Healthcare professionals face many unique challenges, not the least of which is ensuring that they have everything they need to effectively treat their patients. Planning and allocating funds and resources is difficult under the best of circumstances, but with the World Health Organization expecting a 10 million healthcare worker shortfall by 2030, budgeting is more important than ever. But how a healthcare organization budgets can have a huge impact on more than just the facility itself, affecting staff, patients and the larger community as well. Decision-makers and healthcare financial professionals must understand the ins and outs of the budget process and take great care at each step, from planning the budget to tracking performance and making adjustments when needed.

What Is Healthcare Budgeting?

Healthcare budgeting, like budgeting in other industries, plans and distributes financial resources over a set timeframe, often a month, quarter or year. The budgeting process includes estimating revenue and expenses and setting financial objectives that align with the organization’s overall strategic goals. Once completed, the budget acts as a road map, guiding the organization’s financial undertakings and informing decisions. Effective budgets in healthcare focus on more than just numbers, as funding decisions must empower healthcare providers to deliver top-quality care to patients while preserving financial viability. This is especially important for hospitals and other large healthcare providers, as resources are often limited and demand for services is high. To meet this challenge and effectively allocate these resources, budgets must be regularly analyzed and adjusted as new medical standards and public health needs arise, and healthcare professionals must prioritize investments in new equipment and best practices when they become available. Overly rigid or shortsighted budgeting can leave hospitals unprepared to meet patients’ needs, a dangerous risk for any healthcare organization.

Key Takeaways

- Budgeting helps healthcare organizations effectively plan and track revenue and expenses by allocating limited resources and funds to reduce waste and better serve their patients and communities.

- Healthcare professionals use several budget types, including operational, capital and rolling budgets. Each serves a unique purpose, including planning day-to-day costs, purchasing equipment and regularly updating financial projections.

- The healthcare industry faces unique challenges in budgeting due to the unpredictability of demand for services and resources. Adopting flexible and agile budgeting methods that can be recalibrated as results are recorded and circumstances change is essential to meeting patient demand.

Healthcare Budgeting Explained

Healthcare budgeting is a dynamic process, demanding both strategic foresight and meticulous attention to detail. Balancing effective, compassionate patient care and financial sustainability pose a formidable challenge for healthcare financial professionals, and detailed budgeting acts as a compass for departments, managers and staff to follow. The budgeting process should be deliberate and take a big-picture approach, starting with strategic planning and forecasting, where the organization’s goals are outlined to inform the rest of the process. Even after the budget is finalized and implemented, regular monitoring of revenue and expenses is critical to ensure adherence and to make necessary adjustments, such as those caused by an unexpected resource scarcity, public health crisis or change to insurance guidelines and procedures.

Healthcare budgeting is an ongoing process, with thorough reviews and analyses conducted during and after the financial period to assess the budget’s effectiveness and to refine the subsequent budgeting cycle. Over time, a detailed record of budget accuracy — or an analysis of where and how estimates went wrong — helps inform future decisions, strategies and, of course, budgets. This robust process helps healthcare professionals maintain high standards and readiness without incurring losses or cash deficits.

Healthcare Budgeting vs. Budgeting in Other Industries

Healthcare budgeting presents a unique set of challenges that set it apart from other industries, including unpredictable pressure from new or evolving public health issues, changes to insurance processes, the emergence and implementation of new technologies and escalating costs. According to the American Hospital Association (AHA), hospital expenses increased by 17.5% between 2019 and 2022. Unlike other industries, patient demand is not always directly determined by customers’ preferences but, rather, is typically based on externalities that dictate needs, such as required medications, surgery after an accident or other services that patients urgently require, often unexpectedly. This volatility is less prevalent in other sectors, where demand can often be forecast with greater accuracy.

After services are performed and/or goods are sold, a healthcare organization’s accounts receivable are apt to encounter additional challenges not found in other industries, such as specific billing regulations and unique workflows for different insurance providers. For example, healthcare providers in regions with government-funded, single-payer insurance systems will likely have different protocols from organizations that work with many insurance providers, all with their own potentially different billing protocols and payment cycles. These differences require more flexibility than other industries face when budgeting and estimating future cash balances and incoming revenue calculations.

Hospital Cost Structures and Fee-for-Service Payments

Hospital costs are divided into two categories: fixed and variable. Fixed costs are the same, regardless of the number of patients treated — think rent, administrative costs and equipment depreciation. Variable costs fluctuate from period to period and include supplies, medications and labor costs — the last of which can vary significantly from overtime and additional staffing costs during busy periods, especially during labor shortages. Fixed costs are easier to budget for, as they do not change from one financial period to the next. Variable cost estimations can be informed by prior budgets and forecasts and are often aided by forecasting tools integrated into a larger business platform, such as an enterprise resource planning (ERP) system.

