Growing a business is a constant battle to increase sales while reducing expenses. Obviously, the wider the margin between the two, the greater the profit. Cost management is critical, especially in challenging economic markets where recurring, everyday expenses — known as operating costs — can take a big bite out of, or entirely swallow, a company’s profitability. Small businesses with limited financial resources and that lack the bargaining power of their larger counterparts to negotiate favorable pricing are particularly vulnerable.

This article identifies operating costs, delves into specific examples and shows how to calculate them as part of an income statement.

What Are Operating Costs?

Operating costs are a business’s ongoing, day-to-day expenses, consisting of two main components: the cost of goods sold (COGS) — or the cost of sales — and operating expenses. COGS covers expenses tied to the creation of a product, such as materials, labor and overhead. Operating expenses are incurred from managing the organization, with the majority of them related to selling, general and administrative (SG&A) expenses. These costs encompass everything that is part of the business but not directly related to creating a product or service, including general salaries, rent, utilities, sales and marketing costs, supplies and maintenance. Operating expenses also include most investments in research and development (R&D) and depreciation of assets.

Key Takeaways

- Operating costs are the day-to-day expenses companies incur to keep operations running.

- They include the direct costs of creating products and services, as well as more general operational expenses, like rent and utilities.

- Operating costs are either fixed, variable or semi-variable.

- Understanding operating costs not only helps companies run lean and profitably but also identifies areas in need of greater efficiency.

Operating Costs Explained

Calculating and tracking operating costs can sometimes feel like navigating a maze with moving walls. That’s because operating costs are diverse — rent, utilities, payroll, maintenance and countless others — and each one behaves differently over time and under changing business conditions. For example, rent typically remains fairly stable over the course of a lease, but utility expenses can fluctuate significantly depending on the season. It also can be easy to inadvertently underestimate indirect operating costs, like depreciation or administrative expenses, which can result in inaccurate financial projections and misguided decisions. This type of unpredictability and insufficient detail can make it difficult to obtain stable results.

On the flip side of operating costs are capital expenditures. These consist of nonrecurring expenses that companies incur to improve and grow operations, such as to purchase property or equipment; they are recorded as assets on a balance sheet, rather than as expenses on an income statement.

How to Calculate Operating Costs

Operating costs, which are recorded in a company’s income statement, directly impact profitability. The lower a company’s operating costs in relation to revenue, the more profit a company makes. So it’s little wonder that 600 global business executives surveyed by the Boston Consulting Group unanimously cited cost reduction as their top priority. The ability to carefully manage operating costs helps companies allocate resources more effectively to drive lasting growth and maintain competitiveness.

The basic formula for calculating operating costs is:

Operating cost = Cost of goods sold + Operating expenses

COGS includes all direct costs related to producing or purchasing the goods and services a business sells in a given period, such as a quarter. Operating expenses cover all costs necessary to run the business that aren’t included in COGS, such as rent, utilities and salaries for nonproduction staff like salespeople, during the same time period.

Each variable of the equation involves its own calculation, the sums of which are added together to determine the total operating cost. This detailed process, best left to accounting software to ensure accuracy, provides a comprehensive view of what it costs to operate the business, excluding non-operating expenses like interest and taxes. When analyzing the data, it’s important to keep seasonality in mind before drawing conclusions. For example, retailers often tally higher staffing costs during holiday seasons. The goal is to identify trends and areas for cost reduction that ultimately improve strategic decisions.

