Environmental, social and governance (ESG) principles have become a pivotal aspect of modern business and investment strategies. According to Morningstar Index’s “Voice of the Asset Owner Survey 2023,” 67% of investors believe that ESG has increasingly become more important to investment policy over the past five years, with environmental factors a driving force. This growing trend underscores a shift in perspective, where sustainable and ethical operations are seen not just as corporate responsibility, but also as integral to long-term success and resilience in a rapidly changing global business landscape.

This guide delves into the nuances of ESG, exploring its significance across different industries while highlighting the challenges and opportunities that come with the territory.

What Is ESG?

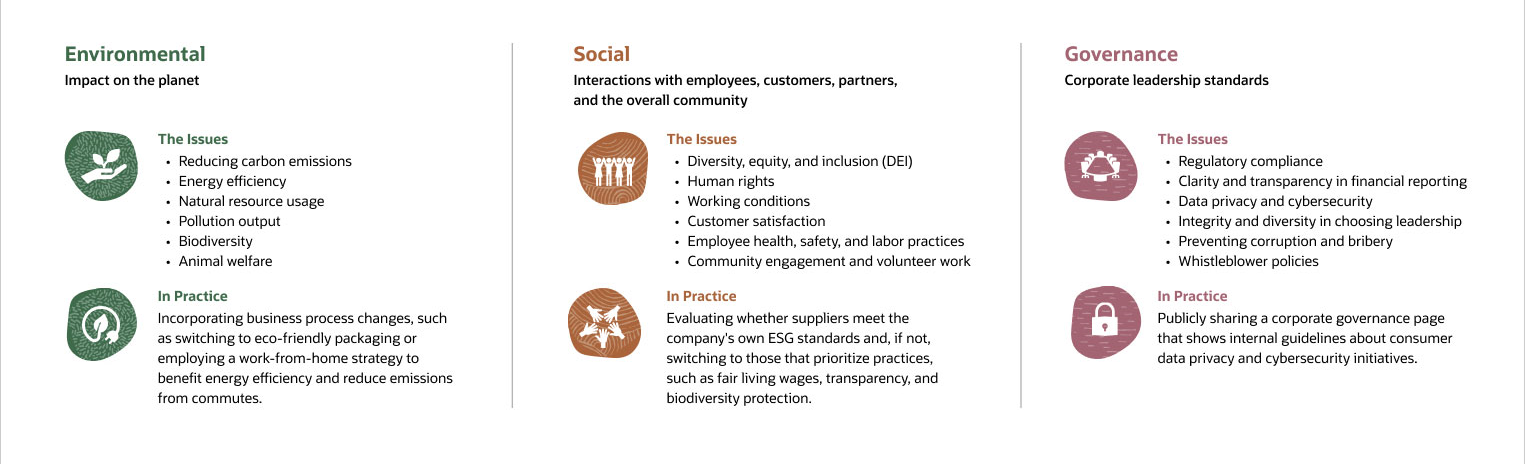

ESG refers to the environmental, social and governance criteria deemed central to sustainable and ethical business operations. Its principles aim to help assure that companies positively contribute to society while pursuing their financial objectives.

Key Takeaways

- ESG encompasses a broad range of practices, from environmental stewardship to social responsibility and ethical governance, and touches businesses in all industries and sectors.

- The ongoing evolution of ESG signifies its lasting impact on corporate strategies and investing, as well as the desire to help align business success with broader societal goals.

- In spite of challenges, like greenwashing and a clear need for standardized reporting, proactive measures are being taken globally to enhance ESG effectiveness and credibility.

- Advanced tools, like robust enterprise resource planning (ERP) software, can help proactive companies take charge of a transparent and tangible ESG strategy, with lasting effects.

