Don’t exceed the budget: It’s cash management 101. To that end, recording and controlling current expenditures are obviously key, but how can businesses manage their future costs for long-term financial sustainability? This is where cost forecasting comes in. By understanding the forces and best practices underlying cost forecasting, as well as the different methods used to predict likely outlays, businesses will be able to successfully plan for upcoming costs in a way that maximizes profits and ensures success.

What Is Cost Forecasting?

Cost forecasting is a financial planning technique that organizations use to predict the different costs they are likely to incur in forthcoming accounting periods or for specific projects. By estimating future expenses based on the most current information available, they can plan more accurate budgets, secure the necessary labor and materials and be better prepared to pivot should circumstances change.

Key Takeaways

- A cost forecast is an estimate of future costs, obtained from known information and informed assumptions.

- Unlike a budget, a cost forecast can be updated as new information comes to light.

- There are three cost forecasting methods: quantitative, qualitative and causal.

- Cost forecasting can help businesses prepare for the future, anticipate downturns and take advantage of new opportunities.

Cost Forecasting Explained

Cost forecasting is the process of estimating future business expenditures. It can be applied to a whole business, individual business lines or specific projects, or it might cover a limited time period or the duration of a project or venture. However, the longer the time period, the less accurate the forecast is likely to be. In light of this, businesses typically update their cost forecasts as prices and conditions change or better information emerges.

Prepared in conjunction with revenue forecasts, businesses use cost forecasts to estimate break-even points — i.e., the point at which total revenue and total expenses are equal — in order to determine the best prices for their goods and services, as well as maximum profits. Cost forecasts also inform business investment decisions.

Cost forecasting creates the best possible picture of the business’s costs at a particular point in time, based on known information and relevant assumptions. The process typically starts with the gathering of historical cost data; additional information, such as market research, customer surveys and competitive analyses, provides a fuller picture. Cost forecasters use automated tools to generate a set of informed estimates of future costs from the data collected and analyzed, and then perform financial modeling (detailed later in this article).

What’s the Difference Between Project Budgeting and Cost Forecasting?

Project budgeting establishes a static plan for a specific expenditure. Typically, a budget is set early in a project’s life cycle, though it may be updated at predetermined points during the span of the project. Actual costs, as they come in, are recorded and monitored for variances against the budget.

Cost forecasting estimates future expenditures, based on the most current information available. The process is typically undertaken at the start of a project, then repeated as information changes. Cost forecasting can help project managers foresee any future variances against budget and anticipate the likelihood of cost overruns.

Benefits of Cost Forecasting

Cost forecasting offers significant benefits relative to both projects and businesses. For projects, sound cost forecasting optimizes budgets and highlights possible inefficiencies and cost overruns that can hinder timely completion. For businesses, cost forecasting similarly improves budgeting and management of variances. Strategic business benefits also include the ability to:

- Prepare for upcoming trends and downturns: Estimating the effects of future market trends and anticipating economic downturns are essential for business survival. Modeling cost forecasts under different scenarios allows businesses to develop strategies for surviving difficult times and taking advantage of new opportunities.

- Identify opportunities for cost reduction: Cost forecasting can help managers pinpoint areas in need of better cost control or targeted cost reduction. Used in conjunction with revenue forecasting, it can highlight profitable parts of the business and shine a spotlight on areas that might need to be pruned or divested.

- Forecast the effects of additional expenditures: Every business wants to make the most of new opportunities, but up-front expenditures and future ongoing costs must be considered. Forecasting the costs of introducing new or upgraded products, services or business infrastructure supports investment decision-making.

Types of Cost Forecasting

Forecasting methods can be classified in three main ways: quantitative, which is based on numerical data and calculations; qualitative, which uses subjective information, such as surveys; and causal, which combines quantitative and qualitative methods. Which method a business selects will depend on the nature of the project, how the forecast will be used and a host of other factors. Of note, cost forecasters often use multiple cost forecasting methods, particularly when uncertainty is high.

