Professional services firms operate on the principle that time is literally money, making financial statements a necessity for managing these businesses. They provide a comprehensive, yet concise view of a firm’s financial health, helping leaders understand their financial position, operational results, and cash flow—all essential indicators of profitability. However, professional services firms face unique challenges in financial reporting, especially when handling project-based revenue and complex billing structures. This article explores the components, considerations, and challenges inherent in financial statements for professional services firms. We’ll also investigate the ways modern technologies make it easier to compile and analyze financial statements in the pursuit of financial excellence.

What Are Financial Statements for Professional Services?

Financial statements are a collection of standardized reports that present a company’s accounting information in a structured manner to inform investors, owners, and stakeholders when making decisions. The three core financial statements for professional services firms are:

- The income statement, which shows revenues, expenses, and profitability.

- The balance sheet, which presents a snapshot of assets, liabilities, and equity.

- The cash flow statement, which tracks cash inflows and outflows.

While each financial statement serves a distinct purpose and can be analyzed individually, the three are intended to be reviewed together to provide a holistic view of a company’s financial health. Because their preparation incorporates historical data, financial statements reflect the past and present states of the business and provide a foundation for prospective analyses, such as strategic planning, resource allocation, pricing decisions, and forecasting. They also serve as valuable tools for industry benchmarking and comparative analysis.

The preparation and presentation of financial statements adhere to guidelines and norms established by Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS), which provide consistency and comparability across organizations. Unlike businesses that sell physical products, professional services firms—such as law practices, accounting firms, consulting agencies, and marketing companies—primarily sell their specialized knowledge and skills. This unique business model shapes their financial reporting needs.

Beyond their internal purposes, financial statements are often shared with external stakeholders, like investors, creditors, and regulatory bodies, to promote transparency, build trust, and demonstrate financial viability. For example, banks may require financial statements when a firm applies for a loan, and investors use them to assess potential returns. Public companies must also provide these statements under mandates from the Securities and Exchange Commission (SEC).

Key Takeaways

- While the three core financial statements—income statement, balance sheet, and cash flow statement—each tell a story about a firm’s financial health, they become more powerful when read together.

- Financial statements are used by lenders, investors, and compliance agencies. They also serve as a starting point for internal processes, like budgeting and forecasting.

- Professional services firms face unique challenges when preparing and interpreting their financial statements.

- Financial metrics derived from the financial statements are used to analyze and benchmark profitability, liquidity, leverage, and efficiency.

- Applying modern accounting and reporting technologies to overhaul the financial statement processes improves accuracy, saves time and resources, and enhances data accessibility.

Financial Statements for Professional Services Explained

In most professional services firms, the finance and accounting team, led by the chief financial officer or controller, is responsible for preparing financial statements. They gather and analyze financial data, verify that proper accounting procedures are followed, and generate statements on a monthly, quarterly, and annual basis as part of the financial close process. Their expertise ensures accuracy, compliance with accounting standards, and timely reporting. Using appropriate accounting software and tools can streamline the process, improve accuracy, and facilitate real-time reporting and analysis. Some smaller firms may outsource this function to external accounting professionals.

Though professional services firms may follow different preparation processes, based on their size and complexity, they must preserve consistent accounting policies and procedures to maintain reliable and comparable financial statements over time.

The steps involved in generating accurate financial statements in a professional services firm include:

- Data collection: Gathering financial data from various sources, such as time-tracking systems, billing software, bank statements, and expense reports.

- Bookkeeping: Recording financial transactions in the firm’s accounting system, ensuring proper categorization and adhering to accounting principles and company policies.

- Reconciliation: Verifying the accuracy and completeness of financial records by comparing them to external sources, such as bank statements and supplier invoices.

- Adjusting entries: Making necessary adjustments to account for items like revenue accruals and deferrals that cover long-term customer projects, depreciation, expense accruals, and prepaid expenses.

- Financial statement preparation: Compiling the adjusted financial data into the required financial statement formats, such as the income statement, balance sheet, and cash flow statement.

- Review and analysis: Examining the prepared financial statements to identify trends and variances with regard to budgets.

- Closing entries: Recording any final adjustments and closing the books for the financial period.