ESG Explained

ESG embodies the pillars of an organization’s commitment to responsible operations and ethical practices. The environmental dimension focuses on particular factors, such as a company’s ecological footprint and sustainable resource use, and is often aligned with global initiatives, such as the Paris Agreement (opens in new tab). The social criterion scrutinizes how well a company nurtures relationships with its key stakeholders: its workforce, suppliers, customers and the communities where it operates. Success in this regard contributes to benefits that include improved job satisfaction, employee retention and increased community engagement, and it minimizes social risks, such as negative press and boycotts. Governance pertains to the company’s corporate governance standards, internal systems of control and ethical conduct.

Originating as a niche investment filter, ESG has become a fundamental aspect of both corporate strategy and consumer choice. And despite challenges in measuring ESG’s impact, not to mention concerns about greenwashing — where companies exaggerate their environmental efforts — the focus on ESG continues to intensify. (More on greenwashing later.) According to Morgan Stanley’s mid-2023 “Sustainable Reality” report, ESG funds continue to outperform their peers. The drive for ESG emerges from its potential to foster sustainable business models that contribute to long-term economic success and societal well-being.

Environmental Factors

Environmental stewardship aims to mitigate adverse effects on the planet through strategic business practices. Initiatives encompassing carbon footprint reduction, energy efficiency and waste management not only serve ecological preservation, but they also offer economic benefits. For example, companies that install energy-efficient lighting and HVAC systems can reduce their customers’ utility bills while appealing to eco-conscious consumers.

Diving deeper, here’s a look at three significant environmental factors related to ESG: the climate crisis, environmental sustainability and animal welfare.

-

Climate crisis:

As the 2050 target for net-zero greenhouse gas emissions looms closer — a goal required by the Paris Agreement to limit global warming for a sustainable future — it’s clear that climate change and how companies manage it will remain pressing issues within the ESG framework. Businesses, in turn, must continue to adopt more aggressive carbon reduction targets. Transitioning to renewable energy and innovating product design to reduce emissions are some of the key strategies for doing so. In practice, for example, an appliance manufacturer might choose to develop energy-efficient products that consume less power, thus reducing the carbon footprint for its customers. Simultaneously, the company might decide to recycle and upcycle its scraps to minimize waste, reducing its own carbon footprint. This dual approach helps highlight the company’s commitment to ESG values.

Various tools and resources are available to help businesses enhance their climate response, meet regulatory requirements and demonstrate commitment to sustainable practices. For example, climate footprint calculators make it possible to measure greenhouse gas emissions, get a baseline for improvement strategies and track changes over time. Similarly, energy audit services can help identify areas to increase energy efficiency, leading to further emission reductions.

-

Environmental sustainability:

Environmental sustainability focuses on judicious resource utilization, biodiversity protection, waste management and similar factors. Companies integrating these sustainability principles, such as those using recycled materials or adopting zero-waste policies, not only diminish their environmental impact but also contribute to a more eco-friendly global economic system.

To help move the needle, investors and regulators are increasingly exerting pressure on companies to develop credible transition plans focused on sustainable practices. Nature Action 100, for instance, is an initiative in which participating global investors are engaging with 100 companies in key sectors to drive corporate action on nature and biodiversity loss, aiming to reverse these trends by 2030.

Meanwhile, regulatory frameworks, such as the European Union’s European Green Deal and the United States’ Environmental Protection Agency (EPA) initiatives, are setting ambitious targets, like the EU’s goal for a 55% reduction in greenhouse gas emissions by 2030. Similarly, the EPA has strict air and water quality standards aimed at improving the health of humans and their environments. These regulations encourage companies to develop innovative solutions and strategies that prioritize environmental sustainability.

Note that the benefits of environmental sustainability can extend beyond compliance. By adopting more sustainable practices, companies can mitigate risks, such as resource scarcity — a threat to business viability — while positioning themselves as innovators in their industries. Aligning operations with environmental sustainability also resonates with consumer values, enhancing brand loyalty and potentially opening up new market opportunities by resonating with eco-conscious consumers.

