Accountants tend to be in high demand when the economy is thriving — and when it isn't. People and businesses often need guidance managing their finances during boom times and recessions alike. And while most people envision accountants as tax preparers who toil long hours between January and April filing individuals' and businesses' tax returns for the prior year, the truth is that work abounds all year long for most accountants. Tax preparation is only a small portion of accounting work. The accounting field is quite expansive, and there are almost as many types of accountants as there are specialized interests and areas of expertise.

What Are the Types of Accountants?

How many kinds of accountants exist? The answer depends on who fields the question. Accounting specialties vary far and wide; they include forensics, government, auditing, management and more.

To most, accountants and taxes go hand in hand. Although tax preparation remains an important aspect of many accountants' jobs, the accounting profession includes many diverse roles. The regular duties of an accountant include preparing and maintaining financial reports, ensuring the accuracy of financial documents, evaluating financial results of operations, recommending best practices, offering guidance on revenue enhancement and cost reduction, conducting risk analysis, producing financial forecasts and, of course, preparing and filing tax returns.

Here are 15 types of accountants found in today's workplaces:

- Certified public accountant (CPA)

- Management accountant

- Chartered accountant (CA)

- Auditor

- Government accountant

- Tax examiner

- Project accountant

- Financial adviser

- Investment accountant

- Forensic accountant

- Cost accountant

- Chartered Global Management Accountant (CGMA)

- Tax accountant

- Financial accountant

- Financial controller

15 Types of Accountants to Know

There is no one-size-fits-all accounting job. Nearly as varied as the professionals who occupy them, accounting positions focus on a broad array of roles, responsibilities and areas of expertise. No definitive list of accountant types exists, but here are 15 that can be found working in public accounting firms, businesses, government agencies, nonprofits and other organizations.

-

Certified public accountant (CPA):

A certified public accountant is an accounting professional who has met specific licensing requirements in one or more U.S. states. To attain that professional designation, one must earn a bachelor's degree in accounting, have real-world accounting experience and pass the Uniform CPA Exam. While the detailed eligibility requirements for taking the test vary from state to state, the test itself is the same everywhere and covers four areas: auditing and attestation, business environment and concepts, financial accounting and reporting, and regulation.

Once certified, accountants can work in a sector of their choosing: for public accounting firms in business or industry, for a government body, in education, for nonprofits, etc. The primary role of a CPA is to ensure that businesses and individuals adhere to generally accepted accounting principles (GAAP) — the accounting tenets, procedures and standards established by the Financial Accounting Standards Board (FASB). While tax preparation may be part of a CPA's job, the role is usually much broader in scope, including financial planning and reporting, audits, consulting, litigation support and other accounting tasks. CPAs can also choose a specialization that suits their interest, be it auditing, forensic accounting, staff management or something else.

-

Management accountant:

When making strategic business decisions, senior managers need to gauge the financial health of their organizations and assess how certain choices could affect it. A management accountant helps business leaders do just that by performing tasks such as budgeting and planning, profitability analysis, risk management and financial reporting to internal stakeholders. The ability to communicate clearly and concisely is particularly important for management accountants, given that they need to organize information and present it to business executives in an easy-to-digest format.

-

Chartered accountant (CA):

As business becomes more global, U.S. companies are learning how to navigate the laws and regulations of countries other than the United States. Enter the chartered accountant, or CA, who is highly trained in international accounting. Like "CPA," "CA" is a professional designation that requires specialized training and expertise. Chartered accountants are well versed in the International Financial Reporting Standards (IFRS), which are accounting rules aimed at making companies' financial statements transparent, consistent and comparable around the globe. IFRS, the non-U.S. analog of GAAP, has been adopted by 120 nations. By understanding how tax laws and business regulations differ among countries, CAs can help businesses abroad comply with local regulations. Within the accountancy field, CAs focus on four areas: applied finance, financial accounting and reporting, management accounting and taxation.

