted Accounting Principles (GAAP) when preparing their financial statements. Additionally, hotels usually follow the Uniform System of Accounts for the Lodging Industry (USALI), a more comprehensive set of rules specifically targeted at simplifying hotel accounting for easier comparison and accountability.

Even small, private hotels and bed-and-breakfasts, which may not be required to follow the same GAAP regulations as large or public hotel companies, often follow these standardized formats to simplify and streamline their financial statement processes. Disorganized, obtuse or abstract financial statements invite misunderstandings, leading to potentially damaging results when operational changes are implemented or audits are conducted, so following GAAP and USALI is beneficial to hotels of all sizes. Additionally, unique nuances are likely to appear on hotel financial statements, and understanding these particulars ensures that hotel leaders use the most accurate and relevant data when making decisions. For example, accurately tracking “food and beverage” and “rooms” as distinct sections of revenue in the income statement can help managers track the profitability of both operations separately and inform pricing and cost analysis.

The Hotel Balance Sheet

The hotel balance sheet is an important financial document that offers a snapshot of a hotel’s financial standing up to a specific point. This statement serves as an outline of the business’s financial health and its ability to meet obligations by detailing what the hotel owns (assets), what it owes (liabilities) and the difference between them (equity). The balance sheet should always “balance” the equation Assets = Liabilities + Shareholders’ Equity. By juxtaposing assets against liabilities, hotel proprietors and managers can gain valuable insights into their financial position and plan future strategies, such as servicing debt or securing external financing. The balance sheet is often compared with prior periods to track any changes in a hotel’s financial position over time and identify trends.

Key Components

Balance sheets for hotels follow the same model as most other industries and include many of the same components. Here are the three primary components of the balance sheet:

- Assets are the tangible and intangible resources that a hotel owns. Short-term, or current, tangible assets can be converted to cash within a year and include cash, inventory (including food and beverages) and accounts receivable. Long-term tangible assets include physical infrastructure, such as buildings, furniture and equipment. Additionally, intangible assets, like the hotel’s brand reputation, intellectual property and goodwill, are also included.

- Liabilities are the financial obligations that a hotel must pay. Like assets, these are separated into current and long-term. Current liabilities include accounts payable, wages, accrued expenses and short-term loans. Long-term liabilities include financial commitments, such as mortgages or other loans not due within one year of the balance sheet’s date.

- Equity represents the hotel’s net assets after all liabilities have been settled and may also be labeled as owners’ or shareholders’ equity on the balance sheet. Equity serves as a measure of the hotel’s overall net worth, health and long-term sustainability, as ongoing negative equity points to a hotel’s inability to pay its debts, wages and other obligations. Hotels with negative equity can improve their operations by increasing revenue, reducing liabilities, seeking appropriate external funding or more effectively managing their assets to earn a higher return on investment.

Hotel Example

The balance sheet of hypothetical boutique hotel The Bow Tea Room shown below includes all three of these sections:

- Assets: Current assets include accounts receivable for unpaid guests, cash reserves and food inventory. Long-term assets include the property value, room furniture and intangible assets, like brand value.

- Liabilities: Current liabilities include accounts payable for vendors, taxes, short-term loans and due wages. Long-term liabilities include the property mortgage.

- Equity: By adding all assets and subtracting all liabilities, the boutique hotel can calculate the overall net worth of the company.