Traditionally, when accounting for revenue, hospitals have followed a fee-for-service model, in which they are compensated for each service or procedure performed. This incentivizes provision of a higher volume of services to increase revenue. But recently, many hospitals have begun prioritizing value-based care or bundled services to avoid unnecessary procedures. These hospitals hope to reestablish an emphasis on enhancing patient outcomes while reducing costs, even if it reduces overall revenue. However, hospitals must strive to strike a balance between these two cost structures, as the fee-for-service model gives doctors and providers flexibility as to which services they recommend, rather than relying on bundled procedures, and holistic and bundled services can avoid excessive costs and unnecessary testing, procedures and stress for patients. The balance that a healthcare organization achieves between these cost structures must be explicitly communicated and understood by both the medical staff and the financial team. If not, the uncertainty surrounding medical-decision protocols could complicate the budgeting process for supplies, expenses and revenue, leading to inaccurate forecasts and potential difficulties for decision-makers.

Importance of Healthcare Budgeting

Healthcare revenue and costs can be highly variable, and budgeting is important to ensure that each department has the funds it needs to provide high-quality care for its patients. On the revenue side, funds can come from taxes, insurance, patient payments, grants and private donations, and tracking these sources and determining how reliable they will be in the future is critical to informing future revenue estimates. Costs, on the other hand, can vary greatly from patient to patient, even when similar services are provided. For example, two patients may have the same knee surgery, but their recovery timeline and associated costs may be very different. Additionally, insurance differences between the two patients may lead to a disparity in compensation, both in time and amount.

Because of these factors and more, healthcare organizations must carefully allocate their resources and budget their funds to avoid a cash crunch when patients need supplies and services, especially during times when delays could cause real harm. Comprehensive budgeting also allows managers and accounting teams to track performance over time to set future budgets more accurately and ensure that shortfalls are addressed and improved for the next period. This gives staff the ability to help people in need more effectively and avoid dangerous delays, a particularly critical requirement for organizations providing emergency or intensive care services.

Healthcare Budget Types

Healthcare organizations typically use a combination of three primary budgets: operational, capital and rolling. All three budget types are used to distribute resources, anticipate costs and ensure high-quality patient care, but understanding the differences among them, and knowing when to rely on which, is essential for decision-makers navigating the financial intricacies of healthcare institutions.

1. Operational Budgets

Operational budgets outline the day-to-day revenue and expenditures necessary to maintain normal business operations. These budgets form a comprehensive financial structure used to estimate future financial periods, and they include recurring revenue sources, such as regular insurance and customer payments, and costs like staff compensation, medical supplies, utilities and more. Due to the unpredictable nature of healthcare, operational budgets need to factor in the potential flux of patient needs and strike a balance between cost-effectiveness and resource availability. This balance will vary among organizations, depending on regional health trends, population size, medical specializations and other factors. Regular scrutiny and fine-tuning of the operational budget help healthcare providers adapt to shifts in patient influx, staffing requisites, medical supply costs and other variable expenses. Through detailed analysis of operational budgets, often occurring monthly, healthcare organizations can maintain financial health while delivering consistent care for their patients.

2. Capital Budgets

Capital budgets focus on investments in long-term assets, such as state-of-the-art medical equipment, advanced technology upgrades and infrastructure enhancements. These assets yield value over an extended period and help healthcare organizations keep up with the latest medical standards and technology. This proactive approach not only empowers healthcare providers to deliver superior patient care but also fortifies competitive standing in the healthcare sector. Capital budgets must also anticipate challenges, such as the substantial costs and compliance requirements associated with medical equipment and infrastructural upgrades, while also weighing potential risks and benefits of new equipment and procedures. Potential returns on investment, both financially and from improved patient care, should be carefully assessed and compared with overall strategic objectives.

While capital budgets are separate from day-to-day finances, they inform the funding available for operations. If a healthcare organization overexerts its capital expenditures, a cash deficit might ensue that can impact patient care before the new long-term assets have had a chance to recoup their costs. Therefore, ongoing review and recalibration of the capital budget is essential to help healthcare organizations adapt to the evolving landscape of technology, patient needs and the healthcare sector at large. By doing so, they can optimize their resources to serve their patients without overextending themselves or investing in untested or unrelated technologies that can hurt the standard of care and strain resources.

3. Rolling Budgets

Creating and managing budgets can be a time-consuming process, and any lag between data collection and implementation can create problems and lead to funding gaps and inaccuracies. Many healthcare organizations use rolling budgets to make budgeting a more regular and fluid process, rather than a set-in-stone annual document. To do this, accountants and managers establish budgets for a set period in the future, usually 12 to 15 months, and then recalibrate the budget at regular intervals, typically monthly or quarterly, and add new financial forecasts on the back end.

For example, say a hospital began the year with a 12-month budget from January 2023 to January 2024. Then, at the end of the first month, it analyzed the budget and examined how closely it aligned with reality, granting an opportunity to make adjustments from February 2023 through January 2024, as well as a chance to draft a more accurate February 2024 budget. The hospital can follow this process month after month to continually map out the year ahead and maintain a reasonable way to make smaller adjustments over time, while folding in new technology and healthcare developments, rather than having to build an entirely new budget from the ground up when 2024 rolls around.

