Automation can help replace financial forecasting uncertainty with precision, using artificial intelligence and advanced algorithms to analyze historical data, detect patterns, and generate accurate forecasts. With automation, companies can spot downward trends before they become problems or test scenarios instantly to see the ripple effects of decisions. It doesn’t just save time; it builds confidence in every number and decision, turning forecasting into a strategic powerhouse instead of a tedious chore.

But like any tool, automation can present challenges if not implemented thoughtfully and strategically.

What Is Financial Forecasting?

Financial forecasting applies historical data, market trends, and business insights to predict a company’s future financial performance. By anticipating revenue, expenses, and cash flow, a financial forecast can help guide decisions pertaining to budgeting, growth strategies, and risk management.

Accurate, complete data is essential to building reliable forecasts. Advanced forecasting techniques, powered by automation and artificial intelligence (AI), can help uncover insights that lead to smarter decisions, such as determining when to scale production or whether to delay a product launch. It also fosters investor and stakeholder confidence by providing transparency and a clear view of the company’s financial health.

Key Takeaways

- Automating financial forecasting reduces manual effort, improves accuracy, and accelerates decision-making.

- Companies should focus their efforts on areas that will drive the most efficiency and accuracy, such as data entry, data cleansing, and cash flow.

- Implementing automation in financial forecasting requires an organized approach that identifies quick wins and emphasizes communication to avoid overwhelming teams.

- Though automation tools can be game-changers for financial forecasting, it’s important to preserve human oversight when interpreting data and guiding decisions.

Why Automate Financial Forecasting?

Automating financial forecasting isn’t just about efficiency—it’s about reimagining the way businesses plan for the future. By using automation technology to simplify complex financial processes, companies can unlock the following benefits.

- Automation improves decision-making: Real-time insights gained from automated financial forecasting turn decision-making into a proactive, data-driven process. By consolidating and analyzing live data, automation can help uncover trends, inform adjustments, and test scenarios instantly.

- Automation minimizes errors: Nine out of 10 CFOs say forecasting accurately is a challenge—one that nearly half deem “significant,” according to PwC. Indeed, manual forecasting leaves too much room for overlooked details and data-entry mistakes. Automated financial forecasting synchronizes data directly from trusted sources and applies consistent calculations.

- Automation saves time: Automation takes the repetitive, time-consuming tasks of financial forecasting—such as data collection, consolidation, and analysis—and completes them in seconds. By simplifying these processes, finance teams gain more time to interpret results and shape strategy.

- Automation helps scalability: As businesses grow, forecasting complexity grows too, with more data, more variables, and more scenarios to analyze. Automation handles scaling effortlessly by processing large volumes of data and adapting to new inputs without slowing down. It allows finance teams to expand their forecasting capabilities without having to add extra hours or resources.

- Automation improves shareholder confidence: Clear, reliable forecasts build trust with shareholders by showing that a business is prepared for what’s ahead. Automated financial forecasting delivers precise, up-to-date projections backed by real-time data, demonstrating that decisions are grounded in facts.

4 Common Types of Financial Forecasts

From predicting revenue streams to managing expenses and cash flow during a specific period of time, different types of financial forecasts provide a unique lens into a company’s future. Together, the following four forecasts can create a road map for improving agility and staying prepared for what’s ahead.

- Sales forecast: A sales forecast projects future sales revenue by analyzing past sales data, market conditions, and upcoming opportunities. Key components often include anticipated sales volume, pricing trends, and seasonal fluctuations. Accurate sales forecasting helps businesses set realistic goals, allocate resources effectively, and capture growth opportunities. It’s not an easy task, however. More than 80% of companies missed their sales forecast in at least one quarter over the past two years, a recent report found.

- Rolling forecast: Unlike static forecasts that lock in projections for the year, rolling forecasts constantly update as new data comes in. Predictions are adjusted and extended based on real-time performance and shifting market conditions to help companies stay agile and forward-focused.

- Cash flow forecast: A cash flow forecast maps the movement of money in and out of a business over a specific time period to predict potential cash shortages or surpluses before they happen. By properly managing their income and expenses, companies can forestall liquidity crises, plan investments, and maintain financial stability, even amid uncertainty.

- Income forecast: An income forecast unites the sales forecast with estimated costs. By subtracting projected expenses from expected sales, the income forecast calculates a company’s profitability over a defined period. This view helps companies understand how much money they’ll earn and how much of it they’ll keep as profit.

Which Financial Forecasting Processes Can Be Automated?

Focusing automation efforts on processes that promote the greatest efficiency and accuracy can have an outsized impact on forecasting outcomes. The following areas highlight where automation can make the biggest difference by helping companies save time, reduce errors, and uncover deeper insights.

1. Data Entry

Manual data entry is slow, error-prone, and drains valuable time from finance teams. Automating this process not only eliminates mistakes but also accelerates access to accurate, real-time data. For example, an ecommerce company might use automation to pull sales figures directly from its platform into forecasting tools that present up-to-date insights, without the need for tedious manual updates. The seamless flow of information means teams can focus on analyzing trends and refining strategies instead of double-checking numbers.