-

Time Series Analysis

Time series analysis is a quantitative forecasting method based on historical data that uses mathematical techniques to project the future. It can highlight and help to explain seasonal variations in the data, such as sales increases at Christmas; cyclical patterns over longer periods of time — for example, the famous “business cycle” of economic upticks and downturns; and long-term trends and growth rates.

The weakness in time series analysis is that it assumes past data is a reliable guide to the future. Thus, it is best used when plenty of reliable historical data is available, and the trends and relationships in the data are clear and relatively stable.

Within the category of time series analysis, businesses can opt for:

-

A moving-average time series, which smooths out variations in data to reveal an underlying trend. Each data point in a moving-average time series consists of an average of several underlying historical data items. Moving averages can be calculated for any time period for which historical data exists. Time periods commonly used by businesses are seven days, three or six months and four quarters.

-

Exponential smoothing, which is similar to moving-average time series analysis, except that the historical data points are assigned weights that exponentially decrease with the age of the data point. There are many varieties of exponential smoothing, some of which are mathematically complex and can be incorporated into machine-learning models (more on that soon).

-

The X-11 method, another type of weighted moving-average time series analysis. It applies symmetrical weights to all data points in a time series except those at the beginning and end of the series.

-

The Box-Jenkins method, which uses autoregression, a statistical technique that assumes the current value of a time series is a function of its past values. Box-Jenkins uses autoregressive moving averages (ARMA) or autoregressive integrated moving averages (ARIMA) to calculate the best match of a time series to past values. It’s mathematically complex, but computer software is readily available to run it. The Box-Jenkins method is best used for short-term forecasts.

-

Trend projection, which takes a trend that has been stable for a significant period of time and projects it as an indication of likely performance in the future. Like other time series analyses, it assumes the future is like the past and does not anticipate trend breaks or shocks.

-

-

Econometric Models

Econometric models help businesses, investors and creditors forecast the likely impact of different economic scenarios on costs. For example, higher inflation might increase the cost of raw materials, energy and haulage.

Commonly used types of econometric models include several varieties of linear regression, vector autoregression, panel data models, ARIMA models, probit and logit models, and limited dependent variable models. However, all econometric models serve essentially the same purpose: to identify and quantify the relationships between different pieces of economic data.

For example, an economist who wants to test whether higher public debt leads to higher inflation might use a simple linear regression model that tests the relationship between an independent (or “explanatory”) and dependent variable. In this example, the independent variable is public debt and the dependent variable is inflation. If the hypothesis that higher public debt leads to higher inflation is true, then the model will show a positive change in inflation whenever there is a positive change in public debt.

The inclusion of other independent variables, such as economic growth or unemployment, would make this model a multiple, linear regression model. This is the most common type of econometric model, most of which are usually mathematically complex and typically take the form of computer algorithms.

-

Machine-Learning Techniques

Machine learning (ML) is an advanced technology that underpins predictive modeling and predictive analytics. Defined in the 1950s by artificial intelligence (AI) pioneer Arthur Samuel as “the field of study that gives computers the ability to learn without being explicitly programmed,” ML is a subset of the broader AI sphere that is increasingly used to help forecast future scenarios under conditions of uncertainty. It is thus a useful tool for cost forecasting.

In simple ML, algorithms analyze input data and predict outputs within preset parameters. The algorithms respond to new data by optimizing their performance. This is known as “learning” from the data. Over time, the algorithms develop a body of “learned” information, behaviors and parameters, known as “intelligence.”

There are four types of machine learning: supervised, semi-supervised, unsupervised and reinforcement.

-

In supervised machine learning, the computer is taught by example. The operator provides a known data set that includes desired inputs and outputs, and the algorithm works out how to arrive at those inputs and outputs. Typically, the learning process is iterative, with the algorithm responding to operator corrections by adjusting its calculations until it achieves a close fit with the specified inputs and outputs.