Financial Statement Considerations for Professional Services

Professional services firms face unique challenges and considerations when preparing and analyzing financial statements. For example, tracking and reporting intangible assets, such as human capital and intellectual property, are particularly important in this sector. Accurate revenue recognition, especially for project-based or long-term engagements, is also critical. Additionally, given the often longer billing and payment cycles that professional services encounter, financial statements play an important role in managing cash flow and working capital.

To guarantee accurate and meaningful financial statements, professional services firms must carefully consider the following areas, which can significantly impact their financial performance and position.

-

Revenue recognition for long-term projects or contracts:

Revenue recognition becomes complex when engagements or contracts span multiple accounting periods. Accurately aligning revenue recognition with customer billing schedules and the progress of work performed is particularly challenging when projects involve multiple milestones or deliverables. Proper revenue recognition makes sure that the income statement accurately reflects the firm’s performance over time, rather than showing large swings in revenue that could significantly affect metrics like profitability and cash flow. For example, a consulting firm working on a 12-month, $120,000 project might need to determine whether to recognize revenue evenly over the contract period or to base it on milestones achieved. Common revenue recognition methods for long-term projects include:

- The percentage-of-completion method, which recognizes revenue based on the progress of work completed.

- The milestone method, which is based on specific deliverables.

- The completed contract method, which defers all revenue recognition until the project is finished.

-

Importance of work-in-progress (WIP) accounting:

Work-in-progress (WIP) accounting captures the value of work performed but not yet billed to clients. Recorded as an asset on the balance sheet, WIP represents unbilled time and expenses incurred on client projects. Accurate tracking and valuation of WIP are essential for both understanding the firm’s true financial position and recognizing revenue in the appropriate period. However, managing WIP can be challenging, especially for firms with numerous ongoing projects or complex billing arrangements. For instance, an architectural firm working on a multiphase project might need to carefully track WIP for each phase to ensure accurate financial reporting. WIP accounting typically involves tracking direct costs, such as salaries and materials, along with indirect costs, such as overhead, and allocating these costs to the appropriate projects, based on time and resources consumed.

-

Handling of unearned or deferred revenues:

It’s common for professional services firms to receive advance payments, such as deposits or retainers, from clients before work is performed. Accounting for these unearned revenues typically involves creating a liability account for each advance payment received and gradually reducing this liability on the balance sheet while recognizing revenue on the income statement that records the delivered services. Proper handling of unearned revenues ensures that financial statements will accurately reflect the firm’s liabilities and revenue, avoiding any distortion of profitability. However, tracking and managing unearned revenues can be complex, especially for firms with numerous clients and varying payment terms.

-

Employee-related costs and considerations, especially for firms relying heavily on human Capital:

In professional services firms, employee talent and expertise—often called human capital—are their primary “assets.” However, unlike other assets, human capital is not reflected on the balance sheet, like cash or inventory would be. Rather, payroll expenses are usually recognized when incurred, following the accrual basis of accounting. Only payroll costs for billable work not yet invoiced to clients would be recorded as a WIP asset. Salaries, bonuses, benefits, training, and other employee-related costs often make up a substantial portion of a firm’s expenses, directly impacting profitability. Accurate tracking and allocation of these employee costs to specific projects or clients is crucial for understanding the true profitability of each engagement. However, managing employee costs can be challenging, particularly for firms with a large workforce or complex compensation structures. For instance, a marketing agency with a mix of full-time employees, part-time staff, and freelancers would need to carefully track and allocate employee costs so that financial reports can be relied on for job costing, pricing, profitability analysis, and hiring.

Types of Financial Statements for Professional Services

Professional services firms prepare and analyze three primary financial statements: income statement, balance sheet, and cash flow statement. While these statements are prepared according to established standards, their specific format and content may vary based on the firm’s size, structure, and reporting needs. For example, a law firm might report revenue by practice area or choose to disclose partner contributions and distributions separately on the cash flow statement. Tailored approaches within GAAP or IFRS guidelines allow firms to provide more relevant information for stakeholders and specific operating insights into performance. It’s also important to be aware of certain industry-specific reporting requirements, such as for client trust accounts in law firms or client escrow accounts in real estate brokerages.

The following sections take a closer look at each of the three core financial statements, exploring their standard components and nuances relative to professional services firms.

