Businesses are dynamic entities that rarely abide by a neat 12-month calendar. So why should their forecasts? As business leaders push their companies forward, rolling forecasts extend their line of sight by continually dropping a time period that has just finished and adding a new one to the end. As a result, a business can more accurately estimate where it is likely heading, allowing it to make adjustments and guide their future paths as situations change and new events unfold.

What Is a Rolling Forecast?

A rolling forecast is a specific type of forecast that continually drops a completed period and adds another period extending by the same amount in the future. It requires objective analysis of internal and external quantitative and qualitative factors, as well as a deep understanding of how the business operates, if the forecast is to be as realistic as possible.

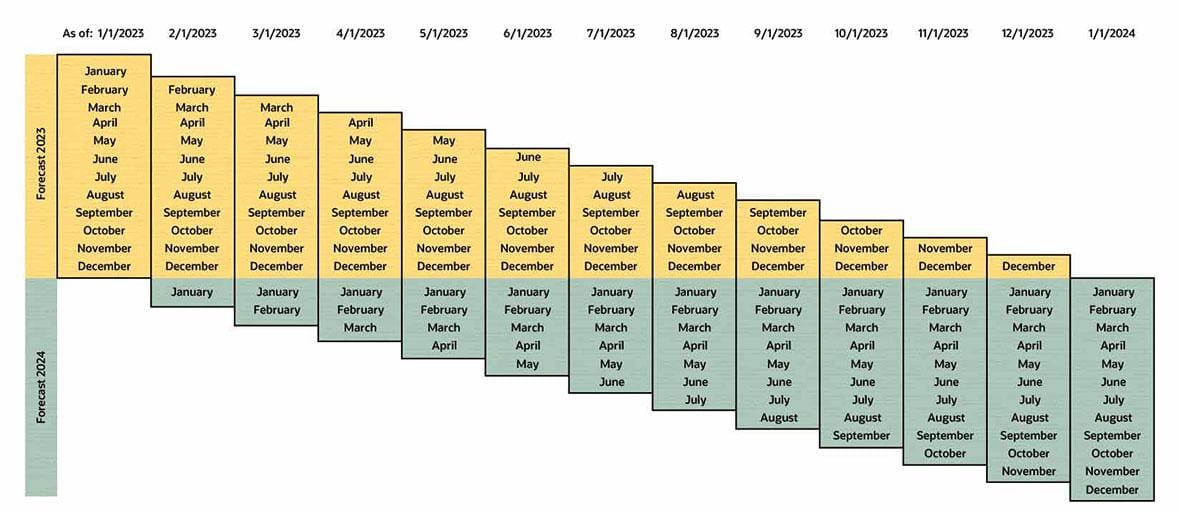

To illustrate, consider a 12-month rolling forecast that begins in January 2023 and goes through December 2023. When the actual results of January 2023 are finalized, the rolling forecast would be recalculated to cover February 2023 through January 2024. In this way, the forecast always includes 12 months, sliding forward after each month ends.

Key Takeaways

- Forecasts are estimates of likely business results.

- Rolling forecasts use a “drop/add” approach: They drop a completed time period and add a new one, which slides the time frame for the forecast further into the future.

- Adopting a rolling forecast is a four-step process, backed by best practices that help ensure reliability.

- The right software can help businesses reallocate the time and resources needed for preparing and maintaining a rolling forecast, to be used for analysis and action.

Rolling Forecasts Explained

Financial forecasts are often used to estimate a company’s financial future, but the rolling forecast approach can also be used to address a variety of business functions, including sales, supply chain management and head-count planning.

Financial rolling forecasts estimate the activity underlying a company’s three primary financial statements: the income statement, balance sheet and cash flow statement. Of these, the income statement rolling forecast is often the most prevalent because it provides business leaders with revenue, expense and profit expectations that help shape their decision-making. Forecasting cash flow is also crucial, especially for small and midsize businesses, since it gives advance warning of cash crunches likely to arise.

Replacing forecasted periods with actual results, known as “actualizing,” and then adding another forecast period is a defining characteristic of a rolling forecast. Also referred to as dynamic forecasts, rolling forecasts can be actualized at any cadence that makes sense for the business, such as weekly, monthly or quarterly. Advanced technology can automate the actualization process, allowing for more frequent updates and, in turn, more accurate results. Most often, rolling forecasts examine a 12-month period that traverses more than one fiscal year. Rolling forecasts based on longer periods, such as 24 months, tend to be less accurate, due to the cumulative effect of estimates compounded over an extended length of time.

Rolling Forecasts vs. Static Budgets: What’s the Difference?