-

Semi-supervised machine learning is similar to supervised but includes unlabeled data that the algorithm learns to label by referencing labeled data.

-

In unsupervised machine learning, the computer learns by analyzing patterns in data. Reinforcement learning defines a set of rules and then allows the computer to learn to obey those rules through a process of trial and error.

-

Monte Carlo simulation is a good choice when historical data is inadequate for ML. Monte Carlo simulation is a probability-based technique that indicates likely future paths under conditions of uncertainty. Algorithms that perform Monte Carlo simulation don’t optimize their performance through learning; rather, the algorithm repeats many times with different, randomly generated input values. The results are then averaged to identify the probability of different outcomes.

-

-

Expert Judgment

When numerical data is scarce or unreliable, or when the aim of the forecast is to gain an overview of a product or market, tapping into expert judgment can be effective. Two qualitative methods that use expert judgment are the Delphi method and panel consensus.

-

The Delphi method involves interrogating a panel of experts using a series of questionnaires, with the aim of eventually reaching a group consensus. The anonymous feedback from each questionnaire determines the questions posed in subsequent questionnaires. Participants are able to review the responses, so all experts have access to the same information for their forecasting decisions. This approach prevents a majority opinion from dominating a forecast and enables dissenting opinions to be taken into consideration.

-

The panel consensus method relies on the assumption that a panel of experts can arrive at a better forecast than a single expert can. The panel is encouraged to communicate freely, share information openly and collaborate to produce a consensus forecast. A risk, however, is that the majority opinion can dominate, allowing social biases to influence the forecast.

-

-

Comparative Analysis

Comparative analysis compares the costs of two or more alternative projects or business lines to determine which ones are most cost-effective. Comparative cost forecasts can help with resource allocation and help identify areas for cost reduction. They can also be useful for new ventures if the company is able to obtain or estimate cost information about similar products already on the market.

However, a comparative analysis is dependent on the accurate identification of costs. Where costs can’t be accurately identified or are subject to sudden change, assumptions may have to be made, which raises the risk of making less-than-ideal business decisions.

When making business investment decisions, comparative cost forecasts should be used in conjunction with comparative revenue forecasts, so that the estimated future profitability of all the alternatives can be compared.

