I’ve been a CPA for more years than I care to admit and have always used the terms “work in progress” and “work in process” interchangeably. So do many of my colleagues. Now I’ve come to learn that my casual references weren’t always correct — and may even have caused confusion. See, a work in progress refers to long-term projects that haven’t been completed, not partially completed product inventory, which is the definition of work in process.

Sometimes works in progress are internal capital projects, like when a manufacturer builds a new factory. Other times, the projects are the core products or services a business provides, such as commercial construction or when a consulting company performs an 18-month engagement for a client. In all cases, properly managing and accounting for works in progress is important because of their impact on a company’s financial stability. This article is a clarifying deep dive into that impact.

What Is a Work in Progress (WIP)?

A work in progress (WIP) is an unfinished project that customarily remains in various stages of completion over multiple fiscal periods. Such projects are usually formalized with a contract. The term is used in many industries that lend themselves to long-term deliverables. Examples include:

- Construction: Costs incurred for partially completed commercial and residential buildings.

- Professional services: Billable hours spent on a client engagement that have not yet been invoiced, based on the service contract.

- Software development: Labor, licensing and hardware costs incurred to develop code, features or modules of an application that is not yet complete and released.

- Aerospace and defense: Labor, materials and engineering costs incurred for partially completed aircraft, military vehicles and satellites.

