To get a sense of how dramatically the accounting profession is evolving, consider the shifting expectations for accountants themselves. Once focused almost exclusively on reporting and compliance, accountants are now asked to use AI tools, develop data analytics skills, interpret sustainability metrics, and collaborate across functions (and borders) to guide strategic business decisions. In support, many firms—big and small—are adopting cloud-based platforms, embedding automation into workflows, expanding flexible work policies, and upskilling staff to build more agile, analytics-driven teams.

Key Takeaways

- From AI tools to cloud-based software and robotic automation, accounting is becoming increasingly tech-centric.

- As automation handles routine tasks, even junior accountants are expected to be savvy advisors—reshaping education and talent development.

- Firms are struggling to attract and retain skilled accountants amid a tight labor market while adapting to the expectations of a new generation of professionals.

- Businesses must continue to keep pace with frequent changes in accounting standards, tax laws, disclosure requirements, and sustainability standards.

- Practices like proactive and agile accounting emphasize adaptability, continuous improvement, and meeting business needs in real time.

What Are Accounting Trends?

Accounting trends are key developments that can reshape the way accounting professionals operate. They reflect ongoing responses to pressures, such as technological change, evolving regulations, talent market dynamics, and shifting business models. These trends often emerge gradually, building on years of transformation, such as the move to cloud-based systems, wider access to automation tools, and the normalization of remote work.

Unlike short-term fads, accounting trends represent deeper changes in how accounting functions manage risk, stay compliant, create value, and deliver financial insights. They can influence everything from day-to-day workflows to long-term planning.

Tech Trends

The accounting trends defining 2025 (and beyond) fall into four overall categories: technology, finance functions, talent and workforce, and compliance, risk, and standards. Let’s start with the tools and infrastructure shaping the discipline’s future.

-

Artificial Intelligence (AI)

AI is becoming embedded in core financial operations for companies of all sizes. One 2024 study found that 71% of organizations are using AI to some degree in their financial operations, with 41% using AI to a moderate or large degree. But rather than replacing professionals, AI is being used to reduce manual workloads to support faster, more consistent analysis. Common use cases include reporting, financial planning, treasury and risk management, forecasting, data extraction, transaction categorization, document classification, and dynamic budgeting tied to live data.

Machine learning models are also being used to flag anomalies in large datasets to help identify potential fraud with fewer false positives. And large language models are starting to assist with tasks such as summarizing financial documents and drafting internal memos.

Despite the benefits, adoption remains cautious. AI tools are evolving quickly, and many firms have concerns about impartiality, accuracy, and auditability. In response to the growing demand for reliable and regulated systems, the Big Four accounting firms are developing AI assurance services to verify the functionality, safety, accuracy, and ethical design of AI tools.

-

Technology and Automation

More and more firms are automating core accounting workflows, such as reconciliations, journal entries, and revenue recognition, to speed up the close process and improve audit trails. With routine tasks handled by software, accountants can concentrate on reviewing outputs and analyzing results.

Beyond robotic process automation (RPA) tools that handle high-volume, repetitive transaction tasks with consistency that’s hard to match manually, some firms are now adopting hyper-automation—the practice of layering multiple tools such as AI, machine learning, and process mining—to generate real-time updates and feed automated KPI dashboards. These systems can improve the quality of decision-making but still depend on human expertise for setup, monitoring, and interpretation.

Much of this automation is built on cloud-based platforms that allow for scalable, low-code deployments with minimal IT overhead, leveling the playing field for smaller teams.