Factors That Affect Cost Forecasting

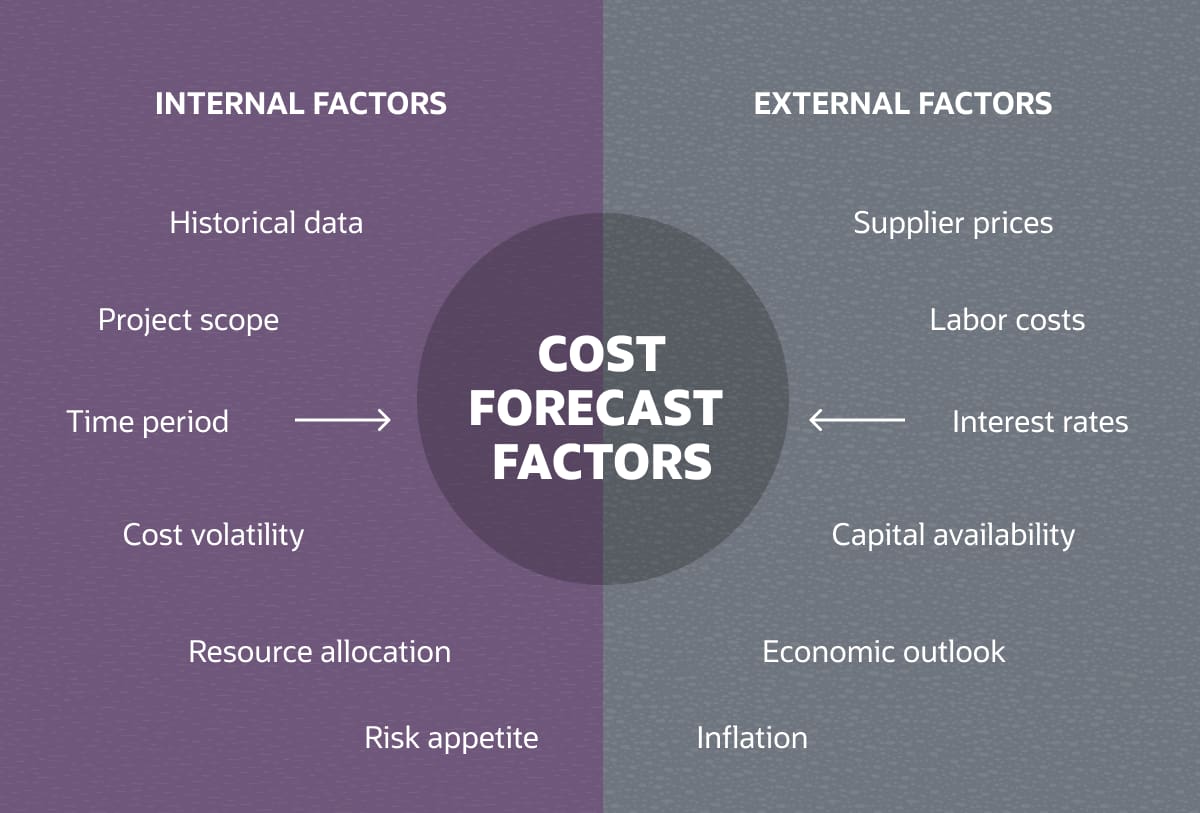

Cost forecasting is influenced by a variety of internal business factors, such as project scope and availability of data; and external factors, such as labor costs and inflation. Here’s a summary of factors likely to affect cost forecasting for a typical business, followed by several specific explanations.

-

Historical Data

Many approaches to cost forecasting assume that the future will be similar to the past, and they therefore construct new forecasts by projecting forward from historical data. Thus, availability and reliability of historical data are imperative for accurate cost forecasts.

-

Project Scope

Cost forecasting should include all expected future costs. If the scope of a project is undefined, future costs will be, to some extent, unknown, which makes it difficult to embark on cost forecasting or setting a budget. Yet, even with the best of plans in place, the scope of a project can change along the way if, for example, requirements are revised or unexpected obstacles are encountered. When the scope of a project changes, costs will also change — and so must the project’s cost forecast.

-

Project Duration

A project’s length affects its cost. It’s typically easier to accurately estimate the costs of short projects up front; but for longer projects, it may not be possible to nail down reliable cost estimates until several months into them. Cost estimates are also more likely to be influenced by external factors, such as inflation and interest rate changes.

Changes in costs can be monitored as variances against the budget, but cost forecasts should be redone whenever costs change or prior estimates of future costs become certain.

-

Labor Costs

Labor costs are typically a major part of project and business costs, and they are subject to change. Cost forecasts should take into account this variability and possibly involve sensitivity analysis (aka “what-if analysis”) related to external factors that can influence wages, such as inflation. Availability of labor can also affect costs — skills shortages, for example, can cause wages for in-demand talent to increase. And if a project is at risk of falling behind its deadline, overtime may have to be paid or temporary staff brought on board.

In addition, employee benefits, such as medical insurance, bonus payments, hiring and firing expenses and payroll taxes, need to be included in cost forecasts. So should the value of noncash benefits, such as company cars.

Cost forecasts should be recalculated whenever labor costs change or external factors or project overruns necessitate additional labor costs. On the flip side, cost forecasts can also be recalculated if efficiency improvements or other changes result in decreased labor costs, offering managers the opportunity to channel their savings elsewhere.

Steps in Cost Forecasting

Cost forecasting is a complex process involving multiple inputs. As such, it’s important to have a defined process. Here are the five major steps for creating a cost forecast.