Income Statement (Profit and Loss Statement)

The income statement, also known as the P&L or profit and loss statement, summarizes revenues, expenses, and profitability over a specific period, typically a month, quarter, or year. It provides valuable insights into the firm’s financial performance, helping stakeholders assess the company’s ability to generate profits and make decisions about resource allocation, pricing strategies, and cost management. Professional services firms can use the income statement to track profitability over time, and then compare that performance against internal expectations and industry benchmarks. This helps leaders identify areas for improvement: If gross profit margins are declining, the firm may need to reassess its pricing strategy or find ways to reduce direct costs; if operating expenses are growing faster than revenue, the firm may need to find ways to cut indirect costs.

For professional services firms, the key components of the income statement are:

- Revenues: Revenue is earned by providing professional services to clients, usually in the form of billable hours or project fees. Service revenue is the primary source of income for most professional services firms and is often broken down by service type or client segment to present a detailed view of revenue streams. Other revenue streams, including royalties, product sales, or interest income, are reported separately.

- Cost of services: These are the direct costs associated with delivering professional services to clients. These costs mainly include labor of billable staff, such as salaries, benefits, overtime, and bonuses for professionals directly involved in client projects. Other expenses commonly reported in the cost of services include project-specific travel, materials, subcontractor fees, equipment rental, and insurance. The litmus test is their direct attribution to a specific engagement.

- Gross profit: Gross profit is calculated by subtracting the cost of services from service revenue. It represents the profit earned from professional services before accounting for indirect and overhead expenses. Gross profit appears as a key subtotal on a professional service firm’s income statement, as it indicates the profitability of its core service offerings and helps with setting prices.

- Operating expenses: These are the indirect costs associated with running the professional services firm, rather than those pertaining to delivery of client services. Operating expenses include rent, utilities, administrative salaries, marketing, technology infrastructure, professional liability insurance, and the firm’s own professional service costs, like bank and legal fees. Managing operating costs is particularly important since they are non-billable activities that can significantly impact a firm’s overall profitability.

- Net income: Net income is the final profitability measure on the income statement, casually referred to as the bottom line. It’s calculated by subtracting all expenses, including cost of services, operating expenses, taxes, one-time losses, and interest costs, from total revenue. It’s the most comprehensive measure of performance. When expenses are greater than revenue, it’s listed as “net loss” rather than net income.

Income statements can be presented in various formats, such as single-step and multi-step, depending on preferred level of detail. Professional service firms tend to use either the single-step or multi-step income statement. The single-step format, which is the simplest, groups together all revenues and all expenses to calculate net income in a single calculation. This format is suitable for small service businesses with straightforward operations, as it does not require details about the cost of services provided. As firms grow in size and complexity, the multi-step income statement is more commonly used because it adds details. This format can also be tailored to specific types of service businesses—for example, a consulting firm might break down revenue by service type, while an IT services firm might list hardware costs and software licensing as separate line items.

