The terms “income” and “revenue” are often used interchangeably. But, for a business, they have totally different meanings. Net income is the profit a business generates, while revenue is the money the business earns. Both concepts are crucial metrics for businesses, but they serve separate purposes. This article explains the different types of income and revenue, how to calculate them and how they can support business decision-making.

Key Takeaways

- Net income is the money that remains from total revenue after a company pays all of its expenses.

- Revenue is the money the company has earned from business activities and other sources before any expenses are paid.

- Net income measures the company’s ability to generate profits, while revenue measures its ability to generate sales.

What Is Net Income?

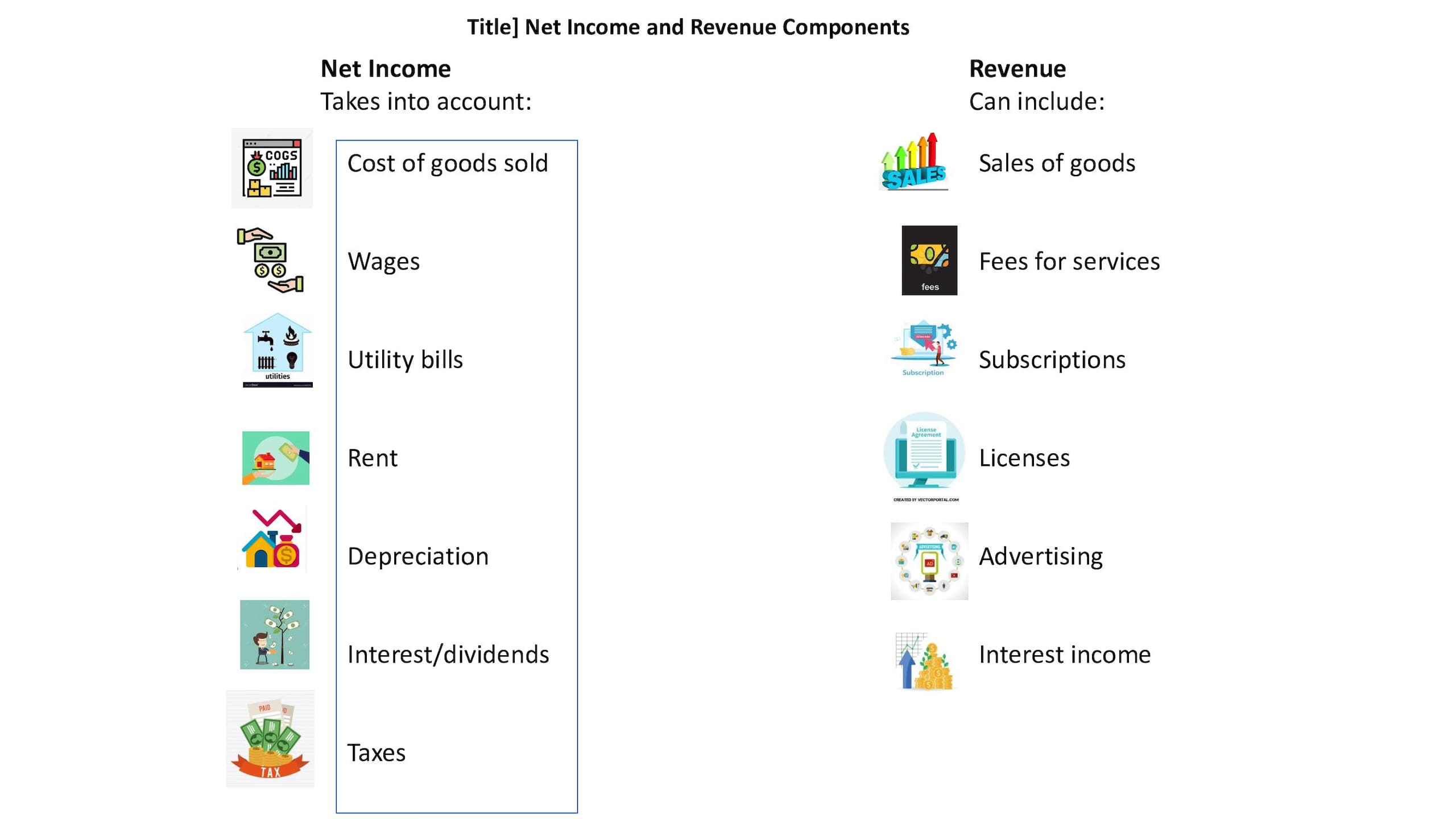

Net income is the amount of money a business has left from total sales/revenue after it pays for all of its expenses, including interest and taxes, at the end of an accounting period. It is also known as “net earnings,” “net profit” and the “bottom line,” because it is reported at the bottom of the income statement. Net income is a key measure of the company’s profitability.

Types of Net Income

The type of net income that a company reports in its financial statements at the end of an accounting period depends on its circumstances. Most companies calculate net income by deducting their expenses (detailed in the next section) from revenue. But if there are large one-off or exceptional items, a company might report “adjusted net income.” And if a company is a holding company or parent of a group of companies, it will report “consolidated net income.”

- Adjusted net income: Adjusted net income is a company’s net income excluding non-recurring costs, such as losses on asset sales; non-cash costs, such as depreciation; and exceptional items, such as disaster recovery. It is used by investors to assess the long-term value of the company.

- Consolidated net income: Consolidated net income is the total net income of all subsidiary companies within a parent company after transactions among the constituent parts are eliminated. Consolidated net income appears on the bottom line of the consolidated income statement in a set of consolidated financial accounts.

How to Calculate Net Income

Calculating net income requires detailed knowledge of business revenues and expenses, both operating and non-operating. Fortunately, the structure of the income statement enables businesses to break it down into several steps. Let’s work through the construction of a basic income statement.

A business starts by calculating gross income, which is net sales minus cost of goods sold (COGS).

| Revenue | |

|---|---|

| Net sales | $3,470,000 |