Benefits of Creating a Hospital Budget

Effective budgeting does more for healthcare providers than just plan and track earnings and spending, though that is a worthwhile benefit on its own. By fully understanding all the benefits that detailed budgeting can bring, healthcare providers can get the most out of their budgets, seize potential opportunities, mitigate risks and build success. Here are some of the areas that budgeting can help optimize:

-

Financial control and management:

A comprehensive hospital budget allocates how funds will be used. For instance, it can delineate personnel compensation, medical supplies, equipment upkeep and other operational expenditures and compare these costs with revenue projections. This transparency enables healthcare organizations to vigilantly monitor and regulate spending, while revealing areas to reduce waste. If a budget review uncovers a disproportionate allocation of funds toward outdated equipment, for example, it could trigger a strategic shift toward investing in more efficient technology.

-

Allocation of resources:

Budgets help healthcare organizations allot funds and other resources, such as medicines. This helps ensure that every department is fully equipped to meet its patients’ needs, including distributing general supplies (masks, gloves, etc.) throughout the organization and replacing medical equipment as needed. Without the transparency gained through detailed budgeting, healthcare organizations risk wasting resources on unneeded equipment and falling short on supplies, leaving staff unprepared to serve patients or unprotected from contagious illnesses.

-

Planning and forecasting:

Hospital budgets establish a comprehensive financial road map by outlining anticipated revenue and expenses and providing a clear framework for managers to follow. Healthcare providers can use budgetary projections to improve financial forecasts, determine the feasibility of potential strategies and allocate the resources needed to implement these plans. With detailed budgets, healthcare organizations can more effectively plan contingencies and mitigate the risks associated with the unpredictability of the healthcare industry.

-

Performance evaluation:

Regular monitoring of actual performance against budgeted figures helps inform financial plans and improve forecasts, often with the aid of accounting software and ERP platforms with real-time data capabilities. Budgets help track trends in key performance indicators (KPIs), such as cost per patient, patient volume, financial returns on investment (ROI) and any other relevant financial metrics. Consistently underperforming areas or inaccurate forecasts should be analyzed in greater detail to find where estimates went wrong and what can be done to minimize these errors in future budgets.

-

Communication and coordination:

Hospital budgeting can foster a culture of open communication and coordination across various departments by involving different stakeholders in the budgeting process, including managers, accountants and top-level decision-makers. This encourages honest dialogue among collaborators about resource allocation, strategic goals and financial constraints, and helps promote a shared understanding of the hospital’s overall strategic direction, goals and limitations. As a result, managers feel heard during the budgeting process and decision-makers gain key insights from staff who will be directly affected by budgeting decisions. Clear budgets also help ensure that all parties are on the same page and understand how to track performance and identify when course corrections are necessary.

-

Accountability:

Detailed budgets will likely include a framework for resource allocation that lists specific departments or teams in charge of implementation and management of funds, supplies and equipment. By explicitly stating these financial goals and expectations, staff can clearly see what they’re accountable for, and supervisors can track progress and quickly identify any problems or areas that are not meeting expectations. Additionally, many hospitals also rely on grants to fund operations, which come with specific criteria on how funds can be used. Regular budget reviews, by both staff and supervisors, can help identify shortcomings early, before projects are off-budget or out of line with grant requirements and unable to be corrected. And if discrepancies do occur, teams will have the opportunity to justify the changes and collaborate to prevent these variances in future budgets.

-

Strategic decision-making:

A well-structured hospital budget provides a clear overview of an organization’s financial health, enabling leaders to make informed decisions about resource allocation, investments, cost-cutting measures and more by identifying areas for growth and potential risks. By continuously monitoring actual financial performance against budgeted figures, healthcare administrators can make real-time adjustments to their strategies and track how those changes impact revenue, costs, patient outcomes and other relevant metrics. Decision-makers can rely on budgets to ensure that financial resources are optimally deployed in support of their organizations’ long-term vision, while maintaining financial health.

-

Compliance and reporting:

Healthcare financial statements are typically standardized and formatted to accommodate relevant accounting standards, such as Generally Accepted Accounting Principles. Budgeting helps healthcare organizations adhere to standards and deadlines for monitoring and reporting on financial data, including revenue from government entities such as Medicare and Medicaid. Budgets can also simplify audits, both for internal analysis and from external regulatory bodies, by showing cost and revenue breakdowns and exactly how funds were spent. Additionally, budgets align financial operations with legal and ethical standards by letting healthcare professionals set financial priorities, and they help avoid compliance breaches, legal challenges and financial penalties. By building compliance into budgeting from the start, healthcare professionals can focus more on helping patients and improving operations, rather than preparing for audits and double-checking the books.