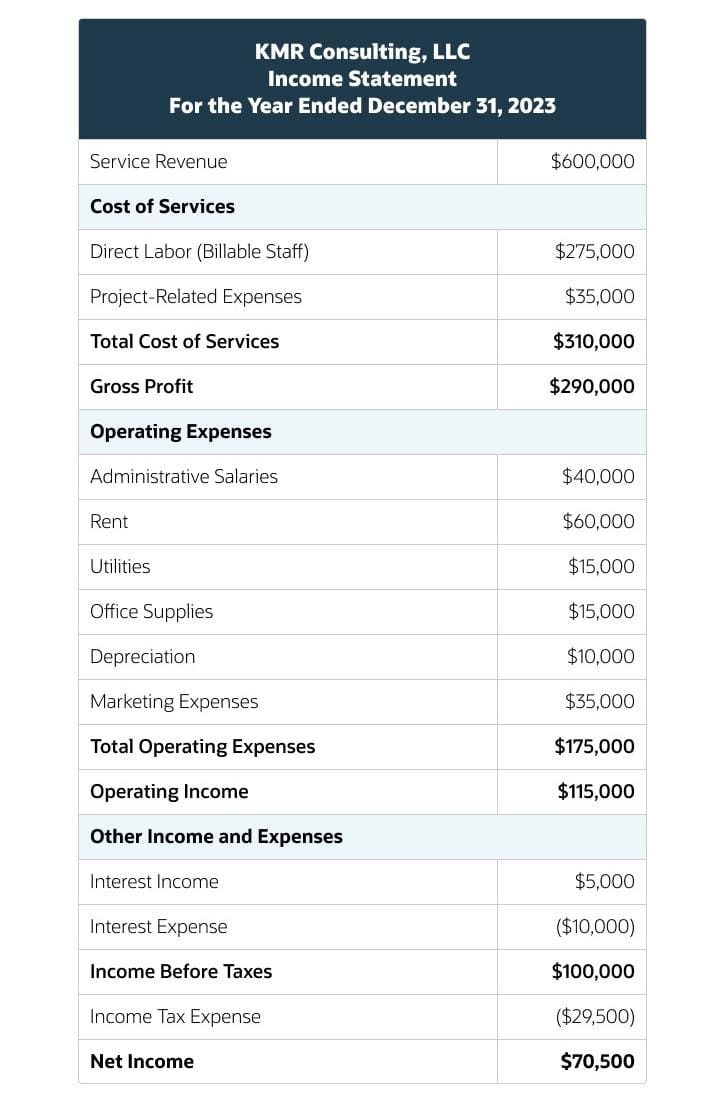

Here is an example of a multistep income statement for a fictional consulting firm:

While multistep income statements can be more complex to create, they offer several key benefits that can make the additional effort worthwhile. First, they include a gross profit calculation, which is essential for making pricing decisions and identifying improvements in the firm’s core services. Second, they separate operating from nonoperating items, allowing the firm to evaluate core business operations independently of other financial activities. Last, because many service industries use the multi-step format, it facilitates easier benchmarking against competitors.

Balance Sheet (Statement of Financial Position)

The balance sheet provides a snapshot of a professional services firm’s financial position at a specific point in time, which is why it is sometimes called the statement of financial position. It presents the firm’s assets, liabilities, and owners’ or shareholders’ equity and is based on the fundamental accounting equation: Assets = Liabilities + Owners’ Equity. This equation highlights the relationship between a firm’s resources, obligations, and ownership interests.

Professional services firms can use the balance sheet to assess their liquidity (i.e., ability to meet short-term obligations) and solvency (ability to meet long-term obligations). For example, a firm with a high proportion of current assets to current liabilities may have a strong liquidity position, while a firm with a high debt-to-equity ratio may be considered more financially leveraged. As a result, the balance sheet helps executives make decisions about investments, financing, and resource allocation.

The key components of the balance sheet for professional services firms include:

-

Assets (current and noncurrent): These areresources owned by the firm that have future economic value. They are typically classified as current (or, expected to be converted into cash or used within one year) and noncurrent. Current assets may include cash, accounts receivable, WIP, and prepaid expenses, while noncurrent assets include property, equipment, certain intangibles (such as software or intellectual property), and long-term investments. In general, assets are initially recorded at historical cost (that is, their original purchase price) but some, like stocks or pension funds, may be recorded at fair value, reflecting current market prices.

Liabilities (current and long-term): These are the firm’s financial obligations that must be paid in the future. For professional services firms, current liabilities, due within a year, may include accounts payable, accrued payroll related expenses, short-term loans, and unearned revenue. Long-term liabilities, due in more than a year, may include term loans and lease obligations. Liabilities like accrued bonuses, pension obligations, and deferred compensation plans may require special attention in professional services firms, especially those with partner structures or performance-based compensation models that add complexity to their valuation. Similarly, calculating tax liabilities can be complicated, particularly for firms operating in multiple jurisdictions.

-

Owner’s/shareholders’ equity: This represents a firm’s ownership structure and non-debt funding. At a high level, it includes initial investments, contributed capital, accumulated profits, and distributions to owners. However, the specific components of this section vary, depending on the firm’s ownership structure. Sole proprietors, partnerships, corporations, and the various derivatives, like limited liability corporations (LLCs), have different legal factors that trigger the changes. For example, a partnership’s equity section details partner contributions, distributions, and allocated profits/losses, while a corporation’s equity section includes common stock, additional paid-in capital, and retained earnings. Less common items, such as treasury stock and restricted reserves, may also appear in this section. Regardless of the components, equity is calculated as the difference between the firm’s assets and its liabilities, allowing the balance sheet to balance.

