Just as a garment’s integrity hinges on every stitch, success within the apparel and fashion industry depends on seamless collaboration across every division within an organization. Key performance indicators (KPIs) help make this collaboration possible by providing a common language and measurable benchmarks for manufacturing, wholesale, and retail teams to meet their strategic goals and objectives. These metrics are especially important amid a shifting economic landscape, supply chain challenges, rapid trend cycles, and constantly evolving consumer preferences.

What Are KPIs?

KPIs are quantifiable metrics that track progress toward an organization’s desired outcomes and industry benchmarks. They provide a framework for syncing operational decision-making and resource allocation with strategic priorities.

What Are Apparel and Fashion KPIs?

Apparel and fashion KPIs are specialized performance metrics that measure success (or the lack thereof) at every industry touchpoint from initial design, materials sourcing, and manufacturing to distribution, retail sales, and customer experience. These KPIs, such as defect rate and inventory turnover, go beyond general business indicators to address the industry’s unique challenges, including seasonal shifts in demand and complex global supply networks. They also help apparel and fashion companies evaluate their competitive positions and identify opportunities for operational improvement and increased profitability.

Key Takeaways

- Apparel and fashion KPIs track each step of a product’s lifecycle, including lead times, manufacturing output, and on-time order fulfillment.

- KPIs fuel agility in sourcing, production, and delivery to ensure quality control and protect profit margins.

- Software that gathers and centralizes real-time KPIs in a single platform enables collaboration across an organization’s teams.

Why Is Tracking Apparel and Fashion KPIs Important?

Much as a designer combines separate pattern pieces to create an article of clothing, KPIs integrate individual data points into one real-time narrative that provides both tactical insights and strategic direction. By monitoring fluctuations in performance, apparel and fashion companies can optimize what is working and improve what’s not, regardless of whether the cause is related to workforce productivity, production efficiency, or quality control. KPI results can also influence pricing strategies, revenue forecasts, inventory management, order fulfillment—essentially, all the parts of a business that affect its overall financial health.

Apparel and fashion KPIs lay the groundwork for data-driven decision-making that can ultimately boost profitability by saving companies time and money—resources that they can reinvest in innovation and growth. For retailers and merchandisers, KPIs facilitate better supplier evaluation, more accurate inventory planning, and the ability to understand customer preferences. For manufacturers, KPIs that target production workflows, resource inefficiencies, and material waste can help shore up their operations and drive continuous improvement.

Moreover, in an industry under constant pressure to maintain transparency and ensure ethical practices, KPI tracking helps create accountability, which boosts investor confidence when a company is seeking external funding.

10 Key Apparel and Fashion KPIs to Monitor in 2025

Any KPI worth tracking should align with specific business objectives and provide actionable insights to help decision-makers move the business forward. Flexibility is also key, meaning that teams should be able to add or remove KPIs as needed for new business challenges, shifting market dynamics, or other circumstances.

The following KPIs are among the most helpful for apparel and fashion businesses seeking visibility into production capacity, quality control, fulfillment capabilities, and inventory management. Some are useful for gauging the performance of manufacturers, which is critical intelligence for retailers as they evaluate supplier reliability and manage their inventories.

-

Production Efficiency

Production efficiency measures output in relation to labor hours during a designated period. Output could be for single or multiple product lines. This KPI sheds light on worker productivity for use in cost management, capacity planning, and labor allocation. It can also flag issues with machinery or gaps in workers’ skills and training that result in inefficiencies or bottlenecks on a factory floor.

The formula to calculate this KPI is:

Production efficiency = Total output produced / Total labor input in hours

If a manufacturer produces 500 pairs of sunglasses in an 8-hour shift, its production efficiency rate would be 62.5 pieces per hour (500 / 8).

For retailers, a manufacturer’s production efficiency directly impacts product availability, pricing stability, and reorder capabilities.

-

Defect Rate

Defect rate is the percentage of faulty products discovered at the manufacturing, brand, or retail level. For manufacturers, this KPI measures defects per hundred units (DHU):

DHU = (Number of defects found / Total pieces inspected) x 100

If an inspector finds 40 defects among 300 garments, the DHU is 13% [(40 / 300) x 100]. Each defective garment may have multiple defects.

Imperfect products may also go unnoticed during manufacturing and reach retailers. The formula to analyze defect rates is:

Defect rate = (Number of defective products / Total products sold or inspected) x 100

Following the manufacturing example, if a manufacturer shipped the remaining 260 garments to a retailer, which found 15 garments with various defects, the retailer’s defect rate would be approximately 6% [(15 / 260) x 100].

Both KPIs speak to production and quality-control standards, and they can impact costs, revenue, reputation, product return rates, and customer satisfaction.

-

On-Time Delivery

Throughout the apparel and fashion supply chain, on-time delivery influences customer retention and revenue growth, whether it’s third-party manufacturers delivering orders to brands, brands delivering orders to retailers, or ecommerce platforms fulfilling end-customer orders. The on-time delivery KPI calculates the percentage of all orders delivered as scheduled by the agreed-upon or targeted delivery date. The formula is:

On-time delivery = (Total orders shipped on time / Total orders shipped) x 100

If an online retailer shipped 2,000 orders in a month and 1,600 of them arrived at their destinations on time, the on-time delivery rate would be 80% [(1,600 / 2,000) x 100].