Sample Balance Sheet

The Bow Tea Room Hotel

Balance Sheet - 12/31/2022

| Assets | |

|---|---|

| Current Assets | |

| Cash | $ 175,000 |

| Accounts Receivable | $ 90,000 |

| Inventory | $ 40,000 |

| Total Current Assets | $ 305,000 |

| Non-Current Assets | |

| Property | $ 885,000 |

| Furniture | $ 500,000 |

| Intangible Assets | $ 50,000 |

| Total Non-Current Assets | $ 1,435,000 |

| Total Assets | $ 1,740,000 |

| Liabilities | |

| Current Liabilities | |

| Short-term Debt | $ 75,000 |

| Accounts Payable | $ 115,000 |

| Payroll | $ 100,000 |

| Taxes | $ 63,000 |

| Total Current Liabilities | $ 353,000 |

| Non-Current Liabilities | |

| Long-term Debt | $ 500,000 |

| Total Non-Current Liabilities | $ 500,000 |

| Total Liabilities | $ 853,000 |

| Total Equity | $ 887,000 |

The Hotel Income Statement

The income statement, also known as the profit and loss (P&L) statement, reports a hotel’s revenue, costs, gains and losses over a specific time frame to ultimately determine net income. This net figure shows whether the hotel earned more than it spent over the financial period and is also known as the bottom line, as it is the final line of the financial statement. The income statement illustrates the flow of money, beginning with the total revenue before subtracting costs, including cost of goods sold (COGS), operating costs and other miscellaneous expenses. After these calculations are made, the income statement can show different profitability measures to focus analysts and decision-makers on areas for improvement to reduce expenses and increase earnings.

Key Components

The income statement is often the first document viewed when assessing a hotel’s financials. Analysts must understand the statement’s key components to gain an accurate view of performance and create actionable strategies to increase revenue, reduce costs and grow profits. Here are the key components of the income statement:

- Revenue represents the cumulative income that the hotel earns from its goods and services. Many hotel income statements will segment this section into different revenue streams, such as room rentals, food and beverage sales, events and other supplementary services. These sales are typically considered the lifeblood of the hotel, as the income generated here must fund the rest of the operation.

- Costs denote the expenditures that the hotel incurs during operation. These are often separated into COGS, such as room amenities that accrue costs only when sales are made, operational expenses like administrative overhead and other costs, such as taxes.

- Profits show the funds left over after all expenses are paid. Income statements often have intermediary profit measures before the net profit, including gross profits (revenue – COGS), operating profits (gross profit – operating expenses) and EBITDA (earnings before interest, taxes, depreciation and amortization).

Hotel Example

The Bow Tea Room’s sample income statement includes detailed information for all three of these categories, as shown below.

- Revenue: The income statement shows room sales, food and beverage purchases and additional income from a gift shop located in the lobby for the month.

- Costs: The costs listed on the income statement include COGS for room supplies, worker salaries and wages, interest payments on loans and taxes.

- Profits: To understand where costs are accruing, the hotel chooses to list gross profits to track direct sales profitability and net profits to see the bottom line.

Sample Income Statement

The Bow Tea Room Hotel

Income Statement - 12/1/2022 to 12/31/2022

| Revenue | |

|---|---|

| Room Sales | $ 125,000 |

| Food and Beverage Sales | $ 40,000 |

| Gift Shop Sales | $ 13,000 |

| Total Revenue | $ 178,000 |

| Costs | |

| COGS | $ 20,000 |

| Payroll | $ 80,000 |

| Interest | $ 7,500 |

| Taxes | $ 10,000 |

| Total Expenses | $ 117,500 |

| Misc Gains and Losses | |

| Gains on Equipment Disposal | $ 4,000 |

| Profit | |

| Gross | $ 158,000 |

| Net Income | $ 64,500 |

The Hotel Cash Flow Statement

The cash flow statement tracks the inflow and outflow of cash from three main activities: operations, investments and financing. This helps assess a company’s liquidity and shows changes in income, accounts receivable/payable and any other factors that influenced cash flow, typically by showing the beginning, net change and end cash levels over a given financial period. For hotels, monitoring cash flow is critical as guests traditionally pay at the end of their stay — accruing expenses before the hotel recoups costs, especially for long-term guests. Even a fully booked hotel may struggle to make ends meet while it waits for checkout and payment.

Hotels must track and manage their cash flow to ensure that they have enough cash reserves to cover obligations and maintain inventory levels until payments are made. Through regular reporting, hotels can track cash flow seasonality and more effectively forecast their cash sources and needs, creating a more resilient operation that can better meet obligations and deliver great customer experiences throughout both busy and slow seasons.