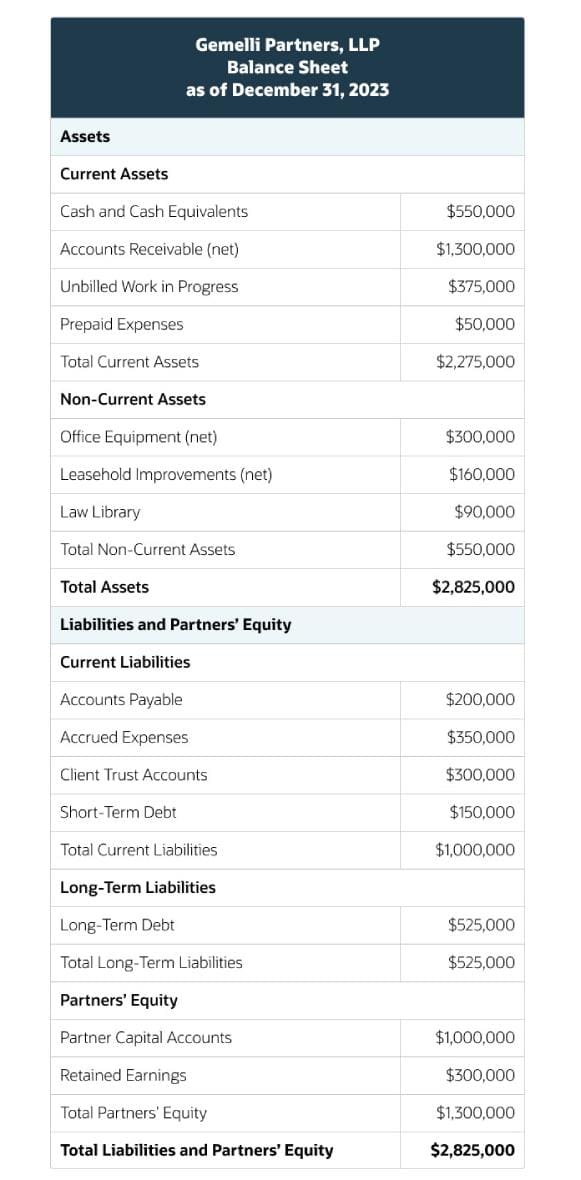

The following is an example of a balance sheet for a fictional law firm.

Note that while the basic structure of the balance sheet is consistent across various professional services sectors, the composition can vary significantly. These differences reflect each sector’s unique business model, asset requirements, and revenue recognition patterns. For instance, the example balance sheet above reflects some unique aspects of law firms, such as the higher proportion of accounts receivable. Architecture and engineering firms, on the other hand, may have a higher proportion of fixed assets, due to specialized equipment needs. Consulting firms generally have substantial deferred revenue liabilities from long-term contracts, and software development firms may include reserves for stock-based compensation in their equity accounts. Understanding these sector-specific nuances is essential for accurate balance sheet analyses.

Cash Flow Statement

In an industry where human capital is the most valuable asset, cash is king—after all, nobody likes to be paid in IOUs or high fives. The cash flow statement, which presents the inflows and outflows of cash and cash equivalents during a specific period, is an essential means of monitoring and managing cash position.

A cash flow statement organizes cash sources and uses into three categories so that readers can clearly see how operations, investments, and financing activities impact cash balances. It strips out the impact of non-cash activity, such as depreciation, on the income statement and adjusts for balance sheet changes that represent “hidden” cash flows, like mounting accounts payable balances. The result translates accrual-based accounting data into information about liquid cash, which is particularly important for professional services firms, given their extended client payment cycles and the up-front costs many projects require before revenue is generated.

Positive cash flow—which occurs when cash inflows exceed outflows—is essential for sustainability and growth, while persistent negative cash flow can signal the need for adjustments to the business model or operations. The cash flow statement also supports financial planning by helping managers make informed decisions about investments and financing to fund growth strategies.

The cash flow statement is divided into three main sections:

- Operating activities: This section shows cash flows generated from or used in the firm’s core revenue-generating activities. It starts with the accrual basis net income and adjusts for non-cash items and changes in working capital. It includes cash received from clients for services provided, as well as cash paid to suppliers, employees, interest, and taxes. This analysis helps firms assess their ability to generate cash from their core business operations and spot potential cash collection or expense management issues. Due to project-based billing, operating cash inflows in the professional services industry can be volatile.

