Most businesses rely on other businesses to keep their operations running, especially when it comes to obtaining raw materials and supplies. And they’re often at the mercy of their vendors’ availability, prices and delivery times for these critical components. Beyond direct supply orders, procurement teams must also keep an eye on global supply chain disruptions and rising prices to find cost-effective solutions without compromising quality or order-fulfillment times. But businesses are not without options when it comes to navigating these complex relationships and market conditions. To overcome challenges and ensure a smooth flow of supplies, companies can implement strong procurement strategies, supported and enhanced by the right metrics and data.

This article explores common procurement metrics and how to use them to continually improve operations, as well as best practices for optimizing purchasing processes and keeping supplies flowing and the business healthy.

What Are Procurement KPIs?

Procurement key performance indicators (KPIs) are quantifiable metrics that business leaders and managers use to track and evaluate how efficiently and effectively their companies procure supplies and raw materials. These KPIs provide valuable insights into various aspects of procurement performance, such as costs, timeliness, success rates and supplier relationships. By monitoring these data points, businesses can identify areas where they can reduce costs or improve operational efficiency, as well as set goals and make well-informed decisions that align procurement activities with overall business objectives.

Analyzing procurement KPIs enables companies to benchmark their performance against forecasted estimates, regulatory standards and industry peers. This data-focused analysis helps decision-makers identify gaps in their procurement processes and implement targeted improvements to drive innovation, adapt to changing market conditions and achieve sustainable growth.

Key Takeaways

- By tracking the right procurement KPIs, businesses can improve their purchasing processes, reduce costs and boost efficiency.

- To get the most out of their KPI analysis, businesses should follow up-to-date best practices, including aligning KPIs with strategic objectives and using reliable data collection processes.

- Businesses often track KPIs over time to establish trends and be able to respond to any changes in their industry, often aided by analytics and reporting tools.

Procurement KPIs Explained

By embracing procurement KPIs, managers can gain a comprehensive view of their company’s purchasing performance that allows them to assess the successes and weaknesses of their procurement strategies. Specific metrics, such as cost per invoice, spend under management and supplier defect rates, give decision-makers real and quantifiable performance data to drive strategic improvements. This data is often collected and organized by digital tools with customizable reporting capabilities, giving businesses a real-time look at operations.

KPIs are often analyzed over time as part of ongoing trend analyses, rather than as single data points, as many of these metrics benefit from additional context and historical data. Through continuous monitoring, businesses can identify patterns and anomalies to bolster future decisions. This allows companies to adapt to changing market conditions quickly and set realistic targets for both internal procurement processes and external vendor performance. For example, if a supplier’s quality rating has been decreasing, a business can bring that data to the supplier so they can collaborate on finding a better solution or negotiate new contract terms.

Why Measure Procurement Efficiency?

Procurement efficiency KPIs measure how well a business is maximizing the value of its purchasing activities and minimizing potential risks by helping companies identify overspending, bottlenecks, disruptions or other inefficiencies. Failure to accurately and continually measure procurement efficiency can lead to lost visibility into key areas of the procurement process, including supplier performance, maverick spending and material quality control. If a company isn’t tracking its rate of emergency purchases, for example, it may be overspending on expedited shipping without realizing it. By prioritizing procurement efficiency, businesses can reduce costs, boost their bottom line, enhance customer satisfaction and find ways to pull ahead of the competition.

How to Develop Effective Procurement KPIs

With so many KPIs to choose from, businesses must carefully select which ones to prioritize. Their KPI choices should be “SMART” — specific, measurable, achievable, relevant and timely — and should cater to their specific needs and goals. Companies can follow these five steps to help choose the KPIs that will work best for them.

- Align metrics with the company’s overall objectives and priorities. This ensures that the business selects KPIs that directly contribute to its success and lead to specific and targeted improvements.

- Identify the most relevant and impactful metrics for the company’s specific industry, size and procurement processes. This often involves benchmarking current performance against industry standards and peers, consulting with procurement experts and engaging with stakeholders from across various departments.

- Establish clear targets and goals for each KPI. Keep goals ambitious, but realistic. This approach allows business leaders to clearly tell managers and implementation teams what to expect and what each party will be responsible and accountable for.

- Invest in data collection and reporting systems. Modern tools and business platforms often leverage automation to streamline data organization and provide accurate and real-time insights into both successes and areas where performance is falling short of expectations.

- Regularly hold review meetings with stakeholders and continually monitor KPIs. Ongoing analysis allows businesses to translate KPI trends and insights into actionable improvements, which keeps the procurement team aligned with the company’s evolving needs and priorities.