| Cost of goods sold (COGS) | - $1,350,000 |

| Gross income | $2,120,000 |

Next, the business needs to calculate the business’s operating income, which is the income generated solely from its core business activities. This requires subtracting operating expenses, the depreciation of tangible fixed assets (such as production machinery) and the amortization of intangible assets (such as computer software) from gross income.

| Gross income | $2,120,000 |

| Operating expenses | - $954,000 |

| Depreciation expense | - $4,000 |

| Amortization expense | - $3,000 |

| Operating income | $1,159,000 |

Now, the business can calculate its net non-operating revenues by deducting non-operating expenses — costs not tied to day-to-day operational costs, such as losses on asset sales — from non-operating revenues, and add this to operating income. Some companies report this as the company’s earnings before interest and taxes (EBIT).

| Dividend income | + $500,000 |

| Loss on asset sale | – $250,000 |

| Net non-operating revenue | $250,000 |

| Operating income | $1,159,000 |

| Net non-operating revenue | + $250,000 |

| EBIT | $ 1,409,000 |

Now the business deducts any interest paid on debt.

| EBIT | $ 1,409,000 |

| Interest paid | – $750,000 |

| Pre-tax profit: | $659,000 |

Finally, taxes payable are calculated and deducted from pre-tax profit to arrive at the company’s net income.

| Pre-tax profit: | $659,000 |

| Taxes (20% of pre-tax profit) | – $131,800 |

| Net income | $527,700 |

What Is Revenue?

Revenue is the money that a business generates from sales and other activities. It is reported at the top of the income statement, so is often called the “top line.” Revenue is an important indicator of the company’s ability to attract customers and generate sales. It’s also known as “turnover.”

Types of Revenue

A company’s revenue can come from many sources, but broadly speaking, there are two different types of revenue: the revenue a company earns from sales and revenue derived from other sources. The income statement separates them. When people talk about “revenue” without specifying the type, they usually mean sales revenue.

- Operating: Operating revenue is the money generated from the company’s core business activities. What those business activities are depends on the nature of the company’s business. For example, operating revenue for a retailer would be revenue from sales of goods; for a software company, operating revenue might be revenue from licenses and technical support; for a moneylender, operating revenue would be the interest and fees earned from lending. Gross operating revenue is all the money generated from business activities. Net operating revenue is money generated from business activities after deducting returns, discounts and other sales-related costs.