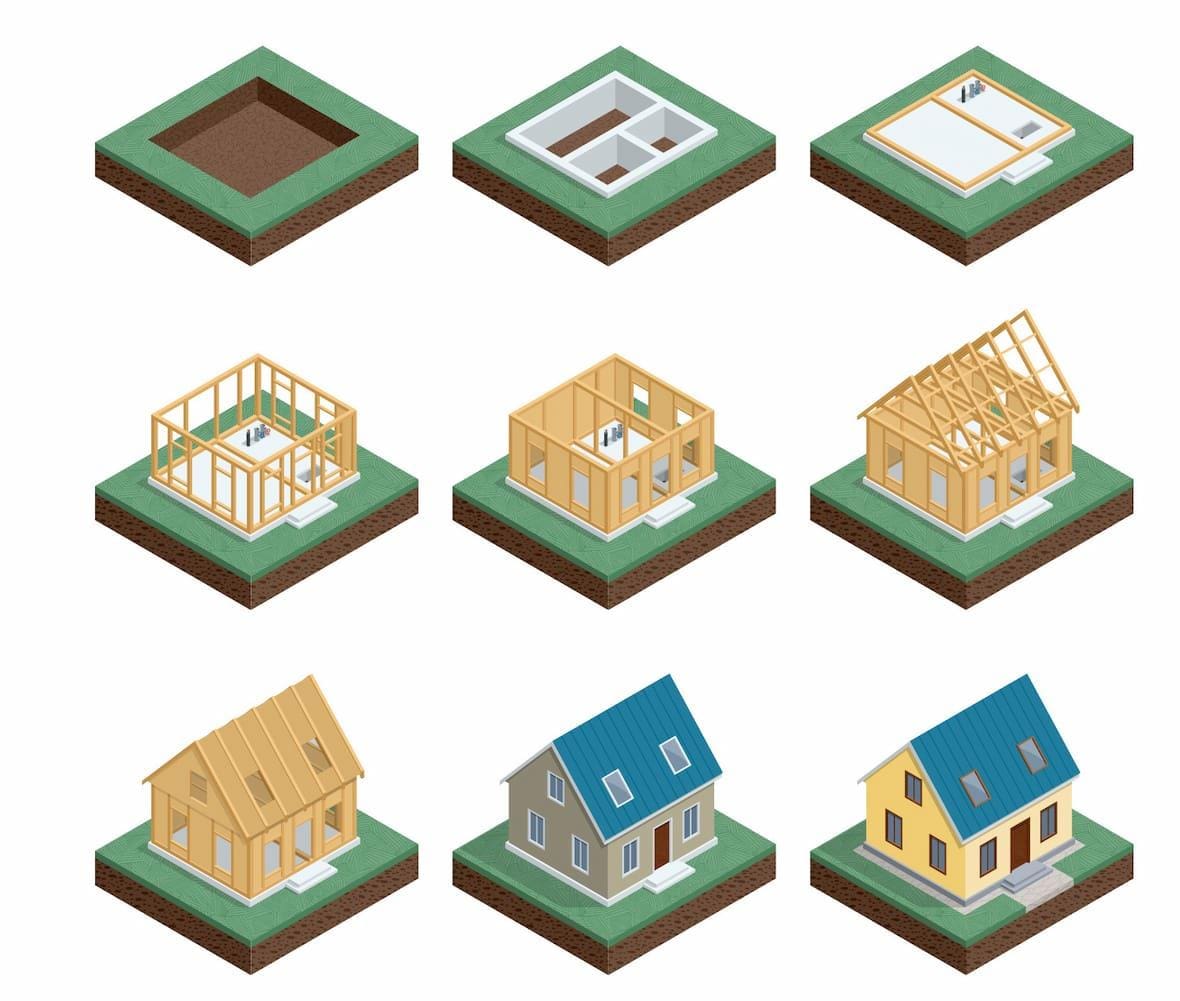

WIP at Various Stages of Completion in the Construction Industry

Key Takeaways

- In accounting, a work in progress represents the costs accumulated for long-term projects that are not yet complete.

- WIP is capitalized on the balance sheet, deferring expense recognition until the project is completed or until certain conditions are met.

- WIP can materially impact several aspects of a company’s financial health, such as its financial position, revenue recognition and cash flow.

- Managing and accounting for WIP is easier and more accurate with the right accounting software.

Works In Progress (WIP) Explained

WIP is important for project management and accounting. Project managers use WIP schedules to track all of the tasks involved in a project, noting which ones have been completed and which ones remain open. These schedules are useful for, well, scheduling work by the calendar, allocating resources, identifying and overcoming bottlenecks and meeting deadlines. On the accounting side, WIP is a temporary holding place to accumulate the costs incurred as a project progresses toward completion. The project management and accounting aspects of WIP should be aligned so that a company’s books and records reflect the stage of completion based on the actual tasks of the project.

Once a project is completed, accountants reclassify WIP entries as appropriate. For example, WIP related to an internal capital project would be reclassified as a long-term asset, such as property, plant and equipment in the case of the factory example. Professional services WIP is reclassified to cost of sales. And in the case of a long-term manufacturing process, such as the 18 to 24 months required to build an army tank, WIP becomes finished goods inventory until it is sold to the military.

To further explain WIP, let’s take a closer look at how WIP differs from work in process and finished goods.

-

Work in Progress vs. Work in Process

WIP and work in process share some similarities (not to mention an acronym) but have different meanings. Both accounts are used to accumulate costs of partially completed products or services, including raw materials, labor and overhead. However, WIP is used for long-term projects that tend to be high value and complex, such as in construction or software development. Work in process refers to partially finished products, mostly in the manufacturing and retail industries. The creation of a bespoke commercial jet is a work in progress, whereas the assembly of mass produced kitchen chairs are works in process. A work in process requires application of cost accounting inventory valuation methods, such as standard costing, and cost-flow assumptions, such as first-in, first-out (FIFO) and weighted average costing (WAC), since the products involved tend to be uniform and interchangeable.

Work in Progress vs. Work in Process

Work in Progress Work in Process Accounting Application Accumulate cost of raw materials, labor and overhead Accumulate cost of raw materials, labor and overhead Duration Long, multiperiod projects Short production cycles Typical Industries Construction, software development, professional services, and aerospace Manufacturing and retail Valuation Methods Completed contract, percentage of completion Standard cost, FIFO, LIFO, WAC Key characteristics of work in progress as compared to work in process. -

Work in Progress vs. Finished Goods

The key difference between WIP and finished goods is the product’s/project’s stage of completion. WIP means that the product is incomplete, such as a building that has been framed but is still missing plumbing, electric or heating. Finished goods have been fully converted into products and are ready for sale or to be turned over to the customer. By its nature, the term “finished goods” is usually associated with the manufacture of standardized products, such as clothing, consumer electronics and packaged food.

How WIP Affects Valuation and Reporting

If your core business involves WIP, such as in construction or software development, it’s particularly important to properly track and value WIP. WIP affects asset values, which can be a significant driver of the overall value of a business. If a business has multiple unfinished projects at once, the effect of WIP accounting on asset values and, in turn, on the company’s balance sheet, can be large. WIP also affects the timing of revenue recognition and profitability for the project. This is because revenues and profits on long-term projects can be recognized at different times: while still in progress, contingent upon meeting specific obligations, when certain milestones are achieved or upon transfer of control to the customer. This dynamic is unlike the hypothetical kitchen chair manufacturer that earns revenue only when finished goods are sold.