-

Gather Information

Good cost forecasting depends on the availability of plentiful, high-quality information on which to base the forecasts. Exactly what data points to gather depends on the nature of the desired cost forecast, but items typically collected include historical and estimated labor and materials costs, interest rates, pricing information, competitive analyses, market research and customer feedback. If the forecast is intended to feed into a project’s budget, information about the project’s scope is also necessary.

-

Analyze Historical Data

The next step is to clean up, reformat and analyze historical data. Detailed recordkeeping throughout the business smooths this process and diminishes the need for adjustments, both of which can improve forecasting. However, even in businesses with impeccable control procedures, data can be incomplete, incorrect, in the wrong format, poorly understood or spurious. Cleaning up historical data and putting it into a common format is essential before constructing forecast models, especially if automated tools are to be used.

Historical data can be completed or adjusted by referring to information whose reliability is certain, such as published financial data, or by obtaining supporting information from data providers. If possible, financial data adjustments should be recorded as journal entries to establish an audit trail. Missing data can be roughly calculated using estimating tools.

Of note, beware the possibility of “diminishing returns” when it comes to historical data collection and trend analysis. At some point, the cost of obtaining and cleaning up data may exceed the benefits of a more accurate forecast. However, it’s wise to conduct a risk assessment before deciding to call time on this process, particularly if the cost forecast will be used to drive critical business decisions.

-

Perform Preliminary Exploratory Analysis

Exploratory data analysis is the process of investigating a data set to identify patterns, trends and relationships; eliminate anomalies and outliers; and test assumptions. This investigative process includes historical and estimated data, as well as qualitative and quantitative information. The analyses can be bivariate (comparing two data items) or multivariate (comparing several data items). Automated tools are typically used at this point.

The trends and patterns found in preliminary exploratory analysis can be useful in themselves. For example, identifying a positive relationship between wages and distance to work could help inform a company’s recruitment strategy. But more often, the findings of preliminary analysis are more useful for determining which forecasting model to use. For example, the hypothesis “people who are paid more will travel further to work” could be tested using a linear regression model.

-

Choose and Fit Models

Choosing the right model is essential, but it’s not as simple as it sounds. Several factors must be taken into account when choosing a model:

- Accuracy: If critical decisions depend on the outcome of the model, it’s wise to choose one with a high degree of accuracy —perhaps an ML model rather than a simple linear regression.

- Interpretability: Will the model’s decision-making process need to be explained, or can it be treated as a “black box” in which the details are left alone?

- Complexity: Complex models can be extremely accurate, but they are expensive to run and, if the data specification is too tightly calibrated, can generate spurious results. Simpler models can, in many cases, be adequate.

- Scalability: Some models that work well for small data sets can be overwhelmed by large ones, resulting in long processing times and errors, due to data overflows.

Try to establish criteria for comparing different models, taking into consideration any known constraints, such as processing capacity, and the desired outcomes. The model also needs to be “fitted” to the data that it will process. This requires an important balance, particularly for ML models. If the model is too tightly fitted to its training data, it will not cope well with new types of data; this is known as “overfitting.” Alternatively, if the model is too simple, it will miss important patterns in the data, known as “underfitting.” Correctly calibrating the model is vital for obtaining reliable results.

-

Evaluate and Use a Forecasting Model

The mathematical models used in Step 3 generate information needed for a cost forecast. But to create the forecast itself, a forecasting model will be needed, be it qualitative, quantitative or causal (as described earlier). Which model is appropriate for the business to use depends on several factors, such as whether the forecast is intended to be long-term or short-term, the stage of a project’s or product’s life cycle, the degree of uncertainty in the business outlook, the availability and quality of historical data and the perceived reliability of qualitative information.

Cost Forecasting Challenges

Cost forecasting attempts to predict the future. Since no one has a crystal ball, a cost forecast can never achieve 100% accuracy and thus should be considered a guide, not a blueprint. On top of that, cost forecasting can encounter several challenges that, if not managed, can seriously interfere with the forecast’s reliability and, hence, its usefulness.