- Non-operating revenue: Non-operating revenue is the portion of a

company’s total revenue that does not come from its ordinary business activities. It can

include income from investments, gains or losses from foreign exchange, asset sales and

asset write-downs. For a non-financial company, it can also include interest income.

Many non-operating revenue items are non-recurring, such as asset sales and write-downs. But some are recurring, such as interest income. Non-operating revenue and non-operating expenses are reported on the income statement separately from operating revenue and expenses. However, they do form part of net income.

How to Calculate Revenue

The company’s total revenue is its gross or net operating revenue plus non-operating revenue. Calculating operating revenue is straightforward, though it requires the business to keep accurate records of sales, prices, discounts and sales-related costs. Calculating non-operating revenue can be complicated and may require a specialist’s financial expertise, such as when it involves revaluing investments at market price.

To calculate gross operating revenue, multiply the total number of units sold by the unit price. For example, the gross operating revenue for a business that has sold 1,735 units at a unit price of $2,500 would be $4,337,500 (1,735 x $2,500).

However, most companies report net operating revenue, which accounts for price variation due to discounts, returns and refunds. To calculate this, multiply the total number of units sold by the average sale price, not the unit price. For example, if the business above offered a discount scheme for regular customers and seasonal reductions that together resulted in an average sale price of $2,000, its net operating revenue would be $3,470,000 (1,735 x $2,000).

As seen in this example, the difference between gross and net operating revenue ($867,500) can be considerable.

Key Differences Between Net Income and Revenue

Net income and revenue differ in important ways, ranging from the way they are calculated to the factors affecting them. Understanding these differences is key to using them effectively in financial analysis and business management.

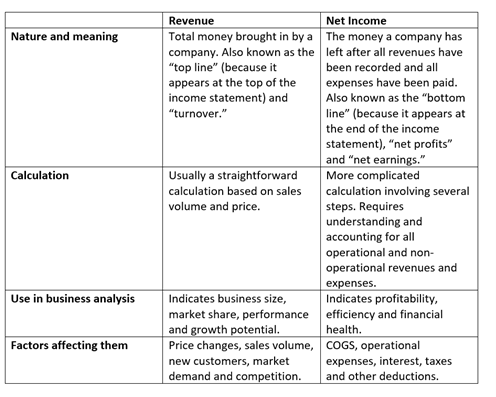

Nature and Meaning

Revenue is the total money that the company has earned from sales and other activities before any expenses have been accounted for. It is the top line on the company’s income statement and the starting point for net income calculations. Net income is how much is left of the money the company has earned — its profit — after all expenses have been accounted for. It is the company’s “bottom line” and determines investor revenues.

Calculation

Calculating operating revenue is straightforward, although, as described above, calculating non-operating revenue is more complicated. Calculating net income can also be complicated and is typically done in several steps.

Use in Business Analysis

Analysts use revenue as an indicator of business size, market share, performance and growth potential. They use net income as a measure of profitability and an indicator of the company’s efficiency and financial health.

Factors Affecting Net Income and Revenue

Revenue is affected by market conditions, customer demand, competition, pricing strategies, sales volume and production capacity. Net income is affected by costs (including COGS), operating expenses, depreciation, gains and losses on investments, interest, taxes and other deductions.

Why Both Metrics — Net Income and Revenue — Are Crucial

Net income is the primary measure of a company’s profitability. It’s the money left over from sales after all expenses are paid. If business managers relied on revenue figures alone, they would have no idea whether the sales they were generating were making profits — and making profits is what doing business is all about.

However, net income is influenced by factors outside a business’s control, such as interest rates and taxes. And it’s prone to sudden swings, due to short-term variation in costs. So, to gain a picture of the longer-term potential of a company, it’s also useful to look at revenue. A rising revenue trend can mean the company has a promising outlook, even if its current profitability is low or even negative. Young companies, particularly, can have low or negative profits but strong revenue growth. As the company matures, revenue growth typically slows but profitability increases.