- Investing activities: These are cash flows related to the purchase and sale of long-term assets and investment opportunities. While professional service firms generally make fewer capital purchases than equipment-intensive industries, they still invest in various assets. These may include property, office equipment, software, new service lines, geographic expansions, and acquisitions or divestitures of other firms or business units. Monitoring cash flow from investing activities helps firms evaluate their capital allocation strategies and assess potential returns on investments.

- Financing activities: This section captures cash flows related to changes in equity and debt, including transactions with owners or shareholders and external lenders. Cash inflows may include proceeds from issuing equity or debt, loans, lines of credit, and partner capital contributions. Cash outflows include loan or lease repayments and distributions or dividends paid to owners or shareholders. Analyzing cash flow from financing activities helps professional services firms grasp how they are funding operations and growth, as well as assess the impact of financing decisions on their overall cash position.

Here’s an example of a cash flow statement for a hypothetical architectural services firm.

Reading and Interpreting Financial Statements

Each financial statement serves a unique purpose, but like dancers in a ballet, their true power emerges when they move in harmony to tell the complete financial story. For example, at the end of each period, net income from the income statement is closed out and swept into the balance sheet’s equity section, increasing retained earnings. Retained earnings, in turn, can fund future growth, influencing financing decisions that ripple through all three financial statements. Another example is the link between revenue on the income statement and the cash and accounts receivable balance on the balance sheet. Additionally, changes in working capital accounts, like accounts receivable, WIP, and accounts payable, affect the cash flow statement as hidden sources and uses of cash. And keep in mind that the cash flow statement begins with the opening cash balance from the balance sheet, adds net income from the income statement, and then reconciles activity to arrive at the period’s final cash balance on the balance sheet.

This deeper understanding helps readers avoid common pitfalls, such as paying attention only to surface-level metrics. For instance, focusing solely on revenue or net income gives but a partial view of financial health; assessing cash flow, liquidity, and leverage provides a fuller picture. Comparing a firm’s metrics to competitors’ or other industry averages can add valuable context, but differences in firm size, service offerings, and location should be considered to avoid misleading conclusions. Readers should also watch for nonoperating items, such as one-time events like asset sales or legal settlements, which can distort overall performance and should be evaluated separately to assess “quality of earnings.” Finally, it’s particularly important for professional services firms to understand cash flow nuances; positive net income doesn’t always translate to positive cash flow, so analyzing the cash flow statement closely can help identify potential liquidity issues.

Financial Statement Metrics for Professional Services

Financial statement metrics serve as a dashboard of indicators for professional services firms, offering a concise, yet powerful snapshot of financial position and performance. These metrics and ratios are derived from the income statement, balance sheet, and cash flow statement to assess four dimensions of financial health—profitability, liquidity, leverage, and efficiency. Financial metrics should be regularly monitored to uncover trends and can be benchmarked against industry norms.

Four essential metrics for professional services firms are profit margin, current ratio, debt-to-equity ratio, and accounts receivable turnover.

Profit Margin

Net income or net profit is the bottom line on an income statement, expressed as a dollar value. Profit margin measures a firm’s profitability by expressing net income as a percentage of total revenue. It indicates the amount of each dollar of revenue that the firm retains as profit after accounting for all expenses. To calculate profit margin, divide net income by total revenue and multiply by 100.

For professional services firms, tracking profit margin is essential for assessing pricing strategies, cost management, and overall financial performance. Higher profit margins suggest that a firm is effectively managing its expenses and generating sufficient revenue to cover costs and create value for owners.

It’s helpful to compare profit margins to budget expectations over time, in addition to comparing them against industry benchmarks. However, it’s also important to keep the firm’s unique situation in mind when doing so. For example, net profit margin for law firms ranges from 25% to 45%, depending on the number of lawyers in the firm, according to the American Bar Association.

Gross profit margin and operating profit margin are two other important versions of profit margin that are derived from similar formulas, using gross profit and operating profit subtotals from the income statement, respectively.

Using the information from KMR Consulting’s income statement, we can calculate the following:

Profit margin = (Net income / Total revenue) x 100

= ($70,500 / $600,000) x 100

= 11.75%

Gross profit margin = (Gross profit / Total revenue) x 100

= ($290,000 / $600,000) x 100

= 48.3%

Operating profit margin = (Operating profit

/ Total revenue) x 100

= ($115,000 / $600,000) x 100

= 19.2%

Current Ratio

The current ratio is a liquidity metric that measures a firm’s ability to pay its short-term obligations using its current assets. It’s calculated by dividing current assets, such as cash, accounts receivable, and inventory, by current liabilities, such as accounts payable and accrued expenses.

