Businesses have been known to fail because they ran out of cash to pay bills or make payroll—even when their sales were strong. It can happen because businesses that sell on credit experience a lag between selling goods or services and receiving cash for them. If such companies don’t do a good job managing their cash flow, they may be forced to opt for high-cost emergency borrowing, missing payments, or—in the most drastic cases—halting operations altogether.

Cash flow problems can affect companies in any industry, be they retailers weathering slow periods or fast-growing startups whose expenses outpace customer payments. But these organizations can survive and thrive by understanding the ins and outs of cash flow management, including the formulas, the challenges, and the best practices.

What Is Cash Flow Management?

Cash flow management is the process of tracking and controlling funds as they move in and out of a business. Companies manage their cash flow to make sure they have enough money on hand to cover short-term obligations, including vendor bills, operating costs, and wages.

Businesses assess their cash flow by monitoring cash inflows from sales, investments, or financing, as well as cash outflows, including expenses, loan payments, and capital expenditures. Traditional profit metrics—such as those found on an income statement—include noncash items like depreciation or sales made on credit, while cash flow tracks only the movement of cash. This real-time cash focus helps businesses balance immediate cash needs with long-term investments.

Key Takeaways

- Cash flow management tracks actual money coming in and going out of the business, not profit.

- Even profitable companies must manage cash flow to be sure they have enough funds to support day-to-day operations and growth initiatives.

- Managing cash flow requires proactive and targeted strategies, including forecasting cash needs, timing payments, controlling expenses, and building sufficient reserves.

- Financial software can automatically track cash inflows and outflows, schedule payments, and alert staff when cash levels run low.

Cash Flow Management Explained

Businesses manage their cash flow to secure enough “cash on hand” to pay employees, vendors, contractors, and creditors on time. There are three primary types of cash flow:

- Operating cash flow is generated by core business activities, such as sales and routine expenses.

- Investing cash flow comes from purchasing or selling assets.

- Financing cash flow is from loans, investments, or changes in equity, such as dividend payments.

Each type measures different aspects of financial performance; together, they can paint a complete picture of a business’s financial health and sustainability. Even profitable companies can face cash crunches when bills come due, if slow-paying customers or poor financial management lead to insufficient cash flow—regardless of how much revenue the company has recognized.

Cash flow management goes beyond bookkeeping to help companies proactively plan for seasonal fluctuations, seize early payment discounts and more favorable terms from suppliers, and time expansion investments to maximize returns. Conversely, poor cash flow management can result in delayed response to changing business conditions as companies scramble to find emergency funding or else miss growth opportunities entirely.

Why Is Cash Flow Management Important?

Cash flow management is crucial for both the short-term operations and long-term sustainability of a business. These seven benefits that good cash flow management can bring to a business show why:

- Strengthens financial stability: Regularly monitoring cash flow helps businesses maintain enough working capital for daily operations without incurring disruptions or late payments. By planning for upcoming expenses, companies avoid not only souring vendor relationships but also the need for emergency borrowing, which often comes at a high cost.

- Builds financial resilience: Reserve funds created through ongoing cash management act as a buffer during economic downturns, slow seasons, or unexpected expenses. This cushion lets businesses continue earning revenue without interruption, until business picks up again.

- Optimizes utilization: Understanding cash flow patterns helps businesses use surplus cash for growth initiatives, short-term investments, or early debt repayment without leaving bills unpaid. Rather than sitting on a bank account full of idle funds, companies can confidently earn higher returns, yet still maintain enough liquidity to fund operations.

- Identifies growth opportunities: Visibility into a solid cash position could let a business seize expansion opportunities, bulk purchase discounts, or strategic acquisitions without overstraining its resources. With strong cash flow management, companies can outmaneuver competitors that need to secure financing before acting.

- Enhances decision-making: Real-time cash flow information helps business leaders make data-driven financial decisions about hiring, inventory purchases, and capital investments.

- Protects from insolvency: Profitable businesses can fail due to cash flow problems. Proactive cash flow management prevents situations where companies cannot pay bills due to poor cash allocation or timing mismatches between customer payments and vendor obligations.