-

Financial stability and growth:

Effective budgeting improves both short-term stability and long-term growth prospects through setting goals and limits for expenses and by optimizing how funds are split between day-to-day obligations, such as wages and supplies, and investments in long-term assets, such as facility expansions, equipment repairs and technology. Without proper budgeting to emphasize this balance, providers are more likely to experience supply scarcity or outdated and broken equipment, ultimately causing reputational harm due to poor or unreliable patient care.

Factors That Affect Hospital Budgets

Navigating the intricate landscape of hospital budgets requires a keen understanding of the myriad factors that shape them, from fluctuating patient volume and reimbursement rates to inflation and other macroeconomic forces. Juggling these factors, and many more, is fundamental to effective budgeting, and hospitals must consider the extent to which these factors affect delivery of top-tier care, even as they secure solid financial footing. Below are 11 of the most common factors that affect hospital budgets.

-

Patient volume and mix:

Patient volume — the number of patients a hospital caters to — is one of the biggest factors impacting a hospital’s budget, whether it’s a matter of high volumes stretching resources thin or low volumes causing resource underutilization and costly waste. The variety of patient cases pertaining to age, health conditions and insurance coverage, known as patient mix, also carries its own cost implications and influences reimbursement rates, as patients will likely need different treatments and have diverse ways to pay for it. Tracking trends in patient volume and mix over time can help increase forecast accuracy, but hospitals must still follow public health news and retain some flexibility to be able to meet patient demand.

-

Reimbursement rates:

Reimbursement rates dictate the compensation a hospital receives for each service rendered and are defined by insurance providers and government programs, such as Medicare and Medicaid. These rates change over time and can be affected by several variables, including the type and location of the prescribed service and the patient’s insurance plan. These fluctuations can significantly affect a hospital’s revenue by changing payment amounts and timing as costs continue to accrue. Hospitals must stay current with the latest rate changes to recalibrate their budgets as needed and maintain financial stability to ensure that they have the funds necessary to cover operations and capital investments.

-

Staffing costs:

Staffing costs include the salaries of doctors, nurses and administrative personnel, but also include indirect labor costs, such as benefits, training and recruitment expenses. According to the AHA, labor expenses typically account for roughly half of a hospital’s budget. Some hospitals may have predictable staffing expenses, but many healthcare organizations experience large swings in these costs because of overtime and temporary staffing during peak patient-volume periods. In fact, the AHA says labor costs for hospitals increased by 20.8% between 2019 and 2022, primarily due to a greater reliance on contract staffing agencies. The balance between a well-staffed hospital that can meet demand and manageable labor costs can be improved by a budget that tracks outcomes based on key measures, such as staff-to-patient ratios and productivity.

-

Inflation:

Inflation — a surge in prices alongside a decrease in a currency’s purchasing power — can strain a hospital’s budget as the prices of goods and services rise faster than revenue. High inflationary periods touch every aspect of hospital operations, from supply costs and utility bills to labor pressures as staff seek wage increases to compensate for the decrease in their own personal purchasing power. If a hospital doesn’t adjust its budgets to meet these higher costs, it may be left with shortages —in both supplies and labor. To meet these inflationary challenges, hospitals must monitor macroeconomic trends, carefully choose investments when expanding or purchasing assets, and regularly review and adjust their budgets, even when operations seem to be running smoothly.

-

Supplies and medical equipment:

The procurement and management of supplies and medical equipment encompass everything a hospital needs in order to deliver high-quality healthcare, from commonplace items like gloves to high-value machinery, such as MRI scanners. Supply and equipment costs are influenced by order size, market demand, supply chain issues, new innovations and pricing changes. Additionally, hospitals must monitor equipment performance, as well as any new technological advancements, to more accurately budget repair and replacement costs. Each hospital will arrive at a different balance between cost and preparedness, but regular monitoring and budget recalibration for both routine supplies and major equipment are essential to prevent unexpected financial strain, yet ensure high-quality care.

-

Technology and medical advancements:

Technology and medical advancements can affect budgets in complex ways, as they often raise short-term expenses but can also elevate patient care standards and reduce long-term costs by increasing efficiency, improving diagnoses and optimizing operations. Because medical breakthroughs can happen quickly, new equipment and personnel training are typical features of a hospital budget, but new medical technology often comes with a high price tag that may not be clear until it hits the market — often long after the budget has been set. Additionally, it may take some time for patients to become comfortable with new advancements and techniques, making the ROI on these assets difficult to calculate in the short term. Therefore, hospitals must maintain some budgetary flexibility when considering new technology, even when these advancements will likely bring long-term benefits.

-

Capital expenditures:

Capital expenditures are an important part of a hospital’s long-term sustainability because they represent investments into long-term assets that enhance or sustain the quality of healthcare services through the acquisition of new infrastructure, comprehensive renovations and new medical equipment. Given the considerable, and often ongoing, financial commitment these purchases require, they can have a significant impact on budgets. When budgeting for capital expenditures, healthcare financial professionals should assess potential ROI, the hospital’s current financial health, the anticipated influence on patient care and the timing of when the investment will take place. While hospitals may be inclined to focus on surviving the current financial period, these future-focused investments are crucial for long-term success as they maintain the hospital’s competitive standing and improve patient care.