35 Procurement KPIs to Monitor

Because different KPIs provide different insights, businesses should track a range of KPIs to gain a more comprehensive view of their procurement operations. Though specific KPIs may vary depending on the company and industry, here are some essential procurement KPIs to consider.

1. Cost Savings

Cost savings is a general KPI that tracks the money saved through strategic initiatives, including procurement strategies like negotiating better prices, consolidating suppliers or reducing waste. This KPI shows the success of cost reduction initiatives, helping businesses repeat successes and improve upon failures. In fact, cost savings was listed as the most important procurement optimization initiative in KPMG’s 2023 Global Procurement survey, with 91% of respondents selecting it as a top-three choice.

The formula for cost savings is:

Original cost – Actual cost = Cost savings

For example, if a manufacturing project’s raw materials cost $15,000 before the rate was negotiated down to $12,000, the project would have a $3,000 cost saving.

2. Cost per Invoice and PO

Cost per invoice and purchase order (PO) measures the average cost of each procurement invoice or PO, including labor, technology and other associated expenses. This KPI helps businesses view their costs in the context of their orders and understand the impact of cost reduction strategies on margins, such as seizing bulk order discounts or diversifying suppliers.

The formula for cost per invoice and PO is:

Total procurement cost / Number of invoices and POs processed = Cost per invoice and PO

3. Procurement ROI

Procurement return on investment (ROI) compares the financial benefits of procurement strategies to total procurement costs. This KPI helps businesses evaluate the effectiveness of their procurement strategies and adds context to the savings these strategies bring. Higher ROIs signify a more effective cost reduction strategy.

The formula for procurement ROI is:

(Total cost savings / Total procurement costs) x 100 = Procurement ROI

4. Spend Under Management (SUM)

Spend under management (SUM) is the percentage of total procurement spending that is directly managed by the procurement team through contracts, negotiations and supplier relationships. This metric shows how much of the spend is actively controlled by the procurement team, as well as the amount of “maverick spend” — that is, any unapproved or unofficial purchases made outside of the company’s standard spending rules. If SUM is decreasing over time, businesses may want to consider implementing stronger cost control and expense tracking to minimize unauthorized spending.

The formula for SUM is:

(Managed spend / Total spend) x 100 = Spend under management

For instance, an 85% SUM indicates that 85% of expenses are controlled, while 15% aren’t directly managed by the procurement team.

5. Total Cost of Ownership (TCO)

Total cost of ownership (TCO) goes beyond the price tag to measure the total cost of acquiring, operating and maintaining a product or service over its entire life cycle. By considering all associated costs, including purchase price, installation, training, maintenance and disposal, businesses can invest more wisely in procurement assets and services, such as technology or service contracts, and minimize long-term expenses.

The formula for TCO varies depending on the specific product or service but generally includes:

Purchase price + Installation costs + Training costs + Operating costs + Maintenance costs + Disposal costs = Total cost of ownership

6. Price Competitiveness

Price competitiveness compares the prices a business pays for goods or services with what its industry peers pay. This KPI helps identify opportunities for finding better deals or new suppliers, ensuring that the company can maintain competitive margins by not overpaying during procurement.

The formula for price competitiveness is:

[(Current price – Competitor’s price) / Current price] x 100 = Price competitiveness

7. Supplier Quality Rating

Supplier quality rating measures a supplier’s overall performance based on certain factors, such as product quality, on-time delivery and compliance. This KPI identifies the top-performing suppliers to prioritize for future orders and helps businesses balance price with quality when placing orders.

Due to its subjectivity, supplier quality doesn’t have a standard formula. Businesses can calculate supplier quality rating by creating a weighted scorecard of performance criteria that suits their values and needs. A grocery store, for example, may prioritize speedy delivery to extend the selling period of its perishable goods. Therefore, it would weigh on-time delivery more heavily than other factors, such as price or supplier communication.

8. Supplier Lead Time

Supplier lead time measures the average time that elapses between placing an order and receiving the goods or services from the supplier. While most businesses can benefit from quick supplier turnarounds when ordering supplies, this KPI is especially important for businesses that rely on timely deliveries to maintain just-in-time production schedules and/or meet time-sensitive customer demands, as any delays could lead to significant bottlenecks and losses.

The formula for average supplier lead time is:

Total lead time / Number of orders = Average supplier lead time

9. Purchase Order Accuracy

PO accuracy measures the percentage of POs containing all the necessary information, such as correct quantities, prices and delivery dates, without any errors. This helps businesses identify issues in their administrative processes that may lead to delays, incorrect orders, costly returns or overspending. Many businesses improve this metric by implementing digital tools that leverage automation to generate accurate POs quickly.