-

Animal welfare:

Within ESG’s environmental scope, animal welfare is also gaining prominence, with companies implementing humane treatment standards in their supply chains. This commitment aligns environmental concerns with consumer expectations for ethical sourcing. A cosmetics company’s refusal to test on animals, thereby earning certifications and the loyalty of consumers who prioritize cruelty-free products, is a well-known example. Likewise, a food company that partners with suppliers adhering to certified animal welfare standards can demonstrate a proactive commitment to environmentally harmonious practices while meeting consumer demands for ethically produced food.

Beyond humane treatment in supply chains and ethical sourcing, animal welfare is also significant from an environmental sustainability and biodiversity standpoint. By promoting practices that ensure the welfare of animals, companies can contribute to the preservation of biodiversity and the maintenance of healthy ecosystems. This is particularly crucial in industries like seafood, where sustainable fishing practices are essential to preventing overfishing and maintaining marine diversity.

Social Responsibility

Ernst & Young’s “Global Board Risk Survey 2023” found that 66% of 500 global board director respondents believe their enterprises can be resilient only if they are environmentally sustainable — and an equal number agree that addressing sociopolitical issues will build trust with employees and customers. The “social” component of ESG evaluates a company’s capacity for having a positive influence on its employees, customers and the communities where it operates. It encompasses a variety of factors, such as diversity, equity and inclusion (DEI), human rights and consumer protections, all of which are paramount for cultivating a robust social strategy. Companies with strong social commitments often see enhanced employee satisfaction, customer loyalty and community engagement, which all can lead to more sustainable business growth.

Let’s look at three key elements of social responsibility in more detail: diversity, human rights and consumer protections.

-

Diversity:

In the business world, DEI initiatives are not just about fairness; they’re also about strategic imperatives and can attract diverse talent, drive innovation and open up new markets. In fact, companies that foster an inclusive culture are known to report higher creativity, better problem-solving capabilities and even improved financial performance, demonstrating tangible benefits of diversity within ESG frameworks.

The key, however, is to move beyond superficial measures, like occasional mandatory DEI training sessions. More comprehensive strategies, such as mentorship programs that support the professional development of underrepresented groups and the implementation of transparent policies that guarantee equal opportunities for career advancement, are likely to have more lasting — and tangible — effects. In other words, ESG businesses need to demonstrate that their true commitment to diversity involves embedding DEI into the fabric of their corporate cultures and decision-making processes, that it is not a shallow initiative that only looks good on paper.

-

Human rights:

Respecting human rights is a critical issue within ESG because it reflects a company’s dedication to ethical practices and labor standards. By guaranteeing fair working conditions and opposing discrimination, businesses can cultivate a better place to work, a more reputable brand reputation and even a more loyal customer base.

For businesses looking to delve deeper into practical implementation, consider the complexities of global supply chains. A technology company, for instance, might make it its mission to ensure conflict-free sourcing of valuable minerals. This would involve rigorous due diligence to verify that human rights are respected at every level of the supply chain, from raw material extraction to final product assembly. Such an approach can help prevent labor exploitation, while it supports global communities in resource-rich regions. But the global supply chain can be hard to navigate. Tools like supply chain management and supplier relationship management software can make it easier to track and manage supplier information, allowing companies to assess and monitor compliance with ESG standards from point A to point B and beyond.

Companies that prioritize human rights may also position themselves as ethical leaders in their industry — a powerful differentiator in the marketplace that can attract consumers and investors that value corporate responsibility.

-

Consumer protections:

Companies that prioritize consumer rights often gain a competitive edge by building trust and credibility. Consumer protection laws, such as the United States’ Consumer Protection Act, help by preventing exploitation of consumers exposed to deceptive practices and by promoting transparency in terms of product information and pricing. But the consumer protection element of ESG can — and arguably should — extend beyond legal requirements.