It is equally important to track and value WIP related to an internal capital project, like the manufacturer that is building a new factory, because those costs can be capitalized on the balance sheet until the project is completed. Doing so means that no expenses hit the income statement until the asset is placed in service and begins depreciating over its useful life.

-

Job Costing

In order to properly value and report WIP, accountants often segregate revenue and expenses for individual projects into distinct profit centers. This process, called job costing (or job order costing), accumulates all of the direct costs of a project, such as materials and labor, and indirect costs, such as equipment and utilities. Direct costs are included by calculating the actual labor hours spent by labor rates, plus the costs of the materials used. Indirect costs are typically allocated to each job using a standard rate applied to actual usage. Tracking jobs with job costing is especially useful for long-term projects that span more than one fiscal year because they require special treatment for accounting and tax purposes.

While job costing is the standard bookkeeping approach for accumulating WIP expenses for reporting on the balance sheet, when and how those expenses are ultimately transferred to the income statement depends on which of two possible revenue recognition approaches a company chooses: the completed contract method (CCM) or the percentage of completion method (PCM).

-

Completed Contract Method

CCM is the simplest method, under which all project expenses are accumulated on the balance sheet as WIP until the entire project is completed. This means that although cash may be spent on labor and materials, it is not recognized on the income statement. When the project is completed and the contract has been satisfied, only then is all of the project revenue, expense and profit recognized on the income statement. This is done by removing the WIP from the balance sheet and reclassifying it as cost of goods sold (COGS) on the income statement. Certain types of construction, software development and professional services companies use CCM.

-

Percentage of Completion Method

PCM is the more common method used to recognize revenue and expenses for long-term projects. Under PCM, accountants create a ratio of a project’s expected total revenue and expenses. At various stages, this ratio is used to calculate a portion of the project’s revenue and expenses to be recognized in the current period, based on the project’s actual progress. WIP plays a major role in PCM in two ways: First, the project manager’s WIP schedule is used to show progress against the project’s milestones and deliverables. Second, the actual costs of the project are accumulated in the WIP account(s) in the general ledger. Together, they serve as a basis for determining the stage (or percentage) of completion.

WIP Implications for Financial Statements

Tracking WIP is a vital financial management process. It impacts every one of the primary financial statements — the balance sheet, income statement and cash flow statement. Beyond helping to ensure accuracy in financial reporting, WIP serves as a way to control costs and check the accuracy of revenue recognition and customer billing.

-

Impact on the Balance Sheet

The actual costs incurred for a project, such as materials and labor, are accumulated in a WIP account and presented in the asset section — in other words, “capitalized” — on the balance sheet. WIP is considered an asset because it’s an investment that will yield future economic value when it is completed and/or sold. If the WIP is expected to be completed within a year, it’s classified as a current asset. If completion is expected beyond a year, it’s classified as a noncurrent asset. Classification makes a difference when looking at a company’s liquidity. Many of the 3.8 million U.S. construction companies report WIP as “construction in progress” (CIP) on their balance sheet.

-

Influence on the Income Statement

Costs that have been capitalized as WIP on the balance sheet have not hit the income statement. This practice preserves the integrity of a company’s net income since the revenue associated with those costs hasn’t been recognized on the income statement yet, either. Once the project is completed, WIP is transferred into the COGS account on the income statement to be matched with the related revenue. In PCM, portions of WIP are transferred over to COGS throughout the project duration, as each milestone is achieved and the associated portions of revenue are recognized. Thus, PCM avoids swings in gross margin that are typical of CCM and also helps make the project’s operational efficiency and profitability more transparent.

-

Effects on the Cash Flow Statement

Keeping track of cash flow is critical, particularly for businesses that have a long cash-conversion cycle (the time it takes to convert assets like WIP into collected sales). In addition, the substantial costs involved in long-term projects put pressure on managing working capital. When a business’s WIP balance rises, that means it has more capital tied up in unfinished projects. This is reflected as a use of cash in the operating section of the cash flow statement. Conversely, when WIP balances decrease, that means WIP was transferred to COGS and should have related revenue attached. This is reflected as a source of cash on the cash flow statement.