-

Accounting Software

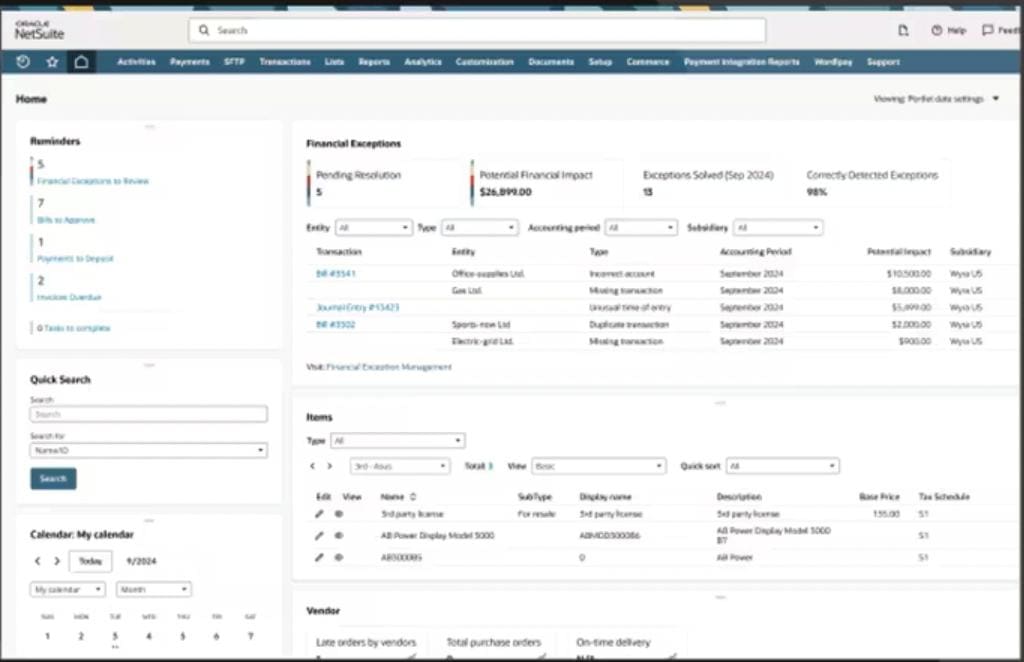

Finance teams are consolidating their tech stacks, moving away from discrete solutions toward integrated platforms that offer broader control and timely access to financial data. Cloud-based accounting platforms are quickly becoming the industry norm. They support secure, multiuser collaboration from any location, reducing many of the constraints of legacy desktop systems, such as limited remote access, version control issues, and dependence on local infrastructure.

Modern accounting platforms also integrate with adjacent business functions, such as CRM, payroll, and inventory, to create a centralized data environment that reduces redundancy and improves reporting accuracy. APIs and prebuilt connectors help data move cleanly between tools to preserve data integrity and reduce the need for manual input. These integration tools can also help firms stay compliant with regulatory changes by automatically applying updates to accounting standards. This can be particularly valuable for businesses operating across borders.

Many systems include built-in business intelligence tools, AI assistants, and automated close features that reduce manual effort and support better-informed decisions.

-

Data Analytics and Forecasting Tools

Among the accounting tips for both small businesses and larger companies, increasing the use of data analytics and visualization tools is one of the most impactful. These tools are helping finance teams shift from backward-looking reports to forward-focused decision-making. Rolling forecasts, for instance, update dynamically as new data comes in to offer a more responsive view of financial performance. Advanced scenario modeling and “what-if” analyses help teams simulate the financial impact of operational or market changes in real time. Predictive models can flag emerging risks, such as liquidity constraints or customer delinquency, before they affect business performance.

With the help of interactive dashboards and business intelligence tools engrained in many modern accounting platforms, finance teams can bring data to life, making trends and insights clearer for even nonfinancial stakeholders. This can accelerate cross-functional decision-making, encouraging alignment across teams and keeping financial context part of broader business conversations.

-

Digital Transformation

Once about adopting new tools, digital transformation is now about changing how financial work gets done. Manual, sequential workflows are being replaced by automated, continuous processes that support faster closes, cleaner data, and greater transparency. The goal: less time spent on reconciliations and error-checking, and more time delivering accurate information when it’s needed.

Take the financial close and compliance as examples. Automated close software can execute recurring tasks, like journal entries, on a continuous basis to reduce end-of-period workloads. And instead of relying on manual tagging at the end of the reporting cycle to meet SEC and European Securities and Markets Authority (ESMA) requirements, many firms are now embedding XBRL—an electronic language for financial reporting—directly into their reporting systems. This shift moves XBRL from a standalone compliance step to a built-in part of the process, reducing manual formatting, improving data quality, and accelerating the production of filing-ready reports.