Use of order-tracking technology to proactively monitor and address delivery delays can improve delivery results and keep customers in the loop. Integrated business management systems also pinpoint production, supplier, or logistics problems contributing to the delays.

-

Inventory Turnover

A company’s inventory turnover rate highlights how well it manages and converts inventory into sales by tallying how many times inventory is sold and restocked during a defined time frame. Used to guide purchasing decisions, the inventory turnover KPI also demonstrates a company’s forecasting expertise, the strength of its supply chain and inventory management system, and the success of its sales strategy and marketing efforts.

The formula to calculate this KPI is based on two variables: cost of goods sold (COGS) and average inventory, the latter of which represents the average value of inventory over a specific period of time:

Inventory turnover = COGS / Average inventory

If a retailer posts $25,000 in COGS and $10,000 in average inventory in the first quarter of 2025, its inventory turnover ratio is 2.5 ($25,000 / $10,000). This could be considered low for some retail sectors but might be appropriate for others selling higher-value or slower-moving goods.

In general, a high inventory turnover rate indicates well-managed inventory that matches customer preferences and market trends—though a very high rate could result in stockouts. Conversely, a low inventory turnover rate could mean that a company may be overstocking products or experiencing anemic sales.

-

Lead Time

Speed is paramount in the fashion industry, particularly in fast fashion. Lead time measures the total amount of time required to produce and deliver finished products to a customer after they place an order. That could include the total time it takes a manufacturer to create and ship a new line of jeans to a retailer. It also could include the amount of time a retailer needs to fulfill an online order placed by an end consumer or the time it takes to restock inventory.

The formula to calculate lead time is:

Lead time = Order delivery date – Order request date

If a retailer orders 250 pairs of sneakers from a manufacturer on March 15, and the manufacturer delivers the complete order on April 14, the lead time is 30 days (April 14 – March 15).

Lead times rely on accurate production forecasts that account for such factors as material sourcing, production line capabilities, quality control, and logistics. Collaborative forecasting and planning with suppliers can foster faster lead times. Other strategies to reduce lead time include nearshoring, lean manufacturing, and automation.

-

Cost Per Unit

Cost per unit is the average cost of producing a single item. A critical KPI tied to direct and indirect manufacturing costs, cost per unit is a function of sourcing capabilities, design complexity, production volume, labor productivity, and production and operational efficiency.

When calculating cost per unit, organizations must take into account both direct costs, such as fabric, labor, packaging, and logistics, and indirect costs, such as overhead for utilities and administrative and marketing costs. The formula to calculate the cost per unit KPI is:

Cost per unit = Total production costs / Total number of units produced

If the total cost to produce 1,000 pairs of men’s trousers is $25,000, then the cost per unit is $25 ($25,000 / $1,000). This KPI informs product pricing decisions and helps companies identify cost-saving opportunities, both of which impact a company’s bottom line.

-

Capacity Utilization

Capacity utilization measures how thoroughly a factory is using its production resources. It’s based on comparing actual production output against the highest level of output possible if every available resource (labor, machines, hours) were to be used to its fullest potential.

The formula to calculate capacity utilization is:

Capacity utilization = (Actual output / Maximum potential output) x 100

If, under ideal circumstances, a factory has the potential to produce 40,000 T-shirts per month but produces only 30,000, its capacity utilization rate is 75% [(30,000 / 40,000) x 100]—meaning the factory is operating at 75% of its full capacity.

A high capacity-utilization rate indicates that a manufacturer is maximizing its production capabilities and minimizing waste. It also allows fixed expenses to be absorbed over a greater number of goods, thereby reducing costs per unit and, likely, increasing profit margins. Although this is good news for the manufacturer, retailers must keep in mind that a factory that is consistently operating at nearly 100% capacity might struggle to accommodate rush orders or seasonal demands.

-

Worker Productivity

The worker productivity KPI monitors the per-worker number of units or products manufactured per line, product category, or factory to determine if the company will reach its production targets. It focuses purely on the quantity of output, not the quality, and is most helpful when comparing workers producing the same or similar items.

The formula for calculating worker productivity is:

Worker productivity = Total units produced / Number of workers

If the 30,000 T-shirts produced by the aforementioned factory required 150 workers working 8-hour shifts in a given month, worker productivity is 200 shirts per worker (30,000 / 150).

Businesses can use the worker productivity KPI as a starting point to study labor performance and to estimate factory capacity for production planning, including estimated lead times. But to truly understand how smoothly their production operations are running, stakeholders typically incorporate other KPIs as well, such as equipment performance, resource allocation, and item defects.

-

Machine Downtime

Idle machines don’t make garments—or money. As the name implies, the machine downtime KPI tracks the amount of time equipment is nonoperational. Downtime can occur when a machine malfunctions or breaks down, operators make errors, production lines slow, or time is lost due to resetting machines for style changeovers.