To further enhance consumer protections, businesses can adopt measures, such as transparent product labeling and ethical advertising practices, both of which can help consumers make well-informed purchasing decisions. Robust customer service and other responsive feedback mechanisms also play a critical role by providing an outlet to promptly address concerns. Digital security is also vital, especially for companies that rely on ecommerce platforms or access to online accounts. Strong data security measures, such as encryption and secure data storage, along with robust data and user privacy policies, help companies safeguard sensitive information and build trust.

By going beyond the minimum legal requirements in consumer protections, businesses can create a strong brand identity centered on trust and reliability. Such practices are not only ethically sound but also strategically advantageous, once again improving customer loyalty, fostering positive brand perception and, ultimately, promoting a more sustainable and resilient business model.

Governance Aspects

Governance in ESG pertains to the systems and processes that companies use to ensure accountability, transparency and ethical behavior at the corporate level. It involves oversight of actions and policies that affect stakeholders, including shareholders, employees, customers and the broader community. Effective governance mechanisms can help businesses navigate legal and ethical obligations, reduce the risk of disputes and prevent reputational damage. By monitoring board structure, regulatory compliance, risk management practices, whistleblower policies, data privacy guidelines and similar factors, companies can demonstrate their commitment to upholding high standards of conduct and decision-making.

Here’s a specific look at a few significant elements of governance: employee relations, executive compensation and employee compensation.

-

Employee relations:

Strong employee relations are a key part of sound governance. Effective communication channels, fair dispute resolution processes, transparent decision-making and clear policies contribute to a supportive work environment. For example, a tech company might enhance employee relations by implementing regular “innovation sessions,” where team members present their ideas for new technologies or improvements to existing products. The company could also offer clear opportunities for career advancement, such as mentorship programs with senior developers. These measures can help contribute to a workplace where employees feel respected, involved and motivated, which, in turn, can foster a culture of trust, innovation and loyalty — and cultivate a positive impact on the company’s ESG standing.

To deepen employee engagement and satisfaction, some companies also implement employee resource groups, or ERGs. These groups provide platforms for employees from diverse backgrounds to share their experiences and insights to foster a more inclusive and understanding work environment.

But it’s important to remember that any policies and practices pertaining to employee relations also help represent a company’s commitment to ethical governance by aligning employee interests with the broader goals of the organization. For example, a manufacturing company might establish cross-departmental teams to work on sustainability initiatives, allowing employees from different levels and functions to collaborate on ideas for reducing waste and improving energy efficiency. Done right, inclusive initiatives can enhance overall business performance, while reflecting a company’s commitment to its most valuable asset — its people.

-

Executive compensation:

The role of governance in executive compensation helps ensure that pay is fair and responsible and that executive rewards are aligned with the long-term ESG interests of the company and its stakeholders. A key aspect of responsible governance in executive compensation is transparency. Disclosing compensation structures, including base salaries, bonuses and equity awards, allows stakeholders — including shareholders and the public — to understand how executives are rewarded in relation to company performance and ethical commitments. This transparency is vital for maintaining trust and confirming that executive pay is indeed matched to overall organizational values and objectives.

In practice, businesses might tie executive compensation to performance metrics, including ESG targets. A global retail chain, for instance, might link a portion of executive bonuses to specific sustainability achievements, such as reducing the company’s carbon footprint or moving to a supply chain that prioritizes fair trade. This type of governance can help make sure incentives are not only tied to short-term financial results but also to the achievement of important social and environmental goals.

However, it’s vital to recognize that such achievements are rarely the sole result of executive actions. Rather, they likely involve the efforts of many employees across the organization. A governance strategy that prioritizes a fair and comprehensive approach would consider how that broader workforce is also rewarded and recognized for their contributions, whether through companywide bonus schemes or other employee recognition programs tied to the same ESG targets.

-

Employee compensation:

Employee compensation is another critical aspect of corporate governance. It reflects how a company values and rewards its workforce. Equitable pay practices, including addressing gender pay equity and providing comprehensive benefits, reflect a company’s commitment to fair governance. Note that these practices extend beyond the legal requirements of fair wage standards to embody broader ESG principles of ethical and responsible business conduct.