-

Regulatory compliance costs:

Regulatory compliance costs stem from the necessity to meet regulations and standards set forth by multiple regulatory bodies, including standards governing care and proper billing procedures. These regulations aim to protect patients and uphold a requisite quality of care. Compliance costs include expenses for staff training, system enhancements, IT security and audits. With the evolving landscape of healthcare regulations, these costs can vary from one financial period to the next, so healthcare providers must carefully track any upcoming changes and incorporate them into recalibrated and future budgets. Noncompliance can lead to more than financial or legal penalties; it can also do reputational harm and erode public trust in a healthcare provider.

-

Community health needs:

Hospitals don’t operate in a bubble and neither do their budgets. Hospitals must consider the demographic and socioeconomic attributes of their surrounding community to effectively budget and allocate resources to meet their needs. For example, a hospital located in an area with a sizable elderly population will likely need more funds allocated to geriatric care than a hospital frequented by younger patients. Similarly, hospitals in areas with low-insured populations will likely have different revenue streams and reimbursement schedules than hospitals primarily dealing with insurance companies to collect payments. Hospitals can better plan their services and resources by analyzing community data, conducting community outreach and collecting feedback to see how they can meet their community’s unique needs. This can both improve the hospital’s reputation and create a more reliable budget for future periods.

-

Economic conditions:

The overall economic landscape can hit a hospital’s budget in major ways, from rising prices to surges in unemployment rates. Downturns in the economy can increase the number of patients who are uninsured or unable to pay but are still in need of medical care, which can exert significant pressure on hospital resources that may not be recouped in revenue. On the other hand, a thriving economy can increase the demand for elective or more advanced procedures, which can boost revenue. Such macroeconomic trends can be complex, as heightened revenue may also lead to inflated costs for supplies and labor. Hospital financial specialists must adapt their budgets regularly, deliberately and with great care, and not defer to a one-size-fits-all approach that is based on a small number of economic indicators.

-

Public health:

Unforeseen public health events, such as pandemics or natural disasters, can trigger a spike in the need for medical services and resources, which may or may not have been budgeted for. For example, during the COVID-19 pandemic, a sharp increase in demand for personal protective equipment (masks, gloves, gowns, etc.) left many hospitals undersupplied for critical supplies, and it took months for the supply chain to catch up and meet demand. Shifts in public health policies, such as government-regulated pricing for some medicines, can also influence healthcare budgets. To keep up with these shifts, many healthcare organizations bring policy experts into the budgeting process to help align the hospital’s priorities with those of the larger health sector. Through this collaboration, hospitals can more effectively allocate their resources to address both current and emerging healthcare challenges, helping to mitigate risks and minimize the impact of public health shifts on financial health.

Impacts of Hospital Budgeting

As much as healthcare financial professionals must monitor external market forces to effectively create and recalibrate their budgets, they must also consider how their budgeting decisions can influence trends in the larger healthcare industry. As stated in Sir Isaac Newton’s third law of motion: “For every action, there is an equal and opposite reaction.” Failure to consider the implications of this law when budgeting could be detrimental to patients, healthcare facilities, the larger community and even the country. Let’s take a look at the potential impact of hospital budgeting on various entities.

- On patients: Budgeting decisions have a direct impact on the patient experience, informing patients’ encounters with the healthcare system, as well as the tangible outcomes of their treatment. Effective budgeting can elevate patient care, increase patient satisfaction and enhance health outcomes. But even when resources are scarce or funds are tight, hospitals must provide the best care possible and ensure that patients know that their needs will be met. Hospitals must be transparent from the get-go, offering a realistic timeline on when and how they will be able to provide the necessary services. If a hospital is unable to meet patients’ needs, outcomes are likely to suffer and patients may seek care elsewhere (or not at all), hurting the hospital’s long-term success and potentially harming patients’ overall health. Because of this, budgets must always prioritize patient safety and care quality, even in the face of financial constraints.

- On the healthcare facility: Hospitals must distribute resources across many departments, and budgets set priorities by determining what percentage of a hospital’s limited resources each department will receive. These allocation decisions can impact the organization’s performance and staff morale, and are especially important during volatile economic times, such as during supply chain disruptions and inflationary periods, which can increase costs and reduce stock levels. Hospitals must consider their unique circumstances, when setting budget targets, by assessing what they do well and how best to allocate resources. This strategy is often applied to both operational and capital budgets, as hospitals can improve their standing by investing in state-of-the-art equipment that can enhance their competitive edge. For example, a hospital with the best neonatal care in the region may choose to emphasize that department’s needs over other fields of medicine by investing in advanced NICU instruments to maintain its “best in the region” status.