A current ratio greater than 1 indicates that the firm has sufficient current assets to cover its current liabilities, while a ratio below 1 suggests potential liquidity issues. For professional services firms, maintaining a healthy current ratio is crucial for managing cash flow and ensuring its ability to meet obligations, like payroll. However, too high a ratio might suggest inefficient use of assets or overly conservative financial management. Firms should monitor their current ratio regularly and take steps to optimize their working capital management, such as by improving collections processes or negotiating better payment terms with vendors. For context, management consulting firms historically maintain current ratios around 1.1 to 1.4.

Using the information from Gemelli Partners’ balance sheet, we can calculate the following:

Current ratio = Current assets / Current liabilities

= $2,275,000 / $1,000,000

= 2.28

Debt-to-Equity Ratio

This basic leverage metric compares a firm’s total debt to its total equity as a way to gauge the firm’s capital structure, as well as the extent to which it relies on debt financing. The traditional formula for the debt-to-equity ratio is to divide total liabilities by total equity.

For professional services firms, a lower debt-to-equity ratio generally indicates a more stable and less risky profile. This is due to less reliance on external debt, which carries interest charges, and greater participation from owners. However, the optimal ratio may vary, depending on the firm’s growth stage, industry norms, ownership structure, and strategic objectives. For example, firms looking to expand rapidly or acquire other practices might take on more debt, temporarily increasing their debt-to-equity ratio. A modified version of the debt-to-equity formula excludes non-interest-bearing current liabilities, like accounts payable and accrued vacation pay, reasoning that they are operating obligations rather than formal debt. The specific formula used is less important than consistently applying the chosen formula when monitoring the debt-to-equity ratio and making decisions about debt financing.

Gemelli Partners’ debt-to-equity ratio indicates that its creditors are financing more than the owners, although moderately so. It’s calculated as follows, using balance sheet data:

Debt to equity = Total liabilities / Shareholders’ equity

= ($1,000,000 + $525,000) / $1,300,000

= 1.17

Accounts Receivable Turnover

Accounts receivable turnover is an efficiency metric that measures how quickly a firm collects payments from its clients. It’s calculated by dividing total credit sales by average accounts receivable. A higher turnover ratio indicates that the firm is collecting payments efficiently, while a lower ratio suggests potential issues with collections or credit policies.

What constitutes a “good” turnover ratio can vary, depending on industry norms. For example, professional services firms in sectors with longer payment cycles, such as construction or architecture, may have lower turnover ratios compared with those with shorter payment cycles, like legal or advertising. For professional services firms, monitoring accounts receivable turnover is essential for maintaining a healthy cash flow and minimizing the risk of bad debts. By its nature, this metric ignores cash sales, such as deposits and retainers that are paid up front, which can artificially inflate the turnover rate for service firms that have a high occurrence of such transactions. Firms should track this metric regularly and implement strategies to improve collections, such as shortening payment terms, offering incentives for early payment, and using automated billing and payment systems.

The accounts receivable turnover ratio is closely related to another metric, called days sales outstanding (DSO), which measures the average number of days it takes for a firm to collect payment after a sale has been made. It’s calculated by dividing 365 days by the accounts receivable turnover rate.

Calculating the accounts receivable turnover requires data that isn’t always shown on the face of the financial statements, such as net credit sales. It also requires calculating the average accounts receivable balance, which is the balance at the beginning of the period plus the balance at the end of the period, divided by 2.

Using the following data for fictional Alpha Advertising Associates, accounts receivable turnover is calculated as follows:

Net credit sales for the 12 months ended Dec. 31, 2023: $1,500,000

Accounts receivable balance as of Jan. 1, 2023: $250,000

Accounts receivable balance as of Dec. 31, 2023: $325,000

Accounts receivable turnover = Net credit

sales / Average accounts receivable

=

$1,500,000 / [($250,000 + $325,000) / 2]

= 5.2

Converting accounts receivable turnover to DSO means that, on average, it takes Alpha 70 days (365 days / 5.2 turnover) to collect payment on their sales. If Alpha’s payment terms stipulate 30 days, this DSO would indicate that collection is 40 days late, on average.