Common Misconceptions About Net Income and Revenue

Net income and revenue are important business metrics, but they can be easily misunderstood or misused. It’s important for businesses to understand what they really tell us and how they can best be used to support decision-making. Here are explanations of some common misconceptions.

Higher Revenue Means Higher Profitability

High revenue shows the company is good at generating sales. But if its costs are also high, then its profits can be low, despite high revenue. Higher revenue means higher profitability only if costs are low. If costs rise in line with revenue, then profitability remains the same. If costs increase relative to revenue, then profitability falls, even if revenue is rising. Companies that are nearing the limit of their production capacity can find that costs rise faster than revenues; this is known as “diminishing marginal returns.”

Negative Net Income Indicates a Failing Business

When times are hard, companies may see losses. These appear on the income statement as negative net income. But negative net income doesn’t necessarily mean the company is failing. That depends on two other factors: Does the company have sufficient cash flow to meet its obligations, and does the company have sufficient equity (shareholders’ funds) to absorb the losses?

Either of these can mean the company is insolvent, if the answer is no. To determine whether a company is at risk of failing, therefore, analysts need to examine its cash flow statement and balance sheet, as well as the income statement.

Many companies recover from short periods of negative net income. But if negative net income is sustained, the company may become insolvent.

Revenue Is a Comprehensive Indicator of Business Size

Revenue is often used as a simple indicator of the size of a business. However, it’s not the only indicator, and, for some businesses, other measures are better. For example, the U.S. Small Business Administration uses revenue, number of employees and type of business to determine whether a company is a small business. Another measure of business size is total assets as shown on the balance sheet. This is particularly useful for companies whose business involves leasing or deploying assets to earn a return.

Net Income Is the Only Measure of a Company’s Financial Health

Net income measures a business’s profitability, but profitability doesn’t mean the company is financially healthy. Net income is susceptible to sudden swings, due to market conditions and unexpected expenses. A business may suffer serious cash flow problems if revenue suddenly drops, even if it has been profitable. This is particularly true if it has large debts or other fixed obligations. Cash generated from operations and free cash flow are important additional measures of financial health, as are balance sheet ratios, such as the current ratio (current assets/current liabilities), debt-to-assets ratio (debt/assets) and debt-to-equity ratio (debt/equity).

Revenue Growth Always Indicates Business Success

Revenue growth can be a good indicator of a business’s potential, but relying on it presents some pitfalls. First of all, revenue growth is affected by pricing. Overpricing relative to competitors can increase revenue in the short term, but, if sustained, will mean a smaller market share and, eventually, lower profits as customers drift away. Conversely, underpricing relative to competitors can build market share, but doing so can come at the expense of profits.

Revenue growth is also affected by market conditions and changes in consumer preferences. For example, the rise of online shopping has increased the revenues of online retailers, but it has negatively impacted the revenues of shopping malls. Finally, revenue growth also does not account for business costs and debt service, which can significantly alter a business’s bottom line, even if revenue growth is strong.

Net Income Reflects Cash in Hand

Operating revenue is recorded when it is earned, not when it is received. And non-operating revenue includes non-cash items, such as unrealized foreign exchange gains. Depreciation and amortization are also non-cash items, as are some non-operating expenses, such as losses on asset write-downs. Consequently, net income can differ substantially from the amount of cash the company has in hand.

Cash in hand is recorded both on the balance sheet, as a short-term asset, and on the cash flow statement.

All Expenses Are Deducted Directly From Revenue to Get Net Income

The income statement is carefully structured to separate out the different types of revenue and expenses. So, although net income does include all revenue and expenses, it’s not true to say that all expenses are deducted directly from revenue. Here is how it works:

- Gross or net operating revenue is the top line of the income statement.

- COGS and operating expenses are deducted from gross or net operating revenue to calculate operating profit.

- Interest payments, depreciation and amortization are then deducted from operating profit. Any non-operating revenue net of non-operating expenses is also added at this point. This gives net earnings before interest and taxes (EBIT).

- Finally, taxes are deducted from EBIT to give net income.