To calculate PO accuracy, use the following formula:

(Number of accurate POs / Total number of POs) x 100 = Purchase order accuracy

10. Compliance Rate

Compliance rate measures the percentage of purchases that adhere to a company’s procurement policies, contracts and regulatory requirements. Businesses use this KPI to track how effectively their processes meet both internal and external standards. This is especially crucial for businesses in highly regulated industries, such as food service and healthcare, where noncompliance can harm customers and lead to financial, reputational and legal penalties.

To calculate compliance rate, use the following formula:

(Number of compliant purchases / Total number of purchases) x 100 = Compliance rate

11. Contract Compliance

Contract compliance measures the percentage of contracts that successfully adhere to every term and condition, such as pricing, quality standards and delivery timelines. This KPI is often calculated for each supplier to help businesses identify which vendors consistently meet their obligations and which require corrective actions or phasing out to create a more reliable and predictable operation. This KPI is often part of larger supplier audits that aim to improve supplier relationships, transparency and performance.

The contract compliance formula is:

[(Total number of contracts – Noncompliant contracts) / Total number of contracts] x 100 = Contract compliance

12. Procurement Cost Avoidance

Procurement cost avoidance measures the potential savings achieved by preventing unnecessary or overpriced purchases before they occur. This is different from cost-savings metrics, which measure discounts and reductions on completed purchases. For example, if a manufacturer still has sufficient wood supplies from last month due to a production slowdown, it can avoid the cost of this month’s scheduled procurement order until inventory levels drop.

To calculate procurement cost avoidance, use the following formula:

Potential cost – Actual cost = Procurement cost avoidance

13. Procurement Cost Reduction

Procurement cost reduction — a procurement-focused variant of the more general cost savings KPI — measures the actual savings achieved through various procurement initiatives, including improving quality control measures and production workflows to reduce order size. This KPI helps businesses track their cost-reduction successes and avoid repeated failures.

The procurement cost reduction formula is:

Previous cost – New cost = Procurement cost reduction

14. Purchase Price Variance (PPV)

Purchase price variance (PPV) calculates the difference between the actual price paid for goods or services and the standard or budgeted price. But unlike some other price-difference metrics, PPV includes the full quantity purchased to show the difference in real dollars, rather than as an average or percentage. This KPI helps businesses create more realistic budgets and see the real impact of price variances.

To calculate PPV, use the following formula:

(Actual price – Standard price) x Quantity purchased = Purchase price variance

15. Rate of Emergency Purchases

This KPI measures the percentage of procurement orders placed outside of the regular purchasing process due to unexpected demand spikes or shortages. These purchases often come with increased shipping costs and a higher risk of stockouts and may indicate poor planning, inaccurate demand forecasting, inefficient inventory management or supplier issues.

To calculate the rate of emergency purchases, also known as the emergency purchase ratio, use the following formula:

(Number of emergency purchases / Total number of purchases) x 100 = Rate of emergency purchases

16. PO Cycle Time

PO cycle time is the average time it takes to process a purchase order from initial request to final approval. This KPI helps businesses identify bottlenecks in their procurement processes and track the impact of new techniques and strategies, such as a new PO system or workflow. By reducing PO cycle time, businesses can more quickly and reliably receive the goods and services they need to deliver satisfactorily for their customers.

To calculate PO cycle time, use this formula:

Total time spent on PO processing / Total number of POs processed = PO cycle time

17. Procurement Cycle Time

Procurement cycle time measures the average time it takes for a business’s procurement department to complete a procurement order. Some companies begin tracking time from the moment the need is identified, while others instead start the procurement life cycle when an order is formally placed. Therefore, it’s important to make sure analysts and stakeholders are all using the same criteria when using this KPI to identify ways to speed up deliveries.

The formula for procurement cycle time is:

Total time spent on procurement / Total number of procurement orders placed = Procurement cycle time

18. Inventory Accuracy

Inventory accuracy monitors discrepancies between actual physical inventory and recorded inventory levels in the company’s books or software platform. This KPI helps decision-makers feel confident that they’re working with up-to-date inventory levels in order to align sales with current stock and ensure that the right amounts are on hand to meet upcoming demand. High inventory accuracy, often obtained through barcode scanners and automated picking robots, enables businesses to purchase and allocate supplies appropriately, knowing they’ll be available when and where the business needs them.

The inventory accuracy formula is:

(Actual inventory count / Recorded inventory count) x 100 = Inventory accuracy

19. Inventory Turnover

Inventory turnover measures how quickly a company sells and replaces its inventory over a given period of time. This KPI is an indirect metric for procurement managers, as it helps businesses track inventory efficiency and identify slow-moving or excess stock, which in turn informs procurement and production schedules. A higher inventory turnover rate generally indicates that sales and procurement are well aligned and that the business is efficiently using its working capital, while a low rate often implies surplus stock and, therefore, higher carrying costs.