Types of Operating Costs

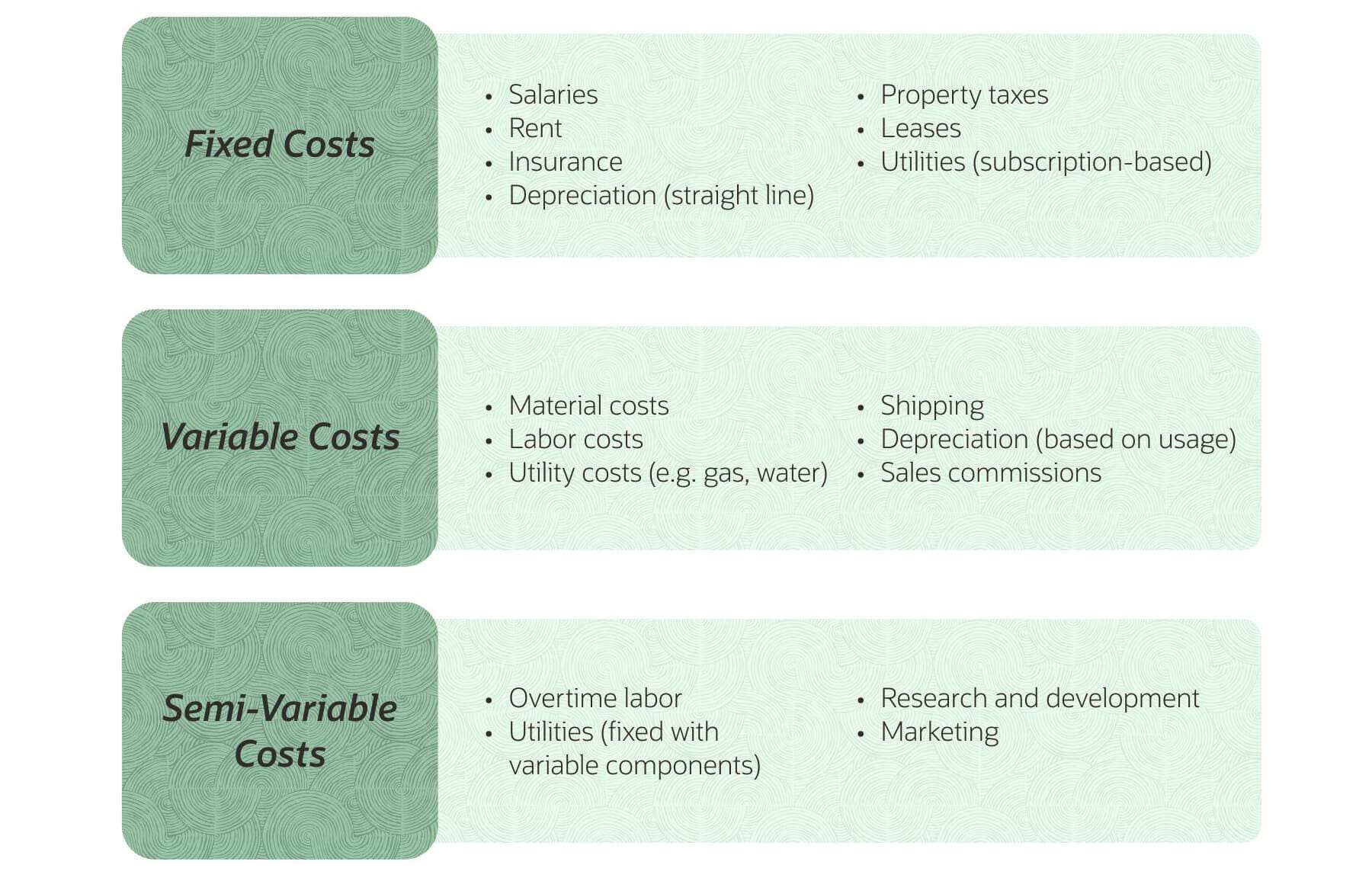

There are three types of operating costs: fixed, variable or semi-variable. They differ in the degree to which they fluctuate over time or with volume. Understanding each type helps business managers gauge an expense’s controllability and calculate break-even points (i.e., when total revenue equals total expenses).

3 Types of Operating Costs

Fixed Costs

Fixed costs don’t fluctuate, regardless of production volume or sales. These steady bills are determined by agreements that lock in the amount owed for a set period, until, for example, it’s time to renegotiate a lease or renew insurance. Fixed costs include:

- Salaries: Base salaries are paid regardless of the number of hours worked or the level of output.