2. Data Cleansing

Dirty data—think: duplicates, inaccuracies, or outdated records—can derail any type of forecast. Automated data cleansing identifies and resolves these issues quickly so information fed into forecasts is accurate and consistent. For example, a retail chain can use automation to standardize sales data across multiple locations, which can catch mismatched formats or incomplete entries. Clean data means finance teams will have clear, trustworthy forecasts for their decision-making tasks.

3. Cash Flow Forecasting

Automating cash flow forecasting turns a traditionally labor-intensive process into a streamlined, dynamic system. By pulling real-time data from multiple sources, such as accounts payable, accounts receivable, and bank feeds, automation establishes an up-to-date view of cash inflows and outflows. A manufacturing company, for example, can instantly see the impact of customers’ delayed payments on its short-term liquidity, allowing the manufacturer to spot potential cash shortfalls early, avoid overdrafts, and make confident investment decisions.

4. Trend Analysis

Spotting forecasting trends manually takes time—and often misses patterns hidden within large datasets. Automated trend analysis uses advanced algorithms to identify shifts in sales, expenses, or market conditions with speed and accuracy. For example, a subscription-based business can track recurring revenue trends to predict customer churn before it happens. As a result, finance teams can refine their sales forecasts, adjust their budgets, or plan for new growth opportunities before changes become challenges.

5. Financial Tracking

Tracking financial performance against forecasts and budgets is tedious when done manually, but automation makes it seamless. Automated dashboards pull actual results in real time and compare them to projections to highlight variances instantly. For example, a software-as-a-service company can use automation to track subscription revenue against monthly targets. The dashboard can then flag underperformance before it impacts cash flow. Variance analysis also becomes faster and more accurate with automation, enabling finance teams to understand why results didn’t pan out as projected and to guide adjustments.

6. Anomaly Detection

Detecting anomalies manually is time-consuming and prone to human error. Automation uses AI and machine learning to flag unusual patterns in real time, whether that involves an unexpected spike in expenses or a sudden drop in revenue. For example, a hospitality business might identify unusual booking trends, which could signal a potential system glitch or even fraud. By catching outliers early, automation helps finance teams address issues before they can escalate, protecting both cash flow and operational efficiency.

7. Report Generation

Forecasts are most valuable when reports are accurate, timely, and easy to understand; automation delivers all three qualities. By pulling data from multiple sources, aligning it with forecasting models, and generating polished reports in minutes, automated report generation eliminates the bottlenecks that arise from traditional manual processes. A growing startup, for example, can automate its monthly forecasting reports to provide real-time projections and actionable insights for investors without incurring hours of manual effort.

8. Predictive Insights

Predictive insights give companies a competitive edge by turning historical data into actionable forecasts. Automation tools use advanced algorithms to analyze past performance and forecast future trends, such as revenue growth or market demand shifts. For instance, an online retailer can use an automation tool to predict seasonal spikes in sales and adjust inventory levels accordingly to avoid stockouts or carrying excess inventory. With automation, finance teams gain deeper visibility into what’s ahead, so they can plan more intelligently and respond faster to emerging opportunities.

How to Automate Your Financial Forecasts

Implementing automation in financial forecasting requires a thoughtful approach for maximum impact. Using the following steps, companies can transition from manual processes to automated workflows with minimal disruption.

- Identify steps in your existing process that can be easily automated: Start by mapping out current forecasting workflows to detect repetitive tasks, such as data entry, cleansing, or report generation, that consume time without adding strategic value. Automating these steps not only accelerates the process but also frees teams to focus on higher-level analyses and decision-making.

- Evaluate the technology at your disposal: Next, evaluate your tools to determine whether they support automation and can integrate with modern forecasting solutions. Features, such as data integration, real-time updates, and customizable dashboards, can significantly streamline forecasting workflows to deliver forecasts that are accurate, timely, and actionable.

- Assign a point person and, if needed, assemble a team of stakeholders: Assigning a point person ensures accountability and keeps the automation process on track. The appointed individual can coordinate with a team of stakeholders representing finance, IT, and operations to identify needs and maintain alignment among the groups. A collaborative approach simplifies implementation and strengthens buy-in across departments, paving the way for an effective transition.

- Begin work automating the action: Once the plan is in place, begin automating targeted steps using the chosen tools and technologies. Start small by automating straightforward tasks to build momentum and demonstrate value. Gradually expand automation for a smoother rollout and minimal disruption of existing workflows.

- Test the new workflow and, if necessary, troubleshoot any issues: Testing the new workflow confirms that the automation is functioning correctly and aligns with existing processes. This phase helps identify issues, such as incorrect data mappings or unexpected delays, so teams can resolve them prior to full implementation. Fine-tuning the system early helps to avoid disruptions later and to deliver accurate, reliable results.