- Improves trust with lenders: Consistently positive cash flow demonstrates financial discipline to banks, creditors, and investors. With it, companies can get better loan repayment terms, higher credit limits, and easier access to capital.

Key Components of Cash Flow Management

Cash flow management is built on several interconnected practices that work together to sustain cash flow stability and foster growth. Each component targets a specific money management challenge—such as predicting future cash sources and uses or implementing integrated accounting software that monitors transfers in real time:

-

Cash Flow Forecasting

Cash flow forecasting predicts when money will enter and leave the business over specific periods—for example, weekly, monthly, or quarterly—based on a combination of historical data, anticipated customer payments, and expected expenses. Companies can then foresee cash shortages and make contingency plans, such as tapping into credit lines, taking out loans, building cash reserves, or delaying major purchases. Many businesses use rolling forecasts that continually update as new information becomes available, providing a dynamic view of their cash position that helps align large investments with surplus cash periods.

-

Monitoring Cash Inflows and Outflows

Financial teams track daily and weekly cash movements to assess the impact of their cash flow strategies. For example, comparing customer payments against due dates for different products or services can show how various credit terms affect accounts receivable or how new approval workflows affect overall expenses. By regularly monitoring short- and long-term cash flow, businesses can spot concerning trends early and avoid missed deadlines or poorly timed large cash outflows. Many companies rely on accounting software with built-in cash flow analysis tools that can send automated alerts when account balances fall outside of predetermined ranges.

-

Building Reserves

Businesses typically store enough cash in reserve to cover three to six months of operating expenses, though some industries or business models may benefit from setting more aside. Companies can then access these reserves if unexpected costs arise or revenue is disrupted by an unforeseen event, such as a supply shortage. Building reserves requires disciplined saving during cash-positive periods—resisting the temptation to invest every dollar back into immediate growth or paying down long-term debts. To separate reserves from operating cash, companies often place reserves in separate interest-bearing accounts or money market funds.

-

Managing AP and AR

Accounts receivable (AR) and accounts payable (AP) departments can do much to influence when cash enters and leaves the business. Aligning both departments helps businesses bring in money faster than they spend it. On the receivables side, strategies like 24/7 payment portals, shorter credit terms, and credit checks for new customers can reduce days sales outstanding (DSO), thereby accelerating incoming cash cycles. Businesses can also offer discounts and automated payment reminders to motivate customers to pay bills early. For payables, companies can extend their payment window by negotiating with existing vendors—or finding new ones—to gain more favorable credit terms and schedule payments to be made only after cash inflows. Taking advantage of vendor discounts for early payments or bulk purchases can also free up cash.

-

Controlling Expenses

Regularly reviewing expenses can reveal unnecessary costs that drain cash reserves, such as outdated subscriptions or contracts. By analyzing budgets and updating approval workflows, businesses can make sure their cash is going where it can do the most good. Companies often save money by eliminating duplicate services, switching to more cost-effective materials, or consolidating vendors to unlock bulk discounts and reduce administrative overhead. Businesses can also preserve working capital by thoughtfully timing when they acquire assets—buying equipment during cash-rich periods or leasing during slower periods, for instance.

-

Negotiating Discounts and Payment Terms

Strategically negotiating with vendors and customers can improve cash timing. For instance, securing a 2% supplier discount if a 30-day invoice is paid within 10 days—often written as “2/10 net 30”—provides flexibility to either save money or delay payments if cash would earn higher returns elsewhere. On the customer side, offering similar early payment incentives can accelerate receivables from cost-conscious buyers. Companies with strong, long-term vendor relationships may be able to negotiate better payment terms, such as extended payment windows or incremental payment plans.

-

Technology Improvements

Some accounting software can automatically collect, organize, and analyze companywide financial information. According to Bank of America’s “2024 Business Owner Report,” 99% of the 1,038 small business owners surveyed have “adopted digital strategies to optimize their business and operations over the past 12 months,” with 50% saying these tools helped manage cash flow. Cloud-based financial systems give users real-time updates on cash positions, generate automated forecasts and cash flow statements, and integrate banking, accounting, and payment systems to eliminate inaccurate and redundant data entry. Furthermore, automated AR and AP systems help teams accelerate receivables and optimize payment timing.