-

Reporting and Disclosure Requirements

The notes to the financial statements contain additional information about items they contain. U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS) requires many disclosures for CIP and WIP. The primary objectives of these disclosures are to clarify the nature of the projects, the value and components of WIP, the method of valuation and to communicate any estimates or associated risks. The information in the disclosures is subject to the same level of audit scrutiny as the financial statements themselves. Auditors examine WIP accounts carefully because they tend to be materially significant and, therefore, errors can distort the financial statements.

Tax Considerations for Works in Progress

The IRS has its own set of rules for WIP and the long-term contracts that typically give rise to WIP. Figuring out which of the many rules to use and how to apply them is complicated, so be sure to check with a tax expert for your specific situation. The nature of the WIP is a key tax consideration, with different rules for true inventory (like the military tank), professional services, software development and construction (residential and commercial). Also, be aware that the way the IRS taxes profit from long-term contracts differs from its standard policy of taxing cash in the year it is received. For example, certain residential builders and small construction companies may be able to use CCM, which means that taxes are deferred on WIP until the entire project is completed. Other construction companies are required to use PCM, which is based on WIP and may require periodic tax payments.

Other WIP-related tax considerations include allowable depreciation methods for capital assets, tax credits for certain types of development expenses and treatment of property taxes for in-progress builds.

Manage WIP Accounting More Easily in NetSuite

Accounting for WIP and the associated long-term contracts can be very labor-intensive. Manually attempting job order costing, for example, quickly becomes inefficient and error-prone, especially considering the multitude of distinct profit centers a small to midsize company might be actively using. Further, every contract can be accounted for using different general accounting methods and may also have different tax rules. NetSuite’s cloud accounting software supports job costing and helps with tax compliance, reducing the administrative burden of WIP accounting and improving efficiency. As part of the integrated NetSuite Enterprise Resource Planning System, WIP can be updated in real time based on actual transactions in both the inventory and accounting modules, including labor costs and materials.

Works in progress — unfinished, long-term projects that are usually contracted — are common in the construction, software development, consulting and professional services, aerospace and defense industries. Job costing is used to track WIP costs, such as labor, materials and overhead, until the project is completed. WIP affects asset valuation, revenue recognition and cash flow, so it’s critical to get it right. Accounting software, especially when integrated with inventory management and payment systems, is the best way to manage WIP.

Work In Progress FAQs

What are the risks of mismanaging WIP in a business?

Mismanagement of WIP can have several unfortunate consequences. It may cause projects to get off track operationally, missing deadlines or key milestones. It may also lead to cost overruns if WIP is not regularly monitored and compared to project budgets. And when used as a basis for recognizing revenue using the percentage of completion method, it may cause the income statement to be inaccurate.

How do international operations affect WIP accounting and reporting?

Companies with international operations may need to follow International Financial Reporting Standards (IFRS) instead of U.S. Generally Accepted Accounting Principles (GAAP). IFRS 15, Revenue From Contracts With Customers, together with International Accounting Standards (IAS) 2 Inventories, is the prevailing guidance for WIP, except in the construction industry, which falls under IAS 11 Construction Contracts. There are many differences between IFRS and GAAP as a result of these various standards, like the exclusion of last-in, first-out costing.

What are the key considerations for auditing WIP in financial statements?

Key considerations for auditing WIP include materiality, use of estimates, complexity of the projects and asset classification. WIP tends to involve large, long-term projects with many moving parts. This increases the potential for inaccuracies that can lead to meaningful errors. Auditors examine the methods of valuing WIP, as well as the disclosures required by professional standards.

What is the meaning of work in progress?

A work in progress (WIP) is an unfinished project. WIPs tend to be long-term, spanning multiple fiscal periods. WIPs can be at various stages of completion and upon completion are no longer categorized as WIP. WIPs are found in many industries, such as construction, software development, consulting and professional services.

Is it correct to say work in progress?

It’s correct to say work in progress when referring to unfinished long-term, high-value projects, such as in construction or software development. However, work in progress is often — mistakenly — used interchangeably with work in process, which refers to partially finished products in the manufacturing and retail industries.