- Roll out the new workflow: Rolling out the new workflow involves introducing automated processes across the organization as you maintain clear communication with all stakeholders. Gradual implementation, supported by training and feedback loops, helps teams adapt smoothly and diminishes resistance. This step brings the full benefits of automation to life by improving efficiency and accuracy across forecasting activities.

Best Practices for Automating Financial Forecasting

Successful automation requires more than the right tools—it also depends on thoughtful execution and a strategic approach. Following proven best practices helps maximize the value of automation while retaining flexibility and fostering human insight.

- Start small: Begin by automating one or two foundational tasks that are simple yet impactful, such as automating data entry or creating basic dashboards. This gives teams a chance to acquaint themselves with automation on a manageable scale, setting the stage for confidently tackling more advanced forecasting processes in the future.

- Look for easy opportunities: Focus on identifying high-impact tasks that are ripe for automation but don’t require complex integration, such as consolidating data from multiple systems or generating recurring forecast reports. Automating these time-consuming processes delivers immediate results, showing measurable value to stakeholders and freeing up resources for higher-level analysis. Easy wins like these build momentum and help demonstrate the practical benefits of automation throughout the company.

- Choose the right software: Selecting the right software is critical to successful automation. Companies should prioritize tools that integrate with their existing systems, offer user-friendly interfaces, and provide comprehensive features, such as real-time analytics and customizable dashboards. The right solution streamlines workflows and scales with the business’s needs, boosting long-term value.

- Invest in employee training: Employee training equips teams to use automation tools effectively and assuredly. Hands-on learning sessions and ongoing support help staff adapt quickly to new workflows. Well-trained employees can fully leverage the software’s capabilities to derive more value from financial forecasting automation.

- Maintain the human element: Automation certainly improves financial forecasting, but human expertise remains essential for interpreting results and making strategic decisions. While automated tools handle data processing, finance teams bring the context, judgment, and creativity needed to act on resulting insights. Balancing technology with human acumen ultimately delivers forecasts that generate meaningful business outcomes.

AI-Powered Software for Financial Planning

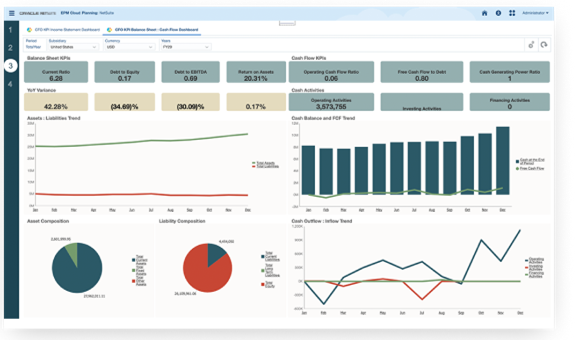

NetSuite offers a suite of tools with built-in automation and AI capabilities designed to streamline financial forecasting. NetSuite Planning and Budgeting automates data consolidation from multiple sources, simplifying such tasks as variance analysis, creation of rolling forecasts, and scenario planning. With real-time dashboards and AI-driven insights, the cloud-based platform helps businesses identify trends and make informed decisions faster.

NetSuite’s financial management module, part of NetSuite Enterprise Resource Planning (ERP), integrates forecasting with core financials and automates processes, such as cash flow tracking and expense management, to improve accuracy and decrease manual effort. Additionally, NetSuite’s SuiteAnalytics provides advanced reporting capabilities and predictive insights, so teams can visualize outcomes and adjust strategies on the fly.

NetSuite’s ability to centralize data and automate workflows not only increases efficiency but also builds consistent and reliable forecasts to help companies balance comprehensive financial planning with prolonged agility in a competitive market.

Financial forecasting is no longer about outlasting upheavals in the market—it’s about thriving because of them. Automation creates a foundation of accuracy and efficiency that allows companies to anticipate changes and respond with confidence. The key now is using these technologies to not only forecast the future but actively shape it.

Financial Forecasting Automation FAQs

Can AI build a financial model?

AI can build financial models by analyzing historical data, identifying patterns, and generating forecasts with speed and accuracy. Machine learning algorithms can automate tasks, such as trend analysis, scenario modeling, and sensitivity analysis, reducing the need for manual calculations. AI also adapts to new data in real time, refining models to reflect immediate conditions. However, while AI handles the heavy lifting, human input remains necessary to interpret results and align them with business strategy.

Can Excel be used to automate financial forecasting?

Excel can automate parts of financial forecasting, using features such as formulas, pivot tables, and macros. However, its capabilities are limited compared to those in specialized tools, and complex automation often requires advanced knowledge of Excel’s functionalities.

Are there risks to using ChatGPT for financial modeling?

Using ChatGPT for financial modeling carries risks, including the potential for errors because of its reliance on preexisting data. ChatGPT can also struggle to verify real-time information. In addition, it may lack the domain-specific expertise necessary for complex models or nuanced regulatory considerations. But, ultimately, ChatGPT’s results depend on the quality of user prompts. If details are unclear, the risk of errors increases. While ChatGPT can help with drafting models or explaining concepts, human oversight is critical to validate results and align them with financial goals.