The benefits of an equitable compensation governance strategy are manifold. For one, they can lead to improved morale, higher employee retention rates and a more committed workforce. At the same time, clarity and openness in pay structures can help address a growing desire for pay transparency in the workplace. Moreover, companies that go beyond basic compliance and adopt “good-to-have” practices, such as performance-based incentives, support for work-life balance and other employee-focused benefits, often see a positive impact on their corporate culture — benefiting the social element of ESG, as well.

In an era where talent acquisition and retention are critical business challenges, such equitable and transparent governance around employee compensation practices can set a company apart as an employer of choice.

ESG Investing

ESG investing is a strategy that incorporates environmental, social and governance factors into the investment decision-making process. It reflects a growing trend among investors to consider not only their own financial return, but also the societal impact of their investments, with brokerage firms and mutual funds making exchange-traded funds and other investment vehicles that prioritize companies with strong ESG practices easily available to the general public. This shift is partly driven by generational changes, with millennials and Gen Z showing particular interest in ESG investing — even if it means accepting a below-average return.

Unlike its socially responsible investing, aka SRI, predecessor, which primarily focuses on excluding companies with negative societal impacts, ESG investing actively seeks out companies that demonstrate positive ESG characteristics. This approach reflects a more integrated strategy, where financial performance and societal impact are considered in tandem. ESG rating agencies, such as MSCI and Sustainalytics, play a vital role in this process by providing assessments of companies’ ESG performance to guide investors in making more informed decisions.

For business owners, the rise of ESG investing is significant, not only from an investment standpoint but also in terms of attracting investors. Businesses that demonstrate strong ESG practices are increasingly appealing to a growing segment of investors looking to support companies that contribute to sustainable development.

However, ESG investing is not without its challenges. Critics argue that focusing too heavily on ESG factors can lead to lower returns, while the effectiveness of ESG in driving tangible societal change has been a point of debate. The ESG investing landscape is also influenced by external factors, such as politics. In the U.S., some states have introduced bills and resolutions against ESG investment criteria, for example, by trying to prevent state pension systems from including environmental and social criteria in their investment decisions. As of mid-2023, this has forced some investors and businesses to navigate a complex regulatory environment, balancing compliance with new state laws against achieving ESG goals promised to stakeholders.

Challenges and Criticisms of ESG

Despite the growing adoption of ESG principles, the practice faces significant challenges and criticisms. A primary concern is the lack of standardization in ESG reporting and measurement. This can lead to inconsistent and noncomparable data that, in turn, makes it difficult for investors and stakeholders to accurately assess a company’s true ESG performance. Additionally, the potential for greenwashing undermines the credibility of ESG initiatives and can mislead consumers and investors. And whether ESG practices actually create change is still up for debate.

-

Standardization and measurement: The absence of uniform ESG standards presents a hurdle for accurate measurement and comparison of ESG practices. Companies may report on different metrics or interpret guidelines in varied ways, contributing to a lack of uniformity that can make it difficult for stakeholders to make fully informed decisions. In addition, ESG scoring doesn’t always provide adequate context, and the proliferation of ESG scoring providers can lead to contradictory results, further compounding the issue.

However, global efforts are underway to create more cohesive frameworks around ESG standardization. The International Financial Reporting Standards Foundation, for instance, has begun to establish a baseline for sustainability-related financial disclosures that should help make it easier for companies to report on ESG performance in a consistent and comparable manner. Meanwhile, the EU is also implementing sustainable reporting rules that require companies to show how they’re making an impact on issues like climate change, as well as to disclose how their sustainability-related opportunities and risks affect their financial performance. These rules will start going into effect in 2024.

-

Greenwashing: Greenwashing, where businesses give a false impression of their environmental efforts, remains a significant concern in the realm of ESG. This practice can range from exaggerated marketing claims to overstating the impact of green initiatives. Greenwashing erodes public trust and can also lead to legal repercussions for companies, such as consumer lawsuits, fines from regulatory bodies or enforcement actions for misleading advertising.