-

Auditor:

Auditors are responsible for reviewing an organization's financial records to ensure accuracy and compliance with tax laws, regulations and other accounting standards. It is the auditor's responsibility to make sure that an organization's financial information is reasonably correct and free of "material" misstatements. In a large company, "material" could translate to "millions of dollars." An auditor can point out discrepancies and offer guidance in ways to correct them. They also help analyze the controls that are in place to protect businesses from fraud and make suggestions to enhance companies' operational efficiency.

Most companies are audited annually to make sure their financial records are in order. Auditors can be employed internally, in which case they work for the company whose financial and business practices they examine, or externally. In the latter scenario, the auditor — usually a CPA — works independently of the company being audited and acts as an unbiased third party. The role of auditor involves examining financial statements, inspecting accounting records, evaluating financial operations and making recommendations for improving said operations.

-

Government accountant:

As the name denotes, government accountants work in the federal, state or local government sector. These professionals must possess knowledge of business codes, governmental statutes and regulations that oversee both public and private sectors. A government accountant's duties include budgeting and managing public funds, helping government agencies plan their fiscal-year activities, investigating white-collar crimes and performing system audits. Also, they may work in tandem with regulatory groups, such as the Internal Revenue Service (IRS). At the state and local levels, government accountants must ensure that agencies or departments comply with standards set forth by the Governmental Accounting Standards Board (GASB). At the federal level, government bodies must comply with the Federal Accounting Standards Advisory Board (FASAB).

-

Tax examiner:

Employed by federal, state and local governments, tax examiners review the relatively simple tax returns filed by individuals and small businesses. They determine how much tax is owed, check returns for completeness and accuracy, code returns for processing, conduct audits and collect overdue tax payments. Tax examiners may also discuss erroneous or missing information on returns with taxpayers. Revenue agents perform essentially the same functions, but they "handle complicated tax returns of large businesses and corporations," according to the U.S. Bureau of Labor Statistics.

-

Project accountant:

The overseers of specific projects, these accountants may be regular employees or contractors hired to manage a particular company initiative — for example, the construction of a new facility or the launch of a brand-new product. A project accountant takes responsibility for every aspect of a project that might have an impact on the project's overall cost or on the revenue it generates. That includes recording expenses, verifying billable hours, preparing customer invoices, updating budgets, and revenue recognition. By keeping tabs on project-related expenses, they can report back to management on whether a project's budget is on track.

Because project accountants work closely with colleagues, including accounting teams, project managers and external suppliers, strong communication and interpersonal skills serve them well. Although commonly hired by construction companies and engineering firms, project accountants can find work in any sector.

-

Financial adviser:

Financial advisers help individuals, businesses and government entities by providing short- and long-term financial planning and guidance — but they're not always actual accountants. These professionals aim to help clients manage the money they currently have and increase their wealth in the future. Topics they discuss with clients include insurance, tax strategies, savings (in general and for special events such as retirement), budgeting, and investing through vehicles such as stocks and bonds, 401(k) plans and individual retirement accounts (IRAs). Financial advisers who work for businesses recommend investment and hedging strategies to help companies manage cash flow and liquidity. Areas of study for anyone seeking a career as a financial adviser might include risk management, taxation, managerial accounting, supply chain management and corporate finance. While financial advisers often study accounting in some form, they are most often not accountants, although they may be required to meet certain licensing requirements.

-

Investment accountant:

These professionals usually work in the financial services industry, at an asset management firm or in a brokerage. Their expertise lies in investment vehicles, such as stocks and bonds, currencies, exchange-traded funds (ETFs), precious metals, and more. Investment accountants work with asset managers and brokers to process investments and keep tabs on third-party activity. They also determine how assets and investments affect a client's taxes, help develop a firm's financial strategy and ensure that their employers comply with federal and state regulations tied to their industry.