- On the community: Budgeting decisions affect more than just the hospital itself, extending into the wider community. By budgeting for community outreach and marketing strategies focused on awareness and preventative care, hospitals can raise the overall health of a community without accruing the costs of surgeries and procedures. Hospitals can also budget for reduced-rate or uncompensated services by increasing funding for procedures or equipment that make care more accessible and affordable for underserved — and often underinsured — segments of the local community. Strategies emphasizing preemptive care can help reduce the impact of community health problems on a hospital’s budget when outbreaks and other widespread health issues occur. For example, getting ahead of the flu early, by promoting an annual vaccine campaign, can reduce the number of patients needing hospital beds. But these campaigns must be properly planned and implemented, which typically requires budgeted funds and assigned staff, before they can make a real difference in the community.

- On the country: The relationship between hospital budgets and our larger economy goes both ways, with local budget decisions impacting the national landscape and broader market forces in major ways. Local budgets contribute to overall national healthcare costs and outcomes, and they inform national policies since local doctors are often the first stop for patients with questions regarding national policies and healthcare standards. Additionally, during periods of resource scarcity or skyrocketing costs, government-controlled regulations may set price limits or exert control over the supply chain, as they did during the COVID-19 pandemic to coordinate the distribution of tests and vaccines and overcome supply chain bottlenecks. Front-line healthcare providers worked in tandem with oversight organizations to make budgeting decisions, which, in turn, both influenced how these resources were distributed and informed national policy regarding the virus’s spread and community guidelines.

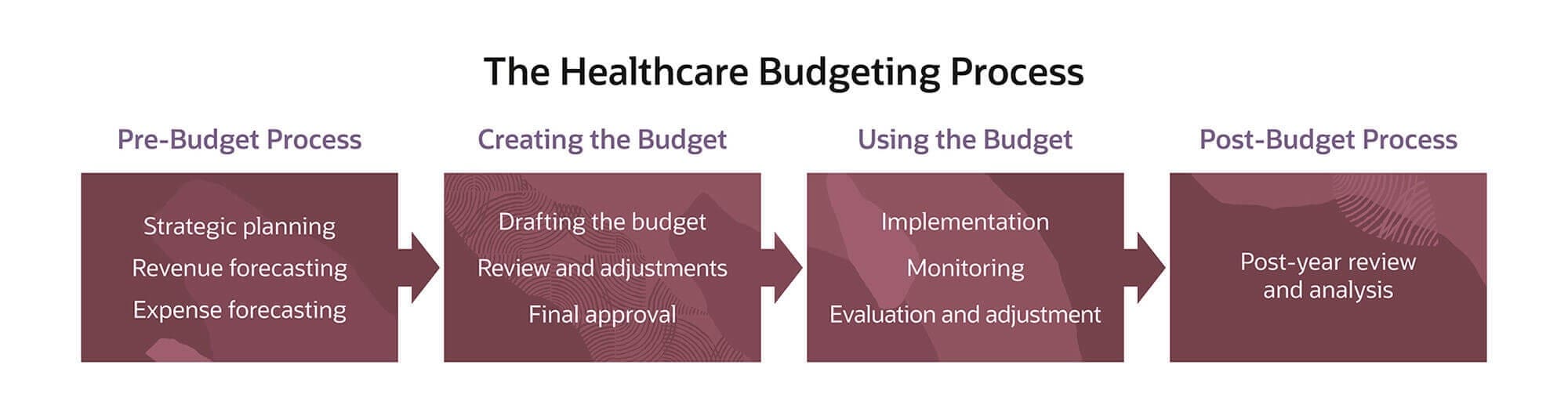

Healthcare Budgeting Process

The healthcare budgeting process is more than just taking funds from one column and allocating them to another. Effective budgeting requires deliberate planning, adjustments and monitoring, based on hard data and detailed forecasts, often achieved with the help of accounting or integrated ERP software. Understanding each step of this process helps accountants and healthcare financial leaders make the most of their budgets and create a more realistic and accurate road map for healthcare professionals to follow. Here are the 10 key steps involved in the healthcare budgeting process:

1. Strategic Planning

Before the budget is drafted, a healthcare organization must establish its broad goals and objectives to inform future budgetary decisions. The planning phase should include an analysis of the organization’s financial well-being and operational efficacy, as well as the trends, challenges and opportunities in the larger healthcare environment. This helps keep the budget realistically focused on achieving real goals that align with the organization’s overall mission.

2. Revenue Forecasting

Revenue forecasting is a pivotal step because it estimates the income that will fund the rest of the budget. These forecasts, often compiled by sophisticated data analysis software and/or financial experts, are based on a meticulous analysis of historical data and current or expected trends. Many hospitals have diverse revenue streams and must account for patient fees, insurance reimbursements, government funding, donations, grants and any additional sources of income. Accuracy at this stage is critical, as revenue overestimation can lead to cash shortfalls, and underestimation can lead to wasteful surpluses.