Cash Flow Formulas

Cash flow formulas quantify a business’s financial position so leaders can make decisions based on hard data, not hunches or guesswork. While most businesses use software to calculate these figures and monitor any changes automatically, the formulas are relatively straightforward, even when calculating by hand. Let’s explore the four primary cash flow formulas and how to use them.

Operating Cash Flow Formula

Operating cash flow measures the cash generated from core business operations, usually from sales for goods or services. Companies calculate it by starting with their net income and then adding back any noncash expenses, such as depreciation and amortization, and adding or subtracting changes in working capital, such as an increase or decrease, respectively, in AP balances. The formula is:

Operating cash flow = Net income + Noncash expenses +/– Changes in working capital

A positive operating cash flow shows that the business is generating enough cash from its primary activities to sustain operations without additional financing. Tracking this metric monthly or quarterly helps businesses spot trends and address issues before they affect liquidity.

Free Cash Flow Formula

Free cash flow represents the cash available after accounting for capital expenditures, including investments in long-term assets (known as PP&E, which stands for property, plant, and equipment), technology, or new products. The formula is:

Free cash flow = Operating cash flow – Capital expenditure

This metric shows the available cash to pay dividends or fund growth initiatives. Investors and lenders use this formula to assess the company’s true financial flexibility.

Days Payable Outstanding

Days payable outstanding (DPO) calculates the average time a company takes to pay its suppliers during a specific period. It’s important that all the numbers used in the formula are derived from the same period. The DPO formula is:

DPO = (Average AP balance × Number of days in period) / Cost of goods sold for the period

A rising DPO indicates that the company is holding cash longer—especially when compared to its customer counterpart, DSO—but excessively high DPO can strain partnerships. An ideal DPO should maximize cash retention without negatively impacting supplier relationships to avoid late fees and long-term issues, such as less favorable credit terms.

Net Cash Flow

Net cash flow is an “all-in” metric that captures every cash outflow and inflow over a specific period. The simplest net cash flow formula is:

Net cash flow = Total cash inflows – Total cash outflows

This formula determines whether a business is generating cash or spending it, overall. Tracking net cash flow weekly or monthly helps financial teams compare spending, investing, and major purchases to revenue and other income over the same period, establishing cash trends that inform structural or funding decisions, such as seeking new lines of credit or paying down debt.

Cash Flow Management Challenges

According to the US Chamber of Commerce, cash flow problems are the number one challenge small businesses face. Even well-run businesses can unexpectedly run out of cash and be forced to pause growth plans or operations. Cash challenges, such as late-paying customers or seasonal price hikes from suppliers, require targeted strategies to prevent minor issues from ballooning into major cash crises. Here are the most common cash flow challenges to look out for:

- Managing late payments: When customers consistently pay 30, 60, or even 90 days past due—or worse, don’t pay at all—businesses may not have the cash on hand to meet their own obligations. Late payments force companies to tap into credit lines or delay vendor payments, potentially increasing financing costs and hurting vendor relationships.

- Seasonal demand: Most businesses’ revenue fluctuates throughout the year, with peak seasons generating surplus income that offsets slower periods. Similarly, supplier prices may also vary throughout the year, making budgeting more difficult.

- Managing operating costs: Rising expenses and supplier prices, as well as unexpected maintenance costs, can drain cash reserves. Many businesses struggle to find areas to cut operating costs without negatively affecting either quality or customer or employee satisfaction.

- Balancing cash flow with rapid growth: Fast-growing companies often face cash shortages as they invest in inventory, staff, and infrastructure before collecting revenue from new customers. Temporary cash injections through loans and lines of credit can end up saddling the business with debt and interest charges, if sales scale too slowly.

- Forecasting mistakes: Overly optimistic revenue or expense projections can lead to cash shortages. Inaccurate forecasts are often the result of inadequate or inaccurate financial data that fails to account for market shifts or creates rigid projections that don’t change as conditions evolve.