Technology and Professional Service Financial Statements

Technology continues to fundamentally change how professional service firms prepare, analyze, and use financial statements. This leads to greater accuracy, efficiency, and insights into financial management. Increased automation and better integration of financial data across systems reduce the need for manual data entry, saving time and minimizing human error. Automatically importing and categorizing transactions—whether from external sources, like bank feeds and credit card processors, or internal systems, like time tracking and project management—ensures that the most current data is readily available, cutting down on time-consuming reconciliations. For professional services firms, this automation can significantly improve the accuracy and efficiency of revenue recognition, receivable collections, and cash flow management. Additionally, powerful analytics tools help firms monitor key metrics, detect trends and anomalies, and flag potential issues before they get out of hand.

Cloud-based financial technology also enhances collaboration and accessibility, particularly for firms with remote teams or multiple offices, by allowing multiple users to access and update financial statements simultaneously, from any location. Mobile apps and web-based interfaces further simplify the process by enabling professionals to review and approve financial reports on the go, thus improving decision-making speed and overall efficiency.

Manage Your Financial Statements Easily With NetSuite Financial Management Software

NetSuite’s Cloud Accounting Software is a comprehensive cloud-based solution designed to help teams efficiently—and accurately—create financial statements. By automating manual tasks and integrating disparate systems, NetSuite saves time and reduces risks of errors. Its advanced features, including automated bank feeds, intelligent revenue recognition, and customizable reporting, directly address many of the specific challenges faced by professional services firms. For example, NetSuite’s automated reconciliation tools significantly cut down the time and effort required to maintain accurate financial statements, while its intelligent revenue recognition features help maintain compliance with complex accounting standards, like ASC 606 and IFRS 15, essential for firms with long-term or complex client contracts.

NetSuite’s real-time financial reporting and analytics help professional services firms track key metrics, detect trends, and adapt to changing conditions by providing insights into project profitability, resource utilization, and cash flow. Its cloud-based architecture enables seamless collaboration across locations, with a mobile app for remote invoice and expense approvals to ensure timely financial reporting. Additionally, robust security features, including role-based access controls, data encryption, and automatic backups, enhance compliance and internal controls while maintaining a clear audit trail.

Financial statements are essential documents that help professional services firms monitor and communicate financial health, drive profitability, and make informed strategic decisions. These firms face unique challenges when preparing and interpreting their financial statements, mostly with regard to project-based revenue recognition, WIP accounting, and managing employee-related costs. Mastering the key components of the three core financial statements—income statement, balance sheet, and cash flow statement—and fully grasping their interconnections join forces to elevate statements’ interpretive value and usefulness. Regularly monitoring essential financial metrics from these statements allows firms to spot changes in profitability, liquidity, leverage, and efficiency, while offering foundational data that can be benchmarked against industry norms. Modern accounting and reporting technology further support these efforts.

Professional Services Financial Statements FAQs

What are the financial statements for professional services?

The primary financial statements for professional services firms provide a comprehensive view of their financial health. The income statement reports on the firm’s operations over a specific accounting period, detailing revenues, expenses, and overall profitability. The balance sheet offers a snapshot of the firm’s financial position at a given point in time, outlining assets, liabilities, and equity. Lastly, the cash flow statement tracks the movement of cash through operating, investing, and financing activities, helping firms manage liquidity and financial planning effectively.

What form of income statement is appropriate for a service business?

For professional services firms, a multi-step income statement is generally the most appropriate format. This type of income statement separates operating revenues and expenses from nonoperating items, providing a clear picture of the firm’s core business performance. The multi-step format also allows for the calculation of key metrics, such as gross profit and operating income, that are essential for evaluating the profitability of the firm’s services.

What specific employee-related costs should service firms be most concerned about?

Direct labor costs, including salaries, wages, overtime pay, and performance bonuses, are typically the largest expense category for most professional services companies and have a significant impact on profitability. Other employee-related costs include employee benefits, payroll taxes, insurance, training, and professional development expenses. Employee benefits, such as health insurance, retirement plans, and paid time off, can add significantly to total compensation costs. Additionally, payroll taxes and insurance, like Social Security, Medicare, unemployment insurance, and workers’ compensation, are mandatory expenses that can increase overall labor costs.