3. Expense Forecasting

On the other side of revenue are expenses, generally compartmentalized into fixed costs — salaries, rent, etc. — and variable costs that fluctuate as services are performed, such as medical supplies. While expenses, like revenue, are based on historical data, trend analysis and market shifts, they will often include a safety net to help meet demand spikes and account for potential, unforeseen expenditures, such as public health crises or significant alterations in regulations. During budget performance reviews, any unspent safety funds can then be reallocated to appropriate places at the end of the year, such as to bonuses or capital expenditures. Expenses should be monitored and adjusted throughout the budgetary period, as underestimating expenses can result in budget shortfalls and resource scarcity, while overestimation can leave funds idle that could have been productively deployed elsewhere.

4. Drafting the Budget

Once the planning and forecasting stages are completed, the budget can be drafted. This step links expected revenue with expected costs to show where funds will come from and where they will go. Collaborators from different departments can present detailed proposals at this stage to help balance the budget and ensure that everyone gets the funds they need to effectively meet patient demand and cover all necessary expenses in line with the organization’s overall strategic goals.

5. Review and Adjustments

After the overarching budget draft is prepared, it’s sent to decision-makers for review and fine-tuning to ensure that it’s achievable and that it supports the overall financial well-being and performance standards of the organization. Through a detailed review and adjustment process, diverse stakeholders hone the budget to precision for accuracy and effectiveness before finalization and implementation. This stage also takes into account any big-picture shifts in the industry or internal organization that might inform budget strategies and alterations.

6. Final Approval

Following rigorous review, the budget is finalized and approved by all relevant parties and prepared for implementation. It’s important to keep in mind that even after the final approval, the budget remains a living document and should be regularly monitored, analyzed and adjusted to ensure that it retains its efficacy and adaptability in the face of evolving financial conditions.

7. Implementation

In this phase, the budget is disseminated to all pertinent departments and personnel that will be responsible for implementing the budget and ensuring that it’s properly followed. All accountable parties must fully comprehend their role within the budget framework and how it shapes their daily operations, as small misunderstandings can have ripple effects throughout the budgeted period and beyond.

8. Monitoring

Budgets are rarely perfect and require regular monitoring to assess what’s on track, what needs recalibration and what lessons the healthcare organization can learn from both scenarios to improve future budgets. Monitoring requires detailed examination of financial reports to compare actual revenue and expenses against the budgeted figures to pinpoint any deviations. Small variations can inform proactive adjustments, while significant discrepancies signal that an issue should be further examined and addressed. Monitoring typically requires tracking and analysis of KPIs, such as inventory levels, outstanding insurance reimbursement timelines and uncompensated care costs.

9. Evaluation and Adjustment

After any budget deviations are identified, analysts should delve into the underlying reasons behind these discrepancies to pinpoint root causes, not symptoms. These problems may require only a simple fix, such as reallocating a handful of resources from a fully stocked department to a struggling hospital wing. However, major errors may require a deeper reassessment of strategic goals, such as a major investment into new equipment to create a more efficient way to deliver complex patient care. Accurately planned and implemented budgeting triumphs are also worth evaluating, as the steps that led to their success may be replicated across the organization.

10. Post-Year Review and Analysis

Even after the budgeting period is over, healthcare financial professionals can still learn valuable lessons from their budgets. They can study any incremental analysis conducted throughout the period to determine what impact mid-period changes had and if they were successful in course-correcting discrepancies, which can inform the planning of and adjustments to future budgets. Additionally, a big-picture look at the entire budgeting period can spotlight areas where revenue or costs spiked or dipped unexpectedly to help prepare for future outliers. Over time, this cyclical process of planning, implementing, monitoring, adjusting and reviewing budgets refines the precision of healthcare budgeting and helps providers build long-term success.

10 Healthcare Budgeting Best Practices

Every healthcare budget is unique and should address the specific strengths, weaknesses and goals of the organization it is made for. Still, some near-universal best practices can help healthcare professionals get the most out of their budgeting process and more effectively balance financial viability with exceptional patient care. Here are 10 best practices for healthcare professionals to follow:

- Align with strategic goals. Every aspect of the budget should support the overall goals of the healthcare provider to avoid wasted or misallocated funds. Every row of the budget should be justified, deliberate and fit with the larger strategy, such as a five-year expansion plan for a new wing of a hospital.

- Incorporate data analytics. Resource allocation should be based on hard data, not hunches, and a data-focused approach should be embedded at every stage of the budgeting process. This includes collecting robust data to pinpoint costs and revenue sources and identify trends.

- Engage stakeholders. Budgeting requires collaboration among departments and stakeholders to understand how decisions will affect the staff directly involved with patients and to inform the overall budget proceedings through budget proposals and presentations. This also helps front-line workers identify problems they encounter almost daily and to voice actionable suggestions to decision-makers.

- Monitor performance regularly. Regular performance checks vis-à-vis prior budget estimates and forecasts enable early identification of issues and, thus, timely interventions. A proactive approach can safeguard a healthcare provider’s finances, preventing budget overruns and reinforcing financial sustainability.

- Use a rolling forecast. Rolling forecasts allow for perpetual planning and fine-tuning based on real-time financial performance and evolving circumstances. This dynamic approach offers more flexibility and responsiveness than traditional and rigorous annual budgeting and is especially important during challenging economic periods, such as inflation.