- Rent: Rent remains constant, regardless of business activity.

- Insurance: Premiums for business insurance typically offer coverage over time that doesn’t fluctuate with business volume.

- Depreciation: Straight-line depreciation of tangible assets over their life span doesn’t usually change unless a revaluation occurs.

- Property taxes: Property taxes are determined annually based on property value and are due regardless of business activity levels.

- Leases: Leases for office equipment or vehicles are set in advance and must be paid on a regular basis, regardless of business performance.

- Certain utilities: Some utilities, such as internet subscriptions or certain telecoms costs, have fixed components that remain constant, regardless of the quantity of utility used.

Fixed costs are recorded on a company’s income statement as either direct, such as for salaries or insurance, or indirect, such as for straight-line depreciation on buildings. On the positive side, fixed costs decrease on a per-unit basis when production scales, which is known as economies of scale. The downside: It’s tough to cut these when companies are struggling.

Variable Costs

Some expenses fluctuate with the level of business activity. Known as variable costs, they increase as production ramps up and decrease when activities slow down. Variable costs are calculated on a cost-per-unit basis. For example, the cost of a specific fabric needed to make a skirt multiplies to reflect the number of skirts produced. These costs are recognized on an income statement when goods are produced or services rendered. Variable costs include:

- Materials: The costs for raw materials needed to deliver a product, including packaging costs, change as production scales up or down. For example, a furniture maker’s total cost for wood and nails will vary in relation to the number of tables and chairs it makes.

- Labor: This includes wages for hourly employees, which increase as production hours increase.

- Certain utilities: The majority of utility costs, like electricity, gas and water, fluctuate with production and employee levels.

- Shipping: Expenses associated with delivering products to customers rise as more products are sold.

- Marketing: Advertising and marketing expenses are typically considered variable because they are often allocated based on a percentage of revenue, and they can ebb and flow with changing strategies and market conditions.

Changes in volume and rates can also affect variable costs. For example, if a bakery boosts bread production, it will likely spend more on flour and wages for additional employees, resulting in higher overall variable costs. For small-business owners, even slight changes in variable costs can significantly impact their bottom line.

Semi-Variable Costs

Semi-variable costs are partly fixed, partly variable. In other words, they remain fixed — but only to a certain point. For example, a company might receive customer support services at a fixed monthly cost, up to a certain number of calls; if that threshold is exceeded, additional service calls mean additional charges. Common semi-variable costs include:

- Overtime labor: Salaried employee wages are fixed, but when some employees work overtime, the additional wages paid are variable.

- Sales compensation: While a salesperson’s salary might be fixed, commissions based on sales are variable, depending on performance over a given period of time.

- Certain utilities: Costs for electricity and gas, for example, may consist of a fixed monthly charge plus a variable component based on usage.

- R&D: R&D expenditures, such as salaries for permanent research staff and facility costs, are typically fixed. But there may also be variable components that are project-specific, for materials, patents or contracts with third-party researchers, for example.

Semi-variable costs are heavily dependent on factors like production volume, operational hours and sales levels. Companies frequently track the fixed component of semi-variable costs separately from the variable element to establish more precise budgeting and financial analysis, as well as to identify areas in need of streamlining.

Operating Costs Examples

Let’s take a look at some hypothetical income statements to observe how operating costs work and how they fit within the calculation of a company’s operating income. The first example is for an umbrella manufacturer with $5 million in revenue.

- Its COGS includes $1.5 million for fabric, metal frames, handles and packaging materials, plus $500,000 for shipping services to transport some raw materials to its manufacturing plant.

- Its operating costs include $500,000 in R&D, $10,000 in utilities, $30,000 in rent for a manufacturing facility, $925,000 in salaries, $200,000 in depreciation on equipment and $35,000 for business insurance.

- There are no non-operating costs.

