Faced with global competition, supply chain disruptions, and increasing market demands, companies can no longer treat distribution as an afterthought—or rely on a single strategy. It’s not enough to get products into customers’ hands. Businesses must do so in ways that meet buyer expectations, align with business goals, and preserve brand integrity. This article explains what a distribution strategy is, describes the different approaches companies can take, and shares advice on how to choose the most suitable models.

What Is a Distribution Strategy?

A distribution strategy is a company’s plan for moving products from the point of production to the final customer. It defines the channels and processes involved in that journey, influencing every touchpoint from inventory management and logistics to post-sale customer service.

Key Takeaways

- Successful distribution strategies improve reach, increase revenue, and strengthen customer relationships.

- Because some strategies focus on brand control while others emphasize market penetration, companies often employ a mix to strike the right balance.

- When distribution isn’t aligned with company capabilities and buyer needs, the result can be subpar service.

Distribution Strategy Explained

A distribution strategy involves deliberate decisions that shape both the customer experience and a business’s ability to meet its targets. Those choices include the types of channels to use, the balance between in-house capabilities and external partners, the geographic scope of operations, and the systems that coordinate it all. Developing a strategy starts with defining business goals, such as broader market reach, tighter brand control, cost reduction, and faster delivery. From there, the company selects an approach—direct, indirect, exclusive, or hybrid—that aligns with its product, audience, and infrastructure. These goals and approaches should adapt as conditions shift. For example, companies may decide to add channels, consolidate partners, change fulfillment models, or adjust their geographic focus.

Effective distribution involves multiple departments within a company. C-suite leaders set the strategic direction, approve investments, and form high-level partnerships. Their decisions determine whether the business will invest in internal distribution capabilities, outsource to third parties, or rely on a mix. Operations teams implement those choices through logistics networks and warehouse management processes; they’re responsible for quickly and efficiently moving products, which also involves identifying and preventing potential breakdowns. Meanwhile, marketing generates product demand and coordinates with partners to maintain brand consistency and campaign alignment, while sales attracts new customers, pursues new partners, and fosters existing relationships.

Why Does the Right Distribution Strategy Matter?

The right distribution strategy makes it easier to reach customers and generate revenue. It defines product movement and availability, supports consistent buyer experiences across channels, and helps businesses adapt and differentiate. Whether responding to supply chain disruptions, entering new markets, or launching new products, companies with flexible distribution models can take quick, informed action. When distribution syncs with customer behavior and market demand, products arrive faster, partnerships run more smoothly, and internal teams operate with greater efficiency, all to contribute to competitive advantage.

On the other hand, poor distribution strategies often lead to missed sales and opportunities that create financial pressure. Customers expect products to be available when and where they want them. If a business can’t meet those expectations, buyers will look elsewhere. Flawed planning can erode margins and complicate forecasting. Excess inventory leads to higher storage costs and potential waste, for instance, while product shortages result in back orders and lost sales.

The Elements of a Distribution Strategy

The best distribution approach is one that’s tailored to both product logistics and buyer needs. It also hinges on a company’s budget and may shift to keep up with competitors’ moves and changing market conditions. The following interrelated components are key to maintaining an effective strategy:

- Product type: A product’s characteristics define its storage, handling, and delivery processes. Perishable goods may require cold-chain logistics to preserve their quality, while luxury items may have presentation-grade packaging that reinforces brand value.

- Product audience: Customer preference plays an increasingly important role in selecting the right distribution channels. Younger demographics tend to buy through mobile ecommerce platforms with next- and same-day delivery options, for example.

- Budget: Distribution costs must comply with financial targets. A business with a large budget might invest in warehouses and automation, but a leaner operation may choose to limit its footprint and rely more heavily on logistics partners.

- Competition: If rivals dominate big-box retail, it might make sense to focus on direct-to-consumer channels instead. Or, if competitors lack presence in specific regions or verticals, those areas could represent growth opportunities.

- Market conditions: Broader economic and logistical realities, such as changes in fuel costs, labor availability, regulations, and customer expectations, can affect the viability of certain distribution channels. In response, companies will need to cultivate new strategies and tactics, such as advanced trend analysis, to maintain the same service levels.

Types of Distribution Strategies

Distribution strategies vary based on how much control a company wants, how widely it needs to distribute its products, and what type of customer experience it aims to deliver. Some strategies offer reach, while others emphasize brand control. Many companies use a mix of the following approaches to serve different segments or product lines.

-

Direct distribution:

Direct distribution eliminates middlemen: Companies sell straight to end users through their own stores, websites, or sales teams. This approach creates a tightly controlled experience and allows the business to own every touchpoint; it also supports faster feedback loops, unified branding, and greater access to customer data. Those advantages come with high expenses and operational complexity, however, because businesses must manage distributed inventory, fulfill orders, and handle customer service internally. For companies with high-touch, high-value, or brand-sensitive products, the benefits outweigh the costs.