Audit readiness is improving, too. Many modern systems log user actions, approval steps, and data changes automatically, creating a real-time audit trail without extra effort. Blockchain is also being explored as a way to create immutable transaction records that reduce fraud risk and simplify verification during audits.

Finance Function Trends

The following trends demonstrate how the scope, influence, and responsibilities of finance teams are moving beyond reporting to underpin business strategy.

-

Evolution of the Accountant Role

The role of the accountant continues to transform from a number-crunching bookkeeper to a strategic advisor. With automation handling routine tasks like data entry, finance professionals can take on more analytical work to support cost analysis, performance management, pricing strategies, and day-to-day decisions.

Communication, general business acumen, and data literacy skills are essential for this evolution, as is some technical expertise. Accountants should be able to work fluently with modern accounting systems, which include analytics platforms and emerging technologies such as AI.

This strategic shift is no longer limited to senior roles, either; junior staff are now expected to bring insight and judgment from day one, even if their formal education hasn’t fully prepared them to do so. In response, firms are rethinking how they onboard and develop talent, placing greater emphasis on accelerated training, mentorship, and practical exposure to strategic work. Some are investing in formal upskilling programs to support this transition, contributing to a more proactive, tech-enabled finance function that’s deeply integrated into strategic planning, not just tracking performance, closing the books, and delivering statements.

-

Data Stewardship and the Expanding Role of Finance

Finance teams are increasingly seen as custodians of both financial and nonfinancial information, reflecting the broader recognition of data as a strategic asset and their central role in stewarding it. Using advanced analytics, AI, and machine learning, finance teams are integrating financial data with across-the-board business data: operational metrics; consumer behavior patterns; market trends; environmental, social and corporate governance (ESG) indicators; and more. The goal is to extract comprehensive insights that inform decisions on everything from marketing investment to resource allocation and long-term planning.

This trend is also reshaping performance management and dashboard use. Since these tools can incorporate—and intuitively display—diverse data streams in real time, more finance teams are finding themselves at the forefront of non-number-crunching initiatives, such as:

- Data governance: Establishing and enforcing policies to validate data accuracy, consistency, and reliability, which are indispensable to trustworthy performance metrics.

- Privacy protection: Implementing safeguards to comply with privacy regulations and protect sensitive cross-functional data.

- Data literacy: Spearheading initiatives to improve organizationwide data literacy so other departments can better understand and act upon insights.

Why finance? The function is uniquely positioned to lead in these areas, given its analytical capabilities, enterprisewide visibility, regulatory expertise, and experience managing data integrity and risk. Their traditional responsibility for financial accuracy extends naturally into broader data stewardship.

-

Treasury Innovation and Cash Strategy

As the role of CFOs evolves, so does the way companies manage their money. Treasury management, once focused mainly on keeping cash safe, is becoming a key player in improving financial performance. This shift is fueled by AI-powered tools that help companies predict cash flow more accurately and support better decisions about how to use available funds.

More specifically, these systems can analyze historical cash flows, customer payment behavior, seasonal patterns, and macroeconomic indicators to generate dynamic forecasts. When integrated with automated liquidity systems that monitor and manage cash positions in real time, companies can quickly make more informed decisions about where and when to put their cash, which is especially valuable in a volatile interest rate environment.

Similarly, digital real-time payment systems are generating rich data streams about transaction timing, customer behavior, and more. This information can be fed back into forecasting models to turn treasury into a more intelligent, forward-looking function.

Meanwhile, for midsize companies, treasury-as-a-service solutions are gaining traction. These solutions provide outsourced access to sophisticated treasury capabilities, such as cash pooling, FX management, and hedging, without requiring in-house expertise or large internal teams.

-

Agile Accounting

Borrowed from software development, agile principles are changing the way finance teams operate. Instead of relying on static monthly cycles, agile accounting applies short, iterative “sprints” to support continuous reconciliations, rolling forecasts, and real-time reporting. This approach helps teams shorten close times, identify performance trends earlier, and respond faster to business needs.

