Every small business needs an accounting and finance function. How many people are on that team and what their jobs entail depends on the size of the business and the complexity of its finances.

Accounting and finance staffing firm Robert Half’s 2019 Benchmarking Accounting & Finance Functions report details the average size of finance functions at small businesses. Businesses with less than $25 million in revenue employed a median of three people in a finance role. Those with revenue between $25 and $99 million employed a median of six finance professionals.

Another way to gauge how much to invest in a finance team is to think of the cost as a percentage of revenue. For many businesses, the finance function should consume about 1% of revenue.

At smaller companies, many finance functions get outsourced at first, perhaps to a part-time bookkeeper or tax specialist, or through a third-party firm that can handle multiple roles.

What Are the Key Responsibilities of the Finance and Accounting Departments in a Small Business?

No matter how many people are performing finance-related tasks, the core responsibilities are universal across businesses. They include basic accounting duties like:

- Accounts payable

- Accounts receivable

- Payroll

- Reporting and financial statements

- Financial controls

- Tax and compliance

Read on for a more thorough explanation of each of these duties.

Small Business Finance and Accounting Responsibilities Explained

Depending on the employee’s level of experience and professional certifications and the size of the business, the accounting responsibilities listed here may be combined into a single role or span multiple roles. They could also be outsourced to a third party. Internal AR and AR specialists will get paid between $60,000–$80,000 per year, and up.

-

Accounts Payable (AP):

This involves keeping track of all payments and expenditures, including purchase orders and invoices. Accounts payable maintains records, verifies journal entries and compares reports from systems to actual balances. Accounts payable also verifies expense reports and prepares reimbursements to employees. Accounts payable communicates with and pays vendors by scheduling payments and ensuring all outstanding credit is current. -

Accounts Receivable (AR):

This function makes sure the company receives payments for the goods and services it sells and records these receipts. Billing—which includes generating invoices and account statements—is often an accounts receivable responsibility. The accounts receivable department performs account reconciliations, maintains all files and records and follows up on any irregularities. -

Payroll:

Robert Half says payroll is the most common function to outsource, at least partially. Businesses with under $499 million in revenue are more likely to outsource payroll than larger ones. The payroll function processes paychecks, reconciles the payroll sub-ledger to the general ledger, remits payroll taxes, manages governmental reporting and compliance with tax laws, and prepares payroll statements. Payroll answers payroll-related questions and provides tax documentation to employees, as well. -

Reporting and Financial Statements:

The accounting team—ideally with the help of accounting software—is responsible for generating financial statements that tell the business whether it earned a profit, what it owns and owes, and whether it has sufficient cash on hand to cover its obligations. These financial statements include the income statement, the balance sheet and the cash flow statement. Those statements help the business track its progress against goals, understand what adjustments to make and build forecasts. -

Financial Controls:

Every business, small or large, public or private, needs strong financial controls. For small, private businesses, financial controls like splitting up functions within the department to ensure one person doesn't both approve vendor payments and cut checks to vendors, can protect against fraud. Plus, by setting up strong financial controls and reporting from the beginning, a small business is prepared for the increased scrutiny that will come as it grows. Financial controls are required by law for publicly-traded companies. The penalties for not complying with the processes, audits, controls and reporting required by the Sarbanes-Oxley Act can include fines and jail time. -

Tax & Compliance:

Accounting and finance teams make sure the company pays its taxes. These include corporate income tax, regional taxes, municipal taxes, payroll tax and equity tax (if applicable), value-added tax and withholding tax. Depending on the complexity of the business, it’s a good idea to involve a Certified Public Accountant (CPA) in tax preparation and filing processes.

6 Key Positions in Small Business Accounting and Finance Departments

In the beginning, your hires should be bookkeepers and accountants—but as you grow your revenue base and decisions start to revolve around financing and forecasting, how you grow your finance team shifts in the direction of finance.

- Bookkeeper: In small businesses, a bookkeeper is often the first—and most important—hire. This person's responsibilities can vary widely depending on the maturity of the company, but bookkeepers focus on daily accounting tasks. This person could be responsible for recording and monitoring all of the company’s financial transactions, including accounts payable, accounts receivable, cash flow and payroll. They also reconcile bank statements with the general ledger and help close the books every month. A bookkeeper doesn't have the qualifications to work with the IRS in the event of a tax audit. A half-time accountant in this role will cost between $30,000–$60,000 per year.

- Billing Specialist: For companies with complex billing processes, billable hours or a large volume of bills, having an employee dedicated to the billing function makes a lot of sense. In a law firm, for instance, a billing specialist compiles hours billed by attorneys for client cases and makes sure all clients have been billed properly. The billing specialist is responsible for invoice creation. They also answer questions from clients about bills.

-

Payroll Specialist: This person processes payroll and prepares and maintains payroll-related records and reports, including year-end reporting and tax documents for employees. This role requires knowledge of regulations surrounding payroll and benefits. Certifications help ensure the payroll specialist has these competencies.