To calculate inventory turnover, use the following formula:

Cost of goods sold / Average inventory value = Inventory turnover

20. Head Count and Spend per Employee

For this KPI, head count refers to the total number of employees and contractors working in the procurement department, while spend per employee represents the average procurement spending amount managed by each member of the procurement team. By tracking these metrics, companies can monitor whether they have too many or too few staff, relative to the size of the operation, and whether skills and funds are being properly utilized to generate revenue. For example, if a business sees its spend per employee rising rapidly over a financial period, it might point to higher sales contributing to more procurement spending. However, it could also signify an expanding operation that requires additional hires. Because of these different results, changes in spend per employee are worth investigating further before drawing conclusions.

The following formula calculates spend per employee:

Total procurement spend / Number of procurement employees = Spend per employee

21. Vendor Availability

Vendor availability measures a supplier’s success rate for fulfilling orders and/or providing services as requested. This KPI helps businesses assess supplier reliability and replace poorly performing vendors, enabling them to strengthen their supply chain and create a smoother operation. According to Deloitte’s 2023 Global Chief Procurement Officer survey, “increasing the level of supplier collaboration” was the top strategy to deliver the most value, with 61% of respondents selecting it. But that collaboration must be two-way, as unresponsive or unreliable vendors can leave businesses in the dark when they could be actively offering solutions.

The vendor availability formula is:

(Number of orders fulfilled / Total number of orders placed) x 100 = Vendor availability

22. Number of Suppliers

This KPI is simply the total number of vendors a company works with to procure goods and services. This metric helps businesses assess the complexity of their supply chain and identify opportunities for consolidation or diversification. Too few suppliers can lead to stagnant innovation and supply chain risks if one of the suppliers experiences a slowdown or exits the market. On the other hand, too many suppliers can add complexity to procurement and point to higher shipping costs because of a lack of bulk discounts. This KPI doesn’t have a clear positive or negative valuation but is often tracked over time to assess the successes of specific consolidation or diversification initiatives.

To calculate the number of suppliers, simply count the total number of active vendors in the company’s supplier database.

23. Supplier Defect Rate

The supplier defect rate calculates the percentage of a supplier’s deliveries that don’t meet quality standards or specifications. This metric allows companies to assess their vendors’ quality and reliability over time when deciding where to place orders. A high supplier defect rate can lead to increased delivery processing time and quality control costs, production delays, higher risk to equipment and customer dissatisfaction from subpar and inconsistent goods unless the business works with the supplier to resolve the issue(s) — or switches to a higher quality vendor.

To calculate supplier defect rate, use this equation:

(Number of defective units / Total number of units received) x 100 = Supplier defect rate

24. Supplier Rejection Rate and Costs

Supplier rejection rate measures the percentage of goods or materials from a supplier that are rejected due to quality issues, noncompliance with specifications or other reasons. While this KPI is similar to supplier defect rate, which measures defects that are identified at any point after delivery, supplier rejection rate focuses on deliveries that are rejected immediately for obvious reasons, such as incorrect orders or materials damaged during transit. When rejecting orders, businesses may still incur some costs, even if the vendor issues refunds or replacements, including the labor and material costs involved with returning, replacing or disposing of the rejected goods. Even if the supplier covers return shipping and/or replacement, the incumbent delays can slow down production and increase order fulfillment times. Vendor-focused KPIs like this one can give businesses valuable leverage during price negotiations.

The supplier rejection rate formula is:

(Number of rejected units / Total number of units received) x 100 = Supplier rejection rate

25. Project Delivery

This KPI measures the percentage of completed procurement projects — such as implementing a new digital system or auditing a supplier — that meet quality standards as well as initial expectations. Project delivery helps businesses assess how effectively they manage projects and identify any bottlenecks that may have occurred. A high project delivery rate typically implies that procurement teams are successfully realizing the company’s objectives and goals.

To calculate project delivery, use the following formula:

(Number of projects completed successfully / Total number of projects) x 100 = Project delivery

26. Projects on Time and Within Budget

While project delivery is a broad KPI that looks at the overall quality and success of a project, projects on time and within budget is a more granular metric that considers only the time and resources spent during a project’s completion. This metric helps track how effectively the business is managing its procurement projects and lends support to the management style, budgets, labor allocation and timelines of future projects.

The following formula calculates the percentage of projects on time and within budget:

(Number of projects completed on time and within budget / Total number of projects) x 100 = Projects on time and within budget

27. New Contracts Negotiated

This KPI tracks the number of new contracts that the procurement team successfully negotiates within a given period, including vendor and service contracts. It helps businesses assess how well their procurement teams negotiate and the value they bring to the company’s expansion efforts. However, it’s important to remember that new contracts negotiated tracks only the quantity of contracts and is often analyzed in conjunction with other KPIs that measure cost savings, supplier performance and supply chain resilience.