-

Forensic accountant:

The so-called "detectives" of the accounting world, forensic accountants analyze financial records to enforce compliance with standards and laws — and, often, to uncover omissions, errors or fraud. Because these types of accountants tend to deal with financial data that may be difficult or impossible to obtain, they need to be creative in their endeavors, with the goal of investigating and re-creating unavailable or missing information. They often team up with IT staff to find and access data online and on computer networks. Highly skilled at resolving complex financial issues, forensic accountants sometimes serve as expert witnesses during trials. They are most commonly employed by insurance companies, banks, government agencies and public accounting firms.

-

Cost accountant:

Businesses often hire a cost accountant to help improve margins on the goods or services by analyzing the costs of production or delivery and identifying opportunities to reduce these costs — the analysis may also help inform pricing decisions. Cost accountants analyze every expense tied to a company's supply chain, including the cost of labor, materials, shipping, production and administration. They compile the collected information and communicate it to the business's leaders, who then use the data to set product pricing and budgets.

To help businesses maintain healthy supply chains, cost accountants must understand effective inventory management, including inventory control and costing. That means being well versed in the four inventory costing methods for computing both cost of goods sold (COGS) and the ending inventory for a given period — first in, first out (FIFO); last in, first out (LIFO); weighted average cost (WAC); and specific identification. In addition, cost accountants often collaborate with business leaders to identify ways to improve operational efficiency and their analysis helps inform product pricing decisions.

-

Chartered Global Management Accountant (CGMA):

As CPAs who specialize in management accounting, CGMAs must demonstrate advanced proficiency in finance, operations, strategy and management. The prestigious CGMA designation was created in 2012 by the American Institute of Certified Public Accountants (AICPA) and the Chartered Institute of Management Accountants (CIMA) in response to growing demand among corporate employers for accounting personnel with an expanded skillset. To receive a CGMA designation, management accountants must fulfill specific educational, experiential and testing requirements.

-

Tax accountant:

This is the accountant who does, in fact, choose to make tax preparation their professional mainstay. Tax accountants often choose to work at public accounting firms, whose broad client base consists of individuals, businesses, nonprofits and government agencies. Otherwise, they may opt for employment at a large corporation, where their tax expertise can be leveraged for the financial well-being of the organization. Any tax accountant working with a diverse clientele should demonstrate top-notch communication and listening skills.

Tax accountants help individuals and businesses comply with the Internal Revenue Code when filing their taxes; interpret tax laws and explain the implications of tax law changes; assist with planning for future returns by identifying strategies for deferring, minimizing or eliminating tax payments; file returns on behalf of clients; and arrange audits with tax authorities.

-

Financial accountant:

Financial accountants keep a record of an organization's financial results over time. By entering, summarizing and reporting all transactions related to a company's business operations, financial accountants accurately record financial transactions and produce financial reports. Accountants with this title oversee a number of areas, including accounts payable and receivable, and are responsible for maintaining the general ledger. They also investigate financial discrepancies, reconcile accounts, correct errors, and work with senior leaders to prepare detailed financial statements.

-

Financial controller:

The financial controller is both the senior accountant within an organization and the person tasked with managing all accounting-related activities. Duties include performing high-level financial reporting and analysis; consolidating subsidiary financial statements; working with auditors and tax accountants; ensuring compliance with financial regulations; sharing reports and analyses with executive teams; and recruiting, training and mentoring accounting department employees. In organizations where there is no CFO, the financial controller plays an expanded role: As a member of the executive team, this professional helps develop the company's financial strategy, manages cash flow and provides investment advice to guide the organization.

Conclusion

Individuals pursuing a career in accounting can choose from a wide breadth of opportunities and positions. Not simply tax-return preparers, accountants specialize in many different areas, including government, forensics, business finance, auditing, project management and investment strategy.

Types of Accountants FAQs

How many types of accountants are there?