Key Components

Not every hotel cash flow statement will look the same, even within the same company, as individual hotels may use different kinds of investments or financing during a given financial period. Here are the three primary components of a standard cash flow statement:

- Operating activities involve day-to-day business processes, such as booking rooms, selling food and beverages and renting event spaces. This metric typically starts with net income, carried over from the income statement. However, this figure must be adjusted to compensate for any changes in accounts receivable and payable, as those represent sales and expenses that have been transacted but are yet to be recorded. For example, income may track revenue when sales are made, but until customers pay their bills, those balances are reflected in accounts receivable, not cash-in-hand, and the overall income level needs to be adjusted to reflect this lag between the two measures. Operating activities may also include other factors, such as depreciation, that can impact operational cash flow.

- Investing activities include cash from long-term investments, such as property and equipment purchases and sales, mergers and acquisitions and other non-current asset transactions. While the funds earned through investing activities may ultimately go toward running the hotel, they are often atypical and non-repeating and do not reflect the profitability of core hotel operations.

- Financing activities include financing from lenders and creditors and principal debt payments. Depending on how much debt a hotel uses to finance operations, this section may have a major impact on cash flow. This section also includes payments to owners and cash raised from stock transactions.

Hotel Example

The cash flow statement for the hypothetical Bow Tea Room Hotel, shown below, segments cash flow into the three primary categories. As expected for this smaller hotel, operating activities make up the bulk of the cash flow for the financial period.

- Operating activities: The Bow Tea Room Hotel earned $64,500 from its primary operations, and that figure is adjusted for changes in accounts payable/receivable. The hotel also spent $9,000 on new inventory purchases, reducing its overall cash supply.

- Investing activities: The investing activities done during this period were $40,000 in new equipment purchases and $30,000 earned from selling old equipment, creating a net loss of $10,000 in cash.

- Financing activities: The hotel took out a new $10,000 loan and made a $3,000 debt payment during this period, increasing cash flow by $7,000.

Sample Cash Flow Statement

The Bow Tea Room Hotel

Cash Flow Statement - 12/1/2022 to 12/31/2022

| Operating Activities | ||

|---|---|---|

| Net Income | $ | 64,500 |

| Change In Accounts Receivable | $ | 12,000 |

| Change In Accounts Payable | $ | 7,000 |

| Change in Inventory | $ | 9,000 |

| Net Operating Cash Flow | $ | 50,500 |

| Investing Activities | ||

| Equipment Purchases | $ | 40,000 |

| Asset Sales | $ | 30,000 |

| Net Investing Cash Flow | $ | 10,000 |

| Financing Activities | ||

| New Loans | $ | 10,000 |

| Debt Payments | $ | 3,000 |

| Net Financing Cash Flow | $ | 7,000 |

| Net Changes in Cash | $ | 47,500 |

| Cash ,Beginning of Period | $ | 127,500 |

| Cash ,End of Period | $ | 175,000 |

The Hotel Statement of Changes in Equity

The statement of changes in equity shows any changes in ownership structure or equity values over a given period. This statement is used by hotels that want to provide additional context connecting some of the information on their income statement and balance sheet and gives shareholders and investors information to inform their investment decisions. This document shows the starting and final equity for a financial period and any changes, including profits and losses, distributed dividends, stock transactions and prior period adjustments to correct errors.

Key Components

The statement of changes in equity is less likely to be included in a set of financial statements than the balance sheet, income statement and cash flow statement and is not considered as essential as the other documents. However, if a hotel generates this statement, it will likely include the following key components:

- Opening equity is the equity value at the beginning of the financial period covered by the statement. This serves as a baseline for adjustments and comparison.

- Profits often come from the income statement (listed as net income in the prior example) and are added to the opening equity. These profits may be distributed to owners further down the statement or held as retained earnings, increasing the equity of the hotel.

- Losses may decrease equity if the net income is negative. Other losses (and gains) can include prior period adjustments, share capital changes and asset revaluation.

- Distributions include all profits distributed to shareholders or owners and they are subtracted from the overall equity. High distributions can signify to investors profitable periods and a healthy return on investment, but too many distributions can reduce equity and hurt the hotel’s sustainability.

Once all these items are recorded, the final equity balance can be calculated and written at the bottom of the statement of changes in equity.