Companies With Similar Revenues Have Similar Business Models or Operations

Businesses from different industries typically have very different business models. Even within the same industry, businesses can have different corporate structures and operating models. A company’s revenue doesn’t reveal anything about its business model. Rather, it reflects the company’s position in the market, the quality of its products and services, and the strength of its management.

Example of Net Income vs. Revenue

Here’s an example of net income and revenue for a hypothetical company named Westcliff Retrofit, which designs and installs energy-efficiency schemes for residential and community buildings. It earns revenue from design and project management services, as well as from product sales. Calculations and the resulting income statement are based on the same dollar amounts used to calculate net income and revenue earlier in this article.

2022-23, Westcliff Retrofit sold 1,735 units of product at an average price of $2,000. Multiplying 1,735 by $2,000 gives a net revenue of $3,470,000.

Westcliff Retrofit’s cost of goods sold in 2022-23 was $1,350,000. In addition, the company rents premises for $10,000 per month and employs 10 people earning an average annual salary of $75,000. Utility bills are $5,000 per month, and other expenses average $2,000 per month. Operating expenses are, respectively: $120,000 + $750,000 + $60,000 + $24,000 = $954,000.

The company depreciates its computer equipment and other machinery on a straight-line basis over five years. Its depreciation expense is $4,000 per annum and its amortization expense is $3,000.

The company has taken minority equity stakes in some of its suppliers, from which it receives dividend income. It recently divested a product line, due to changes in environmental standards, and sold the production machinery at a loss.

Here is Westcliff Retrofit’s income statement for 2022-23:

| Revenue | |

|---|---|

| Net sales | $3,470,000 |

| Cost of goods sold (COGS) | $1,350,000 |

| Gross income | $2,120,000 |

| Operating expenses | $954,000 |

| Depreciation expense | $4,000 |

| Amortization expense | $3,000 |

| Operating income | $1,159,000 |

| Dividend income | $500,000 |

| Loss on asset sale | $250,000 |

| Net non-operating revenue | $250,000 |

| Interest Paid | $750,000 |

| Pre-tax profit | $659,000 |

| Tax payable | $131,800 |

| Net income | $527,200 |

Streamline Your Financial Statements With NetSuite Financial Management

There is no overstating the importance of financial statement accuracy. Used by business managers, investors, lenders and compliance agencies alike as a foundation for a multitude of strategic decisions, financial statements — including the income statement, balance sheet and statement of cash flows — paint a picture of a company’s profitability, net worth and liquidity/solvency. With NetSuite’s Cloud Accounting Software, businesses can be assured that they’re working with the most precise real-time data to confidently monitor their top and bottom lines and keep their finger on their companies’ financial health, profitability and market share. This software solution handles all of the steps in the accounting cycle, from identifying, recording and posting transactions to the creation of the financial statements and the closing of the books for an accounting period. The software also calculates critical financial metrics, including profitability ratios, and automates many time-consuming and error-prone manual accounting tasks, freeing staff for higher-level analysis.

Revenue and net income are perhaps the two most fundamental metrics for a company. Revenue measures the company’s ability to generate sales, which is an important indicator of business size and a crucial driver of future growth. Net income measures the company’s efficiency and profitability. Both measures can be misleading if used alone, but in conjunction with other indicators, they can give managers, analysts and investors a clear picture of the financial health and growth potential of the businesses they’re examining.

Net Income vs. Revenue FAQs

Is net income and revenue the same?

Net income and revenue are not the same. Revenue is the total money that the company has earned. Net income is what is left of that money after all expenses have been paid.

Is net income or revenue better?

Net income and revenue are equally important metrics for business managers. Net income measures the company’s profitability and is an indicator of efficiency and financial health. Revenue measures the company’s ability to generate sales and is an indicator of business size and potential growth.

Is net income part of revenue?

Net income is what is left of revenue after all expenses have been paid.

Why is revenue higher than net income?

Revenue is always higher than net income because expenses are deducted from it to calculate net income.

What is the difference between income, revenue and profit?

Net income is revenue minus expenses. It is the same as net profit.