Cash Flow Management Strategies and Best Practices

Successful cash flow management requires a two-pronged approach: First, devise defensive measures to prevent shortfalls, and second, promote proactive strategies for using cash as it comes in. Businesses can implement the following six strategies to build resilience and construct the flexibility to pursue growth opportunities as they arise:

-

Improve Inventory Control

Cash tied up in excess inventory cannot fund other business needs. However, insufficient stock can hurt sales, drive customers to the competition, and force rushed and expensive reorders. Companies can optimize stock levels by implementing inventory controls, such as automated or just-in-time ordering software that integrates with demand forecasts. These systems analyze sales data and inventory counts to help businesses allocate goods and replace slow-selling or low-margin items with more popular, and profitable, choices. Regular inventory audits can help firms identify obsolete stock to liquidate, freeing up cash and cutting carrying costs.

-

Keep a Cash Reserve

Keeping money in the bank—enough to fund business operations for a quarter or two—helps businesses make investments and other financial decisions without worrying about meeting next week’s payroll or heating bill. Some companies build reserves by automatically transferring a percentage of monthly profits to separate high-yield accounts that are earmarked for unexpected disruptions or predictable seasonal downturns. Though it’s tempting to reinvest every dollar when revenues are high, businesses should treat these reserve contributions like any other fixed expense—mandatory and time-sensitive. Reserves help businesses minimize reliance on future debt or emergency financing options, an especially important benefit during high-interest periods. Reserves also empower businesses to seize unexpected opportunities they otherwise might not be able to afford.

-

Enhance Forecasting Accuracy

More accurate cash flow predictions help businesses anticipate problems and take steps to mitigate their effects. To keep forecasts accurate, financial teams regularly update their projections based on real results, analyze multiple scenarios (best case, worst case, and most likely case, for example), and track variances to pinpoint where they went wrong. All this feeds into forecast refinements. In this way, over the long term, forecasts become a combination of historical data and current market conditions, with input from sales, operations, and finance teams capturing on-the-ground insights that deliver more than raw data. Many businesses use rolling cash flow forecasts that are updated at the end of every week to balance near-term accuracy with forward-looking planning.

-

Encourage Early Payments

Accelerating customer payments can improve cash flow without any changes to sales volume or financing structure. Reinforce expectations and keep customers informed with clear payment terms on every invoice, automated reminder emails before and after due dates, and late payment penalties. Customers are more likely to pay quickly if companies offer convenient ways to pay, such as through portals that accept credit cards, and automatically update customer accounts after business hours. Early payment discounts—even small ones like 1% or 2%—can further motivate quick payments, compensating for slightly smaller margins. Payment plans for large purchases, in lieu of waiting for customers to pay the full amount, can also create a steady cash flow.

-

Prepare for a Crisis

Contingency plans position businesses for fast response to unexpected events that threaten cash flow, such as economic downturns, supplier shutdowns, natural disasters, or major customer losses. Some common crisis plans include diversifying lenders and vendors, identifying noncritical expenses that can be cut or deferred without affecting short-term operations, and establishing alternative revenue sources. Companies should also establish strong relationships with alternative creditors and stress-test their cash flow by creating detailed contingency plans for different scenarios, such as losing their largest customer or facing a 25% revenue drop.

-

Utilize Financial Software

Software can help businesses take a proactive approach to financial management by automating data collection, analysis, and reporting. Some current systems can connect bank accounts, payment processors, and accounting data in real-time dashboards with automated alerts for cash position and account balances. Such integrated platforms virtually eliminate manual data entry errors and speed up invoice generation, payment collection, and bill scheduling, relieving the administrative burden on finance teams. Cloud-based platforms also give business leaders and financial teams access to cash flow data and forecasts from any location, aiding quick collaboration and decision-making.

Examples of Cash Flow Management

The following two examples of strategic cash flow management are hypothetical, but are based on real-world experiences.