Unsurprisingly, cloud platforms and automation help make this continuous accounting process possible by digitizing transaction processing and automating core financial workflows, freeing up time for analysis and strategic planning.

Agile practices also encourage more dynamic performance management. Finance teams are beginning to incorporate customer satisfaction and operational metrics alongside traditional financial KPIs. These leading indicators help teams anticipate changes before they show up in financial results. With that foresight, finance can adjust forecasts—or shift priorities—to stay aligned with other parts of the organization during each sprint or planning cycle.

Continuing the theme of role expansion, agile accounting requires upskilling in data and statistical analysis, digital tools, and cross-functional communication. These capabilities are essential in a faster-paced environment where finance is expected to contribute regular, iterative insights, not just periodic reports.

-

Proactive Accounting

Proactive accounting reflects a broader shift underway across the profession, building on trends such as agile accounting, expanded data analytics, increased use of technology, and the evolving role of accountants. Rather than focusing on retrospective reporting, finance teams are using real-time data to guide decisions as business conditions unfold.

For example, KPIs, such as days sales outstanding and burn rate, along with financial metrics, like budget variances, are continuously monitored to support timely adjustments throughout the period, not just at month-end. Meanwhile, rolling reconciliations and live dashboards support faster, more confident decision-making.

Lean accounting builds on this shift. It organizes financial information around “value streams”—the full set of activities required to deliver a product or service—and links financial results directly to operational performance metrics that teams use in their day-to-day work. Instead of relying on complex monthly statements, lean teams often use daily or weekly visual reports that combine financial and operational data to deliver real-time insight into profitability and performance.

As a result, accountants are becoming more embedded in day-to-day operations, and they’re better equipped to communicate pressing issues and opportunities with leadership. Organizations adopting proactive accounting report greater agility, stronger compliance, and a finance function that influences strategy.

Talent and Workforce Trends

The next trio of trends showcases how accounting teams are attracting, developing, and organizing talent.

-

Talent Retention

A wave of retirements and a shrinking pipeline of young talent have been putting the accounting industry through a talent crisis. Poor work-life balance continues to drive turnover, especially during peak seasons like audits and tax filings. While these trends aren’t new, they’re prompting firms to rethink how they attract and keep their employees.

Current retention trends reflect a shift from reactive hiring to long-term talent cultivation and meaningful culture changes. Flexible schedules and remote work options are proving especially effective at reducing burnout and increasing retention, especially among younger professionals who value work-life balance. Many firms are strengthening career development pathways, for example, by offering support for CPA licensure, funding continuing education, and introducing mentorship programs. This includes equipping early-career hires with skills like data analysis, communication, and AI literacy, as firms prepare them for more strategic responsibilities earlier in their careers—making skill-building central to retention planning.

A greater emphasis on recognition, ongoing feedback, and a sense of purpose is also helping firms build trust and increase engagement.

-

Online Collaboration and Remote Workforce

Remote and hybrid work models are permanent fixtures in the accounting industry, driven by a mix of factors: talent shortages, new employee expectations, and the overall digital transformation. Distributed teams now routinely close books, prepare forecasts, and conduct audits across locations. This type of work is made possible through cloud-based accounting platforms with features such as version-controlled document sharing, secure review workflows, and embedded audit trails. Real-time collaboration tools further support financial reviews, approvals, and cross-functional projects so teams can work efficiently, even when dispersed.

At the same time, protecting sensitive financial data has become a top priority. Many companies have standardized tools, such as VPN access, multifactor authentication, and endpoint protection, to strengthen security across teams and locations.

-

Outsourcing

With persistent talent shortages, heavy workloads, and secure cloud tools that make remote collaboration easier, many finance leaders are outsourcing at least some of their accounting functions. External providers are handling tasks like payroll, accounts payable, and bookkeeping to reduce internal burden and control costs. Some firms are turning to offshore providers, particularly in India, to tap into a growing pool of qualified accounting talent.

Co-sourcing models are gaining traction by allowing internal teams to stay focused on high-impact areas—such as forecasting or compliance—while outsourcing standardized processes, such as invoice processing, travel and expense reporting, or reconciliations to external partners. These models often include shared systems, standardized workflows, and clear role definitions to keep collaboration efficient and transparent. Meanwhile, the finance-as-a-service business model bundles cloud-based accounting platforms with on-demand advisory and execution support that gives businesses flexible access to expertise as needs arise.