The umbrella manufacturer’s income statement looks like this:

Income Statement

| Net Sales | |

| Products | $4,000,000 |

| Services | $1,000,000 |

| Total Net Sales | $5,000,000 |

| Cost of Sales | |

| Products | $1,500,000 |

| Services | $500,000 |

| Total Cost of Sales | $2,000,000 |

| Gross Profit | $3,000,000 |

| Operating Expenses | |

| Research and Development | $500,000 |

| Selling, General and Administrative | $1,000,000 |

| Depreciation | $200,000 |

| Total Operating Expenses | $1,700,000 |

| Operating Income | $1,300,000 |

Let’s look at another example, this time for a smaller business. A small woodworking company has net sales of $200,000 for its products and $100,000 for its restoration services, for a total of $300,000.

- Its COGS includes $80,000 for wood, finishing materials, hardware, adhesives and polishing materials. It also includes $40,000 for equipment leasing and waste disposal services.

- The company doesn’t own equipment, so it carries no depreciation costs. It doesn’t invest in R&D, either.

- Its operating costs consist of SG&A expenses, including $70,000 in salaries, $6,000 in rent, $2,500 in utilities and $1,500 for insurance.

The woodworking company’s income statement looks like this:

Income Statement

| Net Sales | |

| Products | $200,000 |

| Services | $100,000 |

| Total Net Sales | $300,000 |

| Cost of Sales | |

| Products | $80,000 |

| Services | $40,000 |

| Total Cost of Sales | $120,000 |

| Gross Profit | $180,000 |

| Operating Expenses | |

| Selling, General and Administrative | $80,000 |

| Total Operating Expenses | $ 80,000 |

| Operating Income | $100,000 |

Note the difference in the mix of operating expenses for a small organization vs. a larger operation. The larger organization’s higher operating costs reflect the broader scale of its operations, with significant investments in R&D, as well as higher SG&A expenses. The small business’s operating costs reflect a much more streamlined operational approach, likely with more focus on direct selling and essential services, like rent and utilities, as opposed to R&D.

Drive Business Strategy and Growth With NetSuite

Calculating and managing operating costs is an important part of the overall financial management process. NetSuite Financial Management provides powerful capabilities for financial management, planning and analysis that address the complexities of operating costs and much more. It excels in real-time financial visibility, helping businesses understand spending patterns, optimize expenses and make more informed strategic decisions. The solution is a core component of the NetSuite Enterprise Resource Planning system, which seamlessly integrates other native modules for human resources, inventory, supply chain and customer relationship management. NetSuite’s all-in-one, fully cloud-based approach eliminates the need for multiple, disparate systems and delivers a unified view of companywide financial health. This not only simplifies a company’s financial operations but also aligns them with broader operational goals to create a clear path to growth and efficiency.

When companies refer to practicing financial restraint as “tightening their belts,” it’s only because “tightening their operating costs” doesn’t have the same flair. Regardless of what they call it, however, understanding and managing operating costs is one of the most important levers companies can pull in the quest to boost profitability.

Operating Costs FAQs

How do you calculate operating cost?

To calculate operating cost, tally all expenses related to the day-to-day running of the business, including the cost of goods sold (COGS) and all operating expenses, such as rent, salaries, utilities and marketing. Combine those totals to arrive at total operating cost.

What is an example of operation costing?

Operation costing is a hybrid accounting method used by manufacturers to calculate the cost of products that have both standardized (process costing) and customized (job costing) elements. Manufacturers often use process costing for items that follow the same process every time, such as chemicals, food and beverages. For more complex items, operation costing paints a more accurate picture. For example, a furniture manufacturer might use standard costs for basic components like mass-produced wood frames but apply job costing for custom finishes or designs requested by customers. This allows for accurate tracking of the cost of mass-produced items while also accounting for variations created by customization.

Does operating cost include salary?

Yes, operating cost includes salaries for employees involved in the day-to-day operations of a business. This comprises wages and salaries for both direct labor (those who manufacture products) and indirect labor (such as administrative and sales staff). Salaries are a significant part of a company’s operating expenses, reflecting the cost of maintaining a workforce essential for running the business.