New contracts negotiated can be calculated by simply counting the total number of new contracts signed within a specified period.

28. Suppliers and Contracts Managed

Suppliers and contracts managed measures the total number of suppliers and contracts that the procurement team is actively managing over a measured time period. It helps businesses assess their staff members’ workloads and the complexity of their procurement operations. This allows managers to allocate labor and ensure that staff has adequate resources to effectively manage their supplier relationships, without overspending on unnecessary shifts or workers. This can be a major challenge, with 68% of respondents to KPMG’s Global Procurement survey listing “lack of visibility and control over contracts” as a top-three challenge in their contract life cycle management process.

Like other raw total KPIs, this metric involves a simple count of the total suppliers and contracts managed over the chosen period.

29. Managed Vendor Performance

Managed vendor performance measures active suppliers’ overall ability to consistently deliver for customers. Because businesses may place different values on different aspects of procurement, this KPI typically weighs particular traits, such as quality, delivery, cost and responsiveness, to create a unified scale that businesses can use to quantify performance according to their own needs. By tracking this KPI over time, companies can identify top-performing suppliers, address underperforming ones and make more reasonable decisions when placing orders.

The managed vendor performance KPI typically uses a weighted scorecard that assigns points to different performance criteria, such as product quality, delivery speed and accuracy, and cost responsiveness.

30. Stakeholder Satisfaction

Stakeholder satisfaction measures the approval of the procurement team’s performance by internal stakeholders, such as employees, managers and executives. This KPI helps assess how well procurement processes meet the company’s needs, expectations and goals. Stakeholder satisfaction can be improved through open and regular communication at all levels to quickly identify problems as they occur and brainstorm solutions.

Businesses can measure satisfaction through surveys or interviews, asking stakeholders to rate their satisfaction with various aspects of procurement performance on a clear and consistent scale, such as 1 through 10. They can average the scores across all respondents or across the entire survey to determine overall satisfaction levels.

31. Training and Development Hours

Training and development hours measure the total amount of time procurement team members spend on learning and ongoing development activities, such as attending workshops, completing online courses or participating in mentoring programs. This KPI helps managers better allocate their staff’s time between active, revenue-generating work and continual improvement and skill development, which can lead to better long-term performance and increased value for the organization.

To calculate training and development hours, track the number of hours each team member spends on learning and development activities over a given period, such as monthly or quarterly, and add them all together. Managers can also average this figure per employee and compare the results to industry benchmarks, or they can use the metric to set future expectations.

32. Product Quality

Product quality measures the percentage of goods received from suppliers that meet the company’s quality standards. This KPI is similar to supply defect rate, but it’s more specific, focusing on individual goods rather than entire deliveries. And like other supplier performance KPIs, product quality helps businesses ensure that they are receiving high-quality materials that keep production moving and customers satisfied.

To calculate product quality, use the following formula:

(Number of acceptable units / Total number of units received) x 100 = Product quality

33. On-Time Delivery Rate

On-time delivery rate is the percentage of orders that suppliers deliver within their estimated shipping window. This KPI is especially important for businesses that rely on timely deliveries, such as retailers that sell perishable goods or just-in-time manufacturers. Not all goods require quick shipping, however, so on-time delivery calculates a percentage based on expectations, as opposed to average time-length metrics, such as delivery time or lead time. For example, an overseas manufacturing vendor may be consistently delivering low-urgency metal materials as promised, despite a slow delivery time. Therefore, this metric might be used to inform future procurement decisions by identifying suppliers that consistently meet or exceed set expectations, rather than as a measure of delivery speed.

The delivery time formula is:

(On-time orders / Total number of orders) x 100 = On-time delivery rate

34. Supplier Diversity

Procurement teams often use the term “supplier diversity” to describe two different KPIs. The first measures how well a business varies its vendors to minimize overreliance on a small number of suppliers and the supply chain risks that often accompany a consolidated procurement operation. This version of the KPI may also be called “supplier base diversification.”

This version of the supplier diversity KPI can be calculated with this formula:

(Spend with top suppliers / Total spend) x 100 = Supplier base diversification

The other common use of “supplier diversity” measures the percentage of a company’s total procurement spend that goes to diverse suppliers, such as minority-owned, women-owned, veteran-owned or small businesses. This version of the KPI helps companies support diversity within their supply chain, leading to increased innovation, new collaborative ideas and community goodwill. Many organizations prioritize diversity spend targets as part of a larger corporate social-responsibility initiative.