Compliance, Risk, and Standards Trends

The next five trends address external pressures and internal safeguards that are shaping accounting practices.

-

Data Security

Accounting systems are a prime target for cybercriminals, not just because of the sensitive data they hold, but because they’re often connected to banking, payroll, and ERP platforms. As a result, companies are adopting stronger security protocols to safeguard both sensitive information and stakeholder trust.

Many companies have made baseline controls, like multifactor authentication, standard across all accounting systems. But with threats growing more targeted, they’re also layering on advanced protections, such as AI-driven anomaly detection, user behavior analytics, and stricter role-based permissions to limit access to sensitive financial data and prevent unauthorized transactions. In addition, more firms are securing financial data using bank-level encryption standards, such as AES-256, to protect records both in transit and at rest.

Regular security audits and ongoing staff training (e.g., phishing awareness or secure file transfers), while increasingly common in recent years, remain essential to reduce human error and stay compliant with evolving data protection standards.

-

Environmental, Social and Corporate Governance (ESG)

With new standards raising expectations for rigor and consistency, ESG reporting is transitioning from a “nice to have” to a formalized extension of financial disclosure. In addition to the SEC’s new climate rule (mentioned earlier), the International Sustainability Standards Board has released sustainability disclosure requirements for companies—particularly those reporting under IFRS—that call for ESG data to be presented alongside financial statements. In the EU, the Corporate Sustainability Reporting Directive has entered into force and will phase in mandatory ESG disclosures over the coming years, requiring companies to report detailed, standardized metrics on environmental and social performance.

Given these requirements, the accountant’s role is expanding to include the capture and verification of nonfinancial metrics, such as carbon emissions, energy usage, workforce diversity, and supply chain ethics—areas where stakeholders increasingly expect the same level of rigor as traditional financial reporting. For many in-house teams, this means developing entirely new skill sets and building systems, controls, and processes from the ground up to accurately track and report ESG data.

To support the shift, some accounting firms are broadening their services to include ESG advisory and assurance, helping clients measure sustainability performance and meet emerging regulatory expectations. It’s yet another sign of how the accountant’s role is shifting from recordkeeper to cross-functional advisor.

-

Accounting Standards

It’s not just ESG reporting that’s evolving. In the United States, FASB guidance taking effect in 2025 will require certain crypto assets to be measured at fair value—replacing the impairment model with real-time gains and losses impacting net income. Accountants will also need to address additional disclosure requirements as part of this shift.

Another FASB update, effective in 2026 for annual reporting, will require public companies to disaggregate key income statement expenses—such as compensation, depreciation, and inventory costs—in the statement’s footnotes. The goal is to give investors clearer insight into what drives major line items. For accounting teams, this likely means revisiting their chart of accounts (COA) structures to make sure they can easily report these expenses. It also requires preparing prior period data for comparative disclosure, as well as anticipating a more granular level of audit scrutiny.

Internationally, updates to IFRS 9 and IFRS 7, effective January 1, 2026, introduce new requirements for accounting and disclosure of financial instruments. Separately, IFRS 18 will replace IAS 1 to overhaul how financial statements are presented, with stricter requirements for categories, subtotals, and custom performance measures. IFRS 18 is effective for annual reporting periods beginning on or after January 1, 2027. Like the FASB changes, these updates will likely require accounting teams to revisit COA structures, compare financials across periods, and be ready for deeper audit scrutiny.

These are just a few upcoming changes. More updates are expected in the years ahead.

-

Tax Policy

Ever-shifting global and domestic tax policies are always creating new challenges for finance teams. Frequent legislative updates mean accounting teams must continuously monitor changes and apply new rules quickly.

One significant development is the Organization for Economic Co-operation and Development’s Pillar Two framework, which enforces a global 15% minimum tax on large multinationals. While these companies already face complex tax environments and generally invest heavily in tax planning, the new rules are prompting a rethink of existing tax strategies, especially around deferred tax assets and global structuring. And as more jurisdictions enact local versions of the framework, compliance demands only grow. More accountants will need to be familiar with corporate taxation than ever before.