-

Indirect distribution:

Indirect distribution relies on intermediaries, such as wholesalers, retailers, or value-added resellers, to reach the end customer. Companies hand off logistics, local sales, and, in many cases, customer support to these partners. This model significantly expands reach, simplifies internal operations, and is particularly effective for companies that want to grow quickly or focus on product development. The trade-off is reduced visibility and control. Indirect distribution suits fast-moving consumer goods, mass-market products, and businesses entering international markets.

-

Selective distribution:

Selective distribution relies on a curated network of authorized partners. The company selects a limited number of retailers or resellers that meet specific criteria related to location, service quality, or customer alignment. This approach strikes a balance between reach and control and allows companies to protect brand equity, deliver high-touch customer experiences, and avoid the downsides of mass-market distribution. Selective distribution is common among mid-range to high-end consumer brands, especially in electronics, appliances, and fashion.

-

Exclusive distribution:

Exclusive distribution limits product availability to one or very few partners within a defined territory to create prestige and deepen strategic collaboration with chosen distributors or retailers. Companies use exclusivity to build strong brand associations, protect pricing, and invest heavily in training and experience at the point of sale. The trade-off is limited exposure and high dependence on the performance of a single partner. This strategy is especially effective for luxury, specialty, or highly regulated products.

-

Intensive distribution:

Intensive distribution aims for maximum exposure by placing products in as many outlets as possible to favor convenience, volume, and customer access over brand control. It requires extensive logistics integration and high inventory availability and works best for high-frequency, low-consideration purchases, such as beverages, snacks, and household goods. Products are stocked in supermarkets, convenience stores, vending machines, and other high-traffic locations.

-

Dual distribution:

Dual distribution combines strategies, typically both direct and indirect channels. For example, a company may sell through its own website and stores but also partner with third-party retailers or distributors. This hybrid model supports broader reach and flexibility and allows companies to serve different customer segments in different ways, such as offering white-glove service in owned channels and scaling via partners. The main challenge is managing potential conflicts, as direct and indirect channels may compete on price, promotions, or service, leading to friction with partners.

-

Reverse distribution:

Reverse distribution focuses on retrieving products or materials from end users, including returns, repairs, recycling, trade-ins, and disposals. It’s increasingly important for companies committed to sustainability or those in industries with high return rates or strict regulatory requirements. However, reverse distribution adds complexity to logistics operations because it requires infrastructure to handle intake, inspection, sorting, and either disposal or reintegration into the supply chain.

Real-World Examples of Different Distribution Strategies

Distribution strategies vary widely by industry. Some businesses prioritize reach and scale, while others focus on control and exclusivity. Each of the following companies has tailored its distribution model to fit its products, market, and strategic priorities:

- Apple blends direct and selective distribution in a way that both preserves brand consistency and expands its reach. The company sells straight to customers through its website and stores, which gives it complete control over service, pricing, and presentation. Apple also partners with a limited number of authorized retailers that must meet strict quality criteria.

- Procter & Gamble uses a fully indirect distribution strategy to move high-volume consumer staples, such as Tide laundry detergent and Gillette razors, through a vast network of wholesalers and retailers. In doing so, the company can focus internally on product development and marketing but still reach millions of customers globally, all without building out its own logistics or retail infrastructure.

- Bose takes a selective approach, distributing its audio equipment through a select set of retail partners chosen for their ability to explain technical features, offer product demonstrations, and uphold Bose’s premium positioning. This strategy helps the company deliver a more personalized buying experience while maintaining pricing integrity.

- Coca-Cola follows an intensive distribution model that maximizes product availability at nearly every consumer touchpoint, from supermarkets and convenience stores to vending machines and restaurants. The company works with a broad network of local bottlers and distributors to stock high-turnover beverages wherever demand exists. These products rely on habitual, impulse-driven purchases, so ubiquity is critical.

- Nike uses a dual distribution strategy to serve different segments through different channels. It keeps full control over merchandising, pricing, and customer experience through its owned stores and ecommerce site. Meanwhile, sporting goods chains, department stores, and other retail partners extend the brand’s reach into markets where operating its own stores may not be viable. This mix allows Nike to balance brand consistency with global scale.

10 Tips for Choosing the Right Distribution Strategy for Your Product or Service

Choosing the optimal distribution strategy requires a thorough, honest evaluation of a company’s product, audience, and internal capabilities. An approach that doesn’t align with those core components faces greater risk of poor customer service and supply chain disruption. The following ten steps offer a guide for selecting a distribution model that meets the needs of all stakeholders:

- Evaluate your product’s characteristics and needs: A product’s size, fragility, and shelf life all influence its storage and delivery requirements. Assess the handling processes and shipping methods needed to safely get the product into customers’ hands.