Budgets and forecasts are each produced through a lens of what is likely to happen, though they serve separate purposes and cover different, yet overlapping time periods. A budget is a fixed document that presents the company’s overall financial plan for a set period of time. Budgets are typically derived from historical data and prepared before the start of a fiscal year. They are based on the company’s revenue and profit goals for the predetermined period of time. Later on, they serve as a helpful benchmark for evaluating what actually happened, as compared to the initial plans. It is typically easier to create a budget than it is to create a rolling forecast, but the trade-off is that a budget often becomes quickly outdated and disregarded.

On the other hand, a rolling forecast is an evolving document that focuses on what is likely to happen, rather than on a company’s goals. When preparing a rolling forecast, the company’s historical data is just the starting point. The rolling forecast process also continually updates data based on changes in market size, market share, macroeconomic factors, staffing levels, material costs and availability, customer dynamics and any other operational drivers that impact the business. Consequently, building and updating a rolling forecast is a much more involved process than making a budget, but it is also considered more useful for ongoing decision-making.

Also of note, rolling forecasts differ from projections because of the viewpoint used during their creation. Rolling forecasts take an objective approach of what’s likely to happen, whereas projections use a hypothetical what-if scenario approach.

Benefits of Rolling Forecasts

Many business leaders use rolling forecasts to help chart the right course for their companies as they navigate the future in conjunction with other forecasting methods. Rolling forecasts are particularly useful as a financial planning document, providing additional — and, arguably, more valuable — benefits alongside static documents, such as budgets, what-if projections and full-year forecasts. Specifically, rolling forecasts:

- Increase accuracy of estimates: Since rolling forecasts are updated more frequently than other static financial planning documents, businesses have more opportunities to make corrections and refine estimates. Additionally, rolling forecasts reflect current conditions inside and outside of the company more accurately than other planning documents.

- Allow for more objectivity: Rolling forecasts are based on data-supported operational drivers, such as sales head counts, market share and production capacities, rather than opinions and casual guesses. Moreover, as each period is actualized, any variances from the forecast can be analyzed to identify adjustments that need to be made for future periods. This approach also increases stakeholder awareness of the various factors that can impact business results.

- Support business flexibility: Rolling forecasts provide earlier alerts about expected changes in a company’s performance. Business leaders who use rolling forecasts gain a longer line of sight and, therefore, more lead time to change course, whether to prepare for potential new opportunities or to address emerging performance issues that may require some type of operational adjustment. Furthermore, the iterative long-term outlook helps managers adjust action plans and realize the anticipated results in a more timely manner.

- Aid decision-making: Rolling forecasts are more useful in informing day-to-day decision-making, since they are more up to date, accurate and objective. They also provide an easier way to help identify trends in revenue, expenses and profits.

- Support various business functions: Rolling forecasts are effective in many areas of a company. For instance, a rolling forecast can be a helpful tool for spotting potential market or industry threats that should be included in a company’s risk management plan. The accounting team can also use rolling forecasts as part of their close process to spot anomalies that require further investigation. And the financial planning and analysis teams can leverage rolling forecasts when reporting to external stakeholders, prospective new investors and lenders, and for kickstarting budget and strategic planning exercises.

How to Create a Rolling Forecast

Creating and maintaining a rolling forecast requires thoughtful planning and, best-case scenario, technology that supports its preparation and analysis. Creating a rolling forecast involves four key steps:

- Lay the groundwork. As with any business initiative, the business should first articulate the objective of the rolling forecast, such as prioritizing resources, factoring for head count changes or simply maintaining an updated view of the future. Key stakeholders in the process should also be identified: those who will rely on the end product for decision-making, those who will create the rolling forecasts, and anyone else who will provide input for the forecast.

- Establish the parameters. Parameters include the granularity of information, the cadence for updating the rolling forecast, the operational drivers to be used, the sources of data and the forecast’s time frame. Consider the following questions: Will the rolling forecast be prepared at the companywide level or for each division or department? Should the company develop its rolling forecast based on the financial statement level, at the general ledger account level or somewhere in between? Are monthly drop-and-add updates adequate, or should the business update the forecast weekly or quarterly? Establishing the time frame for how far the overall forecast looks into the future is a good place to start, with typical choices being 12, 18 and 24 months. Ensure that the stakeholders identified in the first step are all on board with the plan.

- Prepare the forecast. The actual preparation step can be tricky, due to the large volume of data involved. Building robust automation into the process can ensure that the rolling forecast is timelier and more accurate. For example, the technology can arrange for automatic updates of actuals and operational data analytics, such as labor rates. After dropping the actualized period, be sure to slide the forecast forward one period into the future.

- Review the results. As each period is actualized, it’s important to analyze variances. Some variances will arise because of faulty estimates, which should be fixed for the coming periods. Others will occur due to errors or anomalies in the actual data during the period, requiring corrections or explanations. Finally, when businesses discover any true operating variances, they should investigate the issues to ascertain the root causes.

Rolling Forecast Best Practices

A good rolling forecast should reduce the chances of surprises, such as shifts in customer demand, a disruption in a supply chain or a cash crunch from an unexpected expense. The following best practices can help businesses create a reliable rolling forecast and balance their resources to maintain it.