One key factor contributing to greenwashing is the lack of robust mechanisms for accurately monitoring and calculating the environmental impact of a company’s operations. To combat this issue, there’s a growing push for stricter regulations designed to ensure that ESG claims are substantiated. For example, regulatory efforts, such as the EU’s “green” taxonomy initiative, are stepping up to reduce greenwashing by providing clear criteria for what constitutes an environmentally sustainable economic activity. Several organizations, including Ernst & Young, Deloitte and SGS offer third-party ESG verification and assurance services to help add additional credibility to a company’s claims.

Still, businesses themselves should aim to take proactive steps to avoid greenwashing. This includes implementing more accurate and transparent reporting systems, engaging in sincere and substantial environmental initiatives, and making sure that all claims are backed by verifiable data and practices. For example, instead of just using recycled paper, a company might commit to a comprehensive waste reduction program that includes recycling, composting and reducing overall paper consumption. The company can also deploy environmental impact software to track and analyze metrics, such as the volume of paper recycled and reduction in use over time. This clear source of data can then be validated through third-party verification.

-

Effectiveness and impact debate: The debate over the effectiveness of ESG principles centers on ESG’s actual impact on environmental and social issues. Critics question whether ESG-focused companies are genuinely achieving meaningful change or simply ticking boxes for better public perception. The discussion extends to the impact of ESG on financial performance, with mixed evidence as to whether ESG contributes to or detracts from financial returns.

To ensure that ESG initiatives are not merely symbolic, companies need to integrate related principles into their core business strategies. This involves setting clear, measurable ESG goals and conducting regular impact assessments to evaluate effectiveness. For example, a company could establish quantifiable targets for reducing carbon emissions or improving workforce diversity and publish progress reports regularly.

Transparency plays a key role here. The more engagement a business can get from its stakeholders — including customers, employees and investors — the more valuable insights into the real-world impact of the company’s ESG initiatives can be discussed and improved. That said, some suggest a need to clearly distinguish “ESG investing” from “impact investing,” the latter of which is a strategy that explicitly aims to generate measurable social or environmental benefits.

ESG Examples

ESG principles are increasingly influencing business operations across various sectors. Let’s take a look at how ESG can apply to companies in the manufacturing, finance and hospitality industries.

-

Manufacturing: Environmental initiatives in the manufacturing space could focus on reducing greenhouse gas emissions, transitioning to energy-efficient operations or finding innovative ways to reduce waste. Social initiatives could include labor standards improvements or employee wellness programs, while governance might focus on disclosing ethical sourcing policies.

Take, for example, Patagonia, a clothing manufacturer known for its environmental and social initiatives. The company uses sustainable materials and practices in its manufacturing process. It also actively participates in environmental activism by donating 1% of sales to the preservation and restoration of the natural environment. In turn, this approach has strengthened its brand as a leader in ethical and sustainable manufacturing, attracting a loyal customer base that values these principles. Of course, managing a global supply chain is complex and unfortunate “surprises,” like harmful by-products, can crop up. But Patagonia has publicly addressed and rectified such issues with transparency.

-

Finance: Environmental initiatives in the finance industry might include investments in sustainable products; eco-friendly operational practices, such as paperless billing; or promoting green lending practices that help fund environmental improvements. These environmental initiatives might intersect with social projects, such as a community investment program that aims to install solar streetlamps in public parks or a financial literacy initiative. As far as governance goes, finance companies might focus on transparent reporting, data privacy and ethical investment policies.

JPMorgan Chase, for instance, has made significant commitments to sustainable finance. In 2020, it committed $2.5 trillion over 10 years to address climate change and contribute to sustainable development, including $1 trillion earmarked for green initiatives, such as renewable energy and clean technologies. That said, the company has faced criticism for its investment in fossil fuel projects, which, some argue, contradicts its sustainability commitments. But it’s also worth noting that implementing ESG initiatives is often a long-term transition process that, especially for major corporations, requires a careful balance between moving toward sustainability and maintaining operations.