This KPI can be calculated by spend or number, based on the business’s preferences:

(Total spend with or number of diverse suppliers / Total procurement spend or suppliers, respectively) x 100 = Supplier diversity

35. Vendor Risk Management

Vendor risk management is a subjective KPI that assesses each supplier’s potential risks, such as financial instability, data security vulnerabilities or unethical practices. Monitoring this KPI helps companies proactively manage their suppliers to mitigate risks that could disrupt their supply chain or damage their reputation. Businesses often gather this information from third-party assessments or audits, ongoing monitoring and market research.

Like vendor performance, vendor risk management involves assigning a risk score or rating to each supplier, based on factors such as:

- Financial stability

- Data security and privacy protocols

- Compliance with regulations, and industry and quality standards

- Environmental and social responsibilities

Categorization of Procurement KPIs

Procurement analysts and managers often categorize procurement into several key areas to gain a comprehensive, but focused, view of procurement when developing targeted strategies. These categories should cater to a business’s specific needs, so they often include criteria such as cost savings, supplier performance, compliance and risk, operational efficiency, strategic management and supplier/contract management.

This chart below provides an overview of the procurement KPIs discussed in this article, sorted into six sample categories. This categorization helps business leaders ensure that they’re monitoring a balanced set of metrics that cover all critical aspects of procurement performance, thereby minimizing the risk of unreported inefficiencies and bottlenecks.

Procurement KPIs |

|||||

|---|---|---|---|---|---|

| Financial Performance | Supplier Performance | Compliance & Risk | Operational Efficiency | Strategic Management | Supplier & Contract Management |

| Cost savings | Supplier quickly rating | Compliance rate | Purchase order accuracy | Project on time and within budget | New contracts negotiated |

| Cost per invoice and PO | Supplier lead time | Contact compliance | Rate of emergency purchase | Project delivery | Suppliers and contracts managed |

| Procurement ROI | Supplier defect rate | Vendor risk management | PO cycle time | Stakeholder satisfaction | Number of suppliers |

| Spend under management | Vendor availability | Procurement cycle time | Training and development hours | Supplier diversity | |

| Total cost of ownership | Supplier rejection rate and costs | Inventory accuracy | Product quality | Managed vendor performance | |

| Price competitiveness | Inventory turnover | On-time delivery rate | |||

| Purchase price variance | Head count and spend per employee | ||||

| Procurement cost avoidance | |||||

| Procurement cost reduction | |||||

Best Practices for Tracking Procurement KPIs

Tracking procurement KPIs is important, but simply monitoring a set of metrics isn’t always enough to truly understand procurement performance and how it can be improved. Let’s explore nine common best practices that help businesses maximize the value they gain from tracking their procurement KPIs.

1. Align KPIs With Strategic Objectives

With so many KPIs to choose from, businesses must be deliberate in their selection. They should choose metrics that align with their overall strategic objectives to avoid wasting time and resources on unhelpful or irrelevant data. By tying KPIs to broader business goals, such as reducing material costs, consolidating suppliers or increasing order efficiency, procurement teams can demonstrate their value and secure the necessary resources and support they need to continually improve their processes.

2. Select Relevant KPIs

Not all procurement KPIs are equally relevant to every business, and relevant metrics will depend on such factors as the company’s industry, size, maturity and specific procurement challenges. To select appropriate KPIs, procurement teams should conduct a thorough assessment of their current processes to identify key areas for improvement and prioritize metrics that will have the greatest impact. For example, if a procurement audit reveals consistently delayed orders from top suppliers, managers can prioritize tracking KPIs, like supplier diversity and on-time delivery rates, to monitor the impact of new strategies. Remember, a list of relevant KPIs should be regularly adjusted to reflect current market conditions. These adjustments are often informed by industry-benchmark comparisons, collaborations with internal stakeholders and use of external expertise to identify emerging trends.

3. Establish Specific Goals and Targets

After selecting all relevant KPIs, businesses can set clear, measurable targets for each metric. These targets should be ambitious but realistic and consider the company’s current performance, industry standards, market conditions and available resources. By establishing specific goals and timelines, procurement teams can create a sense of urgency and accountability that helps ensure that everyone is working toward the same objectives and understands their responsibilities. During this phase, businesses should maintain clear and open communication between upper management and the staff implementing these strategies. This allows all parties to quickly identify obstacles, provide regular progress updates and reach informed decisions about additional support or timeline adjustments. In fact, 85% of respondents to Deloitte’s 2023 Global Chief Procurement Officer survey chose “standardization of policies, processes, systems and data” as an orchestrator of value.