- Uncertainties and volatility: All businesses operate under conditions of uncertainty and volatility. Variable costs, such as for raw materials, fluctuate with business demand and market conditions, while fixed costs, such as rent, can change from one accounting period to the next. When uncertainty and volatility are low, future costs can often be reliably extrapolated from historical trends, but the opposite holds true as well, especially over the longer term. Variance analysis can help identify the impact of uncertainties and volatility.

- External factors: External factors that affect cost forecasts include changes in interest rates, volatility in global markets for raw materials and commodities, supplier price changes, supply chain disruption, skills shortages, changes in unemployment and immigration, technological disruptions, foreign exchange volatility and changing government policies.

- Managing risks: Scenario analysis that models the various threats facing the business, weighted by likelihood and cost impact, can help business managers identify strategies for mitigating the risks arising from external factors, economic uncertainty and market volatility.

Best Practices for Cost Forecasting

The cost forecasting process can be complex, especially without the right tools to handle the many calculations upon which decisions are made. These nine best practices can help businesses navigate the process effectively.

-

Use historical data: Historical data is a good starting point for cost forecasting. Oftentimes, the patterns and trends in the data are themselves sufficiently stable and well established to provide a reliable guide to the future. But even when they can’t be used as the sole basis for a cost forecast, they are still useful in conjunction with other information, such as customer surveys and the opinions of experts.

The nature of historical data also helps determine the best choice of forecasting model. If historical data is reliable and plentiful, time-series models work well. Otherwise, scenario modeling or qualitative analysis may be better. Even if the cost forecast is for a completely new venture, it’s still worth looking for historical data for similar products or businesses that could offer an idea of how the venture might respond to changing economic circumstances.

-

Be efficient: Efficiency in business processes makes for faster, smoother and less time-consuming data collection and analysis, not to mention the cost forecasting process itself. This can be achieved by:

- Using automated methods to collect data, identify and resolve any anomalies or inconsistencies, and to perform preliminary analysis.

- Setting and enforcing common data standards for all data providers.

- Assessing risks and defining tolerance levels for inaccuracy in data reporting and calculations.

-

Be conservative: The aim of cost forecasting is to provide a realistic estimate of future costs. In business, the past and future are typically a continuum: Sudden, large deviations from established data or trends, whether positive or negative, are unusual (and can be red flags), but overoptimism in the form of significantly understated cost forecasts can have devastating consequences for a business’s cash flow and even solvency. When preparing a baseline cost forecast, therefore, it’s sensible to err on the side of stability and caution, avoiding sudden falls in costs or rises in revenues.

-

Consider scenarios: The downside to an exclusively conservative approach in forecasting is that it can lead to excessive risk aversion and missed profit opportunities. One way around this is to perform a scenario analysis that estimates costs under different assumptions — for example, high and low interest rates, operational events or market conditions — and then compare them to the baseline forecast. Break-even analysis can also be done, and opportunities and risks can be identified for each scenario. Interactive modeling tools can be useful for scenario analysis.

-

Be flexible: Cost forecasts are estimates, which by their nature are subject to change. The effort required to obtain and analyze historical data and qualitative information is considerable, so it can be tempting to treat these estimates as fixed for the duration of the forecast process. But new information can come along and turn a forecast on its head. Good business decision-making depends on complete, up-to-date forecasts. It’s important to be open to incorporating new information as it becomes available, even if it means having to redo much of the forecast.

-

Include nonfinancial data: Financial data is like a skeleton. It gives a cost forecast shape and structure but, by itself, does not tell the whole story. For a more comprehensive picture, nonfinancial data, such as customer feedback, market research and expert opinion, is also critical. Information like market size, market share, lead times and skills availability can also be important to include.