The formula to calculate machine downtime is:

Machine downtime = (Time machinery is down / Planned operating time) x 100

If a sewing machine that’s scheduled to operate for 40 hours per week is nonoperational for 6 hours, the machine downtime is 15% [(6 / 40) × 100].

Scheduling downtime for regular inspections and preventive maintenance can head off or limit unexpected and costly disruptions that impact the rest of the supply chain. Skilled workers play an essential role in ensuring that machines are running and used properly.

-

Order Accuracy

Order accuracy refers to the percentage of orders completed without errors and in accordance with customer specifications. Fulfilled orders arrive on time with the correct products in the right quantities and free of defects and damage—and with the proper paperwork. The formula to calculate order accuracy is:

Order accuracy = (Number of error-free orders / Total orders fulfilled) x 100

If a brand processes 20,000 orders in one month and 19,800 are accurate, the order accuracy rate would be 99% [(19,800 / 20,000) x 100].

Higher order accuracy rates reflect an efficient supply chain and adherence to quality-control standards. They also mean fewer product exchanges and returns, which helps contain added costs.

Measure Apparel and Fashion Manufacturing KPIs With NetSuite

Monitoring multiple KPIs over time is critical for improving performance standards among employees, workflows, and machinery in the apparel and fashion industry. But the ability to manage and extract value from those KPIs shouldn’t become a KPI itself.

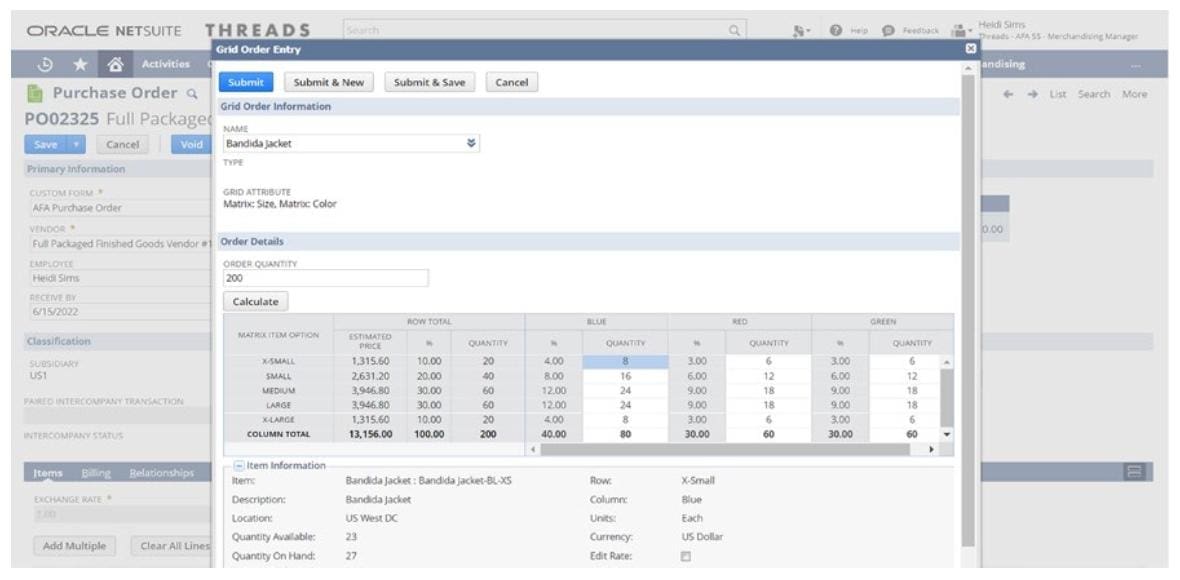

NetSuite’s Apparel, Footwear and Accessories (AFA) edition of its flagship ERP solution centralizes and tracks KPI data across a business. The cloud-based, scalable platform allows for data-driven decision-making by providing real-time views into operations and analytics that cover financials and accounting, supply chain management, inventory and order management, customer relationship management and marketing, retail point of sales, and ecommerce. NetSuite AFA comes with prepackaged KPIs that are role- and feature-based, with the ability for users to generate customized KPIs. Dashboard portlets allow for comparisons of multiple KPIs and visual representations of data over designated time spans.

A Perfect Fit

Just as a well-constructed garment depends on precise measurements, KPIs provide critical insights into production efficiency, quality control, inventory management, and order fulfillment—all factors that directly impact the bottom line in the apparel and fashion industry. By consistently tracking these metrics, companies can quickly identify performance problems, address operational weaknesses, make better-informed business decisions, increase profit margins, and maintain their competitive advantage. In other words, apparel and fashion companies have everything to gain.

Apparel and Fashion KPI FAQs

What is productivity in the apparel industry?

Productivity in the apparel industry is measured by the ratio of production output, such as the number of garments, to production inputs, including material, labor, machinery, and labor hours. This shows how efficiently an apparel company uses its resources, but it doesn’t account for output quality or the effectiveness of the process.

What is MMR in the garment industry?

The man-to-machine ratio (MMR) KPI compares the total number of direct and indirect employees in a manufacturing facility to the number of operational machines, such as sewing machines. Garment industry factories use this metric to assess resource allocation and the cost of production.