The American Payroll Association (APA)(opens in new tab) has two types of certification: the Fundamental Payroll Certification (FPC) and the Certified Payroll Professional (CPP). The FPC is for entry-level staff. The CPP is an advanced certification requiring previous experience in the field and in-depth knowledge of concepts such as employment taxes, employee benefits and the Fair Labor Standards Act (FLSA). CPP certification ensures in-depth knowledge of paycheck calculations, payroll systems and payroll administration. A payroll specialist should also have a thorough understanding of regulations and recent legislation in this area.

- Tax Preparer: An accountant can handle tax submissions and can report to the IRS if it audits the business. But a small business can also contract with a tax preparer if it doesn’t have someone with this competency in-house. A tax preparer completes and files business tax returns, including 1120,1120-S and 1065 forms and past-due returns. This person can lift an IRS levy or federal tax lien, set up a tax payment plan or remove wage garnishment.

- Accounting Managers: Businesses with more complex finances that need an internal resource who can take care of tax submissions, year-end statements and government paperwork should hire an accounting manager. The accounting manager can manage the bookkeeper and use that person’s accurate daily accounting to gain insights into the company’s finances, including opportunities to cut costs and or gain efficiencies. An accounting manager may be a CPA, an exam-based license for accountants that reflects rigorous training and experience in the field.

- Controller: As business become more complex and the accounting team grows, companies may need to hire a controller. Controllers take a more strategic view of the business’ financial situation than the roles outlined above and are responsible for creating and instituting financial procedures. Controllers also take a forward-looking view of the business, building budgets and forecasts. They can also negotiate financial agreements with banks, like loans and lines of credit.

How Accounting and Financial Software Can Help

Robert Half’s Benchmarking Survey found that businesses of every size have increased the level of automation in their accounting processes over the last year. Some 39% of firms with less than $500 million in revenue use automated software, with the functions most likely to be automated including invoicing, financial report generation, data collection and documentation storage and compliance. Unsurprisingly, smaller businesses were the group least likely to have automated financial decision-making, predictive reporting and financial modeling capabilities.

More than half of those surveyed said that they use some or only cloud-based software for accounting and finance, and business' reliance on Microsoft Excel continues to decline, even among smaller businesses. Some 59% of companies with less than $25 million in revenue said they use Excel for budgeting and planning, but that’s 10 points lower than the 2018 survey and nearly 20 points lower than the 2017 survey.

Accounting software can improve the quality and boost the efficiency of a small business accounting team. Finance software can help to automate data entry and account reconciliation tasks, saving staff time and reducing errors. The time saved on manual data entry can be used for more strategic work.

Automating accounts payable, for example, can lead to faster vendor payments, which can qualify the business for better payment. For accounts receivable, businesses can use software to automatically send reminders to customers about outstanding bills and monthly statements to reduce days sales outstanding.

Accounting software has helped smaller businesses decrease the amount of time it takes to finalize financial reports from 13 days to 10 days, according to Robert Half. Storing all financial information on a single platform not only makes it easier to prepare these reports and file taxes, but ensures accuracy and compliance.

Additionally, accounting and finance software can help improve financial controls with role-based access and permissions that ensure only approved employees can access certain financial data.

Free Small Business Finance and Accounting Org Chart

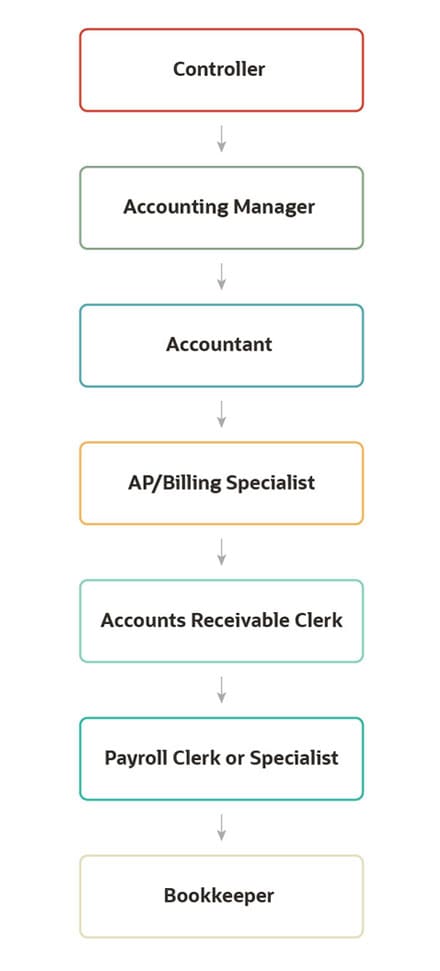

Small businesses do not typically have CFOs. If there is a strategic financial leader, it is usually a controller, and that person heads up the finance and accounting organization.

One of the biggest challenges small businesses may face is finding qualified people to work in their finance department as demand for people with these skills increases. Robert Half’s 2020 Salary Guide for accounting and finance notes demand is high and supply is low for accounting and finance professionals in the United States. Companies are holding onto top performers by providing better pay, perks and advancement opportunities than competitors. Accounting software supports those efforts, because it provides automation that gives accounting and finance team members more time to further develop other skills that are in demand, like critical thinking and communication.

And with a cloud-based accounting system, these employees can further build one of the most in-demand technology skills for accountants: proficiency with cloud-based financial solutions.