Hotel Example

The hypothetical Bow Tea Room Hotel has a short statement of changes in equity, as it did not have major stock transactions for the year measured. But equity was changed when net income contributed to an increase, despite some of those profits being distributed to owners. Additionally, due to an error in a previous financial period that was discovered after close, there are some adjustments, shown below. This statement serves as a link between the balance sheet and the income statement and helps stakeholders gain more information on some of the data found on those financial statements.

Sample Changes in Equity Statement

The Bow Tea Room Hotel

Statement of Changes in Equity - 1/1/2022 to 12/31/2022

| Opening Balance of Equity | $ | 860,000 |

| Net Income | $ | 64,500 |

| Prior Period Adjustment | $ | 12,500 |

| Distributions | $ | 25,000 |

| Net Change to Equity | $ | 27,000 |

| Closing Balance of Equity | $ | 887,000 |

Importance of Hotel Financial Statements

Financial statements help hotel proprietors and managers understand the reality of a hotel’s standing, which isn’t always clear from a quick glance or an external perspective. For example, a bustling hotel may be experiencing losses from an inefficient food and beverage department, while a small hotel only half-booked may be earning healthy profits from high margins and a lean operation. Through detailed and organized financial statements, decision-makers can gain deeper insights into what’s working and what needs to be improved by finding inefficiencies and places to cut costs and/or improve processes. By regularly generating financial statements, hotels can detect problems early, establish a data-driven way to track trends over time and understand how changes impact the hotel’s performance. Here are four areas where hotel financial statements play a key role:Strategic Planning

Hotel financial statements improve strategic planning by giving analysts and decision-makers a detailed evaluation of the company to inform resource allocation and investment decisions. These statements also highlight areas of financial risk, enabling proactive risk management and mitigation, and provide the historical financial data necessary to set realistic financial goals. Viewing these statements over time can help hoteliers understand what has worked in the past so that they can more effectively forecast results, avoid repeating missteps and ensure the hotel’s long-term financial stability and growth.

Performance Measurement

The fluctuating demand and seasonality of the hospitality industry requires regular performance reviews to ensure that the hotel’s structure, offered services and staff can keep up with evolving guest expectations. Hotel financial statements play a pivotal role, offering tangible metrics that track the impact of any changes in the hotel’s operations and tactics. These documents empower decision-makers to see how operational changes impact key financial metrics, such as room revenue, inventory expenses, cash flow and more. By diligently tracking these figures, hotel proprietors can discern patterns, gauge progress toward goals and benchmarks and make informed decisions based on prior successes. And when performance falls short of expectations or begins trending in the wrong direction, regular analysis of financial statements can ensure that these problems are identified and addressed quickly before they heavily impact the guest experience and the hotel’s bottom line.

Investor Relations

Investors play an important role in many hotels’ expansion and long-term success, and hotel financial statements help facilitate clear communication between hotel leaders and their investors. These documents show a hotel’s financial vitality, operational prowess and growth potential, helping investors assess its business model, the efficacy of its strategies and how it stacks up in the competitive landscape of the industry. Financial statements can also help investors understand complex financial periods by providing additional context for changes in a hotel’s finances. For example, if a hotel makes a large real-estate investment to expand into a new region, overall financial metrics, including net income or cash flow, may show losses. But by including additional details, such as those found under assets and liabilities on the balance sheet, the hotel can provide investors with the necessary perspective to see that the company is effectively reinvesting profits into its future. Detailed financial statements show exactly how a hotel has been earning and spending its money, and investors can use this information to more confidently choose their prospects and put their money to good use.

Legal and Regulatory Compliance

Hotels must follow all relevant legal and regulatory compliance requirements or risk fines and legal consequences. Financial statements give transparency to regulatory bodies and help ensure that all reported finances are accurate and up to date. For larger and public companies, following GAAP is required, but smaller hotels can also benefit from the structured layout and standardized information on GAAP-compliant financial statements. Many hotels choose to go above and beyond these standards with more regular reporting to spotlight performance from specific revenue streams, expenses or any other metric that a hotel can benefit from tracking. And if errors occur or an audit is needed, detailed financial records can help make the reconciliation or auditing process smoother, letting the hotel focus on growth and revenue, rather than digging through old files and putting out fires.