- Analyze your target market: Study shopping habits, including where and how customers like to make purchases. Segment audiences by these preferences to guide decisions around channel usage.

- Factor in costs and margins: Calculate the total cost of serving customers for each distribution strategy under consideration. Evaluate each approach’s ability to support defined pricing structures and profitability goals.

- Maintain legal and regulatory compliance: Distribution often butts up against complex laws and regulations, from customs and import/export restrictions to safety and environmental standards. Noncompliance can delay shipments, trigger fines, and block entry into certain markets.

- Set clear business objectives: Define overall goals, such as expanding into new markets or controlling brand reputation, and identify the distribution strategies that best sustain them. These goals create a benchmark for evaluating trade-offs and prioritizing investments.

- Create channel rules of engagement: Clearly communicate the roles of all sales channels, remembering to include pricing policies and promotional guidelines. Offer incentives that align with these roles to minimize partner conflict.

- Assess your warehouse and logistics capabilities: Evaluate internal warehouse capacity and logistics partner performance. Look for inefficiencies and bottlenecks that can delay deliveries and increase costs.

- Track key performance indicators (KPIs): Regularly monitor inventory turnover, fill rate, customer satisfaction, and other metrics through a CRM dashboard. This data helps measure CRM success and identify emerging issues before they become serious problems.

- Continuously optimize: KPIs also inform analysis of partner performance and fulfillment timelines. Use these evaluations to identify areas for improvement, and test and refine changes as needed.

- Use technology to improve operations: Adopt software that increases inventory visibility and enhances demand forecasting. Rely on advanced analytics to identify supply chain risks and support real-time decision-making.

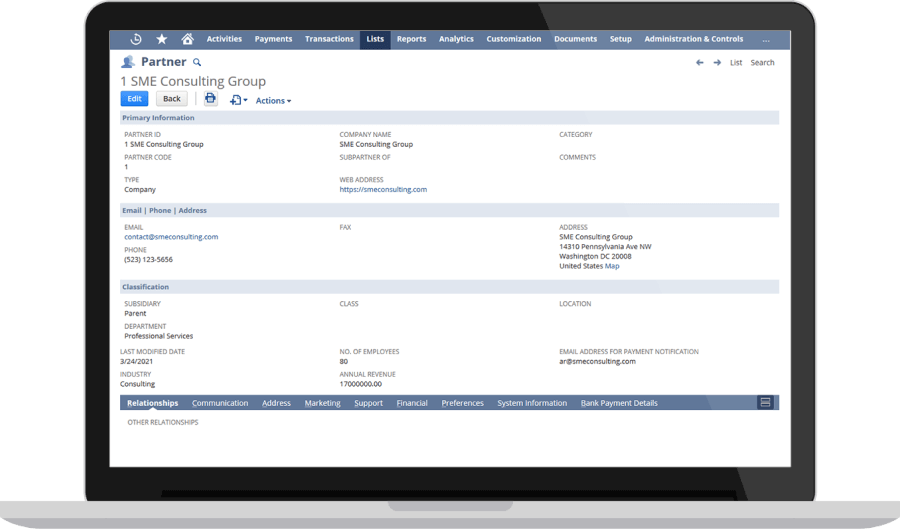

NetSuite CRM Delivers a Unified View of Your Customers

NetSuite CRM helps companies optimize distribution processes and strategies by centralizing customer data for segmenting and targeting, automating sales pipelines and order fulfillment, and providing a unified view that spans sales, marketing, fulfillment, and service. Quotes, orders, support cases, and other customer transactions appear in a single dashboard, giving cross-functional teams the context from which to deliver responsive, personalized service. Automated order management and real-time inventory updates improve accuracy and speed, while multichannel integration eliminates silos as the business grows. Teams gain the ability to forecast demand, identify supply chain risks, and collaborate among locations, allowing businesses to maintain strong customer relationships and adapt faster to market fluctuations.

Manage Channel Partners With NetSuite CRM

Distribution strategies determine the paths products take from production to customer—and how those paths help companies achieve their goals. Businesses may choose direct distribution models to maintain brand control, indirect models to expand reach through partners, or hybrid models to balance both. As product lines grow and customer expectations shift, these strategies must evolve to reflect new operational and market realities. A clear, well-executed distribution strategy provides the structure to scale and the flexibility to adapt without sacrificing performance.

Distribution Strategy FAQs

Who are the primary stakeholders in a distribution strategy?

The primary stakeholders in a distribution strategy are executives who make high-level decisions, operations managers who implement them, and the sales and marketing teams responsible for go-to-market activities. Together, they develop and execute plans that meet the needs of customers, partners, and the business as a whole.

How do you choose a distribution strategy?

To choose a distribution strategy, start by evaluating product needs, customer behavior, and business goals. From there, assess budget, market conditions, and available infrastructure to identify the most viable model.