-

Communicate clearly: Cost forecasting involves teamwork. Everyone involved in producing the forecast must understand the end goal, the process steps and where each contributor fits into them. Suffice it to say, good communication is vital. For example, data standards and format requirements need to be clearly specified to minimize errors and omissions. If the forecasting process requires explanation, consider how best to do this: Mathematical models rooted in algebra or Python script might not be comprehensible to everyone. And the forecast itself needs to be presented in a way that is accessible to anyone who needs to read and understand it. If information and assumptions are frequently updated during the forecasting process, consider using a formal change management procedure to keep everyone informed.

-

Review regularly: A cost forecast is a best estimate at a particular point in time of what the future costs of a project or business venture are likely to be. But the information available at the time of the forecast’s creation is frequently superseded by more and better information as it becomes available, such as when interest rates change, which causes cost forecasts to quickly become out of date. Businesses would be wise, therefore, to set up a regular review process for cost forecasts. For projects, cost forecast reviews can be instituted at set points in the project life cycle. For business lines, cost forecasts can be reviewed at regular time intervals.

-

Measure performance: It’s also smart to establish key performance indicators to compare cost outturns against forecasts. This enables forecast accuracy to be measured over time. For example, management could set a performance metric that says if cost outturns deviate from estimates by more than a predetermined percentage in two successive quarters, the forecasting approach and processes must be reviewed and estimating criteria tightened.

By following these best practices, cost forecasters can better predict the business’s future costs.

Forecasting Costs More Accurately With NetSuite

Whatever approach a business takes to cost forecasting, it must be accurate and timely to be successful. NetSuite’s cloud-based financial planning software includes all of the necessary tools to collect and analyze data, identify key trends and patterns and model different scenarios. The software scales to any business and supports collaborative work in multidisciplinary teams. Cost forecasters can quickly and easily generate baseline and scenario analyses and produce a range of timely, well-presented reports to support business planning and risk management.

Integration with other business applications in NetSuite’s financial management suite enables cost forecasts to be monitored and managed in real time for maximum accuracy. NetSuite’s flexible software efficiently handles changes in data and assumptions, ensuring that forecasts always reflect the best information available.

Cost forecasting is a planning tool that helps businesses estimate their future expenditures. It relies on historical and current data, both qualitative and quantitative, that can be analyzed using a variety of methods and modeling techniques that help predict future costs. Accurate and timely cost forecasts serve as a source of business advantage, enabling organizations to potentially increase their profits and identify new opportunities while controlling their costs and building resilience to sudden changes in market and economic conditions.

Cost Forecasting FAQs

What are cost forecasting methods?

Cost forecast methods are quantitative and qualitative techniques that companies use to predict their future expenses. They include time series analysis (such as exponential smoothing and the X-11 method), econometric models and machine-learning (supervised and unsupervised and Monte Carlo).

Why is cost forecasting important for businesses?

Cost forecasting allows businesses to anticipate and plan for future expenses, enabling them to make better informed decisions and allocate resources more efficiently.

What are the five methods commonly used for cost forecasting?

Five methods commonly used for cost forecasting are historical data analysis, expert judgment, market research and industry analysis, scenario analysis and sensitivity analysis, and forecasting tools and software.

How accurate are cost forecasts usually?

Although 100% accuracy is impossible, cost forecasters generally aim for a high percentage. The shorter the term of the forecast, the more accurate it is likely to be. The type of cost forecast also determines accuracy: Short-term production cost forecasts in stable businesses with good financial and information control can reach 95% or more, while the accuracy of longer-term financial forecasts under conditions of uncertainty is likely to be much lower.

How can cost forecasting help with budgeting and financial planning?

Cost forecasting feeds into the budgeting cycle and informs financial planning. Annual or project budgets are typically set on the basis of an initial cost forecast. Unlike a budget, a cost forecast can be updated, enabling variances in both actual and forecast data to be managed.

What are the three types of forecasting?

The three types of forecasting are: quantitative, using financial (typically historical) data; qualitative, using subjective information, such as market research and expert judgment; and causal, which builds comprehensive relationship models using both quantitative and qualitative information.