4. Use Relevant and Reliable Data

Businesses must ensure that they’re collecting data from reliable and appropriate sources. Otherwise, their KPI analysis may be incomplete or inaccurate. For modern businesses, this typically involves integrating data from multiple systems, such as enterprise resource planning and supplier management platforms, to create a comprehensive view of efficiency and performance. Once data is collected, it’s important to establish clear governance and validation policies to maintain data quality, consistency and security. Additionally, regular data audits and cleansing exercises can proactively identify and address problems before they impact the accuracy and reliability of KPI measurements.

5. Implement Automated Data Collection

Manual data collection and analysis can be time-consuming and error-prone, leading to KPI data that may not be reliable. Automated data collection tools can help streamline this process, reducing the burden on staff while improving data speed and accuracy. Automated solutions range from simple spreadsheet calculations to advanced software platforms that bring together data from multiple sources to provide real-time dashboards and alerts. However businesses choose to automate their data processes, the right tools and the right training can help staff focus more on how to fix problems, rather than struggling to make sense of the data.

6. Analyze Trends and Compare Benchmarks

After data is collected and organized, businesses can then assess their KPIs over time to compare current performance to historical data. This comparison helps spotlight significant changes, trends or anomalies. Additionally, businesses can compare their KPIs to industry benchmarks to gauge relative performance and discover areas where they’re falling behind. Regular analysis helps procurement teams continue to fine-tune their operation and quickly adapt to evolving market trends and economic conditions, such as changing prices or shifting customer demand.

7. Leverage Insights for Decision-Making

Keep in mind that the ultimate goal when tracking procurement KPIs is to do more than just monitor performance — it’s to improve it. To do this, businesses must take the insights gained from KPI analyses and apply them to their decision-making, including which contracts to pursue, what technologies to invest in and where to allocate resources. Clear KPI processes and guidelines help businesses leverage available technology and collaborate with key stakeholders to translate these insights into actionable initiatives, driving meaningful and long-lasting improvements in cost savings, efficiency and overall business performance.

8. Conduct Regular Monitoring and Reporting

Ongoing monitoring and reporting help decision-makers ensure that procurement operations remain on track and that any issues are identified and addressed before they begin affecting customers. Businesses should use consistent reporting formats and set regular intervals for reviewing KPI data, such as weekly, monthly or quarterly, depending on the specific metric and the company’s needs. For example, delivery times might be assessed weekly, while supplier diversity and new contracts negotiated get reviewed quarterly. This regularity helps analysts make clear and direct comparisons between one report and the next. Generating reports typically involves summarizing key findings, highlighting trends and outliers, and providing suggestions for the upcoming period. Additionally, these reports should be shared among procurement teams, senior management and cross-functional partners. This fosters collaboration and accountability, sustaining procurement KPIs a priority for the organization.

9. Adjust KPIs as Necessary

As a business’s needs and priorities change over time, it’s important for procurement managers to adjust their chosen KPIs. This ensures that operations remain aligned with organizational goals and relevant for current customers. This may involve adding or removing specific metrics, modifying targets or benchmarks, or changing how data is collected and assessed. For example, an expanding company may prioritize growth KPIs, such as new contracts negotiated and total cost of ownership for new investments. In contrast, an established company with long-term vendor relationships may focus more on internal efficiency improvements through metrics like PO accuracy and inventory turnover. To optimize their KPI analyses, procurement teams should conduct periodic assessments and gather input from all relevant parties and stakeholders. This helps businesses monitor changes in the market, customer base, industry or competitive landscape. By remaining flexible and adaptable in their approach to KPI tracking, companies can make sure they continue to measure what matters most to maintain their competitive edge.