Analysis of Hotel Financial Statements

The real value found in hotel financial statements is deeper than the surface data — though that is still important. Hotels can use these statements to gain a deeper understanding of their operations and financial health through easy-to-understand financial metrics and key performance indicators (KPIs). Decision-makers can compare these measures against competitors, prior periods or other benchmarks to see what’s going right and what needs to be adjusted to gain and maintain a competitive edge and ensure long-term success.

Ratio Analysis

An essential way that analysts assess a business’s performance is through ratios. These ratios compare two or more data points from financial statements to give a streamlined value, often as a percentage or decimal, for easier comparison and analysis. Here are four key financial ratio categories that can benefit hotels:

- Profitability ratios track how much money business processes bring in after expenses are paid. They include measures such as gross profit, operating profit and net profit that may or may not be listed on the income statement. They also include return ratios, such as return on equity (ROE) and return on assets (ROA), which show how effectively a hotel is using its resources to generate profit. These profitability ratios are typically found by comparing revenue and costs to show overall profitability of specific aspects of the hotel’s business and find areas where efficiency can be improved.

- Liquidity ratios show a company’s ability to pay its short-term debts and obligations. A hotel’s balance sheet may show more assets than liabilities, but if those assets are primarily long-term, such as property, the hotel may not be able to pay its bills on time and maintain normal operations. Common liquidity ratios include the current ratio — current assets / current liabilities — and the quick ratio — (cash + accounts receivable + marketable securities) / current liabilities. The higher the liquidity ratios, the more easily the hotel can pay its bills.

- Solvency ratios focus on a business’s ability to pay long-term debts and are primarily used by lenders to establish creditworthiness before issuing funding. There are several ways to calculate solvency, but the primary solvency ratio is (net income + depreciation) / all liabilities. Other, more specific solvency ratios include debt-to-equity — sum of all debts / total equity — and interest coverage — earnings before interest and taxes / interest expenses. A “good” solvency ratio varies by industry and how much of a business’s operation is funded by debt, so it’s best to compare it with direct competitors, not as a standardized benchmark.

- Efficiency ratios measure how effectively a hotel is using its resources to generate income. The most basic efficiency ratio is found by dividing expenses by revenue, but many analysts use similar ratios by isolating specific areas, such as turnover ratios in accounts receivable (net sales / average accounts receivable), accounts payable (total supply purchases / average accounts payable) and inventory (COGS / average inventory). If efficiency ratios are trending in the wrong direction, hotel managers should look for bottlenecks or areas where costs can be cut to create a leaner and more efficient operation.

Trend Analysis

Due to ever-shifting customer demand in the hospitality industry, hotels tracking their financial statements over time can better identify trends than hotels managing by gut instinct and eyeballing balances and inventory levels. These trends can help hotels identify seasonal patterns and better allocate resources where and when they are needed. Trend analysis also helps decision-makers and managers more quickly identify problem areas, letting them adjust and improve performance before serious problems arise. For example, if a hotel starts picking up more regular bookings, cleaning expenses and room amenity orders will likely increase as well. But if the hotel isn’t regularly monitoring these expenses over time, it can find itself incurring heavier losses and hurting profits. With regular expense reporting, like those found on a detailed income statement, the hotel can find where costs are rising faster than revenue and look for ways to realign the balance, such as changing distributors or switching to more cost-effective in-room items.

Comparative Analysis

The information contained in financial statements can be compared with benchmarks (i.e., forecasts, break-even points or growth goals) to track performance over time and adjust budgets, risk assessments and pricing as time goes on and market forces evolve. Hotels can also compare their results with competitors, especially those that publicly publish their financial statements. This can help inform marketing campaigns and future strategies to better compete in the industry. By regularly assessing performance and comparing results with internal and external data, hotels can continually improve operations and adapt to new market and demand trends.

Use of Analysis in Decision-Making

The two primary categories informed by financial statements are investments and financing. External creditors, lenders and investors analyze a hotel’s financial statements when determining creditworthiness and setting borrowing terms, such as interest rates and repayment periods. Hotels with detailed records of financial responsibility and growth are more likely to obtain funding and better terms. These statements can also help decision-makers inside the hotel system manage when and how to pay down debt. For example, if the income and cash flow statements show healthy profits flowing into the hotel, it may be a good time to pay down old debt. However, if these statements show the opposite, it may be a sign to borrow more and invest in places that can increase revenue and bring in more long-term success.