In the United States, the pending expiration of key provisions from the 2017 Tax Cuts and Jobs Act is adding further uncertainty to long-term planning. Expected at the end of 2025, these changes will affect a wide range of business types, including C corps, S corps, partnerships, and sole proprietors.

At the same time, tax authorities are increasing scrutiny. The IRS and international counterparts now require more detailed reporting, particularly for cross-border transactions and tax positions that involve interpretation or carry compliance risk. These disclosures are meant to improve transparency and give regulators insight into potentially aggressive or unclear tax strategies.

-

Statutory and Regulatory Compliance

Beyond tax policy, accounting teams are contending with a broader and evolving regulatory landscape. In early 2024, the SEC adopted rules that would require companies to provide more detailed disclosures on climate-related risks, including greenhouse gas emissions and their potential financial impacts—significantly expanding the scope of financial and ESG-related reporting.

In parallel, the Public Company Accounting Oversight Board (PCAOB) adopted its new AS 1000 standard, which consolidates and modernizes foundational auditor responsibilities to emphasize investor protection, clarify partner duties, and tighten documentation timelines.

Looking ahead, the PCAOB’s QC 1000 standard, effective December 15, 2025, will require firms to proactively identify and manage quality risks through robust governance, risk assessment, and monitoring processes. The framework compels firms to set clear quality objectives, assess and respond to risks, and improve firmwide communication and leadership, all with the goal of elevating audit quality and consistency across the profession.

Although the two PCAOB standards are most relevant to auditors, they’ll likely have meaningful downstream effects on CFOs and accounting teams. Firms should plan for increased audit scrutiny and the need for stronger internal controls. They may also want to review their financial service providers to confirm they’re also meeting heightened standards.

Modern Accounting Software for Forward-Thinking Businesses

Accounting in 2025 is defined by AI integration, agile methodologies, heightened compliance demands, and a push toward the accountant’s role as a strategic advisor. Navigating this era requires a comprehensive solution like NetSuite Cloud Accounting Software. NetSuite helps finance teams adapt by automating routine tasks—such as journal entries, reconciliations, and invoice processing—to reduce errors and free up time for high-value analysis. Its continuous close capabilities allow teams to update financials throughout the period, reducing end-of-month bottlenecks.

Built on a unified cloud platform, NetSuite also supports real-time access to cash flow, profitability, and compliance metrics across departments, so finance teams can proactively guide decisions. And with tools that address everything from regulatory compliance to dynamic forecasting, NetSuite empowers organizations to modernize their accounting operations and keep up with change.

Accounting in 2025 is largely defined by integration, insight, and agility. Finance teams are moving beyond traditional reporting to play a central role in shaping business strategy—supported by real-time data, cross-functional collaboration, and evolving regulatory demands. As tools, expectations, and responsibilities shift, firms that adapt quickly will be better positioned to manage risk, drive performance, and deliver value across the organization. The trends outlined above signal not only where accounting is going, but how it is being redefined as a core strategic function in modern business.

Accounting Trends FAQs

What are the biggest challenges facing accountants today?

Today’s accountants face several major challenges, including adapting to rapid technological change (such as AI and automation), navigating increasingly complex and evolving regulations, addressing significant talent shortages, strengthening cybersecurity to protect sensitive data, and meeting rising client expectations for specialized advisory services and sustainability reporting.

How do you keep up with accounting trends?

Staying current requires a mix of continuing education and ongoing training, attending webinars from professional organizations, and reading industry publications. Many accountants also rely on reputable accounting software providers for updates on standards, tools, and best practices.

What are some future trends in accounting technology?

Continued growth in AI and machine learning, real-time reporting, predictive analytics, and integrated cloud platforms are all expected. Emerging areas include AI-assisted forecasting, blockchain for audit trails, and ESG reporting tools embedded within accounting software. Technology will increasingly automate routine work, such as data entry and reconciliations, elevating the accountant’s role from bookkeeper to strategic advisor.