The number of existing accountant types varies depending on who is asked and what sources are consulted. Accounting roles are quite diverse. While some accountants focus on the preparation and filing of taxes, others specialize in such areas as forensics, government, auditing, international accounting or investments.

What are the 4 types of accountants?

Accounting jobs come in many shapes and sizes, but accounting can sometimes be broken down into four categories: corporate, public, government and forensic. Corporate accountants work for businesses, filing and managing a company's financial data for tax compliance and external reporting purposes. Public accountants work with external clients — individuals, businesses, nonprofits or government bodies. Government accountants are employed by federal, state and local governments, while forensic accountants generally collect, recover and reconstruct financial data that is hard to obtain.

What is the highest-paid type of accountant?

According to PayScale, financial controllers earn the highest pay among accountants, with an average base salary of $85,714 per year. Chartered accountants don't lag far behind, with an average salary of $80,000, while forensic accountants earn an average of $71,832. Accountants' salaries can vary widely, however — even among professionals with similar jobs — depending on the employer, job location and the accountant's years and level of experience.

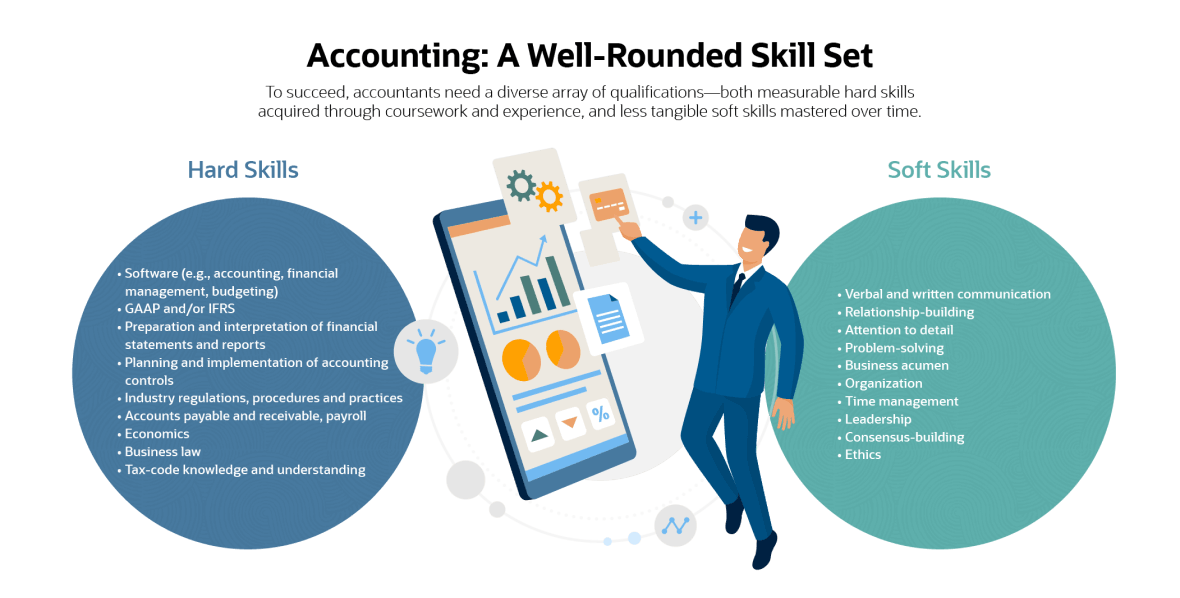

What skills do you need to be an accountant?

To excel in their field, accountants need a variety of hard and soft skills. When it comes to measurable skills they can acquire through education and certifications, accountants must have a command of financial accounting and management principles, knowledge of economics and IT proficiency (especially with accounting, budgeting and financial and project management software). They must be familiar with the regulations, procedures and practices established in a variety of industries, and they need to be experts in preparing and interpreting financial statements and reports. As for soft skills, the most important are communication, relationship-building, attention to detail, problem-solving and general business acumen.