Challenges in Hotel Financial Statement Analysis

Analysts in the hospitality industry have specific challenges when generating and understanding their financial statements, and they must fully understand and overcome these challenges or run the risk of learning the wrong lessons, compounding problems or missing potentially profitable opportunities. Here are common challenges that hotels need to address.

Seasonality of the Hotel Business

Hotel revenue may fluctuate wildly with the seasons, depending on the location of the hotel, and businesses must prepare for this fluctuation to meet demand during busy seasons and keep the lights on and the staff paid during slow seasons. But without detailed financial data, understanding when those seasonal bumps will occur can be challenging. And even with that data, changing weather patterns, evolving customer demand and other local factors can throw unexpected wrenches into a hotel’s calendar. For example, a hotel located near a busy ski mountain may expect a busy winter but may also have unexpected seasonal bumps throughout the year if the mountain is used for other purposes, such as a new summer music festival. By monitoring local announcements and tracking seasonal trends through financial reporting, hotels can ensure that they have sufficient inventory, staff and ready-to-rent rooms when needed, while saving costs during slower periods by reducing staff and minimizing supply orders.

Impact of Non-operating Items

While a large percentage of a hotel’s revenue and costs will typically come from routine operations — booking rooms and providing goods and services to guests — some non-operating items can substantially impact a hotel’s financial health. Selling assets can give hotels a bump in cash, especially for hotels with large amounts of furniture and equipment. However, overreliance on these asset sales, as well as external funding through investors, creditors and lenders, can create long-term issues for hotels if they’re taking losses on their primary operations. Analysts can use financial statements to see a complete picture of incoming and outgoing funds and gain a better sense of a business’s core financial strength. Similarly, other one-time events, such as lawsuits, settlements or insurance claims, can impact a hotel, and financial statements add context to how finances were impacted by these non-recurring events. This can help assuage the worries of the public or external parties after a period of losses or help managers effectively turn a one-time cash boon into a long-term investment in the company.

Variances in Accounting Standards

Hotels have their own unique accounting challenges, and many hotels follow the recommendations of the USALI. But as the industry evolves, so, too, do those recommendations; the current USALI standard is the 11th edition, with the 12th nearing completion. For example, early previews of the upcoming 12th edition show a new emphasis on sustainability by increasing reporting standards for energy, water and waste. These updates recommend that hotels consolidate related records and expenses, and monitor sustainability metrics such as energy consumption per occupied room (POR) and water consumption POR. As new standards and regulations become accepted, both from USALI and broader GAAP, even smaller hotels may want to track and implement new guidelines to make comparison analysis simpler and show external parties that they are committed to following up-to-date best practices.

The Effect of Depreciation

Depreciation, the accounting method that allocates the cost of an asset over its useful life instead of entirely at the time of purchase, presents challenges for hotel accountants, as depreciation is a non-cash item that can under- or overstate a hotel’s actual profitability and cash flow month after month. For example, if a hotel makes an equipment purchase of $120,000 at the beginning of the year and expects that equipment to remain useful for one year, the hotel can depreciate the cost of that equipment throughout the year’s financial statement, say $10,000 per month. Because the expense is spread out on paper, but not in actual payments, the cash flow for the first month will seem higher than it is (as $110,000 in expenses have not been factored in yet), and later months will include the $10,000 depreciation expense despite no more cash changing hands.

This linear depreciation is not the only way to calculate depreciation, however, and other methods may be used, such as larger expenses upfront that decrease throughout the year. Depending on how hotels choose to depreciate their assets, it can influence analysis ratios and how financial statements show cash flow and profitability. Therefore, it is important for analysts and decision-makers to understand the differences between how recorded finances differ from the on-the-ground reality before making decisions or comparing statements.