-

Hospitality: In the hospitality sector, particularly in hotels, environmental initiatives might focus on energy-saving measures, such as incorporating solar lights or using all LED lights, reducing water and food waste, and sourcing food sustainably. Social projects might include measures to support local communities, such as offering discounted rates for local businesses looking to rent out conference or convention spaces. Governance models might focus on customer privacy policies.

Marriott International is an example of a hotel company that has implemented numerous sustainability initiatives, including reducing water consumption, minimizing waste and improving energy efficiency across its hotels. These initiatives not only reduce operational costs but also attract environmentally conscious travelers, reinforcing Marriott’s commitment to sustainability.

Take Charge of Your ESG Efforts With NetSuite

Businesses looking to improve their efforts on the ESG front would be wise to consider enterprise resource planning (ERP) solutions, such as NetSuite’s. NetSuite ERP can help streamline ESG data management by funneling all business data into a centralized hub that can then be referenced whenever, wherever and in whatever context is relevant — be it finance, supply chain, human capital management or customer relationship management. And with automated data collection, NetSuite reduces the risk of errors, while customizable dashboards that facilitate real-time monitoring and analysis of ESG metrics proactively support the management of sustainability goals.

In addition, NetSuite provides a comprehensive suite of tools for robust sustainability reporting. For example, NetSuite Planning and Budgeting can be used to track ESG-related expenditures, easing strategic planning and planning for a sustainable future. With full ad hoc analysis, reporting, and dashboard capabilities, you can easily get an overview of your ESG metrics and do a detailed analysis to track your performance toward your ESG targets. Similarly, supply chain modules can be configured to support sustainable sourcing and emissions tracking to help make sure products are environmentally responsible from origin to end user.

NetSuite also offers access to additional applications that can be used to further fine-tune the software. CarbonSuite’s Carbon Accounting for NetSuite (opens in new tab) app, for example, helps customers measure, report on and reduce their carbon footprints. The app helps manage ESG-related factors, such as emissions, carbon credits, carbon offsets, overall sustainability and ESG reporting.

For the future, ESG will remain a defining factor in the corporate world, shaping business practices and investment strategies. The integration of environmental stewardship, social responsibility and strong corporate governance is increasingly recognized as central to sustainable success in a world where stakeholders are acutely aware of the societal and environmental impacts of businesses. Although the journey toward fully realizing ESG principles is complex and multifaceted, the trajectory is clear: ESG is no longer a niche interest but a fundamental aspect of contemporary business and investment strategies.

ESG FAQs

What is ESG in simple terms?

In simple terms, ESG stands for environmental, social and governance. These are the three key factors considered when measuring the sustainability and ethical impact of an investment in a company or business.

What does ESG really mean?

ESG really means considering the environmental, social and governance practices of companies, in addition to their financial metrics. It’s about ensuring that companies are operating in a way that is genuinely sustainable, ethical and responsible.

Why is ESG controversial?

ESG has been considered controversial because it has historically involved subjective judgments about what constitutes responsible corporate behavior. There’s also debate over the effectiveness and sincerity of ESG initiatives. And without standardized metrics, ESG can be prone to greenwashing, a practice in which companies intentionally or unintentionally overstate their sustainability efforts.

Why is ESG a risk?

ESG can be a risk for companies, if it is not managed properly. Poor ESG practices, such as greenwashing, can lead to reputational damage, legal penalties and financial loss. Conversely, overly aggressive ESG strategies can compromise profitability and shareholder value, if not aligned with business objectives.

What are examples of ESG?

Examples of ESG include a company reducing its carbon footprint, implementing fair labor practices, enhancing diversity and inclusion, and maintaining transparency and accountability in its corporate governance.