Maximize Your Procurement KPI Effectiveness With NetSuite

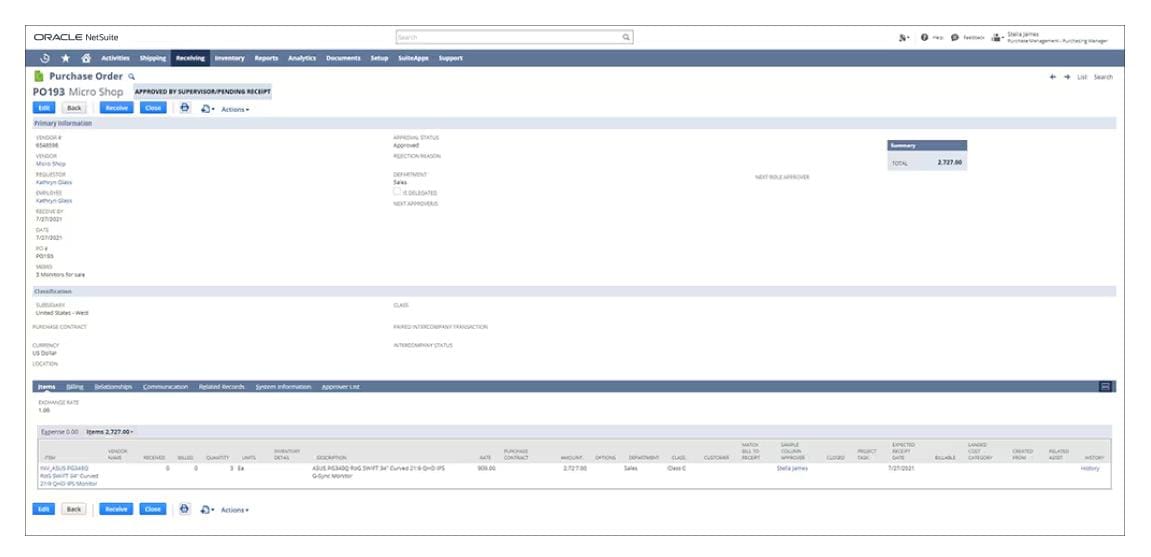

Tracking procurement KPIs is a crucial part of understanding your business’s performance, but it can be challenging without the right tools. NetSuite Procurement is designed to optimize purchasing processes and reduce costs by integrating with existing systems to consolidate KPI data into one centralized location. From automatically linking transactions with records and receipts to real-time collaboration in vendor portals, NetSuite Procurement enhances visibility, helping businesses strengthen their supply chain. With NetSuite, procurement teams can focus on increasing profitability with data-driven strategies, rather than relying on guesswork and hunches.

Tracking KPIs With NetSuite SuiteAnalytics

In addition to NetSuite’s dedicated procurement software, NetSuite SuiteAnalytics Reporting & Dashboards solution provides comprehensive reporting on KPIs through its customizable, user-friendly dashboards, giving decision-makers and procurement teams a real-time view into both overall and more granular performance metrics. NetSuite’s built-in business intelligence provides leaders with detailed insights and actionable suggestions, enabling procurement teams to quickly spot areas for improvement and pivot operations when needed.

Procurement KPIs are important metrics that help businesses improve the efficiency of their purchasing processes, reduce costs and adapt to changes in their industry. But to get the most out of their KPIs, businesses must select the right metrics, establish clear goals, follow best practices and implement appropriate analytics and reporting tools. When tracked properly, KPIs allow procurement teams to gain valuable, relevant and actionable insights into their performance, informing data-driven decisions that deliver measurable improvements. As the procurement landscape continues to evolve, companies that prioritize KPI tracking and adopt innovative solutions will better navigate challenges, seize opportunities and achieve long-term success.

Procurement KPIs FAQs

What are KPIs in procurement?

Procurement key performance indicators (KPIs) are quantifiable metrics used to measure and evaluate the performance of a company’s purchasing activities. KPIs are typically measured over time to establish trends and provide insights into the successes and failures of procurement strategies, as well as to monitor progress and identify areas where the business can improve performance.

What is a KPI dashboard for procurement?

KPI procurement dashboards are visual tools that display specific metrics related to a company’s purchasing activities. They typically provide real-time data and insights, allowing procurement professionals to customize their view to monitor performance, identify trends and make informed decisions quickly. Procurement KPI dashboards are often cloud-based and can be accessed through various devices, enabling teams to stay connected and aligned with company objectives.

What is procurement benchmarking?

Procurement benchmarking compares a company’s procurement performance with industry best practices, standards or peer performance. Businesses should choose benchmarks that reflect their priorities, emphasizing measures such as cost savings, supplier performance, success rates and other efficiency metrics. Benchmarking helps procurement teams stay competitive, set realistic targets and drive continuous improvement.

What is the ROI of procurement?

Procurement return on investment (ROI) is the financial benefit gained from the procurement function relative to the costs involved. It measures how effectively the business uses its resources to turn purchased goods, materials and supplies into revenue. Calculating procurement ROI involves comparing the total value generated by procurement initiatives with the resources and expenses invested in the procurement process.

What are five key performance indicators?

While specific key performance indicators (KPIs) vary, depending on the organization and industry, five common procurement KPIs are inventory turnover, compliance rate, on-time delivery rate, procurement cycle time and cost per invoice. These, along with other KPIs, give businesses a better sense of their procurement performance and where strategic adjustments could be made.

How can you measure procurement performance?

Businesses can measure their procurement performance by following these five steps:

- Align chosen KPIs with the company’s overall objectives and priorities.

- Identify the most relevant and impactful metrics for the company’s specific industry, size and procurement processes.

- Establish clear targets and goals for each KPI.

- Invest in data collection and reporting systems.

- Regularly hold review meetings with stakeholders and continually monitor KPIs.