Impact of Other External Factors

The hospitality industry is at the mercy of any number of external factors, from changes in local tourism trends to climate disasters. Like other industries, technology has impacted hotels — such as online travel booking platforms that can cut into margins and allow guests to filter results based on specific criteria to match their preferences — forcing hotels to closely track customer behavior and feedback to remain competitive. Hotels are also especially sensitive to natural disasters, as weather events can damage areas, reduce tourism and take weeks, months or even years to fully recover from. For example, two weeks after Hurricane Ida hit the Gulf region of the United States in September 2021, 75% of the 208 New Orleans hotels researched by hotel data analytics company STR remained closed. Meanwhile, hotels in other areas experienced an uptick in demand, as displaced residents searched for places to stay. Weather events can be difficult to predict or plan for, as they can impact hotels in both positive and negative ways. Hotels should plan for contingencies and monitor external factors to mitigate risks and build a more resilient operation.

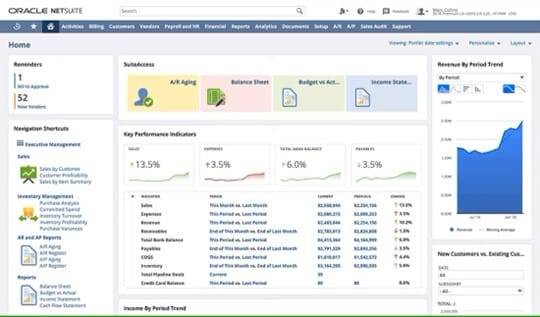

Make Hotel Financial Management Easy with NetSuite

Regular financial reporting can be a time-consuming process, and by the time the data is collected and statements are generated, the data may be too old to be useful to address the issues a hotel is facing right now. With NetSuite Financial Management, accountants can quickly generate real-time customizable financial statements to show exactly what information stakeholders and decision-makers need to improve operations and increase profitability.

NetSuite has built-in features to manage assets, reconcile accounts, streamline accounts payable and receivable and more, freeing up staff to focus on increasing efficiency and growing the business rather than addressing symptoms and running damage control. NetSuite’s Financial Management solution uses secure and real-time data to give accountants the ability to close with confidence and report accurate and detailed financial information to all relevant parties.

Hotel professionals face unique challenges from the dynamic nature of customer demand and the often-unpredictable impacts it can have on a hotel’s finances. To face these challenges and gain an edge over the competition, hoteliers must possess an intimate understanding of their financials. By leveraging detailed financial data, organized into comprehensive financial statements, hotel managers and decision-makers can effectively identify areas of weakness and strength. Hotel financial statements give hotels the tools they need to better allocate resources, increase profitability, better serve guests and build a strong and resilient future.

Hotel Financial Statement FAQs

What are the four main financial statements in the hotel industry?

The four main financial statements in the hotel industry are:

- The balance sheet lists the equity, assets and liabilities for a hotel as of a specific date.

- The income statement compiles the profits, expenses, losses and gains to calculate the net income for a financial period.

- The cash flow statement shows the incoming and outgoing cash flow for a financial period.

- The statement of change in equity shows any changes in a company’s net worth over a financial period, including net income/loss and investment contributions/distributions.

What is the P&L of a hotel?

The profit and loss statement, also known as the P&L or income statement, shows the net income for a hotel over a financial period. This is calculated by adding all revenues and gains and subtracting all losses and expenses. This net income is also known as the bottom line, as it is the final line of the P&L statement.

How does seasonality impact a hotel’s financial statements?

Hotels are especially vulnerable to seasonal fluctuations in demand and often need to rely on busy periods to fund operations for the rest of the year. By generating and analyzing regular financial statements, hotels can compare different periods over the year, as well as year-over-year results, to make sure there is enough liquidity during slow periods to maintain staff levels and keep the hotel supplied. This data also helps control expenses by optimizing when staff levels are changed and supplies are reordered.

What is trend analysis, and how is it used in understanding a hotel’s financial performance?

Trend analysis examines historical data to identify patterns and predict how key metrics will change in the future. For hotels, it can inform revenue and expense forecasts to better allocate resources and optimize operations. Trend analysis can also set benchmarks and assess performance over time, helping decision-makers identify issues and inefficiencies early before they affect customer satisfaction and hurt profits.