- Link the forecast with the company’s mission. As when making any organizational change, implementing a rolling forecast is likely to be more successful if it is tied to a strategic goal and has an executive company sponsor, such as the CEO. The sponsor should ensure that the rolling forecast is consistent with the company’s objectives and that it facilitates collaboration and holds participants accountable. During implementation, consider a phased, iterative approach that focuses on the right level of detail.

- Determine the ideal time frame. Pinpoint the time frame for the rolling forecast that makes sense for your particular business situation. For example, some businesses will create a 12-month rolling forecast, while those with longer business cycles might find an 18-month forecast more beneficial.

- Allocate the proper resources. Rolling forecast preparation needs adequate human resources and technological support. It requires staff to have an in-depth knowledge of the business, financial and accounting acumen, technical proficiency and good communication skills. Participation from a variety of departments, such as human resources, sales and purchasing, should also be encouraged. In addition, businesses should invest in the right software tools. Attempting to build a rolling forecast with spreadsheets, for example, can lead staff to spend a disproportionate amount of time and effort on preparation, rather than on analysis and action. Implementing technical support, including high-quality data sources and flexible forecasting software, is key to ensuring that rolling forecasts are more accurate and timely, as well as less labor-intensive.

- Integrate the forecast into day-to-day activities. Businesses should incorporate rolling forecasts into ongoing business activities and use them as a tool for decision-making and improving performance. It’s important to keep the focus of the forecast on what is expected or likely to happen, unlike other planning documents that are focused on setting goals and managing expectations.

- Track and adjust the forecast as you go. Businesses should keep close tabs on rolling forecasts, comparing them with actual results so they can make any necessary adjustments. It’s best to approach rolling forecasts as evolving, flexible tools.

No Matter How You Forecast, NetSuite Has It Handled

Budgets, projections, forecasts and rolling forecasts all require data, models and reporting. Because rolling forecasts are the most comprehensive and forward-looking financial planning documents, they rely heavily on software like NetSuite Financial Management to help reallocate the time and effort needed for preparation, analysis and action. Automated templates and workflows are one way the solution makes the forecast process more efficient. The ability to produce different planning tools, such as what-if projections and budgets from a single solution, is another.

Data synchronization with NetSuite Enterprise Resource Planning (ERP) ensures automated, ongoing access to up-to-date financial and operational data, which is essential for keeping rolling forecasts current. And because the software is cloud-based, the technology facilitates collaboration across the entire company.

Rolling forecasts help keep business leaders focused on the future. They are a valuable planning tool that uses internal and external data to estimate likely business results. A defining characteristic of a rolling forecast is the sliding time frame, where periods are dropped as they are completed and additional forecasted periods are added to the future timeline. Rolling forecasts require more effort to create and maintain than static budgets, but are often considered more useful for decision-making. Several best practices, including tying the forecast to the company’s strategic goals and integrating it into day-to-day business activities, combined with investing in the right supportive technology, can help businesses adopt reliable, actionable rolling forecasts.

Rolling Forecast FAQs

What challenges come with rolling forecasts?

The primary challenge of rolling forecasts is allocating the effort and resources, both human and technological, needed to maintain them. The underlying operational drivers typically represent a lot of data from many sources, which can be difficult for businesses to obtain and keep current. By their nature, rolling forecasts are updated at regular intervals, unlike static plans that are created only once per year. Other challenges include transforming the company culture to embrace rolling forecasts.

What is the objective of rolling forecasts in continuous planning?

The rolling forecast is a financial tool that projects where a business is heading in the future. The forecast shows company managers how the business is likely to perform, providing a longer line of sight and more lead time to change course, if necessary.

What is an example of a rolling forecast?

A rolling forecast uses a system of dropping and adding time periods, meaning that completed periods are dropped and replaced with another period in the future. For example, a 12-month rolling forecast would begin as January through December for 2022, and when January 2022 actual results are finalized, that month would be dropped and replaced by January 2023. The forecast still encompasses 12 months, but it slides forward each month.

How do you calculate a rolling forecast?

Several factors go into preparing a rolling forecast and its supporting calculations. These include determining the time frame of the forecasts, such as 12, 18 or 24 months; identifying the appropriate operational drivers, such as headcount; building the level of granular detail; and outlining the cadence for updating the document. Rolling forecasts often cover 12 months, are updated monthly and slide across fiscal years.

What is the difference between forecasting and rolling forecasting?

Forecasting involves estimating what is likely to happen in a business, using quantitative and qualitative factors. A rolling forecast is a specific type of forecast that continuously drops a completed period and replaces it with another period in the future.

What is a rolling vs. a static forecast?

A static full-year forecast has a set time frame, while a rolling forecast is regularly updated by dropping a completed period and replacing it with another period. This slides the time frame forward into the future.