- Budget for contingencies. The unpredictable nature of healthcare requires contingency plans — and funding — to absorb costs from unexpected events, such as public health crises or natural disasters. This forward-looking approach helps providers maintain care continuity during periods when patients need it most.

- Promote a culture of accountability. A budget is only as effective as the team implementing it, and a clear delineation of responsibility and accountability helps prevent misspent funds and poorly implemented budgeting strategies. Make sure every team member knows exactly what they need to do and how and when they need to do it.

- Plan for capital expenditures. Technology is constantly being introduced to meet new and evolving healthcare needs, and healthcare providers must budget for new equipment. Additionally, they should analyze the life cycle and performance of existing assets to plan and budget for repairs. While these capital expenditures take away from the funds available for day-to-day expenses, effective planning and timing can help strike the right balance between optimizing today’s care with building long-term success for tomorrow’s patients.

- Review and learn. The budgeting process is ongoing and should continue as long as the healthcare organization is collecting revenue and accruing expenses. By analyzing successes and missteps in current and prior budgets, hospitals can continuously improve and enhance future budgeting processes.

- Leverage technology. Technology, particularly budgeting software and integrated business platforms, can expedite the budgeting process through automation, enhance precision through scenario modeling and yield invaluable insights and actionable strategies. Technology can give healthcare financial professionals the tools they need to quickly and regularly generate and adjust budgets, replacing the antiquated manual budgeting process that could take weeks or even months to fine-tune and implement.

Machine Learning and AI in the Hospital Budgeting Process

Machine learning and artificial intelligence (AI) have been implemented in many sectors, healthcare included. These technologies can improve decision-making across healthcare organizations through sophisticated and automated data collection and extrapolation techniques, creating more accurate and far-reaching forecasts than even the savviest accounting team might achieve. These insights, often organized into easy-to-read dashboards or comprehensive reports, allow users to quickly find the information they need, and they are often more accurate than manually entered data. These platforms can also generate ad hoc reports and increase flexibility by carrying adjustments throughout the entirety of the budget, minimizing missteps or double-counted expenses and revenue.

But it is important to remember that these technologies present some challenges. There is a substantial cost in implementing machine learning and AI, from capital expenses to onboarding and training staff in their proper use. Additionally, privacy concerns exist for comprehensive data analysis, especially for a field as regulated as medical records. And automation isn’t perfect; it still requires a human touch to ensure that the information presented is accurate and being applied appropriately. A field as human-driven and complex as healthcare needs to be budgeted and managed with compassion and with an emphasis on patient care, not just spreadsheets and numbers. Collaborations between technology and humans often yield the best results, and automated budgeting processes are no exception.

Collaborative Budgeting, Planning and “What-If” Modeling for Hospitals With NetSuite

In the rapidly evolving healthcare industry, the demand for robust, adaptable and collaborative budgeting solutions is greater than ever. With NetSuite’s Healthcare and Life Sciences software, financial professionals can more effectively track revenue and costs and improve visibility across their organizations, letting healthcare providers focus more on helping patients and less on crunching numbers.

Healthcare Budgeting FAQs

What are the different types of budgets in healthcare?

There are three primary types of budgets in healthcare: operational, capital and rolling. Operational budgets cover day-to-day expenses and revenue. Capital budgets focus on long-term assets and larger investments. Rolling budgets focus on a set amount of time in the future, typically 12 to 15 months, and are regularly adjusted as time goes on.

Why is a budget important in healthcare?

Due to the high variability in expenses and revenue sources for the healthcare industry, budgets are necessary to ensure that medical professionals can provide high-quality care to patients in need. Inaccurate budgets can lead to supply scarcity and suboptimal care resulting from poorly allocated funds and resources. Over time, this can cause financial issues for hospitals, from lost revenue to reputational harm.

Why is a flexible budget important in healthcare?

A flexible budget allows healthcare organizations to adapt to fluctuations in patient volumes, respond to regulatory changes, manage medical emergencies and support strategic initiatives to better align resources with patient care. Because public health crises, such as outbreaks or natural disasters, can occur at any time, healthcare organizations must be able to recalibrate their budgets as conditions evolve and patients’ needs change.

How does a shift from fee-for-service to value-based care impact healthcare budgeting?

Fee-for-service healthcare is commonly criticized for emphasizing revenue over patient outcomes because each service earns revenue. With value-based care, healthcare professionals aim to take a more holistic approach to providing care. However, budgeting for bundled services and tracking patient outcomes require extensive data collection, which can present challenges for small healthcare providers and may require investments in resource utilization and accounting software.

How often is a healthcare budget updated?

Healthcare organizations can choose to update their budgets as often or as infrequently as they deem appropriate. But given the high variability in revenue and expenses in the healthcare industry and the rapid expansion and implementation of new technology, equipment and best practices, many healthcare organizations choose to update their budgets monthly or quarterly.