A construction company reassessed its finances after finding it difficult to pay its subcontractors, even though its profits were rising. Its accountant discovered a three-month cash gap between when it paid subcontractors for work and when it received final client payments. By replacing its 25% down payment, 75% upon job completion billing process with an incremental billing cycle that collected 30% up front, 40% at project midpoint, and 30% upon completion, the company was able to pay both vendors and subcontractors throughout the project.

An ecommerce retailer had high sales volume during the holiday season but struggled with cash flow over the summer, when sales were low. The business set up an automatic deposit to put 15% of peak season profits into a high-yield business savings account to maintain liquidity during the slow season. This reserve covered all fixed costs, freeing up enough cash to maintain a diversified product line that included summer-specific items to increase slow-period sales.

Financial Software Helps You Manage Cash Flow Effectively

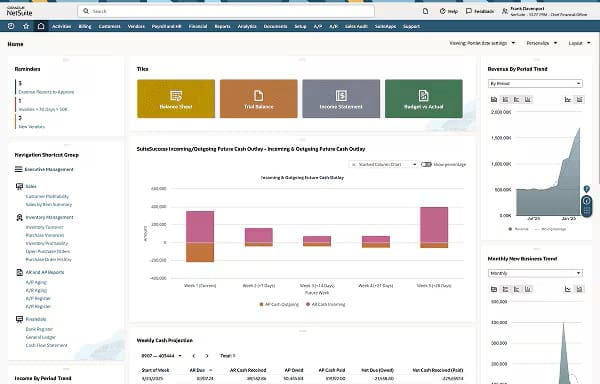

Managing cash flow with spreadsheets and manual processes can quickly become unwieldy and rife with errors, especially across multiple accounts, currencies, and business units. NetSuite Cash Management gives financial teams a real-time look at cash status across the entire organization, combining data from bank accounts, credit sources, and payment systems into one system with role-based access permissions. NetSuite uses historical patterns, scheduled transactions, account balances, and cash flow measures, such as DSO and DPO, to automatically generate cash flow forecasts, send alerts, and create detailed financial reports. Integrated accounts receivable and payable functions further help businesses manage cash flow by scheduling payments, accelerating collections, and balancing daily liquidity needs with long-term growth initiatives.

NetSuite’s Cash Management Dashboard

Even highly profitable companies must manage their cash, keeping enough on hand to pay bills without letting too much sit idle. Cash management strategies—such as proactively building reserves, timing payments, and tracking expenses and inventory—help companies balance daily liquidity needs with growth initiatives. Whether facing seasonal slowdowns, rapid expansion, or unexpected setbacks, businesses that manage their cash flow can consistently turn on-paper profits into sustainable growth.

Award-winning

expense

management

software

Free

Product

Tour(opens in a new tab)

Cash Flow Management FAQs

What is the primary goal of cash flow management?

The primary goal of cash flow management is to keep enough cash on hand to meet all short-term obligations without missing payment deadlines or taking on emergency debt. This is often achieved by strategically timing incoming and outgoing transfers.

How is cash flow management different from budgeting?

Budgets are a company’s plan for future income and expenses, used to align resources with business priorities. Cash flow management tracks actual cash movement into and out of the business, based on when collections and spending occur. While budgets set financial targets predicated on planned revenue, cash flow management focuses on maintaining enough cash on hand to pay bills.

How is cash flow management different from profit?

Profit measures revenue minus expenses over a given period, including noncash items, such as depreciation and sales on credit. By contrast, cash flow tracks only the actual cash moving in and out. Profitable companies can still run into cash shortages if customers pay slowly or expenses come due before revenue payments arrive.

Is cash flow a KPI?

Yes, many cash flow metrics are key performance indicators (KPIs), including operating cash flow, free cash flow, and net cash flow. Each of these KPIs measures a company’s liquidity and financial health, as well as other cash metrics, such as days sales outstanding and days payable outstanding.

What’s one mistake commonly made regarding cash flow?

Many businesses focus exclusively on profitability and assume that strong sales indicate healthy cash flow. This ignores transfer timing and, if customer payments lag behind supplier bills, companies may need emergency financing to cover their short-term obligations.